0001274737FALSE00012747372025-03-112025-03-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 11, 2025

EXAGEN INC.

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

|

|

|

|

|

| Delaware |

| 001-39049 |

| 20-0434866 |

(State or other jurisdiction of incorporation) |

| (Commission File Number) |

| (IRS Employer Identification No.) |

1261 Liberty Way

Vista, CA 92081

(Address of principal executive offices) (Zip Code)

(760) 560-1501

(Registrant’s telephone number, including area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

|

|

|

|

|

| Title of each class |

| Trading Symbol(s) |

| Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

| XGN |

| The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On March 11, 2025, the Company reported its financial results for the quarter and year ended December 31, 2024. A copy of the press release issued by the Company is furnished as Exhibit 99.1 to this report.

The information furnished with Item 2.02 of this report, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filings under the Exchange Act or under the Securities Act of 1933, as amended, whether made before or after the date hereof, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits | | | | | | | | |

|

|

|

| Exhibit No. |

| Description |

|

|

| 99.1 |

| |

|

|

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | | | | | | | | | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

| EXAGEN INC. |

|

|

|

|

Date: March 11, 2025 |

|

|

| By: |

| /s/ Jeffrey G. Black |

|

|

|

|

|

| Jeffrey G. Black |

|

|

|

|

|

| Chief Financial Officer |

Exagen Inc. Reports Strong Fourth Quarter and Full-Year 2024 Results and Business Highlights

Delivered record full-year total revenue and AVISE CTD average selling price

Improved full-year adjusted EBITDA loss, net loss and cash use by over 40%

Commercialized new biomarkers to enhance clinical utility of AVISE CTD

Carlsbad, Calif., – Exagen Inc. (Nasdaq: XGN), a leading provider of autoimmune testing, today reported financial results for the fourth quarter and full year ended December 31, 2024, and recent business highlights.

| | | | | | | | | | | | | | | | |

| | | Three Months Ended December 31, | | Year Ended December 31, | | |

| | 2024 | | 2024 | | |

| (in thousands, except ASP data) | | | | |

| Revenue | | $ | 13,655 | | | $ | 55,641 | | | |

| Gross margin | | 62.1 | % | | 59.5 | % | | |

| Operating expenses | | $ | 11,860 | | | $ | 46,748 | | | |

| Loss from operations | | $ | (3,383) | | | $ | (13,636) | | | |

| Net loss | | $ | (3,761) | | | $ | (15,115) | | | |

| Adjusted EBITDA | | $ | (2,535) | | | $ | (10,149) | | | |

| Cash, cash equivalents and restricted cash | | $ | 22,236 | | | $ | 22,236 | | | |

| Trailing-twelve-month average selling price (ASP) | | $ | 411 | | | $ | 411 | | | |

2024 Financial Highlights:

•Delivered record total revenue of $55.6 million on the strength of continued ASP expansion

•Expanded AVISE® CTD trailing twelve-month average selling price (ASP) of $411, an increase of $75 per test

•Grew gross margin by 300 basis points to 62.1% in the fourth quarter and 59.5% for the full year over the same periods in 2023

•Improved net loss by $1.8 million in the fourth quarter and by over $8 million for the full year compared to the same periods in 2023

•Improved adjusted EBITDA loss by $1.3 million in the fourth quarter and by nearly $7 million for full-year from the same periods in 2023

•Ended 2024 with a cash and restricted cash balance of $22.2 million

2024 and Recent Business Highlights:

•Achieved key commercial milestone with completion of 1,000,000th patient tested by AVISE CTD

•Featured five abstracts at the 2024 American College of Rheumatology (ACR) annual meeting highlighting Exagen’s innovative research on novel T Cell biomarkers for Lupus and sero-negative autoantibodies for rheumatoid arthritis, in addition to a plenary presentation in collaboration with Johns Hopkins University, highlighting a urinary biomarker panel that holds the potential to guide precision management of Lupus Nephritis patients

•Secured New York State Department of Health approval for and executed commercial launch of new systemic lupus erythematosus (SLE) and rheumatoid arthritis (RA) biomarker assays in January 2025

“The execution of our operational turnaround continued in earnest during 2024, which is reflected in our transformative financial results and is a testament to the strength of our team and strategy,” said John Aballi, President and CEO. “We have continued to grow profitable revenue and expand gross margins while significantly reducing operating expenses and cash burn.”

“Additionally, the successful launch of our new AVISE CTD biomarkers this past January is a significant milestone in our commitment to improving patient care. With these accomplishments, Exagen is better positioned for success, and I am excited about the momentum we carry into 2025 as we drive towards profitability.”

Financial Outlook

The company expects total revenue of at least $14.5 million for the first quarter of 2025, and anticipates to be on-track to deliver positive adjusted EBITDA in the fourth quarter of 2025. The company expects to provide its full-year 2025 financial outlook in connection with the release of its first quarter 2025 financial results.

Conference Call

A conference call to provide a business update and review fourth quarter and full-year 2024 financial results is scheduled for today March 11, 2025 at 8:30 AM Eastern Time (5:30 AM Pacific Time). Interested parties may access the conference call by dialing (201) 389-0918 (U.S.) or (877) 407-0890 (international). Additionally, a link to a live webcast of the call will be available in the Investor Relations section of Exagen's website at investors.exagen.com.

Participants are asked to join a few minutes prior to the call to register for the event. A replay of the conference call will be available until Monday, April 14, 2025 at 11:59 PM Eastern Time (8:59 PM Pacific Time). Interested parties may access the replay by dialing (201) 612-7415 (U.S.) or (877) 660-6853 (international) using passcode 13751928. A link to the replay will also be available in the investor relations section of Exagen's website.

Use of Non-GAAP Financial Measures (Unaudited)

In addition to the financial results prepared in accordance with generally accepted accounting principles in the United States (GAAP), this press release contains the metric adjusted EBITDA, which is not calculated in accordance with GAAP and is a non-GAAP financial measure. Adjusted EBITDA excludes from net loss interest income (expense), income tax expense (benefit), depreciation and amortization expense, stock-based compensation expense and other expenses or income that management believes are not representative of the company’s operations. Such items could have a significant impact on the calculation of GAAP net loss.

Exagen uses adjusted EBITDA internally because the company believes these metrics provide useful supplemental information in assessing its operating performance reported in accordance with GAAP. Exagen believes adjusted EBITDA may enhance an evaluation of our operating performance because it excludes the impact of prior decisions made about capital investment, financing, investing and certain expenses the company believes are not indicative of our ongoing performance. However, this non-GAAP financial measure may be different from non-GAAP financial measures used by other companies, even when the same or similarly titled terms are used to identify such measures, limiting their usefulness for comparative purposes.

This non-GAAP financial measure is not meant to be considered in isolation or used as a substitute for net loss reported in accordance with GAAP, should be considered in conjunction with our financial information presented in accordance with GAAP, has no standardized meaning prescribed by GAAP, is unaudited, and is not prepared under any comprehensive set of accounting rules or principles. In addition, from time to time in the future, there may be other items that Exagen may exclude for purposes of these non-GAAP financial measures, and the company may in the future cease to exclude items that it has historically excluded for purposes of these non-GAAP financial measures. Likewise, Exagen may determine to modify the nature of adjustments to arrive at these non-GAAP financial measures. Because of the non-standardized definitions of non-GAAP financial measures, the non-GAAP financial measure as used by the company in this press release and the accompanying reconciliation table have limits in their usefulness to investors and may be calculated differently from, and therefore may not be directly comparable to, similarly titled measures used by other companies. Accordingly, investors should not place undue reliance on non-GAAP financial measures.

A reconciliation of net loss to non-GAAP adjusted EBITDA is provided in the financial schedules that are part of this press release.

About Exagen

Exagen is a leading provider of autoimmune testing and its purpose as an organization is to provide clarity in autoimmune disease decision making with the goal of improving patients’ clinical outcomes. Exagen is located in San Diego County, California.

For more information, please visit Exagen.com or follow @ExagenInc on X.

Forward Looking Statements

Exagen cautions you that statements contained in this press release regarding matters that are not historical facts are forward-looking statements. These statements are based on Exagen’s current beliefs and expectations. Such forward-looking statements include, but are not limited to, statements regarding: Exagen’s goals, strategies, positioning, and ambitions; evaluations and judgments regarding financial results and the potential implications of those results, potential future financial and business performance, including any improvements to adjusted EBITDA, net loss and potential profitability; the potential utility and effectiveness of Exagen’s services and testing solutions; potential shareholder value and growth and full-year 2025 guidance. The inclusion of forward-looking statements should not be regarded as a representation by Exagen that any of its plans will be achieved. Actual results may differ from those set forth in this press release due to the risks and uncertainties inherent in Exagen’s business, including, without limitation: delays in reimbursement and coverage decisions from Medicare and third-party payors and in interactions with regulatory authorities, and delays in ongoing and planned clinical trials involving its tests; and changes in laws and regulations related to Exagen’s regulatory requirements. Exagen’s commercial success depends upon attaining and maintaining significant market acceptance of its testing products among rheumatologists, patients, third-party payors and others in the medical community; Exagen’s ability to successfully execute on its business strategies; third-party payors not providing coverage and adequate reimbursement for Exagen’s testing products, including Exagen’s ability to collect on funds due; Exagen’s ability to obtain and maintain intellectual property protection for its testing products; regulatory developments affecting Exagen’s business; and other risks described in Exagen’s prior press releases and Exagen’s filings with the Securities and Exchange Commission (“SEC”), including under the heading “Risk Factors” in Exagen’s Annual Report or Form 10-K for the year ended December 31, 2024, to be filed with the SEC on or before March 14, 2025 and any subsequent filings with the SEC. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, and Exagen undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement, which is made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

Contact:

Ryan Douglas

Exagen Inc.

ir@exagen.com

760.560.1525

Exagen Inc.

Statements of Operations

(in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended December 31, | | Year Ended December 31, |

| | | 2024 | | 2023 | | 2024 | | 2023 |

| | | (Unaudited) | | | | |

| Revenue | | $ | 13,655 | | | $ | 13,765 | | | $ | 55,641 | | | $ | 52,548 | |

| Costs of revenue | | 5,178 | | | 5,620 | | | 22,529 | | | 23,092 | |

| Gross margin | | 8,477 | | | 8,145 | | | 33,112 | | | 29,456 | |

| Operating expenses: | | | | | | | | |

| Selling, general and administrative expenses | | 10,204 | | | 12,216 | | | 41,373 | | | 47,428 | |

| Research and development expenses | | 1,656 | | | 1,076 | | | 5,375 | | | 4,865 | |

| | | | | | | | |

| | | | | | | | |

| Total operating expenses | | 11,860 | | | 13,292 | | | 46,748 | | | 52,293 | |

| Loss from operations | | (3,383) | | | (5,147) | | | (13,636) | | | (22,837) | |

| Interest expense | | (563) | | | (566) | | | (2,234) | | | (2,335) | |

| Interest income | | 185 | | | 146 | | | 767 | | | 1,516 | |

| Loss before income taxes | | (3,761) | | | (5,567) | | | (15,103) | | | (23,656) | |

| Income tax expense | | — | | | (6) | | | (12) | | | (33) | |

| Net loss | | $ | (3,761) | | | $ | (5,573) | | | $ | (15,115) | | | $ | (23,689) | |

| Net loss per share, basic and diluted | | $ | (0.20) | | | $ | (0.31) | | | $ | (0.83) | | | $ | (1.34) | |

| Weighted-average number of shares used to compute net loss per share, basic and diluted | | 18,427,887 | | | 17,836,090 | | | 18,203,044 | | | 17,679,467 | |

Exagen Inc.

Balance Sheets

(in thousands, except share and per share data)

| | | | | | | | | | | | | | |

| | December 31, |

| | | 2024 | | 2023 |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 22,036 | | | $ | 36,493 | |

| Accounts receivable, net | | 7,835 | | | 6,551 | |

| Prepaid expenses and other current assets | | 6,584 | | | 4,797 | |

| Total current assets | | 36,455 | | | 47,841 | |

| Property and equipment, net | | 5,283 | | | 5,201 | |

| Operating lease right-of-use assets | | 2,401 | | | 3,286 | |

| | | | |

| Other assets | | 550 | | | 616 | |

| Total assets | | $ | 44,689 | | | $ | 56,944 | |

| Liabilities and Stockholders' Equity | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 4,137 | | | $ | 3,131 | |

| Operating lease liabilities | | 1,096 | | | 976 | |

| Borrowings-current portion | | 423 | | | 264 | |

| Accrued and other current liabilities | | 7,850 | | | 7,531 | |

| Total current liabilities | | 13,506 | | | 11,902 | |

| Borrowings-non-current portion, net of discounts and debt issuance costs | | 19,822 | | | 19,231 | |

| Non-current operating lease liabilities | | 1,664 | | | 2,760 | |

| | | | |

| Other non-current liabilities | | 157 | | | 357 | |

| Total liabilities | | 35,149 | | | 34,250 | |

| Commitments and contingencies | | | | |

| Stockholders' equity: | | | | |

| | | | |

Common stock, $0.001 par value; 200,000,000 shares authorized at December 31, 2024 and December 31, 2023; 17,640,328 and 17,045,954 shares issued and outstanding at December 31, 2024 and December 31, 2023, respectively | | 18 | | | 17 | |

Additional paid-in capital | | 303,853 | | | 301,893 | |

| Accumulated deficit | | (294,331) | | | (279,216) | |

| Total stockholders' equity | | 9,540 | | | 22,694 | |

| Total liabilities and stockholders' equity | | $ | 44,689 | | | $ | 56,944 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Exagen Inc.

Reconciliation of Non-GAAP Financial Measures (UNAUDITED)

The table below presents the reconciliation of adjusted EBITDA, which is a non-GAAP financial measure. See "Use of Non-GAAP Financial Measures (UNAUDITED)" above for further information regarding the Company's use of non-GAAP financial measures.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| | | 2024 | | 2023 | | 2024 | | 2023 |

| (in thousands) | | | | |

| Adjusted EBITDA | | | | | | | | |

| Net loss | | $ | (3,761) | | | $ | (5,573) | | | $ | (15,115) | | | $ | (23,689) | |

| Other (Income) Expense | | (185) | | | (146) | | | (767) | | | (1,516) | |

| Interest Expense | | 563 | | | 566 | | | 2,234 | | | 2,335 | |

| Income tax expense | | — | | | 6 | | | 12 | | | 33 | |

| Depreciation and amortization expense | | 415 | | | 508 | | | 1,724 | | | 2,168 | |

| Stock-based compensation expense | | 433 | | | 763 | | | 1,763 | | | 3,617 | |

| Adjusted EBITDA (Non-GAAP) | | $ | (2,535) | | | $ | (3,876) | | | $ | (10,149) | | | $ | (17,052) | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

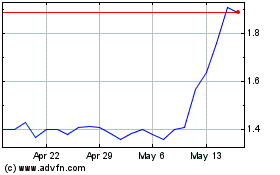

Exagen (NASDAQ:XGN)

Historical Stock Chart

From Feb 2025 to Mar 2025

Exagen (NASDAQ:XGN)

Historical Stock Chart

From Mar 2024 to Mar 2025