false

0001526119

0001526119

2025-01-14

2025-01-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

January 14, 2025

Verastem,

Inc.

(Exact Name of Registrant as Specified in

Charter)

| Delaware |

|

001-35403 |

|

27-3269467 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

| 117 Kendrick Street, Suite 500, Needham, MA |

|

02494 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (781) 292-4200

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common stock, $0.0001 par value per share |

|

VSTM |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02. Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

Chief Operating Officer Appointment

Effective January 14, 2025, Verastem, Inc. (the “Company”)

appointed Matthew E. Ros as Chief Operating Officer of the Company.

Mr Ros, age 58, has more than 35 years of experience in global

pharmaceutical and early-stage biotechnology companies. Mr. Ros served as the Chief Executive Officer and board member at FORE

Biotherapeutics, a privately held clinical-stage precision oncology company, from April 2022 to August 2023. Prior to this, Mr. Ros

served at Epizyme, Inc., a publicly traded biopharmaceutical company, as Chief Operating Officer between May 2016 and November 2018

and then as Executive Vice President, Chief Strategy and Business Officer from October 2018 to November 2021. Mr. Ros has served as

a board member at Cogent Biosciences, Inc. since 2019. He received a B.S. from the State University of New York, College at

Plattsburgh and completed the Executive Education Program in Finance and Accounting for the Non-Financial Manager at Wharton School

of the University of Pennsylvania.

In connection with his appointment, the Company entered into an employment

agreement with Mr. Ros (the “Agreement”), dated January 14, 2025. Under the Agreement, Mr. Ros will receive an initial annual

base salary of $485,000 and is eligible for an annual bonus target of 45% of his base salary.

Pursuant to the terms of the Agreement and subject to the approval

of the Company’s board of directors, the Company will grant Mr. Ros (i) 50,000 restricted stock units (“RSUs”), to vest

as to 25% of the shares on the one-year anniversary of the Grant Date, and as to an additional 6.25% of the shares at the end of each

successive three-month period following the first anniversary of the Grant Date until the fourth anniversary of the Grant Date, and (ii)

33,333 RSUs, with the award to vest based on achievement of mutually agreed upon milestones, in each subject to Mr. Ros’ continuing

service with the Company on the applicable vesting date.

Under the Agreement and subject to Mr. Ros’ execution and non-revocation

of an effective release of claims, if Mr. Ros’ employment is terminated by the Company without Cause (as defined in the Agreement)

or by Mr. Ros for Good Reason (as defined in the Agreement), he will be entitled to receive the following severance benefits: (i) nine

months of base salary continuation, (ii) if Mr. Ros exercises his right to continue participation in the Company’s health and dental

plans under the federal law known as COBRA, a monthly cash amount equal to the full premium cost of that participation for nine months

(or, if earlier, until the time when Mr. Ros becomes eligible to enroll in the health or dental plan of a new employer), and (iii) any

base salary earned, but not yet paid, through the date of termination and any bonus which has been awarded, but not yet paid, on the date

of termination. Mr. Ros will also be entitled to certain rights in connection with a Change of Control (as defined in the Agreement) of

the Company, as set forth in the Agreement.

The foregoing summary of the Agreement is qualified in its entirety

by the copy of the Agreement filed as Exhibit 10.1 hereto and incorporated herein by this reference.

Item 9.01 Financial Statements and Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

VERASTEM, INC. |

| |

|

|

| Dated: January 21, 2025 |

By: |

/s/ Daniel W. Paterson |

| |

|

Daniel W. Paterson |

| |

|

President and Chief Executive Officer |

Exhibit 10.1

EMPLOYMENT AGREEMENT

THIS EMPLOYMENT AGREEMENT

(the “Agreement”), effective as of January 14, 2025 (the “Effective Date”), is by and between Verastem, Inc.

(the “Company”), a Delaware corporation with its principal place of business at 117 Kendrick Street, Suite 500, Needham,

MA 02494, and Matthew E. Ros, (the “Executive”).

WHEREAS, the Executive has

certain experience and expertise that qualify him to provide management direction and leadership for the Company.

WHEREAS, the Company now wishes

to employ the Executive to serve as its Chief Operating Officer.

NOW, THEREFORE, in consideration

of the mutual covenants and promises contained herein and other good and valuable consideration, the receipt and sufficiency of which

are hereby acknowledged, the Company offers and the Executive accepts employment upon the following terms and conditions:

1. Term,

Position and Duties. Upon the terms and subject to the conditions set forth in this Agreement, the Company hereby offers and the Executive

hereby accepts employment with the Company to serve as its Chief Operating Officer, reporting to the Company’s President and Chief

Executive Officer. The Executive agrees to perform the duties of the Executive’s position and such other duties as reasonably may

be assigned to the Executive from time to time. Subject to prior approval of the President and Chief Executive Officer, the Executive

may join the board of directors or advisory committee of up to two companies, provided such endeavors do not, individually or in the aggregate,

interfere with the Executive’s duties and responsibilities hereunder or breach any of the provisions of this Agreement or the Employee

Non-Solicitation, Non-Competition, Confidential Information and Inventions Assignment Agreement referenced below. The Executive also agrees

that while employed by the Company, the Executive will devote one hundred percent (100%) of the Executive’s business time and the

Executive’s reasonable commercial efforts, business judgment, skill and knowledge exclusively to the advancement of the business

and interests of the Company and to the discharge of the Executive’s duties and responsibilities for it.

2. Compensation

and Benefits. During the Executive’s employment as the Company’s Chief Operating Officer, as compensation for all services

performed by the Executive for the Company and subject to his performance of his duties and responsibilities for the Company, pursuant

to this Agreement or otherwise, the Company will provide the Executive the following pay and benefits:

(a) Base

Salary; Annual Bonus. The Company will pay the Executive a base salary at the rate of Four Hundred Eighty-Five Thousand Dollars ($485,000)

per year. Such amount shall be payable in accordance with the regular payroll practices of the Company for its executives, as in effect

from time to time, and subject to increase from time to time by the Board of Directors Of the Company (the “Board”) in its

discretion. The Executive shall have the opportunity to earn an annual target bonus measured against performance criteria to be determined

by the Board (or committee thereof) of forty five percent (45%) of the Executive’s then current annual base salary (the “Target

Bonus”), the actual amount of the bonus , if any, is to be determined by the Board (or committee

thereof). Any bonus amount payable by the Company, if any, shall be paid no later than March 15 of the year following the year in

which such bonus is earned. The Executive must remain employed through the last day of the year for which the bonus is earned in order

to be eligible to receive any bonus.

(b) Restricted

Stock Units. Subject to Board approval and at all times pursuant to the Verastem, Inc. 2021 Equity Incentive Plan (the “Plan”)

and any applicable stock option award agreement or restricted stock unit award, the Company will grant the Executive:

i. a

grant of restricted stock units with respect to 50,000 shares (the “Time-based Award”) of the Common Stock (the “RSU

Award”) to vest as to 25% of the shares subject to the option on the first anniversary of the Grant Date and as to an

additional 6.25% of the shares at the end of each successive three-month period following the first anniversary of the Grant Date

until the fourth anniversary of the Grant Date (with the number of shares vesting on each vesting date rounded down to the nearest

whole share, except with respect to the final vesting date on which all remaining unvested shares shall vest), provided that the

Executive continues to serve as an employee of or other service provider to the Company on each such vesting date; and

ii. a

grant of restricted stock units with respect to 33,333 shares (the “Performance based Award” and, together with the Time-based

Award, the “Inducement Awards”) of the Common Stock, to be granted as soon as practicable after the Effective Date, with the

award to vest based on achievement of mutually agreed upon milestones, provided that the Executive continues to serve as an employee of

or other service provider to the Company on each such vesting date.

(c) Participation

in Employee Benefit Plans. The Executive will be eligible to participate in all Employee Benefit Plans from time to time in effect

for employees of the Company generally, except to the extent such plans are duplicative of benefits otherwise provided the Executive under

this Agreement (e.g., severance pay) or under any other agreement. The Executive’s participation will be subject to the terms of

the applicable plan documents and generally applicable Company policies. The Company may alter, modify, add to or delete its Employee

Benefit Plans at any time as it, in its sole judgment, determines to be appropriate, without recourse by the Executive. For purposes of

this Agreement, “Employee Benefit Plan” shall have the meaning ascribed to such term in Section 3(3) of ERISA, as

amended from time to time.

(d) Business

Expenses. The Company will pay or reimburse the Executive for all reasonable business expenses incurred or paid by the Executive in

the performance of his duties and responsibilities for the Company, subject to any maximum annual limit and other restrictions on such

expenses set by the Company and to such reasonable substantiation and documentation as it may specify from time to time. Any such payment

or reimbursement that would constitute nonqualified deferred compensation subject to Section 409A of the Internal Revenue Code (including

the regulations promulgated thereunder, “Section 409A”) shall be subject to the following additional rules: (i) no

payment or reimbursement of any such expense shall affect the Executive’s right to payment or reimbursement of any other such expense

in any other taxable year; (ii) payment or reimbursement of the expense shall be made, if at all, not later than the end of the calendar

year following the calendar year in which the expense was incurred; and (iii) the right to payment or reimbursement shall not be

subject to liquidation or exchange for any other benefit.

3. Confidential

Information, Non-Competition and Proprietary Information. As a condition of employment, the Executive has executed or will execute

the Company’s standard Employee Non-Solicitation, Non-Competition, Confidential Information and Inventions Assignment Agreement

(the “Non-Compete Agreement”). It is understood and agreed that a material breach by the Executive of the Employee Non-Compete

Agreement shall constitute a material breach of this Agreement.

4. Termination

of Employment. The Executive’s employment under this Agreement shall continue until terminated pursuant to this Section 4.

(a) The

Company may terminate the Executive’s employment for “Cause” upon written notice to the Executive received setting forth

in reasonable detail the nature of the Cause. The following shall constitute Cause for termination: (i) the Executive’s

willful failure to perform, or gross negligence in the performance of, the Executive’s material duties and responsibilities to the

Company or its Affiliates which, if capable of being remedied, is not remedied within thirty (30) days of written notice thereof; (ii) material

breach by the Executive of any material provision of this Agreement or any other material agreement with the Company or any of its Affiliates

which, if capable of being remedied, is not remedied within thirty (30) days of written notice thereof;

(iii) fraud, embezzlement or other intentional misconduct with respect to the Company or any of its Affiliates that causes material

financial or reputational injury to the Company or any of its Affiliates; or (iv) the Executive’s commission of a felony or

other crime involving moral turpitude relating to his employment and/or duties to the Company.

(b) The

Company may terminate the Executive’s employment at any time other than for Cause upon written notice to the Executive.

(c) The

Executive may terminate his employment hereunder for Good Reason by providing notice to the Company of the condition giving rise to the

Good Reason no later than thirty (30) days following the occurrence of the condition, by giving the Company thirty (30) days to remedy

the condition and by terminating employment for Good Reason within thirty (30) days thereafter if the Company fails to remedy the condition.

For purposes of this Agreement, “Good Reason” shall mean, without the Executive’s consent, the occurrence of any one

or more of the following events: (i) material diminution in the nature or scope of the Executive’s responsibilities, duties

or authority, provided that neither (x) the Company’s failure to continue the Executive’s appointment or election as

a director or officer of any of its Affiliates nor (y) any diminution in the nature or scope of the Executive’s responsibilities,

duties or authority that is reasonably related to a diminution of the business of the Company or any of its Affiliates shall constitute

“Good Reason”; (ii) a material reduction in the Executive’s base salary; (iii) a material breach by the Company

of any material provision of this Agreement or any other material agreement with Executive; or (iv) relocation of the Executive’s

principal place of business more than forty (40) miles from the then-current location of the Executive’s principal place of business.

(d) The

Executive may terminate his employment with the Company other than for Good Reason at any time upon sixty (60) days’ notice to the

Company. In the event of termination of the Executive’s employment in accordance with this Section 4(d), the Board may elect

to waive the period of notice, or any portion thereof, and, if the Board so elects, the Company will pay the Executive his then current

base salary for the period so waived.

(e) This

Agreement shall automatically terminate in the event of the Executive’s death during employment. The Company may terminate the Executive’s

employment, upon notice to the Executive, in the event the Executive becomes disabled during employment and, as a result, is unable to

continue to perform substantially all of his material duties and responsibilities under this Agreement for one-hundred and twenty (120)

days during any period of three hundred and sixty-five (365) consecutive calendar days. If any question shall arise as to whether

the Executive is disabled to the extent that the Executive is unable to perform substantially all of his material duties and responsibilities

for the Company and its Affiliates, the Executive shall, at the Company’s request and expense, submit to a medical examination by

a physician selected by the Company to whom the Executive or the Executive’s guardian, if any, has no reasonable objection to determine

whether the Executive is so disabled and such determination shall for the purposes of this Agreement be conclusive of the issue. If

such a question arises and the Executive fails to submit to the requested medical examination, the Company’s determination of the

issue shall be binding on the Executive.

5. Severance

Payments and Other Matters Related to Termination.

(a) Termination

pursuant to Section 4(b) or 4(c). Except as provided in Section 5(c) below, in the event of termination of the

Executive’s employment either by the Company other than for Cause pursuant to Section 4(b) of this Agreement (which, for

the avoidance of doubt, shall not include a termination due to death or disability under Section 4(e) of this Agreement) or

by the Executive for Good Reason pursuant to Section 4(c) of this Agreement, or as a result of the Company’s delivery

of a notice of non-renewal in accordance with Section 1(a) of this Agreement:

i. The

Company shall pay the Executive’s then-current annual base salary for a period of nine (9) months in accordance with the Company’s

payroll practice then in effect, beginning on the Payment Commencement Date.

ii. If

the Executive is participating in the Company’s group health plan and/or dental plan at the time the Executive’s employment

terminates, and the Executive exercises his right to continue participation in those plans under the federal law known as COBRA, or any

successor law, the Company will pay the Executive a monthly cash amount equal to the full premium cost of that participation (the “Benefits

Payment”) for nine (9) months following the date on which the Executive’s employment with the Company terminates or,

if earlier, until the date the Executive becomes eligible to enroll in the health (or, if applicable, dental) plan of a new employer,

payable in accordance with regular payroll practices for benefits beginning on the Payment Commencement Date.

iii. The

Company will also pay the Executive on the date of termination any base salary earned but not paid through the, date of termination (collectively,

the “Accrued Amounts”). In addition, the Company will pay the Executive any bonus which has been awarded to the Executive,

but not yet paid on the date of termination of his employment, payable in a lump sum on the later of such date when bonuses are paid to

executives of the Company generally in accordance with the timing rules of Section 2(a) and the Payment Commencement Date.

iv. Any

obligation of the Company to provide the Executive severance payments or other benefits under this Section 5(a) (other than

the Accrued Amounts) is conditioned on the Executive’s signing, returning and not revoking an effective release of claims in the

form provided by the Company (the “Employee Release”) within the deadline specified therein (and in all events within sixty

(60) days following the termination of the Executive’s employment), which release shall not apply to (i) claims for indemnification

in the Executive’s capacity as an officer or director of the Company under the Company’s Certificate of Incorporation, By-laws

or agreement, if any, providing for director or officer indemnification, (ii) rights to receive insurance coverage and payments under

any policy maintained by the Company and (iii) rights to receive retirement benefits that are accrued and fully vested at the time

of the Executive’s termination and rights under such plans protected by ERISA. Any severance payments to be made in the form of

salary continuation pursuant to the terms of this Agreement shall be payable in accordance with the normal payroll practices of the Company,

and will begin on the Payment Commencement Date but shall be retroactive to the date of termination. The Executive agrees to provide the

Company prompt notice of the Executive’s eligibility to participate in the health plan and, if applicable, dental plan of any new

employer. The Executive further agrees to repay any overpayment of health benefit premiums made by the Company hereunder.

(b) Termination

other than pursuant to Section 4(b) or 4(c). In the event of any termination of the Executive’s employment, other

than a termination by the Company pursuant to Section 4(b) of this Agreement or a termination by the Executive for Good Reason

pursuant to Section 4(c) of this Agreement, the Company will pay the Executive the Accrued Amounts. In addition, the Company

will pay the Executive any bonus which has been awarded to the Executive, but not yet paid on the date of termination of the Executive’s

employment, at such time when bonuses are paid to executives of the Company generally in accordance with the timing rules of Section 2(a).

The Company shall have no other payment obligations to the Executive under this Agreement.

(c) Upon

a Change of Control. If, within ninety (90) days prior to a Change of Control or within eighteen (18) months following a Change

of Control (as defined in Section 6 hereof), the Company or any successor thereto terminates the Executive’s employment other

than for Cause pursuant to Section 4(b) of this Agreement (which, for the avoidance of doubt, shall not include a termination

due to death or disability under Section 4(e) of this Agreement), the Executive’s employment terminates as a result of

the Company’s delivery of a notice of non-renewal in accordance with Section 1(a) of this Agreement, or the Executive

terminates his employment for Good Reason pursuant to Section 4(c) of this Agreement, then, in lieu of any payments to the Executive

or on the Executive’s behalf under Section 5(a) hereof:

i. All

of the Executive’s then-unvested stock options, restricted stock and restricted stock units which, by their terms, vest only based

on the passage of time (disregarding any acceleration of the vesting of such options, restricted stock or restricted stock units based

on individual or Company performance) that are outstanding immediately prior to the date of termination shall (notwithstanding anything

to the contrary in the applicable award agreement) remain outstanding and eligible to vest until the Payment Commencement Date and, subject

to Section 5(c)(vi), automatically become fully vested as of the Payment Commencement Date.

ii. The

Company shall pay, on the Payment Commencement Date, a lump sum payment equal to twelve (12) months of the Executive’s then-current

annual base salary; provided, however, that if such termination occurs prior to a Change of Control, such severance payments shall be

made at the time and in the manner set forth in Section 5(a)(i) during the period beginning on the date of termination through

the date of the Change of Control with any severance remaining to be paid under this Section 5(c)(ii) payable in a lump sum

on the closing date of the Change of Control (or, if later, the Payment Commencement Date).

iii. If

the Executive is participating in the Company’s group health plan and/or dental plan at the time the Executive’s employment

terminates, and the Executive exercises his right to continue participation in those plans under the federal law known as COBRA, or any

successor law, the Company will pay the Executive the Benefits Payment for twelve (12) months following the date on which the Executive’s

employment with the Company terminates or, if earlier, until the date the Executive becomes eligible to enroll in the health (or, if applicable,

dental) plan of a new employer, with such amount payable on a pro-rata basis in accordance with the Company’s regular payroll practices

for benefits beginning on the Payment Commencement Date.

iv. The

Company shall pay the Executive a pro-rata portion of his Target Bonus for the year in which the date of termination occurs, calculated

based on the number of days the Executive has been employed by the Company in such year and payable on the Payment Commencement Date.

v. The

Company will also pay the Executive the Accrued Amounts. In addition, the Company will pay the Executive any bonus which has been awarded

to the Executive, but not yet paid on the date of termination of his employment, payable in a lump sum on the later of such date when

bonuses are paid to executives of the Company generally in accordance with the timing rules of Section 2(a) and the Payment

Commencement Date.

vi. Any

obligation of the Company to provide the Executive severance payments or other benefits under this Section 5(c) (other than

the Accrued Amounts) is conditioned on the Executive’s signing, returning and not revoking the Employee Release by the deadline

specified therein (and in all events within sixty (60) days following the termination of the Executive’s employment), which release

shall not apply to (i) claims for indemnification in the Executive’s capacity as an officer or director of the Company under

the Company’s Certificate of Incorporation, By-laws or agreement, if any, providing for director or officer indemnification, (ii) rights

to receive insurance coverage and payments under any policy maintained by the Company and (iii) rights to receive retirement benefits

that are accrued and fully vested at the time of the Executive’s termination and rights under such plans protected by ERISA. The

Executive agrees to provide the Company prompt notice of the Executive’s eligibility to participate in the health plan and, if applicable,

dental plan of any new employer. The Executive further agrees to repay any overpayment of health benefit premiums made by the Company

hereunder.

(d) Except

for any right the Executive may have under applicable law to continue participation in the Company’s group health and dental plans

under COBRA, or any successor law, benefits shall terminate in accordance with the terms of the applicable benefit plans based on the

date of termination of the Executive’s employment, without regard to any continuation of base salary or other payment to the Executive

following termination. Notwithstanding anything herein to the contrary, if the payment by the Company of the Benefits Payments will subject

or expose the Company to taxes or penalties, the Executive and the Company agree to renegotiate the provisions of Section 5(a)(ii) or

5(c)(iii), as applicable, in good faith and enter into a substitute arrangement pursuant to which the Company will not be subjected

or exposed to taxes or penalties and the Executive will be provided with payments or benefits with an economic value that is no less than

the economic value of the Benefits Payments.

(e) Upon

a Change of Control, any then-unvested stock options, restricted stock and restricted stock units which are outstanding as of the Effective

Date and which, by their terms, vest based on the achievement of specified performance criteria shall (notwithstanding anything to the

contrary in the applicable award agreement), to the extent not assumed or continued by the acquirer in such Change of Control on substantially

identical terms, become vested as of the consummation of the Change of Control.

(f) Provisions

of this Agreement shall survive any termination if so provided in this Agreement or if necessary or desirable to accomplish the purposes

of other surviving provisions, including without limitation the Executive’s obligations under Section 3 of this Agreement and

under the Employee Non-Solicitation, Non-Competition, Confidential Information and Inventions Assignment Agreement. The obligation of

the Company to make payments to the Executive or on the Executive’s behalf under Section 5 of this Agreement is expressly conditioned

upon the Executive’s continued full performance of the Executive’s obligations under Section 3 hereof, under the Employee

Non-Solicitation, Non-Competition, Confidential Information and Inventions Assignment Agreement to be executed herewith, and under any

subsequent agreement between the Executive and the Company or any of its Affiliates relating to confidentiality, non-competition, proprietary

information or the like.

6. Definitions.

For purposes of this agreement; the following definitions apply:

“Affiliates” means

all persons and entities directly or indirectly controlling, controlled by or under common control with the Company, where control may

be by management authority, equity interest or otherwise.

“Change of Control”

shall mean (i) the acquisition of beneficial ownership (as defined in Rule 13d-3 under the Securities Exchange Act of 1934,

as amended (the “Exchange Act”)) directly or indirectly by any “person” (as such term is used in Sections 13(d) and

14(d) of the Exchange Act) of securities of the Company representing a majority or more of the combined voting power of the Company’s

then outstanding securities, other than an acquisition of securities for investment purposes pursuant to a bona fide financing of the

Company; (ii) a merger or consolidation of the Company with any other corporation in which the holders of the voting securities of

the Company prior to the merger or consolidation do not own more than 50% of the total voting securities of the surviving corporation;

or (iii) the sale or disposition by the Company of all or substantially all of the Company’s assets other than a sale or disposition

of assets to an Affiliate of the Company or a holder of securities of the Company; notwithstanding the foregoing, no transaction or series

of transactions shall constitute a Change of Control unless such transaction or series of transactions constitutes a “change in

control event” within the meaning of Treasury Regulation Section 1.409A-3(i)(5)(i).

“Payment Commencement

Date” shall mean the Company’s next regular payday for executives that follows the expiration of sixty (60) calendar days

from the date the Executive’s employment terminates.

“Person” means

an individual, a corporation, an association, a partnership, an estate, a trust and any other entity or organization, other than the Company

or any of its Affiliates.

7. Conflicting

Agreements. The Executive hereby represents and warrants that his signing of this Agreement and the performance of his obligations

under it will not breach or be in conflict with any other agreement to which the Executive is a party or is bound and that the Executive

is not now subject to any covenants against competition or similar covenants or any court order that could affect the performance of the

Executive’s obligations under this Agreement. The Executive agrees that he will not disclose to or use on behalf of the Company

any proprietary information of a third party without that party’s consent.

8. Withholding;

Other Tax Matters. Anything to the contrary notwithstanding, (a) all payments required to be made by the Company hereunder to

Executive shall be subject to the withholding of such amounts, if any, relating to tax and other payroll deductions as the Company may

reasonably determine it should withhold pursuant to any applicable law or regulation, and (b) all severance payments and benefits

payable pursuant to Sections 5(a) and 5(c) hereof shall be subject to the terms and conditions set forth on Exhibit A attached

hereto.

9. Assignment.

Neither the Executive nor the Company may make any assignment of this Agreement or any interest in it, by operation of law or otherwise,

without the prior written consent of the other; provided, however, that the Company may assign its rights and obligations under this Agreement

without the Executive’s consent to one of its Affiliates or to any Person with whom the Company shall hereafter affect a reorganization,

consolidate with, or merge into or to whom it transfers all or substantially all of its properties or assets. This Agreement shall inure

to the benefit of and be binding upon the Executive and the Company, and each of our respective successors, executors, administrators,

heirs and permitted assigns.

10. Severability.

If any portion or provision of this Agreement shall to any extent be declared illegal or unenforceable by a court of competent jurisdiction,

then the remainder of this Agreement, or the application of such portion or provision in circumstances other than those as to which it

is so declared illegal or unenforceable, shall not be affected thereby, and each portion and provision of this Agreement shall be valid

and enforceable to the fullest extent permitted by law.

11. Miscellaneous.

This Agreement, together with the Employee Non-Solicitation, Non-Competition, Confidential Information and Inventions Assignment Agreement,

sets forth the entire agreement between the Executive and the Company and replaces all prior communications, agreements and understandings,

written or oral, with respect to the terms and conditions of the Executive’s employment. This Agreement may not be modified or amended,

and no breach shall be deemed to be waived, unless agreed to in writing by the Executive and an expressly authorized representative of

the Board. The headings and captions in this Agreement are for convenience only and in no way define or describe the scope or content

of any provision of this Agreement. This Agreement may be executed in two or more counterparts, each of which shall be an original and

all of which together shall constitute one and the same instrument. This is a Massachusetts contract and shall be governed and construed

in accordance with the laws of the Commonwealth of Massachusetts, without regard to the conflict-of-laws principles thereof.

12. Notices.

Any notices provided for in this Agreement shall be in writing and shall be effective when delivered in person, consigned to a reputable

national courier service for overnight delivery or deposited in the United States mail, postage prepaid, and addressed to the Executive

at the Executive’s last known address on the books of the Company or, in the case of the Company, to it by notice to the Lead Director

of the Board of Directors, c/o Verastem, Inc. at its principal place of business, or to such other addressees) as either party may

specify by notice to the other actually received.

[Rest of page intentionally left blank.]

IN WITNESS WHEREOF, this Agreement

has been executed as a sealed instrument by the Company, by its duly authorized representative, and by the Executive, as of the date first

stated above.

| THE EXECUTIVE |

|

THE COMPANY |

|

| |

|

|

|

| /s/ Matthew E. Ros |

|

/s/ Daniel W. Paterson |

|

| Matthew E. Ros |

|

Daniel W. Paterson |

|

| |

|

President and Chief Executive Officer |

|

Exhibit A

Payments Subject to Section 409A

1. Subject

to this Exhibit A, any severance payments that may be due under the Agreement shall begin only upon or following the date of the

Executive’s “separation from service” (determined as set forth below) which occurs on or after the termination of Executive’s

employment. The following rules shall apply with respect to distribution of the severance payments, if any, to be provided to Executive

under the Agreement, as applicable:

(a) It

is intended that each installment of the severance payments under the Agreement provided under shall be treated as a separate “payment”

for purposes of Section 409A. Neither the Company nor Executive shall have the right to accelerate or defer the delivery of any such

payments except to the extent specifically permitted or required by Section 409A.

(b) If,

as of the date of Executive’s “separation from service” from the Company, Executive is not a “specified employee”

(within the meaning of Section 409A), then each installment of the severance payments shall be made on the dates and terms set forth

in the Agreement.

(c) If,

as of the date of Executive’s “separation from service” from the Company, Executive is a “specified employee”

(within the meaning of Section 409A), then:

(i) Each

installment of the severance payments due under the Agreement that, in accordance with the dates and terms set forth herein, will in all

circumstances, regardless of when Executive’s separation from service occurs, be paid within the short-term deferral period (as

defined under Section 409A) shall be treated as a short-term deferral within the meaning of Treasury Regulation Section 1.409A-1(b)(4) to

the maximum extent permissible under Section 409A and shall be paid on the dates and terms set forth in the Agreement; and

(ii) Each

installment of the severance payments due under the Agreement that is not described in this Exhibit A, Section 1(c)(i) and

that would, absent this subsection, be paid within the six-month period following Executive’s “separation from service”

from the Company shall not be paid until the date that is six months and one day after such separation from service (or, if earlier, Executive’s

death), with any such installments that are required to be delayed being accumulated during the six-month period and paid in a lump sum

on the date that is six months and one day following Executive’s separation from service and any subsequent installments, if any,

being paid in accordance with the dates and terms set forth herein; provided, however, that the preceding provisions of this sentence

shall not apply to any installment of payments if and to the maximum extent that that such installment is deemed to be paid under a separation

pay plan that does not provide for a deferral of compensation by reason of the application of Treasury Regulation 1.409A-1(b)(9)(iii) (relating

to separation pay upon an involuntary separation from service). Any installments that qualify for the exception under Treasury Regulation

Section 1.409A-1(b)(9)(iii) must be paid no later than the last day of Executive’s second taxable year following the taxable

year in which the separation from service occurs.

2. The

determination of whether and when Executive’s separation from service from the Company has occurred shall be made and in a manner

consistent with, and based on the presumptions set forth in, Treasury Regulation Section 1.409A-1(h). Solely for purposes of this

Exhibit A, Section 2, “Company” shall include all persons with whom the Company would be considered a single employer

under Section 414(b) and 414(c) of the Code.

3. The

Company makes no representation or warranty and shall have no liability to Executive or to any other person if any of the provisions of

the Agreement (including this Exhibit) are determined to constitute deferred compensation subject to Section 409A but that do not

satisfy an exemption from, or the conditions of, that section.

v3.24.4

Cover

|

Jan. 14, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 14, 2025

|

| Entity File Number |

001-35403

|

| Entity Registrant Name |

Verastem,

Inc.

|

| Entity Central Index Key |

0001526119

|

| Entity Tax Identification Number |

27-3269467

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

117 Kendrick Street

|

| Entity Address, Address Line Two |

Suite 500

|

| Entity Address, City or Town |

Needham

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02494

|

| City Area Code |

781

|

| Local Phone Number |

292-4200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.0001 par value per share

|

| Trading Symbol |

VSTM

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

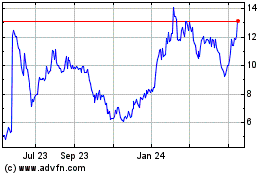

Verastem (NASDAQ:VSTM)

Historical Stock Chart

From Dec 2024 to Jan 2025

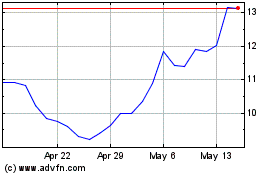

Verastem (NASDAQ:VSTM)

Historical Stock Chart

From Jan 2024 to Jan 2025