Exagen Inc. (Nasdaq: XGN), a leading provider of autoimmune

testing, today announced it has received conditional approval from

the New York State Department of Health for its new systemic lupus

erythematosus (SLE) and rheumatoid arthritis (RA) biomarker assays,

with a planned commercial launch in January 2025. The company

also announced preliminary unaudited select financial results for

the fourth quarter and full year ended December 31, 2024, in line

with prior financial guidance.

New AVISE CTD Biomarkers

The company’s new SLE and RA biomarkers will be incorporated

into the AVISE CTD platform. Collectively, the company expects

these new biomarkers will further improve the clinical utility of

AVISE CTD, and provide clinicians with the information they need to

definitively diagnose patients and shorten their autoimmune

diagnostic journeys.

The new biomarkers are as follows:

- T-Cell Lupus profile comprises new biomarkers; TC4d,

TIgG, and TIgM. These markers provide superior sensitivity

for SLE compared to conventional SLE biomarkers, further enhancing

our industry-leading AVISE Lupus profile for a more comprehensive

diagnosis, particularly in clinically ambiguous cases.

- RA profile includes additional anti-RA33 biomarkers;

IgA, IgG, and IgM. These markers provide clinicians with

more data to confidently identify patients with RA and substantiate

a seronegative RA diagnosis.

Preliminary Unaudited Select Financial

Results

|

|

|

Three Months EndedDecember 31,

2024 |

|

Twelve Months EndedDecember 31,

2024 |

| (in millions, except trailing

12-month average selling price) |

|

|

|

|

| Revenue |

|

$13.3 to $13.8 |

|

$55.3 to $55.8 |

| Net Loss |

|

($3.4) to ($4.4) |

|

($14.8) to ($15.8) |

| Adjusted EBITDA |

|

($2.2) to ($3.2) |

|

($9.8) to ($10.8) |

| AVISE CTD Trailing 12-month

average selling price |

|

$408 to $412 |

|

$408 to $412 |

| Cash, cash equivalents and

restricted cash |

|

$22.2 |

|

$22.2 |

| |

|

|

|

|

The preliminary unaudited select financial results reported

today represent:

- Record full-year 2024 revenue and AVISE CTD ASP

- AVISE CTD trailing twelve-month ASP improvement of $72 to $76

compared to Q4 2023

- Full-year 2024 adjusted EBITDA improvement of to 37% to 43%

compared to full-year 2023

- Net neutral cash usage in the fourth quarter of 2024

“2024 was a remarkable year for Exagen by many accounts. We

reached a significant milestone by testing our 1,000,000th patient

with AVISE CTD, an impressive achievement for any proprietary test,

but especially one in a field that hasn’t seen robust biomarker

innovation for many decades,” said John Aballi, CEO. “We’ve also

made great strides in optimizing our company’s operations and

continued our progress toward profitability - a goal which is now

firmly within reach, all while delivering record reimbursement per

test and record overall revenue performance."

Mr. Aballi continued, “To start 2025 with New York State’s

approval of our new assays is another significant milestone, and we

now sit in the midst of several growth catalysts with strong

momentum to start the year. I’m very grateful to the dedicated team

we have, and couldn’t be more excited about what lies ahead.”

Cautionary Note Regarding Select Preliminary Unaudited

Financial Results

The company is providing the above preliminary unaudited select

financial information and results of operations as of and for the

three months and year ended December 31, 2024, based on currently

available information. The company’s financial closing procedures

with respect to the estimated financial data provided above are not

yet complete. These procedures often result in changes to accounts.

Our independent registered public accounting firm has not audited,

reviewed, compiled or performed any procedures with respect to the

preliminary unaudited select financial information and,

accordingly, our independent registered public accounting firm does

not express an opinion or any other form of assurance with respect

thereto. As a result, the company’s final results may vary from the

preliminary results presented above. Management undertakes no

obligation to update or supplement the information provided above

until it releases its audited financial statements prepared in

accordance with U.S. Generally Accepted Accounting Principles

(GAAP) for the year ended December 31, 2024.

Use of Unaudited Non-GAAP Financial

Measures

In addition to the financial results prepared in accordance with

GAAP, this press release contains the metric adjusted EBITDA, which

is not calculated in accordance with GAAP and is a non-GAAP

financial measure. Adjusted EBITDA excludes from net loss interest

income (expense), income tax expense (benefit), depreciation and

amortization expense, stock-based compensation expense and other

expenses or income that management believes are not representative

of the company’s operations. Such items could have a significant

impact on the calculation of GAAP net loss.

The table below presents the reconciliation of preliminary net

loss to adjusted EBITDA, which is a non-GAAP financial measure. See

"Use of Non-GAAP Financial Measures (UNAUDITED)" above for further

information regarding the company's use of non-GAAP financial

measures.

Reconciliation of Non-GAAP Financial Measures

(UNAUDITED)

|

|

|

Three Months EndedDecember 31,

2024 |

|

Twelve Months EndedDecember 31,

2024 |

| (in millions) |

|

|

| Adjusted

EBITDA |

|

|

|

|

| Net loss |

|

($3.4) to ($4.4) |

|

($14.8) to ($15.8) |

|

Other (Income) Expense |

|

($0.2) |

|

($0.8) |

|

Interest Expense |

|

$0.6 |

|

$2.3 |

|

Depreciation and amortization expense |

|

$0.4 |

|

$1.7 |

|

Stock-based compensation expense |

|

$0.4 |

|

$1.8 |

| Adjusted EBITDA (Non-GAAP) |

|

($2.2) to ($3.2) |

|

($9.8) to ($10.8) |

| |

|

|

|

|

Management believes that this non-GAAP financial measure, taken

in conjunction with GAAP financial measures, provides useful

information for both management and investors by excluding certain

non-cash and other expenses that are not indicative of the

company’s core operating results. Management uses non-GAAP measures

to compare the company’s performance relative to forecasts and

strategic plans and to benchmark the company’s performance

externally against competitors. However, this non-GAAP financial

measure may be different from non-GAAP financial measures used by

other companies, even when the same or similarly titled terms are

used to identify such measures, limiting their usefulness for

comparative purposes. Non-GAAP information is not prepared under a

comprehensive set of accounting rules and should only be used to

supplement an understanding of the company’s operating results as

reported under U.S. GAAP

This non-GAAP financial measure is not meant to be considered in

isolation or used as a substitute for net loss reported in

accordance with GAAP, should be considered in conjunction with

financial information presented in accordance with GAAP, has no

standardized meaning prescribed by GAAP, is unaudited, and is not

prepared under any comprehensive set of accounting rules or

principles. In addition, from time to time in the future, there may

be other items that management may exclude for purposes of this

non-GAAP financial measure, and may in the future cease to exclude

items that historically have been excluded for purposes of this

non-GAAP financial measure. Likewise, management may determine to

modify the nature of adjustments to arrive at this non-GAAP

financial measure.

About Exagen

Exagen Inc. (Nasdaq: XGN) is a leading provider of autoimmune

diagnostics, committed to transforming care for patients with

chronic and debilitating autoimmune conditions. Based in San Diego

County, California, Exagen’s mission is to provide clarity in

autoimmune disease decision making and improve clinical outcomes

through its innovative testing portfolio. The company’s flagship

product, AVISE® CTD, enables clinicians to more effectively

diagnose complex autoimmune conditions such as lupus, rheumatoid

arthritis, and Sjögren’s syndrome earlier and with greater

accuracy. Exagen’s laboratory specializes in the testing of

rheumatic diseases, delivering precise and timely results,

supported by a full suite of AVISE-branded tests for disease

diagnosis, prognosis, and monitoring. With a focus on research,

innovation, education, and patient-centered care, Exagen is

dedicated to addressing the ongoing challenges of autoimmune

disease management.

For more information, please visit Exagen.com or follow

@ExagenInc on X (formerly known as Twitter).

Forward Looking Statements

Exagen cautions you that statements contained in this press

release regarding matters that are not historical facts are

forward-looking statements. These statements are based on Exagen’s

current beliefs and expectations. Such forward-looking statements

include, but are not limited to, statements regarding: Exagen’s

goals, strategies and ambitions; the potential utility and

effectiveness of Exagen’s services and testing solutions, including

the newly approved SLE and RA biomarkers; potential shareholder

value and growth and profitability; preliminary financial

information as of and for December 31, 2024; and guidance. The

inclusion of forward-looking statements should not be regarded as a

representation by Exagen that any of its plans will be achieved.

Actual results may differ from those set forth in this press

release due to the risks and uncertainties inherent in Exagen’s

business, including, without limitation: delays in reimbursement

and coverage decisions from Medicare and third-party payors and in

interactions with regulatory authorities, and delays in ongoing and

planned clinical trials involving its tests; Exagen’s commercial

success depends upon attaining and maintaining significant market

acceptance of its testing products among rheumatologists, patients,

third-party payors and others in the medical community; Exagen’s

ability to successfully execute on its business strategies;

third-party payors not providing coverage and adequate

reimbursement for Exagen’s testing products, including Exagen’s

ability to collect on funds due; Exagen’s ability to obtain and

maintain intellectual property protection for its testing products;

regulatory developments affecting Exagen’s business; and other

risks described in Exagen’s prior press releases and Exagen’s

filings with the Securities and Exchange Commission (SEC),

including under the heading “Risk Factors” in Exagen’s Annual

Report on Form 10-K for the year ended December 31, 2023, filed

with the SEC on March 18, 2024 and any subsequent filings with the

SEC. You are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date hereof,

and Exagen undertakes no obligation to update such statements to

reflect events that occur or circumstances that exist after the

date hereof. All forward-looking statements are qualified in their

entirety by this cautionary statement, which is made under the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995.

Contact:Ryan DouglasExagen

Inc.ir@exagen.com760.560.1525

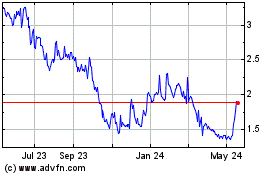

Exagen (NASDAQ:XGN)

Historical Stock Chart

From Dec 2024 to Jan 2025

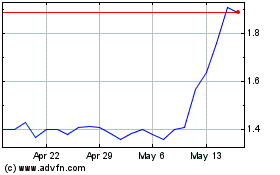

Exagen (NASDAQ:XGN)

Historical Stock Chart

From Jan 2024 to Jan 2025