J. Crew Sales Fall as Slump Continues

01 September 2016 - 9:00AM

Dow Jones News

J. Crew Group Inc.'s two-year slump showed no signs of improving

in the latest quarter, as sales fell 4% and the apparel chain

struggled to regain customers.

Chairman and CEO Mickey Drexler cited a "difficult traffic

environment" and said the company is focused on new merchandising,

marketing and supply-chain initiatives. This week he also announced

plans to start selling J. Crew merchandise in 16 Nordstrom Inc.

department stores.

Sales at stores open at least a year declined 8% in fiscal

second quarter ended July 30, following a decrease of 11% in the

same period a year earlier. Rival Gap Inc.'s Banana Republic brand

posted a 9% decline in the same period this year.

As in previous quarters, the Madewell brand posted stronger

results than the namesake brand. Same-store sales decreased 9% at

J. Crew, while that metric increased 3% at Madewell. The company's

net loss narrowed to $8.6 million, compared with $13.6 million a

year ago.

J. Crew, which was taken private in 2011 and has about $2

billion in debt, has struggled to win back shoppers after a number

of style, sizing and quality missteps alienated its customer base.

Like many teen retailers, J. Crew also faces declining foot traffic

and fierce competition from fast-fashion players.

On Monday, the company said Nordstrom will be selling an edited

assortment of merchandise from its namesake brand in 16 locations

and on its website beginning Sept. 12. The department store has

been selling product from Madewell since last year.

Unlike some chains that have been shrinking their footprint, J.

Crew plans to open 36 new stores this year, including 3 J. Crew

retail locations, 23 factory stores and 10 Madewell locations.

Write to Khadeeja Safdar at khadeeja.safdar@wsj.com

(END) Dow Jones Newswires

August 31, 2016 18:45 ET (22:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

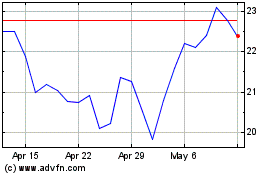

Gap (NYSE:GPS)

Historical Stock Chart

From Apr 2024 to May 2024

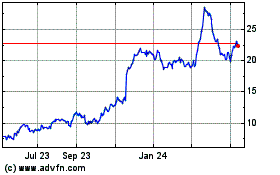

Gap (NYSE:GPS)

Historical Stock Chart

From May 2023 to May 2024