Schwab Prices Exchange Offer - Analyst Blog

24 August 2012 - 2:52AM

Zacks

The Charles Schwab Corporation (SCHW) has

declared the pricing terms of an earlier announced exchange offer.

The offer involves replacement of outstanding 4.950% old senior

notes (maturing in 2014) with 3.225% new senior notes (maturing in

2022).

The total exchange price for each of $1000 worth of old senior

notes will include a cash consideration of $75.18. Further, the

exchange price is inclusive of early participation payment of $30.

The senior notes qualified for exchange must be validly tendered

and not withdrawn on or before 5:00 p.m., New York City time, on

August 21, 2012, which is the early participation date accepted by

the company for the exchange offer.

However, it must be mentioned that to avail the offer on the early

settlement date, certain conditions are needed to be fulfilled.

These conditions include the requirement of $250 million worth of

senior notes validly tendered and not withdrawn prior to the early

participation date. As per the offering agent – Global Bondholder

Services – nearly $256 million of senior notes have been tendered

and not withdrawn on or prior to the early participation date.

Moreover, the exchange offer on the final settlement date is

subject to certain conditions, including the requirement that the

new notes issued on the final settlement date will be fungible for

U.S. federal income tax purposes.

The early settlement date for qualified old notes is August 27,

2012. The offer will reach expiration at midnight on August 28,

2012. The extension of the offer and waiving any of the requisite

conditions is solely the discretion of the company’s

management.

With this exchange offer, Schwab will be able to reduce its

interest expense burden as the new notes carry a lower coupon rate

compared to the old notes. Further, with the maturity of these

notes extending to 2022, the company will be capable of withholding

the amount for a longer period.

Schwab currently retains a Zacks #3 Rank, which translates into a

short-term Hold rating. One of its peers – Arlington Asset

Investment Corp. (AI) – retains a Zacks #1 Rank, which

translates into short-term Strong Buy rating.

ARLINGTON ASSET (AI): Free Stock Analysis Report

SCHWAB(CHAS) (SCHW): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

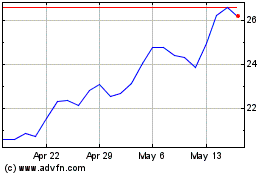

C3 AI (NYSE:AI)

Historical Stock Chart

From Jun 2024 to Jul 2024

C3 AI (NYSE:AI)

Historical Stock Chart

From Jul 2023 to Jul 2024