As filed with the Securities and Exchange Commission on November 3, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________

Form S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

____________________________________________________

LAS VEGAS SANDS CORP.

(Exact name of registrant as specified in its charter)

____________________________________________________

| | | | | | | | |

Nevada | | 27-0099920 |

(State or other jurisdiction | | (I.R.S. Employer |

of incorporation) | | Identification No.) |

5420 S. Durango Dr.

Las Vegas, Nevada 89113

(702) 923-9000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

____________________________________________________

D. Zachary Hudson

5420 S. Durango Dr.

Las Vegas, Nevada 89113

(702) 923-9000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

____________________________________________________

Copies to:

David J. Goldschmidt, Esq.

Howard L. Ellin, Esq.

Michael J. Hong, Esq.

Skadden, Arps, Slate, Meagher & Flom LLP

One Manhattan West

New York, New York 10001

(212) 735-3000

____________________________________________________

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. o

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. x

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ☒ | | Accelerated filer | | ☐ |

| | | |

| Non-accelerated filer | | ☐ (Do not check if a smaller reporting company) | | Smaller reporting company | | ☐ |

| | | | | | |

| | | | Emerging growth company | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act.

PROSPECTUS

Debt Securities

Preferred Stock

Common Stock

Depositary Shares

Warrants

Purchase Contracts

Units

This prospectus contains a general description of securities that may be offered for sale from time to time. The specific terms of the securities, including their offering prices, will be contained in one or more supplements to this prospectus. You should read this prospectus and any supplement carefully before you invest.

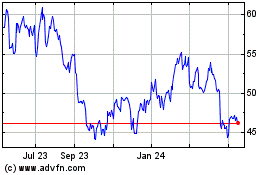

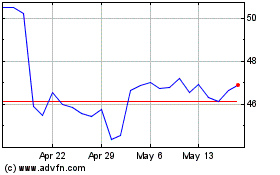

All of the securities listed above will be issued by Las Vegas Sands Corp. The common stock of Las Vegas Sands Corp. is listed on the New York Stock Exchange under the trading symbol “LVS.”

Investing in our securities involves risks that are referenced under the heading “Risk Factors” on page 6 of this prospectus. These securities have not been approved or disapproved by the Securities and Exchange Commission ("SEC") or any state securities commission nor has the SEC or any state securities commission passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

No gaming regulatory agency has passed upon the accuracy or adequacy of this prospectus or the investment merits of the securities offered hereby. Any representation to the contrary is unlawful.

The date of this prospectus is November 3, 2023.

Table of Contents

ABOUT THIS PROSPECTUS

To understand the terms of the securities offered by this prospectus, you should carefully read this prospectus and any applicable prospectus supplement. You should also read the documents referenced under the heading “Where You Can Find More Information” for information on Las Vegas Sands Corp. and its financial statements. Certain capitalized terms used in this prospectus are defined elsewhere in this prospectus.

This prospectus is part of a registration statement that Las Vegas Sands Corp. has filed with the SEC using a “shelf” registration procedure. Under this procedure, we may offer and sell from time to time, any of the following securities, in one or more series:

• debt securities,

• preferred stock,

• common stock,

• depositary shares,

• warrants,

• purchase contracts and

• units.

As described under the heading “Plan of Distribution,” certain third parties may also offer securities from time to time. The securities may be sold for U.S. dollars, foreign-denominated currency or currency units. Amounts payable with respect to any securities may be payable in U.S. dollars or foreign-denominated currency or currency units as specified in the applicable prospectus supplement.

This prospectus provides you with a general description of the securities that may be offered. Each time securities are offered, we will provide you with a prospectus supplement that will describe the specific amounts, prices and terms of the securities being offered. The prospectus supplement may also add, update or change information contained or incorporated by reference in this prospectus.

The prospectus supplement may also contain information about any material U.S. federal income tax considerations relating to the securities covered by the prospectus supplement. Securities may be sold to

underwriters who will sell the securities to the public on terms fixed at the time of sale. In addition, the securities may be sold directly or through dealers or agents designated from time to time, which agents may be affiliates of ours. If we, directly or through agents, solicit offers to purchase the securities, we reserve the sole right to accept and, together with our agents, to reject, in whole or in part, any offer.

The prospectus supplement will also contain, with respect to the securities being sold, the names of any underwriters, dealers or agents, together with the terms of the offering, the compensation of any underwriters and the net proceeds to us.

Any underwriters, dealers or agents participating in the offering may be deemed “underwriters” within the meaning of the Securities Act of 1933, as amended, which we refer to in this prospectus as the “Securities Act.”

As used in this prospectus, unless the context requires otherwise, the terms “we,” “us,” “our,” “Las Vegas Sands” or “the Company” refer to Las Vegas Sands Corp., a Nevada corporation.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC under the Securities Exchange Act of 1934, as amended, which we refer to in this prospectus as the “Exchange Act.” You may obtain such SEC filings from the SEC’s website at www.sec.gov.

As permitted by SEC rules, this prospectus does not contain all of the information we have included in the registration statement and the accompanying exhibits and schedules we file with the SEC. You may refer to the registration statement, exhibits and schedules for more information about us and the securities. The registration statement, exhibits and schedules are available through the SEC’s website.

INCORPORATION BY REFERENCE

The SEC allows us to “incorporate by reference” information we have filed with it, which means we can disclose important information to you by referring you to those documents. The information we incorporate by reference is an important part of this prospectus, and later information we file with the SEC will automatically update and supersede this information. The following documents have been filed by us with the SEC and are incorporated by reference into this prospectus:

•The description of the common stock set forth in our Registration Statement on Form 8-A filed pursuant to Section 12 of the Exchange Act on December 8, 2004, and any amendment or report filed for the purpose of updating any such description. All documents and reports we file with the SEC (other than any portion of such filings that are furnished under applicable SEC rules rather than filed) under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act from the date of this prospectus until the termination of the offering under this prospectus shall be deemed to be incorporated in this prospectus by reference. The information contained on or accessible through our website (www.sands.com) is not incorporated into this prospectus.

You may request a copy of these filings, other than an exhibit to these filings unless we have specifically included or incorporated that exhibit by reference into the filing, from the SEC as described under “Where You Can Find More Information” or, at no cost, by writing or telephoning Las Vegas Sands at the following address:

Las Vegas Sands Corp.

5420 S. Durango Dr.

Las Vegas, Nevada 89113

Attention: Investor Relations

Telephone: (702) 923-9000

You should rely only on the information contained or incorporated by reference in this prospectus, the prospectus supplement, any free writing prospectus that we authorize and any pricing supplement that we authorize. We have not authorized any person, including any underwriter, salesperson or broker, to provide information other than that provided in this prospectus, the prospectus supplement, any free writing prospectus that we authorize or any pricing supplement that we authorize. We have not authorized anyone to provide you with different information. We do not take responsibility for, and can provide no assurance as to the reliability of, any information others may give you. We are not making an offer of the securities in any jurisdiction where the offer is not permitted.

You should assume the information in this prospectus, any prospectus supplement, any free writing prospectus that we authorize and any pricing supplement that we authorize is accurate only as of the date on its cover page and any information we have incorporated or will incorporate by reference is accurate only as of the date of such document incorporated by reference.

Any statement contained in a document incorporated or deemed to be incorporated by reference into this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent a statement contained in this prospectus, any prospectus supplement or any other subsequently filed document that is deemed to be incorporated by reference into this prospectus modifies or supersedes the statement. Any statement so modified or superseded will not, except as so modified or superseded, be deemed to constitute a part of this prospectus.

STATEMENTS REGARDING FORWARD-LOOKING INFORMATION

This prospectus and the documents incorporated by reference into this prospectus contain forward-looking statements that are made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include the discussions of our business strategies and expectations concerning future operations, margins, profitability, liquidity and capital resources. In addition, in certain portions included in this prospectus and the documents incorporated by reference into this prospectus, the words “anticipates,” “believes,” “estimates,” “seeks,” “expects,” “plans,” “intends” and similar expressions, as they relate to our Company or management, are intended to identify forward-looking statements. Although we believe that these forward-looking statements are reasonable, we cannot assure you that any forward-looking statements will prove to be correct. These forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements. These factors include, among others, those discussed under “Risk Factors” or otherwise discussed in our most recent annual report on Form 10-K and quarterly reports on Form 10-Q and in our other filings made from time to time with the SEC after the date of the registration statement of which this prospectus is a part. These factors also include, among others, the risks associated with:

•our ability to maintain our Concession in Macao and gaming license in Singapore;

•our ability to invest in future growth opportunities, or attempt to expand our business in new markets and new ventures;

•the ability to execute our previously announced capital expenditure programs and produce future returns;

•general economic and business conditions internationally, which may impact levels of disposable income, consumer spending, group meeting business, pricing of hotel rooms and retail and mall tenant sales;

•uncertainty about the pace of recovery of travel and tourism in Asia from the impacts of the COVID-19 pandemic;

•disruptions or reductions in travel and our operations due to natural or man-made disasters, pandemics, epidemics or outbreaks of infectious or contagious diseases, political instability, civil unrest, terrorist activity or war;

•the uncertainty of consumer behavior related to discretionary spending and vacationing at our Integrated Resorts (as defined below) in Macao and Singapore;

•the extensive regulations to which we are subject and the costs of compliance or failure to comply with such regulations;

•new developments and construction projects at our existing properties (for example, development at our Cotai Strip properties and the MBS Expansion Project (as described in the documents that we have filed with the SEC, including our most recent annual report on Form 10-K and quarterly reports on Form 10-Q));

•regulatory policies in China or other countries in which our patrons reside, or where we have operations, including visa restrictions limiting the number of visits or the length of stay for visitors from China to Macao, restrictions on foreign currency exchange or importation of currency, and the judicial enforcement of gaming debts;

•the possibility that the laws and regulations of mainland China become applicable to our operations in Macao and Hong Kong;

•the possibility that economic, political and legal developments in Macao adversely affect our Macao operations, or that there is a change in the manner in which regulatory oversight is conducted in Macao;

•our leverage, debt service and debt covenant compliance, including the pledge of certain of our assets (other than our equity interests in our subsidiaries) as security for our indebtedness and ability to refinance our debt obligations as they come due or to obtain sufficient funding for our planned, or any future, development projects;

•fluctuations in currency exchange rates and interest rates, and the possibility of increased expense as a result;

•increased competition for labor and materials due to planned construction projects in Macao and Singapore and quota limits on the hiring of foreign workers;

•our ability to compete for limited management and labor resources in Macao and Singapore, and policies of those governments that may also affect our ability to employ imported managers or labor from other countries;

•our dependence upon properties primarily in Macao and Singapore for all of our cash flow and the ability of our subsidiaries to make distribution payments to us;

•the passage of new legislation and receipt of governmental approvals for our operations in Macao and Singapore and other jurisdictions where we are planning to operate;

•the ability of our insurance coverage to cover all possible losses that our properties could suffer and the potential for our insurance costs to increase in the future;

•our ability to collect gaming receivables from our credit players;

•the collectability of our outstanding loan receivable;

•our dependence on chance and theoretical win rates;

•fraud and cheating;

•our ability to establish and protect our intellectual property rights;

•reputational risk related to the license of certain of our trademarks;

•the possibility that our securities may be prohibited from being traded in the U.S. securities market under the Holding Foreign Companies Accountable Act;

•conflicts of interest that arise because certain of our directors and officers are also directors and officers of Sands China Limited;

•government regulation of the casino industry (as well as new laws and regulations and changes to existing laws and regulations), including gaming license regulation, the requirement for certain beneficial owners of our securities to be found suitable by gaming authorities, the legalization of gaming in other jurisdictions and regulation of gaming on the internet;

•increased competition in Macao, including recent and upcoming increases in hotel rooms, meeting and convention space, retail space, potential additional gaming licenses and online gaming;

•the popularity of Macao and Singapore as convention and trade show destinations;

•new taxes, changes to existing tax rates or proposed changes in tax legislation;

•the continued services of our key officers;

•any potential conflict between the interests of our Principal Stockholders and us;

•labor actions and other labor problems;

•our failure to maintain the integrity of our information and information systems or comply with applicable privacy and data security requirements and regulations;

•the completion of infrastructure projects in Macao;

•limitations on the transfers of cash to and from our subsidiaries, limitations of the pataca exchange markets and restrictions on the export of the renminbi;

•the outcome of any ongoing and future litigation; and

•potential negative impacts from environmental, social and governance and sustainability matters.

For additional information about the factors that could cause actual results to differ materially from those described in forward-looking statements, please see the documents that we have filed with the SEC, including our most recent annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and proxy statements.

All future written and verbal forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. New risks and uncertainties arise from time to time, and it is impossible for us to predict these events or how they may affect us. Readers are cautioned not to place undue reliance on these forward-looking statements. We assume no obligation to update any forward-looking statements after the date of this report as a result of new information, future events or developments, except as required by federal securities laws.

THE COMPANY

We are the leading global developer and operator of destination properties ("Integrated Resorts") that feature premium accommodations, world-class gaming, entertainment and retail malls, convention and exhibition facilities, celebrity chef restaurants and other amenities.

We currently own and operate Integrated Resorts in Macao and Singapore. We believe our geographic diversity, best-in-class properties and convention-based business model provide us with the best platform in the hospitality and gaming industry to continue generating growth and cash flow while simultaneously pursuing new development opportunities. Our unique convention-based marketing strategy allows us to attract business travelers during the slower mid-week periods while leisure travelers occupy our properties during the weekends. Our convention, trade show and meeting facilities, combined with the on-site amenities offered at our Macao and Singapore Integrated Resorts, provide flexible and expansive space for meetings, incentives, conventions and exhibitions.

For a description of our business, financial condition, results of operations and other important information regarding our Company, we refer you to our filings with the SEC incorporated by reference in this prospectus. For instructions on how to find copies of these documents, see “Where You Can Find More Information.”

We are organized under the laws of the state of Nevada. Our principal executive office is located at 5420 S. Durango Dr., Las Vegas, Nevada 89113. Our telephone number at that address is (702) 923-9000. Our website address is www.sands.com. The information on our website is not part of this prospectus.

RISK FACTORS

Investing in our securities involves risk. You should carefully consider the specific risks discussed or incorporated by reference in the applicable prospectus supplement, together with all the other information contained in the prospectus supplement or incorporated by reference in this prospectus and the applicable prospectus supplement. You should also consider the risks, uncertainties and assumptions discussed under the heading “Risk Factors” included in our Annual Report on Form 10-K for the year ended December 31, 2022 and in our Quarterly Reports on Form 10-Q for the periods ended March 31, 2023, June 30, 2023 and September 30, 2023, all of which are incorporated by reference in this prospectus. These risk factors may be amended, supplemented or superseded from time to time by other reports we file with the SEC in the future.

USE OF PROCEEDS

We will use the net proceeds we receive from the sale of the securities offered by this prospectus for general corporate purposes, unless we specify otherwise in the applicable prospectus supplement. General corporate purposes may include future construction and development projects, additions to working capital, capital expenditures, repayment of debt, the financing of possible acquisitions and investments or stock repurchases.

DESCRIPTION OF THE DEBT SECURITIES

We may offer debt securities in one or more series, which may be senior debt securities or subordinated debt securities and which may be convertible into another security.

The following description briefly sets forth certain general terms and provisions of the debt securities. The particular terms of the debt securities offered by any prospectus supplement and the extent, if any, to which the following general terms and provisions may apply to the debt securities, will be described in an accompanying prospectus supplement. Unless otherwise specified in an accompanying prospectus supplement, our debt securities will be issued in one or more series under the indenture, dated as of July 31, 2019, between us and U.S. Bank National Association, trustee, which has been attached as an exhibit. The terms of the debt securities will include those set forth in the indenture and those made a part of the indenture by the Trust Indenture Act of 1939 (“TIA”). You should read the summary below, any accompanying prospectus supplement and the provisions of the indenture in their entirety before investing in our debt securities.

The aggregate principal amount of debt securities that may be issued under the indenture is unlimited. The prospectus supplement relating to any series of debt securities that we may offer will contain the specific terms of the debt securities. These terms may include, among others, the following:

•the title and aggregate principal amount of the debt securities and any limit on the aggregate principal amount of such series;

•any applicable subordination provisions for any subordinated debt securities;

•the maturity date(s) or method for determining same;

•the interest rate(s) or the method for determining same;

•the dates on which interest will accrue or the method for determining dates on which interest will accrue and dates on which interest will be payable and whether interest will be payable in cash, additional securities or some combination thereof;

•whether the debt securities are convertible or exchangeable into other securities and any related terms and conditions;

•redemption or early repayment provisions;

•authorized denominations;

•if other than the principal amount, the principal amount of debt securities payable upon acceleration;

•place(s) where payment of principal and interest may be made, where debt securities may be presented and where notices or demands upon the company may be made;

•the form or forms of the debt securities of the series including such legends as may be required by applicable law;

•whether the debt securities will be issued in whole or in part in the form of one or more global securities and the date as of which the securities are dated if other than the date of original issuance;

•whether the debt securities are secured and the terms of such security;

•the amount of discount or premium, if any, with which the debt securities will be issued;

•any covenants applicable to the particular debt securities being issued;

•any additions or changes in the defaults and events of default applicable to the particular debt securities being issued;

•the guarantors of each series, if any, and the extent of the guarantees (including provisions relating to seniority, subordination and release of the guarantees), if any;

•the currency, currencies or currency units in which the purchase price for, the principal of and any premium and any interest on, the debt securities will be payable;

•the time period within which, the manner in which and the terms and conditions upon which we or the holders of the debt securities can select the payment currency;

•our obligation or right to redeem, purchase or repay debt securities under a sinking fund, amortization or analogous provision;

•any restriction or conditions on the transferability of the debt securities;

•provisions granting special rights to holders of the debt securities upon occurrence of specified events;

•additions or changes relating to compensation or reimbursement of the trustee of the series of debt securities;

•provisions relating to the modification of the indenture both with and without the consent of holders of debt securities issued under the indenture and the execution of supplemental indentures for such series; and

•any other terms of the debt securities (which terms shall not be inconsistent with the provisions of the TIA, but may modify, amend, supplement or delete any of the terms of the indenture with respect to such series of debt securities).

General

We may sell the debt securities, including original issue discount securities, at par or at a substantial discount below their stated principal amount. Unless we inform you otherwise in a prospectus supplement, we may issue additional debt securities of a particular series without the consent of the holders of the debt securities of such series or any other series outstanding at the time of issuance. Any such additional debt securities, together with all other outstanding debt securities of that series, will constitute a single series of securities under the indenture.

We will describe in an accompanying prospectus supplement any other special considerations for any debt securities we sell that are denominated in a currency or currency unit other than U.S. dollars. In addition, debt securities may be issued where the amount of principal and/or interest payable is determined by reference to one or more currency exchange rates, commodity prices, equity indices or other factors. Holders of such securities may receive a principal amount or a payment of interest that is greater than or less than the amount of principal or interest

otherwise payable on such dates, depending upon the value of the applicable currencies, commodities, equity indices or other factors. Information as to the methods for determining the amount of principal or interest, if any, payable on any date, and the currencies, commodities, equity indices or other factors to which the amount payable on such date is linked will be described in an accompanying prospectus supplement.

United States federal income tax consequences and special considerations, if any, applicable to any such series will be described in an accompanying prospectus supplement.

We expect most debt securities to be issued in fully registered form without coupons and in denominations of $2,000 and any integral multiple of $1,000 in excess thereof. Subject to the limitations provided in the indenture and in an accompanying prospectus supplement, debt securities that are issued in registered form may be transferred or exchanged at the designated corporate trust office of the trustee, without the payment of any service charge, other than any tax or other governmental charge payable in connection therewith.

Certain Definitions

The following are certain of the terms defined in the indenture:

“Gaming Authority” means any agency, authority, board, bureau, commission, department, office or instrumentality of any nature whatsoever of the United States or foreign government, any state, province or any city or other political subdivision, whether now or hereafter existing, or any officer or official thereof, including without limitation, the Macao Gaming Authorities, the Singapore Gambling Regulatory Authority and any other agency with authority to regulate any gaming operation (or proposed gaming operation) owned, managed or operated by the Company or any of its subsidiaries.

“Gaming Laws” means the gaming laws of a jurisdiction or jurisdictions to which the Company or a Subsidiary of the Company is, or may at any time after the date of the applicable indenture be, subject, including all applicable provisions of all: (1) constitutions, treatises, statutes or laws governing gaming operations (including, without limitation, card club casinos and pari-mutuel race tracks) and rules, regulations and ordinances of any Gaming Authority; (2) any governmental approval relating to any gaming business (including pari-mutuel betting) or enterprise; and (3) orders, decisions, judgments, awards and decrees of any Gaming Authority.

“Gaming Licenses” means every license, franchise or other authorization required to own, lease, operate or otherwise conduct activities of the Company or any of its subsidiaries and the regulations promulgated pursuant thereto, and other applicable federal, state, foreign or local laws.

Mandatory Disposition Pursuant to Gaming Laws

Gaming Authorities in several jurisdictions extensively regulate our casino entertainment operations. The Gaming Authority of any jurisdiction in which we or any of our subsidiaries conduct or propose to conduct gaming may require that a holder of the debt securities or the beneficial owner of the debt securities of a holder be licensed, qualified or found suitable under applicable Gaming Laws. Under the indenture, each person that holds or acquires beneficial ownership of any of the debt securities shall be deemed to have agreed, by accepting such debt securities, that if any such Gaming Authority requires such person to be licensed, qualified or found suitable under applicable Gaming Laws, such holder or beneficial owner, as the case may be, shall apply for a license, qualification or a finding of suitability within the required time period.

Except as described in the applicable prospectus supplement relating to such series of debt securities, if a person required to apply or become licensed or qualified or be found suitable fails to do so, we will have the right, at our election, (1) to require such person to dispose of its debt securities or beneficial interest therein within 30 days of receipt of notice of such finding by the applicable Gaming Authority or such earlier date as may be requested or prescribed by such Gaming Authority or (2) to redeem such debt securities at a redemption price equal to the lesser of:

•100% of the principal amount thereof;

•the price at which such person acquired the debt securities; or

•the fair market value of the debt securities as determined in good faith by the board of directors of the Company, together with, in each case, accrued and unpaid interest to the earlier of the date of redemption or

such earlier date as may be required by the Gaming Authority or the date of the finding of unsuitability by such Gaming Authority, which may be less than 30 days following the notice of redemption, if so ordered by such Gaming Authority,

or such other price as may be ordered by the Gaming Authority. Immediately upon a determination that a holder or beneficial owner will not be licensed, qualified or found suitable, the holder or beneficial owner will have no further rights (a) to exercise any right conferred by the debt securities, directly or indirectly, through any trustee, nominee or any other person or (b) to receive any interest or other distribution or payment with respect to the debt securities except the redemption price of the debt securities described in this paragraph.

We will notify the trustee in writing of any such redemption as soon as practicable. Under the indenture, we will not be required to pay or reimburse any holder of the debt securities or beneficial owner who is required to apply for such license, qualification or finding of suitability for the costs of the licensure or investigation for such qualification or finding of suitability.

Global Securities

Unless we inform you otherwise in an accompanying prospectus supplement, the debt securities of a series may be issued in whole or in part in the form of one or more global securities that will be deposited with, or on behalf of, a depositary identified in an accompanying prospectus supplement. Unless and until a global security is exchanged in whole or in part for the individual debt securities, a global security may not be transferred except as a whole by the depositary for such global security to a nominee of such depositary or by a nominee of such depositary to such depositary or another nominee of such depositary or by such depositary or any such nominee to a successor of such depositary or a nominee of such successor.

Governing Law

The indenture and the debt securities shall be construed in accordance with and governed by the laws of the State of New York.

DESCRIPTION OF CAPITAL STOCK

The following description of the terms of our common stock and preferred stock sets forth certain general terms and provisions of our common stock and preferred stock, par value $0.001 per share, to which any prospectus supplement may relate. This section also summarizes relevant provisions of Nevada law. The following summary of the terms of our common stock and preferred stock does not purport to be complete and is subject to, and is qualified in its entirety by reference to, the applicable provisions of Nevada law and our restated articles of incorporation and our second amended and restated by-laws, copies of which are exhibits to the registration statement of which this prospectus forms a part.

Capital Stock

Our authorized capital stock currently consists of 1,000,000,000 shares of common stock and 50,000,000 shares of preferred stock. As of September 30, 2023, we had 764,490,874 outstanding shares of common stock, including vested and unvested shares of restricted stock and excluding the following shares of common stock:

•14,453,463 shares of common stock issuable upon the exercise of stock options outstanding as of September 30, 2023, with a weighted-average exercise price of $48.09 per share; and

•1,816,318 shares of common stock reserved for future awards under our 2004 equity award plan.

As of September 30, 2023, there were approximately 304 holders of record of our common stock.

As of September 30, 2023, we had no shares of preferred stock outstanding.

Common Stock

The holders of our common stock are entitled to one vote per share on all matters submitted to a vote of stockholders, including the election of directors. Holders of the common stock do not have any preemptive rights or cumulative voting rights, which means that the holders of a majority of the outstanding common stock voting for the election of directors can elect all directors then being elected. The holders of our common stock are entitled to receive dividends when, as and if declared by our board of directors out of legally available funds. Upon our liquidation or dissolution, the holders of common stock will be entitled to share ratably in those of our assets that are legally available for distribution to stockholders after payment of liabilities and subject to the prior rights of any holders of preferred stock then outstanding. All of the outstanding shares of common stock are fully paid and nonassessable. The rights, preferences and privileges of holders of common stock are subject to the rights of the holders of shares of any series of preferred stock that may be issued in the future.

Preferred Stock

We are authorized to issue up to 50,000,000 shares of preferred stock. Our board of directors is authorized, subject to limitations prescribed by Nevada law and our restated articles of incorporation, to determine the terms and conditions of the preferred stock, including whether the shares of preferred stock will be issued in one or more series, the number of shares to be included in each series and the powers, designations, preferences and rights of the shares. Our board of directors also is authorized to designate any qualifications, limitations or restrictions on the shares without any further vote or action by the stockholders. The issuance of preferred stock may have the effect of delaying, deferring or preventing a change in control of our Company and may adversely affect the voting and other rights of the holders of our common stock, which could have an adverse impact on the market price of our common stock.

Certain Articles of Incorporation, By-Laws and Statutory Provisions

The provisions of our restated articles of incorporation and second amended and restated by-laws and of Chapter 78 of the Nevada Revised Statutes (“NRS”) summarized below may have an anti-takeover effect and may delay, defer or prevent a tender offer or takeover attempt that you might consider in your best interest, including an attempt that might result in your receipt of a premium over the market price for your shares.

Limitation of Liability of Officers and Directors

Nevada law currently provides that neither our directors nor officers will be personally liable to our Company, our stockholders or our creditors for damages for any act or omission as a director or officer other than in circumstances where both (i) the presumption that the director or officer acted in good faith, on an informed basis and with a view to the interests of the Company has been rebutted; (ii) the act or failure to act of the director or officer is proven to have been a breach of his or her fiduciary duties as a director or officer; and (iii) such breach is proven to have involved intentional misconduct, fraud or a knowing violation of law.

As a result, neither we nor our stockholders have the right, through stockholders’ derivative suits on our behalf, to recover damages against a director or officer as a result of an act or failure to act in his or her capacity as a director or officer, except where the standards described above are met. Nevada law allows the articles of incorporation of a corporation to provide for greater liability of the corporation’s directors and officers. Our restated articles of incorporation do not provide for such expanded liability.

Special Meetings of Stockholders

Our restated articles of incorporation and second amended and restated by-laws provide that special meetings of stockholders may be called only by the chairman or by a majority of the members of our board. Stockholders are not permitted to call a special meeting of stockholders, to require that the chairman call such a special meeting, or to require that our board request the calling of a special meeting of stockholders.

Stockholder Action; Advance Notice Requirements for Stockholder Proposals and Director Nominations

Our restated articles of incorporation provide that stockholders may not take action by written consent unless this action and the taking of such action by written consent have been expressly approved by the board of directors, and otherwise may only take action at duly called annual or special meetings. In addition, our second amended and restated by-laws establish advance notice procedures for:

•stockholders to nominate candidates for election as a director; and

•stockholders to propose topics for consideration at stockholders’ meetings.

Stockholders must notify our corporate secretary in writing prior to the meeting at which the matters are to be acted upon or directors are to be elected. The notice must contain the information specified in our second amended and restated by-laws. To be timely, the notice must be received at our corporate headquarters not less than 90 days nor more than 120 days prior to the first anniversary of the date of the prior year’s annual meeting of stockholders. If the annual meeting is advanced by more than 30 days, or delayed by more than 70 days, from the anniversary of the preceding year’s annual meeting, notice by the stockholder, to be timely, must be received not earlier than the 120th day prior to the annual meeting and not later than the later of the 90th day prior to the annual meeting or the 10th day following the day on which we notify stockholders of the date of the annual meeting, either by mail or other public disclosure. In the case of a special meeting of stockholders called to elect directors, the stockholder notice must be received not earlier than 120 days prior to the special meeting and not later than the later of the 90th day prior to the special meeting or 10th day following the day on which we notify stockholders of the date of the special meeting, either by mail or other public disclosure. These provisions may preclude some stockholders from bringing matters before the stockholders at an annual or special meeting or from nominating candidates for director at an annual or special meeting.

Election and Removal of Directors

Each director shall be elected to hold office for a term expiring at the next annual meeting of stockholders and until the election and qualification of his or her successor in office or such director’s earlier death, resignation, disqualification or removal from office. A director may be removed from office at any time, but only for cause and only by the affirmative vote of at least 66⅔% of the total voting power of our outstanding shares of capital stock entitled to vote generally in the election of directors, voting together as a single class. Our board of directors is authorized to elect a director to fill a newly created directorship resulting from any increase in the authorized number of directors or to fill any vacancies on our board resulting from death, resignation, disqualification, removal from office or other cause.

Nevada Anti-Takeover Statutes

Combinations with Interested Stockholders

Pursuant to our restated Articles of Incorporation, we have opted out of the “business combination” provisions Sections 78.411 through 78.444, inclusive, of the NRS regulating corporate takeovers. These statutes prevent certain Nevada corporations, under certain circumstances, from engaging in various “combination” transactions with any “interested stockholder” for a period of up to four years after the date of the transaction in which the person became an interested stockholder, unless the combination or transaction by which the person first became an interested stockholder was approved in advance by the board of directors. An “interested stockholder” for purposes of these provisions is defined as a beneficial owner of 10% or more of the voting power of the corporation, including an affiliate or associate of the corporation that, within two years prior to the combination, beneficially owned such percentage of the voting power. Where the person becoming an interested stockholder was not approved in advance by the board of directors, the Nevada business combination statute imposes a basic moratorium of two years on business combinations unless they are approved by the board of directors and stockholders owning at least 60% of the outstanding voting power not beneficially owned by the interested stockholder and its affiliates and associates. After the two-year period, but before four years, combinations remain prohibited but may also be permitted if the interested stockholder satisfies certain requirements with respect to the aggregate consideration to be received by holders of outstanding shares in the combination.

With the approval of our stockholders, we may amend our articles of incorporation in the future to become governed by NRS Sections 78.411 to 78.444, inclusive.

Acquisitions of Controlling Interests

NRS Sections 78.378 to 78.3793, inclusive, provides that, in certain circumstances, a stockholder who acquires a controlling interest in a Nevada corporation having at least 200 stockholders of record (including at least 100 of whom have addresses in Nevada appearing on the stock ledger of the corporation) from voting its “control shares” in the issuing corporation’s stock after crossing certain ownership threshold percentages, unless the acquirer obtains

approval of the issuing corporation’s disinterested stockholders or unless the issuing corporation amends its articles of incorporation or bylaws within 10 days following the acquisition to provide that these sections do not apply to the corporation or to an acquisition of a controlling interest, specifically by types of existing or future stockholders, whether or not identified. The statute specifies three thresholds: one-fifth or more but less than one-third, one-third but less than a majority, and a majority or more, of the outstanding voting power of a corporation. Generally, once an acquirer crosses one of the foregoing thresholds, those shares acquired in an acquisition or offered to acquire in an acquisition and acquired within 90 days immediately preceding the date that the acquirer crosses one of the thresholds become “control shares,” and such control shares are deprived of the right to vote until disinterested stockholders restore the right. In addition, the corporation, if provided in its articles of incorporation or bylaws in effect on the tenth day following the acquisition of a controlling interest, may cause the redemption of all of the control shares at the average price paid for such shares if the stockholders do not accord the control shares full voting rights. If control shares are accorded full voting rights and the acquiring person has acquired a majority or more of all voting power, all other stockholders who did not vote in favor of authorizing voting rights to the control shares are entitled to demand payment for the fair value of their shares in accordance with statutory procedures established for dissenters’ rights. Our board of directors may unilaterally avoid the statute’s burdens on an acquisition of control shares by amending our by-laws either before or within ten days after the relevant acquisition of such control shares. In addition, the articles of incorporation or bylaws of a Nevada corporation may impose stricter requirements than those of NRS 78.378 to 78.3793. Presently, neither our restated articles of incorporation nor our second amended and restated by-laws opt out of this statute.

Amendment to Certain Articles of Incorporation and By-Law Provisions

Our restated articles of incorporation provide that amendments to certain provisions of the articles will require the affirmative vote of the holders of at least 66⅔% of the outstanding shares of our voting stock, namely:

•the provisions requiring a 66⅔% stockholder vote for removal of directors;

•the provisions requiring a 66⅔% stockholder vote for the amendment, repeal or adoption of our by-law provisions (described below);

•the provisions requiring a 66⅔% stockholder vote for the amendment of certain provisions of our articles of incorporation; and

•the provisions prohibiting stockholder action by written consent except under certain circumstances.

In addition, our restated articles of incorporation and second amended and restated by-laws provide that our by-laws are subject to adoption, amendment or repeal either by a majority of the members of our board of directors or the affirmative vote of the holders of not less than 66⅔% of the outstanding shares of our voting stock voting as a single class.

The 66⅔% vote will allow the holders of a minority of our voting securities to prevent the holders of a majority or more of our voting securities from amending certain provisions of our restated articles of incorporation and our second amended and restated by-laws.

Transfer Agent and Registrar

The transfer agent and registrar for the common stock is Equiniti Trust Company, LLC. Its telephone number is (800) 937-5449.

Listing

Our common stock is listed on the New York Stock Exchange under the symbol “LVS.”

DESCRIPTION OF THE DEPOSITARY SHARES

General

We may, at our option, elect to offer fractional shares rather than full shares of the preferred stock of a series. In the event that we determine to do so, we will issue receipts for depositary shares, each of which will represent a

fraction (to be set forth in the prospectus supplement relating to a particular series of preferred stock) of a share of a particular series of preferred stock as more fully described below.

The shares of any series of preferred stock represented by depositary shares will be deposited under one or more deposit agreements among us, a depositary to be named in the applicable prospectus supplement, and the holders from time to time of depositary receipts issued thereunder. Subject to the terms of the applicable deposit agreement, each holder of a depositary share will be entitled, in proportion to the applicable fraction of a share of preferred stock represented by the depositary share, to all the rights and preferences of the preferred stock represented thereby (including, as applicable, dividend, voting, redemption, subscription and liquidation rights).

The depositary shares will be evidenced by depositary receipts issued pursuant to the deposit agreement. Depositary receipts will be distributed to those persons purchasing the fractional shares of the related series of preferred stock.

The following description sets forth certain general terms and provisions of the depositary shares to which any prospectus supplement may relate. The particular terms of the depositary shares to which any prospectus supplement may relate and the extent, if any, to which such general provisions may apply to the depositary shares so offered will be described in the applicable prospectus supplement. To the extent that any particular terms of the depositary shares or the deposit agreement described in a prospectus supplement differ from any of the terms described below, then the terms described below will be deemed to have been superseded by that prospectus supplement relating to such deposited shares. The forms of deposit agreement and depositary receipt will be filed as exhibits to the documents incorporated or deemed to be incorporated by reference in this prospectus.

The following summary of certain provisions of the depositary shares and deposit agreement does not purport to be complete and is subject to, and is qualified in its entirety by express reference to, all the provisions of the deposit agreement and the applicable prospectus supplement, including the definitions.

Immediately following our issuance of shares of a series of preferred stock that will be offered as fractional shares, we will deposit the shares with the depositary, which will then issue and deliver the depositary receipts to the purchasers thereof. Depositary receipts will only be issued evidencing whole depositary shares. A depositary receipt may evidence any number of whole depositary shares.

Pending the preparation of definitive depositary receipts, the depositary may, upon our written order, issue temporary depositary receipts substantially identical to (and entitling the holders thereof to all the rights pertaining to) the definitive depositary receipts but not in definitive form. Definitive depositary receipts will be prepared thereafter without unreasonable delay, and such temporary depositary receipts will be exchangeable for definitive depositary receipts at our expense.

Dividends and Other Distributions

The depositary will distribute all cash dividends or other cash distributions received in respect of the related series of preferred stock to the record holders of depositary shares relating to the series of preferred stock in proportion to the number of the depositary shares owned by the holders.

In the event of a distribution other than in cash, the depositary will distribute property received by it to the record holders of depositary shares entitled thereto in proportion to the number of depositary shares owned by the holders, unless the depositary determines that the distribution cannot be made proportionately among the holders or that it is not feasible to make the distributions, in which case the depositary may, with our approval, adopt any method as it deems equitable and practicable for the purpose of effecting the distribution, including the sale (at public or private sale) of the securities or property thus received, or any part thereof, at the place or places and upon those terms as it may deem proper.

The amount distributed in any of the foregoing cases will be reduced by any amounts required to be withheld by us or the depositary on account of taxes or other governmental charges.

Redemption of Depositary Shares

If any series of the preferred stock underlying the depositary shares is subject to redemption, the depositary shares will be redeemed from the proceeds received by the depositary resulting from any redemption, in whole or in part, of the series of the preferred stock held by the depositary. The redemption price per depositary share will be

equal to the applicable fraction of the redemption price per share payable with respect to the series of the preferred stock. If we redeem shares of a series of preferred stock held by the depositary, the depositary will redeem as of the same redemption date the number of depositary shares representing the shares of preferred stock so redeemed. If less than all the depositary shares are to be redeemed, the depositary shares to be redeemed will be selected by lot or substantially equivalent method determined by the depositary.

After the date fixed for redemption, the depositary shares so called for redemption will no longer be deemed to be outstanding and all rights of the holders of the depositary shares will cease, except the right to receive the monies payable upon redemption and any money or other property to which the holders of the depositary shares were entitled upon such redemption, upon surrender to the depositary of the depositary receipts evidencing the depositary shares. Any funds deposited by us with the depositary for any depositary shares that the holders thereof fail to redeem will be returned to us after a period of two years from the date the funds are so deposited.

Voting the Underlying Preferred Stock

Upon receipt of notice of any meeting at which the holders of any series of the preferred stock are entitled to vote, the depositary will mail the information contained in the notice of meeting to the record holders of the depositary shares relating to the series of preferred stock. Each record holder of the depositary shares on the record date (which will be the same date as the record date for the related series of preferred stock) will be entitled to instruct the depositary as to the exercise of the voting rights pertaining to the number of shares of the series of preferred stock represented by that holder’s depositary shares. The depositary will endeavor, insofar as practicable, to vote or cause to be voted the number of shares of preferred stock represented by the depositary shares in accordance with the instructions, provided the depositary receives the instructions sufficiently in advance of the meeting to enable it to so vote or cause to be voted the shares of preferred stock, and we will agree to take all reasonable action that may be deemed necessary by the depositary in order to enable the depositary to do so. The depositary will abstain from voting shares of the preferred stock to the extent it does not receive specific instructions from the holders of depositary shares representing the preferred stock.

Withdrawal of Stock

Upon surrender of the depositary receipts at the corporate trust office of the depositary and upon payment of the taxes, charges and fees provided for in the deposit agreement and subject to the terms thereof, the holder of the depositary shares evidenced thereby will be entitled to delivery at such office, to or upon his or her order, of the number of whole shares of the related series of preferred stock and any money or other property, if any, represented by the depositary shares. Holders of depositary shares will be entitled to receive whole shares of the related series of preferred stock, but holders of the whole shares of preferred stock will not thereafter be entitled to deposit the shares of preferred stock with the depositary or to receive depositary shares therefor. If the depositary receipts delivered by the holder evidence a number of depositary shares in excess of the number of depositary shares representing the number of whole shares of the related series of preferred stock to be withdrawn, the depositary will deliver to the holder or upon his or her order at the same time a new depositary receipt evidencing the excess number of depositary shares.

Amendment and Termination of a Deposit Agreement

The form of depositary receipt evidencing the depositary shares of any series and any provision of the applicable deposit agreement may at any time and from time to time be amended by agreement between us and the depositary. However, any amendment that materially adversely alters the rights of the holders of depositary shares of any series will not be effective unless the amendment has been approved by the holders of at least a majority of the depositary shares of the series then outstanding. Every holder of a depositary receipt at the time the amendment becomes effective will be deemed, by continuing to hold the depositary receipt, to be bound by the deposit agreement as so amended. Notwithstanding the foregoing, in no event may any amendment impair the right of any holder of any depositary shares, upon surrender of the depositary receipts evidencing the depositary shares and subject to any conditions specified in the deposit agreement, to receive shares of the related series of preferred stock and any money or other property represented thereby, except in order to comply with mandatory provisions of applicable law. The deposit agreement may be terminated by us at any time upon not less than 60 days prior written notice to the depositary, in which case, on a date that is not later than 30 days after the date of the notice, the depositary shall deliver or make available for delivery to holders of depositary shares, upon surrender of the depositary receipts

evidencing the depositary shares, the number of whole or fractional shares of the related series of preferred stock as are represented by the depositary shares. The deposit agreement shall automatically terminate after all outstanding depositary shares have been redeemed or there has been a final distribution in respect of the related series of preferred stock in connection with any liquidation, dissolution or winding up of us and the distribution has been distributed to the holders of depositary shares.

Charges of Depositary

We will pay all transfer and other taxes and the governmental charges arising solely from the existence of the depositary arrangements. We will pay the charges of the depositary, including charges in connection with the initial deposit of the related series of preferred stock and the initial issuance of the depositary shares and all withdrawals of shares of the related series of preferred stock, except that holders of depositary shares will pay transfer and other taxes and governmental charges and any other charges as are expressly provided in the deposit agreement to be for their accounts.

Resignation and Removal of Depositary

The depositary may resign at any time by delivering to us written notice of its election to do so, and we may at any time remove the depositary. Any resignation or removal will take effect upon the appointment of a successor depositary, which successor depositary must be appointed within 60 days after delivery of the notice of resignation or removal and must be a bank or trust company having its principal office in the United States and having a combined capital and surplus of at least $50,000,000.

Miscellaneous

The depositary will forward to the holders of depositary shares all reports and communications from us that are delivered to the depositary and which we are required to furnish to the holders of the related preferred stock.

The depositary’s corporate trust office will be identified in the applicable prospectus supplement. Unless otherwise set forth in the applicable prospectus supplement, the depositary will act as transfer agent and registrar for depositary receipts and if shares of a series of preferred stock are redeemable, the depositary will also act as redemption agent for the corresponding depositary receipts.

DESCRIPTION OF THE WARRANTS

The following description of the terms of the warrants sets forth certain general terms and provisions of the warrants to which any prospectus supplement may relate. We may issue warrants for the purchase of senior debt securities, subordinated debt securities, preferred stock, depositary shares or common stock. Warrants may be issued independently or together with debt securities, preferred stock or common stock offered by any prospectus supplement and may be attached to or separate from any such offered securities. Each series of warrants will be issued under a separate warrant agreement to be entered into between us and a bank or trust company as warrant agent. The warrant agent will act solely as our agent in connection with the warrants and will not assume any obligation or relationship of agency or trust for or with any holders or beneficial owners of warrants. The following summary of certain provisions of the warrants does not purport to be complete and is subject to, and qualified in its entirety by reference to, the provisions of the warrant agreement that will be filed with the SEC in connection with the offering of such warrants. Holders of warrants for debt securities will be subject to all of the provisions of the section entitled “Description of the Debt Securities — Mandatory Disposition Pursuant to Gaming Laws.”

Debt Warrants

The prospectus supplement relating to a particular issue of debt warrants will describe the terms of such debt warrants, including the following:

•the title of such debt warrants;

•the offering price for such debt warrants, if any;

•the aggregate number of such debt warrants;

•the designation and terms of the debt securities purchasable upon exercise of such debt warrants;

•if applicable, the designation and terms of the debt securities with which such debt warrants are issued and the number of such debt warrants issued with each such debt security;

•if applicable, the date from and after which such debt warrants and any debt securities issued therewith will be separately transferable;

•the principal amount of debt securities purchasable upon exercise of a debt warrant and the price at which such principal amount of debt securities may be purchased upon exercise (which price may be payable in cash, securities or other property);

•the date on which the right to exercise such debt warrants shall commence and the date on which such right shall expire;

•if applicable, the minimum or maximum amount of such debt warrants that may be exercised at any one time;

•whether the debt warrants represented by the debt warrant certificates or debt securities that may be issued upon exercise of the debt warrants will be issued in registered or bearer form;

•information with respect to book-entry procedures, if any;

•the currency or currency units in which the offering price, if any, and the exercise price are payable;

•if applicable, a discussion of material United States federal income tax considerations;

•the antidilution or adjustment provisions of such debt warrants, if any;

•the redemption or call provisions, if any, applicable to such debt warrants; and

•any additional terms of such debt warrants, including terms, procedures, and limitations relating to the exchange and exercise of such debt warrants.

Stock Warrants

The prospectus supplement relating to any particular issue of depositary share warrants, preferred stock warrants or common stock warrants will describe the terms of such warrants, including the following:

•the title of such warrants;

•the offering price for such warrants, if any;

•the aggregate number of such warrants;

•the designation and terms of the offered securities purchasable upon exercise of such warrants;

•if applicable, the designation and terms of the offered securities with which such warrants are issued and the number of such warrants issued with each such offered security;

•if applicable, the date from and after which such warrants and any offered securities issued therewith will be separately transferable;

•the number of shares of common stock, preferred stock or depositary shares purchasable upon exercise of a warrant and the price at which such shares may be purchased upon exercise;

•the date on which the right to exercise such warrants shall commence and the date on which such right shall expire;

•if applicable, the minimum or maximum amount of such warrants that may be exercised at any one time;

•the currency or currency units in which the offering price, if any, and the exercise price are payable;

•if applicable, a discussion of material United States federal income tax considerations;

•the antidilution or adjustment provisions of such warrants, if any;

•the redemption or call provisions, if any, applicable to such warrants; and

•any additional terms of such warrants, including terms, procedures and limitations relating to the exchange and exercise of such warrants.

DESCRIPTION OF THE PURCHASE CONTRACTS

We may issue, from time to time, purchase contracts, including contracts obligating holders to purchase from us and us to sell to the holders, a specified principal amount of senior debt securities, subordinated debt securities, shares of common stock or preferred stock, depositary shares, government securities, or any of the other securities that we may sell under this prospectus at a future date or dates. The consideration payable upon settlement of the purchase contracts may be fixed at the time the purchase contracts are issued or may be determined by a specific reference to a formula set forth in the purchase contracts. The purchase contracts may be issued separately or as part of units consisting of a purchase contract and other securities or obligations issued by us or third parties, including United States treasury securities, securing the holders’ obligations to purchase the relevant securities under the purchase contracts. The purchase contracts may require us to make periodic payments to the holders of the purchase contracts or units or vice versa, and the payments may be unsecured or prefunded on some basis. The purchase contracts may require holders to secure their obligations under the purchase contracts. Holders of purchase contracts for debt securities will be subject to all of the provisions of the section entitled “Description of the Debt Securities — Mandatory Disposition Pursuant to Gaming Laws.”

The prospectus supplement related to any particular purchase contracts will describe, among other things, the material terms of the purchase contracts and of the securities being sold pursuant to such purchase contracts, a discussion, if appropriate, of any special United States federal income tax considerations applicable to the purchase contracts and any material provisions governing the purchase contracts that differ from those described above. The description in the prospectus supplement will not necessarily be complete and will be qualified in its entirety by reference to the purchase contracts, and, if applicable, collateral arrangements and depositary arrangements, relating to the purchase contracts.

DESCRIPTION OF THE UNITS

We may, from time to time, issue units comprised of one or more of the other securities that may be offered under this prospectus, in any combination. Each unit may also include debt obligations of third parties, such as U.S. Treasury securities. Each unit will be issued so that the holder of the unit is also the holder of each security included in the unit. Thus, the holder of a unit will have the rights and obligations of a holder of each included security. The unit agreement under which a unit is issued may provide that the securities included in the unit may not be held or transferred separately at any time, or at any time before a specified date or other specific circumstances occur. To the extent that units include debt securities, holders of the units will be subject to all of the provisions of the section entitled “Description of the Debt Securities — Mandatory Disposition Pursuant to Gaming Laws.”

Any prospectus supplement related to any particular units will describe, among other things:

•the material terms of the units and of the securities comprising the units, including whether and under what circumstances those securities may be held or transferred separately;

•any material provisions relating to the issuance, payment, settlement, transfer or exchange of the units or of the securities comprising the units;

•if appropriate, any special United States federal income tax considerations applicable to the units; and

•any material provisions of the governing unit agreement that differ from those described above.

PLAN OF DISTRIBUTION

We may offer and sell the securities in any one or more of the following ways:

•to or through underwriters, brokers or dealers;

•directly to one or more other purchasers;

•through a block trade in which the broker or dealer engaged to handle the block trade will attempt to sell the securities as agent, but may position and resell a portion of the block as principal to facilitate the transaction;

•through agents on a best-efforts basis;

•in “at the market” offerings, as defined in Rule 415 under the Securities Act, at negotiated prices, at prices prevailing at the time of sale or at prices related to such prevailing market prices, including sales made directly on the New York Stock Exchange or other stock exchange or trading market, or sales made through a market maker other than on an exchange or other similar offerings through sales agents; or

•otherwise through a combination of any of the above methods of sale.

We may also issue common stock for cash or other consideration upon the exercise of outstanding warrants and other securities.

In addition, we may enter into option, share lending or other types of transactions that require us to deliver shares of common stock to an underwriter, broker or dealer, who will then resell or transfer the shares of common stock under this prospectus. We may enter into hedging transactions with respect to our securities. For example, we may:

•enter into transactions involving short sales of the shares of common stock by underwriters, brokers or dealers;

•sell shares of common stock short themselves and deliver the shares to close out short positions;

•enter into option or other types of transactions that require us to deliver shares of common stock to an underwriter, broker or dealer, who will then resell or transfer the shares of common stock under this prospectus; or

•loan or pledge the shares of common stock to an underwriter, broker or dealer, who may sell the loaned shares or, in the event of default, sell the pledged shares.

We may enter into derivative transactions with third parties, or sell securities not covered by this prospectus to third parties in privately negotiated transactions. If the applicable prospectus supplement indicates, in connection with those derivatives, the third parties may sell securities covered by this prospectus and the applicable prospectus supplement, including in short sale transactions. If so, the third party may use securities pledged by us or borrowed from us or others to settle those sales or to close out any related open borrowings of stock, and may use securities received from us in settlement of those derivatives to close out any related open borrowings of stock. The third party in such sale transactions will be an underwriter and, if not identified in this prospectus, will be identified in the applicable prospectus supplement (or a post-effective amendment). In addition, we may otherwise loan or pledge securities to a financial institution or other third party that in turn may sell the securities short using this prospectus. Such financial institution or other third party may transfer its economic short position to investors in our securities or in connection with a concurrent offering of other securities.

Each time we sell securities, we will provide a prospectus supplement that will name any underwriter, dealer or agent involved in the offer and sale of the securities. The prospectus supplement will also set forth the terms of the offering, including:

•the purchase price of the securities and the proceeds we will receive from the sale of the securities;

•any underwriting discounts and other items constituting underwriters’ compensation;

•any public offering or purchase price and any discounts or commissions allowed or re-allowed or paid to dealers;

•any commissions allowed or paid to agents;

•any other offering expenses;

•any securities exchanges on which the securities may be listed;

•the method of distribution of the securities;

•the terms of any agreement, arrangement or understanding entered into with the underwriters, brokers or dealers; and

•any other information we think is important.

If underwriters or dealers are used in the sale, the securities will be acquired by the underwriters or dealers for their own account. The securities may be sold from time to time in one or more transactions:

•at a fixed price or prices, which may be changed;

•at market prices prevailing at the time of sale;

•at prices related to such prevailing market prices;

•at varying prices determined at the time of sale; or

•at negotiated prices.

Such sales may be effected:

•in transactions on any national securities exchange or quotation service on which the securities may be listed or quoted at the time of sale;

•in transactions in the over-the-counter market;

•in block transactions in which the broker or dealer so engaged will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction, or in crosses, in which the same broker acts as an agent on both sides of the trade;

•through the writing of options; or

•through other types of transactions.

The securities may be offered to the public either through underwriting syndicates represented by one or more managing underwriters or directly by one or more of such firms. Unless otherwise set forth in the prospectus supplement, the obligations of underwriters or dealers to purchase the securities offered will be subject to certain conditions precedent and the underwriters or dealers will be obligated to purchase all the offered securities if any are purchased. Any public offering price and any discount or concession allowed or reallowed or paid by underwriters or dealers to other dealers may be changed from time to time.