Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

26 September 2022 - 8:01PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of September, 2022

EMPRESA DISTRIBUIDORA Y COMERCIALIZADORA NORTE S.A. (EDENOR)

(DISTRIBUTION AND MARKETING COMPANY OF THE NORTH )

(Translation of Registrant's Name Into English)

Argentina

(Jurisdiction of incorporation or organization)

Av. del Libertador 6363,

12th Floor,

City of Buenos Aires (A1428ARG),

Tel: 54-11-4346-5000

(Address of principal executive offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F X Form 40-F

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes No X

(If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .)

September 23,2022

Messrs.

COMISIÓN NACIONAL DE VALORES

Subgerencia de Sociedades Emisoras

25 de Mayo 175

City of Buenos Aires

Messrs.

BOLSAS Y MERCADOS ARGENTINOS S.A.

Sarmiento 299

City of Buenos Aires

Ref: Material fact

Risk Rating

Class 9 Negotiable Obligations

Exchange Offer and

Issuance of Additional Class 1

Negotiable Obligations

Dear Sirs:

I hereby address you on behalf of

Empresa Distribuidora y Comercializadora Norte S.A. (EDENOR S.A.) (indistinctly, “EDENOR” or the “Company”) in

accordance with the provisions of CNV Rules, Title XII, Chapter I, Section II, Art. 3, Inc. 29), in order to inform that onthis date,

the exchange offer of the Negotiable Obligations Class No. 9 issued by the Company with maturity on October 25, 2022 at a fixed interest

rate of 9.75% nominal annual for a Outstanding nominal value of US$ 26,231,000.- for Additional Negotiable Obligations Class No. I, denominated

and payable in US dollars, at a fixed interest rate of 9.75% annual nominal, maturing in 2025, in the framework of the Global Program

for the Issuance of Simple Negotiable Obligations (not convertible into shares) for a face value of up to US$ 750,000,000 (or its equivalent

in other currencies) has been launched. The terms and conditions of the exchange and issuance of the Additional Negotiable Obligations

Class No. I are detailed in the Notice of Subscription and Exchange and the Prospectus and Exchange Supplement loaded on the AIF with

the IDs 2948141 and 2948162 respectively.

Yours faithfully.

Silvana E. Coria

Market Relations Officer.

Empresa Distribuidora y Comercializadora Norte Sociedad Anónima (EDENOR S.A.)

Avda. del Libertador 6363 – Buenos Aires, C1428ARG – Argentina. Tel.: 4346-5400

Fax: 4346-5327

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Empresa Distribuidora y Comercializadora Norte S.A. |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Germán Ranftl |

|

|

Germán Ranftl |

|

|

Chief Financial Officer |

Date:

September 23, 2022

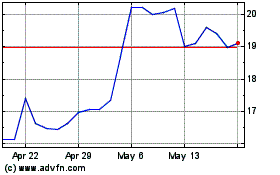

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Dec 2024 to Jan 2025

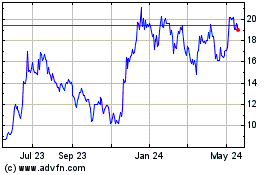

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Jan 2024 to Jan 2025