FALSE000002409000000240902023-08-042023-08-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 4, 2023

COMMISSION FILE NUMBER: 000-16509

CITIZENS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Colorado | | 84-0755371 |

(State or other jurisdiction of incorporation) | | (I.R.S. Employer Identification No.) |

11815 Alterra Pkwy, Suite 1500, Austin, TX 78758

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number: (512) 837-7100

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Class A Common Stock | CIA | New York Stock Exchange |

| (Title of each class) | (Trading Symbol) | (Name of each exchange on which registered) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter). ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Conditions

On August 4, 2023, Citizens, Inc. (the “Company”) issued a press release regarding the Company’s financial results for the quarter ended June 30, 2023. A copy of the Company’s press release is attached hereto as Exhibit 99.1.

The information contained in this Current Report shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits |

| | | | | | | | |

| |

| | |

| | |

| 104 | | Inline XBRL for the cover page of this Current Report on Form 8-K |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | CITIZENS, INC. |

| | | | |

| | | By: | /s/ Gerald W. Shields |

| | | | Chief Executive Officer and President |

Date: August 4, 2023

Citizens, Inc. Reports Second Quarter 2023 Financial Results

AUSTIN, TX – August 4, 2023 – Citizens, Inc. (NYSE: CIA), a leading diversified financial services company specializing in life, living benefits, and final expense insurance, today reported financial results for the second quarter ended June 30, 2023.

Second Quarter 2023 Financial Highlights

•Net income increased to $6.1 million in Q2 2023, from $2.5 million in Q2 2022. Earnings per share increased to $0.12 in Q2 2023, from $0.05 in the year-ago quarter.

•Total revenues increased to $58.5 million in Q2 2023, from $53.7 million in the year-ago quarter.

•First year premiums increased 3% in Q2 2023, the third consecutive quarter of year-over-year growth in first year premiums, driven by new products and focused marketing campaigns.

•Cash, cash equivalents, and short-term investments of $21.2 million and no debt at June 30, 2023.

•Book value per Class A share of $2.96 increased 20% over the year-ago quarter. Book value per Class A share excluding accumulated other comprehensive income (loss) (AOCI) of $5.55 increased 12% over the year-ago quarter.

Recent Business Highlights

•Added additional white-label partnership to deliver unique products through established fast-growing distribution channels.

•Insurance issued increased 22% in the first six months of 2023 compared to the same period in 2022.

•AM Best initiated financial strength and credit ratings on Citizens, Inc.’s subsidiary, CICA Life Insurance Company of America. AM Best’s ratings recognize CICA’s strength of balance sheet and outlook.

Management Commentary

“We continue to make significant progress on our strategic roadmap and innovation efforts designed to drive increased book value per share and enhanced operating results. Improved performance in the second quarter demonstrates our unique ability to expand our reach and portfolio through a dedicated focus on customer needs in important underserved markets,” said Company Vice Chairman and CEO, Gerald W. Shields. “First year premiums have increased year-over-year for three consecutive quarters, reflecting significant success in building our distribution capabilities and profitable product development expertise. Our rapid introduction of new products continues to generate strong demand, a major contributor to the persistent expansion of our customer base. Looking ahead, our strategic progress, financial strength, and our competitive advantages in growing niche markets fuel the next chapters of our sustainable, long-term growth and profitability.”

Second Quarter 2023 Performance and Highlights

Net income for the second quarter of 2023 totaled $6.1 million, or $0.12 per fully diluted Class A share, increased from net income of $2.5 million, or $0.05 per fully diluted Class A share, in the prior year quarter. Adjusted operating income before taxes totaled $6.4 million for the

second quarter of 2023, compared to $8.5 million in the same period in 2022, primarily due to higher operating costs related to strategic growth initiatives, moving the international business from Bermuda to Puerto Rico and higher total insurance benefits paid or provided, partially offset by higher net investment income.

Total revenues increased 9% to $58.5 million in the second quarter of 2023, compared to the same year-ago period. The increase was driven by the improved fair value of limited partnership investments, higher first year premium sales and net investment income, partially offset by lower renewal year premium revenues.

First year premiums increased 3% to $4.3 million in the second quarter of 2023 compared to the same year-ago period, with growth in both the Life Insurance and Home Service Insurance segments. Despite higher first year premium revenues, life insurance premium revenues decreased 4% in the second quarter of 2023 to $39.3 million, compared to the same period in 2022, due to lower renewal premiums.

Renewal premiums were $35.4 million in the second quarter of 2023, compared to $38.0 million in the same year-ago period. The decrease was due in part to the residual impact of higher surrenders experienced in prior years, increased matured endowments as expected based on contractual maturity dates, and the Company’s strategic exit from the property insurance business on June 30, 2023.

Total benefits and expenses increased by $2.7 million to $52.5 million in the second quarter of 2023, from $49.8 million in the same year-ago period. The increase was due to higher surrenders on policies nearing maturity that no longer carry surrender fees an increase in the number of contractual matured endowments, as well as higher operating costs related to strategic growth initiatives, costs related to moving the international business from Bermuda to Puerto Rico and higher employee benefit costs.

Investments

Net investment income for the second quarter of 2023 increased $1.3 million to $17.2 million, or 8%, compared to the prior year period. The increase in net investment income was driven by higher income from fixed maturity securities resulting from rising interest rates and growth in the Company’s limited partnership asset base. The average pre-tax yield on the investment portfolio was 4.5%, an increase of 27 basis points compared to the second quarter of 2022.

Investment related gains of $0.7 million for the second quarter of 2023 compared to a $5.0 million loss in the second quarter of 2022. The improvement was primarily due to changes in fair market value in the Company’s limited partnership portfolio.

The carrying value of the Company’s fixed maturity securities investment portfolio at June 30, 2023 was $1.2 billion, a 2% decrease compared to the same year ago period. The decrease reflects the impact of interest rate sensitivity on the fair value of the Company’s fixed maturity securities.

Return Capital to Shareholders

The Board of Directors authorized a share repurchase program in May 2022 under which the Company may repurchase up to $8 million of its outstanding shares of Class A common stock. $4.6 million of available repurchases remain on the current authorization.

About Citizens, Inc.

Citizens, Inc. (NYSE: CIA) is a diversified financial services company providing life, living benefits and final expense insurance and other financial products to individuals and small businesses in the U.S., Latin America, and Asia. Through its customer-centric growth strategy, Citizens offers innovative products to address the evolving needs of its customers in their native languages of Spanish, Portuguese, and Mandarin. The Company operates two primary segments: Life Insurance, where the Company is a market leader in US Dollar denominated life insurance and accident and health insurance in growing niche markets in the United States, Latin America, and Asia and Home Services, which operates primarily in the U.S. Gulf coast region. For more information about Citizens, please visit the website at www.citizensinc.com and LinkedIn.

Adoption of New Accounting Standard

Effective January 1, 2023, the Company adopted Accounting Standard Update ("ASU") No. 2018-12, which amended the accounting and disclosure requirements related to targeted improvements to the accounting for long-duration contracts, or LDTI. All prior periods presented have been recast in accordance with the new standard.

Explanatory Notes on Use of Non-GAAP Measures

Adjusted Operating Income

Adjusted Operating Income is a non-GAAP measure that is computed as pre-tax GAAP operating income with discrete adjustments that exclude net investment related gains (losses), income and loss from ceased businesses and unusual items. Management believes that this metric is meaningful, as it allows investors to evaluate underlying profitability and enhances comparability across periods, by excluding items that are heavily impacted by investment market fluctuations and other economic factors and are not indicative of operating trends. Management believes that the pre-tax metric is a more useful comparison than the post-tax metric, as the Company’s effective tax rate can fluctuate significantly from quarter-to-quarter.

Adjusted Book Value Per Class A Common Share

Adjusted book value per Class A common share is a non-GAAP measure that is calculated by dividing actual Class A common stockholders’ equity, excluding AOCI, by the number of Class A common shares outstanding at the end of the period. Management believes this metric is meaningful, as it allows investors to evaluate underlying book value growth by excluding the impact of interest rate volatility.

| | | | | | | | | | | | | | | | | |

| Selected Consolidated Financial Data |

| | | | |

| As of and for the periods ended | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| (In thousands, except per share data) | 2023 | 2022 | | 2023 | 2022 |

| Balance sheet data | | | | | |

| Total assets | $ | 1,623,994 | | 1,634,209 | | | 1,623,994 | | 1,634,209 | |

| Total liabilities | 1,477,148 | | 1,510,885 | | | 1,477,148 | | 1,510,885 | |

| Total stockholders' equity | 146,846 | | 123,324 | | | 146,846 | | 123,324 | |

| Life insurance in force, net | 4,347,683 | | 4,218,214 | | | 4,347,683 | | 4,218,214 | |

| | | | | |

| Operating items | | | | | |

| Insurance premiums | $ | 39,726 | | 42,224 | | | 77,975 | | 81,588 | |

| Net investment income | 17,241 | | 15,892 | | | 34,315 | | 31,379 | |

| Investment related gains (losses), net | 703 | | (5,016) | | | 415 | | (5,598) | |

| Total revenues | 58,527 | | 53,734 | | | 114,441 | | 109,091 | |

| | | | | |

| Claims and surrenders | 32,776 | | 27,097 | | | 63,075 | | 55,531 | |

| Other general expenses | 12,268 | | 10,400 | | | 23,528 | | 21,430 | |

| Total benefits and expenses | 52,483 | | 49,768 | | | 101,682 | | 97,947 | |

| | | | | |

| Income (loss) before federal income tax | 6,044 | | 3,966 | | | 12,759 | | 11,144 | |

| Federal income tax expense (benefit) | (82) | | 1,474 | | | 1,761 | | 2,203 | |

| Net income (loss) | 6,126 | | 2,492 | | | 10,998 | | 8,941 | |

| | | | | |

| Per share data | | | | | |

| Book value per share | $ | 2.96 | | 2.46 | | | 2.96 | | 2.46 | |

| Diluted income (loss) per Class A share | 0.12 | | 0.05 | | | 0.22 | | 0.18 | |

Definition of Reported Segments

The Company is comprised of two operating business segments and other non-insurance enterprises as detailed below. The insurance operations are the Company's primary focus and are the lead income generators of the business.

Life Insurance – The Life Insurance segment primarily issues U.S. dollar-denominated ordinary whole life insurance and endowment policies predominantly sold to non-U.S. residents located principally in Latin America and the Pacific Rim. These products are sold through independent marketing consultants.

Home Service Insurance – The Home Service Insurance segment provides final expense life insurance policies marketed to middle- and lower-income households, and whole life products with higher allowable face values in Louisiana, Mississippi, and Arkansas. These products are sold through independent agents and funeral homes.

| | | | | | | | | | | | | | | | | |

| Selected Segment Financial Data |

| | | | |

| As of and for the periods ended | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| (In thousands) | 2023 | 2022 | | 2023 | 2022 |

| LIFE SEGMENT | | | | | |

| Balance sheet data | | | | | |

| Total assets | $ | 1,227,459 | | 1,222,509 | | | 1,227,459 | | 1,222,509 | |

| | | | | |

| Operating items | | | | | |

| Insurance premiums | $ | 28,773 | | 29,834 | | | 54,980 | | 56,765 | |

| Net investment income | 13,498 | | 12,347 | | | 26,809 | | 24,318 | |

| Investment related gains (losses), net | 738 | | (3,984) | | | 301 | | (4,277) | |

| Total revenues | 43,865 | | 38,830 | | | 83,825 | | 78,527 | |

| | | | | |

| Claims and surrenders | 26,968 | | 21,568 | | | 51,407 | | 43,026 | |

| Total benefits and expenses | 36,392 | | 35,494 | | | 69,980 | | 69,327 | |

| | | | | |

| Income (loss) before federal income tax | 7,473 | | 3,336 | | | 13,845 | | 9,200 | |

| | | | | |

| HOME SERVICE SEGMENT | | | | | |

| Balance sheet data | | | | | |

| Total assets | $ | 347,417 | | 357,542 | | | 347,417 | | 357,542 | |

| | | | | |

| Operating items | | | | | |

| Insurance premiums | $ | 10,953 | | 12,390 | | | 22,995 | | 24,823 | |

| Net investment income | 3,450 | | 3,283 | | | 6,920 | | 6,527 | |

| Investment related gains (losses), net | (12) | | (925) | | | 87 | | (1,167) | |

| Total revenues | 14,392 | | 14,749 | | | 30,003 | | 30,184 | |

| | | | | |

| Claims and surrenders | 5,808 | | 5,529 | | | 11,668 | | 12,505 | |

| Total benefits and expenses | 13,768 | | 12,747 | | | 28,046 | | 26,104 | |

| | | | | |

| Income (loss) before federal income tax | 624 | | 2,002 | | | 1,957 | | 4,080 | |

GAAP to Non-GAAP Reconciliation

| | | | | | | | | | | | | | | | | |

| Reconciliation of Adjusted Income (Loss) Before Federal Income Tax |

| | | | | |

| For the periods ended | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| Unaudited (In thousands) | 2023 | 2022 | | 2023 | 2022 |

| Income (loss) before federal income tax | $ | 6,044 | | 3,966 | | | 12,759 | | 11,144 | |

| Less: | | | | | |

| Investment related gains (losses) | 703 | | (5,016) | | | 415 | | (5,598) | |

| Property insurance business income (loss) | (1,059) | | 458 | | | (1,004) | | 932 | |

| Adjusted income (loss) before federal income tax | $ | 6,400 | | 8,524 | | | 13,348 | | 15,810 | |

| | | | | | | | | | | | | | |

| Reconciliation of Stockholders' Equity and Book Value per Class A Common Share |

| | | | |

| | As of June 30, |

| Unaudited (In thousands, except per share data) | | 2023 | | 2022 |

| Stockholders' equity, end of period | | $ | 146,846 | | | 123,324 | |

| Less: Accumulated other comprehensive income (loss) (AOCI) | | (128,363) | | | (125,552) | |

| Stockholders' equity, end of period, excluding AOCI | | $ | 275,209 | | | 248,876 | |

| | | | |

| Book value per Class A common share - diluted | | $ | 2.96 | | | 2.46 | |

| Less: Per share impact of AOCI | | (2.59) | | | (2.50) | |

| Book value per Class A common share - diluted, excluding AOCI | | $ | 5.55 | | | 4.96 | |

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which can be identified by words such as "may," "will," "expect," "anticipate," “believe,” “project,” "intends," "continue" or comparable words. Such forward-looking statements may relate to the Company’s expectations regarding the impact of the COVID-19 pandemic, business performance, operational strategy, capital expenditures, technological changes, regulatory actions, and other financial and operational measures. In addition, all statements other than statements of historical facts that address activities that the Company expects or anticipates will or may occur in the future are forward-looking statements. Such statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions, which are difficult to predict and many of which are beyond our control. Therefore, actual outcomes and results may differ materially from those matters expressed or implied in such forward-looking statements. The risks, uncertainties and assumptions that are involved in our forward-looking statements include, but are not limited to the risk factors discussed in our most recently filed periodic reports on Form 10-K and Form 10-Q. The Company undertakes no duty or obligation to update any forward-looking statements

contained in this release as a result of new information, future events or changes in the Company's expectations. Accordingly, you should not unduly rely on these forward-looking statements. The Company also disclaims any duty to comment upon or correct information that may be contained in reports published by the investment community.

Contact Information

Investors

Darrow Associates Investor Relations

Jeff Christensen and Matt Kreps

Email: CIA@darrowir.com (Jeff and Matt)

Phone: 703-297-6917 (Jeff) and 214-597-8200 (Matt)

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

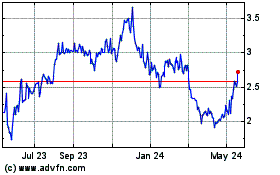

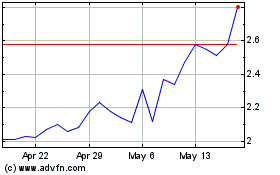

Citizens (NYSE:CIA)

Historical Stock Chart

From Apr 2024 to May 2024

Citizens (NYSE:CIA)

Historical Stock Chart

From May 2023 to May 2024