GasLog Partners LP Announces Proxy Advisory Firms Institutional Shareholder Services Inc. and Glass, Lewis & Co. Recommend Common Unitholders Vote “FOR” Proposed Transaction

29 June 2023 - 6:30AM

GasLog Partners LP (“GasLog Partners” or the

“Partnership”) (NYSE: GLOP), an international owner,

operator and acquirer of liquefied natural gas (“LNG”) carriers,

today announced that proxy advisory firms Institutional

Shareholders Services Inc. and Glass, Lewis & Co. issued

reports on June 27, 2023, recommending that the Partnership’s

common unitholders vote “FOR” the previously

announced merger pursuant to which GasLog Ltd. (“GasLog”) will

acquire all of the outstanding common units of the Partnership not

beneficially owned by GasLog (the “Transaction”), such vote to be

held at the Partnership’s upcoming special meeting of common

unitholders (the “Special Meeting”) scheduled to take place on July

7, 2023, at 10:00 a.m. Eastern Time. If the merger is approved,

each common unit will be entitled to receive overall consideration

of $8.65 in cash, consisting in part of a special distribution by

the Partnership of $3.28 per common unit in cash that will be

distributed to the Partnership’s common unitholders in connection

with the closing of the Transaction and the remainder to be paid by

GasLog as merger consideration at the closing of the

Transaction.

The Special Meeting will be held virtually via webcast at

www.virtualshareholdermeeting.com/GLOP2023SM. The Partnership’s

Board of Directors (acting upon the recommendation of

the Conflicts Committee of the Board of Directors) recommends

that the Partnership’s common unitholders vote

“FOR” the Transaction.

Your vote is important. Please submit your proxy by

telephone or electronically through the Internet before 11:59 p.m.

Eastern Time on July 6, 2023 (or, in the event of an adjournment of

the Special Meeting, such later date and time as may be determined

by the Partnership’s Board of

Directors).

If you need assistance with voting procedures or have questions

regarding the Special Meeting, please contact D.F. King toll-free

at (866) 342-4883 (banks and brokers call collect at

(212) 269-5550).

Forward-Looking Statements

All statements in this press release that are not statements of

historical fact are “forward-looking statements” within the meaning

of the U.S. Private Securities Litigation Reform Act of 1995.

Forward-looking statements include statements that address

activities, events or developments, such as the closing of the

Transaction, that the Partnership expects, projects, believes or

anticipates will or may occur in the future, particularly in

relation to our operations, cash flows, financial position,

liquidity and cash available for dividends or distributions, plans,

strategies, business prospects and changes and trends in our

business and the markets in which we operate. We caution that these

forward-looking statements represent our estimates and assumptions

only as of the date of this press release, about factors that are

beyond our ability to control or predict, and are not intended to

give any assurance as to future results. Any of these factors or a

combination of these factors including the closing of this

Transaction could materially affect future results of operations

and the ultimate accuracy of the forward-looking statements. Other

factors that might cause future results and outcomes to differ

include, but are not limited to, the other risks and uncertainties

described in the Partnership’s Annual Report on Form 20-F filed

with the SEC on March 6, 2023, available

at http://www.sec.gov. Accordingly, you should not unduly rely

on any forward-looking statements.

We undertake no obligation to update or revise any

forward-looking statements contained in this press release, whether

as a result of new information, future events, a change in our

views or expectations or otherwise, except as required by

applicable law. New factors emerge from time to time, and it is not

possible for us to predict all of these factors. Further, we cannot

assess the impact of each such factor on our business or the extent

to which any factor, or combination of factors, may cause actual

results to be materially different from those contained in any

forward-looking statement.

Contacts:

GasLog PartnersRobert BrinbergRose &

CompanyPhone: +1 212-517-0810Email: gaslog@roseandco.com

About GasLog Partners

GasLog Partners is an owner, operator and acquirer of LNG

carriers. The Partnership’s fleet consists of eleven wholly-owned

LNG carriers as well as three vessels on bareboat charters, with an

average carrying capacity of approximately 159,000 cbm. GasLog

Partners is a publicly traded master limited partnership (NYSE:

GLOP) but has elected to be treated as a C corporation for U.S.

income tax purposes and therefore its investors receive an Internal

Revenue Service Form 1099 with respect to any distributions

declared and received. Visit GasLog Partners’ website

at http://www.gaslogmlp.com.

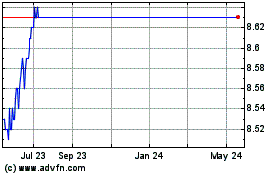

Gaslog Partners (NYSE:GLOP)

Historical Stock Chart

From Dec 2024 to Jan 2025

Gaslog Partners (NYSE:GLOP)

Historical Stock Chart

From Jan 2024 to Jan 2025