FALSE000010513200001051322024-03-042024-03-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________

FORM 8-K/A

(Amendment No. 1)

__________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): March 7, 2024 (March 4, 2024)

WD-40 COMPANY

(Exact Name of Registrant as specified in its charter)

__________

| | | | | | | | | | | | | | |

| Delaware | | 000-06936 | | 95-1797918 |

(State or other jurisdiction of incorporation or organization) | | (Commission File Number) WD 40 CO (Commission Company Name) | | (I.R.S. Employer Identification Number) |

9715 Businesspark Avenue, San Diego, California 92131

(Address of principal executive offices, with zip code)

(619) 275-1400

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| o | Written Communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of exchange on which registered |

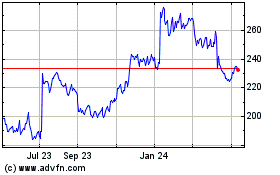

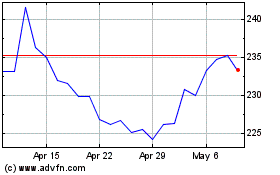

| Common stock, par value $0.001 per share | | WDFC | | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter)

Emerging Growth Company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act o

EXPLANATORY NOTE

This filing amends Item 9.01 of the Current Report on Form 8-K of WD-40 Company (“Company”) filed on March 4, 2024 to insert the agreements referenced in Item 1.01 as exhibits and to replace Exhibit 99.1 (which now contains the Media and Investor Contact).

| | | | | |

| Item 1.01. | Entry into a Material Definitive Agreement. |

On March 4, 2024 (“Closing Date”), WD-40 Holding Company Brasil Ltda. (“Buyer”), a wholly-owned subsidiary of WD-40 Company (“Company”), acquired all of the issued and outstanding capital stock of Brazilian distributor, Theron Marketing Ltda. (“Theron”), from M12 Participações Empresariais S.A. (“Seller”) in a cash-for-stock transaction. The approximate purchase price of $6.9 million USD is subject to a 90-day post closing adjustment. Theron had been the exclusive distributor of WD-40® Brand products in Brazil for the last 27 years. The Quota Purchase Agreement of even date (“Agreement”) entered into by Buyer, Seller, and Theron included the following additional terms and conditions:

a. The establishment of an escrow account containing approximately $200,000 USD of the cash consideration to cover indemnifiable losses, if any, with the balance to be released to Seller on the second anniversary of the Closing Date,

b. The purchase of an insurance bond or policy by Seller to cover certain taxes for which Seller agreed to indemnify Buyer,

c. A three-year non-competition provision, and

d. A one-year non-solicitation provision.

In connection with this acquisition, Theron signed a three-year Transition Services Agreement (“TSA”) with VDBN Representações Comerciais Ltda., a related party of Seller, for logistics and related services, for which the minimum fees total approximately $2.1 million USD.

The foregoing descriptions of the terms of the Agreement and TSA do not purport to be complete and are qualified in their entirety by reference to the full text of the Agreement and TSA, a copy of each which is filed as Exhibit 10.1 and 10.2, respectively, and are incorporated herein by reference.

| | | | | |

| Item 7.01. | Regulation FD Disclosure. |

On March 4, 2024, the Company issued a press release announcing the acquisition of Brazilian distributor, Theron Marketing Ltda., by its Brazilian subsidiary, WD-40 Holding Company Brasil Ltda. The Company also announced that it will share additional details of this acquisition with investors when its results for the second fiscal quarter of 2024 are reported, which are expected to be released on April 9, 2024.

The full text of the press release is furnished herewith as Exhibit 99.1 and is incorporated by reference into this Item 7.01.

The information in Item 7.01, including Exhibit 99.1, is not deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section and is not deemed incorporated by reference into any of the Company’s filings under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits. |

| |

| (d) | Exhibits |

| |

| Exhibit No. | Description |

| |

| 10.1 | |

| 10.2 | |

| 99.1 | |

| 104 | The cover page from this Amendment No. 1 to Current Report on Form 8-K, formatted in Inline XBRL |

| |

| * | Except for Exhibit 1.1 of the Agreement, the other exhibits, schedules and/or attachments to Exhibit 10.1 and 10.2 have been omitted in accordance with Regulation S-K Item 601(b)(10). The Company agrees to furnish a copy of any omitted schedule to the U.S. Securities and Exchange Commission upon its request. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| WD-40 Company |

| |

| (Registrant) |

| |

| Date: March 7, 2024 | /s/ PHENIX Q. KIAMILEV |

| Phenix Q. Kiamilev |

| |

| Vice President, General Counsel and |

| |

| Corporate Secretary |

EXHIBIT 10.1

| | |

| Dated 04 March 2024 |

On the one side: WD-40 HOLDING COMPANY BRASIL LTDA. On the other side: M12 PARTICIPAÇÕES EMPRESARIAIS S.A. As intervening-party: THERON MARKETING LTDA. |

QUOTA PURCHASE AGREEMENT |

Table of Contents

| | | | | | | | |

| 1 | Definitions and Interpretation | 1 |

| 2 | Sale and Purchase of Quotas | 2 |

| 3 | Closing and Closing Actions | 8 |

| 4 | Representations and Warranties of the Seller | 10 |

| 5 | Representations and Warranties of the Buyer | 23 |

| 6 | Indemnity | 24 |

| 7 | Supervening Assets | 29 |

| 8 | Penalties for Default of Payment Obligations | 29 |

| 9 | Confidentiality and Announcements | 30 |

| 10 | Term | 32 |

| 11 | Governing Law and Dispute Resolution | 32 |

| 12 | Miscellaneous | 33 |

Quota Purchase Agreement

This quota purchase agreement (“Agreement”) is entered into by and between the following parties (jointly “Parties” and individually “Party”):

(1) WD-40 HOLDING COMPANY BRASIL LTDA., a limited liability company organized and existing under the Laws of Brazil, with headquarters in the city of São Paulo, State of São Paulo, at Avenida Brigadeiro Luis Antonio, No. 300, 10th floor, Building 104 - part Besta Vista, Zip Code 01318-903, enrolled with CNPJ/MF under No. 53.424.157/0001-00, herein represented pursuant to its corporate documents (“Buyer”);

(2) M12 PARTICIPAÇÕES EMPRESARIAIS S.A., a company organized and existing under the Laws of Brazil, with headquarters in the city of Curitiba, State of Paraná, at Rua Professor Algacyr Munhoz Mader, No. 2,800, Sala A, Cidade Industrial, Zip Code 81310-020, enrolled with CNPJ/MF under No. 39.838.596/0001-39, herein represented pursuant to its corporate documents (“Seller”);

As intervening-party:

(3) THERON MARKETING LTDA., a company organized and existing under the Laws of Brazil, with headquarters in the city of São José dos Pinhais, State of Paraná, at Avenida Rui Barbosa, No. 6,226, Sala C, Afonso Pena, Zip Code 83045-350, enrolled with CNPJ/MF under No. 02.260.769/0001-74, herein represented pursuant to its corporate documents (“Company”).

Whereas:

(A) The Seller is the registered owner of all the issued and outstanding quotas in the corporate capital of the Company (“Quotas”).

(B) The Buyer is willing to purchase, and the Seller is willing to sell the Quotas on and subject to the terms and conditions contained in this Agreement (“Transaction”).

Now, therefore, the Parties and the Company resolve to enter into this Agreement pursuant to the following terms and conditions:

1 Definitions and Interpretation

1.1 Definitions

Capitalized words, both in the singular and plural form, as the case may be, shall have the meaning set out in Exhibit 1.1.

1.2 Rules of Interpretation

1.2.1 Unless defined otherwise, any reference in this Agreement to:

(i) any “Party” shall be construed so as to include its successors in title, permitted assigns and permitted transferees to, or of, its rights and/or obligations under this Agreement;

(ii) “this Agreement” shall be construed as referring to this Agreement, together with the Exhibits, in its entirety and not to any particular Section, Exhibits or portion of it;

(iii) Sections or Exhibits are to Sections of, or Exhibits to, this Agreement;

(iv) any agreement (including this Agreement), document or instrument means such agreement, document or instrument as amended, supplemented, modified, varied, restated or replaced from time to time in accordance with the terms of such agreement, document or instrument and, unless otherwise specified in such agreement, document or instrument, includes all exhibits attached to such agreement, document or instrument; and

(v) a provision of Law is a reference to that provision as amended or re-enacted.

1.2.2 Wherever the words “include”, “includes” or “including” are used in this Agreement, they shall be deemed to be followed by the words “without limitation” and the words following “include”, “includes” or “including” shall not be considered to set out an exhaustive list.

1.2.3 Section and Exhibit headings are for ease of reference only.

1.2.4 References to any period of time shall be deemed to be references to the number of calendar days, except for any provision to the contrary, provided that all terms or periods of time provided for in this Agreement shall be counted excluding the date of the event that causes such term or period of time to begin and including the last day of the relevant term or period of time, as provided for in Article 132 of the Brazilian Civil Code. All terms set out in this Agreement ending on Saturdays, Sundays, or holidays shall be automatically extended to the next succeeding Business Day.

1.2.5 If any payment is required to be made or other action (including the giving of notice) is required to be taken pursuant to this Agreement on a day which is not a Business Day, then such payment or action shall be considered to have been made or taken in compliance with this Agreement if made or taken on the next succeeding Business Day.

1.2.6 Except as otherwise expressly provided in this Agreement:

(i) all currency amounts referred to in this Agreement are stated in Brazilian Reais; and

(ii) any payment contemplated by this Agreement shall be made in cash by wire transfer of immediately available funds to an account specified by the payee.

1.2.7 This Agreement is the result of negotiations among, and has been reviewed by counsel to the Parties, and is the work product of all such Persons. Accordingly, no term of this Agreement shall be construed against any Party because of any such Person’s involvement in the preparation of this Agreement.

2 Sale and Purchase of Quotas

2.1 Sale and Purchase

2.1.1 At the Closing, upon the terms and subject to the conditions set forth herein, the Seller shall sell and transfer to the Buyer and the Buyer shall purchase and acquire from the Seller, all Quotas, free and clear of any Encumbrance, together with all rights and obligations attached or accruing to them.

2.2 Purchase Price

2.2.1 In consideration for the acquisition of the Quotas, and subject to the Purchase Price Adjustment and the Accounts Receivable Adjustment, the Buyer shall pay to the Seller thirty-three million, nine hundred and eighteen thousand, five hundred and sixty-eight Brazilian Reais (R$ 33,918,568.00) (“Purchase Price”), which solely for reference purposes corresponds to six million, eight hundred and fifty-two thousand, five hundred and thirteen United States Dollars (USD 6,852,513.00).

2.2.2 The Purchase Price was agreed by the Parties taking into consideration that the Company will be the owner, at the Closing, of intangibles equivalent to eighteen million and five hundred thousand Brazilian Reais (R$ 18,500,000) (“Purchased Intangibles”) and Purchased Net Asset equivalent to fifteen million, four hundred and eighteen thousand, five hundred and sixty-eight Brazilian Reais (R$ 15, 418, 568.00), calculated pursuant to the Brazilian GAAP with reference to the Base Date (“Estimated Purchased Net Asset”).

2.3 Payment

2.3.1 At the Closing, the Buyer shall pay to Seller the Purchase Price less the Escrow Amount (as defined below which Buyer shall deposit into the Escrow Account (as defined below).

2.3.2 Upon receipt of the payment of the Purchase Price to Seller’s bank account and Escrow Account, under the terms of the Agreement, the Buyer shall automatically receive full, general, irrevocable and irreversible release from the Seller, and no claims shall be asserted by the Seller against the Buyer at any time, as regards the payment of the Purchase Price and the Escrow Amount

2.4 Escrow Amount

2.4.1 The Buyer and the Seller have agreed that a portion of the Purchase Price corresponding to one million Brazilian Reais (R$ 1,000,000.00) (“Escrow Amount”), which solely for reference purposes corresponds to two hundred and two thousand and thirty-two United States Dollars (USD 202,032,00) on the date prior to the signing, to be held for a period of up to twenty-four (24) months after the Closing Date, which shall serve as a guarantee for the full and timely payment of the amounts of any indemnifiable Losses under Section 6.1.1.

2.4.2 On the Closing Date, the Escrow Amount shall be deposited by the Buyer into an escrow account opened in the name of Seller with the Escrow Agent (“Escrow Account”), subject to the terms of this Agreement and the escrow agreement entered into by and between the Escrow Agent, the Seller and the Buyer on or prior to the Closing Date (“Escrow Agreement”). The costs for opening and maintaining the Escrow Account shall be borne by the Buyer.

2.4.3 Subject to the terms of the Escrow Agreement, the Escrow Amount to be deposited in the Escrow Account shall only be used by the Escrow Agent to (i) make payments in favor of the Buyer for Payable Losses owned by the Seller to the Buyer; and/or (ii) make payment in favor of the Seller pursuant the provisions of Section 2.4.6.

2.4.4 The Escrow Amount deposited in the Escrow Account shall be invested according to the Escrow Agreement. Any interest, dividends and other earnings from such

investments shall be part of the Escrow Amount and shall be accrued to the Escrow Amount.

2.4.5 Notwithstanding anything to the contrary in this Agreement, if any Buyer’s Indemnified Party is entitled to an indemnification pursuant to Section 6.1.1, without prejudice to any other right or remedy it or they may have, the Buyer shall deduct the amount of such indemnification from the Escrow Amount.

2.4.6 All amount held in the Escrow Account plus any gains and interests on investments related to such amount, deducted by any applicable Tax; less the amount of the Losses arising out of ongoing Direct Claim or a Third-Party Claim which Notice has been delivered (“Buyer’s Ongoing Claims”), pursuant to Section 6.5.3 (“Retained Amount”), shall be released to the Seller on the second (2nd) anniversary of the Closing Date. For clarification purposes, (a) within thirty (30) days before the end of the second (2nd) anniversary of the Closing Date, the Parties shall negotiate in good faith the amount to be retained of any Buyer’s Ongoing Claims, if there is any amount under dispute, however the amount to be retained shall never surpass the largest of the amounts under dispute (e.g. if plaintiff has claimed R$ 1,000.00 for indemnification and the defendant has argued that the correct amount is R$ 500.00, the Retained Amount to be negotiated between the Parties under this Section shall not surpass R$ 1,000.00); and (b) if there is any Direct Claim or Third-Party Claim (i) that is, at such date, illiquid and, by its nature, the subject matter cannot give rise to a liquid Claim or (ii) without any amount under dispute, no amount shall be retained under this Section. In relation to item (i), if the Direct Claim or Third-Party Claim may give rise to a liquid Claim, the Parties shall negotiate in good faith if any amount should be retained and, if so, the respective amount to be retained following as provided for in item (a) of this Section.

2.4.7 The Retained Amount shall be retained in the Escrow Account after the second (2nd) anniversary of the Closing Date until Final Decisions in relation to all Buyer’s Ongoing Claims are reached.

2.4.8 After each Final Decision is reached, (i) any payments due from the Escrow Account to the Seller shall be released to bank accounts indicated by the Seller; and (ii) any payments due from the Escrow Account to the Buyer shall be released to the bank account to be indicated by Buyer.

2.4.9 Any releases from the Escrow Account shall only be made by the Escrow Agent upon prior joint written authorization from the Buyer and the Seller, which shall not be unreasonably withheld by either Parties, without proper grounds and reasoning for doing so.

2.5 Purchase Price Adjustment

2.5.1 Adjustment to the Purchase Price

Within ninety (90) days after the Closing Date, the Buyer shall prepare and deliver to the Seller a statement that sets forth the Closing Purchased Net Asset, in accordance with Exhibit 1.1(A) (“Closing Statement”).

2.5.2 The Seller shall have a period of thirty (30) days to review the Closing Statement. During such 30-day period, Buyer shall provide reasonable access to all accounts and information necessary for Seller to complete such review. The Seller shall notify the Buyer within such period whether or not the Seller agrees with the

Closing Statement. If the Seller does not notify the Buyer within thirty (30) days of delivery of the Closing Statement then the Seller shall be deemed to have agreed to the Closing Statement with no reservations.

2.5.3 If the Seller agrees with the Buyer’s calculation of the Closing Purchased Net Asset, the Purchase Price shall be adjusted as follows:

(i) if the Closing Purchased Net Asset is greater than the number resulting from the Estimated Purchased Net Asset, the Buyer shall pay to the Seller an amount equal to such excess; and

(ii) if the Closing Purchased Net Asset is lower than the Estimated Purchased Net Asset, the Seller shall pay to the Buyer an amount equal to such shortfall.

The amount resulting from the calculations set forth in this Section 2.5.3, the “Purchase Price Adjustment”. The Purchase Price Adjustment shall be presented in Brazilian Reais and, for reference purposes only, shall be converted into USD based on the Brazilian Central Bank exchange rate (PTAX) calculated based on the average of the PTAX buy rate and sell rate published by the Brazilian Central Bank one business day immediately prior to the date of the Closing Statement.

2.5.4 If the Seller disagrees with the Buyer’s calculation of the Closing Purchased Net Asset, the Seller shall notify the Buyer in writing within thirty (30) days after they have received the Closing Statement. Such notice shall specify in detail the nature of the objections and include specific proposals for adjustment of each disputed item in the draft calculations.

(i) If the Seller notifies the Buyer of any objections to the draft calculations of the Closing Purchased Net Asset, the Buyer and the Seller shall attempt to resolve their disagreement within twenty (20) Business Days. If they fail to do so, the Seller shall request the Independent Auditor to resolve the matter. In this case, the Independent Auditor shall be engaged within up to thirty (30) Business Days as from the end of the term set out above for the Parties to try to resolve their disagreement.

(ii) Each Party shall use its commercially reasonable efforts to provide the Independent Auditor with the work papers and other documents and information concerning the disputed items as the Independent Auditor may reasonably request. The Independent Auditor shall have access to the Company’ books and records and shall have access to interview relevant managers and employees of the Seller, the Buyer and the Company during working hours with at least forty-eight (48) hours prior notice.

(iii) The Independent Auditor shall apply the rules set out in Exhibit 1.1(A). The Independent Auditor shall review the objections made and proposed amendments, if any, and shall decide on the disputed items and determine the Closing Purchased Net Asset. The Closing Purchased Net Asset determined by the Independent Auditor shall be final and binding upon the Parties, except in case of manifest error or if the dispute concerns a legal issue. The Independent Auditor shall deliver its decision to the Parties no later than thirty (30) Business Days after having been appointed. Without

limitation to Section 12.2 of this Agreement, the Parties elect the Independent Auditor and the provisions of Section 2.5 as the sole arbitrator and dispute mechanic of the Purchase Price Adjustment, except as expressly provided in this Section.

(iv) The Party (i.e., either the Buyer or the Seller – acting jointly) that does not prevail in the dispute shall bear and pay all of the fees, costs and expenses of the Independent Auditor. For purposes of determining which Party has prevailed, the prevailing Party shall be the Party that provided the closest amount of the unresolved items to the amount provided by the Independent Auditor in relation thereto. The Parties shall bear their respective expenses incurred in relation to this matter, including the fees and costs of their own accountants and advisors engaged to assist them.

2.5.5 Payment of the Purchase Price Adjustment

(i) If the Seller agrees with the Buyer calculation of the Closing Statement, the Purchase Price Adjustment shall be paid within ten (10) Business Days as of the date on which the Purchase Price Adjustment is agreed by the Parties; and/or

(ii) If the Seller disagrees with the Buyer’s calculation of the Closing Statement, the Purchase Price Adjustment shall be paid within ten (10) Business Days as of the date on which the Purchase Price Adjustment is determined in accordance with Section 2.5.4 above, provided that if the Purchase Price Adjustment is owed by (a) the Buyer to the Seller, such payment shall be made to the Seller to the bank accounts into which the Purchase Price was paid and (b) the Seller to the Buyer, (x) the Buyer will deduct the amount owed by the Seller to the Buyer from the Escrow Amount, subject to the provisions of Section 2.4 and provided that the Escrow Account has sufficient balance; or (y) the Seller shall pay the Buyer pursuant to Section 1.2.6(ii).

2.5.6 Release

Upon receipt of the payment of the Purchase Price Adjustment into its bank account as set forth herein, such Party shall be deemed to have given to other Party an automatic, full, general, irrevocable and irreversible release, in whatever context, whether in court or out of court, in relation to the payment of the Purchase Price Adjustment.

2.6 Accounts Receivable Adjustment

2.6.1 Adjustment to the Accounts Receivable

On the ninety fifth (95) day after the Closing Date, the Buyer shall prepare and deliver to the Seller (i) a statement that sets forth the Net Accounts Receivable on the ninety (90) day after the Closing Date ("90th Day Net Accounts Receivable”), using the same calculation method applied to the calculation of the Net Accounts Receivable of the Closing Date as set forth in Exhibit 1.1(A); and (ii) the supporting documentation (“Accounts Receivable Statement”).

2.6.2 The Seller shall have a period of thirty (30) days to review the Accounts Receivable Statement. During such 30-day period, Buyer shall provide reasonable access to all

accounts and information necessary for Seller to complete such review. The Seller shall notify the Buyer within such period whether or not the Seller agrees with the Accounts Receivable Statement. If the Seller does not notify the Buyer within thirty (30) days of delivery of the Accounts Receivable Statement then the Seller shall be deemed to have agreed to the Accounts Receivable Statement with no reservations.

2.6.3 If the Seller agrees with the Buyer’s calculation of the Accounts Receivable Adjustment, the Closing Net Accounts Receivable, as adjusted by the Purchase Price Adjustment ("Closing Net Accounts Receivable”), shall be adjusted as follows:

(i) if the 90th Day Net Accounts Receivable is greater than the number resulting from the Closing Net Accounts Receivable, the Buyer shall pay to the Seller an amount equal to such excess; and

(ii) if the 90th Day Net Accounts Receivable is lower than the Closing Net Accounts Receivable, the Seller shall pay to the Buyer an amount equal to such shortfall.

The amount resulting from the calculations set forth in this Section 2.6.3, the “Accounts Receivable Adjustment”. The Accounts Receivable Adjustment shall be presented in Brazilian Reais and, for reference purposes only, shall be converted into USD based on the Brazilian Central Bank exchange rate (PTAX) calculated based on the average of the PTAX buy rate and sell rate published by the Brazilian Central Bank one business day immediately prior to the date of the Accounts Receivable Statement.

2.6.4 If the Seller disagrees with the Buyer’s calculation of the 90th Day Net Accounts Receivable, Seller’s shall notify the Buyer in writing within thirty (30) days after they have received the Accounts Receivable Statement. Such notice shall specify in detail the nature of the objections and include specific proposals for adjustment. If the Seller notifies the Buyer of any objections to the draft calculations of the 90th Day Net Accounts Receivable, the Buyer and the Seller shall attempt to resolve their disagreement within twenty (20) Business Days. If they fail to do so, the Parties shall follow the same procedure and deadlines set forth in Section 2.5.4 in order to resolve the dispute over the Accounts Receivable Adjustment. In addition, the Independent Auditor engaged in resolving the dispute over the Closing Purchased Net Asset could be engaged to resolve the dispute over the Accounts Receivable Adjustment.

2.6.5 Notwithstanding the above, if the Parties have not agreed upon the Closing Net Accounts Receivable amount on the date the Accounts Receivable Statement is delivered to the Seller as a result of the Purchase Price Adjustment discussions provided for in Section 2.5 above, the deadlines provided for in this Section 2.6 shall be counted as of the date Closing Net Accounts Receivable amount is determined in accordance with Section 2.5.

2.6.6 Payment of the Accounts Receivable Adjustment

(i) If the Seller agrees with the Buyer calculation of the Accounts Receivable Statement, the Accounts Receivable Adjustment shall be paid within ten

(10) Business Days as of the date on which the Accounts Receivable Adjustment is agreed by the Parties; and/or

(ii) If the Seller disagrees with the Buyer’s calculation of the Accounts Receivable Statement, the Accounts Receivable Adjustment shall be paid within ten (10) Business Days as of the date on which the Accounts Receivable Adjustment is determined in accordance with Section 2.6.4, provided that if the Accounts Receivable Adjustment is owed by (a) the Buyer to the Seller, such payment shall be made to the Seller to the bank accounts into which the Purchase Price was paid and (b) the Seller to the Buyer, (x) the Buyer will deduct the amount owed by the Seller to the Buyer from the Escrow Amount, subject to the provisions of Section 2.4 and provided that the Escrow Account has sufficient balance; or (y) the Seller shall pay the Buyer pursuant to Section 1.2.6(ii).

2.6.7 Release

Upon receipt of the payment of the Accounts Receivable Adjustment into its bank account as set forth herein, such Party shall be deemed to have given to other Party an automatic, full, general, irrevocable and irreversible release, in whatever context, whether in court or out of court, in relation to the payment of the Accounts Receivable Adjustment.

2.7 Transactional Taxes and Costs

Each Party shall be solely responsible for the timely payment of any costs and/or applicable Taxes that are charged to such Party, including Taxes on revenues, income, gain and similar Taxes arising out of or in connection with the transactions contemplated hereby (collectively, “Transactional Taxes”) and such Party shall:

(i) file all necessary Tax Returns and other documentation with respect to the Transactional Taxes for which it is responsible; and

(ii) indemnify, defend and hold the other Party harmless with respect to any Losses incurred in connection with the Transactional Taxes or the related Tax obligations, returns and other requirements for which such Party is responsible.

3 Closing and Closing Actions

3.1 Closing

3.1.1 The consummation of the transactions contemplated in this Agreement (“Closing”) occurs on this date (“Closing Date”).

3.1.2 The Closing shall take place remotely, or at another location previously agreed by the Parties.

3.2 Closing Actions

On the Closing Date, subject to the terms and conditions herein, the Parties shall perform and/or shall cause their Affiliates to perform the following actions:

(i) the Buyer transfers, and the Seller receives, the Purchase Price in accordance with Section 2.3.1;

(ii) the Parties executes the amendment to the articles of association of the Company, transferring the Quotas from the Seller to the Buyer, accepting the resignation of the current officers of the Company appointed by Seller, approving the election of the new officers of the Company and approving the new wording of the Company’s articles of association (“Amendment to the AoA”);

(iii) the Parties execute the Escrow Agreement;

(iv) the Company, VDBN, Seller and Ferragens Negrão execute the transition services agreement (“Transition Services Agreement”);

(v) the Company and Ferragens Negrão execute the supply agreement ("Supply Agreement”);

(vi) the Seller delivers to the Buyer a copy of a quotaholder’s resolution of the Company, duly registered with the applicable commercial registry approving the management accounts, financial statements and the allocation of the results of the five (5) fiscal years prior to the Closing Date;

(vii) the Seller delivers to the Buyer evidence of the transfer of the domain name <wd40.com.br> to the Company;

(viii) the Seller delivers to the Buyer evidence of the revocation of the powers of attorney listed in Exhibit 4.10, except for the powers of attorney listed in items 2, 3 and 7;

(ix) the Seller delivers to the Buyer the power of attorney granted by the Company to the individuals indicated by the Buyer;

(x) the Seller delivers to the Buyer the insurance policy related to Seller’s indemnification obligation;

(xi) the Seller delivers to the Buyer the Seller’s corporate approval approving the Transaction;

(xii) the Seller delivers to the Buyer evidence of the dismissal and all severance payment foreseen by Law to the Company’s officer, Mr. Carlos Pascoal Bordoni; and

(xiii) the Sellers delivers to the Buyer the Company’s bank extracts of one or more bank accounts in the name of the Company, indicating an aggregate balance not less than one million Brazilian Reais (R$ 1,000,000.00).

3.3 Actions after Closing

3.3.1 After Closing, the Parties shall take all appropriate action and execute any documents or instruments of any kind that may be reasonably necessary to give effect to the transactions contemplated in this Agreement and in the other Transaction Documents. The Seller undertakes to sign all corporate documents and forms in connection with filing of the Amendment to the AoA as soon as reasonably possible in order for the Buyer to provide the respective filing of the Amendment to the AoA with the relevant commercial registry, within thirty (30) days from the Closing Date.

3.3.2 The Parties agree that the insurance policy premium set forth in Section 3.2(x) was paid by Seller on March 1, 2024 and shall be reimbursed by Buyer to the Seller after five (5) years as of March 1, 2024 (i.e. March 1, 2029), adjusted by the CDI

Index between March 1, 2024 and the date of payment, provided that the ICMS Contingency does not materialize until March 1, 2029.

3.4 Simultaneous Actions

All actions listed in Section 3.2 shall be deemed simultaneous, provided that no action and/or obligation shall be deemed to have been effectively carried out until all the other actions and/or obligations have been completed, except if the Parties agree otherwise or if otherwise provided in this Agreement.

4 Representations and Warranties of the Seller

The Seller represents and warrants to the Buyer that the following statements are true, accurate and complete on the date of this Agreement, and shall continue to be true, accurate and complete until and including the Closing Date (“Seller’s Warranties”).

4.1 Representations and Warranties Regarding Seller

4.1.1 Organization, Qualification and Corporate Power

The Seller is validly existing and duly incorporated under the Laws of Brazil and is in good standing with all relevant Governmental Authorities located in each jurisdiction in which it has offices, branches, or conducts business, in compliance with all relevant applicable Laws.

4.1.2 Capacity, Legitimacy and Authorization

The Seller has full power, capacity and authority, and has taken all required corporate and other action necessary to execute and deliver this Agreement and the Transaction Documents, and to fulfill its obligations hereunder to consummate all transactions contemplated by this Agreement and the other Transaction Documents. The execution, delivery and performance of this Agreement, the Transaction Documents and of all other documents required to be executed and delivered by the Seller, have been duly authorized by Seller and its corporate bodies.

4.1.3 Enforceability

This Agreement, and each of the Transaction Documents to which the Seller is a party, has been duly executed and delivered by the Seller, and (assuming due authorization, execution and delivery by the other Parties hereto) constitutes a legal, valid and binding obligation, enforceable against the Seller in accordance with its terms.

4.1.4 No Conflicts and/or Consents

(i) The execution, delivery and performance by the Seller of this Agreement and any Transaction Documents to which it is a party do not, and the consummation of the transactions contemplated hereby and thereby and compliance by Seller with the terms hereof and thereof shall not:

(a) conflict with, violate or result in breach of any provision of any organization document (e.g., articles of association) of the Seller;

(b) conflict with or violate any Law or Governmental Order applicable to the Seller;

(c) conflict with, result in any breach of, constitute a default (or event which with the giving of notice or lapse of time, or both, would become a default) under, require any consent under, or give to others any rights of termination, amendment, acceleration, suspension, revocation or cancellation of any material instrument, commitment or agreement entered into by the Seller or the Company; nor

(d) result in the creation of any Encumbrance or limitation in the capacity of the Seller to dispose of its properties and assets.

(ii) No Third-Party’s Consent is required to be obtained or made by or with respect to the Seller in connection with the execution, delivery and performance of this Agreement or the Transaction Documents or the consummation of the transactions contemplated hereby or thereby.

4.1.5 Ownership of Quotas

The Seller is the lawful owner of the Quotas and the Quotas are free and clear from any and all Encumbrances.

4.1.6 No Brokerage Fees

Neither the Buyer nor the Company shall have directly or indirectly any responsibility, liability or expense, as a result of undertakings or agreements of the Seller for brokerage fees, finder’s fees, agent’s commissions or other similar forms of compensation in connection with the Transaction or the Transaction Documents.

4.2 Representations and Warranties regarding the Company

4.2.1 Organization, Qualification and Corporate Power

The Company is validly existing, duly incorporated under the Laws of Brazil, and is in good standing with all relevant Governmental Authorities located in each jurisdiction in which it has offices, branches, or conducts business, in compliance with all relevant applicable Laws, and has all requisite corporate power and authority to possess, own and operate, as owner, lessee or at any other title, the relevant assets and properties currently possessed or owned, as well as carry on the businesses of the Company as now conducted.

4.2.2 Capacity, Legitimacy and Authorization

The Company has full power, capacity and authority, and has taken all required corporate and other actions necessary to execute and deliver this Agreement and the Transaction Documents, and to fulfil its obligations hereunder, and to consummate all transactions contemplated by this Agreement and the other Transaction Documents. The execution, delivery and performance of this Agreement, the Transaction Documents and of all other documents required to be executed and delivered by the Company, have been duly authorized by the Company and its corporate bodies.

4.2.3 Enforceability

This Agreement, and each of the Transaction Documents to which the Company is a party, has been duly executed and delivered by the Company, and (assuming due authorization, execution and delivery by other parties hereto) constitutes a

legal, valid and binding obligation, enforceable against the Company in accordance with its terms.

4.2.4 No Conflicts and/or Consents

(i) The execution, delivery and performance by the Company of this Agreement and the Transaction Documents do not, and the consummation of the transactions contemplated hereby and thereby and compliance by the Company with the terms hereof and thereof shall not:

(a) conflict with, violate or result in breach of any provision of any organization document (e.g., articles of association) of the Company;

(b) conflict with or violate any Law or Governmental Order applicable to the Company;

(c) conflict with, result in any breach of, constitute a default (or event which with the giving of notice or lapse of time, or both, would become a default) under, require any consent under, or give to others any rights of termination, amendment, acceleration, suspension, revocation or cancellation of any Material Contract entered into by the Company; nor

(d) result in the creation of any Encumbrance or limitation in the capacity of the Company to dispose of its properties and assets.

(ii) No Third-Party’s Consent is required to be obtained or made by or with respect to the Company in connection with the execution, delivery and performance of this Agreement or the Transaction Documents or the consummation of the transactions contemplated hereby and thereby.

4.2.5 Subsidiaries

The Company does not hold any interests in any Person.

4.2.6 Branches

The Company has a branch located in the City of Garuva, State of Santa Catarina, located at Rodovia Contorno Sul de Garuva Sidney Pensky, No. 8661, Room A, Palmital, Zip Code 89.248-000 which, since its opening, has never been operational.

4.2.7 Share Capital

The share capital of the Company is fifteen million, four hundred thousand Brazilian Reais (R$ 15,400,000.00), divided into one million, five hundred and forty thousand (1,540,000) quotas, registered and with par value of ten Brazilian Reais (R$ 10.00) each, fully subscribed and paid, and free and clear of any Encumbrances, held by the Seller.

4.2.8 Securities and Other Rights/Agreements

(i) All of the issued Quotas of the Company are duly authorized, validly issued and fully paid and were not issued in violation of any pre-emptive or other rights. The Quotas represent 100% (one hundred percent) of the total share capital (and total voting share capital) of the Company.

(ii) There are no securities, stock option agreements, contractual obligations or outstanding obligations which may result in the issue of new quotas by the Company nor options, warrants, calls, rights, contracts or commitments of any kind to which any of Seller or the Company is a party or by which any of them are bound:

(a) obligating Seller or the Company to issue, deliver or sell, pledge, grant a security interest on or encumber any equity interests of the Company; or

(b) obligating Seller or the Company to grant, extend or enter into any such option, warrant, call, right, contracts or commitment.

(iii) Upon Closing, the Buyer shall have full legal and beneficial title to the Quotas free and clear of any Encumbrances.

4.2.9 Dividends

There is no dividend, interest on net equity (juros sobre o capital próprio) or any other remuneration due to Seller or any other Person which has been declared by the Company or is pending payment.

4.2.10 Financial Statements

(i) Exhibit 4.2.10(i) contains a materially true, accurate and complete copy of the financial statements as of December 31, 2023 and the balance sheet of January 31, 2024 (the “Financial Statements”). The Financial Statements have been prepared in accordance with Brazilian GAAP applied on a consistent basis throughout the periods indicated and with each other.

(ii) The Financial Statements fairly present in all material respects the state of affairs, financial condition, assets and liabilities as well as operating results of the Company as of the dates, and for the periods, indicated therein. Except as set forth in the Financial Statements, the Company has no material liabilities or obligations, contingent or otherwise, other than (i) liabilities incurred in the Ordinary Course of Business and (ii) obligations under contracts and commitments incurred in the Ordinary Course of Business and not required under Brazilian GAAP to be reflected in the Financial Statements, which, in both cases, individually or in the aggregate, are not material to the financial condition or operating results of the Company. Except as disclosed in the Financial Statements, the Company is no guarantor or indemnitor of any indebtedness of any other person or entity.

4.2.11 Books and Records

The Company has and is in possession of all its relevant accounting books and records required by Law, all of which, in all material respects, are in good condition and in accordance with Brazilian GAAP and applicable Law.

4.2.12 Absence of Undisclosed Liabilities

To the best of Seller’s knowledge, there are no Liabilities of the Company other than:

(i) the Liabilities incurred as provided in connection with this Agreement or the other Transaction Documents; or

(ii) material Liabilities reflected or reserved against in the Financial Statements or disclosed in the notes thereto.

4.3 Inventory

In all material aspects, all inventories related to the Company’s Businesses are duly recorded in the Company’s accounting books and records according to Brazilian GAAP, to the applicable Laws and the past accounting practices of the Company, consistently applied, and are in good quality condition and fit for use or sale during the Ordinary Course of Business, taking into consideration the wear and tear arising from normal use.

4.4 Accounts Receivable

All of the Company’s accounts receivables for sales and not collected are duly reflected in its Financial Statements pursuant to Brazilian GAAP and to applicable Laws, and are appropriately documented in order to permit regular collection.

4.5 Conduct of Business

Since July 10, 2023:

(i) the Company has conducted its operations in the Ordinary Course of Business, pursuant to its past practices and in material compliance of the applicable Laws, and is not and has not been in material breach of any such Laws;

(ii) there has been no relevant change to accounting practices, record-keeping policies, or to the terms and conditions according to which the Company operates its businesses and renders its services or delivers its products to customers, clients and/or Affiliates, other than as provided or permitted by the applicable Laws;

(iii) except to the Exhibit 4.5(iii), the Company has not assumed any obligation or liability or made any payments greater than in excess of one hundred thousand Brazilian Reais (R$ 100,000.00); and

(iv) there has been no Material Adverse Effect.

4.6 Assets and Business

4.6.1 The Financial Statements lists all of the relevant assets owned or possessed by the Company used for the conduct of Company’s Business.

4.6.2 The assets owned or possessed by the Company are all material assets used in the performance of the Company’s Business.

4.7 Material Contracts

4.7.1 Exhibit 4.7.1 lists all the Material Contracts of the Company.

4.7.2 Any and all of the Material Contracts shall be valid and in force on the Closing in the substantially the same terms that exist as of the date hereof.

4.7.3 The Company is not a party to any Material Contract in force under which, as a direct result of the entry into and performance of the Transaction Documents:

(i) any other party shall be entitled to be relieved of any obligation or become entitled to exercise any right (including any termination or pre-emption right or other option); or

(ii) the Company shall be materially in default; or

(iii) the Company is committed for capital expenditures or the acquisition of fixed assets.

4.8 Sales Representative Agreements

4.8.1 Exhibit 4.8 lists all the sales representative agreements of the Company.

4.8.2 Any and all of the sales representative agreements shall be valid and in force on the Closing in substantially the same terms that exist as of the date hereof.

4.8.3 The terms and conditions, including the commission payment terms, of the sales representative agreements comply with the applicable Law.

4.8.4 The Company is not a party to any sales representative agreement in force under which, as a direct result of the entry into and performance of the Transaction Documents, any sales representative shall be entitled to be relieved of any obligation or become entitled to exercise any right (including any termination).

4.8.5 The Company has not received any summon of Claim or been notified of a potential Claim against the Company by a sales representative.

4.9 Governmental Subsidies

The Company is not subject to any arrangements for receipt or repayment of any grant, subsidy or financial assistance from any government department or other body.

4.10 Powers of Attorney

All material powers of attorney in effect granted by the Company which contain powers to operate bank accounts, dispose of assets, hire employees and/or assume obligations of any kind on behalf of the Company or to represent the Company in court, out of court or towards Governmental Authorities are listed in Exhibit 4.10.

4.11 Defaults

The Company has not received written notice in the twenty-four (24) months prior to the date of this Agreement stating that it is in default under any Material Contract to which it is a party.

4.12 Related Party

Neither the Seller nor any of its Affiliates have entered into any contract with the Company which is not set out in Exhibit 4.12. All of such contracts were entered into in the Ordinary Course of Business and, to the best of Seller’s knowledge, upon fair and reasonable terms which are no less favorable to the Company than would be obtained in a comparable arm’s length transaction with an entity that is not any of the Seller or its Affiliates.

4.13 Intellectual Property/Information Technology

4.13.1 Exhibit 4.13.1 contains a list of the items of relevant intellectual property necessary to the Ordinary Course of Business of the Company including, without limitation:

(i) patents, inventions, discoveries, processes, designs, techniques, developments, technologies and related enhancements, know-how and show-how, whether patented or patentable;

(ii) copyrights and works of authorship in any media, including hardware, software, applications and computer systems, mobile apps, networks, database, documentation and website contents on the internet;

(iii) trademarks, service marks, fictitious names, brands, corporate names, domain names, logos and trade dress;

(iv) trade secrets, drawings, blueprints and all proprietary or confidential information, documents or materials; and

(v) all registrations, applications and recordings in connection therewith, owned by or licensed to the Company (“Company’s Intellectual Property”),

(vi) which represent the intellectual property licensed or owned by the Company in connection with Company’s Business.

4.13.2 The Company owns or license all rights, title and interest in the Company’s Intellectual Property, free and clear of any material restrictions or licenses, or any Encumbrances.

4.13.3 The Company has not received prior to the date of this Agreement any summon of any Claims against the Company challenging the ownership of or encumbered right to use any of the Company’s Intellectual Property.

4.13.4 To the best of Seller’s knowledge, the operation of the Company’s Business and the Company’s Intellectual Property do not infringe or misappropriate any intellectual property rights of third parties and no third party is infringing or misappropriating any of the Company’s Intellectual Property. No proceeding alleging the foregoing is against the Company and, to the best of Seller’s knowledge, pending against the Company and the Company has not received prior to the date of this Agreement any Claims alleging that any of the Company’s Intellectual Property infringes any rights of any third parties that would adversely affect the business of the Company or sent a written notice alleging that a third party is infringing the Company’s Intellectual Property.

4.13.5 The Company’s Intellectual Property shall be owned and available for use by the Company on the same terms in all material respects on the Closing as if such items were owned and available for use by the Company on the date hereof.

4.13.6 The IT systems of the Company are in working conditions, normal wear and tear excepted, and have been properly maintained and have prior to the date of this Agreement not failed to any material extent, and the data that they process has not been corrupted to any material extent.

4.13.7 The Company is in compliance with the requirements for data protection set forth in the LGPD in all material respects and has not received any Claim alleging it has not complied with the LGPD.

4.14 Product Liability

4.14.1 The Company has not received any Claim relating to nor, to the best of Seller’s knowledge, there are any facts or circumstances that would reasonably be

expected to give rise to, any Claim involving any service provided or any product designed, manufactured, serviced, produced, modified, distributed or sold by or on behalf of the Company resulting from an alleged defect in design, manufacture, materials, workmanship or performance, or any alleged failure to warn, or from any alleged breach of implied representations or warranties, or any alleged non-compliance with any applicable Laws.

4.14.2 There has been no product recall, rework or post-sale warning or similar action conducted by the Company with respect to any product designed, manufactured, serviced, produced, modified, distributed or sold by or on behalf of the Company, or any investigation or consideration made by any director, officer or key employee thereof concerning whether to undertake or not undertake any recall.

4.15 Real Estate

4.15.1 Exhibit 4.15.1 lists all real properties used, leased or licensed by the Company to conduct the Company’s Business in the Ordinary Course of Business (“Real Estate Assets”).

4.15.2 All Real Estate Assets have good title and are free and clear of any Encumbrances. To the best of Seller’s knowledge, none of the Real Estate Assets violates any property right, right of use, right of registration, eminent domain, easement or any applicable Law to zoning, neighbourhood, construction or use of land. To the best of Seller’s knowledge, none of the Real Estate Assets is subject to any Claims, disputes, or ongoing lawsuit (judicial or administrative), including expropriation procedure. The Seller and the Company have not been notified of any ongoing preservation and protection process (processo de tombamento) involving the Real Estate Assets by cultural and historical patrimony Governmental Authorities, and, to the best of Seller’s knowledge, none of the Real Estate Assets are located inside or close to special zones of cultural preservation nor environmental preservation and no activity with risk of environmental, health and/or soil contamination was or is currently carried out in the Real Estate Assets, such as sanitary landfill, storage of radioactive or chemical products, areas of chemical product handling, hazardous waste disposal, pesticides handling, cemetery, hospitals, gas stations or mining areas.

4.15.3 All Taxes levied on the ownership of the Real Estate Assets have been timely paid.

4.16 Insurance

4.16.1 Exhibit 4.16.1 contains a list of all insurance policies of the Company, or contracted by an Affiliate of the Company in which the Company is beneficiary.

4.16.2 The Company has subscribed to all insurance policies required pursuant to applicable Law. To the best of Seller’s knowledge, such policies are with financially sound and reputable insurance companies, in amounts, with such deductibles and covering such risks. Such insurances are all in full force and effect and the Company has paid the insurance premiums relating thereto.

4.16.3 Neither the Company nor the Seller has received written notice of cancellation of any such insurance or refusal of coverage thereunder. Completion of the Transaction shall not invalidate any insurance policy or give the provider of any insurance policy the right to terminate the policy.

4.16.4 The Company has not received any summon of Claim or been notified of a potential Claim against the Company and to the best of Seller’s knowledge, there are no Claims and there are no pending Claims with respect to any of such insurance policies which are reasonably likely to exceed the amount of coverage provided by the applicable policy.

4.17 Environmental

4.17.1 The Company is in material compliance with all relevant Environmental Laws and has conducted in all material respects its business in accordance with all Environmental Laws.

4.17.2 The Company has not received any summon of Claim or been notified of a potential Claim against the Company and to the best of Seller’s knowledge, there are no Claims or there are no proceedings pending against the Company with respect to any breach of Environmental Laws.

4.17.3 The Company has not received any written statutory complaints or statutory notices alleging or specifying any breach of or liability under any Environmental Laws.

4.17.4 All environmental consents required by the Company have been obtained and are being complied with in all material respects and are in full force and effect.

4.18 Employment

4.18.1 Except to Exhibit 4.18.1, the Company is in material compliance with all employment agreements and applicable labor Laws, including, but not limited to, employment contracts, management contracts, employment practices, salaries, wages and working hours regulations, severance payments, social security contributions and collective bargaining.

4.18.2 The Company is in compliance with all Laws on the Mandatory Fund for Unemployment Benefit (Fundo de Garantia por Tempo de Serviço – FGTS) and has timely paid in full all its contributions due under such scheme.

4.18.3 Each of the Company’s workers are duly registered as an employee in the registry documents (including employees’ book and professional booklet), together with his/her corresponding salary and benefits, all in full compliance with applicable Laws and regulations.

4.18.4 The Company is not a party to or bound by any other collective bargaining agreement or agreement of any kind with any union or labour organization, and there is no individual or collective agreement with its respective employees, officers or directors for the payment of any severance or other benefits other than those provided for by Law or in a collective bargaining agreement.

4.18.5 The Company has not changed or agreed to change in any way employment policies, including those applicable to increase salary, deferred compensation, fringe benefits, severance pay plans or retirement plans related to employees, directors and/or officers, other than in order to comply with applicable regulations or collective bargaining agreements.

4.18.6 No key employee of the Company has given, or, to the best of Seller’s knowledge, threatened to give notice of termination of his/her employment or engagement.

4.18.7 The Company has not, during the last two (2) years, illegally outsourced their activities or outsourced activities beyond the constraints in Law, and, therefore, has no relationship of subordination with any outsourced employee nor with any of the employees, personnel or staff of its services providers.

4.18.8 The Company has not been involved, during the last two (2) years, in any strike, lock-out or work stoppages with any of the unions representing the Company’s employees within the entire Brazilian territory.

4.18.9 The Company’s labour practices do not involve, nor has been involved since the date of its incorporation in, practices of discrimination, child labour, allegations of slavery work, moral or sexual harassment, reduction in employees’ remuneration, salaries or benefits.

4.18.10 The Company is not party to or bound by any agreement, arrangement or scheme under which it has obligation to pay or make provision for payment of any pension on the retirement of any past or present officers, directors or employees.

4.18.11 The Company has not received any summon of Claim and is not involved in any Claim, to the best of Seller’s knowledge, is not involved in any investigation by any labour authority, and has not in the last five (5) years or the maximum time period allowed under the relevant statute of limitation been the subject of any Claim, or, to the best of Seller’s knowledge, investigation by, any Governmental Authority.

4.19 No Partnerships

The Company is not a member of any partnership, joint venture or consortium.

4.20 Litigation

4.20.1 Except for Exhibit 4.20.1, there are no Claims by or against the Company or Seller or any Affiliates thereof relating to the Company’s Business and/or the Company, or affecting the Company or the Company’s Business pending before any Governmental Authority (or, to the best of Seller’s knowledge, threatened to be brought by or before any Governmental Authority).

4.20.2 To the best of Seller’s knowledge, neither the Company’s Business nor any of its assets is subject to any Governmental Order (nor, to the best of Seller’s knowledge, are there any such Governmental Orders threatened to be imposed by any Governmental Authority).

4.21 Insolvency and Bankruptcy

4.21.1 The Company is not insolvent or bankrupt under the Laws of Brazil or, to the best of Seller’s knowledge, is liable to any arrangement (whether by court process or otherwise) under which its creditors (or any group of them) would receive less than the amounts due to them, and is able to pay its debts as they fall due.

4.21.2 There are no Claims in relation to any compromise or arrangement with creditors or any winding up, bankruptcy or insolvency proceedings concerning the Company and no events have occurred which would justify such proceedings.

4.21.3 To the best of Seller’s knowledge, no order has been made, petition presented, resolution passed or meeting convened, by the Seller or the Company for the winding up, judicial restructuring or out-of-court restructuring of the Company or for the appointment of an administrator or provisional judicial administrator to them.

4.22 Directors, Officers and Managers

4.22.1 None of the members of the management of the Company has been convicted of any criminal offence or been subject to any criminal proceedings which would prevent them from engaging in commercial activities.

4.22.2 Each of the Company’s directors, officers and managers is duly registered as an employee in the registry documents (including employees’ book and professional booklet), together with his/her corresponding salary and benefits, in material compliance with applicable Laws.

4.22.3 None of the directors, officers or managers of the Company has been subject to any other legal or regulatory proceedings in relation to his/her role as a director, officer or manager of the Company.

4.23 Investigations

The Company has not received written notice or, to the best of Seller’s knowledge, been a party to a written notice indirectly received in the twenty-four (24) months prior to the date of this Agreement of any current or pending investigation or audit by a Governmental Authority.

4.24 Licenses and Permits

Exhibit 4.24 sets out each license, permit and authorization that is material to the Company or the Company’s Business. All such licenses, permits and authorizations are valid, in full force and effect and shall continue after Closing on substantially the same terms that are existing as of the date hereof, and the Company is in compliance therewith in all respective material aspects. All such licenses, permits and authorizations have been obtained with proper means and in full compliance with applicable Law. The implementation of the Transaction shall not cause any breach or result in the cancellation, revocation, modification or termination of any such licenses, permits or authorizations.

4.25 Compliance

4.25.1 The Company has conducted its business and corporate affairs in all material respects in accordance with its articles of association.

4.25.2 The Company has conducted its business and corporate affairs in compliance with the applicable local content requirements in all its material respects.

4.25.3 To the best of Seller’s knowledge, there has been no default by the Company under any order, decree, award or judgment of any court or arbitral tribunal or any governmental or regulatory authority in each jurisdiction in which it is incorporated or where its business is conducted which applies to it.

4.25.4 Neither Seller, nor the Company, nor any director, officer, employee or agent of any such Person (acting in such capacity), have in relation to the Company’s Business:

(i) induced any Person to improperly perform any business, employment or public function where such Person is in a position of trust regarding such function or where such Person would be expected to perform such function in good faith or impartially, or to reward any Person for any such improper performance;

(ii) made, paid, given, authorized (tacitly or otherwise), offered or promised to make any payment or gift to confer any financial or other advantage or to transfer of anything of value (whether directly, indirectly or through a Third Party), to or for the use or benefit of any Person with the intention of improperly influencing an official from a Governmental Authority and thereby obtaining or retaining business or a business advantage; or

(iii) made, authorized, offered or promised to make any unlawful bribe, facilitation payment, rebate, payoff, influence payment or kickback or has taken any other action that would violate any applicable Law that relates to bribery or corruption, including the OECD Convention on Combating Bribery of Foreign Public Officials in International Business Transactions, the United Nations Convention Against Corruption, or the Anti-Corruption Laws.

4.26 No Brokerage Fees

The Buyer shall not have directly or indirectly any responsibility, liability or expense, as a result of undertakings or agreements of the Seller, the Company or any of their Affiliates for brokerage fees, finder’s fees, agent’s commissions or other similar forms of compensation in connection with the Transaction or the Transaction Documents.

4.27 Taxes

Except as provided in Exhibit 4.27, the Company has:

(i) complied with all its Tax filing and payment obligations in all relevant aspects;

(ii) made all returns and disclosures, given all notices and supplied all other information required to be supplied to all relevant Tax Governmental Authorities; all such information, returns and notices were and remain complete, true and accurate in all material respects.

(iii) has kept and maintained and has available for inspection, complete and accurate records, invoices and other relevant information in relation to Tax as it is required by Tax Law to keep and maintain. Such records, invoices and information enable assessment of the relevant Tax liabilities in respect of the statute of limitation period of the applicable Tax prior to the date hereof of the Company to be calculated, and the Company has taken reasonable measures to ensure that it is in possession of sufficient information or has reasonable access to sufficient information to enable it and/or its officers, employees or representatives to compute its liability to Tax in all material respects and to substantiate in all material respects any claim made or position taken in relation to any Tax, in respect to the applicable statute of limitation period prior to the date hereof.

(iv) has complied, within applicable time limits, with all material notices served on it and any other requirements made of it by any Tax Governmental Authority.

(v) has not entered into any agreements with Governmental Authorities for the payment of late Taxes that remain outstanding;

(vi) in accordance with applicable Law, been duly registered with the Governmental Authorities and has, in all material respects, complied and shall continue to comply with all notification and other requirements imposed by such Law or such Governmental Authorities until the Closing;

(vii) sufficient credits, provisions and reserves for payment of Taxes due and not paid;

(viii) filed on time and in the correct form all required Tax declarations, preserved the supporting documents in relation to Taxes, made all Tax payments required, and properly answered any and all requests for clarification from the relevant Governmental Authorities;

(ix) except to Exhibit 4.27(ix), made all relevant provision in its accounts and management accounts as of January 2024 for all applicable Taxes (including deferred tax assets and deferred tax liabilities) in accordance with applicable Law and Brazilian GAAP;

(x) since July 10, 2023 and except in relation to any transaction contemplated by this Agreement, not been involved in any relevant transaction which has given rise to a liability to Tax other than Tax arising from transactions entered in the Ordinary Course of Business;

(xi) not been and is not involved in any current dispute with or any tax litigation with, and investigation by any Governmental Authorities, and has not in the last five (5) years or the maximum time period allowed under the relevant statute of limitation been the subject of any dispute with or any Tax litigation with, and investigation by any Governmental Authorities, including challenges by a Governmental Authority with respect to any Tax planning that could result in a Material Adverse Effect to the Company;

(xii) has duly and punctually complied with its obligations to deduct, withhold or retain amounts of or on account of Tax from any payments made by it and to account for such amounts to the relevant Tax Governmental Authority in all material respects and has complied in all material respects with all its reporting obligations to the relevant Tax Governmental Authority in connection with any such payments;

(xiii) has duly and punctually complied with its obligations relating to employment and payroll Taxation (including in relation to social security contributions, training scheme contributions and any similar amounts) payable to any Tax Governmental Authority in all its material respects;

(xiv) The amounts of PIS and COFINS tax credits available to the Company for use in taxable periods beginning after January 1, 2024 were R$ 66,088.25 and R$ 305,022.57, respectively, and, to the best of Seller’s knowledge, nothing has been done by or on behalf of the Seller or the Company on or before the date of this Agreement which might cause the cancellation, loss or non-availability to the Company of, or any reduction of, all or any material part of such PIS and COFINS tax credits, other than the utilization of any such CIT tax loss credits or PIS and COFINS tax credits in the ordinary course of business; and

(xv) been at all times resident for Tax purposes in Brazil and has not been treated as resident in any other jurisdiction for any Tax purpose (including any double taxation arrangement).

4.28 Guarantees and Indemnities

4.28.1 There is no guarantee, indemnity or security (whether secured or unsecured) given by the Company, or for its benefit, in respect of which obligations or liabilities are still outstanding.

4.28.2 The Company has not lent any money which has not been repaid, nor does it own the benefit of any debt (whether or not due for payment).

4.29 Only Representations and Warranties

Except for the representations and warranties set forth in Section 4, Seller does not make any other representation and warranty, express or implied, relating to Seller or the Company.

4.30 Exceptions Exhibits

The exceptions included related to a determined representation section or subsection of the Seller or the Company in a subsection of Section 4 shall be considered as an exception exhibit to any other representation section or subsection of the Seller or the Company in Section 4, without the need to make an express reference to such respective section or subsection and their respective exhibits.

5 Representations and Warranties of the Buyer

The Buyer represents and warrants to Seller that the following statements are true, accurate and complete as of the date of this Agreement, and shall continue to be true, accurate and complete until and including the Closing Date (“Buyer’s Warranties”).

5.1 Organization, Qualification and Corporate Power

The Buyer is validly existing, duly incorporated under the Laws of Brazil and is in good standing with all relevant Governmental Authorities located in each jurisdiction in which it has offices, branches, or conducts business, in compliance with all relevant applicable Laws, and has all requisite corporate power and authority to possess, own and operate, as owner, lessee or at any other title, the relevant assets and properties currently possessed or owned, as well as carry on the businesses of the Buyer as now conducted.

5.2 Capacity, Legitimacy and Authorization

The Buyer has full power, capacity and authority, and has taken all required corporate and other actions necessary to execute and deliver this Agreement and the Transaction Documents, and to fulfil its obligations hereunder, and to consummate all transactions contemplated by this Agreement and the other Transaction Documents. The execution, delivery and performance of this Agreement, the Transaction Documents and of all other documents required to be executed and delivered by the Buyer, have been duly authorized by the Buyer and its corporate bodies.

5.3 Enforceability

This Agreement, and each of the Transaction Documents to which the Buyer is a party, has been duly executed and delivered by the Buyer, and (assuming due authorization, execution and delivery by other parties hereto) constitutes a legal, valid and binding obligation, enforceable against the Buyer in accordance with its terms.

5.4 No Conflicts and/or Consents

5.4.1 The execution, delivery and performance by the Buyer of this Agreement and any Transaction Documents to which it is a party do not, and the consummation of the transactions contemplated hereby and thereby and compliance by the Buyer with the terms hereof and thereof shall not:

(i) conflict with, violate or result in breach of any provision of any organization document (e.g., articles of association) of the Buyer;

(ii) conflict with or violate any Law or Governmental Order applicable to the Buyer;

(iii) conflict with, result in any breach of, constitute a default (or event which with the giving of notice or lapse of time, or both, would become a default) under, require any consent under, or give to others any rights of termination, amendment, acceleration, suspension, revocation or cancellation of any material instrument, commitment or agreement entered into by the Buyer; nor

(iv) result in the creation of any Encumbrance or limitation in the capacity of the Buyer to dispose of its properties and assets.

5.4.2 No Third Party’s Consent is required to be obtained or made by or with respect to the Buyer in connection with the execution, delivery and performance of this Agreement or the consummation of the Transaction.

6 Indemnity

6.1 Indemnification Obligation

6.1.1 Indemnification by the Seller

Pursuant to Section 6.2 and subject to the limitations set out herein, the Seller shall indemnify, defend and hold the Buyer, its Affiliates and/or any of their Representatives, the Company (“Buyer’s Indemnified Parties”) harmless in respect of Losses incurred or suffered by a Buyer’s Indemnified Party (including any Claim brought or otherwise initiated by any of them) relating to, arising out of or resulting from:

(i) acts, facts, events or Liabilities related to the Company, the Company’s Business and any other of their businesses with triggering event on or prior to the Closing Date, disclosed in this Agreement, in its Exhibits, in the Financial Statements or in any of the Transaction Documents, and regardless of whether or not Seller, the Company, or the Buyer had previous knowledge about them or became aware of them at the date hereof or at a later date;

(ii) any breach of the obligations undertaken by Seller or the Company under this Agreement or the other Transaction Documents;

(iii) any misrepresentation, untruthfulness, inaccuracy or violation of any of the Seller’s Warranties; or

(iv) any acts, facts, events, omissions or Liabilities related to sales representatives of the Company with triggering event on or prior to the Closing Date.

6.1.2 Indemnification by the Buyer

Pursuant to Section 6.2, the Buyer shall indemnify and hold Seller, its Affiliates and/or any of its Representatives (“Seller’s Indemnified Parties”) harmless in respect of all Losses actually incurred or suffered by a Seller’s Indemnified Party (including

any Claim brought or otherwise initiated by any of them) relating to, arising out of or resulting from:

(i) any acts, facts, events, omissions or Liabilities related to sales representatives of the Company or the Transaction, with triggering event after to the Closing Date.

(ii) any breach of the obligations undertaken by the Buyer under this Agreement or the other Transaction Documents; or

(iii) any misrepresentation, untruthfulness, inaccuracy or violation of any of the Buyer’s Warranties.

6.2 Indemnification Procedure

6.2.1 General Rules

In the event of an indemnifiable Loss is effectively incurred, the Buyer’s Indemnified Parties or Seller’s Indemnified Parties, as the case may be (“Indemnified Parties”), shall deliver a Notice (“Indemnification Notice”) to the Seller or to the Buyer, as the case may be (“Indemnifying Party”), about such fact; provided that the indemnification Notice is delivered within the Survival Period.

6.2.2 Third Party Claims

(i) Pursuant to the terms and conditions set forth in Section 6.2.1, in the event the relevant Indemnified Party become aware or receive written notice of any acts, facts, events or businesses mentioned in Section 6.1, and arising from or relating to Claims by third parties (“Third-Party Claims”), which may result in Losses, the relevant Indemnified Party shall give notice to the Indemnifying Party with details of the Third-Party Claim, estimating the amount, if reasonably practicable, of the Loss that has been or may be sustained by the Indemnified Party (“Third-Party Claim Notice").