Current Report Filing (8-k)

20 August 2021 - 8:35PM

Edgar (US Regulatory)

0001766478false00017664782021-08-062021-08-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): August 16, 2021

Angel Oak Mortgage, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maryland

|

001-40495

|

37-1892154

|

|

(State or other jurisdiction of incorporation or organization)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

3344 Peachtree Road Northeast, Suite 1725, Atlanta, Georgia 30326

(Address of Principal Executive Offices and Zip Code)

Registrant’s telephone number, including area code: (404) 953-4900

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, $0.01 par value per share

|

AOMR

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☒

Item 1.01 Entry into a Material Definitive Agreement.

On August 16, 2021, three of the subsidiaries (the “Subsidiaries”) of Angel Oak Mortgage, Inc. (the “Company”) entered into a non-mark-to-market $50.0 million committed financing facility with Veritex Community Bank (“Veritex”) through the execution of a Loan and Security Agreement (the “Loan and Security Agreement”) and a Promissory Note (the “Promissory Note” and together with the Loan and Security Agreement, the “Facility Documents”) among those Subsidiaries and Veritex. Pursuant to the Facility Documents, Veritex agreed to makes one or more advances to one or more of the Subsidiaries of the Company (together, the “Borrowers”) secured by mortgage loans, notes and related collateral (the “Veritex Facility Line”). The Veritex Facility Line expires, and amounts outstanding under the Veritex Facility Line will mature, on August 16, 2023, subject to certain exceptions.

The amount advanced by Veritex for each eligible loan is based on the unpaid principal balance of the loan, the loan-to-value ratio of the loan and the FICO score of the borrower and ranges from 80.00% to 92.50% depending on the type of loan and the aforementioned criteria. The interest rate on any outstanding balance under the Facility Documents is the greater of (1) the sum of (A) one-month LIBOR and (B) 2.30%, and (2) 3.13%.

The obligations of the Borrowers under the Facility Documents are guaranteed by the Company pursuant to a Guaranty Agreement (the “Guaranty”) executed contemporaneously with the Facility Documents. In addition, the Company is subject to various financial and other covenants, including, as of the last day of any fiscal quarter: (1) the Company’s tangible net worth must be at least equal to $150.0 million; (2) the Company’s ratio of (A) EBITDA to (B) debt service, shall be at least equal to 1.25 to 1.0 for such quarter; (3) the Company’s ratio of total liabilities to total tangible net worth must not exceed 5.5 to 1.0; and (4) the Company’s liquidity must at least equal $5.0 million. A copy of the Loan and Security Agreement is attached hereto as Exhibit 10.1 and incorporated herein by reference. A copy of the Promissory Note is attached hereto as Exhibit 10.3 and incorporated herein by reference. A copy of the Guaranty is attached hereto as Exhibit 10.2 and incorporated herein by reference.

In addition, the Facility Documents contain events of default (subject to certain materiality thresholds and grace periods), including payment defaults, breaches of covenants and/or certain representations and warranties, cross-defaults, bankruptcy or insolvency proceedings and other events of default customary for this type of transaction. The remedies for such events of default are also customary for this type of transaction and include acceleration of the principal amount outstanding under the Facility Documents and Veritex’s right to liquidate the collateral then subject to the Facility Documents.

The Borrowers are also required to pay certain customary fees to Veritex and to reimburse Veritex for certain costs and expenses incurred in connection with Veritex’s management and ongoing administration of the Veritex Facility Line.

A copy of the Loan and Security Agreement is attached hereto as Exhibit 10.1 and incorporated herein by reference. A copy of the Promissory is attached hereto as Exhibit 10.2 and incorporated herein by reference. A copy of the Guaranty is attached hereto as Exhibit 10.3 and incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information required by Item 2.03 contained in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit No. Description

Exhibit 104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: August 20, 2021

|

|

|

ANGEL OAK MORTGAGE, INC.

|

|

|

|

|

|

|

|

|

|

By: /s/ Brandon Filson

|

|

|

|

|

Name: Brandon Filson

|

|

|

|

|

Title: Chief Financial Officer and Treasurer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

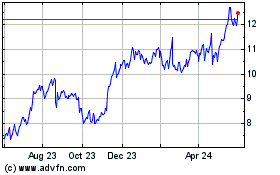

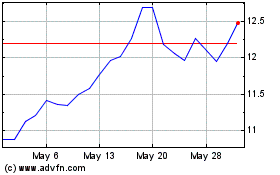

Angel Oak Mortgage REIT (NYSE:AOMR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Angel Oak Mortgage REIT (NYSE:AOMR)

Historical Stock Chart

From Jul 2023 to Jul 2024