WTW announced today that it has acquired a stake in atomos, the

UK-based advice-led wealth manager backed by funds managed by

Oaktree Capital Management, L.P. (“Oaktree”).

The investment follows a successful alliance

with atomos since the end of 2022, during which WTW’s investment

engine has successfully powered atomos’ multi-asset investment

solutions. With its scale and investment rigour, WTW provides

atomos’ clients with access to a broader, more diversified range of

asset classes and investment choices, previously only available to

institutional sized investors.

This next step in the partnership sees WTW

acquire part ownership in the business, as well as providing

additional capital designed to support further growth.

The UK wealth market is large and growing,

estimated to be worth £2.2 trillion. Through this investment WTW

strengthens its relationship with a key strategic partner and

boosts its presence in the UK wealth space.

Mark Calnan, Head of Investments for Europe,

WTW, said: “This is an incredibly exciting development for WTW

which reinforces our commitment to the wealth markets, a strategic

focus area for us and one that has driven significant growth for

our business in recent years. Our investment in atomos is the

natural next step in our successful partnership and extends our

investment capabilities to a wider audience.

“Our stake in atomos enhances our ability to

shape how the industry services the needs and aspirations of savers

in the UK. This is particularly important as individuals take

increased responsibilities for their retirement through defined

contribution schemes and personal savings. It also enables us to

bring our experience and capabilities built over many decades in

occupational pensions

to atomos’ individual clients.”

“Having had the opportunity to work closely with

the atomos leadership team since the end of 2022, we have seen

first-hand the alignment with us. We passionately share the belief

that combining high quality financial planning with

institutional-quality investment portfolios is a winning

combination that delivers sustainable financial outcomes for

savers.”

Federico Alvarez-Demalde, a managing director at

Oaktree, commented on the deal, stating: “In a highly competitive

market, WTW’s strategic minority stake in atomos is both a clear

indication of the value of the UK wealth management sector, and an

endorsement of the company’s differentiated vertically integrated

business model. The deal is designed to deliver better outcomes for

a broad range of clients. It also recognises atomos’ outstanding

growth potential, both organically and through its disciplined

acquisition strategy. The atomos leadership team has ambitious

plans for the business and a clear strategy for realising those

plans.”

Jonathan Polin, CEO of atomos, said: “We are

delighted to be extending our relationship further with WTW after a

highly successful period since the end of 2022 in which, together,

we have transformed the investment proposition we offer our

clients. WTW’s investment in atomos, having seen first-hand the

strength of our client relationships and quality of our people, is

further recognition of the health and growth potential of this

business. As we look for more ways in which we can enhance the

atomos client experience, our closer alignment to such an

established, well-resourced business will play a key part.”

Houlihan Lokey acted as financial advisor to

WTW. Herbert Smith Freehills LLP acted as legal advisor in

connection with the transaction. Fenchurch Advisory Partners acted

as financial advisor to atomos. White & Case acted as legal

adviser to atomos in connection with the transaction.

About WTW

InvestmentsWTW’s Investments business is focused

on creating financial value for end investors through its expertise

in risk assessment, strategic asset allocation, fiduciary

management and investment manager selection. It has over 900

colleagues worldwide, more than 1,000 investment clients globally,

assets under advisory of over US$4.2 trillion and US$167 billion of

assets under management.

About WTWAt

WTW (NASDAQ: WTW), we provide data-driven, insight-led solutions in

the areas of people, risk and capital. Leveraging the global view

and local expertise of our colleagues serving 140 countries and

markets, we help organizations sharpen their strategy, enhance

organizational resilience, motivate their workforce and maximize

performance.

Working shoulder to shoulder with our clients, we uncover

opportunities for sustainable success—and provide perspective that

moves you.

Learn more at wtwco.com.

About

atomosatomos is a UK-based, digitally enabled,

hybrid wealth business providing a full financial planning service

and bespoke portfolio management to UK clients (retail and

professional). Originating from the Sanlam Wealth UK business,

atomos is led by CEO, Jonathan Polin. The company has ~£7 billion

of assets.

atomos will allow clients to view their entire

financial ecosystem through an app and will offer the best of both

worlds where clients will be able to personalise how they interact

with the company, whether digitally, face-to-face or a hybrid of

the two.

The name, meaning “indivisible” in ancient Greek

represents a strong internal culture of collaboration, inclusivity

and diverse perspectives.

WTW Forward-Looking

StatementsThis document contains ‘forward-looking

statements’ within the meaning of Section 27A of the Securities Act

of 1933, and Section 21E of the Securities Exchange Act of 1934,

which are intended to be covered by the safe harbors created by

those laws. You can identify these statements and other

forward-looking statements in this document by words such as “may”,

“will”, “would”, “expect”, “anticipate”, “believe”, “estimate”,

“plan”, “intend”, “continue”, or similar words, expressions or the

negative of such terms or other comparable terminology. These

statements include, but are not limited to, the potential impact of

the investment and other statements that are not historical facts.

Such statements are based upon the current beliefs and expectations

of management and are subject to significant risks and

uncertainties. Actual results may differ from those set forth in

the forward-looking statements. All forward-looking disclosure is

speculative by its nature. There are important risks,

uncertainties, events and factors that could cause our actual

results or performance to differ materially from those in the

forward-looking statements contained herein, including, but not

limited to those described under “Risk Factors” in Willis Towers

Watson Public Limited Company’s most recent 10-K filing and

subsequent filings filed with the SEC.

Media

contacts

WTW: Adam Kirby, +44 (0)20 7520 7634,

wtw@jpespartners.comSarah Toubman, +44 (0)20 7520 7625,

wtw@jpespartners.com

Jamie Kilduff, +44 (0)20 7170 3746, Jamie.kilduff@wtwco.com

atomos: Hilary Morison+44 (0)20 3326 9900,

Hilary.Morison@mrm-london.com

Andrew Appleyard+44 (0)7909 684 468,

andrew.appleyard@mrm-london.com

AdvisersWTW – Houlihan LokeyOaktree – Fenchurch

Advisory Partners

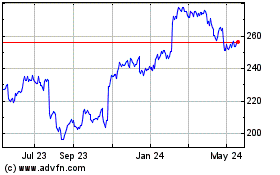

Willis Towers Watson Pub... (NASDAQ:WTW)

Historical Stock Chart

From Oct 2024 to Nov 2024

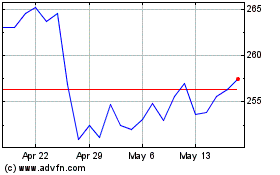

Willis Towers Watson Pub... (NASDAQ:WTW)

Historical Stock Chart

From Nov 2023 to Nov 2024