Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

25 January 2025 - 8:49AM

Edgar (US Regulatory)

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2024

(Unaudited)

Voya

Asia

Pacific

High

Dividend

Equity

Income

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK

:

97.4%

Australia

:

15.7%

21,633

Ampol

Ltd.

$

411,158

0.5

55,060

ANZ

Group

Holdings

Ltd.

1,122,203

1.4

17,273

Aristocrat

Leisure

Ltd.

765,995

1.0

8,052

ASX

Ltd.

347,677

0.4

29,614

BHP

Group

Ltd.

-

Class

DI

780,900

1.0

9,720

CAR

Group

Ltd.

264,184

0.3

3,249

Cochlear

Ltd.

646,940

0.8

35,850

Coles

Group

Ltd.

435,383

0.6

5,048

Commonwealth

Bank

of

Australia

524,056

0.7

20,415

Computershare

Ltd.

425,351

0.5

2,994

CSL

Ltd.

551,982

0.7

130,020

Endeavour

Group

Ltd./

Australia

371,598

0.5

31,284

Fortescue

Metals

Group

Ltd.

387,841

0.5

163,617

GPT

Group

508,895

0.6

48,473

Insurance

Australia

Group

Ltd.

270,195

0.3

78,249

Medibank

Pvt

Ltd.

195,418

0.2

29,532

National

Australia

Bank

Ltd.

755,965

1.0

52,435

QBE

Insurance

Group

Ltd.

685,039

0.9

7,143

Rio

Tinto

Ltd.

552,917

0.7

250,760

Scentre

Group

603,261

0.8

33,921

South32

Ltd.

-

Class

DI

82,323

0.1

237,719

Telstra

Group

Ltd.

612,179

0.8

71,934

Transurban

Group

602,250

0.8

207,899

Vicinity

Ltd.

293,509

0.4

4,102

Wesfarmers

Ltd.

192,811

0.2

12,390,030

15.7

China

:

22.8%

19,800

37

Interactive

Entertainment

Network

Technology

Group

Co.

Ltd.

-

Class

A

46,458

0.1

24,000

AAC

Technologies

Holdings,

Inc.

108,483

0.1

125,500

Alibaba

Group

Holding

Ltd.

1,370,617

1.7

4,400

Autohome,

Inc.,

ADR

121,044

0.2

42,000

Bank

of

Chengdu

Co.

Ltd.

-

Class

A

92,776

0.1

1,067,000

Bank

of

China

Ltd.

-

Class

H

497,506

0.6

112,400

Bank

of

Jiangsu

Co.

Ltd.

-

Class

A

141,073

0.2

46,000

Bank

of

Nanjing

Co.

Ltd.

-

Class

A

67,316

0.1

215,300

BOE

Technology

Group

Co.

Ltd.

-

Class

A

128,502

0.2

7,000

BYD

Co.

Ltd.

-

Class

H

230,895

0.3

472,000

China

CITIC

Bank

Corp.

Ltd.

-

Class

H

301,580

0.4

676,000

China

Communications

Services

Corp.

Ltd.

-

Class

H

356,258

0.4

1,045,960

China

Construction

Bank

Corp.

-

Class

H

790,808

1.0

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

China

(continued)

28,500

China

Hongqiao

Group

Ltd.

$

41,857

0.0

108,500

China

Minsheng

Banking

Corp.

Ltd.

-

Class

H

42,339

0.1

254,000

China

Oilfield

Services

Ltd.

-

Class

H

219,946

0.3

69,116

China

Railway

Signal

&

Communication

Corp.

Ltd.

-

Class

A

61,065

0.1

13,600

(1)

China

Resources

Mixc

Lifestyle

Services

Ltd.

51,573

0.1

87,500

(1)

China

Resources

Pharmaceutical

Group

Ltd.

59,159

0.1

2,002,000

(1)

China

Tower

Corp.

Ltd.

-

Class

H

263,433

0.3

86,500

China

XD

Electric

Co.

Ltd.

-

Class

A

90,715

0.1

32,300

China

Yangtze

Power

Co.

Ltd.

-

Class

A

122,001

0.2

261,000

CMOC

Group

Ltd.

-

Class

H

195,575

0.2

39,500

Dong-E-E-Jiao

Co.

Ltd.

-

Class

A

318,250

0.4

149,500

Fosun

International

Ltd.

81,301

0.1

5,800

(1)

Giant

Biogene

Holding

Co.

Ltd.

37,471

0.0

205,500

Great

Wall

Motor

Co.

Ltd.

-

Class

H

332,851

0.4

78,500

GRG

Banking

Equipment

Co.

Ltd.

-

Class

A

142,356

0.2

61,000

Hisense

Home

Appliances

Group

Co.

Ltd.

-

Class

H

172,986

0.2

52,600

(1)

Huatai

Securities

Co.

Ltd.

-

Class

H

90,977

0.1

8,900

Hubei

Jumpcan

Pharmaceutical

Co.

Ltd.

-

Class

A

36,873

0.0

347,414

Industrial

&

Commercial

Bank

of

China

Ltd.

-

Class

H

204,836

0.3

285,900

Inner

Mongolia

Yuan

Xing

Energy

Co.

Ltd.

-

Class

A

231,611

0.3

23,704

JD.com,

Inc.

-

Class

A

443,099

0.6

98,000

Jiangsu

Expressway

Co.

Ltd.

-

Class

H

99,583

0.1

89,000

Kingsoft

Corp.

Ltd.

362,004

0.5

256,000

Lenovo

Group

Ltd.

302,931

0.4

8,400

Livzon

Pharmaceutical

Group,

Inc.

-

Class

A

44,524

0.1

7,200

Livzon

Pharmaceutical

Group,

Inc.

-

Class

A

38,163

0.0

43,330

(1)(2)

Meituan

-

Class

B

913,972

1.2

35,200

MINISO

Group

Holding

Ltd.

176,053

0.2

20,200

NetEase,

Inc.

351,668

0.4

756,000

People's

Insurance

Co.

Group

of

China

Ltd.

-

Class

H

361,869

0.5

174,000

PetroChina

Co.

Ltd.

-

Class

H

123,888

0.2

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2024

(Unaudited)

(continued)

Voya

Asia

Pacific

High

Dividend

Equity

Income

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

China

(continued)

268,000

PICC

Property

&

Casualty

Co.

Ltd.

-

Class

H

$

406,906

0.5

107,500

Ping

An

Insurance

Group

Co.

of

China

Ltd.

-

Class

H

625,197

0.8

9,600

(1)

Pop

Mart

International

Group

Ltd.

111,440

0.1

3,370

Qifu

Technology,

Inc.,

ADR

128,431

0.2

139,230

Shanghai

Baosight

Software

Co.

Ltd.

-

Class

B

231,350

0.3

142,800

Shanghai

Pharmaceuticals

Holding

Co.

Ltd.

-

Class

H

238,612

0.3

17,200

Shenzhen

YUTO

Packaging

Technology

Co.

Ltd.

-

Class

A

58,456

0.1

6,700

Sieyuan

Electric

Co.

Ltd.

-

Class

A

72,150

0.1

7,000

Silergy

Corp.

91,666

0.1

89,700

Sinoma

International

Engineering

Co.

-

Class

A

129,895

0.2

24,800

Sinopharm

Group

Co.

Ltd.

-

Class

H

65,008

0.1

35,500

Sinotruk

Hong

Kong

Ltd.

98,332

0.1

68,300

Tencent

Holdings

Ltd.

3,527,235

4.5

5,649

Tencent

Music

Entertainment

Group,

ADR

64,455

0.1

39,300

Tianqi

Lithium

Corp.

-

Class

A

208,512

0.3

310,000

(1)

Topsports

International

Holdings

Ltd.

97,759

0.1

4,545

Vipshop

Holdings

Ltd.,

ADR

62,766

0.1

166,000

Weichai

Power

Co.

Ltd.

-

Class

H

230,185

0.3

82,200

Western

Mining

Co.

Ltd.

-

Class

A

192,943

0.2

123,400

(1)(2)

Xiaomi

Corp.

-

Class

B

444,126

0.6

33,100

Yutong

Bus

Co.

Ltd.

-

Class

A

100,330

0.1

30,600

Zhejiang

Chint

Electrics

Co.

Ltd.

-

Class

A

96,470

0.1

67,900

Zhejiang

Longsheng

Group

Co.

Ltd.

-

Class

A

95,505

0.1

12,300

Zhejiang

NHU

Co.

Ltd.

-

Class

A

37,094

0.0

51,100

Zhuzhou

CRRC

Times

Electric

Co.

Ltd.

-

Class

H

181,446

0.2

46,000

ZTE

Corp.

-

Class

H

112,403

0.1

17,976,917

22.8

Hong

Kong

:

5.9%

28,574

AIA

Group

Ltd.

215,151

0.3

23,500

Beijing

Enterprises

Holdings

Ltd.

74,088

0.1

196,500

BOC

Hong

Kong

Holdings

Ltd.

606,301

0.8

622,000

Bosideng

International

Holdings

Ltd.

324,782

0.4

72,800

China

Gas

Holdings

Ltd.

60,482

0.1

124,000

China

Merchants

Port

Holdings

Co.

Ltd.

196,649

0.2

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

Hong

Kong

(continued)

78,500

China

Overseas

Land

&

Investment

Ltd.

$

135,638

0.2

132,500

CK

Asset

Holdings

Ltd.

543,597

0.7

96,500

CK

Hutchison

Holdings

Ltd.

504,647

0.6

498,000

Far

East

Horizon

Ltd.

336,054

0.4

76,000

Guangdong

Investment

Ltd.

47,786

0.1

1,800

Hong

Kong

Exchanges

&

Clearing

Ltd.

67,763

0.1

3,300

Jardine

Matheson

Holdings

Ltd.

144,078

0.2

39,000

Link

REIT

170,592

0.2

55,000

Power

Assets

Holdings

Ltd.

361,535

0.4

462,000

Sino

Biopharmaceutical

Ltd.

194,648

0.2

31,000

Swire

Pacific

Ltd.

-

Class

A

255,251

0.3

580,000

(1)

WH

Group

Ltd.

462,351

0.6

4,701,393

5.9

India

:

17.3%

1,792

ABB

India

Ltd.

157,777

0.2

9,096

Adani

Ports

&

Special

Economic

Zone

Ltd.

128,566

0.2

18,304

Aurobindo

Pharma

Ltd.

274,204

0.3

52,486

Axis

Bank

Ltd.

707,963

0.9

36,327

Bank

of

Baroda

106,229

0.1

105,862

Bharat

Electronics

Ltd.

387,283

0.5

6,072

Bharti

Airtel

Ltd.

117,249

0.1

5,082

Cipla

Ltd./India

92,407

0.1

7,751

Colgate-Palmolive

India

Ltd.

265,468

0.3

16,266

DLF

Ltd.

158,978

0.2

10,733

Havells

India

Ltd.

218,596

0.3

26,636

HCL

Technologies

Ltd.

584,388

0.7

6,557

(1)

HDFC

Asset

Management

Co.

Ltd.

327,036

0.4

4,298

HDFC

Bank

Ltd.

91,718

0.1

700

Hero

MotoCorp

Ltd.

39,536

0.1

36,718

Hindalco

Industries

Ltd.

285,994

0.4

84,329

ICICI

Bank

Ltd.

1,297,460

1.6

67,689

Indian

Oil

Corp.

Ltd.

111,519

0.1

18,180

Infosys

Ltd.

400,954

0.5

28,144

ITC

Ltd.

159,135

0.2

12,512

Kotak

Mahindra

Bank

Ltd.

262,135

0.3

16,817

Larsen

&

Toubro

Ltd.

742,992

0.9

11,776

Lupin

Ltd.

286,137

0.4

1,889

Maruti

Suzuki

India

Ltd.

248,172

0.3

156,565

NMDC

Ltd.

428,161

0.5

145,149

Oil

&

Natural

Gas

Corp.

Ltd.

442,289

0.6

725

PI

Industries

Ltd.

34,939

0.0

2,380

Pidilite

Industries

Ltd.

86,365

0.1

61,441

Power

Finance

Corp.

Ltd.

360,845

0.5

157,464

Power

Grid

Corp.

of

India

Ltd.

614,775

0.8

65,345

REC

Ltd.

412,991

0.5

23,660

Reliance

Industries

Ltd.

363,059

0.5

15,068

Shriram

Finance

Ltd.

539,301

0.7

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2024

(Unaudited)

(continued)

Voya

Asia

Pacific

High

Dividend

Equity

Income

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

India

(continued)

6,167

Sun

Pharmaceutical

Industries

Ltd.

$

130,168

0.2

719

Supreme

Industries

Ltd.

39,625

0.1

18,566

Tata

Consultancy

Services

Ltd.

940,404

1.2

267,264

Tata

Steel

Ltd.

458,627

0.6

20,210

Tech

Mahindra

Ltd.

410,639

0.5

12,055

Torrent

Pharmaceuticals

Ltd.

474,971

0.6

96,244

Vedanta

Ltd.

517,904

0.7

13,706,959

17.3

Indonesia

:

0.6%

538,300

Bank

Central

Asia

Tbk

PT

339,728

0.4

261,500

Indah

Kiat

Pulp

&

Paper

Tbk

PT

119,787

0.2

459,515

0.6

Ireland

:

0.8%

6,565

(2)

PDD

Holdings,

Inc.,

ADR

633,916

0.8

Malaysia

:

2.2%

307,600

AMMB

Holdings

Bhd

373,032

0.5

175,000

Axiata

Group

Bhd

92,222

0.1

34,500

CIMB

Group

Holdings

Bhd

64,028

0.1

238,600

Genting

Bhd

200,927

0.2

604,700

Genting

Malaysia

Bhd

294,059

0.4

34,600

Hong

Leong

Bank

Bhd

161,065

0.2

107,400

Malayan

Banking

Bhd

246,449

0.3

127,400

Public

Bank

Bhd

128,177

0.2

72,300

Sime

Darby

Bhd

37,121

0.0

180,700

YTL

Power

International

Bhd

138,570

0.2

1,735,650

2.2

Philippines

:

0.4%

17,030

International

Container

Terminal

Services,

Inc.

107,463

0.2

137,120

Metropolitan

Bank

&

Trust

Co.

178,457

0.2

285,920

0.4

Singapore

:

3.5%

44,100

(1)

BOC

Aviation

Ltd.

340,953

0.4

219,000

CapitaLand

Ascendas

REIT

428,562

0.5

25,000

DBS

Group

Holdings

Ltd.

793,296

1.0

300,100

Genting

Singapore

Ltd.

171,481

0.2

9,000

Oversea-Chinese

Banking

Corp.

Ltd.

109,392

0.1

91,900

Sembcorp

Industries

Ltd.

358,471

0.5

62,900

Singapore

Exchange

Ltd.

597,131

0.8

2,799,286

3.5

South

Korea

:

9.8%

816

CJ

CheilJedang

Corp.

154,730

0.2

4,022

DB

Insurance

Co.

Ltd.

315,548

0.4

3,143

GS

Holdings

Corp.

94,602

0.1

5,904

Hankook

Tire

&

Technology

Co.

Ltd.

160,021

0.2

200

Hanmi

Pharm

Co.

Ltd.

39,195

0.0

6,009

HD

Hyundai

Co.

Ltd.

336,084

0.4

373

HD

Hyundai

Electric

Co.

Ltd.

94,774

0.1

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

South

Korea

(continued)

2,077

(2)

HD

Korea

Shipbuilding

&

Offshore

Engineering

Co.

Ltd.

$

305,921

0.4

1,126

Hyundai

Mobis

Co.

Ltd.

193,901

0.2

10,165

Hyundai

Steel

Co.

153,203

0.2

6,274

KB

Financial

Group,

Inc.

433,314

0.5

5,991

Kia

Corp.

401,175

0.5

5,902

Korea

Investment

Holdings

Co.

Ltd.

317,115

0.4

1,167

Kumho

Petrochemical

Co.

Ltd.

82,971

0.1

1,108

LG

Chem

Ltd.

226,690

0.3

1,569

LG

Electronics,

Inc.

101,415

0.1

602

LG

H&H

Co.

Ltd.

134,561

0.2

1,355

Lotte

Chemical

Corp.

62,876

0.1

10,653

Mirae

Asset

Securities

Co.

Ltd.

65,572

0.1

38,615

NH

Investment

&

Securities

Co.

Ltd.

370,152

0.5

51,372

Samsung

Electronics

Co.

Ltd.

2,020,113

2.6

1,262

Samsung

Fire

&

Marine

Insurance

Co.

Ltd.

357,042

0.5

410

Samsung

SDS

Co.

Ltd.

43,305

0.1

7,379

Shinhan

Financial

Group

Co.

Ltd.

282,742

0.4

4,015

SK

Hynix,

Inc.

468,765

0.6

4,337

SK

Telecom

Co.

Ltd.

190,929

0.2

2,365

SK,

Inc.

232,333

0.3

8,490

Woori

Financial

Group,

Inc.

101,938

0.1

7,740,987

9.8

Taiwan

:

17.0%

44,000

ASE

Technology

Holding

Co.

Ltd.

209,040

0.3

253,000

Compal

Electronics,

Inc.

288,577

0.4

40,000

Delta

Electronics,

Inc.

474,237

0.6

44,000

Evergreen

Marine

Corp.

Taiwan

Ltd.

295,609

0.4

126,000

Far

Eastern

New

Century

Corp.

130,190

0.2

7,000

Fortune

Electric

Co.

Ltd.

119,386

0.1

161,000

Hon

Hai

Precision

Industry

Co.

Ltd.

980,440

1.2

57,000

Inventec

Corp.

86,879

0.1

20,000

MediaTek,

Inc.

785,285

1.0

28,000

Micro-Star

International

Co.

Ltd.

148,418

0.2

21,000

President

Chain

Store

Corp.

175,026

0.2

9,000

Quanta

Computer,

Inc.

81,819

0.1

25,000

Realtek

Semiconductor

Corp.

369,377

0.5

247,627

Taiwan

Semiconductor

Manufacturing

Co.

Ltd.

7,716,195

9.8

77,000

Uni-President

Enterprises

Corp.

201,066

0.2

207,000

United

Microelectronics

Corp.

280,832

0.4

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2024

(Unaudited)

(continued)

Voya

Asia

Pacific

High

Dividend

Equity

Income

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

Taiwan

(continued)

1,000

Voltronic

Power

Technology

Corp.

$

56,987

0.1

376,000

(2)

Winbond

Electronics

Corp.

187,099

0.2

49,000

Wistron

Corp.

172,981

0.2

2,000

Wiwynn

Corp.

120,686

0.1

134,000

Yang

Ming

Marine

Transport

Corp.

303,682

0.4

63,000

Zhen

Ding

Technology

Holding

Ltd.

224,129

0.3

13,407,940

17.0

Thailand

:

1.4%

10,600

Bumrungrad

Hospital

PCL

64,436

0.1

73,400

Kasikornbank

PCL

322,489

0.4

229,800

Krung

Thai

Bank

PCL

134,296

0.2

62,500

PTT

Exploration

&

Production

PCL

232,840

0.3

106,300

SCB

X

PCL

354,876

0.4

1,108,937

1.4

Total

Common

Stock

(Cost

$65,369,968)

76,947,450

97.4

EXCHANGE-TRADED

FUNDS

:

2.5%

26,177

iShares

MSCI

All

Country

Asia

ex

Japan

ETF

1,942,333

2.5

Total

Exchange-Traded

Funds

(Cost

$1,980,244)

1,942,333

2.5

Total

Long-Term

Investments

(Cost

$67,350,212)

78,889,783

99.9

SHORT-TERM

INVESTMENTS

:

0.7%

Mutual

Funds

:

0.7%

569,000

(3)

BlackRock

Liquidity

Funds,

FedFund,

Institutional

Class,

4.530%

(Cost

$569,000)

$

569,000

0.7

Total

Short-Term

Investments

(Cost

$569,000)

569,000

0.7

Total

Investments

in

Securities

(Cost

$67,919,212)

$

79,458,783

100.6

Liabilities

in

Excess

of

Other

Assets

(466,030)

(0.6)

Net

Assets

$

78,992,753

100.0

ADR

American

Depositary

Receipt

(1)

Securities

with

purchases

pursuant

to

Rule

144A

or

section

4(a)(2),

under

the

Securities

Act

of

1933

and

may

not

be

resold

subject

to

that

rule

except

to

qualified

institutional

buyers.

(2)

Non-income

producing

security.

(3)

Rate

shown

is

the

7-day

yield

as

of

November

30,

2024.

Sector

Diversification

Percentage

of

Net

Assets

Financials

24.1

%

Information

Technology

23.6

Consumer

Discretionary

9.7

Industrials

9.1

Communication

Services

7.6

Materials

6.7

Health

Care

4.5

Real

Estate

4.0

Consumer

Staples

3.0

Energy

2.8

Exchange-Traded

Funds

2.5

Utilities

2.3

Short-Term

Investments

0.7

Liabilities

in

Excess

of

Other

Assets

(0.6)

Net

Assets

100.0%

Portfolio

holdings

are

subject

to

change

daily.

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2024

(Unaudited)

(continued)

Voya

Asia

Pacific

High

Dividend

Equity

Income

Fund

Fair

Value

Measurements

The

following

is

a

summary

of

the

fair

valuations

according

to

the

inputs

used

as

of

November

30,

2024

in

valuing

the

assets

and

liabilities:

Quoted

Prices

in

Active

Markets

for

Identical

Investments

(Level

1)

Significant

Other

Observable

Inputs

#

(Level

2)

Significant

Unobservable

Inputs

(Level

3)

Fair

Value

at

November

30,

2024

Asset

Table

Investments,

at

fair

value

Common

Stock

Australia

$

—

$

12,390,030

$

—

$

12,390,030

China

907,791

17,069,126

—

17,976,917

Hong

Kong

480,132

4,221,261

—

4,701,393

India

86,365

13,620,594

—

13,706,959

Indonesia

339,728

119,787

—

459,515

Ireland

633,916

—

—

633,916

Malaysia

—

1,735,650

—

1,735,650

Philippines

107,463

178,457

—

285,920

Singapore

340,953

2,458,333

—

2,799,286

South

Korea

—

7,740,987

—

7,740,987

Taiwan

—

13,407,940

—

13,407,940

Thailand

354,876

754,061

—

1,108,937

Total

Common

Stock

3,251,224

73,696,226

—

76,947,450

Exchange-Traded

Funds

1,942,333

—

—

1,942,333

Short-Term

Investments

569,000

—

—

569,000

Total

Investments,

at

fair

value

$

5,762,557

$

73,696,226

$

—

$

79,458,783

Liabilities

Table

Other

Financial

Instruments+

Written

Options

$

—

$

(242,460)

$

—

$

(242,460)

Total

Liabilities

$

—

$

(242,460)

$

—

$

(242,460)

#

The

earlier

close

of

the

foreign

markets

gives

rise

to

the

possibility

that

significant

events,

including

broad

market

moves,

may

have

occurred

in

the

interim

and

may

materially

affect

the

value

of

those

securities.

To

account

for

this,

the

Fund

may

frequently

value

many

of

its

foreign

equity

securities

using

fair

value

prices

based

on

third

party

vendor

modeling

tools

to

the

extent

available.

Accordingly,

a

portion

of

the

Fund’s

investments

are

categorized

as

Level

2

investments.

+

Other

Financial

Instruments

may

include

open

forward

foreign

currency

contracts,

futures,

centrally

cleared

swaps,

OTC

swaps

and

written

options.

Forward

foreign

currency

contracts,

futures

and

centrally

cleared

swaps

are

fair

valued

at

the

unrealized

appreciation

(depreciation)

on

the

instrument.

OTC

swaps

and

written

options

are

valued

at

the

fair

value

of

the

instrument.

At

November

30,

2024,

the

following

OTC

written

equity

options

were

outstanding

for

Voya

Asia

Pacific

High

Dividend

Equity

Income

Fund:

Description

Counterparty

Put/

Call

Expiration

Date

Exercise

Price

Number

of

Contracts

Notional

Amount

Premiums

Received

Fair

Value

iShares

MSCI

Australia

ETF

Royal

Bank

of

Canada

Call

12/20/24

USD

25.570

62,573

USD

1,653,804

$

21,600

$

(45,543)

iShares

MSCI

Emerging

Markets

ETF

Royal

Bank

of

Canada

Call

12/20/24

USD

42.950

416,764

USD

18,029,211

275,648

(196,917)

$

297,248

$

(242,460)

Currency

Abbreviations:

USD

—

United

States

Dollar

Net

unrealized

appreciation

consisted

of:

Gross

Unrealized

Appreciation

$

16,321,124

Gross

Unrealized

Depreciation

(4,781,553)

Net

Unrealized

Appreciation

$

11,539,571

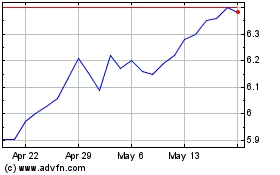

Voya Asia Pacific High D... (NYSE:IAE)

Historical Stock Chart

From Jan 2025 to Feb 2025

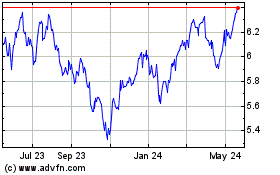

Voya Asia Pacific High D... (NYSE:IAE)

Historical Stock Chart

From Feb 2024 to Feb 2025