Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

27 November 2024 - 3:11AM

Edgar (US Regulatory)

Portfolio

of

Investments

September

30,

2024

JRI

(Unaudited)

SHARES

DESCRIPTION

VALUE

LONG-TERM

INVESTMENTS

-

136.1%

(98.8%

of

Total

Investments)

136292469

COMMON

STOCKS

-

34.2%

(24.8%

of

Total

Investments)

136292469

ENERGY

-

10.9%

233,832

Enbridge

Inc

$

9,495,917

397,599

Energy

Transfer

LP

6,381,464

102,844

Enterprise

Products

Partners

LP

2,993,789

170,367

Gibson

Energy

Inc

2,797,775

33,524

Keyera

Corp

1,045,293

115,932

Kinder

Morgan

Inc

2,560,938

82,698

MPLX

LP

3,676,753

41,063

ONEOK

Inc

3,742,071

145,713

Pembina

Pipeline

Corp

6,006,507

30,332

Plains

All

American

Pipeline

LP

526,867

28,376

Plains

GP

Holdings

LP,

Class

A

524,956

13,175

TC

Energy

Corp

626,286

64,112

Williams

Cos

Inc/The

2,926,713

TOTAL

ENERGY

43,305,329

HEALTH

CARE

EQUIPMENT

&

SERVICES

-

1.3%

261,572

Chartwell

Retirement

Residences

3,013,266

181,659

Sienna

Senior

Living

Inc

2,256,550

TOTAL

HEALTH

CARE

EQUIPMENT

&

SERVICES

5,269,816

REAL

ESTATE

MANAGEMENT

&

DEVELOPMENT

-

1.5%

664,828

Capitaland

India

Trust

599,462

71,124

Cibus

Nordic

Real

Estate

AB

publ

1,234,481

210,575

Hysan

Development

Co

Ltd

362,345

2,091,540

Sino

Land

Co

Ltd

2,284,146

2,356

Sun

Hung

Kai

Properties

Ltd

25,527

769,534

Swire

Properties

Ltd

1,565,377

TOTAL

REAL

ESTATE

MANAGEMENT

&

DEVELOPMENT

6,071,338

TELECOMMUNICATION

SERVICES

-

1.1%

394,010

HKT

Trust

&

HKT

Ltd

503,601

175,029

Infrastrutture

Wireless

Italiane

SpA

2,152,754

2,286,696

NETLINK

NBN

TRUST

1,627,953

TOTAL

TELECOMMUNICATION

SERVICES

4,284,308

TRANSPORTATION

-

3.8%

12,754

Aena

SME

SA

2,801,741

741,469

Atlas

Arteria

Ltd

2,498,665

443,710

Aurizon

Holdings

Ltd

1,079,451

389,829

China

Merchants

Port

Holdings

Co

Ltd

617,697

522,363

Dalrymple

Bay

Infrastructure

Ltd

1,165,186

325,910

Enav

SpA

1,446,084

23,378

Grupo

Aeroportuario

del

Centro

Norte

SAB

de

CV,

ADR

1,585,496

9,488

Grupo

Aeroportuario

del

Pacifico

SAB

de

CV,

ADR

1,651,102

256,461

Transurban

Group

2,317,146

TOTAL

TRANSPORTATION

15,162,568

UTILITIES

-

15.6%

198,102

APA

Group

1,060,189

121,964

CK

Infrastructure

Holdings

Ltd

829,713

64,712

Clearway

Energy

Inc,

Class

A

1,842,351

234,082

CLP

Holdings

Ltd

2,046,441

213,512

Contact

Energy

Ltd

1,108,213

75,570

Dominion

Energy

Inc

4,367,190

30,501

Duke

Energy

Corp

3,516,765

66,415

Endesa

SA

1,450,955

818,478

Enel

SpA

6,537,836

118,157

Engie

SA

2,043,193

184,335

ENN

Energy

Holdings

Ltd

1,384,755

28,497

Entergy

Corp

3,750,490

114,703

Evergy

Inc

7,112,733

27,576

Exelon

Corp

1,118,207

203,311

Iberdrola

SA

3,143,010

Portfolio

of

Investments

September

30,

2024

(continued)

JRI

SHARES

DESCRIPTION

VALUE

UTILITIES

(continued)

116,609

Italgas

SpA

$

704,910

4,737,378

Keppel

Infrastructure

Trust

1,715,393

120,453

National

Grid

PLC

1,665,022

87,870

National

Grid

PLC,

Sponsored

ADR

6,121,903

1,767

Northwestern

Energy

Group

Inc

101,108

22,793

OGE

Energy

Corp

934,969

46,163

Pennon

Group

PLC

365,368

9,952

Pinnacle

West

Capital

Corp

881,648

143,421

Redeia

Corp

SA

2,788,256

335,383

REN

-

Redes

Energeticas

Nacionais

SGPS

SA

901,595

760,407

Snam

SpA

3,873,317

6,252

Spire

Inc

420,697

171,478

Vector

Ltd

412,883

TOTAL

UTILITIES

62,199,110

TOTAL

COMMON

STOCKS

(Cost

$112,570,102)

136,292,469

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

130180153

CORPORATE

BONDS

-

32.7%

(23.7%

of

Total

Investments)

130180153

CAPITAL

GOODS

-

0.9%

$

1,600,000

(a)

Advanced

Drainage

Systems

Inc

6.375

%

06/15/30

1,634,358

1,080,000

(a)

Chart

Industries

Inc

7.500

01/01/30

1,138,240

930,000

(a)

Trinity

Industries

Inc

7.750

07/15/28

976,118

TOTAL

CAPITAL

GOODS

3,748,716

COMMERCIAL

&

PROFESSIONAL

SERVICES

-

0.4%

420,000

(a)

GFL

Environmental

Inc

6.750

01/15/31

440,510

1,125,000

(a)

Wrangler

Holdco

Corp

6.625

04/01/32

1,169,353

TOTAL

COMMERCIAL

&

PROFESSIONAL

SERVICES

1,609,863

CONSUMER

DISCRETIONARY

DISTRIBUTION

&

RETAIL

-

0.2%

705,000

(a)

LCM

Investments

Holdings

II

LLC

4.875

05/01/29

677,412

TOTAL

CONSUMER

DISCRETIONARY

DISTRIBUTION

&

RETAIL

677,412

CONSUMER

SERVICES

-

2.0%

EUR

300,000

(b)

Accor

SA,

Reg

S

7.250

N/A

369,243

530,000

Choice

Hotels

International

Inc

5.850

08/01/34

546,566

1,500,000

(a)

Churchill

Downs

Inc

5.750

04/01/30

1,501,643

1,025,000

(a)

Hilton

Domestic

Operating

Co

Inc

5.875

03/15/33

1,044,426

760,000

(a)

Hilton

Grand

Vacations

Borrower

Escrow

LLC

/

Hilton

Grand

Vacations

Borrower

Esc

6.625

01/15/32

769,314

690,000

(a)

Light

&

Wonder

International

Inc

7.500

09/01/31

723,727

400,000

(a)

Merlin

Entertainments

Group

US

Holdings

Inc

7.375

02/15/31

401,558

1,010,000

Piedmont

Operating

Partnership

LP

9.250

07/20/28

1,130,371

695,000

(a)

Six

Flags

Entertainment

Corp

/

Six

Flags

Theme

Parks

Inc

6.625

05/01/32

719,744

690,000

(a)

Wynn

Resorts

Finance

LLC

/

Wynn

Resorts

Capital

Corp

6.250

03/15/33

699,002

TOTAL

CONSUMER

SERVICES

7,905,594

ENERGY

-

6.0%

935,000

(a)

Archrock

Partners

LP

/

Archrock

Partners

Finance

Corp

6.250

04/01/28

939,646

790,000

(a)

Archrock

Partners

LP

/

Archrock

Partners

Finance

Corp

6.625

09/01/32

810,138

1,240,000

(a)

Blue

Racer

Midstream

LLC

/

Blue

Racer

Finance

Corp

7.000

07/15/29

1,289,085

1,250,000

(a)

Buckeye

Partners

LP

6.875

07/01/29

1,280,713

1,640,000

Cheniere

Energy

Partners

LP

4.500

10/01/29

1,617,575

510,000

(a)

CNX

Midstream

Partners

LP

4.750

04/15/30

476,882

700,000

(a)

CQP

Holdco

LP

/

BIP-V

Chinook

Holdco

LLC

5.500

06/15/31

686,578

300,000

(a)

CQP

Holdco

LP

/

BIP-V

Chinook

Holdco

LLC

7.500

12/15/33

325,493

765,000

(a)

Delek

Logistics

Partners

LP

/

Delek

Logistics

Finance

Corp

8.625

03/15/29

804,892

205,000

(a)

EQM

Midstream

Partners

LP

7.500

06/01/27

210,999

CAD

515,000

Gibson

Energy

Inc

5.250

12/22/80

361,008

1,000,000

(a)

Global

Partners

LP

/

GLP

Finance

Corp

8.250

01/15/32

1,037,289

750,000

(a)

Harvest

Midstream

I

LP

7.500

05/15/32

788,882

CAD

670,000

Keyera

Corp

6.875

06/13/79

509,927

CAD

1,110,000

Keyera

Corp

5.950

03/10/81

806,427

2,685,000

ONEOK

Inc

5.050

11/01/34

2,672,763

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

ENERGY

(continued)

$

915,000

(a)

PBF

Holding

Co

LLC

/

PBF

Finance

Corp

7.875

%

09/15/30

$

942,549

CAD

1,784,000

Pembina

Pipeline

Corp

4.800

01/25/81

1,230,907

731,000

(b),(c)

Plains

All

American

Pipeline

LP

(TSFR3M

+

4.372%)

9.490

N/A

727,851

780,000

(a)

Sunoco

LP

7.000

05/01/29

814,958

800,000

Targa

Resources

Corp

6.150

03/01/29

852,423

1,200,000

Targa

Resources

Corp

6.125

03/15/33

1,287,769

CAD

195,000

Transcanada

Trust

4.200

03/04/81

132,495

1,410,000

(a)

US

LIQUIDSCO0

5.584

10/01/34

1,423,563

720,000

(a)

USA

Compression

Partners

LP

/

USA

Compression

Finance

Corp

7.125

03/15/29

741,565

1,000,000

(a)

Venture

Global

Calcasieu

Pass

LLC

6.250

01/15/30

1,048,261

TOTAL

ENERGY

23,820,638

EQUITY

REAL

ESTATE

INVESTMENT

TRUSTS

(REITS)

-

7.3%

1,910,000

Agree

LP

4.800

10/01/32

1,893,874

1,015,000

Alexandria

Real

Estate

Equities

Inc

5.250

05/15/36

1,032,050

995,000

American

Assets

Trust

LP

6.150

10/01/34

1,006,487

1,405,000

American

Homes

4

Rent

LP

5.500

02/01/34

1,450,789

2,075,000

American

Tower

Corp

5.500

03/15/28

2,148,933

955,000

AvalonBay

Communities

Inc

5.000

02/15/33

976,548

845,000

CubeSmart

LP

4.375

02/15/29

840,617

1,795,000

Essex

Portfolio

LP

5.500

04/01/34

1,865,952

1,830,000

Extra

Space

Storage

LP

5.700

04/01/28

1,904,620

1,740,000

Federal

Realty

OP

LP

5.375

05/01/28

1,786,844

795,000

GLP

Capital

LP

/

GLP

Financing

II

Inc

6.750

12/01/33

874,504

455,000

Kilroy

Realty

LP

6.250

01/15/36

465,868

1,320,000

Kimco

Realty

OP

LLC

4.600

02/01/33

1,309,688

1,130,000

Kite

Realty

Group

LP

5.500

03/01/34

1,164,069

908,000

Kite

Realty

Group

LP

4.000

10/01/26

895,622

1,190,000

Mid-America

Apartments

LP

5.300

02/15/32

1,238,220

444,000

MPT

Operating

Partnership

LP

/

MPT

Finance

Corp

5.000

10/15/27

398,303

1,455,000

Prologis

LP

5.000

03/15/34

1,492,023

3,000,000

(a)

RHP

Hotel

Properties

LP

/

RHP

Finance

Corp

6.500

04/01/32

3,100,278

660,000

(a)

Scentre

Group

Trust

2

5.125

09/24/80

649,139

1,000,000

(a)

Uniti

Group

LP

/

Uniti

Group

Finance

Inc

/

CSL

Capital

LLC

10.500

02/15/28

1,067,406

500,000

(a)

Uniti

Group

LP

/

Uniti

Group

Finance

Inc

/

CSL

Capital

LLC

6.500

02/15/29

434,176

1,215,000

Ventas

Realty

LP

5.000

01/15/35

1,216,874

TOTAL

EQUITY

REAL

ESTATE

INVESTMENT

TRUSTS

(REITS)

29,212,884

FINANCIAL

SERVICES

-

1.4%

1,480,000

(a)

HAT

Holdings

I

LLC

/

HAT

Holdings

II

LLC

8.000

06/15/27

1,567,885

1,150,000

(a)

Hunt

Cos

Inc

5.250

04/15/29

1,112,641

930,000

National

Rural

Utilities

Cooperative

Finance

Corp

7.125

09/15/53

977,037

1,445,000

(a),(d)

Starwood

Property

Trust

Inc

6.000

04/15/30

1,445,588

585,000

(a)

Starwood

Property

Trust

Inc

7.250

04/01/29

613,409

TOTAL

FINANCIAL

SERVICES

5,716,560

HEALTH

CARE

EQUIPMENT

&

SERVICES

-

0.7%

900,000

(a)

CHS/Community

Health

Systems

Inc

10.875

01/15/32

991,786

600,000

(a)

LifePoint

Health

Inc

11.000

10/15/30

677,032

1,130,000

(a)

Prime

Healthcare

Services

Inc

9.375

09/01/29

1,165,576

TOTAL

HEALTH

CARE

EQUIPMENT

&

SERVICES

2,834,394

MEDIA

&

ENTERTAINMENT

-

1.0%

1,000,000

(a)

CCO

Holdings

LLC

/

CCO

Holdings

Capital

Corp

5.125

05/01/27

984,216

1,713,000

(a)

CCO

Holdings

LLC

/

CCO

Holdings

Capital

Corp

6.375

09/01/29

1,715,030

1,200,000

(a)

DISH

Network

Corp

11.750

11/15/27

1,259,436

TOTAL

MEDIA

&

ENTERTAINMENT

3,958,682

TELECOMMUNICATION

SERVICES

-

2.0%

635,000

(a)

Iliad

Holding

SASU

6.500

10/15/26

641,922

705,000

(a)

Iliad

Holding

SASU

7.000

10/15/28

717,209

865,000

(a)

Iliad

Holding

SASU

8.500

04/15/31

930,399

1,000,000

(a)

Level

3

Financing

Inc

10.500

04/15/29

1,090,049

750,000

(a)

Level

3

Financing

Inc

4.875

06/15/29

630,000

1,000,000

(a),(d)

Sable

International

Finance

Ltd

7.125

10/15/32

1,003,750

225,000

(a),(d)

Windstream

Escrow

LLC

/

Windstream

Escrow

Finance

Corp

8.250

10/01/31

228,742

Portfolio

of

Investments

September

30,

2024

(continued)

JRI

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

TELECOMMUNICATION

SERVICES

(continued)

$

500,000

(a)

Windstream

Escrow

LLC

/

Windstream

Escrow

Finance

Corp

7.750

%

08/15/28

$

500,470

1,250,000

(a)

Zayo

Group

Holdings

Inc

4.000

03/01/27

1,118,054

910,000

(a)

Zegona

Finance

PLC

8.625

07/15/29

971,425

TOTAL

TELECOMMUNICATION

SERVICES

7,832,020

TRANSPORTATION

-

1.7%

2,200,000

(a)

Brightline

East

LLC

11.000

01/31/30

1,870,103

1,000,000

(a)

Cargo

Aircraft

Management

Inc

4.750

02/01/28

958,572

2,500,000

(a)

Genesee

&

Wyoming

Inc

6.250

04/15/32

2,570,873

1,200,000

(a)

XPO

Inc

7.125

06/01/31

1,256,329

TOTAL

TRANSPORTATION

6,655,877

UTILITIES

-

9.1%

1,180,000

AEP

Transmission

Co

LLC

5.150

04/01/34

1,222,928

CAD

1,425,000

AltaGas

Ltd

7.350

08/17/82

1,091,480

CAD

1,305,000

AltaGas

Ltd

5.250

01/11/82

890,366

1,835,000

Ameren

Illinois

Co

4.950

06/01/33

1,887,766

500,000

(a)

Calpine

Corp

5.125

03/15/28

493,046

1,025,000

CenterPoint

Energy

Houston

Electric

LLC

5.200

10/01/28

1,065,637

2,500,000

(a)

Clearway

Energy

Operating

LLC

4.750

03/15/28

2,453,104

985,000

CMS

Energy

Corp

3.750

12/01/50

860,320

1,025,000

DTE

Electric

Co

5.200

03/01/34

1,073,051

1,065,000

Duke

Energy

Progress

LLC

5.100

03/15/34

1,110,954

649,000

(a)

Ferrellgas

LP

/

Ferrellgas

Finance

Corp

5.375

04/01/26

647,492

1,125,000

(a)

Ferrellgas

LP

/

Ferrellgas

Finance

Corp

5.875

04/01/29

1,052,764

730,000

Florida

Power

&

Light

Co

4.800

05/15/33

747,251

3,040,000

(a)

ITC

Holdings

Corp

4.950

09/22/27

3,085,475

580,000

(a)

NextEra

Energy

Operating

Partners

LP

7.250

01/15/29

611,540

420,000

(a)

NextEra

Energy

Operating

Partners

LP

4.500

09/15/27

410,340

GBP

1,210,000

NGG

Finance

PLC,

Reg

S

5.625

06/18/73

1,615,494

1,183,000

NRG

Energy

Inc

6.625

01/15/27

1,184,695

675,000

(a)

NRG

Energy

Inc

5.250

06/15/29

672,759

925,000

OGE

Energy

Corp

5.450

05/15/29

963,445

1,520,000

Pacific

Gas

and

Electric

Co

6.150

01/15/33

1,631,739

805,000

(a)

Pattern

Energy

Operations

LP

/

Pattern

Energy

Operations

Inc

4.500

08/15/28

778,747

898,000

PPL

Capital

Funding

Inc

7.530

03/30/67

886,026

615,000

Public

Service

Electric

and

Gas

Co

5.200

03/01/34

645,415

1,090,000

Public

Service

Enterprise

Group

Inc

5.850

11/15/27

1,141,642

580,000

(a)

RWE

Finance

US

LLC

6.250

04/16/54

608,311

1,325,000

(a)

RWE

Finance

US

LLC

5.875

04/16/34

1,385,315

GBP

1,075,000

(b)

SSE

PLC,

Reg

S

3.740

N/A

1,404,062

275,000

(a)

Superior

Plus

LP

/

Superior

General

Partner

Inc

4.500

03/15/29

260,740

1,435,000

(a)

TerraForm

Power

Operating

LLC

4.750

01/15/30

1,373,350

1,410,000

(a)

Vistra

Operations

Co

LLC

7.750

10/15/31

1,518,003

1,370,000

Wisconsin

Power

and

Light

Co

5.375

03/30/34

1,434,256

TOTAL

UTILITIES

36,207,513

TOTAL

CORPORATE

BONDS

(Cost

$126,732,152)

130,180,153

SHARES

DESCRIPTION

VALUE

130039704

REAL

ESTATE

INVESTMENT

TRUST

COMMON

STOCKS

-

32.6%

(23.7%

of

Total

Investments)

130039704

DATA

CENTER

REITS

-

0.4%

55,518

Digital

Realty

Trust

Inc

1,383,509

TOTAL

DATA

CENTER

REITS

1,383,509

DIVERSIFIED

REITS

-

3.4%

88,432

Armada

Hoffler

Properties

Inc

957,719

353,047

British

Land

Co

PLC/The

2,057,119

146,451

Charter

Hall

Long

Wale

REIT

403,427

677,614

GPT

Group/The

2,323,417

382,520

Growthpoint

Properties

Australia

Ltd

703,913

27,589

ICADE

818,270

41,762

Merlin

Properties

Socimi

SA

529,371

SHARES

DESCRIPTION

VALUE

DIVERSIFIED

REITS

(continued)

57,544

Sila

Realty

Trust

Inc

$

1,455,288

6,075

Star

Asia

Investment

Corp

2,254,041

184,774

Stockland

666,452

1,369

United

Urban

Investment

Corp

1,316,318

TOTAL

DIVERSIFIED

REITS

13,485,335

HEALTH

CARE

REITS

-

3.4%

39,220

American

Healthcare

REIT

Inc

1,023,642

3,579,423

Assura

PLC

2,031,200

11,440

CareTrust

REIT

Inc

353,038

68,700

Community

Healthcare

Trust

Inc

1,246,905

199,508

Healthpeak

Properties

Inc

4,562,748

91,692

Omega

Healthcare

Investors

Inc

3,731,865

39,639

Sabra

Health

Care

REIT

Inc

737,682

TOTAL

HEALTH

CARE

REITS

13,687,080

HOTEL

&

RESORT

REITS

-

1.2%

199,216

Apple

Hospitality

REIT

Inc

2,958,358

47,046

Host

Hotels

&

Resorts

Inc

828,009

8,155

Ryman

Hospitality

Properties

Inc

874,542

TOTAL

HOTEL

&

RESORT

REITS

4,660,909

INDUSTRIAL

REITS

-

6.4%

8,099

ARGAN

SA

664,026

727,153

Centuria

Industrial

REIT

1,603,959

80,720

Dream

Industrial

Real

Estate

Investment

Trust

861,841

1,005,422

(a)

FIBRA

Macquarie

Mexico

1,607,450

783,715

Frasers

Logistics

&

Commercial

Trust

698,431

1,297

GLP

J-Reit

1,198,714

1,237

LaSalle

Logiport

REIT

1,235,995

1,122,094

LondonMetric

Property

PLC

3,085,068

273,549

LXP

Industrial

Trust

2,749,168

1,147,760

Mapletree

Industrial

Trust

2,168,882

2,000,983

Mapletree

Logistics

Trust

2,271,401

7,008

Montea

NV

582,648

326,167

Nexus

Industrial

REIT

2,124,686

296,194

Prologis

Property

Mexico

SA

de

CV

968,911

500,597

Tritax

Big

Box

REIT

PLC

1,068,450

561,912

Urban

Logistics

REIT

PLC

948,075

67,843

Warehouses

De

Pauw

CVA

1,810,375

TOTAL

INDUSTRIAL

REITS

25,648,080

MORTGAGE

REITS

-

0.4%

48,709

Blackstone

Mortgage

Trust

Inc,

Class

A

925,958

37,088

Starwood

Property

Trust

Inc

755,853

TOTAL

MORTGAGE

REITS

1,681,811

MULTI-FAMILY

RESIDENTIAL

REITS

-

1.2%

2,311

Daiwa

Securities

Living

Investments

Corp

1,565,602

1,768,627

(e)

Home

Reit

PLC

2,365

49,942

UDR

Inc

2,264,370

70,419

UNITE

Group

PLC/The

886,868

TOTAL

MULTI-FAMILY

RESIDENTIAL

REITS

4,719,205

OFFICE

REITS

-

2.8%

10,088

BXP

Inc

811,681

63,465

COPT

Defense

Properties

1,924,893

15,442

Dexus

80,571

8,407

Equity

Commonwealth

212,278

18,786

Gecina

SA

2,163,008

1,884

KDX

Realty

Investment

Corp

1,985,123

33,396

Kilroy

Realty

Corp

1,292,425

46,594

NSI

NV

1,068,441

349

Orix

JREIT

Inc

372,772

78,178

Postal

Realty

Trust

Inc,

Class

A

1,144,526

TOTAL

OFFICE

REITS

11,055,718

Portfolio

of

Investments

September

30,

2024

(continued)

JRI

SHARES

DESCRIPTION

VALUE

OTHER

SPECIALIZED

REITS

-

2.5%

73,144

Four

Corners

Property

Trust

Inc

$

2,143,851

119,312

Gaming

and

Leisure

Properties

Inc

6,138,602

50,161

VICI

Properties

Inc

1,670,863

TOTAL

OTHER

SPECIALIZED

REITS

9,953,316

REAL

ESTATE

OPERATING

COMPANIES

-

0.6%

1,879,383

Sirius

Real

Estate

Ltd

2,451,059

TOTAL

REAL

ESTATE

OPERATING

COMPANIES

2,451,059

RETAIL

REITS

-

9.2%

803,374

CapitaLand

Integrated

Commercial

Trust

1,320,491

400,543

Charter

Hall

Retail

REIT

996,499

129,692

Choice

Properties

Real

Estate

Investment

Trust

1,450,878

125,793

Crombie

Real

Estate

Investment

Trust

1,473,297

128,870

CT

Real

Estate

Investment

Trust

1,514,100

711,146

Fortune

Real

Estate

Investment

Trust

403,675

1,316,004

Frasers

Centrepoint

Trust

2,351,331

306,969

Hammerson

PLC

1,304,875

89,417

Kimco

Realty

Corp

2,076,263

340,050

Link

REIT

1,695,238

99,561

NETSTREIT

Corp

1,645,743

40,754

NNN

REIT

Inc

1,976,161

186,742

Primaris

Real

Estate

Investment

Trust

2,257,556

110,881

Realty

Income

Corp

7,032,073

68,521

RioCan

Real

Estate

Investment

Trust

1,032,539

24,262

Simon

Property

Group

Inc

4,100,763

952,848

Vicinity

Ltd

1,451,789

860,261

Waypoint

REIT

Ltd

1,564,363

66,812

Wereldhave

NV

1,106,914

TOTAL

RETAIL

REITS

36,754,548

SELF-STORAGE

REITS

-

0.5%

40,460

CubeSmart

2,177,962

TOTAL

SELF-STORAGE

REITS

2,177,962

SINGLE-FAMILY

RESIDENTIAL

REITS

-

0.3%

45,701

American

Homes

4

Rent

1,144,810

TOTAL

SINGLE-FAMILY

RESIDENTIAL

REITS

1,144,810

TELECOM

TOWER

REITS

-

0.3%

10,422

Crown

Castle

Inc

1,236,362

TOTAL

TELECOM

TOWER

REITS

1,236,362

TOTAL

REAL

ESTATE

INVESTMENT

TRUST

COMMON

STOCKS

(Cost

$118,394,115)

130,039,704

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

68909044

$1,000

PAR

(OR

SIMILAR)

INSTITUTIONAL

PREFERRED

-

17.3%

(12.6%

of

Total

Investments)

68909044

ENERGY

-

7.5%

$

2,810,000

Enbridge

Inc

6.000

%

01/15/77

2,812,383

1,530,000

Enbridge

Inc

6.250

03/01/78

1,528,568

696,000

Enbridge

Inc

5.750

07/15/80

683,359

2,305,000

Enbridge

Inc

5.500

07/15/77

2,241,678

1,260,000

Enbridge

Inc

7.625

01/15/83

1,345,887

930,000

Enbridge

Inc

8.500

01/15/84

1,040,203

648,000

Energy

Transfer

LP

7.125

10/01/54

662,685

580,000

Energy

Transfer

LP

8.000

05/15/54

624,062

1,184,000

(c)

Energy

Transfer

LP

(TSFR3M

+

3.279%)

8.527

11/01/66

1,123,118

1,451,000

(b)

Energy

Transfer

LP

7.125

N/A

1,482,233

595,000

(b)

Energy

Transfer

LP

6.500

N/A

593,577

2,260,000

Enterprise

Products

Operating

LLC

5.375

02/15/78

2,159,037

2,920,000

Enterprise

Products

Operating

LLC

5.250

08/16/77

2,880,277

CAD

780,000

Inter

Pipeline

Ltd/AB

6.625

11/19/79

578,150

725,000

(a)

South

Bow

Canadian

Infrastructure

Holdings

Ltd

7.625

03/01/55

751,354

378,000

(a)

South

Bow

Canadian

Infrastructure

Holdings

Ltd

7.500

03/01/55

397,132

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

ENERGY

(continued)

$

300,000

Transcanada

Trust

5.300

%

03/15/77

$

294,517

1,843,000

Transcanada

Trust

5.875

08/15/76

1,829,796

1,340,000

Transcanada

Trust

5.625

05/20/75

1,326,813

1,480,000

Transcanada

Trust

5.600

03/07/82

1,436,929

1,194,000

Transcanada

Trust

5.500

09/15/79

1,153,021

3,072,000

(a),(b)

Venture

Global

LNG

Inc

9.000

N/A

3,113,868

TOTAL

ENERGY

30,058,647

FINANCIAL

SERVICES

-

0.1%

375,000

National

Rural

Utilities

Cooperative

Finance

Corp

5.250

04/20/46

373,843

TOTAL

FINANCIAL

SERVICES

373,843

REAL

ESTATE

MANAGEMENT

&

DEVELOPMENT

-

0.2%

733,000

(a)

EUSHI

Finance

Inc

7.625

12/15/54

773,407

TOTAL

REAL

ESTATE

MANAGEMENT

&

DEVELOPMENT

773,407

TRANSPORTATION

-

0.2%

999,000

BNSF

Funding

Trust

I

6.613

12/15/55

1,007,011

TOTAL

TRANSPORTATION

1,007,011

UTILITIES

-

9.3%

950,000

(a)

AES

Andes

SA

8.150

06/10/55

980,678

1,665,000

AES

Corp/The

7.600

01/15/55

1,751,648

CAD

625,000

AltaGas

Ltd

8.900

11/10/83

505,319

1,087,000

(a)

AltaGas

Ltd

7.200

10/15/54

1,110,244

CAD

675,000

Capital

Power

Corp

7.950

09/09/82

524,778

1,971,000

CMS

Energy

Corp

4.750

06/01/50

1,901,962

995,000

ComEd

Financing

III

6.350

03/15/33

1,032,037

1,743,000

(b)

Dominion

Energy

Inc

4.350

N/A

1,697,595

1,634,000

Dominion

Energy

Inc

7.000

06/01/54

1,784,045

2,460,000

Duke

Energy

Corp

6.450

09/01/54

2,554,218

1,375,000

(b)

Edison

International

5.000

N/A

1,343,499

870,000

(b)

Edison

International

5.375

N/A

861,381

GBP

900,000

(b)

Electricite

de

France

SA,

Reg

S

5.875

N/A

1,174,173

2,048,000

Emera

Inc

6.750

06/15/76

2,059,817

1,698,000

Entergy

Corp

7.125

12/01/54

1,760,553

2,747,000

NextEra

Energy

Capital

Holdings

Inc

5.650

05/01/79

2,724,668

581,000

NextEra

Energy

Capital

Holdings

Inc

6.750

06/15/54

626,952

825,000

NextEra

Energy

Capital

Holdings

Inc

3.800

03/15/82

785,804

2,576,000

NiSource

Inc

6.950

11/30/54

2,661,108

883,000

PG&E

Corp

7.375

03/15/55

926,155

2,075,000

(b)

Sempra

4.875

N/A

2,052,728

1,381,000

Sempra

6.875

10/01/54

1,431,474

1,650,000

Sempra

6.400

10/01/54

1,653,105

1,625,000

Sempra

4.125

04/01/52

1,545,066

1,265,000

Southern

Co/The

4.000

01/15/51

1,247,129

TOTAL

UTILITIES

36,696,136

TOTAL

$1,000

PAR

(OR

SIMILAR)

INSTITUTIONAL

PREFERRED

(Cost

$67,782,230)

68,909,044

SHARES

DESCRIPTION

RATE

VALUE

64285127

$25

PAR

(OR

SIMILAR)

RETAIL

PREFERRED

-

16.1%

(11.7%

of

Total

Investments)

64285127

EQUITY

REAL

ESTATE

INVESTMENT

TRUSTS

(REITS)

-

10.1%

146,715

Agree

Realty

Corp

4.250

3,097,154

80,447

American

Homes

4

Rent

5.875

2,032,896

56,280

Armada

Hoffler

Properties

Inc

6.750

1,437,391

33,798

DiamondRock

Hospitality

Co

8.250

861,849

59,594

Digital

Realty

Trust

Inc

5.250

1,445,750

68,757

Digital

Realty

Trust

Inc

5.200

1,633,666

79,257

Federal

Realty

Investment

Trust

5.000

1,835,592

66,158

Kimco

Realty

Corp

5.125

1,589,115

13,513

Kimco

Realty

Corp

7.250

829,698

91,993

Kimco

Realty

Corp

5.250

2,284,186

2,301

Mid-America

Apartment

Communities

Inc

8.500

136,771

54,508

National

Storage

Affiliates

Trust

6.000

1,362,155

Portfolio

of

Investments

September

30,

2024

(continued)

JRI

SHARES

DESCRIPTION

RATE

VALUE

EQUITY

REAL

ESTATE

INVESTMENT

TRUSTS

(REITS)

(continued)

23,192

Pebblebrook

Hotel

Trust

6.375

%

$

512,079

33,580

Pebblebrook

Hotel

Trust

5.700

664,884

50,450

Pebblebrook

Hotel

Trust

6.300

1,120,999

33,970

Public

Storage

3.950

644,071

56,168

Public

Storage

4.000

1,077,864

53,330

Public

Storage

4.100

1,062,334

54,568

Public

Storage

4.875

1,269,252

40,054

Public

Storage

3.900

749,010

35,975

Public

Storage

4.750

821,669

30,469

Public

Storage

5.050

755,631

31,672

Public

Storage

4.700

711,670

34,375

Public

Storage

4.125

696,781

41,114

Public

Storage

3.875

765,132

49,870

Public

Storage

4.000

973,961

44,113

Public

Storage

4.625

966,957

30,274

Rexford

Industrial

Realty

Inc

5.875

731,117

90,113

Rexford

Industrial

Realty

Inc

5.625

2,165,416

10,819

RLJ

Lodging

Trust

1.950

282,159

72,849

SITE

Centers

Corp

6.375

1,765,860

38,516

Summit

Hotel

Properties

Inc

6.250

807,681

20,251

Summit

Hotel

Properties

Inc

5.875

424,866

43,058

Sunstone

Hotel

Investors

Inc

5.700

942,540

30,844

Sunstone

Hotel

Investors

Inc

6.125

691,214

18,724

UMH

Properties

Inc

6.375

451,061

33,112

Vornado

Realty

Trust

5.250

593,698

9,192

Vornado

Realty

Trust

5.250

164,813

TOTAL

EQUITY

REAL

ESTATE

INVESTMENT

TRUSTS

(REITS)

40,358,942

FINANCIAL

SERVICES

-

0.2%

25,426

Brookfield

Finance

Inc

4.625

497,333

16,112

National

Rural

Utilities

Cooperative

Finance

Corp

5.500

400,544

TOTAL

FINANCIAL

SERVICES

897,877

REAL

ESTATE

MANAGEMENT

&

DEVELOPMENT

-

0.3%

25,270

Brookfield

Property

Partners

LP

6.500

437,171

10,309

Brookfield

Property

Partners

LP

6.375

168,037

35,153

Brookfield

Property

Partners

LP

5.750

520,264

TOTAL

REAL

ESTATE

MANAGEMENT

&

DEVELOPMENT

1,125,472

UTILITIES

-

5.5%

25,854

BIP

Bermuda

Holdings

I

Ltd

5.125

506,997

41,127

Brookfield

BRP

Holdings

Canada

Inc

4.625

715,610

13,470

Brookfield

Infrastructure

Finance

ULC

5.000

259,298

67,929

Brookfield

Infrastructure

Partners

LP

5.125

1,344,994

20,719

Brookfield

Infrastructure

Partners

LP

5.000

420,181

75,559

Brookfield

Renewable

Partners

LP

5.250

1,560,293

35,357

CMS

Energy

Corp

5.875

874,025

29,190

CMS

Energy

Corp

5.625

728,582

66,991

CMS

Energy

Corp

4.200

1,325,752

48,898

CMS

Energy

Corp

5.875

1,211,692

46,327

DTE

Energy

Co

5.250

1,140,108

75,446

DTE

Energy

Co

4.375

1,598,701

73,042

DTE

Energy

Co

4.375

1,560,908

43,179

Duke

Energy

Corp

5.625

1,072,998

49,695

Duke

Energy

Corp

5.750

1,242,872

45,803

Georgia

Power

Co

5.000

1,115,303

19,300

SCE

Trust

VIII

6.950

515,310

76,576

Southern

Co/The

4.950

1,817,914

88,549

Southern

Co/The

4.200

1,956,047

37,425

Southern

Co/The

5.250

935,251

TOTAL

UTILITIES

21,902,836

TOTAL

$25

PAR

(OR

SIMILAR)

RETAIL

PREFERRED

(Cost

$67,103,448)

64,285,127

Investments

in

Derivatives

SHARES

DESCRIPTION

RATE

VALUE

8978676

CONVERTIBLE

PREFERRED

SECURITIES

-

2.3%

(1.6%

of

Total

Investments)

8978676

EQUITY

REAL

ESTATE

INVESTMENT

TRUSTS

(REITS)

-

0.9%

8,595

LXP

Industrial

Trust

6.500

%

$

455,535

69,768

Regency

Centers

Corp

6.250

1,788,154

57,537

Regency

Centers

Corp

5.875

1,401,026

TOTAL

EQUITY

REAL

ESTATE

INVESTMENT

TRUSTS

(REITS)

3,644,715

UTILITIES

-

1.4%

55,856

NextEra

Energy

Inc

6.926

2,589,484

38,650

NextEra

Energy

Inc

7.299

2,143,142

22,463

SCE

Trust

VII

7.500

601,335

TOTAL

UTILITIES

5,333,961

TOTAL

CONVERTIBLE

PREFERRED

SECURITIES

(Cost

$8,636,431)

8,978,676

SHARES

DESCRIPTION

VALUE

–

INVESTMENT

COMPANIES

-

0.8%

(0.6%

of

Total

Investments)

–

661,390

Foresight

Environmental

Infrastructure

Ltd

802,844

266,554

Greencoat

UK

Wind

PLC/Funds

502,124

314,655

Renewables

Infrastructure

Group

Ltd/The

438,337

744,985

Sdcl

Energy

Efficiency

Income

Trust

PLC

628,481

642,814

Sequoia

Economic

Infrastructure

Income

Fund

Ltd

689,506

141,817

Starwood

European

Real

Estate

Finance

Ltd

177,468

TOTAL

INVESTMENT

COMPANIES

(Cost

$3,656,579)

3,238,760

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

–

MORTGAGE-BACKED

SECURITIES

-

0.1%

(0.1%

of

Total

Investments)

–

$

525,000

(a),(c)

Natixis

Commercial

Mortgage

Securities

Trust

2019-MILE,

(TSFR1M

+

4.329%),

2019

MILE

9.426

07/15/36

338,124

310,000

(a),(c)

Natixis

Commercial

Mortgage

Securities

Trust

2019-MILE,

(TSFR1M

+

2.829%),

2019

MILE

7.926

07/15/36

233,264

TOTAL

MORTGAGE-BACKED

SECURITIES

(Cost

$835,000)

571,388

SHARES

DESCRIPTION

MATURITY

VALUE

5,631

COMMON

STOCK

RIGHTS

-

0.0%

(0.0%

of

Total

Investments)

5,631

MATERIALS

-

0.0%

6,245

Montea

NV

10/31/24

5,631

TOTAL

MATERIALS

5,631

TOTAL

COMMON

STOCK

RIGHTS

(Cost

$0)

5,631

TOTAL

LONG-TERM

INVESTMENTS

(Cost

$505,710,057)

542,500,952

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

SHORT-TERM

INVESTMENTS

-

1.7% (1.2%

of

Total

Investments)

6,560,691

REPURCHASE

AGREEMENTS

-

1.7%

(1.2%

of

Total

Investments)

6,560,691

6,560,691

(f)

Fixed

Income

Clearing

Corporation

1.520

10/01/24

6,560,691

TOTAL

REPURCHASE

AGREEMENTS

(Cost

$6,560,691)

6,560,691

TOTAL

SHORT-TERM

INVESTMENTS

(Cost

$6,560,691)

6,560,691

TOTAL

INVESTMENTS

-

137.8%

(Cost

$512,270,748

)

549,061,643

BORROWINGS

-

(38.1)%

(g),(h)

(151,695,000)

OTHER

ASSETS

&

LIABILITIES,

NET

- 0.3%

1,138,049

NET

ASSETS

APPLICABLE

TO

COMMON

SHARES

-

100%

$

398,504,692

Portfolio

of

Investments

September

30,

2024

(continued)

JRI

Part

F

of

Form

N-PORT

was

prepared

in

accordance

with

U.S.

generally

accepted

accounting

principles

(“U.S.

GAAP”)

and

in

conformity

with

the

applicable

rules

and

regulations

of

the

U.S.

Securities

and

Exchange

Commission

(“SEC”)

related

to

interim

filings.

Part

F

of

Form

N-PORT

does

not

include

all

information

and

footnotes

required

by

U.S.

GAAP

for

complete

financial

statements.

Certain

footnote

disclosures

normally

included

in

financial

statements

prepared

in

accordance

with

U.S.

GAAP

have

been

condensed

or

omitted

from

this

report

pursuant

to

the

rules

of

the

SEC.

For

a

full

set

of

the

Fund’s

notes

to

financial

statements,

please

refer

to

the

Fund’s

most

recently

filed

annual

or

semi-annual

report.

Fair

Value

Measurements

The

Fund’s

investments

in

securities

are

recorded

at

their

estimated

fair

value

utilizing

valuation

methods

approved

by

the

Board

of

Directors/

Trustees.

Fair

value

is

defined

as

the

price

that

would

be

received

upon

selling

an

investment

or

transferring

a

liability

in

an

orderly

transaction

to

an

independent

buyer

in

the

principal

or

most

advantageous

market

for

the

investment.

U.S.

GAAP

establishes

the

three-tier

hierarchy

which

is

used

to

maximize

the

use

of

observable

market

data

and

minimize

the

use

of

unobservable

inputs

and

to

establish

classification

of

fair

value

measurements

for

disclosure

purposes.

Observable

inputs

reflect

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Observable

inputs

are

based

on

market

data

obtained

from

sources

independent

of

the

reporting

entity.

Unobservable

inputs

reflect

management’s

assumptions

about

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Unobservable

inputs

are

based

on

the

best

information

available

in

the

circumstances.

The

following

is

a

summary

of

the

three-tiered

hierarchy

of

valuation

input

levels.

Level

1

–

Inputs

are

unadjusted

and

prices

are

determined

using

quoted

prices

in

active

markets

for

identical

securities.

Level

2

–

Prices

are

determined

using

other

significant

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

credit

spreads,

etc.).

Level

3

–

Prices

are

determined

using

significant

unobservable

inputs

(including

management’s

assumptions

in

determining

the

fair

value

of

investments).

The

following

table

summarizes

the

market

value

of

the

Fund's

investments

as

of

the

end

of

the

reporting

period,

based

on

the

inputs

used

to

value

them:

)

Futures

Contracts

-

Short

Description

Number

of

Contracts

Expiration

Date

Notional

Amount

Value

Unrealized

Appreciation

(Depreciation)

U.S.

Treasury

Long

Bond

(18)

12/24

$

(2,231,400)

$

(2,235,375)

$

(3,975)

U.S.

Treasury

Ultra

10-Year

Note

(127)

12/24

(15,016,251)

(15,023,703)

(7,452)

U.S.

Treasury

Ultra

Bond

(18)

12/24

(2,396,098)

(2,395,688)

410

Total

$(19,643,749)

$(19,654,766)

$(11,017)

Interest

Rate

Swaps

-

OTC

Uncleared

Counterparty

Notional

Amount

Fund

Pay/Receive

Floating

Rate

Floating

Rate

Index

Fixed

Rate

(Annualized)

Fixed

Rate

Payment

Frequency

Effective

Date

(i)

Optional

Termination

Date

Maturity

Date

Value

Unrealized

Appreciation

(Depreciation)

Morgan

Stanley

$

112,400,000

Receive

SOFR

1.994%

Monthly

6/01/18

7/01/25

7/01/27

$

1,988,544

$

1,988,544

Level

1

Level

2

Level

3

Total

Long-Term

Investments:

Common

Stocks

$

81,979,804

$

54,312,665

$

–

$

136,292,469

Corporate

Bonds

–

130,180,153

–

130,180,153

Real

Estate

Investment

Trust

Common

Stocks

76,829,168

53,208,171

2,365

130,039,704

$1,000

Par

(or

similar)

Institutional

Preferred

–

68,909,044

–

68,909,044

$25

Par

(or

similar)

Retail

Preferred

64,285,127

–

–

64,285,127

Convertible

Preferred

Securities

8,978,676

–

–

8,978,676

Investment

Companies

–

3,238,760

–

3,238,760

Mortgage-Backed

Securities

–

571,388

–

571,388

Common

Stock

Rights

–

5,631

–

5,631

Short-Term

Investments:

Repurchase

Agreements

–

6,560,691

–

6,560,691

Investments

in

Derivatives:

Interest

Rate

Swaps*

–

1,988,544

–

1,988,544

Futures

Contracts*

(11,017)

–

–

(11,017)

Total

$

232,061,758

$

318,975,047

$

2,365

$

551,039,170

*

Represents

net

unrealized

appreciation

(depreciation).

Principal

denominated

in

U.S.

Dollars,

unless

otherwise

noted.

All

percentages

shown

in

the

Portfolio

of

Investments

are

based

on

net

assets

applicable

to

common

shares

unless

otherwise

noted.

For

Fund

portfolio

compliance

purposes,

the

Fund’s

industry

classifications

refer

to

any

one

or

more

of

the

industry

sub-classifications

used

by

one

or

more

widely

recognized

market

indexes

or

ratings

group

indexes,

and/or

as

defined

by

Fund

management.

This

definition

may

not

apply

for

purposes

of

this

report,

which

may

combine

industry

sub-classifications

into

sectors

for

reporting

ease.

(a)

Security

is

exempt

from

registration

under

Rule

144A

of

the

Securities

Act

of

1933,

as

amended.

These

securities

are

deemed

liquid

and

may

be

resold

in

transactions

exempt

from

registration,

which

are

normally

those

transactions

with

qualified

institutional

buyers.

As

of

the

end

of

the

reporting

period,

the

aggregate

value

of

these

securities

is

$81,444,900

or

14.8%

of

Total

Investments.

(b)

Perpetual

security.

Maturity

date

is

not

applicable.

(c)

Variable

rate

security.

The

rate

shown

is

the

coupon

as

of

the

end

of

the

reporting

period.

(d)

When-issued

or

delayed

delivery

security.

(e)

For

fair

value

measurement

disclosure

purposes,

investment

classified

as

Level

3.

(f)

Agreement

with

Fixed

Income

Clearing

Corporation,

1.520%

dated

9/30/24

to

be

repurchased

at

$6,560,968

on

10/1/24,

collateralized

by

Government

Agency

Securities,

with

coupon

rate

3.500%

and

maturity

date

9/30/26,

valued

at

$6,691,916.

(g)

Borrowings

as

a

percentage

of

Total

Investments

is

27.6%.

(h)

The

Fund

may

pledge

up

to

100%

of

its

eligible

investments

(excluding

any

investments

separately

pledged

as

collateral

for

specific

investments

in

derivatives,

when

applicable)

in

the

Portfolio

of

Investments

as

collateral

for

borrowings.

As

of

the

end

of

the

reporting

period,

investments

with

a

value

of

$288,872,253

have

been

pledged

as

collateral

for

borrowings.

(i)

Effective

date

represents

the

date

on

which

both

the

Fund

and

counterparty

commence

interest

payment

accruals

on

each

contract.

ADR

American

Depositary

Receipt

CAD

Canadian

Dollar

EUR

Euro

GBP

Pound

Sterling

Reg

S

Regulation

S

allows

U.S.

companies

to

sell

securities

to

persons

or

entities

located

outside

of

the

United

States

without

registering

those

securities

with

the

Securities

and

Exchange

Commission.

Specifically,

Regulation

S

provides

a

safe

harbor

from

the

registration

requirements

of

the

Securities

Act

for

the

offers

and

sales

of

securities

by

both

foreign

and

domestic

issuers

that

are

made

outside

the

United

States.

REIT

Real

Estate

Investment

Trust

SOFR

Secured

Overnight

Financing

Rate

TSFR

1M

CME

Term

SOFR

1

Month

TSFR

3M

CME

Term

SOFR

3

Month

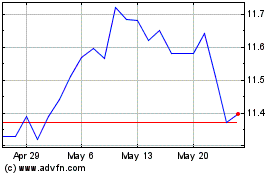

Nuveen Real Asset Income... (NYSE:JRI)

Historical Stock Chart

From Nov 2024 to Dec 2024

Nuveen Real Asset Income... (NYSE:JRI)

Historical Stock Chart

From Dec 2023 to Dec 2024