ING Completes Sale Of ING Direct USA To Capital One

18 February 2012 - 3:26AM

Dow Jones News

Dutch financial services firm ING Group NV (ING) said Friday it

has completed the sale of ING Direct USA to Capital One Financial

Corp (COF) as announced on 16 June 2011.

MAIN FACTS

- Total proceeds of the transaction are approximately $9.0

billion (or approximately EUR6.9 billion), including $6.3 billion

in cash and $2.7 billion in the form of 54.0 million shares in

Capital One, based on the share price of $49.29 at closing on 16

February 2012.

- These shares represent a 9.7% stake in Capital One at

closing.

- The transaction has resulted in a positive result after tax of

approximately EUR0.5 billion.

- The sale has a positive impact on ING Bank's core Tier 1 ratio

of approximately 80 basis points, leading to a pro-forma core Tier

1 ratio of 10.4% at closing, based on core Tier 1 of 9.6% per 31

December 2011.

- In connection with the divestment of ING Direct USA, ING also

completed the adjustment of the agreement with the Dutch State

concerning the structure of the Illiquid Assets Back up Facility

which was also announced on 16 June 2011.

- By Amsterdam Bureau, Dow Jones Newswires;

amsterdam@dowjones.com

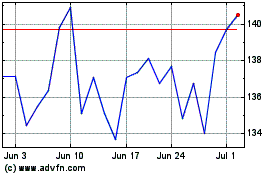

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Jun 2024 to Jul 2024

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Jul 2023 to Jul 2024