Visteon Provides Financial Outlook

09 January 2004 - 1:26AM

PR Newswire (US)

Visteon Provides Financial Outlook DEARBORN, Mich., Jan. 8

/PRNewswire-FirstCall/ -- Visteon Corporation will provide its

financial outlook for full year 2004 and fourth quarter and full

year 2003 during a presentation to financial analysts and investors

today. The company expects GAAP net income in the range of $65 to

$130 million or $0.50 to $1.00 per share for the full year 2004.

For the full year 2003, the company anticipates a GAAP net loss in

the range of $1.13 to $1.25 billion or $9.00 to $9.95 per share,

including significant special charges. (Logo:

http://www.newscom.com/cgi-bin/prnh/20001201/DEF008LOGO ) "We

expect 2004 will be a defining year for Visteon. Our expected

improvement in financial performance reflects new incremental

business coming on stream in 2004, benefits of the recently

announced commercial agreements with Ford, the non-recurrence of

special charges, and our ability to work with our union partners

around the world to strengthen our results," said Peter J.

Pestillo, Visteon's chairman and chief executive officer. "We will

also benefit from the investments we have made in restructuring

actions over the past several years, continued cost control and

improved operational performance." 2004 Outlook Revenue for 2004 is

projected to be about $18.6 billion, up $1 billion from 2003,

reflecting Non-Ford revenue growth. Non-Ford revenue is expected to

reach approximately $5.1 billion, and represent 27% of total

revenue. Year-over-year improvement in earnings is expected to

result from: savings related to the European Plan for Growth, exit

of seating, and other actions; decreased OPEB expenses; lower

SG&A expenses; material cost savings and manufacturing

efficiencies; offset partially by price reductions and unfavorable

economics. Additionally, the company expects minor restructuring

charges in 2004, significantly lower than the restructuring charges

and other special charges recorded in 2003. Fourth Quarter and Full

Year 2003 For the fourth quarter 2003, Visteon expects to record a

GAAP net loss in the range of $780 to $900 million or $6.20 to

$7.15 per share, on revenue of $4.4 billion. Included in these

results are a number of special items, including $250 to $290

million of fixed asset write-downs, an increase of $425 to $475

million in a deferred tax asset valuation allowance, and

restructuring charges of approximately $25 to $35 million. In

aggregate, after tax, these special items total $700 to $800

million or $5.55 to $6.35 per share. For the full year 2003,

Visteon expects to record a GAAP net loss in the range of $1.13 to

$1.25 billion or $9.00 to $9.95 per share, on estimated revenue of

$17.6 billion. Included in these results are the previously

mentioned fixed asset write-downs and increase in the deferred tax

asset valuation allowance, restructuring and other special items of

approximately $215 to $225 million. In aggregate these special

items total $890 to $990 million or $7.10 to $7.90 per share. The

full year results also include the 2003 UAW ratification bonus of

$41 million after tax. Visteon expects to release fourth quarter

and full year actual results on Friday, January 23, 2004. Visteon's

presentation at the conference will be web cast live beginning at

approximately 1:15 p.m. ET. The web cast and presentation material

will be accessible through Visteon's web site at

http://www.visteon.com/presentations . A replay will be available

for one week following the event. Visteon Corporation is a leading

full-service supplier that delivers consumer-driven technology

solutions to automotive manufacturers worldwide and through

multiple channels within the global automotive aftermarket. Visteon

has approximately 75,000 employees and a global delivery system of

more than 180 technical, manufacturing, sales and service

facilities located in 25 countries. This press release contains

forward-looking statements made pursuant to the Private Securities

Litigation Reform Act of 1995. Words such as "anticipate,"

"estimate," "expect," and "projects" signify forward-looking

statements. Forward-looking statements are not guarantees of future

results and conditions but rather are subject to various risks and

uncertainties. Some of these risks and uncertainties are identified

in our periodic filings with the Securities and Exchange

Commission. Should any risks or uncertainties develop into actual

events, these developments could have material adverse effects on

Visteon's business, financial condition, and results of operations.

We assume no obligation to update these forward- looking

statements. http://www.newscom.com/cgi-bin/prnh/20001201/DEF008LOGO

DATASOURCE: Visteon Corporation CONTACT: Media Inquiries: Kimberly

A. Welch, +1-313-755-3537, , Jim Fisher, +1-313-755-0635, , or

Investor Inquiries: Derek Fiebig, +1-313-755-3699, , all of Visteon

Corporation Web site: http://www.visteon.com/

http://www.visteon.com/presentations

Copyright

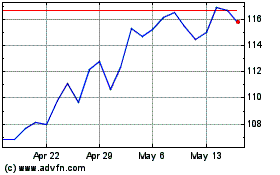

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jun 2024 to Jul 2024

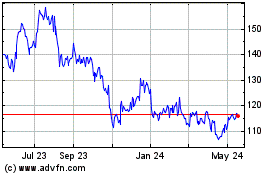

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jul 2023 to Jul 2024