Canadian National Railway Company

(Exact Name of Registrant as Specified in Its Charter)

| Canada |

|

98-0018609 |

(Province or other jurisdiction of incorporation or

organization) |

|

(IRS Employer Identification No.) |

| |

|

|

| |

4011 |

|

| (Primary Standard Industrial Classification Code Number) |

| |

935 de La Gauchetière Street West

Montreal, Québec, Canada H3B 2M9

(514) 399-5430 |

|

| (Address and telephone number of Registrant’s principal executive offices) |

| |

CT Corporation System

111 Eighth Avenue

New York, NY 10011

(212) 590-9070 |

|

(Name, address (including zip code) and telephone number (including area code)

of agent for service in the United States) |

| |

Copies to: |

|

Sean Finn

Canadian National Railway Company

935 de La Gauchetière Street West

Montreal, Québec, Canada H3B 2M9

(514) 399-7091 |

|

John B. Meade

Davis Polk & Wardwell LLP

450 Lexington Avenue

New York, New York 10017

(212) 450-4000 |

| Approximate date of commencement of proposed sale to the public: |

| At such time or times on or after the effective date of this Registration Statement as the Registrant shall determine. |

| Province of Québec, Canada |

| (Principal jurisdiction regulating this offering) |

It is proposed that this filing shall become effective

(check appropriate box):

| A. | ¨ upon

filing with the Commission pursuant to Rule 467(a) (if in connection with an offering being made contemporaneously in the United

States and Canada). |

| B. | x at

some future date (check the appropriate box below): |

| 1. | ¨ pursuant

to Rule 467(b) on (date) at (time) (designate a time not sooner than 7 calendar days after filing). |

| 2. | ¨ pursuant

to Rule 467(b) on (date) at (time) (designate a time not sooner than 7 calendar days or sooner after filing) because the securities

regulatory authority in the review jurisdiction has issued a receipt or notification of clearance (date). |

| 3. | x pursuant

to Rule 467(b) as soon as practicable after notification of the Commission by the Registrant or the Canadian securities regulatory

authority of the review jurisdiction that a receipt or notification of clearance has been issued with respect thereto. |

| 4. | ¨ after

the filing of the next amendment to this Form (if preliminary material is being filed). |

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to the home jurisdiction’s

shelf prospectus offering procedures, check the following box. x

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registration

Statement shall become effective as provided in Rule 467 under the Securities Act of 1933 or on such date as the Commission, acting

pursuant to Section 8(a) of such Act, may determine.

Part I

Information Required to be

Delivered to Offerees or Purchasers

SHORT FORM BASE SHELF PROSPECTUS

CANADIAN NATIONAL RAILWAY COMPANY

CAD$6,000,000,000

Debt Securities

Canadian National Railway Company (the “Company”) may offer

and issue from time to time unsecured debt securities (the “Securities”) in one or more series in an aggregate principal amount

not to exceed CAD$6,000,000,000 or the equivalent, based on the applicable exchange rate at the time of offering, in U.S. dollars or such

other currencies or units based on or relating to such other currencies, as shall be designated by the Company at the time of offering.

This prospectus does not qualify the issuance of debt securities in

respect of which the payment of principal and/or interest may be determined, in whole or in part, by reference to one or more underlying

interests including, for example, an equity or debt security, a statistical measure of economic or financial performance including, but

not limited to, any currency, consumer price or mortgage index, or the price or value of one or more commodities, indices or other items,

or any other item or formula, or any combination or basket of the foregoing items.

The specific terms of any offering of Securities will be set forth

in a prospectus supplement (a “prospectus supplement”) including, where applicable, the title of the Securities, any limit

on the aggregate principal amount of the Securities, the maturity date of the Securities, whether payment on the Securities will be senior

or subordinated to the Company’s other liabilities and obligations, whether the Securities will bear interest, the interest rate

or method of determining the interest rate, whether any conversion or exchange rights attach to the Securities, whether the Company may

redeem the Securities at its option and any other specific terms. The Company reserves the right to include in a prospectus supplement

specific variable terms pertaining to the Securities that are not within the descriptions set forth in this prospectus.

All shelf information permitted under applicable laws to be omitted

from this prospectus will be contained in one or more prospectus supplements that will be delivered to purchasers together with this prospectus.

Each prospectus supplement will be incorporated by reference into this prospectus for the purposes of securities legislation as of the

date of the prospectus supplement and only for the purposes of the distribution of the Securities to which the prospectus supplement pertains.

The Company may offer and sell the Securities to or through underwriters

or dealers purchasing as principals or through agents. The applicable prospectus supplement will identify each underwriter, dealer or

agent engaged by the Company in connection with the offering and sale of the Securities and will set forth the terms of the offering of

such Securities and the method of distribution, including, to the extent applicable, the proceeds to the Company from the sale of the

Securities, any public offering price, any fees, discounts, commissions or any other compensation payable to underwriters, dealers or

agents and any other material terms of the plan of distribution. See “Plan of Distribution”.

Unless otherwise specified in the applicable prospectus supplement,

each issue of Securities will be a new issue of Securities with no established trading market. There is currently no market through

which the Securities may be sold and purchasers may not be able to resell the Securities purchased under this prospectus and the prospectus

supplement relating to such Securities. This may affect the pricing of such Securities in the secondary market, the transparency and availability

of trading prices, the liquidity of the Securities and the extent of issuer regulation.

In this prospectus, unless the context otherwise indicates, the “Company”

refers to Canadian National Railway Company and its subsidiaries.

All dollar amounts referred to in this prospectus are expressed in

Canadian dollars and have been prepared in accordance with United States generally accepted accounting principles (GAAP) unless otherwise

specifically noted.

The Company is a Canadian issuer that is permitted, under a multijurisdictional

disclosure system adopted by the United States, to prepare this prospectus in accordance with the disclosure requirements of all the provinces

and territories of Canada. Prospective investors in the United States should be aware that such requirements are different from those

of the United States.

Prospective investors should be aware that the acquisition of the

Securities may have tax consequences both in the United States and in Canada. Such consequences for investors who are resident in, or

citizens of, the United States may not be fully described herein or in any applicable prospectus supplement.

The enforcement by investors of civil liabilities under United States

federal securities laws may be affected adversely by the fact that the Company is a Canadian corporation, that a majority of its officers

and directors are residents of Canada, that the underwriters may be residents of Canada, that experts named in the registration statement

are residents of Canada and that a substantial portion of the assets of the Company and said persons may be located outside the United

States. See “Enforcement of Civil Liabilities under the U.S. Federal Securities Laws”.

These securities have not been approved or disapproved by the U.S.

Securities and Exchange Commission (the “SEC”) or any U.S. state securities regulator nor has the SEC or any U.S. state securities

regulator passed upon the accuracy or adequacy of this prospectus or any applicable prospectus supplement. Any representation to the contrary

is a criminal offense.

An investment in Securities involves significant risks that should

be carefully considered by prospective investors before purchasing Securities. The risks outlined in this prospectus and in the documents

incorporated by reference herein, including the applicable prospectus supplement, should be carefully reviewed and considered by prospective

investors in connection with any investment in Securities. See “Risk Factors”.

The Company’s head office is located at 935 de La Gauchetière

Street West, Montreal, Quebec H3B 2M9.

table

of contents

Page

Documents

Incorporated by Reference

Information

has been incorporated by reference into this prospectus from documents filed with securities commissions or similar authorities in Canada.

The following documents, filed with the securities commission or other similar authority in each of the provinces and territories of Canada,

are incorporated by reference into, and form an integral part of, this prospectus:

Any document of the type referred to in the preceding

paragraph or required to be incorporated by reference herein pursuant to National Instrument 44-101 – Short-Form Prospectus

Distributions (excluding confidential material change reports, if any) filed by the Company with securities commissions or similar

authorities in the provinces and territories of Canada subsequent to the date of this prospectus and prior to the completion or withdrawal

of any offering under any prospectus supplement shall be deemed to be incorporated by reference into this prospectus.

Any statement contained herein or in a document

incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded, for purposes of this prospectus,

to the extent that a statement contained herein or in any other subsequently filed document which also is, or is deemed to be, incorporated

by reference herein modifies or supersedes such statement. The modifying or superseding statement need not state that it has modified

or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making

of a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or superseded statement, when

made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required

to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made. Any statement

so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

Upon a new annual information form and the related

annual financial statements being filed by the Company with, and, where required, accepted by, the applicable securities regulatory authorities

during the currency of this prospectus, the previous annual information form, the previous annual financial statements and all interim

financial statements, management’s discussions and analysis and material change reports filed prior to the commencement of the Company’s

fiscal year with respect to which the new annual information form is filed shall be deemed no longer to be incorporated by reference into

this prospectus for purposes of future offers and sales of Securities hereunder. Upon interim financial statements and the accompanying

management’s discussion and analysis being filed by the Company with the applicable securities regulatory authorities during the

currency of this prospectus, all interim financial statements and the accompanying management’s discussion and analysis filed prior

to such new interim consolidated financial statements and accompanying management’s discussion and analysis shall be deemed no longer

to be incorporated by reference into this prospectus for purposes of future offers and sales of the Securities hereunder. In addition,

upon a new management information circular for an annual meeting of shareholders being filed by the Company with the applicable securities

regulatory authorities during the currency of this prospectus, the previous management information circular filed in respect of the prior

annual meeting of shareholders shall be deemed no longer to be incorporated by reference into this prospectus for purposes of future offers

and sales of the Securities hereunder.

A prospectus supplement containing the specific

terms in respect of any Securities, updated disclosure of earnings coverage ratios, if applicable, and other information in relation to

the Securities will be delivered to prospective purchasers of such Securities together with this prospectus and will be deemed to be incorporated

by reference into this prospectus as of the date of such prospectus supplement, but only for purposes of the offering of such Securities

covered by that prospectus supplement.

Copies of the documents incorporated herein by

reference may be obtained on request without charge from the Corporate Secretary, Canadian National Railway Company, 935 de La Gauchetière

Street West, Montreal, Quebec, H3B 2M9 (telephone: (514) 399-7091), and are also available electronically at www.sedar.com.

Available

Information

In addition to its continuous disclosure obligations

under the securities laws of the provinces of Canada, the Company is subject to the information requirements of the United States Securities

Exchange Act of 1934, as amended (the “Exchange Act”), and in accordance therewith files reports and other information with

the SEC. Under the multijurisdictional disclosure system adopted by the United States, such reports and other information may be prepared

in accordance with the disclosure requirements of Canada, which requirements are different from those of the United States. Such reports

and other information, when filed by the Company in accordance with such requirements, can be inspected and copied at the Public Reference

Room maintained by the SEC at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operations of the Public

Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports and other information regarding

issuers that file electronically with the SEC. The address of that site is http://www.sec.gov.

The Company has filed with the SEC a Registration

Statement on Form F-10 (the “Registration Statement”) under the United States Securities Act of 1933, as amended (the

“Securities Act”), with respect to the Securities and of which this prospectus is a part. This prospectus does not contain

all of the information set forth in the Registration Statement, certain parts of which are omitted in accordance with the rules and

regulations of the SEC. Reference is made to the Registration Statement and the exhibits thereto for further information with respect

to the Company and the Securities.

Statement

Regarding Forward-Looking Information

Certain information included in this prospectus

and the documents incorporated by reference herein are “forward-looking statements” within the meaning of the United States

Private Securities Litigation Reform Act of 1995 and under Canadian securities laws, including statements based on management’s

assessment and assumptions and publicly available information with respect to the Company. By their nature, forward-looking statements

involve risks, uncertainties and assumptions. The Company cautions that its assumptions may not materialize and that current economic

conditions render such assumptions, although reasonable at the time they were made, subject to greater uncertainty. These forward-looking

statements include, but are not limited to, statements relating to revenue growth opportunities, including those referring to general

economic and business conditions; statements relating to the Company’s ability to meet debt repayments and future obligations in

the foreseeable future, including income tax payments, and capital spending; and statements relating to pension contributions. Forward-looking

statements could further be identified by the use of terminology such as the Company “believes”, “expects”, “anticipates”,

or “assumes”, or references to “outlook”, “plans”, “targets” or other similar words. Such

forward-looking statements are not guarantees of future performance and involve risks, uncertainties and other factors which may cause

the actual results or performance of the Company to be materially different from the outlook or any future results or performance implied

by such statements. Accordingly, readers are advised not to place undue reliance on forward-looking statements.

Important risk factors that could affect the forward-looking

statements include, but are not limited to the duration and effects of the COVID-19 pandemic, general economic and business conditions,

particularly in the context of the COVID-19 pandemic; industry competition; inflation, currency and interest rate fluctuations; changes

in fuel prices; legislative and/or regulatory developments; compliance with environmental laws and regulations; actions by regulators;

increases in maintenance and operating costs; security threats; reliance on technology and related cybersecurity risk; trade restrictions

or other changes to international trade arrangements; transportation of hazardous materials; various events which could disrupt operations,

including illegal blockades of rail networks and natural events such as severe weather, droughts, fires, floods and earthquakes; climate

change; labor negotiations and disruptions; environmental claims; uncertainties of investigations, proceedings or other types of claims

and litigation; risks and liabilities arising from derailments; timing and completion of capital programs; and other risks detailed from

time to time in reports filed by the Company with securities regulators in Canada and the United States, including its Annual Information

Form and Form 40-F. See the section of this prospectus entitled “Risk Factors” and the documents incorporated by

reference herein.

Forward-looking statements reflect information

as of the date on which they are made. The Company assumes no obligation to update or revise forward-looking statements to reflect future

events, changes in circumstances, or changes in beliefs, unless required by applicable Canadian securities laws. In the event the Company

does update any forward-looking statement, no inference should be made that the Company will make additional updates with respect to that

statement, related matters, or any other forward-looking statement.

The

Company

The Company is engaged in the rail and

related transportation business. The Company's tri-coastal network of 18,600 route miles of track spans Canada and the United States

of America (U.S.), connecting Canada’s Eastern and Western coasts with the U.S. South. The Company's extensive network and

efficient connections to all Class I railroads provide its customers access to Canada, the U.S. and Mexico. Essential to the

economy, to the customers, and to the communities it serves, the Company safely transports every year more than 300 million tons of

cargo, serving exporters, importers, retailers, farmers and manufacturers. The Company and its affiliates have been contributing to

community prosperity and sustainable trade since 1919. The Company is committed to programs supporting social responsibility and

environmental stewardship. The Company's freight revenues are derived from seven commodity groups representing a diversified and

balanced portfolio of goods transported between a wide range of origins and destinations.

Additional information about the Company’s

business is included in the documents incorporated by reference into this prospectus.

The Company’s registered and head office

is located at 935 de La Gauchetière Street West, Montreal, Quebec, H3B 2M9, and its telephone number is 1-888-888-5909. The Company’s

common shares are listed for trading on the Toronto Stock Exchange under the symbol “CNR” and the New York Stock Exchange

under the symbol “CNI”.

Use

of Proceeds

Except as may otherwise be set forth in a prospectus

supplement, the net proceeds from the sale of Securities will be used for general corporate purposes, including the redemption and refinancing

of outstanding indebtedness, share repurchases, acquisitions and other business opportunities.

Consolidated

Capitalization

The following table sets forth the consolidated

capitalization of the Company as at March 31, 2022. The consolidated capitalization of the Company does not give effect to the issuance

of Securities that may be issued pursuant to this prospectus and any prospectus supplement, since the aggregate principal amounts and

terms of such Securities are not presently known.

The data in the table below is derived from, and

should be read in conjunction with, the Company’s unaudited interim consolidated financial statements as at and for the three months

ended March 31, 2022 and the notes related thereto, incorporated by reference in this prospectus. There has been no material change

in the share and loan capital of the Company since March 31, 2022.

| | |

As at

March 31, 2022 | |

| | |

| in millions | |

| Current portion of long-term debt | |

$ | 1,504 | |

| Operating lease liabilities included within Accounts payable and other | |

| 108 | |

| Long-term debt | |

| 11,879 | |

| Operating lease liabilities | |

| 322 | |

| Total debt | |

$ | 13,813 | |

| Shareholders’ equity | |

| | |

| Common shares | |

| 3,695 | |

| Common shares in Shares trusts | |

| (88 | ) |

| Additional paid-in capital | |

| 382 | |

| Accumulated other comprehensive loss | |

| (2,280 | ) |

| Retained earnings | |

| 20,143 | |

| Total shareholders’ equity | |

| 21,852 | |

| Total capitalization | |

$ | 35,665 | |

Earnings

Coverage Ratio

The following earnings coverage

ratios are calculated for the twelve-month periods ended December 31, 2021 and March 31, 2022 and give effect to the issuance of

all long-term debt of the Company and repayment or redemption thereof since the beginning of such twelve-month periods, as if such transactions

had occurred on the first day of such twelve-month periods. The adjusted earnings coverage ratios further exclude the effects of the terminated

merger agreement between the Company and Kansas City Southern, including the merger termination fee and transaction-related costs in order

to show the impact excluding these non-recurring items, which we believe is useful for investors. These earnings coverage ratios do not

give effect to the issuance of any Securities that may be issued pursuant to this prospectus and any prospectus supplement, since the

aggregate principal amounts and the terms of such Securities are not presently known.

| |

|

Twelve

months

ended

December 31, 20213 |

|

Twelve

months ended March 31, 20223 |

| Earnings coverage ratio1 |

|

13.93 times |

|

13.76 times |

| Adjusted earnings coverage

ratio2 |

|

12.32 times |

|

12.15 times |

Earnings coverage ratio is

equal to net income before interest and income taxes divided by interest expense on all debt. Adjusted earnings coverage ratio is equal

to net income before interest, income taxes, merger termination fee and transaction-related costs, divided by interest expense on all

debt. These ratios do not purport to be indicative of earnings coverage ratios for any future period.

The

Company’s interest expense requirements would have amounted to approximately $499 million for each of the twelve-month

periods ended December 31, 2021 and March 31, 2022. The Company’s net income before interest and income

taxes for the twelve-month periods ended December 31, 2021 and March 31, 2022, was $6,952 million3 and $6,866 million3,

respectively, which is 13.93 times3 and 13.76 times3 the Company’s interest expense requirements for

the applicable period. The Company’s net income before interest, income taxes, merger termination fee and transaction-related costs

for the twelve-month periods ended December 31, 2021 and March 31, 2022 was $6,150 million3 and $6,064 million3,

respectively, which is 12.32 times3 and 12.15 times3 the Company’s interest expense requirements for the

applicable period.

If the Company offers Securities

having a term to maturity in excess of one year under this prospectus and a prospectus supplement, the prospectus supplement will include

earnings coverage ratios giving effect to the issuance of such Securities and will reflect such other adjustments as may be required by

applicable Canadian securities law requirements.

1

Earnings coverage ratio is required by Item 6 of Form 44-101F1 of Regulation 44-101 respecting Short Form Prospectus Distributions,

which specifies its composition.

2 Adjusted

earnings coverage ratio is a non-GAAP measure and is not a standardized financial measure under U.S. GAAP used to prepare the

financial statements of the Company and might not be comparable to similar financial measures disclosed by other issuers. The

reconciliation of net income to net income before interest, income taxes, merger termination fee and transaction-related costs for

the twelve-month periods ended December 31, 2021 and March 31, 2022 and the computation of adjusted earnings coverage is

as follows:

| | |

Twelve months

ended

December 31, 2021 | | |

Twelve months ended

March 31, 2022 | |

| Net income3 | |

| 4,899 | | |

| 4,841 | |

| Add back: | |

| | | |

| | |

| Interest | |

| 610 | | |

| 606 | |

| Income tax3 | |

| 1,443 | | |

| 1,419 | |

| Merger termination fee | |

| (886 | ) | |

| (886 | ) |

| Transaction-related costs | |

| 84 | | |

| 84 | |

| Net income before interest, income taxes, merger termination fee and transaction-related costs | |

| 6,150 | | |

| 6,064 | |

| Interest expense requirements on all debt (note 1) | |

| 499 | | |

| 499 | |

| Adjusted earnings coverage ratio | |

| 12.32 | | |

| 12.15 | |

Note 1: Interest expense requirements on all debt is the same number

used in the calculation of the earnings coverage ratio and is calculated as interest expense adjusted to annualize interest expense for

debt issuances during the year, exclude interest expense for debt redemptions during the year and remove bridge financing fees related

to the cancelled bridge loan agreement in connection with the terminated merger agreement with Kansas City Southern.

3

In the first quarter of 2022, the Company changed its method of calculating market-related values of pension assets for its defined benefit

plans using a retrospective approach. Figures as of December 31, 2021 reflect the change in methodology. See “Note 2 – Change

in accounting policy” to the Q1 2022 Interim Financial Statements for additional information.

Description

of Securities

The following description sets forth certain general

terms and provisions of the Securities. The Company may issue Securities either separately, or together with or upon the conversion of

or in exchange for other securities. The particular terms and provisions of each series of Securities the Company may offer will be described

in greater detail in the related prospectus supplement which may provide information that is different from this prospectus. The Company

reserves the right to include in a prospectus supplement specific variable terms pertaining to the Securities that are not within the

descriptions set forth in this prospectus. Senior Securities of the Company may be issued under a senior indenture dated as of July 12,

2013, between the Company and BNY Trust Company of Canada, as trustee (the “Canadian Senior Indenture”), or under a senior

indenture dated as of June 1, 1998, as amended and supplemented, between the Company and The Bank of New York Mellon, as trustee

(the “U.S. Senior Indenture” and together with the Canadian Senior Indenture, the “Senior Indentures”). Senior

Securities issued under the Canadian Senior Indenture will not be offered or sold to persons in the United States. Subordinated Securities

may be issued under a subordinated indenture, dated as of June 23, 1999, as amended and supplemented, between the Company and BNY

Trust Company of Canada, as trustee (the “Subordinated Indenture”). Securities may also be issued under new indentures between

the Company and a trustee or trustees as will be described in a prospectus supplement for such Securities. The Senior Indentures and the

Subordinated Indenture are sometimes referred to collectively as the “indentures”, and the trustees under the indentures are

sometimes referred to collectively as the “trustees”.

The following summary of certain provisions of

the indentures and the Securities is not meant to be complete and is subject to and qualified in its entirety by the detailed provisions

of the indentures. For more information, you should refer to the full text of the indentures and the Securities, including the definitions

of certain terms not defined herein, and the related prospectus supplement. Prospective investors should rely on information in the prospectus

supplement if it is different from the following information.

Unless otherwise indicated, references to the

“Company” in this description of Securities are to Canadian National Railway Company but not to any of its subsidiaries.

General

The indentures do not limit the aggregate principal

amount of Securities the Company may issue and do not limit the amount of other indebtedness the Company or any of its subsidiaries may

incur. The Company may issue Securities from time to time in separate series. Securities may also be issued pursuant to a medium-term

note program. Unless otherwise specified in a prospectus supplement,

| · | Securities will be unsecured obligations of the Company; |

| · | senior Securities will rank equally with all other unsecured and unsubordinated indebtedness of the Company; and |

| · | subordinated Securities will be subordinate, in right of payment, to all senior indebtedness (as defined in the Subordinated Indenture). |

The Company conducts a substantial portion of

its operations through its subsidiaries. Claims of creditors of the Company’s subsidiaries generally have priority with respect

to the assets and earnings of those subsidiaries over the claims of creditors of the Company, including holders of the Securities. The

Securities therefore will effectively be subordinated to creditors of the Company’s subsidiaries. The Securities will also be subordinated

to any liabilities of the Company that are secured by any of the Company’s assets including, without limitation, those under capital

leases.

A prospectus supplement will describe the terms

of any series of Securities the Company may offer and may include the following:

| · | the title of the Securities; |

| · | any limit on the aggregate principal amount of Securities that may be issued; |

| · | the date(s) of maturity and the portion (if less than all of the principal amount) of the Securities to be payable upon declaration

of acceleration of maturity; |

| · | the ranking of the Securities relative to our other liabilities and obligations; |

| · | whether the Securities are to be issued at an original issue discount; |

| · | the rate(s) of interest, if any, or the method of calculation, the date(s) interest will begin to accrue, the date(s) interest

will be payable and the regular record date(s) for interest payments or the method for determining such date(s); |

| · | the covenants applicable to the Securities; |

| · | any mandatory or optional sinking fund or analogous provisions; |

| · | the date(s), if, any, and the price(s) at which the Company is obligated, pursuant to any special mandatory redemption provisions

or otherwise, to redeem, or at a holder’s option to purchase, such series of Securities and other related terms and provisions; |

| · | the currency or currencies of any payments to be made on the Securities; |

| · | the period(s) within which, the price(s) at which, and the terms upon which, the Securities may be redeemed, in whole or

in part, at the option of the Company; |

| · | whether or not the Securities will be issued in global form, their terms and the depositary; |

| · | the terms upon which a global note may be exchanged in whole or in part for other Securities; |

| · | the terms, if any, under which the Securities are convertible into common shares or any other security of the Company; and |

| · | any other terms of the series of Securities. |

In addition to new issues of Securities, this

prospectus may be used in connection with the remarketing of outstanding Securities, in which case the terms of the remarketing and of

the remarketed Securities will be set forth in the prospectus supplement.

Conversion or Exchange of Securities

If applicable, the prospectus supplement will

set forth the terms on which a series of Securities may be converted into or exchanged for other securities of the Company. These terms

will include whether conversion or exchange is mandatory, or is at the option of the holder or of the Company. The Company will also describe

in the prospectus supplement how it will calculate the number of securities that holders of Securities would receive if they convert or

exchange their Securities.

Events of Default

Under the indentures, an “event of default”

with respect to any series of Securities includes any of the following:

| · | failure to pay any principal or premium, when due; |

| · | failure to pay any interest when due, and this failure continues for 30 days; |

| · | failure to pay any sinking fund installment when due; |

| · | failure to perform any covenant or agreement relating to the Securities or in the applicable indenture, and the failure continues

for 90 days (60 days in the case of series of Securities issued under the Subordinated Indenture) after written notice by the trustee

or by holders of at least 25% in aggregate principal amount outstanding; |

| · | certain events of bankruptcy, insolvency or reorganization; and |

| · | any other event of default provided for that series of Securities. |

If an event of default occurs and is continuing,

either the trustee or the holders of at least 25% in principal amount of the outstanding Securities of any series affected by the default,

may notify the Company (and the trustee, if notice is given by the holders) and declare that the unpaid principal is due and payable immediately.

However, subject to certain conditions, the holders of a majority in aggregate principal amount of the Securities of the affected series

can rescind and annul this declaration for accelerated payment. The Company will furnish the trustees with an annual certificate as to

compliance with certain covenants contained in the particular indenture.

No event of default with respect to any particular

series of securities necessarily constitutes an event of default with respect to any other series of securities. In particular, for each

series of securities originally issued prior to November 20, 2012 under the Senior Indentures, an “event of default”

also includes the failure to pay principal when due, or acceleration, of any indebtedness of the Company in an aggregate principal amount

exceeding $75 million, and such acceleration is not rescinded or annulled within 30 days after written notice by the trustee or holders

of at least 25% in aggregate principal amount outstanding. In addition, for each series of securities originally issued prior to November 20,

2012, an event of default occurs upon the failure to perform any covenant or agreement relating to the securities or in the applicable

indenture if the failure continues for 60 days instead of the 90 days for the Securities.

Subordinated Securities

The terms of a series of subordinated Securities

will be set forth in the relevant indenture and the prospectus supplement. The subordinated Securities will be unsecured obligations of

the Company and will be subordinate in right of payment to Securities issued under the Senior Indentures and certain other indebtedness

of the Company.

Satisfaction and Discharge of Indentures

The Company may terminate its obligation with

respect to a series of Securities under the indentures if:

| · | all the outstanding Securities of a series have been delivered to the trustee for cancellation; |

| · | the Company has paid all sums it is required to pay under the respective indenture; or |

| · | the Company deposits with the trustee, in trust, sufficient funds, or governmental securities, to cover payments due on all Securities

of such series for principal, premium, if any, and interest and any other sums due under the applicable indenture to the stated maturity

date or a redemption date of the Securities. |

Such defeasance is subject to the Company meeting

certain conditions set forth in the indentures.

Modification and Waiver

The Company and the trustees may modify or amend

the indentures by obtaining approval by the holders of at least a majority of the aggregate principal amount of the outstanding Securities

of each series that is affected. However, certain changes cannot be made without the consent of the holders of all outstanding Securities

affected by such changes. In particular, the holders of all outstanding Securities so affected must consent to changes in:

| · | the stated maturity date; |

| · | the principal, premium, or interest payments, if any; |

| · | the place or currency of any payment; |

| · | the rights of holders to enforce payment; |

| · | the percentage in principal amount of outstanding Securities of any series, the consent of whose holders is needed to modify, amend

or waive certain provisions of the indentures or certain defaults; or |

| · | if applicable, the subordination provisions. |

Except as otherwise specified for a series of

Securities, the holders of at least a majority in aggregate principal amount of the outstanding Securities of any series issued can waive,

or cause the trustees, on behalf of the holders of the entire series, to waive compliance with certain provisions of the relevant indenture.

In addition, holders of at least a majority in principal amount of the outstanding Securities of a series can consent to, or cause the

trustees to waive any past default under the relevant indentures, except for the following:

| · | a default in any payments due under the relevant indenture; and |

| · | a default under an indenture provision that can be modified or amended only with the consent of each holder of an outstanding series

of Securities. |

For each series of securities originally issued

under the U.S. Senior Indenture prior to November 20, 2012, consent of the holders of at least 662/3 in aggregate principal amount

of the outstanding securities of that series is required for modifications, amendments or waivers.

Consolidation, Merger and Sale of Assets

Each indenture provides that the Company may consolidate,

amalgamate or merge with or into any other corporation or sell, convey or lease all or substantially all of its property to any other

corporation authorized to acquire and operate the same; provided that upon any such consolidation, amalgamation, merger, sale, conveyance

or lease, (i) the successor entity (if other than the Company) is organized under the laws of a Canadian or U.S. jurisdiction; (ii) the

payment of the principal and premium, if any, and interest on all of the Securities according to their terms, and the performance of all

the covenants and conditions under that indenture to be performed by the Company, shall be expressly assumed, by supplemental indenture

satisfactory to the relevant trustee, by the corporation (if other than the Company) formed by such consolidation or amalgamation, or

into which the Company shall have been merged, or by the corporation which shall have acquired or leased such property; and (iii) no

event of default or event that could give rise to an event of default will have occurred and be continuing.

Restrictions on Secured Debt

The Company has covenanted in the Senior Indentures

that it will not, nor will it permit a subsidiary to, create, issue, incur, assume or guarantee, any indebtedness for money borrowed,

or guarantees of such indebtedness, now or hereafter existing which is secured by any mortgage, pledge, hypothec, lien, security interest,

privilege, conditional sale or other title retention agreement or similar encumbrance (a “Mortgage”) on any present or future

Railway Properties of the Company or on any shares of stock of any Railroad Subsidiary (“Secured Debt”), without first making

effective provision whereby all outstanding Securities issued thereunder shall be secured by the Mortgage equally and ratably with such

other indebtedness or guarantee thereby secured unless, after giving effect to such creation, issuance, incurrence, assumption or guarantee,

the sum of the aggregate amount of all outstanding Secured Debt of the Company and its subsidiaries would not exceed an amount equal to

10% of the Consolidated Net Tangible Assets. For Secured Debt that provides for an amount less than the principal amount thereof to be

due and payable upon the acceleration of its final maturity, the principal amount of the Secured Debt at any time its principal amount

is measured shall be the principal amount due and payable on the Secured Debt if the Secured Debt were to be accelerated at that time.

The negative pledge covenant is also subject to certain exceptions. For example, this restriction excludes any Mortgage upon Railway Properties

existing or created at the time the Railway Properties are acquired, or Mortgages existing on the shares or to secure indebtedness of

a corporation at the time such corporation becomes a subsidiary, and any extension, renewal or replacement of any such Mortgage. As used

in such covenant, the term “Railway Properties” means all main and branch lines of railway located in Canada or the United

States, including all real property used as the right of way for such lines; the term “Railroad Subsidiary” means a subsidiary

whose principal assets are Railway Properties; the term “subsidiary”, subject to certain exceptions, means a corporation a

majority of the outstanding voting shares of which are owned, directly or indirectly, by the Company or by one or more subsidiaries of

the Company, or by the Company and one or more subsidiaries of the Company; and the term “Consolidated Net Tangible Assets”

means, at any date, the total amount of assets of the Company determined on a consolidated basis after deducting all liabilities due within

one year, all goodwill, trade names, trademarks, patents, unamortized debt discount and expenses and other like intangibles and all appropriate

adjustments on account of minority interests of other persons holding stock of the subsidiaries, as set forth or reflected on the most

recent consolidated balance sheet of the Company. The 10% of the Consolidated Net Tangible Assets exclusion does not apply in the case

of series of securities originally issued under the Senior Indentures prior to November 20, 2012.

Plan

of Distribution

The Company may sell the Securities to or through

underwriters or dealers purchasing as principals or through agents.

The applicable prospectus supplement will identify

each underwriter, dealer or agent engaged by the Company in connection with the offering and sale of the Securities and will set forth

the terms of the offering of such Securities and the method of distribution, including, to the extent applicable, the proceeds to the

Company from the sale of the Securities, any public offering price, any delayed delivery arrangements, any fees, discounts, commissions

or any other compensation payable to underwriters, dealers or agents and any other material terms of the plan of distribution. Any initial

public offering price and any fees, discounts, commissions or any other compensation payable to underwriters, dealers or agents may be

changed from time to time. Unless otherwise set forth in the prospectus supplement relating thereto, the obligations of the underwriters

to purchase the Securities will be subject to certain conditions and the underwriters will be obligated to purchase all of the Securities

if any are purchased.

The Securities may be sold from time to time in

one or more transactions at a fixed price or prices which may be changed or at market prices prevailing at the time of sale, or at prices

related to such prevailing market prices or at negotiated prices.

Underwriters, dealers and agents who participate

in the distribution of the Securities may be entitled under agreements to be entered into with the Company to indemnification by the Company

against certain liabilities, including liabilities under securities legislation, or to contribution with respect to payments which such

underwriters, dealers or agents may be required to make in respect thereof. Such underwriters, dealers and agents may be customers of,

engage in transactions with or perform services for, the Company in the ordinary course of business.

Unless otherwise specified in the applicable prospectus

supplement, each issue of Securities will be a new issue of Securities with no established trading market. There is currently no market

through which the Securities may be sold and purchasers may not be able to resell the Securities purchased under this prospectus and the

prospectus supplement relating to such Securities. This may affect the pricing of such Securities in the secondary market, the transparency

and availability of trading prices, the liquidity of the Securities and the extent of issuer regulation. Subject to applicable laws, certain

dealers may make a market in the Securities, but will not be obligated to do so and may discontinue any market making at any time without

notice. No assurance can be given that any broker-dealer will make a market in the Securities or as to the liquidity of the trading market

for the Securities.

If so indicated in the applicable prospectus supplement,

the Company may authorize dealers or other persons acting as agents to solicit offers by certain institutions to purchase the Securities

directly from the Company pursuant to contracts providing for payment and delivery on a future date. These contracts will be subject only

to the conditions set forth in the applicable prospectus supplement which will also set forth the commission payable for solicitation

of such contacts.

One or more firms, referred to as “remarketing

firms”, may also offer or sell Securities, if the prospectus supplement so indicates, in connection with a remarketing arrangement

upon their purchase. Remarketing firms will act as principals for their own accounts or as agents for the Company. These remarketing firms

will offer or sell the Securities pursuant to the terms of the Securities. The prospectus supplement will identify any remarketing firm

and the terms of its agreement, if any, with the Company and will describe the remarketing firm’s compensation. Remarketing firms

may be deemed to be underwriters in connection with the Securities they remarket. Remarketing firms may be entitled under agreements that

may be entered into with the Company to indemnification by the Company against certain civil liabilities, including liabilities under

securities legislation, or to contribution in respect thereof, and may be customers of, engage in transactions with or perform services

for the Company in the ordinary course of business.

Risk

Factors

Investment in the Securities is subject to a number

of risks. Before deciding whether to invest in any Securities, prospective investors should carefully consider the information contained

in, or incorporated by reference in, this prospectus, including, without limitation, the risks identified and discussed in the AIF, the

2021 MD&A and the Q1 2022 MD&A of the Company which are incorporated by reference in this prospectus and those described or incorporated

by reference in a prospectus supplement relating to a specific offering of Securities.

Taxation

The applicable prospectus supplement will describe

the material Canadian and United States federal income tax consequences to an initial investor acquiring the Securities, including whether

payments of principal, premium, if any, and interest in respect of the Securities will be subject to Canadian non-resident withholding

tax and any such consequences relating to Securities payable in a currency other than United States dollars, Securities that are issued

at an original issue discount or subject to early redemption or other special terms.

Legal

Matters

Unless otherwise specified in the prospectus supplement

relating to a particular offering of Securities, certain legal matters will be passed upon for the Company by the Executive Vice-President,

Corporate Services and Chief Legal Officer of the Company and by Stikeman Elliott LLP. The validity of Securities governed by New York

law will be passed upon for the Company by Davis Polk & Wardwell LLP, New York, New York. Davis Polk & Wardwell LLP

may rely on the opinion of the Executive Vice-President, Corporate Services and Chief Legal Officer of the Company as to all matters of

Canadian federal and Quebec laws.

Enforcement

of Judgments Against Foreign Persons

Jo-ann dePass Olsovsky, Denise Gray, Justin M.

Howell, James E. O’Connor and Laura Stein, directors of the Company, reside outside of Canada. They have appointed Canadian National

Railway Company, 935 de La Gauchetière Street West, Montreal, Quebec H3B 2M9, attention Corporate Secretary, as agent for service

of process in Canada. Purchasers are advised that it may not be possible for investors to enforce judgments against any person that resides

outside of Canada, even if the party has appointed an agent for service of process.

Independent

Auditors

KPMG LLP, Montreal, Quebec, is the external auditor

who prepared the Reports of Independent Registered Public Accounting Firm to the Shareholders and Board of Directors of the Company on

the consolidated balance sheets of the Company as of December 31, 2021 and 2020 and the related consolidated statements of income,

comprehensive income, changes in shareholders’ equity and cash flows for each of the years in the two-year period ended December 31,

2021 and the related notes, and the effectiveness of internal control over financial reporting as of December 31, 2021, incorporated

by reference in this prospectus. KPMG LLP have confirmed with respect to the Company that they are independent within the meaning of the

relevant rules and related interpretations prescribed by the relevant professional bodies in Canada and any applicable legislation

or regulation.

Enforceability

of Civil Liabilities Under the U.S. Federal Securities Laws

The Company is a Canadian company and is governed

by the laws of Canada. A substantial portion of its assets are located outside the United States and a majority of its officers and directors

and of the experts named herein are residents of Canada. As a result, it may be difficult for investors to effect service within the United

States upon the Company and those directors, officers and experts, or to realize in the United States upon judgments of courts of the

United States predicated upon civil liability of the Company and such directors, officers or experts under the United States federal securities

laws. The Company has been advised by its Chief Legal Officer that there is doubt as to the enforceability in a Canadian court in original

actions, or in actions to enforce judgments of United States courts, of civil liabilities predicated upon United States federal securities

laws.

Documents

Filed As Part of the Registration Statement

The following documents have been filed with the

SEC as part of the Registration Statement of which this prospectus is a part: (i) the documents listed in the first paragraph under

“Documents Incorporated by Reference”; (ii) the consent of KPMG LLP, independent registered public accounting firm; (iii) powers

of attorney from directors and officers of the Company; (iv) the U.S. Senior Indenture, the Canadian Senior Indenture and the Subordinated

Indenture; and (v) Form T-1 Statement of Eligibility under the Trust Indenture Act of 1939 of The Bank of New York Mellon, as

trustee under the U.S. Senior Indenture.

Part II

Information

Not Required to be

Delivered to Offerees or Purchasers

Indemnification

Under the Canada Business Corporations Act

(the “CBCA”), a corporation may indemnify a present or former director or officer of the corporation or another individual

who acts or acted at the corporation’s request as a director or officer, or an individual acting in a similar capacity, of another

entity, against all costs, charges and expenses, including an amount paid to settle an action or satisfy a judgment, reasonably incurred

by the individual in respect of any civil, criminal, administrative, investigative or other proceeding in which the individual is involved

because of that association with the corporation or other entity. A corporation may advance moneys to a director, officer or other individual

for the costs, charges and expenses of a proceeding referred to above. A corporation may not indemnify an individual as aforesaid unless

the individual acted honestly and in good faith with a view to the best interests of the corporation, or, as the case may be, to the best

interests of the other entity for which the individual acted as a director or officer or in a similar capacity at the corporation’s

request and, in the case of a criminal or administrative action or proceeding that is enforced by a monetary penalty, the individual had

reasonable grounds for believing that the individual’s conduct was lawful. If the individual does not fulfill the aforesaid conditions,

the individual shall repay the moneys advanced by the corporation. A corporation may, with the approval of a court, indemnify or advance

moneys as aforesaid in connection with a derivative action. A present or former director or officer of the corporation or another individual

who acts or acted at the corporation’s request as a director or officer, or an individual acting in a similar capacity, of another

entity, is entitled to indemnity from the corporation in respect of all costs, charges and expenses reasonably incurred by the individual

in connection with the defense of any civil, criminal, administrative, investigative or other proceeding to which the individual is subject,

because of the individual’s association with the corporation or other entity if the individual seeking indemnity was not judged

by the court or other competent authorities to have committed any fault or omitted to do anything that the individual ought to have done

and fulfills the conditions referred to above.

In accordance with the CBCA, the by-laws of the

Company indemnify a director or officer of the Company, a former director or officer of the Company or any person who acts or acted at

the Company’s request as a director or officer or an individual acting in a similar capacity, of another entity, against all costs,

charges and expenses, including an amount paid to settle an action or satisfy a judgment, reasonably incurred by the individual in respect

of any civil, administrative, investigative or other proceeding in which the individual is involved because of that association with the

Company or other entity. The Company may extend the benefits of the foregoing indemnification to other persons provided such persons are

designated by way of a resolution of the board of directors of the Company.

A policy of directors’ and officers’

liability insurance is maintained by the Company which insures its directors and officers for losses as a result of claims based upon

their acts or omissions as directors and officers of the Company, and also reimburses the Company for amounts paid by the Company to indemnify

its directors and officers as a result of such claims.

Insofar as indemnification for liabilities arising

under the Securities Act of 1933 (the “Act”) may be permitted to directors, officers or persons controlling the Registrant

pursuant to the foregoing provisions, the Registrant has been informed that in the opinion of the U.S. Securities and Exchange Commission

such indemnification is against public policy as expressed in the Act and is therefore unenforceable.

| Exhibit No. |

|

Description of Exhibit |

| |

|

|

| 4.1 |

|

Annual Information Form of the Company dated February 1, 2022 (incorporated by reference to Form 40-F filed with the Securities and Exchange Commission on February 1, 2022) |

| |

|

|

| 4.2 |

|

The audited consolidated financial statements of the Company for the years ended December 31, 2021 and 2020 and related notes thereto, together with the Report of the Independent Registered Public Accounting Firm thereon and on the effectiveness of the Company’s internal controls over financial reporting, and Management’s Discussion and Analysis of Financial Results of the Company, as contained in the Annual Report of the Company for the year ended December 31, 2021 (incorporated by reference to Form 6-K filed with the Securities and Exchange Commission on February 1, 2022) |

| |

|

|

| 4.3 |

|

The Management Information Circular of the Company dated April 5, 2022 prepared in connection with the Company’s annual meeting of shareholders to be held on May 20, 2022 (incorporated by reference to Form 6-K filed with the Securities and Exchange Commission on April 19, 2022) |

| |

|

|

| 4.4 |

|

The unaudited interim consolidated financial statements of the Company as at and for the three months ended March 31, 2022 and the notes related thereto, and Management’s Discussion and Analysis of Financial Results of the Company (incorporated by reference to Form 6-K filed with the Securities and Exchange Commission on April 26, 2022) |

| |

|

|

| 5.1 |

|

Consent of KPMG LLP |

| |

|

|

| 6.1 |

|

Powers of Attorney given by officers and directors signing this Registration Statement (set forth on the signature page) |

| |

|

|

| 7.1 |

|

Indenture dated as of June 1, 1998 between the Company and The Bank of New York Mellon (formerly known as The Bank of New York), as Trustee (incorporated by reference to Registration Statement (File No. 333-236376) on Form F-10 filed February 11, 2020, Exhibit 7.1). |

| |

|

|

| 7.2 |

|

Third Supplemental Indenture dated as of November 20, 2012 between the Company and The Bank of New York Mellon (incorporated by reference to Form 6-K filed with the Securities and Exchange Commission on November 20, 2012, Item 1) |

| |

|

|

| 7.3 |

|

Form T-1 Statement of Eligibility under the Trust Indenture Act of 1939 as amended of The Bank of New York Mellon (formerly known as The Bank of New York), as Trustee with respect to the indenture dated as of June 1, 1998 |

| |

|

|

| 7.4 |

|

Indenture dated as of July 12, 2013 between the Company and BNY Trust Company of Canada, as Trustee (incorporated by reference to Registration Statement (File No. 333-192522) on Form F-10 filed November 25, 2013, Exhibit 7.4) |

| |

|

|

| 7.5 |

|

Indenture dated as of June 23, 1999 between the Company and BNY Trust Company of Canada (formerly The Trust Company of Bank of Montreal), as Trustee (incorporated by reference to Registration Statement (File No. 333- 223014) on Form F-10 filed on February 13, 2018, Exhibit 7.5) |

| |

|

|

| 107 |

|

Filing Fee Tables |

Additional exhibits to this Registration Statement

may be subsequently filed in reports on Form 40-F or on Form 6-K that specifically state that such materials are incorporated

by reference as exhibits in Part II of this Registration Statement.

Part III

Undertaking

and Consent to Service of Process

Item 1. Undertaking

The Registrant undertakes to make available, in

person or by telephone, representatives to respond to inquiries made by the Commission staff, and to furnish promptly, when requested

to do so by the Commission staff, information relating to the securities registered pursuant to Form F-10 or to transactions in said

securities.

Item 2. Consent to Service of Process

Concurrently with the filing of this Registration

Statement on Form F-10, the Registrant is filing with the Commission a written irrevocable consent and power of attorney on Form F-X.

Concurrently with the filing of this Registration

Statement on Form F-10, BNY Trust Company of Canada is filing with the Commission a written irrevocable consent and power of attorney

on Form F-X.

Any change to the name or address of the agent

for service of the Registrant and BNY Trust Company of Canada shall be communicated promptly to the Commission by amendment to Form F-X

referencing the file number of this Registration Statement.

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, the Registrant certifies that is has reasonable grounds to believe that it meets all of the requirements for filing on Form F-10

and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City

of Montreal, Province of Québec, Country of Canada, on this 4th day of May, 2022.

| |

CANADIAN NATIONAL RAILWAY COMPANY |

| |

|

| |

|

| |

By: |

/s/ Tracy Robinson |

| |

|

Name: |

Tracy Robinson |

| |

|

Title: |

President and Chief Executive Officer |

| |

By: |

/s/ Sean Finn |

| |

|

Name: |

Sean

Finn |

| |

|

Title: |

Executive Vice-President, Corporate

Services and Chief

Legal Officer |

POWER OF ATTORNEY

Each person whose signature appears below hereby

authorizes any one of Tracy Robinson, Ghislain Houle, Sean Finn or Bernd Beyer, with full power of substitution, to execute in the name

of such person and to file any amendment or post-effective amendment to this Registration Statement, making such changes in this Registration

Statement as the Registrant deems appropriate, and appoints any one of Tracy Robinson, Ghislain Houle, Sean Finn or Bernd Beyer, with

full power of substitution, attorney-in- fact to sign in his behalf individually and in each capacity below and to file any amendment

and post-effective amendment to this Registration Statement.

Pursuant to the requirements of the Securities

Act of 1933, this Registration Statement on Form F-10 has been signed below by the following persons in the capacities indicated

below on this 4th day of May, 2022.

| Signature |

|

Title |

| |

|

|

| /s/ Tracy Robinson |

|

Director, President and Chief Executive Officer |

| Tracy Robinson |

|

(Principal Executive Officer) |

| |

|

|

| /s/ Ghislain Houle |

|

Executive Vice-President and Chief Financial Officer |

| Ghislain Houle |

|

(Principal Financial Officer and Principal Accounting Officer) |

| |

|

|

| /s/ Robert Pace |

|

Director and Chair of the Board |

| Robert Pace |

|

|

| |

|

|

| /s/ Shauneen Bruder |

|

Director and Vice Chair of the Board |

| Shauneen Bruder |

|

|

| |

|

|

| /s/ Denise Gray |

|

Director |

| Denise Gray |

|

|

| |

|

|

| /s/ Justin M. Howell |

|

Director |

| Justin M. Howell |

|

|

| |

|

|

| /s/ The Honorable Kevin G. Lynch |

|

Director |

| The Honorable Kevin G. Lynch |

|

|

| |

|

|

| /s/ Margaret A. McKenzie |

|

Director |

| Margaret A. McKenzie |

|

|

| |

|

|

| /s/ James E. O’Connor |

|

Director |

| James E. O’Connor |

|

|

| |

|

|

| /s/ Jo-ann dePass Olsovsky |

|

Director |

| Jo-ann dePass Olsovsky |

|

|

| |

|

|

| /s/ Robert L. Phillips |

|

Director |

| Robert L. Phillips |

|

|

| |

|

|

| /s/ Laura Stein |

|

Director |

| Laura Stein |

|

|

AUTHORIZED REPRESENTATIVE

Pursuant to the requirements of Section 6(a) of

the Securities Act of 1933, the undersigned has signed this Registration Statement on Form F-10, solely in the capacity of the duly

authorized representative of Canadian National Railway Company in the United States on this 4th day of May, 2022.

| |

By: |

/s/ Jody Evely |

| |

|

Name: |

Jody Evely |

| |

|

Title: |

Authorized Representative in the United States |

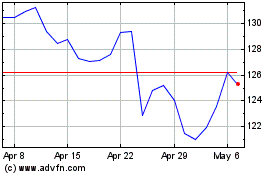

Canadian National Railway (NYSE:CNI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Canadian National Railway (NYSE:CNI)

Historical Stock Chart

From Apr 2023 to Apr 2024