Honeywell Beats Estimates - Analyst Blog

22 April 2011 - 1:45AM

Zacks

Honeywell International

Inc.’s (HON) reported first-quarter 2011 earnings per

share from continuing operations of 88 cents, above the Zacks

Consensus Estimateof 81 cents and prior- year earnings of 63

cents.

Total Revenue

Total revenue was $8.9 billion,

above the Zacks Consensus Estimate of $8.6 billion for the quarter.

Organically total revenue was up 11% year over year, led by strong

growth seen in every business segment of the company. Honeywell

witnesses continued momentum across its

portfolio.

The company reported a revenue

increase in all its segments.

Segment

Performance

Aerospace

segmentsalesclimbed 8% year over year to $2.7 billion, led by

increased original equipment manufacturer (OEM) sales and raised

aftermarket volumes. This increase was partially offset by lower

military and government services sales. An increased volume,

favorable mix, and productivity net of inflation increased

operating margin by 80 bps to 17.3% during the

quarter.

Automation and Control

Solutions segment sales increased by 17% year over year to

$3.7 billion. The segment sales increased in all regions due to an

industrial recovery, introduction of new products, new projects.

Sales in the quarter included 1% favorable impact from foreign

currency. The segment’s operating profit increased 19% during the

quarter.

Transportation

System revenue of $1.2 billion for the quarter, increased

by 19% year over year as a result of increased worldwide sales

volume of Turbo, vigorous launches of new products, increased

availability of European diesel and well as a rise in sales of

friction products. Augmented sales volume, better

productivity and restructuring benefits, increased the segment’s

operating profit by 50%. This was, however, partially offset by

material Inflation.

Specialty Material

sales increased by 19% during the quarter to $1.4 billion, led by

an improved overall market, commercial excellence, and introduction

of new products in the Advanced Materials business as well as

strong UOP growth. Higher sales, commercial excellence, and cost

productivity increased operating profit by 67%. Operating profit

was partially offset by raw material

inflation.

Income

The company incurred total SG&A

expense of approximately $1.3 billion in the quarter versus

approximately $1.1 billion in the first quarter of 2010. Net income

of the company was $708 million compared with $496 million in

prior-year period.

Balance Sheet

Cash and cash equivalents was $3.1

billion with long-term debt of $6.8 billion and shareowner’s equity

of $11.8 billion.

Free cash flow in the quarter was

$0.4 billion excluding pension contributions. Including

contribution of $1 billion to US pension fund, cash flow from

operations was a negative $0.4 billion.

Outlook

The company’s result for the

quarter is quite impressive, supported by an improvement in global

market environment. Led by good first quarter 2011 performance and

improving market condition, Honeywell increased its 2011 sales

outlook from $35.0 billion-$36.0 billion to $36.0 billion-$36.6

billion. Earnings per share outlook was raised from $3.60-$3.80 to

$3.80-$3.95. Free cash flow guidance was maintained at $3.5

billion-$3.37 billion and cash flow from operations in the range of

$3.3 billion-$3.5 billion. Free cash flow expectation excludes US

pension contribution, which is included in cash flow from operation

outlook.

Honeywell’s short-cycle businesses

as well as its commercial aerospace spares and residential and

commercial retrofit businesses are performing impressively well and

are expected to support future growth outlook of the company.

First-quarter 2011 was the eighth consecutive quarter in which

orders in short-cycle businesses have increased. The company’s

long-cycle backlog continued to be at near record levels.

Based in Morris Township, N.J.,

Honeywell International Inc. is a Fortune 100 company providing

technical and manufacturing support to customers worldwide with

aerospace products and services; control technologies for

buildings, homes and industry; automotive products; turbochargers;

and specialty materials. The major competitors of Honeywell are

BorgWarner Inc. (BWA), United Technologies

Corp. (UTX) and Johnson Controls Inc.

(JCI).

We currently maintain our Neutral

rating on Honeywell, with a Zacks #3 Rank (Hold recommendation)

over the next one to three months.

BORG WARNER INC (BWA): Free Stock Analysis Report

HONEYWELL INTL (HON): Free Stock Analysis Report

JOHNSON CONTROL (JCI): Free Stock Analysis Report

UTD TECHS CORP (UTX): Free Stock Analysis Report

Zacks Investment Research

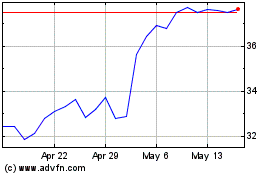

BorgWarner (NYSE:BWA)

Historical Stock Chart

From Jun 2024 to Jul 2024

BorgWarner (NYSE:BWA)

Historical Stock Chart

From Jul 2023 to Jul 2024