Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

07 June 2024 - 6:22AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

|

|

|

| Filed by the Registrant ☒ |

|

|

|

| Filed by a Party other than the Registrant ☐ |

|

|

| Check the appropriate box: |

|

|

|

|

| ☐ Preliminary Proxy Statement

☐ Definitive

Proxy Statement |

|

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

| ☒ Definitive Additional Materials |

|

| ☐ Soliciting Material Pursuant to § 240.14a-12 |

BLACKROCK CALIFORNIA MUNICIPAL INCOME TRUST

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy

Statement, if Other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

| ☒ |

|

No fee required. |

|

|

| ☐ |

|

Fee paid previously with preliminary materials. |

|

|

| ☐ |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Your Vote Matters BlackRock California Municipal Income Trust (NYSE: BFZ) BlackRock is fighting for you. Vote now and make your voice

heard: Vote today! Vote today: ? How to vote: Defend your fund, Phone FOR the BlackRock nominees Online AGAINST Saba’s proposal to terminate save your income. WHITE proxy card investment mgmt. agreement HOW TO VOTE: Use the WHITE proxy card,

and vote FOR your experienced nominees and AGAINST Saba’s proposal. Withhold For All To withhold authority to vote for any individual All Except nominee(s), mark “For All Except” and write the 1. To Elect the Class II Board

Member Nominees. number(s) of the nominee(s) on the line below. 01 J. Phillip Holloman 02 Arthur P. Steinmetz 2. If properly presented at the meeting, a proposal submitted by a hedge fund managed For Abstain by Saba Capital Management, L.P. to

terminate the investment management agreement between the Trust and BlackRock Advisors, LLC. ! IMPORTANT: Do not return any gold proxy card from Saba BlackRock is delivering real value: Your Fund outperformed Sustainable distributions grew, peers in

20231 more than peers1 1 Distribution enhancements (May 2023 – May 2024) Total shareholder returns (2023) 15.84% +51.3% BFZ 4.45% +22.9% BFZ Peer median Peers Actions taken by your Board and BlackRock’s open market share management team

have narrowed repurchase program enhances the BFZ’s discount to NAV value of your investment. Discount narrowing2 Share repurchases drive meaningful 45% gains in NAV.1 $21m $3.3m Discount 8.1% to NAV2 14.7% 5/24/2024 Shares repurchased NAV

accretion for our shareholders 12/31/2022 1 Bloomberg as of 5/24/2024; Notes: Peer set includes MUC, EVM, CEV, VCV, NKX, NAC, PCQ, PCK, and PZC; Total shareholder return on price annualized for periods longer than 1 year (assumes dividends are

reinvested); Distribution growth over the last year 2 12/31/2022 – 5/24/2024; Morningstar/BlackRock data as of 5/24/2024

The truth about Saba Setting the record straight Saba has made numerous unsubstantiated claims about BlackRock, your Fund, and your

Board—but they do not add up. Myth Reality Saba claims that Saba has chosen to use its vast resources to buy large stakes its actions are in in closed-end funds (CEF), engage in costly proxy fights, and

the best interest of force actions that provide Saba with a quick profit for CEF shareholders themselves at your expense. Myth Reality Saba claims BlackRock CEFs have delivered consistent long-term value BlackRock CEFs over time, generating

$3.6 billion in gains in 2023 alone while aren’t delivering paying shareholders $3.1 billion per year via dividends3. We results for investors have also repurchased $1.3 billion in shares, generating over $200 million in

gains4. Myth Reality Saba claims to be a BlackRock has a 35+ year track record of delivering long-term better CEF manager value for CEF shareholders. than BlackRock At the funds Saba has taken over (BRW, SABA), shareholders are now exposed to

riskier strategies, leaving them with a fund that no longer serves their original goals, as well as higher management fees. Saba’s CEF track is marked by failure and underperformance5: BRW Total Shareholder Return5 BRW Morningstar US CEF Bank

Loans BlackRock Bank Loans Funds Median 13.4% Since takeover (6/4/2021 – 18.0% 5/24/2024) 30.6% 3 Annualized estimate based on June 2024 dividends for BlackRock closed-end funds 4 BlackRock. Since

inception of the funds’ repurchase programs to 4/30/2024. Date of inception of BCAT, ECAT, BIGZ, BMEZ and BSTZ repurchase programs is 11/19/2021. Date of inception of BFZ, BNY, MHN, MPA and MYN repurchase programs is 11/15/2018 5 Bloomberg as

of 5/24/2024; Total shareholder return on price (assumes dividends are reinvested)

Vote today. Make your voice heard, and save your fund and your investment. This is no time for taking chances. We need all shareholders

to vote on the enclosed WHITE proxy card today to preserve YOUR Fund: Withhold For All To withhold authority to vote for any individual All Except nominee(s), mark “For All Except” and write the 1. To Elect the Class II Board Member

Nominees. number(s) of the nominee(s) on the line below. 01 J. Phillip Holloman 02 Arthur P. Steinmetz 2. If properly presented at the meeting, a proposal submitted by a hedge fund managed For Abstain by Saba Capital Management, L.P. to terminate

the investment management agreement between the Trust and BlackRock Advisors, LLC. How do I vote? Vote online Vote by phone Vote by mail Using the website provided By calling the toll-free By completing and on YOUR enclosed WHITE number on YOUR

enclosed returning YOUR enclosed proxy card and following WHITE proxy card and WHITE card in the the simple instructions following the simple postage paid envelope instructions provided ! Do NOT send back any proxy card you may receive from Saba If

you have already sent back the proxy card received from Saba, you can still change your vote by promptly voting on the WHITE proxy card, which will replace the proxy card you previously completed. If you have any questions about the proposals to be

voted, please feel free to contact Georgeson LLC (“Georgeson”), toll free at 1-866-529-0071. Important information

about the Fund This material is not an advertisement and is intended for existing shareholder use only. This document and the information contained herein relates solely to BlackRock California Municipal Income Trust (BFZ). The information contained

herein does not relate to, and is not relevant to, any other fund or product sponsored or distributed by BlackRock or any of its affiliates. This document is not an offer to sell any securities and is not a solicitation of an offer to buy any

securities. Common shares for the closed-end fund identified above are only available for purchase and sale at current market price on a stock exchange. A closed-end

fund’s dividend yield, market price and NAV will fluctuate with market conditions. The information for this Fund is provided for informational purposes only and does not constitute a solicitation of an offer to buy or sell Fund shares.

Performance results reflect past performance and are no guarantee of future results. Current performance may be lower or higher than the performance data quoted. All returns assume reinvestment of all dividends. The market value and net asset value

(NAV) of a fund’s shares will fluctuate with market conditions. Closed-end funds may trade at a premium to NAV but often trade at a discount. © 2024 BlackRock, Inc. or its affiliates. All Rights

Reserved. BLACKROCK is a trademark of BlackRock, Inc., or its affiliates. All other trademarks are those of their respective owners. June 2024 | BlackRock California Municipal Income Trust (BFZ) Not FDIC Insured May Lose Value No Bank Guarantee

BFZ_2024_FL6

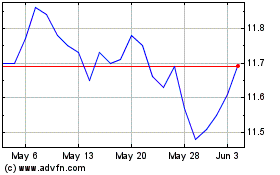

BlackRock California Mun... (NYSE:BFZ)

Historical Stock Chart

From Nov 2024 to Dec 2024

BlackRock California Mun... (NYSE:BFZ)

Historical Stock Chart

From Dec 2023 to Dec 2024