Fourth Quarter

- Net income of $2.2 billion, or $3.80 per share

- Adjusted after-tax operating income1 of $701 million and

operating EPS1 of $1.23 per share

- Premiums and deposits1 of $9.9 billion

- Aggregate core sources of income2,3 increased 4% over the prior

year quarter

- Holding company liquidity of $2.2 billion

- Returned $527 million to shareholders, including $398 million

of share repurchases

Full Year

- Net income of $2.2 billion, or $3.72 per share

- Adjusted after-tax operating income of $2.9 billion and

operating EPS of $4.83 per share

- Premiums and deposits of $41.7 billion

- Aggregate core sources of income3 increased 4% over the prior

year

- Returned $2.3 billion to shareholders, an 81% payout ratio,

including $1.8 billion of share repurchases

Corebridge Financial, Inc. ("Corebridge" or the "Company")

(NYSE: CRBG) today reported financial results for the fourth

quarter and full year ended December 31, 2024.

Kevin Hogan, President and Chief Executive Officer, said, "I am

pleased to report strong performance for Corebridge, as we

generated full year top-line and earnings growth with premiums and

deposits of $41.7 billion and operating earnings per share of

$4.83, an 18% increase year over year. Additionally, our U.S.

insurance subsidiaries increased full year dividends by 10%,

distributing $2.2 billion to the holding company. Organic growth,

balance sheet optimization, expense efficiencies and active capital

management were fundamental to this success, and we will continue

to build on these strategic pillars to drive further growth and

shareholder value.

"This week, the Board of Directors increased our existing share

repurchase authorization by $2 billion and increased our quarterly

dividend to $0.24 per share, reflecting their confidence in our

value proposition and financial strength. Looking forward, we see

ongoing opportunities to extend our positive momentum, powered by

our strategic differentiators and supported by favorable market

dynamics. Our diversified business model, strong balance sheet and

disciplined execution will continue to be key drivers, and the

fundamentals of Corebridge remain compelling."

CONSOLIDATED RESULTS ($ in millions, except per share

data)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2024

2023

2024

2023

Net income (loss) attributable to common

shareholders

$

2,171

$

(1,309

)

$

2,230

$

1,104

Income (loss) per common share

attributable to common shareholders

$

3.80

$

(2.07

)

$

3.72

$

1.71

Weighted average shares outstanding -

diluted

571

633

599

645

Adjusted after-tax operating income

$

701

$

661

$

2,891

$

2,647

Operating EPS

$

1.23

$

1.04

$

4.83

$

4.10

Weighted average shares outstanding -

operating

571

635

599

645

Total common shares outstanding

561

622

561

622

Pre-tax income (loss)

$

2,925

$

(1,763

)

$

2,803

$

940

Adjusted pre-tax operating income1

$

878

$

820

$

3,605

$

3,193

Aggregate core sources of income

$

1,807

$

1,836

$

7,318

$

7,138

Base spread income2

$

893

$

987

$

3,791

$

3,719

Fee income2

$

534

$

485

$

2,098

$

1,913

Underwriting margin excluding variable

investment income2

$

380

$

364

$

1,429

$

1,506

Premiums and deposits

$

9,860

$

10,472

$

41,742

$

39,887

Net investment income

$

3,020

$

3,012

$

12,228

$

11,078

Net investment income (APTOI basis)1

$

2,879

$

2,568

$

11,058

$

9,839

Base portfolio income - insurance

operating businesses

$

2,749

$

2,564

$

10,769

$

9,607

Variable investment income - insurance

operating businesses

$

105

$

4

$

278

$

165

Corporate and other4

$

25

$

—

$

11

$

67

Return on average equity

69.3

%

(52.0

%)

18.8

%

10.7

%

Adjusted return on average equity1

12.8

%

11.2

%

12.8

%

11.3

%

Fourth Quarter

Net income was $2.2 billion compared to a loss of $1.3 billion

in the prior year quarter. The variance largely was a result of

favorable changes in net realized gains (losses), including the

Fortitude Re funds withheld embedded derivative, and fair value of

market risk benefits. Additionally, the Company recognized a gain

on the sale of Laya Healthcare in the prior year.

Adjusted pre-tax operating income ("APTOI") was $878 million, a

7% increase over the prior year quarter. Excluding variable

investment income ("VII"), notable items and the international

businesses, APTOI increased 3% over the same period largely due to

growth in aggregate core sources of income.

Aggregate core sources of income was $1.8 billion, a 2% decrease

from the prior year quarter largely due to the sale of our

international businesses and favorable notable items in 2023.

Excluding notable items and the international businesses, core

sources of income increased 4% over the same period as a result of

higher fee income and underwriting margin.

Premiums and deposits were $9.9 billion, a 6% decrease from an

exceptional prior year quarter. Excluding transactional activity

(i.e., pension risk transfer, guaranteed investment contracts and

Group Retirement plan acquisitions) and the sale of the

international businesses, premiums and deposits decreased 8% from

the same period primarily driven by lower fixed annuity deposits

partially offset by higher fixed index annuity deposits in line

with broader market trends.

Full Year

Net income was $2.2 billion compared to $1.1 billion in the

prior year. The variance largely was a result of favorable changes

in net realized gains (losses) including the Fortitude Re funds

withheld embedded derivative. The Company completed its annual

actuarial assumption review during the third quarter which

decreased pre-tax income by $79 million in the current year

compared to a $22 million increase in the prior year.

APTOI was $3.6 billion, a 13% increase over the prior year.

Excluding VII, notable items and the international businesses,

APTOI increased 7% over the prior year largely due to growth in

aggregate core sources of income coupled with lower expenses. The

annual actuarial assumption review decreased APTOI by $3 million in

the current year compared to a $22 million increase in the prior

year.

Aggregate core sources of income was $7.3 billion, a 3% increase

over the prior year. Excluding notable items and the international

businesses, core sources of income increased 4% over the same

period as a result of higher base spread income, fee income and

underwriting margin.

Premiums and deposits were $41.7 billion, a 5% increase over the

prior year. Excluding transactional activity (i.e., pension risk

transfer, guaranteed investment contracts and Group Retirement plan

acquisitions) and the sale of the international businesses,

premiums and deposits increased 14% over the same period primarily

driven by higher fixed annuity deposits.

CAPITAL AND LIQUIDITY HIGHLIGHTS

- Life Fleet RBC ratio of 420-430%, remained above target

- Holding company liquidity of $2.2 billion as of December 31,

2024, reflecting proceeds from the September and November debt

issuances to pre-fund upcoming maturities in 2025

- Financial leverage ratio2 of 31.1% reflects the impact of

pre-funding debt maturing in 2025. Excluding this pre-funding, the

financial leverage ratio was 28.7%

- Returned $527 million to shareholders in the fourth quarter

through $398 million of share repurchases and $129 million of

dividends

- Returned $2.3 billion to shareholders in 2024 through $1.8

billion of share repurchases and $544 million of dividends

- Board of Directors increased the existing share repurchase

authorization by $2 billion

- Increased quarterly dividend to $0.24 per share of common stock

payable on March 31, 2025, to shareholders of record at the close

of business on March 17, 2025

BUSINESS RESULTS

Individual

Retirement

Three Months Ended

December 31,

($ in millions)

2024

2023

Premiums and deposits

$

5,000

$

5,282

Core sources of income

$

980

$

992

Spread income

$

703

$

715

Base spread income

$

665

$

704

Variable investment income

$

38

$

11

Fee income

$

315

$

288

Adjusted pre-tax operating income

$

578

$

628

- Premiums and deposits decreased $282 million, or 5%, from the

prior year quarter primarily driven by lower fixed annuity

deposits, partially offset by higher fixed index annuity

deposits

- Core sources of income decreased 1% from the prior year quarter

largely due to significant notable items in the prior year period.

Excluding notable items, core sources of income increased 2% over

the prior year quarter largely as a result of favorable market

performance driving higher account values

- APTOI decreased $50 million, or 8%, from the prior year

quarter. Excluding VII and notable items, APTOI decreased 7% from

the prior year quarter mainly due to the impact of changes in

short-term interest rates and related hedging activity on floating

rate asset exposure

Group

Retirement

Three Months Ended

December 31,

($ in millions)

2024

2023

Premiums and deposits

$

1,616

$

2,083

Core sources of income

$

346

$

370

Spread income

$

160

$

193

Base spread income

$

143

$

189

Variable investment income

$

17

$

4

Fee income

$

203

$

181

Adjusted pre-tax operating income

$

161

$

179

- Premiums and deposits decreased $467 million, or 22%, from the

prior year quarter driven by lower out-of-plan annuity deposits, in

line with broader market trends

- Core sources of income decreased 6% from the prior year quarter

and, excluding notable items, it decreased 5% from the same period

largely as a result of net outflows from older age cohorts,

partially offset by higher account values and growing advisory and

brokerage assets under administration

- APTOI decreased $18 million, or 10%, from the prior year

quarter. Excluding VII and notable items, APTOI decreased 10% from

the prior year quarter primarily due to lower base spread income

partially offset by higher fee income

Life

Insurance

Three Months Ended

December 31,

($ in millions)

2024

2023

Premiums and deposits

$

879

$

1,103

Underwriting margin

$

370

$

341

Underwriting margin excluding variable

investment income

$

362

$

343

Variable investment income

$

8

$

(2

)

Adjusted pre-tax operating income

$

156

$

79

- Premiums and deposits decreased $224 million, or 20%, from the

prior year quarter. Excluding the sale of the international life

business, premiums and deposits increased 1% over the same period

primarily driven by higher traditional life premiums

- Underwriting margin excluding VII increased 6% over the prior

year quarter, and excluding notable items and the sale of the

international businesses, it increased 25% over the same period

largely driven by more favorable mortality experience

- APTOI increased $77 million, or 97%, over the prior year

quarter. Excluding VII, notable items and the sale of the

international businesses, APTOI increased 101% over the prior year

quarter primarily as a result of higher underwriting margin

Institutional Markets

Three Months Ended

December 31,

($ in millions)

2024

2023

Premiums and deposits

$

2,365

$

2,004

Core sources of income

$

119

$

131

Spread income

$

127

$

86

Base spread income

$

85

$

94

Variable investment income

$

42

$

(8

)

Fee income

$

16

$

16

Underwriting margin

$

18

$

20

Underwriting margin excluding variable

investment income

$

18

$

21

Variable investment income

$

—

$

(1

)

Adjusted pre-tax operating income

$

133

$

93

- Premiums and deposits increased $361 million, or 18%, over the

prior year quarter largely driven by higher deposits from

guaranteed investment contracts, partially offset by lower premiums

from pension risk transfer transactions

- Core sources of income decreased 9% from the prior year quarter

and, excluding notable items, it decreased 6% from the same period

largely as a result of slightly lower base spread income and

underwriting margin

- APTOI increased $40 million, or 43%, over the prior year

quarter primarily due to higher variable investment income.

Excluding VII and notable items, APTOI decreased 5% from the prior

year quarter primarily as a result of slightly lower base spread

income and underwriting margin

Corporate

and Other

Three Months Ended

December 31,

($ in millions)

2024

2023

Corporate expenses

$

(29

)

$

(36

)

Interest on financial debt

$

(119

)

$

(107

)

Asset management

$

5

$

—

Consolidated investment entities

$

5

$

(2

)

Other

$

(12

)

$

(14

)

Adjusted pre-tax operating (loss)

$

(150

)

$

(159

)

- APTOI increased $9 million over the prior year quarter

primarily due to lower corporate expenses. Results also include

higher interest expense on financial debt due, in part, to the

pre-funding of debt maturing in 2025

___________________________

1

This release refers to financial measures not calculated in

accordance with generally accepted accounting principles

(non-GAAP); definitions of non-GAAP measures and reconciliations to

their most directly comparable GAAP measures can be found in

"Non-GAAP Financial Measures" below

2

This release refers to key operating metrics and key terms.

Information about these metrics and terms can be found in "Key

Operating Metrics and Key Terms" below

3

Excludes notable items and international life businesses

4

Includes consolidations and eliminations

CONFERENCE CALL

Corebridge will host a conference call on Thursday, February 13,

2025, at 10:00 a.m. EST to review these results. The call is open

to the public and can be accessed via a live listen-only webcast in

the Investors section of corebridgefinancial.com. A replay will be

available after the call at the same location.

Supplemental financial data and our investor presentation are

available in the Investors section of corebridgefinancial.com.

About Corebridge Financial

Corebridge Financial, Inc. makes it possible for more people to

take action in their financial lives. With more than $400 billion

in assets under management and administration as of December 31,

2024, Corebridge Financial is one of the largest providers of

retirement solutions and insurance products in the United States.

We proudly partner with financial professionals and institutions to

help individuals plan, save for and achieve secure financial

futures. For more information, visit corebridgefinancial.com and

follow us on LinkedIn, YouTube and Instagram. These references with

additional information about Corebridge have been provided as a

convenience, and the information contained on such websites is not

incorporated by reference into this press release.

In the discussion below, “we,” “us” and “our” refer to

Corebridge and its consolidated subsidiaries, unless the context

refers solely to Corebridge as a corporate entity.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

INFORMATION

Certain statements in this press release and other publicly

available documents may include statements of historical or present

fact, which, to the extent they are not statements of historical or

present fact, constitute “forward-looking statements” within the

meaning of the U.S. Private Securities Litigation Reform Act of

1995. Forward-looking statements can be identified by the use of

words such as “expects,” “believes,” “anticipates,” “intends,”

“seeks,” “aims,” “plans,” “assumes,” “estimates,” “projects,” “is

optimistic,” “targets," “should,” “would,” “could,” “may,” “will,”

“shall” or variations of such words are generally part of

forward-looking statements. Also, forward-looking statements

include, without limitation, all matters that are not historical

facts. Forward-looking statements are made based on management’s

current expectations and beliefs concerning future developments and

their potential effects upon Corebridge. There can be no assurance

that future developments affecting Corebridge will be those

anticipated by management.

Any forward-looking statements included herein are not a

guarantee of future performance and involve risks and

uncertainties, and there are certain important factors that could

cause actual results to differ, possibly materially, from

expectations or estimates reflected or implied in such

forward-looking statements, including, among others, risks related

to:

- changes in interest rates and changes to credit spreads;

- the deterioration of economic conditions, an economic slowdown

or recession, changes in market conditions, weakening in capital

markets, volatility in equity markets, inflationary pressures,

pressures on the commercial real estate market, and geopolitical

tensions, including the ongoing armed conflicts between Ukraine and

Russia and in the Middle East;

- the unpredictability of the amount and timing of insurance

liability claims;

- unavailable, uneconomical or inadequate reinsurance or

recaptures of reinsured liabilities;

- uncertainty and unpredictability related to our reinsurance

agreements with Fortitude Reinsurance Company Ltd. and its

performance of its obligations under these agreements;

- our limited ability to access funds from our subsidiaries;

- our ability to incur indebtedness, our potential inability to

refinance all or a portion of our indebtedness or our ability to

obtain additional financing on favorable terms or at all;

- our ability to maintain sufficient eligible collateral to

support business and funding strategies requiring

collateralization;

- our inability to generate cash to meet our needs due to the

illiquidity of some of our investments;

- the inaccuracy of the methodologies, estimations and

assumptions underlying our valuation of investments and

derivatives;

- a downgrade in our Insurer Financial Strength ratings or credit

ratings;

- exposure to credit risk due to non-performance or defaults by

our counterparties or our use of derivative instruments to hedge

market risks associated with our liabilities;

- our ability to adequately assess risks and estimate losses

related to the pricing of our products;

- the failure of third parties that we rely upon to provide and

adequately perform certain business, operations, investment

advisory, functional support and administrative services on our

behalf;

- the impact of risks associated with our arrangement with

Blackstone ISG-I Advisors LLC (“Blackstone IM”), BlackRock

Financial Management, Inc. or any other asset manager we retain,

including their historical performance not being indicative of the

future results of our investment portfolio and the exclusivity of

certain arrangements with Blackstone IM;

- our inability to maintain the availability of critical

technology systems and the confidentiality of our data, including

challenges associated with a variety of privacy and information

security laws;

- the ineffectiveness of our risk management policies and

procedures;

- significant legal, governmental or regulatory proceedings;

- the intense competition we face in each of our business lines

and the technological changes, including the use of artificial

intelligence, that may present new and intensified challenges to

our business;

- catastrophes, including those associated with climate change

and pandemics;

- business or asset acquisitions and dispositions that may expose

us to certain risks;

- our ability to protect our intellectual property;

- our ability to operate efficiently and compete effectively in a

heavily regulated industry in light of new domestic or

international laws and regulations or new interpretations of

current laws and regulations;

- impact on sales of our products and taxation of our operations

due to changes in U.S. federal income or other tax laws or the

interpretation of tax laws;

- the ineffectiveness of our productivity improvement initiatives

in yielding our expected expense reductions and improvements in

operational and organizational efficiency;

- differences between actual experience and the estimates used in

the preparation of financial statements and modeled results used in

various areas of our business;

- our inability to attract and retain key employees and highly

skilled people needed to support our business;

- the significant influence that AIG and Nippon have over us and

conflicts of interests arising due to such relationships;

- the indemnification obligations we have to AIG;

- potentially higher U.S. federal income taxes due to our

inability to file a single U.S. consolidated federal income tax

return for five years following our initial public offering and our

separation from AIG causing an “ownership change” for U.S. federal

income tax purposes caused by our separation from AIG;

- risks associated with the Tax Matters Agreement with AIG and

our potential liability for U.S. income taxes of the entire AIG

Consolidated Tax Group for all taxable years or portions thereof in

which we (or our subsidiaries) were members of such group;

- the risk that anti-takeover provisions could discourage, delay,

or prevent our change in control, even if the change in control

would be beneficial to our shareholders;

- challenges related to compliance with applicable laws incident

to being a public company, which is expensive and time-consuming;

and

- other factors discussed in “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of

Operations” in our Annual Report on Form 10-K for the year ended

December 31, 2024, as well as our Quarterly Reports on Form

10-Q.

Any forward-looking statement speaks only as of the date on

which it is made, and we undertake no obligation to update or

revise any forward-looking statement to reflect events or

circumstances after the date on which the statement is made or to

reflect the occurrence of unanticipated events, except as otherwise

may be required by law. You are advised, however, to consult any

further disclosures we make on related subjects in our filings with

the Securities and Exchange Commission ("SEC").

NON-GAAP FINANCIAL MEASURES

Throughout this release, we present our financial condition and

results of operations in the way we believe will be most meaningful

and representative of our business results. Some of the

measurements we use are ‘‘non-GAAP financial measures’’ under SEC

rules and regulations. We believe presentation of these non-GAAP

financial measures allows for a deeper understanding of the

profitability drivers of our business, results of operations,

financial condition and liquidity. These measures should be

considered supplementary to our results of operations and financial

condition that are presented in accordance with GAAP and should not

be viewed as a substitute for GAAP measures. The non-GAAP financial

measures we present may not be comparable to similarly named

measures reported by other companies.

Adjusted pre-tax operating income (“APTOI”) is derived by

excluding the items set forth below from income (loss) before

income tax expense (benefit). These items generally fall into one

or more of the following broad categories: legacy matters having no

relevance to our current businesses or operating performance;

adjustments to enhance transparency to the underlying economics of

transactions; and recording adjustments to APTOI that we believe to

be common in our industry. We believe the adjustments to pre-tax

income are useful for gaining an understanding of our overall

results of operations.

APTOI excludes the impact of the following items:

FORTITUDE RE RELATED ADJUSTMENTS:

The modified coinsurance (“modco”) reinsurance agreements with

Fortitude Re transfer the economics of the invested assets

supporting the reinsurance agreements to Fortitude Re. Accordingly,

the net investment income on Fortitude Re funds withheld assets and

the net realized gains (losses) on Fortitude Re funds withheld

assets are excluded from APTOI. Similarly, changes in the Fortitude

Re funds withheld embedded derivative are also excluded from

APTOI.

The ongoing results associated with the reinsurance agreement

with Fortitude Re have been excluded from APTOI as these are not

indicative of our ongoing business operations.

INVESTMENT RELATED ADJUSTMENTS:

APTOI excludes “Net realized gains (losses)”, except for gains

(losses) related to the disposition of real estate investments. Net

realized gains (losses), except for gains (losses) related to the

disposition of real estate investments, are excluded as the timing

of sales on invested assets or changes in allowances depend largely

on market credit cycles and can vary considerably across periods.

In addition, changes in interest rates may create opportunistic

scenarios to buy or sell invested assets. Our derivative results,

including those used to economically hedge insurance liabilities,

or those recognized as embedded derivatives at fair value, are also

included in Net realized gains (losses) and are similarly excluded

from APTOI except earned income (periodic settlements and changes

in settlement accruals) on derivative instruments used for

non-qualifying (economic) hedges or for asset replication. Earned

income on such economic hedges is reclassified from Net realized

gains and losses to specific APTOI line items based on the economic

risk being hedged (e.g., Net investment income and Interest

credited to policyholder account balances).

MARKET RISK BENEFIT ADJUSTMENTS (“MRBs”):

Certain of our variable annuity, fixed annuity and fixed index

annuity contracts contain guaranteed minimum withdrawal benefits

(“GMWBs”) and/or guaranteed minimum death benefits (“GMDBs”) which

are accounted for as MRBs. Changes in the fair value of these MRBs

(excluding changes related to our own credit risk), including

certain rider fees attributed to the MRBs, along with changes in

the fair value of derivatives used to hedge MRBs are recorded

through “Change in the fair value of MRBs, net” and are excluded

from APTOI. Changes in the fair value of securities used to

economically hedge MRBs are excluded from APTOI.

OTHER ADJUSTMENTS:

Other adjustments represent all other adjustments that are

excluded from APTOI and includes the net pre-tax operating income

(losses) from noncontrolling interests related to consolidated

investment entities. The excluded adjustments include, as

applicable:

- restructuring and other costs related to initiatives designed

to reduce operating expenses, improve efficiency and simplify our

organization;

- non-recurring costs associated with the implementation of

non-ordinary course legal or regulatory changes or changes to

accounting principles;

- separation costs;

- non-operating litigation reserves and settlements;

- loss (gain) on extinguishment of debt, if any;

- losses from the impairment of goodwill, if any; and

- income and loss from divested or run-off business, if any.

Adjusted after-tax operating income attributable to our

common shareholders (“Adjusted After-tax Operating Income” or

“AATOI”) is derived by excluding the tax effected APTOI

adjustments described above, as well as the following tax items

from net income attributable to us:

- reclassifications of disproportionate tax effects from AOCI,

changes in uncertain tax positions and other tax items related to

legacy matters having no relevance to our current businesses or

operating performance; and

- deferred income tax valuation allowance releases and

charges.

Adjusted Book Value is derived by excluding AOCI,

adjusted for the cumulative unrealized gains and losses related to

Fortitude Re’s funds withheld assets. We believe this measure is

useful to investors as it eliminates the asymmetrical impact

resulting from changes in fair value of our available-for-sale

securities portfolio for which there is largely no offsetting

impact for certain related insurance liabilities that are not

recorded at fair value with changes in fair value recorded through

OCI. It also eliminates asymmetrical impacts where our own credit

non-performance risk is recorded through OCI. In addition, we

adjust for the cumulative unrealized gains and losses related to

Fortitude Re’s funds withheld assets since these fair value

movements are economically transferred to Fortitude Re.

Adjusted Return on Average Equity (“Adjusted ROAE”) is

derived by dividing AATOI by average Adjusted Book Value and is

used by management to evaluate our recurring profitability and

evaluate trends in our business. We believe this measure is useful

to investors as it eliminates the asymmetrical impact resulting

from changes in fair value of our available-for-sale securities

portfolio for which there is largely no offsetting impact for

certain related insurance liabilities that are not recorded at fair

value with changes in fair value recorded through OCI. It also

eliminates asymmetrical impacts where our own credit

non-performance risk is recorded through OCI. In addition, we

adjust for the cumulative unrealized gains and losses related to

Fortitude Re’s funds withheld assets since these fair value

movements are economically transferred to Fortitude Re.

Adjusted revenues exclude Net realized gains (losses)

except for gains (losses) related to the disposition of real estate

investments, income from non-operating litigation settlements

(included in Other income for GAAP purposes) and changes in fair

value of securities used to hedge guaranteed living benefits

(included in Net investment income for GAAP purposes).

Net investment income (APTOI basis) is the sum of base

portfolio income and variable investment income. We believe that

presenting net investment income on an APTOI basis is useful for

gaining an understanding of the main drivers of investment

income.

Operating Earnings per Common Share ("Operating EPS") is

derived by dividing AATOI by weighted average diluted shares.

Premiums and deposits is a non-GAAP financial measure

that includes direct and assumed premiums received and earned on

traditional life insurance policies and life-contingent payout

annuities, as well as deposits received on universal life

insurance, investment-type annuity contracts and GICs. We believe

the measure of premiums and deposits is useful in understanding

customer demand for our products, evolving product trends and our

sales performance period over period.

KEY OPERATING METRICS AND KEY TERMS

Assets Under Management and Administration

- Assets Under Management ("AUM") include assets in the

general and separate accounts of our subsidiaries that support

liabilities and surplus related to our life and annuity insurance

products.

- Assets Under Administration ("AUA") include Group

Retirement mutual fund assets and other third-party assets that we

sell or administer and the notional value of Stable Value Wrap

("SVW") contracts.

- Assets Under Management and Administration ("AUMA") is

the cumulative amount of AUM and AUA.

Base net investment spread means base yield less cost of

funds, excluding the amortization of deferred sales inducement

assets.

Base spread income means base portfolio income less

interest credited to policyholder account balances, excluding the

amortization of deferred sales inducement assets.

Base yield means the returns from base portfolio income

including accretion and impacts from holding cash and short-term

investments.

Core sources of income means the sum of base spread

income, fee income and underwriting margin, excluding variable

investment income, in our Individual Retirement, Group Retirement,

Life Insurance and Institutional Markets segments.

Cost of funds means the interest credited to

policyholders excluding the amortization of deferred sales

inducement assets.

Fee and Spread Income and Underwriting Margin

- Fee income is defined as policy fees plus advisory fees

plus other fee income. For our Institutional Markets segment, its

SVW products generate fee income.

- Spread income is defined as net investment income less

interest credited to policyholder account balances, exclusive of

amortization of deferred sales inducement assets. Spread income is

comprised of both base spread income and variable investment

income. For our Institutional Markets segment, its structured

settlements, PRT and GIC products generate spread income, which

includes premiums, net investment income, less interest credited

and policyholder benefits and excludes the annual assumption

update.

- Underwriting margin for our Life Insurance segment

includes premiums, policy fees, other income, net investment

income, less interest credited to policyholder account balances and

policyholder benefits and excludes the annual assumption update.

For our Institutional Markets segment, its Corporate Markets

products generate underwriting margin, which includes premiums, net

investment income, policy and advisory fee income, less interest

credited and policyholder benefits and excludes the annual

assumption update.

Financial leverage ratio means the ratio of financial

debt to the sum of financial debt plus Adjusted Book Value plus

non-redeemable noncontrolling interests.

Life Fleet RBC Ratio

- Life Fleet means American General Life Insurance Company

(“AGL”), The United States Life Insurance Company in the City of

New York (“USL”) and The Variable Annuity Life Insurance Company

(“VALIC”).

- Life Fleet RBC Ratio is the risk-based capital (“RBC”)

ratio for the Life Fleet RBC ratios are quoted using the Company

Action Level.

Net Investment Income

- Base portfolio income includes interest, dividends and

foreclosed real estate income, net of investment expenses and

non-qualifying (economic) hedges.

- Variable investment income includes call and tender

income, commercial mortgage loan prepayments, changes in market

value of investments accounted for under the fair value option,

interest received on defaulted investments (other than foreclosed

real estate), income from alternative investments and other

miscellaneous investment income, including income of certain

partnership entities that are required to be consolidated.

Alternative investments include private equity funds which are

generally reported on a one-quarter lag.

RECONCILIATIONS

The following tables present a reconciliation of pre-tax income

(loss)/net income (loss) attributable to Corebridge to adjusted

pre-tax operating income (loss)/adjusted after-tax operating income

(loss) attributable to Corebridge:

Three Months Ended December 31,

2024

2023

(in millions)

Pre-tax

Total Tax

(Benefit)

Charge

Non-

controlling

Interests

After Tax

Pre-tax

Total Tax

(Benefit)

Charge

Non-

controlling

Interests

After Tax

Pre-tax income (loss)/net income

(loss), including noncontrolling interests

$

2,925

$

703

$

—

$

2,222

$

(1,763

)

$

(432

)

$

—

$

(1,331

)

Noncontrolling interests

—

—

(51

)

(51

)

—

—

22

22

Pre-tax income (loss)/net income (loss)

attributable to Corebridge

2,925

703

(51

)

2,171

(1,763

)

(432

)

22

(1,309

)

Fortitude Re related items

Net investment (income) on Fortitude Re

funds withheld assets

(198

)

(43

)

—

(155

)

(471

)

(91

)

—

(380

)

Net realized (gains) losses on Fortitude

Re funds withheld assets

148

32

—

116

(114

)

(27

)

—

(87

)

Net realized (gains) losses on Fortitude

Re funds withheld embedded derivative

(933

)

(201

)

—

(732

)

1,911

408

—

1,503

Subtotal Fortitude Re related

items

(983

)

(212

)

—

(771

)

1,326

290

—

1,036

Other reconciling Items

Reclassification of disproportionate tax

effects from AOCI and other tax adjustments

—

(7

)

—

7

—

15

—

(15

)

Deferred income tax valuation allowance

(releases) charges

—

(84

)

—

84

—

(17

)

—

17

Changes in fair value of market risk

benefits, net

(486

)

(102

)

—

(384

)

478

101

—

377

Changes in fair value of securities used

to hedge guaranteed living benefits

2

—

—

2

5

1

—

4

Changes in benefit reserves related to net

realized gains (losses)

—

1

—

(1

)

—

—

—

—

Net realized (gains) losses(1)

(604

)

(130

)

7

(467

)

1,253

268

—

985

Separation costs

—

—

—

—

59

12

—

47

Restructuring and other costs

68

14

—

54

60

12

—

48

Non-recurring costs related to regulatory

or accounting changes

1

1

—

—

1

—

—

1

Net (gain) loss on divestiture

—

(7

)

—

7

(621

)

(91

)

—

(530

)

Pension expense - non operating

—

—

—

—

—

—

—

—

Noncontrolling interests

(44

)

—

44

—

22

—

(22

)

—

Subtotal Non-Fortitude Re reconciling

items

(1,064

)

(314

)

51

(699

)

1,257

301

(22

)

934

Total adjustments

(2,047

)

(526

)

51

(1,470

)

2,583

591

(22

)

1,970

Adjusted pre-tax operating

income/Adjusted after-tax operating income attributable to

Corebridge

$

878

$

177

$

—

$

701

$

820

$

159

$

—

$

661

Twelve Months Ended December 31,

2024

2023

(in millions)

Pre-tax

Total Tax

(Benefit)

Charge

Non-

controlling

Interests

After Tax

Pre-tax

Total Tax

(Benefit)

Charge

Non-

controlling

Interests

After Tax

Pre-tax income (loss)/net income

(loss), including noncontrolling interests

$

2,803

$

600

$

—

$

2,203

$

940

$

(96

)

$

—

$

1,036

Noncontrolling interests

—

—

27

27

—

—

68

68

Pre-tax income (loss)/net income (loss)

attributable to Corebridge

2,803

600

27

2,230

940

(96

)

68

1,104

Fortitude Re related items

Net investment (income) on Fortitude Re

funds withheld assets

(1,370

)

(293

)

—

(1,077

)

(1,368

)

(291

)

—

(1,077

)

Net realized (gains) losses on Fortitude

Re funds withheld assets

248

53

—

195

224

48

—

176

Net realized (gains) losses on Fortitude

Re funds withheld embedded derivative

518

111

—

407

1,734

369

—

1,365

Subtotal Fortitude Re related

items

(604

)

(129

)

—

(475

)

590

126

—

464

Other reconciling Items

Reclassification of disproportionate tax

effects from AOCI and other tax adjustments

—

49

—

(49

)

—

89

—

(89

)

Deferred income tax valuation allowance

(releases) charges

—

(97

)

—

97

—

(11

)

—

11

Changes in fair value of market risk

benefits, net

(227

)

(48

)

—

(179

)

(6

)

(1

)

—

(5

)

Changes in fair value of securities used

to hedge guaranteed living benefits

10

2

—

8

16

3

—

13

Changes in benefit reserves related to net

realized gains (losses)

(8

)

(1

)

—

(7

)

(6

)

(1

)

—

(5

)

Net realized (gains) losses(1)

1,459

312

7

1,154

1,792

381

—

1,411

Separation costs

94

20

—

74

245

51

—

194

Restructuring and other costs

287

60

—

227

197

41

—

156

Non-recurring costs related to regulatory

or accounting changes

3

1

—

2

18

4

—

14

Net (gain) loss on divestiture

(245

)

(55

)

—

(190

)

(676

)

(43

)

—

(633

)

Pension expense - non operating

—

—

—

—

15

3

—

12

Noncontrolling interests

34

—

(34

)

—

68

—

(68

)

—

Subtotal Non-Fortitude Re reconciling

items

1,406

243

(27

)

1,136

1,663

516

(68

)

1,079

Total adjustments

802

114

(27

)

661

2,253

642

(68

)

1,543

Adjusted pre-tax operating

income/Adjusted after-tax operating income attributable to

Corebridge

$

3,605

$

714

$

—

$

2,891

$

3,193

$

546

$

—

$

2,647

(1) Includes all net realized gains and

losses except earned income (periodic settlements and changes in

settlement accruals) on derivative instruments used for

non-qualifying (economic) hedging or for asset replication.

Additionally, gains (losses) related to the disposition of real

estate investments are also excluded from this adjustment

The following table presents Corebridge’s adjusted pre-tax

operating income by segment:

(in millions)

Individual Retirement

Group Retirement

Life Insurance

Institutional Markets

Corporate & Other

Eliminations

Total Corebridge

Three Months Ended December 31, 2024

Premiums

$

30

$

2

$

366

$

723

$

19

$

—

$

1,140

Policy fees

201

114

371

52

—

—

738

Net investment income

1,474

460

337

583

30

(5

)

2,879

Net realized gains (losses)(1)

—

—

—

—

49

—

49

Advisory fee and other income

114

89

—

—

7

—

210

Total adjusted revenues

1,819

665

1,074

1,358

105

(5

)

5,016

Policyholder benefits

36

3

619

969

—

—

1,627

Interest credited to policyholder account

balances

783

303

85

228

—

—

1,399

Amortization of deferred policy

acquisition costs

164

22

84

3

—

—

273

Non-deferrable insurance commissions

105

31

16

5

1

—

158

Advisory fee expenses

39

35

—

—

—

—

74

General operating expenses

114

110

114

20

70

(3

)

425

Interest expense

—

—

—

—

142

(4

)

138

Total benefits and expenses

1,241

504

918

1,225

213

(7

)

4,094

Noncontrolling interests

—

—

—

—

(44

)

—

(44

)

Adjusted pre-tax operating income

(loss)

$

578

$

161

$

156

$

133

$

(152

)

$

2

$

878

(in millions)

Individual Retirement

Group Retirement

Life Insurance

Institutional Markets

Corporate & Other

Eliminations

Total Corebridge

Three Months Ended December 31, 2023

Premiums

$

40

$

4

$

459

$

1,921

$

19

$

—

$

2,443

Policy fees

180

102

371

50

—

—

703

Net investment income

1,316

488

325

439

7

(7

)

2,568

Net realized gains (losses)(1)

—

—

—

—

(2

)

—

(2

)

Advisory fee and other income

108

79

9

1

14

—

211

Total adjusted revenues

1,644

673

1,164

2,411

38

(7

)

5,923

Policyholder benefits

39

4

736

2,110

—

—

2,889

Interest credited to policyholder account

balances

615

299

87

179

—

—

1,180

Amortization of deferred policy

acquisition costs

147

20

90

3

—

—

260

Non-deferrable insurance commissions

85

34

28

5

1

—

153

Advisory fee expenses

36

31

—

—

—

—

67

General operating expenses

94

106

144

21

78

—

443

Interest expense

—

—

—

—

136

(3

)

133

Total benefits and expenses

1,016

494

1,085

2,318

215

(3

)

5,125

Noncontrolling interests

—

—

—

—

22

—

22

Adjusted pre-tax operating income

(loss)

$

628

$

179

$

79

$

93

$

(155

)

$

(4

)

$

820

(1) Net realized gains (losses) includes

the gains (losses) related to the disposition of real estate

investments

(in millions)

Individual Retirement

Group Retirement

Life Insurance

Institutional Markets

Corporate & Other

Eliminations

Total Corebridge

Twelve Months Ended December 31, 2024

Premiums

$

137

$

12

$

1,483

$

2,894

$

74

$

—

$

4,600

Policy fees

797

442

1,465

197

—

—

2,901

Net investment income

5,679

1,920

1,321

2,127

33

(22

)

11,058

Net realized gains (losses)(1)

—

—

—

—

85

—

85

Advisory fee and other income

454

343

82

8

47

—

934

Total adjusted revenues

7,067

2,717

4,351

5,226

239

(22

)

19,578

Policyholder benefits

126

13

2,681

3,821

—

—

6,641

Interest credited to policyholder account

balances

2,861

1,206

336

799

—

—

5,202

Amortization of deferred policy

acquisition costs

618

85

344

13

—

—

1,060

Non-deferrable insurance commissions

388

120

58

20

2

—

588

Advisory fee expenses

150

134

2

—

—

—

286

General operating expenses

446

415

469

78

302

(4

)

1,706

Interest expense

—

—

—

—

543

(19

)

524

Total benefits and expenses

4,589

1,973

3,890

4,731

847

(23

)

16,007

Noncontrolling interests

—

—

—

—

34

—

34

Adjusted pre-tax operating income

(loss)

$

2,478

$

744

$

461

$

495

$

(574

)

$

1

$

3,605

(in millions)

Individual Retirement

Group Retirement

Life Insurance

Institutional Markets

Corporate & Other

Eliminations

Total Corebridge

Twelve Months Ended December 31, 2023

Premiums

$

213

$

20

$

1,776

$

5,607

$

78

$

—

$

7,694

Policy fees

708

406

1,488

195

—

—

2,797

Net investment income

4,908

1,996

1,282

1,586

92

(25

)

9,839

Net realized gains (losses)(1)

—

—

—

—

(2

)

—

(2

)

Advisory fee and other income

426

309

93

2

54

—

884

Total adjusted revenues

6,255

2,731

4,639

7,390

222

(25

)

21,212

Policyholder benefits

204

31

2,838

6,298

(3

)

—

9,368

Interest credited to policyholder account

balances

2,269

1,182

340

600

—

—

4,391

Amortization of deferred policy

acquisition costs

572

82

379

9

—

—

1,042

Non-deferrable insurance commissions

355

124

88

19

2

—

588

Advisory fee expenses

141

118

2

—

—

—

261

General operating expenses

402

440

619

85

339

—

1,885

Interest expense

—

—

—

—

569

(17

)

552

Total benefits and expenses

3,943

1,977

4,266

7,011

907

(17

)

18,087

Noncontrolling interests

—

—

—

—

68

—

68

Adjusted pre-tax operating income

(loss)

$

2,312

$

754

$

373

$

379

$

(617

)

$

(8

)

$

3,193

(1) Net realized gains (losses) includes

the gains (losses) related to the disposition of real estate

investments

The following table presents a summary of Corebridge's spread

income, fee income and underwriting margin:

Three Months Ended

December 31,

Twelve Months Ended

December 31,

(in millions)

2024

2023

2024

2023

Individual Retirement

Spread income

$

703

$

715

$

2,868

$

2,694

Fee income

315

288

1,251

1,134

Total Individual Retirement

1,018

1,003

4,119

3,828

Group Retirement

Spread income

160

193

727

828

Fee income

203

181

785

715

Total Group Retirement

363

374

1,512

1,543

Life Insurance

Underwriting margin

370

341

1,368

1,442

Total Life Insurance

370

341

1,368

1,442

Institutional Markets

Spread income

127

86

454

355

Fee income

16

16

62

64

Underwriting margin

18

20

81

71

Total Institutional Markets

161

122

597

490

Total

Spread income

990

994

4,049

3,877

Fee income

534

485

2,098

1,913

Underwriting margin

388

361

1,449

1,513

Total

$

1,912

$

1,840

$

7,596

$

7,303

The following table presents Life Insurance underwriting

margin:

Three Months Ended

December 31,

Twelve Months Ended

December 31,

(in millions)

2024

2023

2024

2023

Premiums

$

366

$

459

$

1,483

$

1,776

Policy fees

371

371

1,465

1,488

Net investment income

337

325

1,321

1,282

Other income

—

9

82

93

Policyholder benefits

(619

)

(736

)

(2,681

)

(2,838

)

Interest credited to policyholder account

balances

(85

)

(87

)

(336

)

(340

)

Less: Impact of annual actuarial

assumption update

—

—

34

(19

)

Underwriting margin

$

370

$

341

$

1,368

$

1,442

The following table presents Institutional Markets spread

income, fee income and underwriting margin:

Three Months Ended

December 31,

Twelve Months Ended

December 31,

(in millions)

2024

2023

2024

2023

Premiums

$

732

$

1,929

$

2,929

$

5,642

Net investment income

547

404

1,978

1,446

Policyholder benefits

(952

)

(2,096

)

(3,754

)

(6,243

)

Interest credited to policyholder account

balances

(200

)

(151

)

(689

)

(490

)

Less: Impact of annual actuarial

assumption update

—

—

(10

)

—

Spread income(1)

$

127

$

86

$

454

$

355

SVW fees

16

16

62

64

Fee income

$

16

$

16

$

62

$

64

Premiums

(9

)

(8

)

(35

)

(35

)

Policy fees (excluding SVW)

36

34

135

131

Net investment income

36

35

149

140

Other income

—

1

8

2

Policyholder benefits

(17

)

(14

)

(67

)

(55

)

Interest credited to policyholder account

balances

(28

)

(28

)

(110

)

(110

)

Less: Impact of annual actuarial

assumption update

—

—

1

(2

)

Underwriting margin(2)

$

18

$

20

$

81

$

71

(1) Represents spread income from Pension

Risk Transfer, Guaranteed Investment Contracts and Structured

Settlement products

(2) Represents underwriting margin from

Corporate Markets products, including corporate-and bank-owned life

insurance, private placement variable universal life insurance and

private placement variable annuity products

The following table presents Operating EPS:

Three Months Ended

December 31,

Twelve Months Ended

December 31,

(in millions, except per common share

data)

2024

2023

2024

2023

GAAP

Basis

Numerator for

EPS

Net income (loss)

$

2,222

$

(1,331

)

$

2,203

$

1,036

Less: Net income (loss) attributable to

noncontrolling interests

51

(22

)

(27

)

(68

)

Net income (loss) attributable to

Corebridge common shareholders

$

2,171

$

(1,309

)

$

2,230

$

1,104

Denominator for

EPS

Weighted average common shares outstanding

- basic(1)

569.8

633.0

598.0

643.3

Dilutive common shares(2)

1.6

—

1.2

1.9

Weighted average common shares outstanding

- diluted

571.4

633.0

599.2

645.2

Income per common

share attributable to Corebridge common shareholders

Common stock - basic

$

3.81

$

(2.07

)

$

3.73

$

1.72

Common stock - diluted

$

3.80

$

(2.07

)

$

3.72

$

1.71

Operating

Basis

Adjusted after-tax operating income

attributable to Corebridge common shareholders

$

701

$

661

$

2,891

$

2,647

Weighted average common shares outstanding

- diluted

571.4

635.3

599.2

645.2

Operating earnings per common share

$

1.23

$

1.04

$

4.83

$

4.10

Common Shares

Outstanding

Common shares outstanding, beginning of

period

574.4

633.5

621.7

645.0

Share repurchases

(12.9

)

(11.8

)

(63.5

)

(26.5

)

Newly issued shares

—

—

3.3

3.1

Common shares outstanding, end of

period

561.5

621.7

561.5

621.6

(1) Includes vested shares under our

share-based employee compensation plans

(2) Potential dilutive common shares

include our share-based employee compensation plans

The following table presents the reconciliation of Adjusted Book

Value:

At Period End

December 31, 2024

September 30, 2024

December 31, 2023

(in millions, except per share data)

Total Corebridge shareholders' equity

(a)

$

11,462

$

13,608

$

11,766

Less: Accumulated other comprehensive

income (AOCI)

(13,681

)

(9,884

)

(13,458

)

Add: Cumulative unrealized gains and

losses related to Fortitude Re funds withheld assets

(2,798

)

(2,058

)

(2,332

)

Total adjusted book value (b)

$

22,345

$

21,434

$

22,892

Total common shares outstanding (c)(1)

561.5

574.4

621.7

Book value per common share (a/c)

$

20.41

$

23.69

$

18.93

Adjusted book value per common share

(b/c)

$

39.80

$

37.32

$

36.82

(1) Total common shares outstanding are

presented net of treasury stock

The following table presents the reconciliation of Adjusted

ROAE:

Three Months Ended December

31,

Twelve Months Ended December

31,

(in millions, unless otherwise noted)

2024

2023

2024

2023

Actual or annualized net income (loss)

attributable to Corebridge shareholders (a)

$

8,684

$

(5,236

)

$

2,230

$

1,104

Actual or annualized adjusted after-tax

operating income attributable to Corebridge shareholders (b)

2,804

2,644

2,891

2,647

Average Corebridge Shareholders’ equity

(c)

12,535

10,066

11,882

10,326

Less: Average AOCI

(11,783

)

(16,376

)

(13,134

)

(15,773

)

Add: Average cumulative unrealized gains

and losses related to Fortitude Re funds withheld assets

(2,428

)

(2,886

)

(2,481

)

(2,702

)

Average Adjusted Book Value (d)

$

21,890

$

23,556

$

22,535

$

23,397

Return on Average Equity (a/c)

69.3

%

(52.0

)%

18.8

%

10.7

%

Adjusted ROAE (b/d)

12.8

%

11.2

%

12.8

%

11.3

%

The following table presents a reconciliation of net investment

income (net income basis) to net investment income (APTOI

basis):

Three Months Ended December

31,

Twelve Months Ended December

31,

(in millions)

2024

2023

2024

2023

Net investment income (net income

basis)

$

3,020

$

3,012

$

12,228

$

11,078

Net investment (income) on Fortitude Re

funds withheld assets

(198

)

(471

)

(1,370

)

(1,368

)

Change in fair value of securities used to

hedge guaranteed living benefits

(14

)

(14

)

(58

)

(55

)

Other adjustments

(7

)

(6

)

(30

)

(28

)

Derivative income recorded in net realized

gains (losses)

78

47

288

212

Total adjustments

(141

)

(444

)

(1,170

)

(1,239

)

Net investment income (APTOI

basis)

$

2,879

$

2,568

$

11,058

$

9,839

The following table presents the notable items and alternative

investment returns versus long-term return expectations:

Three Months Ended December

31,

Twelve Months Ended December

31,

(in millions)

2024

2023

2024

2023

Individual Retirement:

Alternative investments returns versus

long-term return expectations

$

(11

)

$

(50

)

$

(81

)

$

(173

)

Investments

—

35

45

17

Annual actuarial assumption review

—

—

18

1

Reinsurance

—

—

—

—

General operating expenses

(2

)

—

(2

)

—

Total adjustments

(13

)

(15

)

(20

)

(155

)

Group Retirement:

Alternative investments returns versus

long-term return expectations

(5

)

(22

)

(36

)

(78

)

Investments

—

5

8

3

Annual actuarial assumption review

—

—

(1

)

—

Reinsurance

—

—

—

—

General operating expenses

(9

)

—

(9

)

—

Total adjustments

(14

)

(17

)

(38

)

(75

)

Life Insurance:

Alternative investments returns versus

long-term return expectations

(3

)

(13

)

(20

)

(47

)

Investments

—

5

8

1

Annual actuarial assumption review

—

—

(29

)

19

Reinsurance

—

—

32

—

General operating expenses

(5

)

—

(5

)

—

Total adjustments

(8

)

(8

)

(14

)

(27

)

Institutional Markets:

Alternative investments returns versus

long-term return expectations

(6

)

(50

)

(100

)

(77

)

Investments

—

5

17

2

Annual actuarial assumption review

—

—

9

2

Reinsurance

—

—

5

—

General operating expenses

(1

)

—

(1

)

—

Total adjustments

(7

)

(45

)

(70

)

(73

)

Total Corebridge:

Alternative investments returns versus

long-term return expectations

(25

)

(136

)

(237

)

(375

)

Investments

—

50

78

23

Annual actuarial assumption review

—

—

(3

)

22

Reinsurance

—

—

37

—

General operating expenses

(17

)

—

(17

)

—

Corporate & other

—

—

32

—

Total adjustments

$

(42

)

$

(86

)

$

(110

)

$

(330

)

Discrete tax items - income tax expense

(benefit)

$

—

$

—

$

(10

)

$

40

The following table presents the premiums and deposits:

Three Months Ended December

31,

Twelve Months Ended December

31,

(in millions)

2024

2023

2024

2023

Individual Retirement

Premiums

$

30

$

40

$

137

$

213

Deposits

4,970

5,245

22,046

17,971

Other(1)

—

(3

)

(9

)

(13

)

Premiums and deposits

5,000

5,282

22,174

18,171

Group Retirement

Premiums

2

4

12

20

Deposits

1,614

2,079

7,619

8,063

Premiums and deposits(2)(3)

1,616

2,083

7,631

8,083

Life Insurance

Premiums

366

459

1,483

1,776

Deposits

411

408

1,579

1,583

Other(1)

102

236

613

941

Premiums and deposits

879

1,103

3,675

4,300

Institutional Markets

Premiums

723

1,921

2,894

5,607

Deposits

1,635

75

5,332

3,695

Other(1)

7

8

36

31

Premiums and deposits

2,365

2,004

8,262

9,333

Total

Premiums

1,121

2,424

4,526

7,616

Deposits

8,630

7,807

36,576

31,312

Other(1)

109

241

640

959

Premiums and deposits

$

9,860

$

10,472

$

41,742

$

39,887

(1) Other principally consists of ceded

premiums, in order to reflect gross premiums and deposits

(2) Includes premiums and deposits related

to in-plan mutual funds of $714 million and $741 million for the

three months ended December 31, 2024 and December 31, 2023,

respectively, as well as $3,065 million and $3,245 million for the

twelve months ended December 31, 2024 and December 31, 2023,

respectively

(3) Excludes client deposits into advisory

and brokerage accounts of $788 million and $603 million for the

three months ended December 31, 2024 and December 31, 2023,

respectively, as well as $3,062 million and $2,381 million for the

twelve months ended December 31, 2024 and December 31, 2023,

respectively

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250207728438/en/

Investor Relations Işıl

Müderrisoğlu investorrelations@corebridgefinancial.com Media Relations Matt Ward

media.contact@corebridgefinancial.com

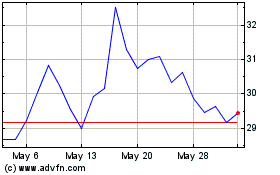

Corebridge Financial (NYSE:CRBG)

Historical Stock Chart

From Jan 2025 to Feb 2025

Corebridge Financial (NYSE:CRBG)

Historical Stock Chart

From Feb 2024 to Feb 2025