FALSE000010513200001051322024-03-042024-03-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________

FORM 8-K

__________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): March 4, 2024

WD-40 COMPANY

(Exact Name of Registrant as specified in its charter)

__________

| | | | | | | | | | | | | | |

| Delaware | | 000-06936 | | 95-1797918 |

(State or other jurisdiction of incorporation or organization) | | (Commission File Number) WD 40 CO (Commission Company Name) | | (I.R.S. Employer Identification Number) |

9715 Businesspark Avenue, San Diego, California 92131

(Address of principal executive offices, with zip code)

(619) 275-1400

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| o | Written Communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of exchange on which registered |

| Common stock, par value $0.001 per share | | WDFC | | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter)

Emerging Growth Company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act o

| | | | | |

| Item 1.01. | Entry into a Material Definitive Agreement. |

On March 4, 2024 (“Closing Date”), WD-40 Holding Company Brasil Ltda. (“Buyer”), a wholly-owned subsidiary of WD-40 Company (“Company”), acquired all of the issued and outstanding capital stock of Brazilian distributor, Theron Marketing Ltda. (“Theron”), from M12 Participações Empresarias S.A. (“Seller”) in a cash-for-stock transaction. The approximate purchase price of $6.9 million USD is subject to a 90-day post closing adjustment. Theron had been the exclusive distributor of WD-40® Brand products in Brazil for the last 27 years. The Quota Purchase Agreement of even date (“Agreement”) entered into by Buyer, Seller, and Theron included the following additional terms and conditions:

a. The establishment of an escrow account containing approximately $200,000 USD of the cash consideration to cover indemnifiable losses, if any, with the balance to be released to Seller on the second anniversary of the Closing Date,

b. The purchase of an insurance bond or policy by Seller to cover certain taxes for which Seller agreed to indemnify Buyer,

c. A three-year non-competition provision, and

d. A one-year non-solicitation provision.

In connection with this acquisition, Theron signed a three-year Transition Services Agreement (“TSA”) with VDBN Representações Comerciais Ltda., a related party of Seller, for logistics and related services, for which the minimum fees total approximately $2.1 million USD.

The foregoing descriptions of the terms of the Agreement and TSA do not purport to be complete and are qualified in their entirety by reference to the full text of the Agreement and TSA, copies of which are expected to be filed on or before March 8, 2024 as exhibits to an amendment to this Current Report on Form 8-K.

| | | | | |

| Item 7.01. | Regulation FD Disclosure. |

On March 4, 2024, the Company issued a press release announcing the acquisition of Brazilian distributor, Theron Marketing Ltda., by its Brazilian subsidiary, WD-40 Holding Company Brasil Ltda. The Company also announced that it will share additional details of this acquisition with investors when its results for the second fiscal quarter of 2024 are reported, which are expected to be released on April 9, 2024.

The full text of the press release is furnished herewith as Exhibit 99.1 and is incorporated by reference into this Item 7.01.

The information in Item 7.01, including Exhibit 99.1, is not deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section and is not deemed incorporated by reference into any of the Company’s filings under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits. |

| |

| (d) | Exhibits |

| |

| Exhibit No. | Description |

| |

| 99.1 | |

| 104 | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| WD-40 Company |

| |

| (Registrant) |

| |

| Date: March 4, 2024 | /s/ PHENIX Q. KIAMILEV |

| Phenix Q. Kiamilev |

| |

| Vice President, General Counsel and |

| |

| Corporate Secretary |

EXHIBIT 99.1

WD-40 Company Acquires Current Brazilian Marketing Distributor

~ New WD-40 Company direct distribution market to be headquartered in Curitiba, Brazil ~

SAN DIEGO — March 4, 2024 — WD-40 Company (NASDAQ:WDFC) announced today that a definitive agreement has been entered into acquiring the company’s current Brazilian marketing distributor and long-time business partner, Theron Marketing Ltda.

WD-40 Company and Theron Marketing have worked closely together to market and sell WD-40® Brand products in Brazil. Theron Marketing was established in 1997 to focus solely on the distribution and sales of WD-40 Company products in Brazil and does not market or sell any other products. The transaction will bring together Theron Marketing’s established workforce, customer base, and distribution logistics with WD-40 Company’s best-in-class marketing and brand building capabilities. As a result of their highly integrated and close historical working relationship, the companies expect a seamless integration.

Pursuant to the terms of the transaction, WD-40 Holding Company Brasil Ltda., a wholly owned subsidiary of WD-40 Company, acquires all outstanding shares of common stock of Theron Marketing Ltda., a wholly owned subsidiary of M12 Participações Empresarias S.A., in an all-cash offer. With this transaction, WD-40 Company will begin direct distribution within the country of Brazil immediately. M12 Participações Empresarias S.A will continue to act as WD-40 Holding Company Brasil’s logistics operator.

“This transaction directly supports our first Must-Win Battle which is to lead geographic expansion of WD-40 Multi-Use Product,” said Steve Brass, president and chief executive officer of WD-40 Company. “This acquisition will enable us to drive faster topline growth, a smoother market transition, and a shortened learning curve compared to building a direct market from the ground up.

“We are fortunate to negotiate a path forward that is in the best interest of both organizations. M12 Participações Empresarias S.A. have been an outstanding partner to us, and I want to thank them for their ongoing support over the years. I also want to extend a special welcome to all the Theron Marketing employees who have done a marvelous job building the WD-40 Brand in Brazil over the last 27 years. We are thrilled to officially welcome you into our WD-40 Company family,” concluded Brass.

“We view today’s announcement as the integration of two companies that have enjoyed a tremendously symbiotic relationship for nearly three decades,” said Milton Saling, Chairman of the Board of M12 Participações Empresarias S.A., parent company of Theron Marketing Ltda. “We are pleased that the execution of this transaction means our partnership with WD-40 Holding Company Brasil as a logistics provider can continue.”

The anticipated impact of this acquisition was included in WD-40 Company’s outlook for fiscal year 2024. The Company will provide additional details when it reports fiscal second quarter earnings which is tentatively scheduled for April 9, 2024.

About WD-40 Company

WD-40 Company is a global marketing organization dedicated to creating positive lasting memories by developing and selling products that solve problems in workshops, factories, and homes around the world. The Company owns a wide range of well-known brands that include maintenance products and

homecare and cleaning products: WD-40® Multi-Use Product, WD-40 Specialist®, 3-IN-ONE®, GT85®, 2000 Flushes®, no vac®, 1001®, Spot Shot®, Lava®, Solvol®, X-14®, and Carpet Fresh®.

Headquartered in San Diego, California, USA, WD-40 Company recorded net sales of $537.3 million in fiscal year 2023 and its products are currently available in more than 176 countries and territories worldwide. WD-40 Company is traded on the NASDAQ Global Select Market under the ticker symbol “WDFC.” For additional information about WD-40 Company please visit http://www.wd40company.com.

Forward-Looking Statements

Except for the historical information contained herein, this press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements reflect the Company’s current expectations with respect to currently available operating, financial and economic information. These forward-looking statements are subject to certain risks, uncertainties and assumptions that could cause actual results to differ materially from those anticipated in or implied by the forward-looking statements. These forward-looking statements are generally identified with words such as “believe,” “expect,” “intend,” “plan,” “project,” “could,” “may,” “aim,” “anticipate,” “target,” “estimate” and similar expressions.

Our forward-looking statements include, but are not limited to, discussions about future financial and operating results, including: expected benefits from the transaction; acquired business not performing as expected; assuming unexpected risks, liabilities and obligations of the acquired business; disruption to the parties’ business as a result of the announcement and transaction; integration of acquired business and operations into the company; growth expectations for maintenance products; expected levels of promotional and advertising spending; anticipated input costs for manufacturing and the costs associated with distribution of our products; plans for and success of product innovation; the impact of new product introductions on the growth of sales; anticipated results from product line extension sales; expected tax rates and the impact of tax legislation and regulatory action; changes in the political conditions or relations between the United States and other nations; the impacts from inflationary trends and supply chain constraints; changes in interest rates; and forecasted foreign currency exchange rates and commodity prices.

The Company’s expectations, beliefs and forecasts are expressed in good faith and are believed by the Company to have a reasonable basis, but there can be no assurance that the Company’s expectations, beliefs or forecasts will be achieved or accomplished. All forward-looking statements reflect the Company’s expectations as of the date hereof. We undertake no obligation to revise or update any forward-looking statements.

Actual events or results may differ materially from those projected in forward-looking statements due to various factors, including, but not limited to, those identified in Part I—Item 1A, “Risk Factors,” in the Company’s Annual Report on Form 10-K for the fiscal year ended August 31, 2023 which the Company filed with the SEC on October 23, 2023, and in the Company’s Quarterly Report on Form 10-Q for the period ended November 30, 2023, which the Company filed with the SEC on January 9, 2024.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

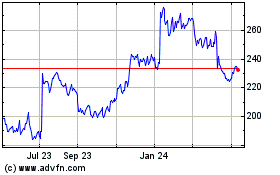

WD 40 (NASDAQ:WDFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

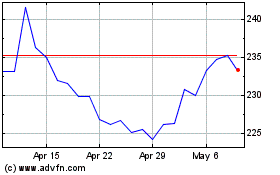

WD 40 (NASDAQ:WDFC)

Historical Stock Chart

From Apr 2023 to Apr 2024