STATEMENT

OF INVESTMENTS

BNY Mellon Strategic Municipal Bond Fund, Inc.

August 31, 2023 (Unaudited)

| | | | | | | | | | |

| |

Description

| Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | | Value

($) | |

Long-Term

Municipal Investments - 151.6% | | | | | |

Alabama

- 5.2% | | | | | |

Alabama Special Care Facilities Financing Authority, Revenue Bonds (Methodist

Home for the Aging Obligated Group) | | 5.50 | | 6/1/2030 | | 1,800,000 | | 1,711,299 | |

Alabama Special Care Facilities Financing Authority, Revenue

Bonds (Methodist Home for the Aging Obligated Group) | | 6.00 | | 6/1/2050 | | 2,710,000 | | 2,303,571 | |

Black Belt Energy Gas District, Revenue Bonds, Refunding, Ser.

D1 | | 4.00 | | 6/1/2027 | | 1,000,000 | a | 989,429 | |

Jefferson County, Revenue Bonds, Refunding, Ser. F | | 7.75 | | 10/1/2046 | | 6,000,000 | b | 6,281,884 | |

The Lower Alabama Gas District, Revenue Bonds, Ser. A | | 5.00 | | 9/1/2046 | | 5,000,000 | | 5,115,120 | |

| | 16,401,303 | |

Alaska - .8% | | | | | |

Northern

Tobacco Securitization Corp., Revenue Bonds, Refunding, Ser. A | | 4.00 | | 6/1/2050 | | 2,900,000 | | 2,564,421 | |

Arizona - 5.6% | | | | | |

Arizona Industrial Development Authority, Revenue Bonds (Equitable

School Revolving Fund Obligated Group) Ser. A | | 4.00 | | 11/1/2045 | | 1,500,000 | | 1,323,200 | |

Arizona Industrial Development Authority, Revenue Bonds (Legacy

Cares Project) Ser. A | | 7.75 | | 7/1/2050 | | 4,305,000 | c,d | 430,500 | |

Arizona Industrial Development Authority, Revenue Bonds, Refunding

(BASIS Schools Projects) Ser. A | | 5.25 | | 7/1/2047 | | 2,000,000 | c | 1,856,319 | |

Glendale Industrial Development Authority, Revenue Bonds, Refunding

(Sun Health Services Obligated Group) Ser. A | | 5.00 | | 11/15/2054 | | 1,500,000 | | 1,390,635 | |

La Paz County Industrial Development Authority, Revenue Bonds

(Harmony Public Schools) Ser. A | | 5.00 | | 2/15/2048 | | 1,550,000 | | 1,436,674 | |

Maricopa County Industrial

Development Authority, Revenue Bonds, Refunding (Legacy Traditional Schools Project) | | 5.00 | | 7/1/2049 | | 1,775,000 | c | 1,555,918 | |

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | | Value

($) | |

Long-Term

Municipal Investments - 151.6% (continued) | | | | | |

Arizona

- 5.6% (continued) | | | | | |

Salt Verde Financial Corp., Revenue Bonds | | 5.00 | | 12/1/2037 | | 1,345,000 | | 1,378,507 | |

Tender Option Bond Trust Receipts (Series 2018-XF2537), (Salt

Verde Financial Corporation, Revenue Bonds) Recourse, Underlying Coupon Rate (%) 5.00 | | 3.41 | | 12/1/2037 | | 4,550,000 | c,e,f | 4,663,335 | |

The Phoenix Arizona Industrial Development Authority, Revenue

Bonds (Legacy Traditional Schools Project) Ser. A | | 6.75 | | 7/1/2044 | | 1,000,000 | c | 1,010,533 | |

The Phoenix Arizona Industrial Development Authority, Revenue

Bonds, Refunding (BASIS Schools Projects) Ser. A | | 5.00 | | 7/1/2046 | | 3,000,000 | c | 2,705,197 | |

| | 17,750,818 | |

Arkansas

- .6% | | | | | |

Arkansas Development Finance Authority, Revenue Bonds (Green Bond) (U.S. Steel

Corp.) | | 5.70 | | 5/1/2053 | | 1,900,000 | | 1,908,019 | |

California

- 7.8% | | | | | |

California Community Choice Financing Authority, Revenue Bonds (Green Bond) (Clean

Energy Project) | | 5.25 | | 10/1/2031 | | 1,500,000 | a | 1,555,816 | |

California Housing Finance Agency, Revenue Bonds, Ser. A | | 3.25 | | 8/20/2036 | | 1,654,485 | | 1,476,718 | |

California Municipal

Finance Authority, Revenue Bonds (Community Health System) Ser. A | | 4.00 | | 2/1/2051 | | 1,500,000 | | 1,312,406 | |

California Municipal Finance Authority, Revenue Bonds (United

Airlines Project) | | 4.00 | | 7/15/2029 | | 1,000,000 | | 987,618 | |

Golden State Tobacco

Securitization Corp., Revenue Bonds, Refunding, Ser. B | | 5.00 | | 6/1/2051 | | 1,000,000 | | 1,038,921 | |

Jefferson Union High School District, COP (Teacher & Staff

Housing Project) (Insured; Build America Mutual) | | 4.00 | | 8/1/2055 | | 1,500,000 | | 1,372,060 | |

San Diego County Regional Airport Authority, Revenue Bonds,

Ser. B | | 5.00 | | 7/1/2051 | | 5,250,000 | | 5,349,858 | |

Tender Option Bond

Trust Receipts (Series 2022-XF3024), (San Francisco City & County, Revenue Bonds, Refunding, Ser.

A) Recourse, Underlying Coupon Rate (%) 5.00 | | 4.05 | | 5/1/2044 | | 5,280,000 | c,e,f | 5,421,992 | |

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | | Value

($) | |

Long-Term

Municipal Investments - 151.6% (continued) | | | | | |

California

- 7.8% (continued) | | | | | |

Tender Option Bond Trust Receipts (Series 2023-XM1114), (Long

Beach Finance Authority, Revenue Bonds) Non-recourse, Underlying Coupon Rate (%) 4.00 | | 2.99 | | 8/1/2053 | | 6,400,000 | c,e,f | 6,048,360 | |

| | 24,563,749 | |

Colorado

- 5.2% | | | | | |

Colorado Health Facilities Authority, Revenue Bonds (CommonSpirit Health Obligated

Group) | | 5.25 | | 11/1/2052 | | 1,000,000 | | 1,019,608 | |

Colorado Health Facilities

Authority, Revenue Bonds, Refunding (Covenant Living Communities & Services Obligated Group) Ser.

A | | 4.00 | | 12/1/2050 | | 4,000,000 | | 3,180,758 | |

Colorado High Performance

Transportation Enterprise, Revenue Bonds (C-470 Express Lanes System) | | 5.00 | | 12/31/2056 | | 1,000,000 | | 977,710 | |

Dominion Water & Sanitation District, Revenue Bonds, Refunding | | 5.88 | | 12/1/2052 | | 2,750,000 | | 2,653,796 | |

Tender Option Bond

Trust Receipts (Series 2020-XM0829), (Colorado Health Facilities Authority, Revenue Bonds, Refunding

(CommonSpirit Health Obligated Group) Ser. A1) Recourse, Underlying Coupon Rate (%) 4.00 | | 2.99 | | 8/1/2044 | | 3,260,000 | c,e,f | 3,501,260 | |

Tender Option Bond Trust Receipts (Series 2023-XM1124), (Colorado

Health Facilities Authority, Revenue Bonds (Adventist Health System/Sunbelt Obligated Group) Ser. A)

Recourse, Underlying Coupon Rate (%) 4.00 | | 0.69 | | 11/15/2048 | | 5,535,000 | c,e,f | 5,124,955 | |

| | 16,458,087 | |

Connecticut

- .2% | | | | | |

Connecticut Housing Finance Authority, Revenue Bonds, Refunding, Ser. A1 | | 3.65 | | 11/15/2032 | | 530,000 | | 526,396 | |

Delaware

- 1.1% | | | | | |

Delaware Economic Development Authority, Revenue Bonds (ACTS Retirement-Life Communities

Inc Obligated Group) | | 5.00 | | 11/15/2048 | | 3,700,000 | | 3,458,671 | |

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | | Value

($) | |

Long-Term

Municipal Investments - 151.6% (continued) | | | | | |

District

of Columbia - .3% | | | | | |

Metropolitan Washington Airports Authority, Revenue Bonds,

Refunding (Dulles Metrorail) Ser. B | | 4.00 | | 10/1/2049 | | 1,000,000 | | 902,801 | |

Florida - 7.3% | | | | | |

Atlantic Beach, Revenue Bonds (Fleet Landing Project) Ser.

A | | 5.00 | | 11/15/2053 | | 2,500,000 | | 2,057,391 | |

Hillsborough County

Port District, Revenue Bonds (Tampa Port Authority Project) Ser. B | | 5.00 | | 6/1/2046 | | 2,500,000 | | 2,511,718 | |

Lee Memorial Health System, Revenue Bonds, Refunding, Ser.

A1 | | 4.00 | | 4/1/2049 | | 1,600,000 | | 1,445,384 | |

Palm Beach County Health

Facilities Authority, Revenue Bonds (ACTS Retirement-Life Communities Obligated Group) | | 5.00 | | 11/15/2045 | | 2,075,000 | | 1,965,595 | |

Palm Beach County Health Facilities Authority, Revenue Bonds

(Lifespace Communities Obligated Group) Ser. B | | 4.00 | | 5/15/2053 | | 2,000,000 | | 1,243,433 | |

Seminole County Industrial Development Authority, Revenue Bonds,

Refunding (Legacy Pointe at UCF Project) | | 5.75 | | 11/15/2054 | | 1,000,000 | | 781,181 | |

Tender Option Bond Trust Receipts (Series 2020-XF2877), (Greater

Orlando Aviation Authority, Revenue Bonds, Ser. A) Recourse, Underlying Coupon Rate (%) 4.00 | | 8.10 | | 10/1/2049 | | 4,065,000 | c,e,f | 3,698,213 | |

Tender Option Bond Trust Receipts (Series 2022-XF1385), (Fort

Myers FL Utility, Revenue Bonds, Refunding, Ser. A) Non-recourse, Underlying Coupon Rate (%) 4.00 | | 1.06 | | 10/1/2044 | | 2,540,000 | c,e,f | 2,417,835 | |

Tender Option Bond Trust Receipts (Series 2023-XM1122), (Miami-Dade

FL County Water & Sewer System, Revenue Bonds, Refunding, Ser. B) Recourse, Underlying Coupon Rate

(%) 4.00 | | 1.42 | | 10/1/2049 | | 7,500,000 | c,e,f | 6,984,229 | |

| | 23,104,979 | |

Georgia - 6.9% | | | | | |

Atlanta Water & Wastewater, Revenue Bonds, Ser. D | | 3.50 | | 11/1/2028 | | 500,000 | c | 501,419 | |

Georgia Municipal Electric Authority, Revenue Bonds (Plant

Vogtle Units 3&4 Project) Ser. A | | 5.00 | | 7/1/2052 | | 2,500,000 | | 2,564,830 | |

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | | Value

($) | |

Long-Term

Municipal Investments - 151.6% (continued) | | | | | |

Georgia

- 6.9% (continued) | | | | | |

Main Street Natural Gas, Revenue Bonds, Ser. A | | 5.00 | | 6/1/2030 | | 1,000,000 | a | 1,025,774 | |

Tender Option Bond Trust Receipts (Series 2016-XM0435), (Private

Colleges & Universities Authority, Revenue Bonds, Refunding (Emory University)) Recourse, Underlying

Coupon Rate (%) 5.00 | | 3.90 | | 10/1/2043 | | 6,000,000 | c,e,f | 5,876,669 | |

Tender Option Bond Trust Receipts (Series 2019-XF2847), (Municipal

Electric Authority of Georgia, Revenue Bonds (Plant Vogtle Unis 3&4 Project) Ser. A) Recourse, Underlying

Coupon Rate (%) 5.00 | | 4.66 | | 1/1/2056 | | 2,720,000 | c,e,f | 2,748,774 | |

Tender Option Bond Trust Receipts (Series 2020-XM0825), (Brookhaven

Development Authority, Revenue Bonds (Children's Healthcare of Atlanta) Ser. A) Recourse, Underlying

Coupon Rate (%) 4.00 | | 1.44 | | 7/1/2044 | | 4,220,000 | c,e,f | 4,350,554 | |

The Atlanta Development Authority, Revenue Bonds, Ser. A1 | | 5.25 | | 7/1/2040 | | 1,000,000 | | 1,017,336 | |

The Burke County Development

Authority, Revenue Bonds, Refunding (Oglethorpe Power Corp.) Ser. D | | 4.13 | | 11/1/2045 | | 4,200,000 | | 3,617,074 | |

| | 21,702,430 | |

Hawaii

- 1.3% | | | | | |

Hawaii Airports System, Revenue Bonds, Ser. A | | 5.00 | | 7/1/2047 | | 2,500,000 | | 2,572,196 | |

Hawaii Department of Budget & Finance, Revenue Bonds, Refunding

(Hawaiian Electric Co.) | | 4.00 | | 3/1/2037 | | 2,500,000 | | 1,700,147 | |

| | 4,272,343 | |

Illinois - 15.4% | | | | | |

Chicago

Board of Education, GO, Refunding, Ser. A | | 5.00 | | 12/1/2033 | | 1,250,000 | | 1,285,797 | |

Chicago Board of Education, GO, Refunding, Ser. B | | 5.00 | | 12/1/2032 | | 400,000 | | 414,741 | |

Chicago Board of Education,

GO, Refunding, Ser. B | | 5.00 | | 12/1/2031 | | 500,000 | | 518,882 | |

Chicago II, GO, Refunding,

Ser. A | | 6.00 | | 1/1/2038 | | 3,000,000 | | 3,163,087 | |

Chicago II, GO, Refunding,

Ser. C | | 5.00 | | 1/1/2024 | | 1,265,000 | | 1,268,604 | |

Chicago II, GO, Ser.

A | | 5.00 | | 1/1/2044 | | 3,000,000 | | 3,030,602 | |

Chicago II Wastewater

Transmission, Revenue Bonds, Refunding, Ser. C | | 5.00 | | 1/1/2039 | | 2,330,000 | | 2,342,063 | |

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | | Value

($) | |

Long-Term

Municipal Investments - 151.6% (continued) | | | | | |

Illinois

- 15.4% (continued) | | | | | |

Chicago Transit Authority, Revenue Bonds, Refunding, Ser. A | | 5.00 | | 12/1/2057 | | 1,000,000 | | 1,012,699 | |

Chicago Transit Authority,

Revenue Bonds, Refunding, Ser. A | | 5.00 | | 12/1/2045 | | 1,000,000 | | 1,031,670 | |

Illinois, GO, Refunding, Ser. A | | 5.00 | | 10/1/2029 | | 900,000 | | 958,132 | |

Illinois, GO, Ser. A | | 5.00 | | 5/1/2038 | | 2,850,000 | | 2,928,024 | |

Illinois, GO, Ser. B | | 5.00 | | 11/1/2030 | | 1,500,000 | | 1,618,327 | |

Illinois, GO, Ser. D | | 5.00 | | 11/1/2028 | | 3,000,000 | | 3,153,780 | |

Metropolitan Pier & Exposition Authority, Revenue Bonds

(McCormick Place Expansion Project) | | 5.00 | | 6/15/2057 | | 2,500,000 | | 2,511,234 | |

Metropolitan Pier & Exposition Authority, Revenue Bonds

(McCormick Place Project) (Insured; National Public Finance Guarantee Corp.) Ser. A | | 0.00 | | 12/15/2036 | | 2,500,000 | g | 1,401,094 | |

Sales Tax Securitization Corp., Revenue Bonds, Refunding, Ser.

A | | 4.00 | | 1/1/2039 | | 2,250,000 | | 2,146,087 | |

Tender Option Bond

Trust Receipts (Series 2017-XM0492), (Illinois Finance Authority, Revenue Bonds, Refunding (The University

of Chicago)) Non-recourse, Underlying Coupon Rate (%) 5.00 | | 3.14 | | 10/1/2040 | | 9,000,000 | c,e,f | 9,159,156 | |

Tender Option Bond Trust Receipts (Series 2023-XM1112), (Chicago

IL Water Works, Revenue Bonds (Insured; Assured Guaranty Municipal Corp.) Ser. A) Non-recourse, Underlying

Coupon Rate (%) 5.25 | | 5.25 | | 11/1/2053 | | 10,000,000 | c,e,f | 10,661,902 | |

| | 48,605,881 | |

Indiana - 1.0% | | | | | |

Indiana Finance Authority, Revenue Bonds (Green Bond) | | 7.00 | | 3/1/2039 | | 4,225,000 | c | 3,151,738 | |

Iowa - 1.5% | | | | | |

Iowa

Finance Authority, Revenue Bonds, Refunding (Iowa Fertilizer Co. Project) | | 5.00 | | 12/1/2050 | | 2,195,000 | | 2,172,272 | |

Iowa Finance Authority, Revenue Bonds, Refunding (Lifespace

Communities Obligated Group) Ser. A | | 4.00 | | 5/15/2053 | | 1,000,000 | | 621,717 | |

Iowa Student Loan Liquidity Corp., Revenue Bonds, Ser. B | | 5.00 | | 12/1/2032 | | 1,000,000 | | 1,070,683 | |

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | | Value

($) | |

Long-Term

Municipal Investments - 151.6% (continued) | | | | | |

Iowa

- 1.5% (continued) | | | | | |

Iowa Tobacco Settlement Authority, Revenue Bonds, Refunding,

Ser. B1 | | 4.00 | | 6/1/2049 | | 815,000 | | 794,475 | |

| | 4,659,147 | |

Kentucky - 2.5% | | | | | |

Christian

County, Revenue Bonds, Refunding (Jennie Stuart Medical Center Obligated Group) | | 5.50 | | 2/1/2044 | | 2,800,000 | | 2,822,212 | |

Kentucky Public Energy Authority, Revenue Bonds, Ser. A1 | | 4.00 | | 6/1/2025 | | 2,560,000 | a | 2,562,569 | |

Kentucky Public Energy Authority, Revenue Bonds, Ser. A1 | | 4.00 | | 8/1/2030 | | 2,680,000 | a | 2,634,266 | |

| | 8,019,047 | |

Louisiana - 3.6% | | | | | |

Louisiana Local Government

Environmental Facilities & Community Development Authority, Revenue Bonds, Refunding (Westlake Chemical

Project) | | 3.50 | | 11/1/2032 | | 2,400,000 | | 2,264,592 | |

New Orleans Aviation

Board, Revenue Bonds (General Airport-N Terminal Project) Ser. A | | 5.00 | | 1/1/2048 | | 1,000,000 | | 1,013,980 | |

Tender Option Bond Trust Receipts (Series 2018-XF2584), (Louisiana

Public Facilities Authority, Revenue Bonds (Franciscan Missionaries of Our Lady Health System Project))

Non-recourse, Underlying Coupon Rate (%) 5.00 | | 3.57 | | 7/1/2047 | | 8,195,000 | c,e,f | 8,247,312 | |

| | 11,525,884 | |

Maryland

- 3.4% | | | | | |

Maryland Economic Development Corp., Revenue Bonds (Green Bond) (Purple Line Transit

Partners) Ser. B | | 5.25 | | 6/30/2055 | | 1,000,000 | | 1,002,695 | |

Maryland Economic Development

Corp., Revenue Bonds (Green Bond) (Purple Line Transit Partners) Ser. B | | 5.25 | | 6/30/2052 | | 1,575,000 | | 1,581,766 | |

Maryland Health & Higher Educational Facilities Authority,

Revenue Bonds (Adventist Healthcare Obligated Group) Ser. A | | 5.50 | | 1/1/2046 | | 3,250,000 | | 3,274,904 | |

Maryland Health & Higher Educational Facilities Authority,

Revenue Bonds, Refunding (Stevenson University Project) | | 4.00 | | 6/1/2051 | | 1,000,000 | | 855,374 | |

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | | Value

($) | |

Long-Term

Municipal Investments - 151.6% (continued) | | | | | |

Maryland

- 3.4% (continued) | | | | | |

Tender Option Bond Trust Receipts (Series 2016-XM0391), (Mayor

& City Council of Baltimore, Revenue Bonds, Refunding (Water Projects)) Non-recourse, Underlying

Coupon Rate (%) 5.00 | | 3.14 | | 1/1/2024 | | 4,000,000 | c,e,f | 4,020,093 | |

| | 10,734,832 | |

Massachusetts - 3.4% | | | | | |

Massachusetts Development

Finance Agency, Revenue Bonds, Refunding (Boston Medical Center Corp. Obligated Group) | | 5.25 | | 7/1/2052 | | 1,000,000 | | 1,024,012 | |

Massachusetts Development Finance Agency, Revenue Bonds, Refunding

(UMass Memorial Health Care Obligated Group) Ser. K | | 5.00 | | 7/1/2038 | | 2,130,000 | | 2,152,238 | |

Massachusetts Development Finance Agency, Revenue Bonds, Refunding,

Ser. A | | 5.00 | | 7/1/2029 | | 1,000,000 | | 1,021,257 | |

Massachusetts Educational

Financing Authority, Revenue Bonds, Ser. B | | 5.00 | | 7/1/2030 | | 1,000,000 | | 1,054,830 | |

Tender Option Bond Trust Receipts (Series 2018-XF0610), (Massachusetts

Transportation Fund, Revenue Bonds (Rail Enhancement & Accelerated Bridge Programs)) Non-recourse,

Underlying Coupon Rate (%) 5.00 | | 3.46 | | 6/1/2047 | | 5,250,000 | c,e,f | 5,423,607 | |

| | 10,675,944 | |

Michigan - 4.4% | | | | | |

Great Lakes Water Authority

Sewage Disposal System, Revenue Bonds, Refunding, Ser. C | | 5.00 | | 7/1/2036 | | 2,000,000 | | 2,069,510 | |

Michigan Building Authority, Revenue Bonds, Refunding | | 4.00 | | 10/15/2049 | | 2,500,000 | | 2,346,071 | |

Michigan Finance Authority,

Revenue Bonds, Refunding (Beaumont-Sprectrum) | | 4.00 | | 4/15/2042 | | 1,000,000 | | 936,552 | |

Michigan Finance Authority, Revenue Bonds, Refunding (Insured;

National Public Finance Guarantee Corp.) Ser. D6 | | 5.00 | | 7/1/2036 | | 1,000,000 | | 1,006,690 | |

Michigan Strategic Fund, Revenue Bonds (AMT-I-75 Improvement

Project) | | 5.00 | | 12/31/2043 | | 5,000,000 | | 5,023,901 | |

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | | Value

($) | |

Long-Term

Municipal Investments - 151.6% (continued) | | | | | |

Michigan

- 4.4% (continued) | | | | | |

Pontiac School District, GO (Insured; Qualified School Board

Loan Fund) | | 4.00 | | 5/1/2045 | | 2,700,000 | | 2,528,554 | |

| | 13,911,278 | |

Minnesota - 1.3% | | | | | |

Duluth

Economic Development Authority, Revenue Bonds, Refunding (Essentia Health Obligated Group) Ser. A | | 5.00 | | 2/15/2058 | | 4,000,000 | | 3,986,581 | |

Missouri

- 4.4% | | | | | |

Missouri Health & Educational Facilities Authority, Revenue Bonds, Refunding

(Lutheran Senior Services Projects) | | 5.00 | | 2/1/2046 | | 1,200,000 | | 1,115,897 | |

St. Louis Land Clearance for Redevelopment Authority, Revenue

Bonds | | 5.13 | | 6/1/2046 | | 4,665,000 | | 4,647,258 | |

Tender Option Bond

Trust Receipts (Series 2023-XM1116), (Jackson County Missouri Special Obligation, Revenue Bonds, Refunding,

Ser. A) Non-recourse, Underlying Coupon Rate (%) 4.25 | | 4.14 | | 12/1/2053 | | 6,000,000 | c,e,f | 5,574,935 | |

The Missouri Health & Educational Facilities Authority,

Revenue Bonds (Lutheran Senior Services Projects) Ser. A | | 5.00 | | 2/1/2042 | | 1,000,000 | | 955,902 | |

The Missouri Health & Educational Facilities Authority,

Revenue Bonds (Mercy Health) | | 4.00 | | 6/1/2053 | | 2,000,000 | | 1,777,649 | |

| | 14,071,641 | |

Multi-State - .6% | | | | | |

Federal

Home Loan Mortgage Corp. Multifamily Variable Rate Certificates, Revenue Bonds, Ser. M048 | | 3.15 | | 1/15/2036 | | 2,360,000 | c | 2,065,142 | |

Nevada - 2.2% | | | | | |

Clark

County School District, GO (Insured; Assured Guaranty Municipal Corp.) Ser. A | | 4.25 | | 6/15/2041 | | 2,770,000 | | 2,736,526 | |

Reno, Revenue Bonds, Refunding (Insured; Assured Guaranty Municipal

Corp.) | | 4.00 | | 6/1/2058 | | 5,000,000 | | 4,321,160 | |

| | 7,057,686 | |

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | | Value

($) | |

Long-Term

Municipal Investments - 151.6% (continued) | | | | | |

New

Hampshire - .9% | | | | | |

New Hampshire Business Finance Authority, Revenue Bonds (University

of Nevada Reno Project) (Insured; Build America Mutual) Ser. A | | 5.25 | | 6/1/2051 | | 1,500,000 | | 1,575,072 | |

New Hampshire Business Finance Authority, Revenue Bonds, Refunding

(Springpoint Senior Living Obligated Group) | | 4.00 | | 1/1/2051 | | 1,500,000 | | 1,123,697 | |

| | 2,698,769 | |

New

Jersey - 6.5% | | | | | |

New Jersey Health Care Facilities Financing Authority, Revenue Bonds (RWJ Barnabas

Health Obligated Group) | | 4.00 | | 7/1/2051 | | 1,250,000 | | 1,161,961 | |

New Jersey Housing

& Mortgage Finance Agency, Revenue Bonds, Refunding, Ser. D | | 4.00 | | 10/1/2024 | | 2,370,000 | | 2,357,581 | |

New Jersey Transportation Trust Fund Authority, Revenue Bonds | | 5.00 | | 6/15/2046 | | 1,365,000 | | 1,404,313 | |

New Jersey Transportation

Trust Fund Authority, Revenue Bonds | | 5.25 | | 6/15/2043 | | 1,500,000 | | 1,566,439 | |

New Jersey Transportation Trust Fund Authority, Revenue Bonds | | 5.50 | | 6/15/2050 | | 2,000,000 | | 2,180,123 | |

New Jersey Turnpike

Authority, Revenue Bonds, Ser. A | | 4.00 | | 1/1/2048 | | 2,400,000 | | 2,286,777 | |

South Jersey Port Corp., Revenue Bonds, Ser. B | | 5.00 | | 1/1/2042 | | 2,025,000 | | 2,033,231 | |

Tender Option Bond

Trust Receipts (Series 2018-XF2538), (New Jersey Economic Development Authority, Revenue Bonds) Recourse,

Underlying Coupon Rate (%) 5.25 | | 4.40 | | 6/15/2040 | | 4,250,000 | c,e,f | 4,400,954 | |

Tobacco Settlement Financing Corp., Revenue Bonds, Refunding,

Ser. A | | 5.25 | | 6/1/2046 | | 1,500,000 | | 1,549,363 | |

Tobacco Settlement

Financing Corp., Revenue Bonds, Refunding, Ser. B | | 5.00 | | 6/1/2046 | | 1,555,000 | | 1,529,977 | |

| | 20,470,719 | |

New

York - 7.4% | | | | | |

New York Convention Center Development Corp., Revenue Bonds (Hotel Unit Fee) (Insured;

Assured Guaranty Municipal Corp.) Ser. B | | 0.00 | | 11/15/2049 | | 5,600,000 | g | 1,464,380 | |

New York Liberty Development Corp., Revenue Bonds, Refunding

(Class 1-3 World Trade Center Project) | | 5.00 | | 11/15/2044 | | 3,400,000 | c | 3,254,104 | |

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | | Value

($) | |

Long-Term

Municipal Investments - 151.6% (continued) | | | | | |

New

York - 7.4% (continued) | | | | | |

New York State Dormitory Authority, Revenue Bonds, Refunding

(Montefiore Obligated Group) Ser. A | | 4.00 | | 9/1/2045 | | 1,000,000 | | 843,214 | |

New York Transportation Development Corp., Revenue Bonds (JFK

International Air Terminal) | | 5.00 | | 12/1/2040 | | 3,050,000 | | 3,145,961 | |

New York Transportation

Development Corp., Revenue Bonds (LaGuardia Airport Terminal B Redevelopment Project) Ser. A | | 5.25 | | 1/1/2050 | | 3,000,000 | | 2,999,968 | |

New York Transportation

Development Corp., Revenue Bonds, Refunding (JFK International Air Terminal) Ser. A | | 5.00 | | 12/1/2035 | | 1,100,000 | | 1,152,152 | |

Niagara Area Development Corp., Revenue Bonds, Refunding (Covanta

Project) Ser. A | | 4.75 | | 11/1/2042 | | 1,000,000 | c | 874,201 | |

Tender Option Bond Trust Receipts (Series 2022-XM1004), (Metropolitan

Transportation Authority, Revenue Bonds, Refunding (Green Bond) (Insured; Assured Guaranty Municipal

Corp.) Ser. C) Non-recourse, Underlying Coupon Rate (%) 4.00 | | 2.22 | | 11/15/2047 | | 5,400,000 | c,e,f | 5,068,935 | |

Triborough Bridge & Tunnel Authority, Revenue Bonds, Refunding,

Ser. A1 | | 5.00 | | 5/15/2051 | | 3,235,000 | | 3,402,268 | |

Westchester County

Local Development Corp., Revenue Bonds, Refunding (Purchase Senior Learning Community Obligated Group) | | 5.00 | | 7/1/2046 | | 1,650,000 | c | 1,339,062 | |

| | 23,544,245 | |

North Carolina - .9% | | | | | |

North Carolina Medical

Care Commission, Revenue Bonds, Refunding (Lutheran Services for the Aging Obligated Group) | | 4.00 | | 3/1/2051 | | 2,000,000 | | 1,365,237 | |

North Carolina Turnpike

Authority, Revenue Bonds (Insured; Assured Guaranty Municipal Corp.) | | 4.00 | | 1/1/2055 | | 1,500,000 | | 1,378,718 | |

| | 2,743,955 | |

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | | Value

($) | |

Long-Term

Municipal Investments - 151.6% (continued) | | | | | |

Ohio

- 3.4% | | | | | |

Buckeye Tobacco Settlement Financing Authority, Revenue Bonds, Refunding, Ser.

B2 | | 5.00 | | 6/1/2055 | | 9,350,000 | | 8,559,701 | |

Centerville, Revenue

Bonds, Refunding (Graceworks Lutheran Services Obligated Group) | | 5.25 | | 11/1/2047 | | 1,500,000 | | 1,290,825 | |

Cuyahoga County, Revenue Bonds, Refunding (The MetroHealth

System) | | 5.00 | | 2/15/2052 | | 1,000,000 | | 960,746 | |

| | 10,811,272 | |

Oklahoma - 3.1% | | | | | |

Tender

Option Bond Trust Receipts (Series 2023-XF1572), (Oklahoma Water Resources Board State Loan Program,

Revenue Bonds, Ser. B) Non-recourse, Underlying Coupon Rate (%) 4.13 | | 3.37 | | 10/1/2053 | | 10,000,000 | c,e,f | 9,720,173 | |

Oregon - 1.3% | | | | | |

Medford Hospital Facilities Authority, Revenue Bonds, Refunding

(Asante Project) Ser. A | | 4.00 | | 8/15/2039 | | 1,000,000 | | 950,283 | |

Port of Portland, Revenue

Bonds, Refunding, Ser. 28 | | 4.00 | | 7/1/2047 | | 2,720,000 | | 2,497,262 | |

Yamhill County Hospital

Authority, Revenue Bonds, Refunding (Friendsview Manor Obligated Group) Ser. A | | 5.00 | | 11/15/2056 | | 1,000,000 | | 732,320 | |

| | 4,179,865 | |

Pennsylvania

- 7.8% | | | | | |

Allentown School District, GO, Refunding (Insured; Build America Mutual) Ser.

B | | 5.00 | | 2/1/2031 | | 1,510,000 | | 1,637,896 | |

Crawford County Hospital

Authority, Revenue Bonds, Refunding (Meadville Medical Center Project) Ser. A | | 6.00 | | 6/1/2046 | | 1,000,000 | | 1,009,344 | |

Franklin County Industrial Development Authority, Revenue Bonds,

Refunding (Menno-Haven Project) | | 5.00 | | 12/1/2053 | | 1,000,000 | | 759,935 | |

Pennsylvania Economic

Development Financing Authority, Revenue Bonds (The Penndot Major Bridges) | | 6.00 | | 6/30/2061 | | 2,000,000 | | 2,172,255 | |

Pennsylvania Economic Development Financing Authority, Revenue

Bonds, Refunding (Presbyterian Senior Living) | | 4.00 | | 7/1/2046 | | 1,000,000 | | 827,836 | |

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | | Value

($) | |

Long-Term

Municipal Investments - 151.6% (continued) | | | | | |

Pennsylvania

- 7.8% (continued) | | | | | |

Pennsylvania Higher Educational Facilities Authority, Revenue

Bonds, Refunding (University of Sciences) | | 5.00 | | 11/1/2033 | | 2,805,000 | | 2,855,487 | |

Pennsylvania Turnpike Commission, Revenue Bonds, Ser. A | | 4.00 | | 12/1/2050 | | 1,500,000 | | 1,367,984 | |

Tender Option Bond

Trust Receipts (Series 2022-XF1408), (Pennsylvania State Turnpike Commission, Revenue Bonds, Refunding,

Ser. A) Non-recourse, Underlying Coupon Rate (%) 4.00 | | 2.33 | | 12/1/2051 | | 10,000,000 | c,e,f | 9,174,310 | |

Tender Option Bond Trust Receipts (Series 2022-XF1525), (Pennsylvania

Economic Development Financing Authority UPMC, Revenue Bonds, Ser. A) Recourse, Underlying Coupon Rate

(%) 4.00 | | 2.91 | | 5/15/2053 | | 3,440,000 | c,e,f | 3,073,164 | |

The Philadelphia School District, GO (Insured; State Aid Withholding)

Ser. A | | 4.00 | | 9/1/2039 | | 2,000,000 | | 1,868,534 | |

| | 24,746,745 | |

Rhode Island - 2.0% | | | | | |

Providence

Public Building Authority, Revenue Bonds (Insured; Assured Guaranty Municipal Corp.) Ser. A | | 5.00 | | 9/15/2037 | | 500,000 | | 524,081 | |

Tender Option Bond

Trust Receipts (Series 2023-XM1117), (Rhode Island Infrastructure Bank State Revolving Fund, Revenue

Bonds, Ser. A) Non-recourse, Underlying Coupon Rate (%) 4.25 | | 5.51 | | 10/1/2053 | | 6,000,000 | c,e,f | 5,797,754 | |

| | 6,321,835 | |

South

Carolina - 5.1% | | | | | |

South Carolina Jobs-Economic Development Authority, Revenue

Bonds (Bishop Gadsden Episcopal Retirement Community Obligated Group) | | 5.00 | | 4/1/2054 | | 1,000,000 | | 838,728 | |

South Carolina Jobs-Economic Development Authority, Revenue

Bonds, Refunding (Bon Secours Mercy Health) | | 4.00 | | 12/1/2044 | | 3,500,000 | | 3,252,490 | |

South Carolina Public Service Authority, Revenue Bonds, Refunding

(Santee Cooper) Ser. A | | 4.00 | | 12/1/2055 | | 2,000,000 | | 1,736,085 | |

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | | Value

($) | |

Long-Term

Municipal Investments - 151.6% (continued) | | | | | |

South

Carolina - 5.1% (continued) | | | | | |

Tender Option Bond Trust Receipts (Series 2016-XM0384), (South

Carolina Public Service Authority, Revenue Bonds, Refunding (Santee Cooper)) Non-recourse, Underlying

Coupon Rate (%) 5.13 | | 3.42 | | 12/1/2043 | | 10,200,000 | c,e,f | 10,193,390 | |

| | 16,020,693 | |

South Dakota - 1.0% | | | | | |

Tender Option Bond

Trust Receipts (Series 2022-XF1409), (South Dakota Heath & Educational Facilities Authority,

Revenue Bonds, Refunding (Avera Health Obligated Group)) Non-recourse, Underlying Coupon Rate (%) 5.00 | | 6.56 | | 7/1/2046 | | 3,200,000 | c,e,f | 3,212,988 | |

Texas - 12.6% | | | | | |

Arlington

Higher Education Finance Corp., Revenue Bonds (Uplift Education) (Insured; Permanent School Fund Guarantee

Program) Ser. A | | 4.25 | | 12/1/2048 | | 1,500,000 | | 1,399,890 | |

Clifton Higher Education

Finance Corp., Revenue Bonds (IDEA Public Schools) Ser. A | | 4.00 | | 8/15/2051 | | 2,000,000 | | 1,634,275 | |

Clifton Higher Education Finance Corp., Revenue Bonds (International

Leadership of Texas) Ser. A | | 5.75 | | 8/15/2045 | | 2,500,000 | | 2,415,329 | |

Clifton Higher Education

Finance Corp., Revenue Bonds (International Leadership of Texas) Ser. D | | 6.13 | | 8/15/2048 | | 3,000,000 | | 3,000,687 | |

Clifton Higher Education Finance Corp., Revenue Bonds (Uplift

Education) Ser. A | | 4.50 | | 12/1/2044 | | 2,500,000 | | 2,213,818 | |

Grand Parkway Transportation

Corp., Revenue Bonds, Refunding (Grand Parkway System) | | 4.00 | | 10/1/2045 | | 2,000,000 | | 1,849,361 | |

Harris County-Houston Sports Authority, Revenue Bonds, Refunding

(Insured; Assured Guaranty Municipal Corp.) Ser. A | | 0.00 | | 11/15/2051 | | 7,500,000 | g | 1,694,786 | |

Houston Airport System, Revenue Bonds, Refunding (Insured;

Assured Guaranty Municipal Corp.) Ser. A | | 4.50 | | 7/1/2053 | | 1,700,000 | | 1,635,009 | |

Houston Airport System, Revenue Bonds, Refunding, Ser. A | | 4.00 | | 7/1/2046 | | 1,000,000 | | 902,212 | |

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | | Value

($) | |

Long-Term

Municipal Investments - 151.6% (continued) | | | | | |

Texas

- 12.6% (continued) | | | | | |

Lamar Consolidated Independent School District, GO | | 4.00 | | 2/15/2053 | | 1,000,000 | | 918,299 | |

Love Field Airport

Modernization Corp., Revenue Bonds (Southwest Airlines Co. Project) | | 5.00 | | 11/1/2028 | | 1,000,000 | | 1,000,129 | |

Mission Economic Development Corp., Revenue Bonds, Refunding

(Natgasoline Project) | | 4.63 | | 10/1/2031 | | 1,000,000 | c | 977,253 | |

Tarrant County Cultural Education Facilities Finance Corp.,

Revenue Bonds (Baylor Scott & White Health Obligated Group) | | 5.00 | | 11/15/2051 | | 1,500,000 | | 1,548,102 | |

Tarrant County Cultural Education Facilities Finance Corp.,

Revenue Bonds, Refunding (MRC Stevenson Oaks Project) | | 6.75 | | 11/15/2051 | | 1,000,000 | | 896,371 | |

Tender Option Bond Trust Receipts (Series 2023-XF1558), (Forney

Texas Independent School District, GO, Refunding (Insured; Permanent School Fund Guarantee Program) Ser.

B) Non-recourse, Underlying Coupon Rate (%) 4.00 | | 1.12 | | 8/15/2053 | | 10,000,000 | c,e,f | 9,385,365 | |

Tender Option Bond Trust Receipts (Series 2023-XM1125), (Medina

Valley Independent School District, GO (Insured; Permanent School Fund Guarantee Program)) Non-recourse,

Underlying Coupon Rate (%) 4.00 | | 4.09 | | 2/15/2053 | | 6,000,000 | c,e,f | 5,649,736 | |

Texas Private Activity Bond Surface Transportation Corp., Revenue

Bonds, Refunding (LBJ Infrastructure Group) | | 4.00 | | 12/31/2039 | | 1,345,000 | | 1,263,321 | |

Texas Private Activity Bond Surface Transportation Corp., Revenue

Bonds, Refunding (LBJ Infrastructure Group) | | 4.00 | | 6/30/2039 | | 1,500,000 | | 1,410,831 | |

| | 39,794,774 | |

U.S.

Related - 1.4% | | | | | |

Puerto Rico, GO, Ser. A | | 0.00 | | 7/1/2024 | | 35,840 | g | 34,538 | |

Puerto Rico, GO, Ser. A | | 0.00 | | 7/1/2033 | | 284,274 | g | 173,210 | |

Puerto Rico, GO, Ser. A1 | | 4.00 | | 7/1/2037 | | 170,415 | | 153,323 | |

Puerto Rico, GO, Ser. A1 | | 4.00 | | 7/1/2041 | | 231,699 | | 200,363 | |

Puerto Rico, GO, Ser. A1 | | 4.00 | | 7/1/2046 | | 240,964 | | 200,597 | |

Puerto Rico, GO, Ser. A1 | | 4.00 | | 7/1/2035 | | 198,557 | | 182,486 | |

Puerto Rico, GO, Ser. A1 | | 4.00 | | 7/1/2033 | | 220,898 | | 206,845 | |

Puerto Rico, GO, Ser. A1 | | 5.38 | | 7/1/2025 | | 246,018 | | 250,698 | |

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | | Value

($) | |

Long-Term

Municipal Investments - 151.6% (continued) | | | | | |

U.S.

Related - 1.4% (continued) | | | | | |

Puerto Rico, GO, Ser. A1 | | 5.63 | | 7/1/2029 | | 2,489,835 | | 2,634,346 | |

Puerto Rico, GO, Ser. A1 | | 5.63 | | 7/1/2027 | | 243,790 | | 254,262 | |

Puerto Rico, GO, Ser. A1 | | 5.75 | | 7/1/2031 | | 232,950 | | 251,955 | |

| | 4,542,623 | |

Utah

- 1.8% | | | | | |

Salt Lake City, Revenue Bonds, Ser. A | | 5.00 | | 7/1/2048 | | 2,000,000 | | 2,028,951 | |

Salt Lake City, Revenue Bonds, Ser. A | | 5.00 | | 7/1/2042 | | 1,565,000 | | 1,588,809 | |

Utah Infrastructure Agency, Revenue Bonds, Refunding, Ser.

A | | 5.00 | | 10/15/2037 | | 2,000,000 | | 1,978,646 | |

| | 5,596,406 | |

Virginia - 6.0% | | | | | |

Henrico

County Economic Development Authority, Revenue Bonds, Refunding (Insured; Assured Guaranty Municipal

Corp.) | | 7.83 | | 8/23/2027 | | 3,200,000 | e | 3,580,505 | |

Tender Option Bond Trust Receipts (Series 2018-XM0593), (Hampton

Roads Transportation Accountability Commission, Revenue Bonds) Non-recourse, Underlying Coupon Rate (%)

5.50 | | 5.04 | | 7/1/2057 | | 7,500,000 | c,e,f | 8,275,842 | |

Virginia College Building Authority, Revenue Bonds (Green Bond)

(Marymount University Project) | | 5.00 | | 7/1/2045 | | 1,000,000 | c | 921,335 | |

Virginia Small Business Financing Authority, Revenue Bonds

(Transform 66 P3 Project) | | 5.00 | | 12/31/2052 | | 4,350,000 | | 4,336,411 | |

Virginia Small Business

Financing Authority, Revenue Bonds, Refunding (95 Express Lanes) | | 4.00 | | 1/1/2048 | | 1,000,000 | | 865,203 | |

Williamsburg Economic Development Authority, Revenue Bonds

(William & Marry Project) (Insured; Assured Guaranty Municipal Corp.) Ser. A | | 4.13 | | 7/1/2058 | | 1,000,000 | | 939,258 | |

| | 18,918,554 | |

Washington

- .7% | | | | | |

Washington Higher Education Facilities Authority, Revenue Bonds (Seattle University

Project) | | 4.00 | | 5/1/2050 | | 1,200,000 | | 1,050,213 | |

Washington Housing

Finance Commission, Revenue Bonds, Refunding (Presbyterian Retirement Communities Northwest Obligated

Group) Ser. A | | 5.00 | | 1/1/2051 | | 1,465,000 | c | 1,107,299 | |

| | 2,157,512 | |

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | | Value

($) | |

Long-Term

Municipal Investments - 151.6% (continued) | | | | | |

Wisconsin

- 3.7% | | | | | |

Public Finance Authority, Revenue Bonds (CHF - Wilmington) (Insured; Assured Guaranty

Municipal Corp.) | | 5.00 | | 7/1/2058 | | 3,665,000 | | 3,717,963 | |

Public Finance Authority,

Revenue Bonds (Cone Health) Ser. A | | 5.00 | | 10/1/2052 | | 1,000,000 | | 1,019,053 | |

Public Finance Authority, Revenue Bonds (EMU Campus Living)

(Insured; Build America Mutual) Ser. A1 | | 5.50 | | 7/1/2052 | | 1,500,000 | | 1,620,880 | |

Public Finance Authority, Revenue Bonds (EMU Campus Living)

(Insured; Build America Mutual) Ser. A1 | | 5.63 | | 7/1/2055 | | 1,650,000 | | 1,796,307 | |

Public Finance Authority, Revenue Bonds (Gannon University

Project) | | 5.00 | | 5/1/2042 | | 750,000 | | 708,221 | |

Public Finance Authority,

Revenue Bonds, Refunding (Mary's Woods at Marylhurst Project) | | 5.25 | | 5/15/2042 | | 750,000 | c | 701,612 | |

Wisconsin Health & Educational Facilities Authority, Revenue

Bonds (Bellin Memorial Hospital Obligated Group) | | 5.50 | | 12/1/2052 | | 1,000,000 | | 1,058,489 | |

Wisconsin Health & Educational Facilities Authority, Revenue

Bonds, Refunding (St. Camillus Health System Obligated Group) | | 5.00 | | 11/1/2046 | | 1,250,000 | | 979,641 | |

| | 11,602,166 | |

Total

Investments (cost $500,759,140) | | 151.6% | 479,162,112 | |

Liabilities, Less Cash and Receivables | | (36.0%) | (113,795,232) | |

VMTPS, at liquidation

value | | (15.6%) | (49,300,000) | |

Net Assets Applicable

to Common Stockholders | | 100.0% | 316,066,880 | |

GO—General

Obligation

a These

securities have a put feature; the date shown represents the put date and the bond holder can take a

specific action to retain the bond after the put date.

b Zero coupon until a specified date at which time the stated

coupon rate becomes effective until maturity.

c Security exempt from registration pursuant to Rule 144A under

the Securities Act of 1933. These securities may be resold in transactions exempt from registration,

normally to qualified institutional buyers. At August 31, 2023, these securities were valued at $190,327,424

or 60.22% of net assets.

d Non-income

producing—security in default.

e The Variable Rate is determined by the Remarketing Agent in

its sole discretion based on prevailing market conditions and may, but need not, be established by reference

to one or more financial indices.

f Collateral for floating rate borrowings. The coupon rate given

represents the current interest rate for the inverse floating rate security.

g Security issued with a zero coupon. Income is recognized through

the accretion of discount.

STATEMENT

OF FINANCIAL FUTURES

BNY Mellon Strategic Municipal Bond Fund, Inc.

August 31, 2023 (Unaudited)

The

following is a summary of the inputs used as of August 31, 2023 in

valuing the fund’s investments:

| | | | | | | |

| | Level 1-Unadjusted Quoted Prices | Level

2- Other Significant Observable Inputs | | Level 3-Significant Unobservable

Inputs | Total | |

Assets ($) | | |

Investments in Securities:† | | |

Municipal

Securities | - | 479,162,112 | | - | 479,162,112 | |

Liabilities

($) | | |

Other Financial Instruments: | | |

Inverse Floater Notes†† | - | (117,805,000) | | - | (117,805,000) | |

VMTPS†† | - | (49,300,000) | | - | (49,300,000) | |

† See

Statement of Investments for additional detailed categorizations, if any.

†† Certain of the fund’s liabilities are held at carrying amount,

which approximates fair value for financial reporting purposes.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification

(“ASC”) is the exclusive reference of authoritative U.S. generally accepted accounting principles

(“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive

releases of the SEC under authority of federal laws are also sources of authoritative GAAP for SEC registrants.

The fund is an investment company and applies the accounting and reporting guidance of the FASB ASC Topic

946 Financial Services-Investment Companies. The fund’s financial statements are prepared in accordance

with GAAP, which may require the use of management estimates and assumptions. Actual results could differ

from those estimates.

The fair value of a financial instrument is the amount that

would be received to sell an asset or paid to transfer a liability in an orderly transaction between

market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy

that prioritizes the inputs of valuation techniques used to measure fair value. This hierarchy gives

the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities

(Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally,

GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly

and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced

disclosures around valuation inputs and techniques used during annual and interim periods.

Various

inputs are used in determining the value of the fund’s investments relating to fair value measurements.

These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted

prices in active markets for identical investments.

Level 2—other significant

observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds,

credit risk, etc.).

Level 3—significant unobservable inputs (including

the fund’s own assumptions in determining the fair value of investments).

The

inputs or methodology used for valuing securities are not necessarily an indication of the risk associated

with investing in those securities.

Changes in valuation techniques may result

in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used

to value the fund’s investments are as follows:

The fund’s Board of Directors (the “Board”)

has designated the Adviser as the fund’s valuation designee to make all fair value determinations with

respect to the fund’s portfolio investments, subject to the Board’s oversight and pursuant to Rule

2a-5 under the Act.

Investments in municipal securities are valued each business day by an independent

pricing service (the “Service”) approved by the Board. Investments for which quoted bid prices are

readily available and are representative of the bid side of the market in the judgment of the Service

are valued at the mean between the quoted bid prices (as obtained by the Service from dealers in such

securities) and asked prices (as calculated by the Service based upon its evaluation of the market for

such securities). Municipal investments (which constitute a majority of the portfolio securities) are

carried at fair value as determined by the Service, based on methods which include consideration of the

following: yields or prices of municipal securities of comparable quality, coupon, maturity and type;

indications as to values from dealers; and general market conditions. The Service is engaged under the

general oversight of the Board. All of the preceding securities are generally categorized within Level

2 of the fair value hierarchy.

When market quotations or official closing prices are not

readily available, or are determined not to accurately reflect fair value, such as when the value of

a security has been significantly affected by events after the close of the exchange or market on which

the security is principally traded, but before the fund calculates its net asset value, the fund may

value these investments at fair value as determined in accordance with the procedures approved by the

Board. Certain factors may be considered when fair valuing investments such as: fundamental analytical

data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence

the market in which the securities are purchased and sold, and public trading in similar securities of

the issuer or comparable issuers. These securities are either categorized within Level 2 or 3 of the

fair value hierarchy depending on the relevant inputs used.

For securities where

observable inputs are limited, assumptions about market activity and risk are used and such securities

are generally categorized within Level 3 of the fair value hierarchy.

Inverse Floater Securities:

The fund participates in secondary inverse floater structures in which fixed-rate, tax-exempt municipal

bonds are transferred to a trust (the “Inverse Floater Trust”). The Inverse Floater Trust typically

issues two variable rate securities that are collateralized by the cash flows of the fixed-rate, tax-exempt

municipal bonds. One of these variable rate securities pays interest based on a short-term floating rate

set by a remarketing agent at predetermined intervals (“Trust Certificates”). A residual interest

tax-exempt security is also created by the Inverse Floater Trust, which is transferred to the fund, and

is paid interest based on the remaining cash flows of the Inverse Floater Trust, after payment of interest

on the other securities and various expenses of the Inverse Floater Trust. An Inverse Floater Trust may

be collapsed without the consent of the fund due to certain termination events such as bankruptcy, default

or other credit event.

The fund accounts for the transfer of bonds to the Inverse

Floater Trust as secured borrowings, with the securities transferred remaining in the fund’s investments,

and the Trust Certificates reflected as fund liabilities in the Statement of Assets and Liabilities.

The fund may invest in inverse floater securities on either a non-recourse or

recourse basis. These securities are typically supported by a liquidity facility provided by a bank or

other financial institution (the “Liquidity Provider”) that allows the holders of the Trust Certificates

to tender their certificates in exchange for payment from the Liquidity Provider of par plus accrued

interest on any business day prior to a termination event. When the fund invests in inverse floater securities

on a non-recourse basis, the Liquidity Provider is required to make a payment under the liquidity facility

due to a termination event to the holders of the Trust Certificates. When this occurs, the Liquidity

Provider typically liquidates all or a portion of the municipal securities held in the Inverse Floater

Trust. A liquidation shortfall occurs if the Trust Certificates exceed the proceeds of the sale of the

bonds in the Inverse Floater Trust (“Liquidation Shortfall”). When a fund invests in inverse floater

securities on a recourse basis, the fund typically enters into a reimbursement agreement with the Liquidity

Provider where the fund is required to repay the Liquidity Provider the amount of any Liquidation Shortfall.

As a result, a fund investing in a recourse inverse floater security bears the risk of loss with respect

to any Liquidation Shortfall.

At August 31, 2023, accumulated net unrealized depreciation

on investments was $21,597,028, consisting of $5,288,448 gross unrealized appreciation and $26,885,476

gross unrealized depreciation.

At August 31, 2023, the cost of investments

for federal income tax purposes was substantially the same as the cost for financial reporting purposes

(see the Statement of Investments).

Additional investment related disclosures

are hereby incorporated by reference to the annual and semi-annual reports previously filed with the

SEC on Form N-CSR.

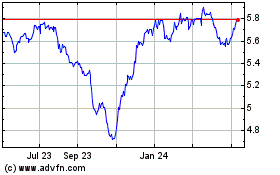

BNY Mellon Strategic Mun... (NYSE:DSM)

Historical Stock Chart

From Nov 2024 to Dec 2024

BNY Mellon Strategic Mun... (NYSE:DSM)

Historical Stock Chart

From Dec 2023 to Dec 2024