U.S. SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES

EXCHANGE ACT OF 1934

Dated October 24, 2024

Commission File Number 1-14878

GERDAU S.A.

(Translation of Registrant’s Name into English)

Av. Dra. Ruth Cardoso, 8,501 – 8° andar

São Paulo, São Paulo - Brazil CEP

05425-070

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Exhibit Index

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: October 24, 2024

| |

GERDAU S.A. |

| |

|

|

| |

By: |

/s/ Rafael Dorneles Japur |

| |

Name: |

Rafael Dorneles Japur |

| |

Title: |

Executive Vice President Investor Relations Director |

Exhibit 99.1

GERDAU S.A.

Corporate Tax ID

(CNPJ/MF): 33.611.500/0001-19

Registry (NIRE):

35300520696

GERDAU S.A. (83: GGBR / NYSE:

GGB) (“Company”), informs that, in report disclosed today, S&P Ratings upgraded the Long-Term Foreign Currency Issuer Default Rating

(IDRs) of Gerdau S.A. to ‘BBB’ from ‘BBB-’. S&P also upgraded Gerdau’s and its related subsidiary companies’ senior unsecured notes

to ‘BBB’ from ‘BBB-’. The Rating Outlook is now stable.

São Paulo,

October 16th, 2024.

Rafael Dorneles

Japur

Executive Vice-President

Investor Relations

Officer

Research Update:

Gerdau S.A. Upgraded To ‘BBB’ From

‘BBB-’ On Sustained Low Leverage And Conservative Financial Policies; Outlook Stable

October 16, 2024

Rating Action Overview

| - | Brazilian steelmaker Gerdau S.A. has sustained low leverage

and sound liquidity, even amid low prices in its main markets. The company posted adjusted debt to EBITDA of 0.8x and FFO to debt of

87.5% in the 12 months ended June 30, 2024, despite its EBITDA margin falling to 16% from 21% in the same period last year. |

| - | At the same time, free operating cash flow (FOCF) has remained

robust, in spite of the company’s significant capex plan. |

| - | As a result, we raised our issuer credit ratings on Gerdau S.A.

and Gerdau Ameristeel Corp. to ‘BBB’ from ‘BBB-’. We also raised our issue ratings on their senior unsecured notes to ‘BBB’ from ‘BBB-’.

At the same time, we affirmed our ‘brAAA’ Brazil national scale rating on Gerdau and on its senior unsecured debentures. |

| - | The stable outlook reflects our expectation that margins in

Brazil will recover and Gerdau will sustain low leverage and robust FOCF, despite significant investment plans, as well as conservative

financial policies. |

Rating Action Rationale

We forecast Gerdau to sustain low leverage while facing weaker market

conditions. The company has maintained strong credit metrics, with debt to EBITDA below 1.0x and funds from operations (FFO) to debt

above 80%, despite lower EBITDA compared with the record highs in 2021 and 2022. The company’s solid performance comes amid the more challenging

market conditions in Brazil the past three quarters and in the U.S. more recently.

We believe the company’s performance is mainly a result of

its commitment to maintain a robust balance sheet, with a strong cash position and controlled nominal gross debt. The company ended June

2024 with cash of Brazilian real (R$) 6.6 billion and gross debt of R$12.6 billion. In addition, its sound business diversity helps to

offset weak regional performance.

PRIMARY CREDIT ANALYST

Matheus H Cortes

Sao Paulo

+ 55 11 3818 4129

matheus.cortes

@spglobal.com

SECONDARY CONTACT

Flavia M Bedran

Sao Paulo

+ 55 11 3039 9758

flavia.bedran

@spglobal.com

| www.spglobal.com/ratingsdirect | October

16, 2024 1 |

Research Update: Gerdau S.A. Upgraded To ‘BBB’ From ‘BBB-’ On Sustained

Low Leverage And Conservative Financial Policies; Outlook Stable

We think Gerdau’s conservative financial policies will keep

net leverage comfortably below 1.5x and support consistent and robust cash generation. The company currently has targets of net leverage

of about 1.0x-1.5x, gross debt around R$12 billion, dividend payouts of 30% of the previous year’s net income, and minimum cash of R$5

billion–R$6 billion.

In our view, such policies provide a cushion against downturns.

We expect Gerdau to be able to maintain leverage below 1.5x even if EBITDA declines by 20%-25% compared with our base-case scenario. Additionally,

we expect the company to take other countercyclical measures (as reduce capex and shareholder’s remuneration) to control leverage if it

faces a downturn.

Recent investments in efficiency, coupled with geographic

and product mix diversification, will sustain solid EBITDA generation. The company’s margins suffered in the first half of 2024 as

a consequence of one-off costs related to the hibernation of plants to adjust production capacity in Brazil. In addition, competition

in the country increased, with high import volumes pressuring domestic prices, though less so for Gerdau given the company’s product mix.

In Brazil, we expect margins to reach double digits by the

end of this year and close to 19% in 2025, from 9% in the first half of 2024, owing to better price adjustments amid supportive demand

(from civil construction, industrial clients, and agriculture) and the company’s recent cost-cutting initiatives. Those included the company

optimizing its operational footprint, revising its logistics network, and modernizing some of its industrial processes.

The improved margins in Brazil the rest of this year and

in 2025 will partially offset the weaker margins we foresee for North America (close to 19%-20%) given more pressured metal spreads in

the region. Nevertheless, for North America, we anticipate still solid demand supported by recent federal government measures, such as

the Chips and Science Act, and the Infrastructure Investment and Jobs Act.

All the

above should culminate in consolidated nominal EBITDA of about R$11.5 billion in 2024 and R$14.2 billion in 2025 for Gerdau, with an

EBITDA margin of 16.8% and 19.4%, respectively.

We expect robust FOCF and solid liquidity despite a significant

capital expenditure (capex) plan. Gerdau is in the middle of its strategic investment plan. The plan considers a total disbursement

of close to R$12 billion until 2027, of which about R$5.9 billion has already been invested. The main projects in place are:

| - | The new iron ore treatment plant in Brazil (R$3.2 billion), |

| - | An increase in capacity in the Midlothian plant in the U.S.

(R$1.5 billion), and |

| - | Hot-rolled coil steel and rolling mill capacity expansion (R$

3.3 billion). |

The strategic investment plan, plus additional capex for

maintenance, should result in total capex of about R$ 6 billion per year in the next few years.

Despite the significant capex, we still forecast Gerdau to

generate FOCF of about R$2 billion–R$3.3 billion per year in 2024 and 2025. This should benefit the company’s liquidity position,

coupled with an extended debt maturity profile and an already solid cash position (plus its undrawn bank line of about U$875 million due

in 2027).

| www.spglobal.com/ratingsdirect | October

16, 2024 2 |

Research Update: Gerdau S.A. Upgraded To ‘BBB’ From ‘BBB-’ On Sustained

Low Leverage And Conservative Financial Policies; Outlook Stable

Outlook

The stable outlook reflects our expectation that Gerdau will

maintain net leverage of 0.5x-1.0x for the next 18-24 months, in spite of a significant capex plan and higher shareholder remuneration.

We also think that the company’s conservative financial policies

will enable it to maintain controlled leverage--below 1.5x--even during cycle downturns.

In addition, we expect Gerdau to maintain a sound liquidity

cushion to withstand a potential downturn and to pass our stress test. As a result, the company can be rated up to two notches above the

‘BBB-’ transfer and convertibility (T&C) assessment of Brazil.

Downside scenario

We could downgrade Gerdau if its adjusted debt to EBITDA

stays above 1.5x and FFO to debt below 60% for a consistent period following a potential downturn in the industry. This scenario could

also result from more aggressive shareholder remuneration, significant mergers or acquisitions, or working capital mismanagement, leading

to significant cash burn. We could also lower the ratings if the company’s liquidity weakens, limiting its ability to be rated above our

T&C assessment of Brazil.

Upside scenario

We could upgrade Gerdau in the next 18-24 months if it sustains

a longer record of adjusted debt to EBITDA below 1.5x and FFO to debt above 60% through industry downturns. In such a scenario, we would

expect the company to have an increased asset base and operational footprint to support its position in the sector, while posting less

volatile margins throughout industry cycles.

An upgrade would also depend on Gerdau’s ability to continue

to post sound liquidity to pass our stress test and to be rated up to two notches above the ‘BBB-’ T&C assessment of Brazil.

Company Description

Gerdau is one of the largest steel producers in the Americas.

With total crude steel production capacity of over 15 million tons, the company operates mainly in Brazil and the U.S., with minor operations

in other Latin American countries such as Argentina, Uruguay, and Peru. Gerdau’s portfolio consists of long and flat steel, including

specialty steel, as well as iron ore for its own use. The company posted net revenues of R$64.6 billion and EBITDA of R$10.3 billion in

the 12 months ended June 30, 2024.

Gerdau is ultimately controlled by the holding company Metalurgica

Gerdau S.A. (MG; not rated), which holds a 33.5% stake in the company. We consider Gerdau a core subsidiary of MG because it’s the only

operating asset and cash flow generator of the holding company, and it holds 100% of the group’s debt. In addition, Gerdau controls subsidiaries

in the steel business, including Gerdau Ameristeel Corp., and financial vehicles.

Our Base-Case Scenario

Assumptions

| - | Brazil’s real GDP to grow by 2.8%, 1.8%, and 2.1% in 2024, 2025,

and 2026, respectively, affecting Brazil utilization rates. |

| - | U.S.’s real GDP growth of 2.7%, 1.8%, and 1.9% in 2024, 2025,

and 2026, respectively, affecting North America utilization rates. |

| www.spglobal.com/ratingsdirect | |

October 16, 2024 3 |

Research Update: Gerdau S.A. Upgraded To ‘BBB’ From ‘BBB-’

On Sustained Low Leverage And Conservative Financial Policies; Outlook Stable

| - | Average inflation of about 4.3%, 3.8%, and 3.5% in Brazil for

2024, 2025, and 2026, respectively, affecting personnel, maintenance, and energy material costs for Brazil division. |

| - | Average inflation of about 2.9%, 2.0%, and 2.4% in the U.S.

for 2024, 2025, and 2026, respectively, affecting personnel, maintenance, and energy material costs for North America division. |

| - | Average foreign exchange rate of R$5.3-R$5.52 per U$1 for the

next years. |

| - | Net revenues roughly stable in 2024, with higher volumes amid

stable demand mitigating the impact of lower prices in Brazil and U.S. In the coming years, we expect revenues to increase through volume

growth in all divisions and prices recovery in Brazil. |

| - | Capex of R$6.0 billion per year in the coming years. |

| - | Dividends of 30%-50% of the previous year’s net income in the

coming years, but depending on the maintenance of solid cash position and controlled leverage. |

| - | Share repurchases of almost R$1.8 billion in 2024, given the

current repurchase plan that the company’s board approved. |

| - | The proceeds from the divestment of Gerdau’s stakes in the joint

ventures Diaco S.A. and Gerdau Metaldom Corp. (amounting to about R$ 1.5 billion) in February and March 2024, and from the monetization

of tax credits (R$1.7 billion) in August 2024. |

Key metrics

Gerdau S.A.--forecast summary

Industry sector: metals

| | |

--Fiscal

year ended Dec. 31-- | |

| (Mil.

R$) | |

2020a | | |

2021a | | |

2022a | | |

2023a | | |

2024e | | |

2025f | | |

2026f | | |

2027f | | |

2028f | |

| Revenue | |

| 43,815 | | |

| 78,345 | | |

| 82,412 | | |

| 68,916 | | |

| 68,533 | | |

| 73,345 | | |

| 76,062 | | |

| 77,775 | | |

| 79,189 | |

| EBITDA (reported) | |

| 8,170 | | |

| 23,682 | | |

| 20,618 | | |

| 13,511 | | |

| 11,492 | | |

| 14,191 | | |

| 14,693 | | |

| 14,695 | | |

| 14,300 | |

| Plus/(less):

Other | |

| (932 | ) | |

| (1,623 | ) | |

| (446 | ) | |

| (853 | ) | |

| 27 | | |

| 27 | | |

| 27 | | |

| 27 | | |

| 27 | |

| EBITDA | |

| 7,237 | | |

| 22,059 | | |

| 20,172 | | |

| 12,657 | | |

| 11,519 | | |

| 14,219 | | |

| 14,720 | | |

| 14,723 | | |

| 14,328 | |

| Less: Cash

interest paid | |

| (1,105 | ) | |

| (1,202 | ) | |

| (997 | ) | |

| (913 | ) | |

| (1,073 | ) | |

| (1,174 | ) | |

| (1,092 | ) | |

| (1,087 | ) | |

| (1,096 | ) |

| Less: Cash

taxes paid | |

| (621 | ) | |

| (2,893 | ) | |

| (3,356 | ) | |

| (1,560 | ) | |

| (1,489 | ) | |

| (1,953 | ) | |

| (2,003 | ) | |

| (1,958 | ) | |

| (1,850 | ) |

| Funds from operations (FFO) | |

| 5,512 | | |

| 17,964 | | |

| 15,819 | | |

| 10,185 | | |

| 8,957 | | |

| 11,092 | | |

| 11,625 | | |

| 11,678 | | |

| 11,382 | |

| Interest expense | |

| 1,093 | | |

| 1,135 | | |

| 1,020 | | |

| 922 | | |

| 1,094 | | |

| 1,197 | | |

| 1,115 | | |

| 1,110 | | |

| 1,119 | |

| Cash flow from operations (CFO) | |

| 5,744 | | |

| 12,484 | | |

| 11,122 | | |

| 11,084 | | |

| 7,910 | | |

| 9,320 | | |

| 9,833 | | |

| 9,993 | | |

| 9,490 | |

| Capital expenditure (capex) | |

| 1,626 | | |

| 2,993 | | |

| 4,263 | | |

| 5,155 | | |

| 6,000 | | |

| 6,000 | | |

| 6,000 | | |

| 5,500 | | |

| 5,500 | |

| Free operating cash flow (FOCF) | |

| 4,118 | | |

| 9,491 | | |

| 6,858 | | |

| 5,930 | | |

| 1,910 | | |

| 3,320 | | |

| 3,833 | | |

| 4,493 | | |

| 3,990 | |

| Dividends | |

| 275 | | |

| 5,339 | | |

| 5,892 | | |

| 2,683 | | |

| 2,261 | | |

| 2,681 | | |

| 3,906 | | |

| 4,007 | | |

| 3,917 | |

| Share repurchases (reported) | |

| -- | | |

| -- | | |

| 1,073 | | |

| -- | | |

| 1,768 | | |

| -- | | |

| -- | | |

| -- | | |

| -- | |

| Discretionary cash flow (DCF) | |

| 3,843 | | |

| 4,151 | | |

| (106 | ) | |

| 3,246 | | |

| (2,120 | ) | |

| 639 | | |

| (74 | ) | |

| 486 | | |

| 74 | |

| Debt (reported) | |

| 17,515 | | |

| 14,040 | | |

| 12,607 | | |

| 10,893 | | |

| 12,393 | | |

| 12,393 | | |

| 12,393 | | |

| 12,393 | | |

| 12,393 | |

| Plus: Lease

liabilities debt | |

| 856 | | |

| 918 | | |

| 1,031 | | |

| 1,278 | | |

| 1,405 | | |

| 1,476 | | |

| 1,549 | | |

| 1,627 | | |

| 1,708 | |

| www.spglobal.com/ratingsdirect | |

October 16, 2024 4 |

Research Update: Gerdau S.A. Upgraded To ‘BBB’ From ‘BBB-’ On Sustained

Low Leverage And Conservative Financial Policies; Outlook Stable

Gerdau S.A.--forecast summary (cont.)

Industry sector: metals

| | |

--Fiscal

year ended Dec. 31-- | |

| (Mil. R$) | |

2020a | | |

2021a | | |

2022a | | |

2023a | | |

2024e | | |

2025f | | |

2026f | | |

2027f | | |

2028f | |

| Plus:

Pension and other postretirement debt | |

| 1,077 | | |

| 713 | | |

| 374 | | |

| 254 | | |

| 254 | | |

| 254 | | |

| 254 | | |

| 254 | | |

| 254 | |

| Less: Accessible

cash and liquid Investments | |

| (7,658 | ) | |

| (6,787 | ) | |

| (5,435 | ) | |

| (5,344 | ) | |

| (7,887 | ) | |

| (8,426 | ) | |

| (8,260 | ) | |

| (8,662 | ) | |

| (8,660 | ) |

| Plus/(less):

Other | |

| 3,960 | | |

| 3,011 | | |

| 1,282 | | |

| 1,233 | | |

| 1,333 | | |

| 1,333 | | |

| 1,333 | | |

| 678 | | |

| 678 | |

| Debt | |

| 15,751 | | |

| 11,895 | | |

| 9,859 | | |

| 8,314 | | |

| 7,499 | | |

| 7,030 | | |

| 7,270 | | |

| 6,290 | | |

| 6,373 | |

| Cash and short-term investments

(reported) | |

| 7,658 | | |

| 6,787 | | |

| 5,435 | | |

| 5,344 | | |

| 7,887 | | |

| 8,426 | | |

| 8,260 | | |

| 8,662 | | |

| 8,660 | |

| Adjusted ratios | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Debt/EBITDA (x) | |

| 2.2 | | |

| 0.5 | | |

| 0.5 | | |

| 0.7 | | |

| 0.7 | | |

| 0.5 | | |

| 0.5 | | |

| 0.4 | | |

| 0.4 | |

| FFO/debt (%) | |

| 35.0 | | |

| 151.0 | | |

| 160.5 | | |

| 122.5 | | |

| 119.4 | | |

| 157.8 | | |

| 159.9 | | |

| 185.6 | | |

| 178.6 | |

| FFO cash interest coverage (x) | |

| 6.0 | | |

| 15.9 | | |

| 16.9 | | |

| 12.2 | | |

| 9.3 | | |

| 10.5 | | |

| 11.7 | | |

| 11.7 | | |

| 11.4 | |

| EBITDA interest coverage (x) | |

| 6.6 | | |

| 19.4 | | |

| 19.8 | | |

| 13.7 | | |

| 10.5 | | |

| 11.9 | | |

| 13.2 | | |

| 13.3 | | |

| 12.8 | |

| CFO/debt (%) | |

| 36.5 | | |

| 105.0 | | |

| 112.8 | | |

| 133.3 | | |

| 105.5 | | |

| 132.6 | | |

| 135.2 | | |

| 158.9 | | |

| 148.9 | |

| FOCF/debt (%) | |

| 26.1 | | |

| 79.8 | | |

| 69.6 | | |

| 71.3 | | |

| 25.5 | | |

| 47.2 | | |

| 52.7 | | |

| 71.4 | | |

| 62.6 | |

| DCF/debt (%) | |

| 24.4 | | |

| 34.9 | | |

| (1.1 | ) | |

| 39.0 | | |

| (28.3 | ) | |

| 9.1 | | |

| (1.0 | ) | |

| 7.7 | | |

| 1.2 | |

| Annual revenue growth (%) | |

| 10.5 | | |

| 78.8 | | |

| 5.2 | | |

| (16.4 | ) | |

| (0.6 | ) | |

| 7.0 | | |

| 3.7 | | |

| 2.3 | | |

| 1.8 | |

| Gross margin (%) | |

| 19.2 | | |

| 30.0 | | |

| 26.2 | | |

| 20.9 | | |

| 19.1 | | |

| 21.5 | | |

| 21.5 | | |

| 20.9 | | |

| 20.0 | |

| EBITDA margin (%) | |

| 16.5 | | |

| 28.2 | | |

| 24.5 | | |

| 18.4 | | |

| 16.8 | | |

| 19.4 | | |

| 19.4 | | |

| 18.9 | | |

| 18.1 | |

| Return on capital (%) | |

| 10.0 | | |

| 39.5 | | |

| 33.5 | | |

| 18.8 | | |

| 15.6 | | |

| 19.0 | | |

| 18.0 | | |

| 16.7 | | |

| 15.2 | |

All figures include S&P Global Ratings adjustments’ unless stated

as reported. a--Actual. e--Estimate. f--Forecast.

Liquidity

We continue to view Gerdau’s liquidity

as strong. Sources will exceed uses of cash for the next 12 months by about 1.7x, and sources would be comfortably higher than uses even

if EBITDA were to decline by 30% from our base-case scenario.

The company has a solid cash position and cash generation,

access to a fully available committed credit facility of $875 million (equivalent to about R$ 4.9 billion) due in October 2027, and a

smooth debt amortization profile. In addition, we believe Gerdau has well-established relationships with banks and high standing in credit

markets, given its large scale and solid operations. We view the company as having overall prudent risk management, and it’s not subject

to financial covenants on its debt.

Principal liquidity sources are:

| - | Cash position of R$6.6 billion as of June 30, 2024; |

| - | Availability under the undrawn portion of its committed credit

facility due 2024 of $875 million (about R$4.9 billion) as of June 30, 2024; |

| - | FFO of R$10.6 billion in the next 12 months; and |

| - | Judicially deposited amounts totaling R$1.8 billion, received

in August 2024. |

| www.spglobal.com/ratingsdirect | |

October 16, 2024 5 |

Research Update: Gerdau S.A. Upgraded To ‘BBB’ From ‘BBB-’ On Sustained

Low Leverage And Conservative Financial Policies; Outlook Stable

Principal liquidity uses are:

| - | Short-term debt maturities of about R$1.7 billion as of June

30, 2024; |

| - | Working capital outflows of R$2.1 billion in the next 12 months; |

| - | Estimated capex of about R$6 billion for the next 12 months;

and |

| - | Dividend payments of about R$2.5 billion and share repurchases

of almost R$1.8 billion for the next 12 months. |

Environmental, Social, And Governance

Environmental, social, and governance (ESG) factors have

an overall neutral influence on our credit analysis of Gerdau. In line with the downstream peers, Gerdau is exposed to the energy-intensive

steel production process. However, it produces about 70% of its steel in electric arc furnaces, which pollute significantly less than

traditional blast furnaces.

Through Gerdau Next, the company has also been making several

investments in renewable energy. It also has in place clean energy projects, such as the construction of two solar parks (one in the U.S.

and the other in Brazil), aiming to diversify its energy matrix.

Additionally, 71% of the steel Gerdau produces has scrap

metal, as its main raw material, that the company sources from metal recyclers. Gerdau also invests in efficient water recirculation programs,

which allows 97.6% of the water used in its production to be reused. Nevertheless, Gerdau has one of the lower averages of greenhouse

gases emissions in the sector, around 0.91 tCO2e/tons of steel produced, and aims to reach 0.82 by 2031, potentially becoming carbon neutral

in 2050.

Group Influence

We analyze consolidated figures and operations at MG’s level.

This doesn’t change our view of the group’s business and financial risk profiles because Gerdau is MG’s only relevant asset, which we

view as a core subsidiary and driver of the group’s credit quality. There’s no material debt at the holding level.

Ratings Above The Sovereign

Given that Gerdau historically generates about 50% of its

EBITDA in Brazil, we stress its ability to withstand a hypothetical sovereign default scenario of that country. The company passes the

stress test, given its solid liquidity and cash flows from foreign operations.

Therefore, we can rate Gerdau above the referenced foreign

currency sovereign rating, which is the weighted average between our ratings on Brazil and the U.S. (about 40% of the company’s historical

EBITDA). The indicative average reference country rating is ‘BBB+’, which we lower one notch because Gerdau’s country of domicile is Brazil,

arriving at the final country rating of ‘BBB’.

In our view, Gerdau operates in an industry that’s

highly sensitive to the domestic economy because the steel sector is primarily non-exporter, limiting the final rating to up to two

notches above the referenced sovereign rating, which could reach ‘A-’.

| www.spglobal.com/ratingsdirect | |

October 16, 2024 6 |

Research Update: Gerdau S.A. Upgraded To ‘BBB’ From ‘BBB-’ On Sustained

Low Leverage And Conservative Financial Policies; Outlook Stable

However, we also analyze the T&C risks that reflect Gerdau’s

ability to satisfy its operating and financial needs in foreign currency, a risk that would stem from Brazil imposing capital controls.

Our T&C assessment of Brazil is ‘BBB-’, and the rating on Gerdau is currently capped at two notches above this level.

Under a hypothetical sovereign default scenario, we assume the following:

| - | Brazil’s GDP to contract 10%, affecting domestic volumes and

not allowing for price increases; |

| - | Higher inflation hurting selling, general, and administrative

expenses and other costs; |

| - | Doubling of foreign exchange rate, raising dollar-denominated

debt’s interest, costs, and principal (while also benefiting the company’s cash flows from U.S. operations and exports); |

| - | Increase of about 50% for floating debt, reaching historical

peaks and increasing Gerdau’s interest expense on its floating-rate debt; |

| - | Capex at maintenance levels, but with a larger portion (about

a third of total capex) in dollars; |

| - | Stressed working capital levels; |

| - | No dividend payments or share repurchases; and |

| - | Haircut of 10% over the company’s bank deposits and of 70% over

its short-term investments in the domestic currency and doubling our assumptions for its exposure to the U.S. dollar, given the real’s

depreciation. |

We view that in a scenario of T&C restrictions, Gerdau’s

available cash and cash generation outside Brazil and 25% of current exports from Brazil would be sufficient to cover the company’s short-term

debt and interest payments in hard currency due to its dollar-denominated cash and revolving credit facility, as well as its sizable U.S.

operations.

Issue Ratings--Subordination Risk Analysis

Capital structure

As of June 30, 2024, Gerdau’s capital structure mainly consisted of:

| - | R$8.1 billion in senior unsecured international bonds due 2027,

2030, and 2044; |

| - | R$2.2 billion in working capital lines and fixed-asset financing;

and |

| - | R$2.3 billion in senior unsecured debentures due 2026 and 2029. |

Gerdau’s debt is mostly senior unsecured debts guaranteed

or issued by the company. The subsidiaries’ debt represents close to 18% of total debt. We consider bonds as debt at the parent level,

given that Gerdau acts as their unconditional guarantor and they were issued by financial arms.

Analytical conclusions

We rate Gerdau’s senior unsecured debt at the same level

as our issuer credit rating because the company has limited secured debt. Even if the senior unsecured debt ranked behind the subsidiaries’

debt in the capital structure, we consider that the risk of subordination is mitigated by a priority debt ratio that is much lower than 50%.

| www.spglobal.com/ratingsdirect | |

October 16, 2024 7 |

Research Update: Gerdau S.A. Upgraded To ‘BBB’ From ‘BBB-’ On Sustained

Low Leverage And Conservative Financial Policies; Outlook Stable

Ratings Score Snapshot

| Issuer Credit Rating |

BBB/Stable/-- |

| Business risk: |

Satisfactory |

| Country risk |

Intermediate |

| Industry risk |

Moderately high |

| Competitive position |

Strong |

| Financial risk: |

Intermediate |

| Cash flow/leverage |

Intermediate |

| Anchor |

bbb |

| Modifiers: |

|

| Diversification/Portfolio effect |

Neutral (no impact) |

| Capital structure |

Neutral (no impact) |

| Financial policy |

Neutral (no impact) |

| Liquidity |

Strong (no impact) |

| Management and governance |

Neutral (no impact) |

| Comparable rating analysis |

Neutral (no impact) |

| Stand-alone credit profile: |

bbb |

Related Criteria

| - | Criteria | Corporates | General: Sector-Specific Corporate Methodology,

April 4, 2024 |

| - | Criteria | Corporates | General: Corporate Methodology, Jan.

7, 2024 |

| - | Criteria | Corporates | General: Methodology: Management And

Governance Credit Factors For Corporate Entities, Jan. 7, 2024 |

| - | General Criteria: National And Regional Scale Credit Ratings

Methodology, June 8, 2023 |

| - | General Criteria: Environmental, Social, And Governance Principles

In Credit Ratings, Oct. 10, 2021 |

| - | General Criteria: Group Rating Methodology, July 1, 2019 |

| - | Criteria | Corporates | General: Corporate Methodology: Ratios

And Adjustments, April 1, 2019 |

| - | Criteria | Corporates | General: Reflecting Subordination Risk

In Corporate Issue Ratings, March 28, 2018 |

| - | Criteria | Corporates | General: Methodology And Assumptions:

Liquidity Descriptors For Global Corporate Issuers, Dec. 16, 2014 |

| - | General Criteria: Methodology: Industry Risk, Nov. 19, 2013 |

| - | General Criteria: Country Risk Assessment Methodology And Assumptions,

Nov. 19, 2013 |

| - | General Criteria: Ratings Above The Sovereign--Corporate And

Government Ratings: |

| | Methodology And Assumptions, Nov. 19, 2013 |

| - | General Criteria: Principles Of Credit Ratings, Feb. 16, 2011 |

| www.spglobal.com/ratingsdirect | |

October 16, 2024 8 |

Research Update: Gerdau S.A. Upgraded To ‘BBB’ From ‘BBB-’ On Sustained

Low Leverage And Conservative Financial Policies; Outlook Stable

Ratings List

| Ratings Affirmed |

|

|

| Gerdau S.A. |

|

|

| Issuer Credit Rating |

|

|

| Brazil National Scale |

brAAA/Stable/-- |

|

| Gerdau S.A. |

|

|

| Senior Unsecured |

brAAA |

|

| Gerdau Holdings Inc. |

|

|

| Senior Unsecured |

BBB |

|

| Upgraded |

|

|

| |

To |

From |

| GTL Trade Finance Inc. |

|

|

| Senior Unsecured |

BBB |

BBB- |

| GUSAP III LP |

|

|

| Senior Unsecured |

BBB |

BBB- |

| Gerdau Ameristeel US Inc. |

|

|

| Senior Unsecured |

BBB |

BBB- |

| Gerdau Trade Inc. |

|

|

| Senior Unsecured |

BBB |

BBB- |

| Upgraded; CreditWatch/Outlook Action |

|

|

| |

To |

From |

| Gerdau S.A. |

|

|

| Gerdau Ameristeel Corp. |

|

|

| Issuer Credit Rating |

BBB/Stable/-- |

BBB-/Positive/-- |

Certain terms used in this report, particularly certain adjectives

used to express our view on rating relevant factors, have specific meanings ascribed to them in our criteria, and should therefore be

read in conjunction with such criteria. Please see Ratings Criteria at www.spglobal.com/ratings for further information. Complete ratings

information is available to RatingsDirect subscribers at www.capitaliq.com. All ratings affected by this rating action can be found on

S&P Global Ratings’ public website at www.spglobal.com/ratings.

| www.spglobal.com/ratingsdirect | |

October 16, 2024 9 |

Research Update: Gerdau S.A. Upgraded To ‘BBB’ From ‘BBB-’ On Sustained

Low Leverage And Conservative Financial Policies; Outlook Stable

Copyright © 2024 by Standard & Poor’s Financial Services

LLC. All rights reserved.

No content (including ratings, credit-related analyses and

data, valuations, model, software or other application or output therefrom) or any part thereof (Content) may be modified, reverse engineered,

reproduced or distributed in any form by any means, or stored in a database or retrieval system, without the prior written permission

of Standard & Poor’s Financial Services LLC or its affiliates (collectively, S&P). The Content shall not be used for any

unlawful or unauthorized purposes. S&P and any third-party providers, as well as their directors, officers, shareholders, employees

or agents (collectively S&P Parties) do not guarantee the accuracy, completeness, timeliness or availability of the Content. S&P

Parties are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, for the results obtained from

the use of the Content, or for the security or maintenance of any data input by the user. The Content is provided on an “as is”

basis. S&P PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY

OR FITNESS FOR A PARTICULAR PURPOSE OR USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT’S FUNCTIONING WILL BE

UNINTERRUPTED OR THAT THE CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no event shall S&P Parties be liable

to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses,

legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence)

in connection with any use of the Content even if advised of the possibility of such damages.

Credit-related and other analyses, including ratings, and statements

in the Content are statements of opinion as of the date they are expressed and not statements of fact. S&P’s opinions, analyses

and rating acknowledgment decisions (described below) are not recommendations to purchase, hold, or sell any securities or to make any

investment decisions, and do not address the suitability of any security. S&P assumes no obligation to update the Content following

publication in any form or format. The Content should not be relied on and is not a substitute for the skill, judgment and experience

of the user, its management, employees, advisors and/or clients when making investment and other business decisions. S&P does not

act as a fiduciary or an investment advisor except where registered as such. While S&P has obtained information from sources it believes

to be reliable, S&P does not perform an audit and undertakes no duty of due diligence or independent verification of any information

it receives. Rating-related publications may be published for a variety of reasons that are not necessarily dependent on action by rating

committees, including, but not limited to, the publication of a periodic update on a credit rating and related analyses.

To the extent that regulatory authorities allow a rating agency

to acknowledge in one jurisdiction a rating issued in another jurisdiction for certain regulatory purposes, S&P reserves the right

to assign, withdraw or suspend such acknowledgment at any time and in its sole discretion. S&P Parties disclaim any duty whatsoever

arising out of the assignment, withdrawal or suspension of an acknowledgment as well as any liability for any damage alleged to have been

suffered on account thereof.

S&P keeps certain activities of its

business units separate from each other in order to preserve the independence and objectivity of their respective activities. As a result,

certain business units of S&P may have information that is not available to other S&P business units. S&P has established

policies and procedures to maintain the confidentiality of certain non-public information received in connection with each analytical

process.

S&P may receive compensation for its ratings and certain analyses,

normally from issuers or underwriters of securities or from obligors. S&P reserves the right to disseminate its opinions and analyses.

S&P’s public ratings and analyses are made available on its Web sites, www.spglobal.com/ratings (free of charge), and www.ratingsdirect.com

(subscription), and may be distributed through other means, including via S&P publications and third-party redistributors. Additional

information about our ratings fees is available at www.spglobal.com/usratingsfees.

STANDARD & POOR’S, S&P and RATINGSDIRECT are registered

trademarks of Standard & Poor’s Financial Services LLC.

| www.spglobal.com/ratingsdirect | |

October 16, 2024 10 |

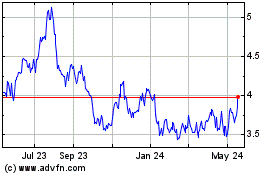

Gerdau (NYSE:GGB)

Historical Stock Chart

From Oct 2024 to Nov 2024

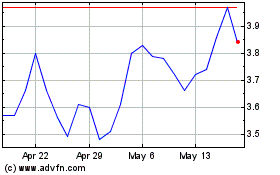

Gerdau (NYSE:GGB)

Historical Stock Chart

From Nov 2023 to Nov 2024