February 14, 20240001410636false00014106362024-02-142024-02-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 14, 2024

American Water Works Company, Inc.

(Exact name of registrant as specified in its charter)

Commission File Number: 001-34028

| | | | | |

| Delaware | 51-0063696 |

(State or other jurisdiction

of incorporation) | (IRS Employer

Identification No.) |

1 Water Street

Camden, NJ 08102-1658

(Address of principal executive offices, including zip code)

(856) 955-4001

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

| Common stock, par value $0.01 per share | | AWK | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events.

Indiana Utility Regulatory Commission (the “IURC”) Approval of Order in Indiana-American Water Company, Inc. (“Indiana American Water”) General Rate Case

On February 14, 2024, the IURC issued an order (the “Order”) approving the adjustment of base rates requested in a rate case filed on March 31, 2023 by Indiana American Water, a wholly owned subsidiary of American Water Works Company, Inc. (the “Company”). The Order approved a $66.3 million annualized increase in water and wastewater system revenues, excluding previously recovered infrastructure surcharges, based on an authorized return on equity (“ROE”) of 9.65%, authorized rate base of $1,835 million, a common equity ratio of 56.15% and a debt ratio of 43.85%. For purposes of determining rates, the adjustment is based on an equity component of 48.19% due to the regulatory practice in Indiana of including certain zero-cost items or tax credit balances in the capital structure calculation.

The annualized revenue increase will include three step increases, with $24.9 million of the increase to be included in rates in February 2024, $17.1 million in May 2024, and $24.3 million in May 2025. The increases are being driven primarily by (i) over $875 million of water and wastewater system capital investments since the completion of Indiana American Water’s last rate case and through April 30, 2025, (ii) higher pension and other OPEB costs, and (iii) increases in production costs, including chemicals, fuel and power costs.

A copy of the press release issued by Indiana American Water on February 15, 2024, has been filed as Exhibit 99.1 hereto and is incorporated herein by reference. References and links to websites and other information contained in this press release are not provided as active hyperlinks, and the information contained in or accessed through these hyperlinks shall not be incorporated into, or form a part of, this Current Report on Form 8-K. Cautionary Statement Concerning Forward-Looking Statements

Certain statements included in this Current Report on Form 8-K (or the exhibits thereto) are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995. In some cases, these forward-looking statements can be identified by words with prospective meanings such as “intend,” “plan,” “estimate,” “believe,” “anticipate,” “expect,” “predict,” “project,” “propose,” “assume,” “forecast,” “outlook,” “future,” “pending,” “goal,” “objective,” “potential,” “continue,” “seek to,” “may,” “can,” “will,” “should” and “could,” or the negative of such terms or other variations or similar expressions. These forward-looking statements are predictions based on the Company’s current expectations and assumptions regarding future events. They are not guarantees or assurances of any outcomes, performance or achievements, and readers are cautioned not to place undue reliance upon them. The forward-looking statements are subject to a number of estimates and assumptions, and known and unknown risks, uncertainties and other factors. Actual results may differ materially from those discussed in the forward-looking statements included in this Current Report on Form 8-K as a result of the factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, as filed with the Securities and Exchange Commission (the “SEC”) on February 14, 2024, and other filings with the SEC, and additional risks and uncertainties, including with respect to (1) the amount and timing of incremental future capital expenditures and investments to be made by Indiana American Water; (2) regulatory, legislative, local or municipal actions affecting the water and wastewater industries, which could adversely affect the Company or Indiana American Water; and (3) other economic, financial, political, business and other factors that may impact or affect the water and wastewater industries generally, the Company or Indiana American Water specifically. These forward-looking statements are qualified by, and should be read together with, the risks and uncertainties set forth above and the risk factors included in the Company’s annual and quarterly reports as filed with the SEC, and readers should refer to such risks, uncertainties and risk factors in evaluating such forward-looking statements. Any forward-looking statements speak only as of the date of this Current Report on Form 8-K. The Company does not have any obligation or intention to update or revise any forward-looking statement, whether as a result of new information, future events, changed circumstances or otherwise, except as otherwise required by the federal securities laws. New factors emerge from time to time, and it is not possible for the Company to predict all such factors. Furthermore, it may not be possible to assess the impact of any such factor on the Company’s or Indiana American Water’s business, either viewed independently or together, or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits to this Current Report have been provided herewith as noted below:

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1* | | |

| 104 | | Cover Page Interactive Data File (the cover page XBRL tags are included and formatted as Inline XBRL). |

| * Filed herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | AMERICAN WATER WORKS COMPANY, INC. |

| | | | | |

| Dated: | February 15, 2024 | | By: | /s/ JOHN C. GRIFFITH |

| | | | | John C. Griffith |

| | | | | Executive Vice President and Chief Financial Officer |

Exhibit 99.1

Press Release

Indiana American Water Granted New Rates by the Indiana Utility Regulatory Commission

Rate adjustment driven by $875 million in system upgrades; low-cost basic water service approved

GREENWOOD, Ind. (February 15, 2024) – The Indiana Utility Regulatory Commission (IURC) yesterday issued an order approving base rate adjustments on a statewide basis for Indiana American Water following a comprehensive 11-month review process.

The company’s rate adjustment request, which was filed on March 31, 2023, was driven primarily by approximately $875 million in water and wastewater investments since the last approved rate adjustment, to be made through April 2025, as well as increases in the cost of procuring chemicals, goods and services.

“By making prudent, ongoing investments to maintain and upgrade our water and wastewater systems, Indiana American Water is committed to providing safe, clean, reliable and affordable water service and fire protection capabilities,” said Indiana American Water President Matt Prine. “We are proud to continue to provide high-quality water that protects customers and the communities we serve.”

The order includes a $66.3 million adjustment to existing authorized operating water and wastewater revenues to address the increased investment and expenses. The increase will be implemented through a phased, three-step process through May 2025.

The increases for residential wastewater customers will vary depending on the community served. Final water and wastewater customer rates will be determined once revised tariffs have been completed and approved by the IURC later this month and will be available on the company’s website at https://www.amwater.com/inaw/customer-service-billing/your-water-rates.

Prior to the most recent rate adjustment, the company last filed for new rates through a general rate filing in September 2018.

Press Release

The IURC also approved a new rate design that provides 1,500 gallons of water usage at no additional cost above the fixed monthly customer charge for all water customers. The change will allow Indiana American Water to provide low-cost basic water service for customers on fixed incomes that use a lower volume of water than the typical residential customer. With this change, the cost for the typical residential water customer using 1,500 gallons will be approximately $20 per month.

Indiana American Water also offers payment plans, budget billing and provides information to customers about the Low-Income Household Water Assistance Plan (LIHWAP - end date for program is slated for March 31, 2024). More information can be found by clicking on the Low Income Program link under the Customer Service & Billing heading on the company’s website or by clicking here. For tips on how to reduce your water bill by conserving water, visit our Wise Water Use page at https://www.amwater.com/inaw/Water-Wastewater-Information/wise-water-use.

About American Water

American Water (NYSE: AWK) is the largest regulated water and wastewater utility company in the United States. With a history dating back to 1886, We Keep Life Flowing® by providing safe, clean, reliable and affordable drinking water and wastewater services to more than 14 million people with regulated operations in 14 states and on 18 military installations. American Water’s 6,500 talented professionals leverage their significant expertise and the company’s national size and scale to achieve excellent outcomes for the benefit of customers, employees, investors and other stakeholders.

For more information, visit amwater.com and join American Water on LinkedIn, Facebook, X and Instagram.

About Indiana American Water

Indiana American Water, a subsidiary of American Water, is the largest investor-owned water utility in the state, providing high-quality and reliable water and wastewater services to approximately 1.4 million people.

###

AWK-IR

Media Contact:

Joe Loughmiller

317-885-2434

joe.loughmiller@amwater.com

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

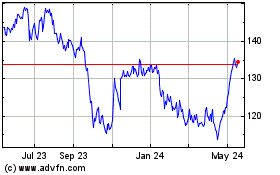

American Water Works (NYSE:AWK)

Historical Stock Chart

From Jun 2024 to Jul 2024

American Water Works (NYSE:AWK)

Historical Stock Chart

From Jul 2023 to Jul 2024