Visteon Completes Restatements and Files Pro Forma Financials

23 November 2005 - 9:13AM

PR Newswire (US)

VAN BUREN TOWNSHIP, Mich., Nov. 22 /PRNewswire-FirstCall/ --

Visteon Corporation (NYSE:VC) today announced that it has completed

the restatement of its financial statements for the years ended

Dec. 31, 2004, 2003 and 2002 and has filed with the U.S. Securities

and Exchange Commission its amended 2004 annual report on Form

10-K/A and quarterly reports on Form 10-Q for the first three

quarters of 2005. Visteon also filed an amendment to its current

report on Form 8-K/A dated Oct. 6, 2005, to provide certain pro

forma financial information required in connection with the closing

of the transactions with Ford Motor Company on Oct. 1, 2005. (Logo:

http://www.newscom.com/cgi-bin/prnh/20001201/DEF008LOGO ) As

announced Oct. 21, Visteon's Audit Committee, with the assistance

of outside counsel, recently completed an independent review of the

accounting for certain transactions originating in the company's

North American purchasing group. As previously reported, the Audit

Committee, as well as management, determined that certain expenses

for freight, raw materials and other supplier costs originating in

North America were recorded in periods after Dec. 31, 2004, and

should have been recorded in prior periods. The filings today

correct these errors and make other adjustments as detailed in the

amended reports. "We are pleased to have completed the independent

review and our required financial filings," said Mike Johnston,

Visteon chairman and chief executive officer. "Throughout this

review process our employees have stayed focused on our customers

and the many actions needed to make Visteon a success." In the

filings made today, Visteon's reported results for the years 2002-

2004 are within the ranges estimated in its Oct. 21 press release.

In addition, Visteon reported a net loss for the first nine months

of 2005 of $1.608 billion, or $(12.78) per share, including nearly

$1.2 billion in special charges, and a net loss for full year 2004

of $1.536 billion, or $(12.26) per share, including nearly $1.3

billion in special charges. The unaudited pro forma consolidated

financial information reflects pro forma revenue for the first nine

months of 2005 of $8.6 billion. This amount includes an estimate of

revenue related to the reimbursement from Automotive Components

Holdings, LLC of costs for leased employees and related services

provided by Visteon, and the elimination of Ford sales of $5.5

billion. In addition, $611 million of other customers' sales,

primarily related to tier two sales to Ford and glass sales, have

been eliminated. "Completing the pro forma financials is an

important part of becoming current in our financial filings,

although they are not necessarily predictive of Visteon's future

results," said Jim Palmer, executive vice president and chief

financial officer. "Many of our non-strategic operations were

addressed with the Ford transaction, yet we continue to review

every facet of our business to reduce our cost base, while

continuing to meet our customer requirements, as we position

Visteon for financial success in this challenging market. Our

previously announced change to post-retirement benefits and

additional restructuring of our manufacturing footprint and

supporting infrastructure will provide further cost benefits in the

future." Visteon Corporation is a leading global automotive

supplier that designs, engineers and manufactures innovative

climate, interior, electronic and lighting products for vehicle

manufacturers, and also provides a range of products and services

to aftermarket customers. With corporate offices in Van Buren

Township, Mich. (U.S.); Shanghai, China; and Kerpen, Germany; the

company has more than 170 facilities in 24 countries and employs

approximately 50,000 people. This press release contains

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. Forward- looking

statements are not guarantees of future results and conditions but

rather are subject to various factors, risks and uncertainties that

could cause our actual results to differ materially from those

expressed in these forward-looking statements, including the

automotive vehicle production volumes and schedules of our

customers, and in particular Ford's North American vehicle

production volumes; our ability to satisfy our future capital and

liquidity requirements and comply with the terms of our credit

agreements; the financial distress of our suppliers; our ability to

implement, and realize the anticipated benefits of, restructuring

and other cost-reduction initiatives and our successful execution

of internal performance plans and other productivity efforts;

charges resulting from restructurings, employee reductions,

acquisitions or dispositions; our ability to offset or recover

significant material surcharges; the effect of pension and other

post- employment benefit obligations; as well as those factors

identified in our filings with the SEC (including our Annual Report

on Form 10-K for the year- ended December 31, 2004). We assume no

obligation to update these forward- looking statements.

http://www.newscom.com/cgi-bin/prnh/20001201/DEF008LOGO DATASOURCE:

Visteon Corporation CONTACT: Media Inquiries: Jim Fisher,

+1-734-710-5557, E-mail: or Investor Inquiries: Derek Fiebig,

+1-734-710-5800, E-mail: , both of Visteon Corporation Web site:

http://www.visteon.com/

Copyright

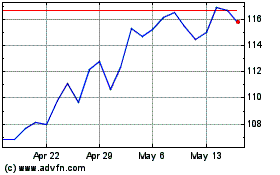

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jun 2024 to Jul 2024

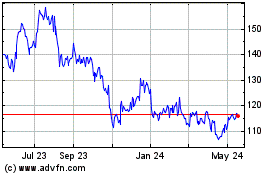

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jul 2023 to Jul 2024