NEW YORK, March 20 /PRNewswire-FirstCall/ -- XTL

Biopharmaceuticals, Ltd. (NASDAQ:XTLB)(LSE:XTL)(TASE:XTL), a

biotechnology company focused on the acquisition, development and

commercialization of therapeutics for the treatment of infectious

diseases, with a focus on hepatitis C, today announced its

financial results for year ended December 31, 2005. Earlier today,

XTL announced that it has entered into definitive agreements with

institutional investors relating to a private placement of $28

million in gross proceeds through the issuance of ordinary shares,

represented by American Depositary Receipts (ADRs), and warrants.

JPMorgan Securities Inc. acted as the lead-placement agent. Brean

Murray, Carret & Co., LLC, Oppenheimer & Co., Inc., and

Punk, Ziegel & Company, L.P. served as co-placement agents in

the transaction. The Company has agreed to register the ordinary

shares, including those issuable upon exercise of the warrants,

under the Securities Act of 1933, list the ADRs for trading on the

Nasdaq Stock Market and to apply to the UK Listing Authority for

the new ordinary shares to be admitted to trading on the London

Stock Exchange. The proceeds of the private placement will be held

in escrow until the securities are registered and listed for

trading. The Company believes that proceeds raised from this

offering will be sufficient to fund its operations into 2008. At

December 31, 2005, the Company had cash and cash equivalents of

$13.4 million, compared to cash, cash equivalents and short-term

bank deposits of $22.9 million at December 31, 2004. The

year-over-year decrease of $9.5 million is attributable primarily

to operating expenses associated with the development of our

hepatitis C product candidates, XTL-2125 and XTL-6865, as well as

to the development of the DOS hepatitis C pre-clinical program,

recently acquired from Vivo Quest, Inc. This decrease was partially

offset by approximately $1.5 million in proceeds from the exercise

of share options during 2005. The loss for the year ended December

31, 2005 was $14,015,000, or $0.08 per ordinary share, compared to

the loss of $16,473,000, or $0.12 per ordinary share, for the year

ended December 31, 2004, representing a decrease in net loss of

$2,458,000. The decrease in loss was primarily attributable to a

decrease of $4,672,000 in research and development costs and due to

a $583,000 reduction in business development costs. This was

partially offset by a $1,783,000 charge associated with acquired

in-process research and development pursuant to the VivoQuest

license and asset purchase agreements that were completed in

September 2005, and an increase of $1,323,000 in general

administrative expenses. In 2005, general and administrative

expenses included a non-cash compensation charge of $2,641,000

associated with stock options in accordance with FAS 123R, that was

adopted by the Company in 2005. Ron Bentsur, Chief Executive

Officer of XTL, commented, "First, I want to take this opportunity

to thank the investors who participated in our highly successful

private placement which priced yesterday in which we raised $28

million. This transaction serves as a strong first step in

introducing XTL to the U.S. marketplace. Mr. Bentsur added, "2005

was an important year for the Company. We completed a refocusing

plan designed to enable the Company to focus its resources on the

development of its lead programs through to clinical proof-of

principle. We initiated a Phase 1 clinical trial of XTL-6865 for

the treatment of hepatitis C chronic patients in September 2005 and

we are weeks away from commencing dosing into our

placebo-controlled Phase 1 study for XTL-2125, also in hepatitis C

chronic patients. We further strengthened our hepatitis C program

with the completion of the Vivo Quest transaction in September

2005. On the HepeX-B front, we successfully completed the

transition of the HepeX-B development activities to Cubist and were

very pleased with the Phase 2b clinical trial results released at

year's end." Contacts: XTLbio Ron Bentsur, Chief Executive Officer

Tel: +1-212-531-5971 ABOUT XTL BIOPHARMACEUTICALS LTD. XTL

Biopharmaceuticals Ltd. ("XTL") is engaged in the acquisition,

development and commercialization of therapeutics for the treatment

of infectious diseases, with a focus on hepatitis C. XTL is

developing XTL-2125 - a small molecule, non-nucleoside inhibitor of

the hepatitis C virus polymerase. XTL-2125 is expected to enter

Phase 1 clinical trial in chronic hepatitis C patients in 1H 2006.

XTL is also developing XTL-6865 - a combination of two monoclonal

antibodies against the hepatitis C virus - presently in Phase 1

clinical trials in patients with chronic hepatitis C. XTL's

hepatitis C pipeline also includes several families of pre-clinical

hepatitis C small molecule inhibitors. In addition, XTL has

out-licensed to Cubist Pharmaceuticals an antibody therapeutic

against hepatitis B, HepeX-B, which has recently completed a Phase

2b clinical study in transplant patients. XTL is publicly traded on

the NASDAQ, London, and Tel-Aviv Stock Exchanges

(NASDAQ:XTLB)(LSE:XTL)(TASE:XTL). Cautionary Statement Some of the

statements included in this press release, particularly those

anticipating future financial performance, clinical and business

prospects for our clinical compounds for hepatitis C, XTL-2125 and

XTL-6865, growth and operating strategies and similar matters, may

be forward-looking statements that involve a number of risks and

uncertainties. For those statements, we claim the protection of the

safe harbor for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995. Among the factors that

could cause our actual results to differ materially are the

following: our ability to successfully complete cost-effective

clinical trials for the drug candidates in our pipeline which would

affect our ability to continue to fund our operations with our

available cash reserves, we may not be able to meet anticipated

development timelines for the drug candidates in our pipeline due

to recruitment, clinical trial results, manufacturing capabilities

or other factors; and other risk factors identified from time to

time in our reports filed with the Securities and Exchange

Commission and the London Stock Exchange . Any forward-looking

statements set forth in this press release speak only as of the

date of this press release. We do not intend to update any of these

forward-looking statements to reflect events or circumstances that

occur after the date hereof. This press release and prior releases

are available at http://www.xtlbio.com/. The information in our

website is not incorporated by reference into this press release

and is included as an inactive textual reference only. XTL

BIOPHARMACEUTICALS LTD. (A Development Stage Company) CONSOLIDATED

BALANCE SHEETS (in thousands of U.S. dollars) December 31 2005 2004

___________ ___________ A s s e t s CURRENT ASSETS: Cash and cash

equivalents 13,360 12,788 Short-term bank deposits -- 10,136

Accounts receivable - trade -- 543 Accounts receivable - other 431

306 ___________ ___________ T o t a l current assets 13,791 23,773

___________ ___________ EMPLOYEE SEVERANCE PAY FUNDS 449 830

___________ ___________ RESTRICTED LONG-TERM DEPOSIT 110 113

___________ ___________ PROPERTY AND EQUIPMENT, NET 762 908

___________ ___________ INTANGIBLE ASSETS, NET -- 39 ___________

___________ T o t a l assets 15,151 25,624 ========= =========

Liabilities and shareholders' equity CURRENT LIABILITIES: Accounts

payable and accruals 2,007 3,134 Deferred gain 399 399 ___________

___________ T o t a l current liabilities 2,406 3,533 ___________

___________ LIABILITY IN RESPECT OF EMPLOYEE SEVERANCE OBLIGATIONS

695 1,291 DEFERRED GAIN 798 1,198 ___________ ___________

COMMITMENTS AND CONTINGENCIES (Note 7) T o t a l liabilities 3,899

6,022 ___________ ___________ SHAREHOLDERS' EQUITY: Ordinary shares

of NIS 0.02 par value (authorized: 300,000,000 as of December 31,

2005 and 2004; issued and outstanding: 173,180,441 as of December

31, 2005 and 168,079,196 as of December 31, 2004) 864 841

Additional paid in capital 110,179 104,537 Deficit accumulated

during the development (99,791) (85,776) stage ___________

___________ T o t a l shareholders' equity 11,252 19,602

___________ ___________ T o t a l liabilities and shareholders'

equity 15,151 25,624 ========= ========= Michael Weiss Ron Bentsur

Chairman of the Board of Chief Executive Officer Directors Date of

approval of the financial statements: March 17, 2006 The

accompanying notes are an integral part of the financial

statements. XTL BIOPHARMACEUTICALS LTD. (A Development Stage

Company) CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands of

U.S. dollars, except share and per share amounts) Period from March

9, 1993* Year ended December 31 to December 31, 2005 2004 2003 2005

(Unaudited) ___________ ___________ ___________ ___________

REVENUES: Reimbursed out-of-pockets expenses 2,743 3,269 -- 6,012

License 454 185 -- 639 ___________ ___________ ___________

__________ 3,197 3,454 -- 6,651 COST OF REVENUES: Reimbursed

out-of-pockets expenses 2,743 3,269 -- 6,012 License (with respect

to 54 32 -- 86 royalties) ___________ ___________ ___________

__________ 2,797 3,301 -- 6,098 GROSS MARGIN 400 153 -- 553

___________ ___________ ___________ __________ RESEARCH AND

DEVELOPMENT COSTS (includes non-cash compensation of $112, $30 and

$0, in 2005, 2004 and 2003, respectively) 7,313 11,985 14,022

82,890 L E S S - PARTICIPATIONS -- -- 3,229 10,950 ___________

___________ ___________ __________ 7,313 11,985 10,793 71,940 IN -

PROCESS RESEARCH AND DEVELOPMENT COSTS 1,783 -- -- 1,783 GENERAL

AND ADMINISTRATIVE EXPENSES (includes non-cash compensation of

$2,641, $2 and $0, in 2005, 2004 and 2003, respectively) 5,457

4,134 3,105 29,012 BUSINESS DEVELOPMENT COSTS (includes non-cash

compensation of $10 in 2005, and $0, in 2004 and 2003, 227 810 664

4,513 respectively) __________ ___________ ___________ __________

OPERATING LOSS 14,380 16,776 14,562 106,695 FINANCIAL 443 352 352

7,143 INCOME - net __________ ___________ ___________ __________

LOSS BEFORE INCOME TAXES 13,937 16,424 14,210 99,552 INCOME TAXES

78 49 78 239 ___________ ___________ ___________ __________ LOSS

FOR THE 14,015 16,473 14,288 99,791 PERIOD ========= =========

========= ======== BASIC AND DILUTED LOSS PER ORDINARY SHARE $0.08

$0.12 $0.13 ========= ========= ========= WEIGHTED AVERAGE NUMBER

OF SHARES USED IN COMPUTING BASIC AND DILUTED LOSS PER ORDINARY

SHARE 170,123,003 134,731,766 111,712,916 ========= =========

========= * Incorporation Date The accompanying notes are an

integral part of the financial statements. XTL BIOPHARMACEUTICALS

LTD. (A Development Stage Company) CONSOLIDATED STATEMENTS OF CASH

FLOWS (in thousands of U.S. dollars) Period from March 9, 1993 (a)

Year ended December 31 to December 31, 2005 2004 2003 2005

(Unaudited) ________ ________ ________ ________ CASH FLOWS FROM

OPERATING ACTIVITIES: Loss for the period (14,015) (16,473)

(14,288) (99,791) Adjustments to reconcile loss to net cash used in

operating activities: Depreciation and 242 319 440 2,829

amortization Linkage difference on 3 -- -- 3 restricted long-term

deposits Acquisition of in process 1,783 -- -- 1,783 research and

development Loss on disposal of 6 1 2 18 property and equipment

Increase (decrease) in liability in respect of employee severance

obligations (159) 30 129 1,228 Impairment charges 26 -- 354 380

Loss (gain) from sales of -- 13 (27) (410) available for sale

securities Stock based compensation expenses (employee and non-

employee) 2,763 32 -- 3,278 Loss (gain) on amounts funded in

respect of employee severance pay funds (6) (4) 5 (91) Changes in

operating assets and liabilities: Decrease (increase) in 543 (543)

-- -- accounts receivable - trade Decrease (increase) in (125) 400

(440) (431) accounts receivable - other Increase (decrease) in

(1,127) 133 499 2,007 accounts payable and accruals Increase

(decrease) in (400) 1,597 -- 1,197 deferred gain ______ ________

________ ________ Net cash used in (10,466) (14,495) (13,326)

(88,000) operating activities ________ ________ ________ ________

CASH FLOWS FROM INVESTING ACTIVITIES: Decrease in short-term 10,136

7,193 14,724 -- deposits Restricted long-term -- 46 (20) (113)

deposits, net Investment in available -- -- (71) (3,363) for sale

securities Proceeds from sales of -- 722 1,048 3,773 available for

sale securities Employee severance pay (50) (136) (112) (891) funds

Purchase of property and (38) (180) (81) (4,021) equipment Proceeds

from disposals 27 5 2 149 of property and equipment Acquisition in

respect of (548) -- -- (548) license and purchase of ________

________ ________ ________ assets Net cash provided by 9,527 7,650

15,490 (5,014) (used in) investing ________ ________ ________

________ activities XTL BIOPHARMACEUTICALS LTD. (A Development

Stage Company) CONSOLIDATED STATEMENTS OF CASH FLOWS (continued)

(in thousands of U.S dollars) Period from March 9, 1993 (a) Year

ended December 31 to December 31, 2005 2004 2003 2005 (Unaudited)

________ ________ ________ ________ CASH FLOWS FROM FINANCING

ACTIVITIES: Issuance of share capital - -- 15,430 -- 104,371 net of

share issuance expenses Exercise of share warrants and 1,511 19 4

2,003 stock options Proceeds from long-term debt -- -- -- 399

Proceeds from short-term debt -- -- -- 50 Repayment of long-term

debt -- -- -- (399) Repayment of short-term debt -- -- -- (50)

________ ________ ________ ________ Net cash provided by financing

1,511 15,449 4 106,374 activities ________ ________ ________

________ NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS 572

8,604 2,168 13,360 BALANCE OF CASH AND CASH EQUIVALENTS AT

BEGINNING OF PERIOD 12,788 4,184 2,016 -- ________ ________

________ ________ BALANCE OF CASH AND CASH EQUIVALENTS AT END OF

PERIOD 13,360 12,788 4,184 13,360 ======= ======= ======= =======

Supplementary information on investing and financing activities not

involving cash flows: Issuance of ordinary shares in respect of

license, and purchase of 1,391 -- -- 1,391 assets Conversion of

convertible -- -- -- 1,700 subordinated debenture into shares

Supplemental disclosures of cash flow information: Income taxes

paid (mainly - tax advance in respect of excess expenses) 49 107

161 321 ======= ======= ======= ======= Interest paid -- -- -- 350

======= ======= ======= ======= (a) Incorporation Date The

accompanying notes are an integral part of the financial statements

XTL BIOPHARMACEUTICALS LTD. (A Development Stage Company) NOTES TO

THE CONSOLIDATED FINANCIAL STATEMENTS 1) GENERAL The consolidated

financial statements of the Company are presented on a going

concern basis, which contemplates the realization of assets and

satisfaction of liabilities in the normal course of business. The

Company has experienced a significant loss from operations. For the

year ended December 31, 2005, the Company incurred a net loss of

$14 million and had an accumulated deficit of $100 million. These

matters raise substantial doubt about the Company's ability to

continue as a going concern. The Company's ability to continue as a

going concern will depend upon its ability to raise additional

capital in the short term. The Company is actively pursuing raising

additional capital to fund its operations although there is no

assurance that such capital will be available to the Company.

Failure to secure additional capital or to expand its revenue base

would result in the Company depleting its available funds and not

being able to pay its obligations when they become due. The

accompanying consolidated financial statements do not include any

adjustments to reflect the possible future effects on the

recoverability and classification of assets or the amounts and

classification of liabilities that may result from the possible

inability of the Company to continue as a going concern. RESEARCH

AND DEVELOPMENT COSTS AND PARTICIPATIONS Research and development

costs are expensed as they are incurred and consist primarily of

salaries and related personnel costs, fees paid to consultants and

other third-parties for clinical and laboratory development,

facilities-related and other expenses relating to the design,

development, testing, and enhancement of product candidates.

Participations from government (and from others) for development of

approved projects are recognized as a reduction of expense as the

related costs are incurred. In connection with purchase of assets,

amounts assigned to intangible assets to be used in a particular

research and development project that have not reached

technological feasibility and have no alternative future use are

charged to in- process research and development costs at the

purchase date. 2) REVENUE RECOGNITION The Company recognizes the

revenue from the licensing agreement with Cubist under the

provisions of the EITF 00-21 "Revenue Arrangements with Multiple

Deliverables" and SAB 104 "Revenue Recognition." Under those

pronouncements, companies are required to allocate revenues from

multiple-element arrangements to the different elements based on

sufficient objective and reliable evidence of fair value. Since the

Company does not have the ability to determine the fair value of

each unit of accounting, the agreement was accounted for as one

unit of accounting, after failing the separation criteria, and the

Company recognizes each payment on the abovementioned agreement

ratably over the expected life of the arrangement. In addition,

through 2005, Cubist had requested that the Company provide

development services to be reimbursed by Cubist. As required by

EITF 01-14 "Income Statement Characterization of Reimbursements

Received for "Out-of-Pocket" Expenses Incurred," amounts paid by

the Company, as a principal, are included in the cost of revenues

as reimbursable out-of-pocket expenses, and the reimbursements the

Company receives as a principal are reported as reimbursed

out-of-pocket revenues. 3) STOCK-BASED COMPENSATION Prior to

January 1, 2005, the Company accounted for employee stock-based

compensation under the intrinsic value model in accordance with

Accounting Principles Board Opinion No. 25 - "Accounting for Stock

Issued to Employees" ("APB 25") and related interpretations. Under

APB 25, compensation expense is based on the difference, if any, on

the date of the grant, between the fair value of the Company's

ordinary shares and the exercise price. When the number of the

underlying shares or the exercise price is not known at the grant

date, the Company updated, at each period, the compensation

expenses until such data becomes known. In addition, in accordance

with FAS 123 No. "Accounting for Stock-Based Compensation" ("FAS

123"), which was issued by the Financial Accounting Standards Board

("FASB"), the Company disclosed pro forma data assuming it had

accounted for employee share option grantsusing the fair

value-based method defined in FAS 123. In December 2004, the FASB

issued the revised FAS No. 123R "Share - Based Payment" ("FAS

123R"), which addresses the accounting for share-based payment

transactions in which a company obtains employee services in

exchange for (a) equity instruments of a company or (b) liabilities

that are based on the fair value of a company's equity instruments

or that may be settled by the issuance of such equity instruments.

In March 2005, the SEC issued Staff Accounting Bulletin No. 107

("SAB 107") regarding the SEC's interpretation of FAS 123R. FAS

123R eliminates the ability to account for employee share-based

payment transactions using APB 25, and requires instead that such

transactions be accounted for using the grant-date fair value based

method. FAS 123R is effective as of the annual reporting period

that begins after June 15, 2005. Early adoption of FAS 123R is

encouraged. FAS 123R applies to all awards granted or modified

after the effective date of the standard. In addition, compensation

cost for the unvested portion of previously granted awards that

remain outstanding on the effective date shall be recognized on or

after the effective date, as the related services are rendered,

based on the awards' grant-date fair value as previously calculated

for the pro-forma disclosure under FAS 123. The Company implemented

early adoption of FAS 123R, as of January 1, 2005, using the

modified prospective application transition method, as permitted by

FAS 123R. Under such transition method, the Company's financial

statements for periods prior to the effective date of FAS 123R

(January 1, 2005) have not been restated. As a result of the early

adoption, the Company reduced the deferred share-based compensation

against the additional paid in capital. The fair value of stock

options granted with service conditions, was determined using the

Black-Scholes valuation model, which is consistent with the

Company's valuation techniques previously utilized for options in

footnote disclosures required under FAS 123, as amended by FAS No.

148, "Accounting for Stock-Based Compensation - Transition and

Disclosure." Such value is recognized as an expense over the

service period, net of estimated forfeitures, using the

straight-line method under FAS 123R. The fair value of stock

options granted with market conditions, was determined using a

lattice model that incorporated a Monte Carlo Simulation method.

Such value is recognized as an expense using the graded method

under FAS123R. The estimation of stock awards that will ultimately

vest requires significant judgment, and to the extent actual

results or updated estimates differ from the Company's current

estimates, such amounts will be recorded as a cumulative adjustment

in the period those estimates are revised. The Company considers

many factors when estimating expected forfeitures, including types

of awards, employee class, and historical experience. Actual

results, and future changes in estimates, may differ substantially

from the Company's current estimates. Both the Black-Scholes model

and a lattice model incorporating the Monte Carlo simulation method

take into account a number of valuation parameters. The application

of FAS 123R had the following effect on reported amounts, for the

year ended December 31, 2005, relative to amounts that would have

been reported using the intrinsic value method under previous

accounting ($ in thousands, except per share amounts): Using Impact

of the As previous adoption of reported accounting FAS 123R

_____________ _____________ ___________ Loss for the year 12,130

1,885 14,015 Basic and diluted loss per (0.07) (0.08) ordinary

share The following table illustrates the effect on loss and loss

per share assuming the Company had applied the fair value

recognition provisions of FAS 123 to its stock-based employee

compensation, for years presented prior to the adoption of FAS

123R: Period from March 9, 1993* Year ended December 31 to December

31, 2004 2003 2004 (Unaudited) ($ in thousands except per share

amounts) ________________________________________ Loss for the

16,473 14,288 85,776 period, as reported Deduct: stock- based

employee compensation expense, included in -- -- (483) reported

loss Add: stock-based employee compensation expense determined

under fair value method for all 239 821 6,355 awards __________

__________ __________ Loss - pro-forma 16,712 15,109 91,648

__________ __________ __________ Basic and diluted loss per share:

As reported 0.12 0.13 ========= ========= Pro-forma 0.12 0.14

========= ========= The Company accounts for equity instruments

issued to third party service providers (non - employees) in

accordance with the fair value method prescribed by FAS123, and as

of January 1, 2005, by FAS 123R, and the provisions Emerging Issues

Task Force Issue No. 96-18, "Accounting for Equity Instruments That

Are Issued to Other Than Employees for Acquiring, or in Conjunction

with Selling Goods or Services" ("EITF 96-18"). 4) LICENSE

AGREEMENT WITH CUBIST The Company entered into a licensing

agreement with Cubist in June 2004, under which the Company granted

to Cubist an exclusive, worldwide license (with the right to

sub-license) to commercialize HepeX-B and any other product

containing an hMAb, or humanized monoclonal antibody, or fragment

directed at the hepatitis B virus owned or controlled by the

Company. See Note 3 for the revenue recognition treatment. In

August 2005, the Company amended its licensing agreement with

Cubist. Under the terms of the agreement, as amended, Cubist paid

the Company an initial up front nonrefundable payment of $1 million

upon the signing of the agreement, and a payment of $1 million (out

of which $454,000 and $185,000 was recorded as revenue in the years

ended December 31, 2005 and 2004, respectively) as collaboration

support paid in 2004 (instead of a total of $2 million to be paid

in installments through 2005, as per the original agreement).

Furthermore under the terms of the agreement, as amended, Cubist

shall make a payment in the amount of $3 million upon achievement

of certain regulatory milestones until the end of 2007 or an amount

of $2 million upon achievement of the same certain regulatory

milestones until the end of 2008. Under this agreement, as amended,

the Company was responsible for certain clinical and product

development activities of HepeX-B through August 2005, at the

expense of Cubist. The Company has transferred full responsibility

for completing the development of HepeX-B to Cubist. Cubist will be

responsible for completing the development and for registration and

commercialization of the product worldwide. The Company accounts

for the payments resulting from the agreement, as follows (i) the

$1 million up-front fee and the collaboration support payments are

recorded as deferred revenue upon receipt, and amortized through

2008 or date regulatory approval are reached, if earlier, and (ii)

the milestone contingent payments will be recorded as revenue when

regulatory approval milestones are obtained. Under the agreement,

the Company is entitled to receive royalties from net sales by

Cubist, if any, generally ranging from 10% to 17%, depending on

levels of net sales achieved by Cubist, subject to certain

deductions based on patent protection of HepeX-B in that territory,

total cost of HepeX-B development, third party license payments and

indemnification obligations. The agreement expires on the later of

the last valid patent claim covering HepeX-B to expire, or 10 years

after the first commercial sale of HepeX-B on a country-by-country

basis. Under a research and license agreement with Yeda, the

Company paid during 2004, $250,000 with respect to the $1 million

up front fee received in June 2004, out of which $54,000 and

$32,000 was recorded as cost of revenues in 2005 and 2004,

respectively. The balance of the deferred gain, related to the

revenue from Cubist, as of December 31, 2004 and 2005, was

presented in the balance sheet, net of the above mentioned payment,

as follows: December 31, 2005 2004 ($ in thousands)

______________________________ Deferred revenue 1,361 1,815 Less -

Deferred expenses related to 164 218 Yeda ________ ________

Deferred gain 1,197 1,597 ======= ======= 6. LICENSE AND ASSET

PURCHASE AGREEMENT WITH VIVOQUEST During September 2005, the

Company licensed perpetually from VivoQuest Inc. ("VivoQuest"), a

US privately-held company, which is a development stage enterprise,

exclusive worldwide rights to VivoQuest's intellectual property and

technology, covering a proprietary compound library, including

VivoQuest's lead hepatitis C compounds. In addition, the Company

acquired from VivoQuest certain assets, including VivoQuest's

laboratory equipment, assumed VivoQuest's lease of its laboratory

space and certain research and development employees. The Company

executed this transaction in order to broaden its pipeline and

strengthen its franchise in infectious diseases. In connection with

the VivoQuest transaction (the "Transaction"): (1) the Company

issued the fair value equivalent of $1,391,000 of its ordinary

shares for a total of 1,314,420 ordinary shares (calculated based

upon the average of the closing prices per share for the period

commencing two days before, and ending two days after the closing

of the transaction), made cash payments of approximately $400,000

to cover VivoQuest's operating expenses prior to the closing of the

Transaction, and incurred $148,000 in direct expenses associated

with the Transaction; (2) the Company agreed to make additional

contingent milestone payments triggered by certain regulatory and

sales targets, totaling up to $34.6 million, $25.0 million of which

will be due upon or following regulatory approval or actual product

sales, and are payable in cash or ordinary shares at the Company's

election. No contingent consideration has been paid pursuant to the

license agreement as of the balance sheet date, because none of the

milestones have been achieved. The contingent consideration will be

recorded as part of the acquisition costs in the future; and (3)

the Company agreed to make royalty payments on future product

sales. As VivoQuest is a development stage enterprise that had not

yet commenced its planned principal operations, the Company

accounted for the Transaction as an acquisition of assets pursuant

to the provisions of FAS No. 142 "Goodwill and Other Intangible

Assets." Accordingly, the purchase price was allocated to the

individual assets acquired, based on their relative fair values,

and no goodwill was recorded. The purchase price consisted of: ($

in thousands) _____________ Fair value of the Company's ordinary

shares 1,391 Cash consideration paid 400 Direct expenses associated

with the 148 Transaction _____________ Total purchase price 1,939

=========== The tangible and intangible assets acquired consisted

of the following: ($ in thousands) _____________ Tangible assets

acquired - property and equipment 113 Intangible assets acquired:

In-process research and development 1,783 Assembled workforce 43

___________ Total intangible assets acquired 1,826 ___________

Total tangible and intangible assets 1,939 acquired ___________ The

fair value of the in-process research and development acquired was

estimated by management with the assistance of an independent

third-party appraiser, using the "income approach." In the income

approach, fair value is dependent on the present value of future

economic benefits to be derived from ownership of an asset. Central

to this approach is an analysis of the earnings potential

represented by an asset and of the underlying risks associated with

obtaining those earnings. Fair value is calculated by discounting

future net cash flows available for distribution to their present

value at a rate of return, which reflects the time value of money

and business risk. In order to apply this approach, the expected

cash flow approach was used. Expected cash flow is measured as the

sum of the average, or mean, probability-weighted amounts in a

range of estimated cash flows. The expected cash flow approach

focuses on the amount and timing of estimated cash flows and their

relative probability of occurrence under different scenarios. The

probability weighted expected cash flow estimates are discounted to

their present value using the risk free rate of return, since the

business risk is incorporated in adjusting the projected cash flows

to the probabilities for each scenario. The risk-free discount rate

assumed for the valuation of the license to the intellectual

property is 4.6%, based upon the yields on long-term U.S. treasury

securities, as of the valuation date. The fair value of the

assembled workforce acquired was estimated by management with the

assistance of an independent third-party appraiser, based upon the

cost approach. The cost approach measures the fair- value based on

the cost of reproducing or replacing an asset, less depreciation

and amortization from physical deterioration and functional or

economic obsolescence, if present and measurable. According to this

approach, the estimated fair-value of the assembled workforce is

based on the cost of replacing VivoQuest's key employees, which

were hired by the Company as a part of Transaction. The amount

allocated to in-process research and development represents the

relative fair value of purchased in-process research and

development that, as of the transaction date, have not reached

technological feasibility and have no proven alternative future

use. Accordingly, they were charged in the consolidated statement

of operations as "in- process research and development costs." The

assembled workforce that was acquired is being amortized using the

straight-line method over its estimated useful life of three years,

and is classified as "intangible assets" on the Company's balance

sheet. For the year ended December 31, 2005, amortization of the

assembled workforce was $4,000. Estimated amortization expenses of

the assembled workforce for future years subsequent to December 31,

2005 are $14,000 for 2006 and 2007, and $11,000 for 2008. 7.

SUPPLEMENTARY FINANCIAL STATEMENT INFORMATION a. Short-term bank

deposits The deposits are denominated in dollars and bear a

weighted average annual interest rate of 4.23 % as of December 31,

2005 (as of December 31, 2004 - 1.81%). b. Accounts receivable -

other: December 31 2005 2004 ($ in thousands)

________________________ Prepaid expenses 285 165 Employees 75 24

Value added tax authorities 17 101 Other 54 16 __________

__________ 431 306 __________ __________ c. Accounts payable and

accruals: December 31 2005 2004 ($ in thousands)

________________________ Suppliers 655 1,108 Accrued expenses 940

1,337 Institutions and employees in respect of salaries and related

benefits 250 294 Provision for vacation pay and recreation 160 385

pay Other 2 10 _________ __________ 2,007 3,134 _________

__________ Statements of operations: d. Research and development

costs: Period from March 9, 1993 Year ended December 31 to December

31, 2005 2004 2003 2005 (Unaudited) ($ in thousands)

____________________________________________________ Wages,

salaries and related benefits (includes non-cash compensation of

$67 in 2005, and $0 in 2004 and 2,764 2,776 3,450 23,709 2003)

Outside 2,054 6,430 6,799 35,910 service providers Lab supplies 558

754 1,128 8,964 Consultants (includes non- cash compensation of $45

in 2005, $30 in 2004 531 549 494 3,725 and $0 in 2003) Rent and 752

725 866 4,756 maintenance Impairment 26 354 380 loss Depreciation

212 277 369 2,929 and amortization Other 416 474 562 2,517 ________

_________ __________ _________ 7,313 11,985 14,022 82,890 ________

_________ __________ _________ e. General and administrative

expenses: Period from March 9, 1993 Year ended December 31 to

December 31, 2005 2004 2003 2005 (Unaudited) ($ in thousands)

____________________________________________________ Wages,

salaries and related benefits (includes non-cash compensation of $5

in 2005, and $0 in 2004 and 2003) 454 1,890 1,244 11,534 Corporate

140 289 228 2,350 communications Professional 890 647 564 4,405

fees Director fees and related (includes non-cash compensation of

$2,636 in 2005, and 2,821 243 183 4,208 $0 in 2004 and 2003) Rent

and 91 90 104 956 maintenance Communications 25 34 33 220

Depreciation 30 42 70 619 and amortization Patent 174 271 125 1,191

registration fees Other 832 628 554 3,529 _________ ________

__________ __________ 5,457 4,134 3,105 29,012 _________ _______

__________ __________ f. Business development costs: Period from

March 9, 1993 Year ended December 31 to December 31, 2005 2004 2003

2005 (Unaudited) ($ in thousands)

____________________________________________________ Wages,

salaries and related Benefits (includes non-cash compensation of

$10 in 2005, and $0 in 171 410 408 2,672 2004 and 2003) Travel 22

36 136 764 Professional 34 364 120 1,077 fees _________ ________

__________ ________ 227 810 664 4,513 _________ ________ __________

________ g. Financial income, net: March 9, 1993 Year ended

December 31 to December 31, 2005 2004 2003 2005 (Unaudited) ($ in

thousands) ___________________________________________________

Financial income: Interest 503 297 458 9,228 income Foreign

exchange differences gain -- 67 -- 203 Gain from available for sale

securities -- 13 62 13 Other -- -- -- 156 ________ ________

________ ________ 503 377 520 9,600 ________ ________ ________

________ Financial expenses: Foreign exchange differences loss 39

-- 148 1,960 Interest -- -- 374 expense Loss from available for

sale securities -- -- -- 14 Other 21 25 20 109 ________ ________

________ ________ 60 25 168 2,457 ________ ________ ________

________ Financial 443 352 352 7,143 income, net ======== ========

======= ======== 8. SUBSEQUENT EVENT During March 2006, the Audit

Committee and the Board of Directors of the Company approved the

grant to the CEO of 7,000,000 options, to the Chairman 9,898,719

options and to a non-executive director 750,000 options, to

purchase ordinary shares of the Company. All of such options are

subject to vesting of which one-third is based on service period,

and the remainder is based on achievement of certain milestones

linked to the Company's valuation on the public markets. The option

grant to the Chairman and to the non-executive director is subbject

to shareholder approval DATASOURCE: XTL Biopharmaceuticals Ltd.

CONTACT: Contacts: XTLbio, Ron Bentsur, Chief Executive Officer

Tel: +1-212-531-5971

Copyright

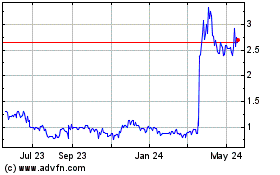

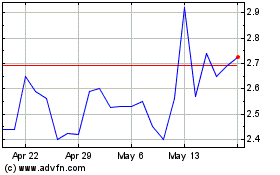

XTL Biopharmaceuticals (NASDAQ:XTLB)

Historical Stock Chart

From Jun 2024 to Jul 2024

XTL Biopharmaceuticals (NASDAQ:XTLB)

Historical Stock Chart

From Jul 2023 to Jul 2024