- Net sales increased 6.0% year-over-year to $718.1 million

- Net income was $29.1 million compared to $59.7 million in the

prior year, with net income margin of 4.1% and 8.8%,

respectively

- Adjusted EBITDA margin1 decreased 160 basis points

year-over-year to 14.6%

- Diluted earnings per share was $0.22 compared to $0.46 in the

prior year quarter; adjusted diluted earnings per share1 was

$0.40 compared to $0.49 in the prior year quarter

- Operating cash flow for the thirty-nine weeks ended September

29, 2024 was $176.9 million with free cash flow1 of $142.3

million

- Reiterates 2024 financial outlook

MasterBrand, Inc. (NYSE: MBC, the “Company,” or “MasterBrand”),

the largest residential cabinet manufacturer in North America,

today announced third quarter 2024 financial results.

“We are pleased to announce that our third quarter financial

performance was in-line with our expectations, as we continued to

navigate choppiness in our end markets,” said Dave Banyard,

President and Chief Executive Officer. “Our associates performed at

an exceptionally high level in the quarter, delivering on our core

business objectives and making steady progress on the integration

of our Supreme acquisition. We are encouraged to see our highly

complementary products, dealer channel and operations coming

together as planned.”

“As we look to close out 2024, we remain focused on positioning

the Company for growth in any end market environment and delivering

superior financial returns for our shareholders,” Banyard

continued.

Third Quarter 2024

Net sales were $718.1 million, an increase of 6% compared to the

third quarter of 2023, driven by the 9% of growth from our Supreme

acquisition. This increase was partially offset by lower average

selling price (ASP) of 3%, with volume and foreign exchange having

no impact on year-over-year performance. Gross profit was $238.0

million, compared to $237.5 million in the prior year. Gross profit

margin decreased 200 basis points to 33.1%, on lower ASP, personnel

and freight inflation, and a one-time benefit in the prior year

period attributable to medical insurance rebates and insurance

proceeds related to tornado damage sustained at our Jackson,

Georgia facility. This was partially offset by additional cost

savings from strategic initiatives and continuous improvement

efforts and favorable variable compensation.

Net income was $29.1 million, compared to $59.7 million in the

third quarter of 2023, a decrease of 51.3%, primarily due to

acquisition-related costs, lower gross profit margin as discussed

above, restructuring charges and higher interest expense, partially

offset by favorable variable compensation and positive net income

contribution from Supreme. Net income margin was 4.1% compared to

8.8% in the prior year.

Adjusted EBITDA1 was $104.5 million, compared to $109.8

million in the third quarter of 2023. Adjusted EBITDA

margin1 decreased 160 basis points to 14.6%, driven by a

decrease in gross profit margin.

Diluted earnings per share were $0.22 compared to $0.46 in the

third quarter of 2023. Adjusted diluted earnings per share1

were $0.40 compared to $0.49 in the third quarter of 2023.

Balance Sheet, Cash Flow and Capital

Allocation

As of September 29, 2024, the Company had $108.4 million in cash

and $350.4 million of availability under its revolving credit

facility. Total debt was $1,062.3 million and our ratio of total

debt to net income from the most recent trailing twelve months was

7.2x as of September 29, 2024. For the same period, net

debt1 was $953.9 million and our ratio of net debt to

adjusted EBITDA1 was 2.5x.

Operating cash flow was $176.9 million for the thirty-nine weeks

ended September 29, 2024, compared to $336.5 million in the

thirty-nine weeks ended September 24, 2023. This decline was due to

a benefit in the prior year from a strategic inventory build

release. Free cash flow1 was $142.3 million for the

thirty-nine weeks ended September 29, 2024, compared to $315.1

million for the thirty-nine weeks ended September 24, 2023.

During the thirty-nine weeks ended September 29, 2024, the

Company repurchased approximately 371 thousand shares of common

stock for approximately $6.5 million. No shares were repurchased in

the quarter ended September 29, 2024.

2024 Financial Outlook

For full year 2024, the Company reiterates prior

expectations:

- Net sales year-over-year increase of low single-digit

percentage

- Organic decline of low single-digit percentage

- Acquisition-related increase of mid single-digit

percentage

- Adjusted EBITDA1,2 in the range of $385 million to $405

million, with related adjusted EBITDA margin1,2 of roughly

14.0% to 14.5%

- Adjusted Diluted EPS1,2 in the range of $1.50 to

$1.62

The Company expects organic net sales performance to be in line

with the underlying market demand, as new products, channel

specific offerings, and previously implemented price actions gain

traction.

“Our third quarter financial performance was driven by our

continued operational excellence and our acquisition of Supreme, as

we delivered year-over-year net sales growth in a softer end market

environment,” said Andi Simon, Executive Vice President and Chief

Financial Officer. “In-line with our prior expectations, we believe

demand trends across our R&R and new construction end markets

will remain mixed for the balance of the year. With these factors

in mind, our 2024 outlook is unchanged; we anticipate

year-over-year growth in net sales and profitability.”

Conference Call Details

The Company will hold a live conference call and webcast at 4:30

p.m. ET today, November 5, 2024, to discuss the financial results

and business outlook. Telephone access to the live call will be

available at (877) 407-4019 (U.S.) or by dialing (201) 689-8337

(international). The live audio webcast can be accessed on the

“Investors” section of the MasterBrand website

www.masterbrand.com.

A telephone replay will be available approximately one hour

following completion of the call through November 19, 2024. To

access the replay, please dial 877-660-6853 (U.S.) or 201-612-7415

(international). The replay passcode is 13749429. An archived

webcast of the conference call will also be available on the

"Investors" page of the Company's website.

Non-GAAP Financial

Measures

To supplement the financial information presented in accordance

with generally accepted accounting principles in the United States

(“GAAP”) in this earnings release, certain non-GAAP financial

measures as defined under SEC rules have been included. It is our

intent to provide non-GAAP financial information to enhance

understanding of our financial information as prepared in

accordance with GAAP. Non-GAAP financial measures should be

considered in addition to, not as a substitute for, other financial

measures prepared in accordance with GAAP. Our methods of

determining these non-GAAP financial measures may differ from the

methods used by other companies for these or similar non-GAAP

financial measures. Accordingly, these non-GAAP financial measures

may not be comparable to measures used by other companies.

We use EBITDA, adjusted EBITDA, adjusted EBITDA margin, adjusted

net income, adjusted net income margin, adjusted diluted earnings

per share (“adjusted diluted EPS”), free cash flow, net debt, and

net debt to adjusted EBITDA, which are all non-GAAP financial

measures. EBITDA is defined as earnings before interest, taxes,

depreciation and amortization. We evaluate the performance of our

business based on income before income taxes, but also look to

EBITDA as a performance evaluation measure because interest expense

is related to corporate functions, as opposed to operations. For

that reason, we believe EBITDA is a useful metric to investors in

evaluating our operating results. Adjusted EBITDA is calculated by

removing the impact of non-operational results and special items

from EBITDA. Adjusted EBITDA margin is calculated as adjusted

EBITDA divided by net sales. Adjusted net income is calculated by

removing the impact of non-operational results, including non-cash

amortization expense, which is not deemed to be indicative of the

results of current or future operations, and special items from net

income. Adjusted net income margin is calculated as adjusted net

income divided by net sales. Adjusted diluted EPS is a measure of

our diluted earnings per share excluding non-operational results

and special items. We believe these non-GAAP measures are useful to

investors as they are representative of our core operations and are

used in the management of our business, including decisions

concerning the allocation of resources and assessment of

performance.

Free cash flow is defined as cash flow from operations less

capital expenditures. We believe that free cash flow is a useful

measure to investors because it is a meaningful indicator of cash

generated from operating activities available for the execution of

our business strategy, and is used in the management of our

business, including decisions concerning the allocation of

resources and assessment of performance. Net debt is defined as

total balance sheet debt less cash and cash equivalents. We believe

this measure is useful to investors as it provides a measure to

compare debt less cash and cash equivalents across periods on a

consistent basis. Net debt to adjusted EBITDA is calculated by

dividing net debt by the trailing twelve months adjusted EBITDA.

Net debt to adjusted EBITDA is used by management to assess our

financial leverage and ability to service our debt obligations.

As required by SEC rules, detailed reconciliations of these

non-GAAP financial measures to the most directly comparable GAAP

measure are included in the financial statement section of this

earnings release. We have not provided a reconciliation of our

fiscal 2024 adjusted EBITDA, adjusted EBITDA margin and adjusted

diluted EPS guidance because the information needed to reconcile

these measures is unavailable due to the inherent difficulty of

forecasting the timing or amount of various items that have not yet

occurred, including gains and losses associated with our defined

benefit plans and restructuring and other charges, which are

excluded from adjusted EBITDA, adjusted EBITDA margin, adjusted net

income, adjusted net income margin, and adjusted diluted EPS.

Additionally, estimating such GAAP measures and providing a

meaningful reconciliation consistent with the Company’s accounting

policies for future periods requires a level of precision that is

unavailable for these future periods and cannot be accomplished

without unreasonable effort. Forward-looking non-GAAP measures are

estimated consistent with the relevant definitions and assumptions

used for historical non-GAAP measures.

About MasterBrand:

MasterBrand, Inc. (NYSE: MBC) is the largest manufacturer of

residential cabinets in North America and offers a comprehensive

portfolio of leading residential cabinetry products for the

kitchen, bathroom and other parts of the home. MasterBrand products

are available in a wide variety of designs, finishes and styles and

span the most attractive categories of the cabinets market: stock,

semi-custom and premium cabinetry. These products are delivered

through an industry-leading distribution network of over 6,000

dealers, major retailers and builders. MasterBrand employs over

13,000 associates across more than 20 manufacturing facilities and

offices. Additional information can be found at

www.masterbrand.com.

Forward-Looking Statements:

Certain statements contained in this Press Release, other than

purely historical information, including, but not limited to

estimates, projections, statements relating to our business plans,

objectives and expected operating results, and the assumptions upon

which those statements are based, are forward-looking statements.

Statements preceded by, followed by or that otherwise include the

word “believes,” “expects,” “anticipates,” “intends,” “projects,”

“estimates,” “plans,” “may increase,” “may fluctuate,” and similar

expressions or future or conditional verbs such as “will,”

“should,” “would,” “may,” and “could,” are generally

forward-looking in nature and not historical facts. Where, in any

forward-looking statement, we express an expectation or belief as

to future results or events, such expectation or belief is based on

the current plans and expectations of our management. Although we

believe that these statements are based on reasonable assumptions,

they are subject to numerous factors, risks and uncertainties that

could cause actual outcomes and results to be materially different

from those indicated in such statements. These factors include

those listed under “Risk Factors” in Part I, Item 1A of our Form

10-K for the fiscal year ended December 31, 2023, Part II, Item 1A

of our Form 10-Q for the quarterly period ended June 30, 2024, and

other filings with the SEC.

The forward-looking statements included in this document are

made as of the date of this Press Release and, except pursuant to

any obligations to disclose material information under the federal

securities laws, we undertake no obligation to update, amend or

clarify any forward-looking statements to reflect events, new

information or circumstances occurring after the date of this Press

Release.

Some of the important factors that could cause our actual

results to differ materially from those projected in any such

forward-looking statements include:

- Our ability to develop and expand our business;

- Our ability to develop new products or respond to changing

consumer preferences and purchasing practices;

- Our anticipated financial resources and capital spending;

- Our ability to manage costs;

- Our ability to effectively manage manufacturing operations and

capacity, or an inability to maintain the quality of our

products;

- The impact of our dependence on third parties to source raw

materials and our ability to obtain raw materials in a timely

manner or fluctuations in raw material costs;

- Our ability to accurately price our products;

- Our projections of future performance, including future

revenues, capital expenditures, gross margins, and cash flows;

- The effects of competition and consolidation of competitors in

our industry;

- Costs of complying with evolving tax and other regulatory

requirements and the effect of actual or alleged violations of tax,

environmental or other laws;

- The effect of climate change and unpredictable seasonal and

weather factors;

- Conditions in the housing market in the United States and

Canada;

- The expected strength of our existing customers and consumers

and any loss or reduction in business from one or more of our key

customers or increased buying power of large customers;

- Information systems interruptions or intrusions or the

unauthorized release of confidential information concerning

customers, employees, or other third parties;

- Worldwide economic, geopolitical and business conditions and

risks associated with doing business on a global basis;

- The effects of a public health crisis or other unexpected

event;

- The inability to recognize, or delays in obtaining, anticipated

benefits of the acquisition of Supreme Cabinetry Brands, Inc. (the

“Acquisition”), including synergies, which may be affected by,

among other things, competition, the ability of the combined

company to grow and manage growth profitably, maintain

relationships with customers and suppliers and retain key

employees;

- The impact of our current and any additional future debt

obligations on our business, current and future operations,

profitability and our ability to meet other obligations;

- Business disruption following the Acquisition;

- Diversion of management time on Acquisition-related

issues;

- The reaction of customers and other persons to the Acquisition;

and

- Other statements contained in this Press Release regarding

items that are not historical facts or that involve

predictions.

1 - See "Non-GAAP Financial Measures" and the

corresponding financial tables at the end of this press release for

definitions and reconciliations of non-GAAP measures.

2 - We have not provided a reconciliation of our fiscal

2024 adjusted EBITDA, adjusted EBITDA margin and adjusted diluted

EPS guidance because the information needed to reconcile these

measures is unavailable due to the inherent difficulty of

forecasting the timing or amount of various items that have not yet

occurred and which may be excluded from adjusted EBITDA, adjusted

EBITDA margin and adjusted diluted EPS. Additionally, estimating

such GAAP measures and providing a meaningful reconciliation for

future periods requires a level of precision that is unavailable

for these future periods and cannot be accomplished without

unreasonable effort. Forward-looking non-GAAP measures are

estimated consistent with the relevant definitions and assumptions

used for historical non-GAAP measures.

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME

(Unaudited)

13 Weeks Ended

39 Weeks Ended

(U.S. Dollars presented in millions,

except per share amounts)

September 29,

2024

September 24,

2023

September 29,

2024

September 24,

2023

NET SALES

$

718.1

$

677.3

$

2,032.7

$

2,049.1

Cost of products sold

480.1

439.8

1,359.0

1,370.8

GROSS PROFIT

238.0

237.5

673.7

678.3

Gross Profit Margin

33.1

%

35.1

%

33.1

%

33.1

%

Selling, general and administrative

expenses

166.3

140.3

450.8

417.3

Amortization of intangible assets

6.3

3.6

13.7

11.6

Restructuring charges

7.8

1.4

11.0

4.1

OPERATING INCOME

57.6

92.2

198.2

245.3

Interest expense

20.0

15.3

54.7

49.9

Other income, net

(1.8

)

(1.0

)

(5.0

)

(0.1

)

INCOME BEFORE TAXES

39.4

77.9

148.5

195.5

Income tax expense

10.3

18.2

36.6

49.6

NET INCOME

$

29.1

$

59.7

$

111.9

$

145.9

Average Number of Shares of Common Stock

Outstanding

Basic

127.1

127.6

127.0

128.1

Diluted

130.8

130.3

130.8

129.9

Earnings Per Common Share

Basic

$

0.23

$

0.47

$

0.88

$

1.14

Diluted

$

0.22

$

0.46

$

0.86

$

1.12

SUPPLEMENTAL INFORMATION -

Quarter-to-date

(Unaudited)

13 Weeks Ended

September 29,

September 24,

(U.S. Dollars presented in millions,

except per share amounts and percentages)

2024

2023

1. Reconciliation

of Net Income to EBITDA to ADJUSTED EBITDA

Net income (GAAP)

$

29.1

$

59.7

Interest expense

20.0

15.3

Income tax expense

10.3

18.2

Depreciation expense

13.8

11.9

Amortization expense

6.3

3.6

EBITDA (Non-GAAP Measure)

$

79.5

$

108.7

[1] Separation costs

—

0.1

[2] Restructuring charges

7.8

1.4

[3] Restructuring-related adjustments

—

(0.4

)

[4] Acquisition-related costs

15.0

—

[5] Purchase accounting cost of products

sold

2.2

—

Adjusted EBITDA (Non-GAAP

Measure)

$

104.5

$

109.8

2. Reconciliation

of Net Income to Adjusted Net Income

Net Income (GAAP)

$

29.1

$

59.7

[1] Separation costs

—

0.1

[2] Restructuring charges

7.8

1.4

[3] Restructuring-related adjustments

—

(0.4

)

[4] Acquisition-related costs

15.0

—

[5] Purchase accounting cost of products

sold

2.2

—

[7] Amortization expense

6.3

3.6

[8] Income tax impact of adjustments

(7.8

)

(1.2

)

Adjusted Net Income (Non-GAAP

Measure)

$

52.6

$

63.2

3. Earnings per

Share Summary

Diluted EPS (GAAP)

$

0.22

$

0.46

Impact of adjustments

$

0.18

$

0.03

Adjusted Diluted EPS (Non-GAAP

Measure)

$

0.40

$

0.49

Weighted average diluted shares

outstanding

130.8

130.3

4. Profit

Margins

Net Sales (GAAP)

$

718.1

$

677.3

Net Income Margin % (GAAP)

4.1

%

8.8

%

Adjusted Net Income Margin % (Non-GAAP

Measure)

7.3

%

9.3

%

Adjusted EBITDA Margin % (Non-GAAP

Measure)

14.6

%

16.2

%

SUPPLEMENTAL INFORMATION -

Year-to-date

(Unaudited)

39 Weeks Ended

September 29,

September 24,

(U.S. Dollars presented in millions,

except per share amounts and percentages)

2024

2023

1. Reconciliation

of Net Income to EBITDA to Adjusted EBITDA

Net income (GAAP)

$

111.9

$

145.9

Interest expense

54.7

49.9

Income tax expense

36.6

49.6

Depreciation expense

39.5

34.9

Amortization expense

13.7

11.6

EBITDA (Non-GAAP Measure)

$

256.4

$

291.9

[1] Separation costs

—

2.3

[2] Restructuring charges

11.0

4.1

[3] Restructuring-related adjustments

—

(0.7

)

[4] Acquisition-related costs

19.4

—

[5] Purchase accounting cost of products

sold

2.2

—

Adjusted EBITDA (Non-GAAP

Measure)

$

289.0

$

297.6

2. Reconciliation

of Net Income to Adjusted Net Income

Net Income (GAAP)

$

111.9

$

145.9

[1] Separation costs

—

2.3

[2] Restructuring charges

11.0

4.1

[3] Restructuring-related adjustments

—

(0.7

)

[4] Acquisition-related costs

19.4

—

[5] Purchase accounting cost of products

sold

2.2

—

[6] Non-recurring components of interest

expense

6.5

—

[7] Amortization expense

13.7

11.6

[8] Income tax impact of adjustments

(13.2

)

(4.3

)

Adjusted Net Income (Non-GAAP

Measure)

$

151.5

$

158.9

3. Earnings per

Share Summary

Diluted EPS (GAAP)

$

0.86

$

1.12

Impact of adjustments

$

0.30

$

0.10

Adjusted Diluted EPS (Non-GAAP

Measure)

$

1.16

$

1.22

Weighted average diluted shares

outstanding

130.8

129.9

4. Profit

Margins

Net Sales (GAAP)

$

2,032.7

$

2,049.1

Net Income Margin % (GAAP)

5.5

%

7.1

%

Adjusted Net Income Margin % (Non-GAAP

Measure)

7.5

%

7.8

%

Adjusted EBITDA Margin % (Non-GAAP

Measure)

14.2

%

14.5

%

TICK LEGEND:

[1] Separation costs

represent one-time costs incurred directly by MasterBrand related

to the separation from Fortune Brands.

[2] Restructuring charges

are nonrecurring costs incurred to implement significant cost

reduction initiatives and may consist of workforce reduction costs,

facility closure costs, and other costs to maintain certain

facilities where operations have ceased, but which we are still

responsible for. The restructuring charges for all periods

presented are mainly comprised of workforce reduction costs and

other costs to maintain facilities that have been closed, but not

yet sold.

[3] Restructuring-related

charges are expenses directly related to restructuring initiatives

that do not represent normal, recurring expenses necessary to

operate the business, but cannot be reported as restructuring under

GAAP. Such costs may include losses on disposal of inventories from

exiting product lines, and gains/losses on the sale of facilities

closed as a result of restructuring actions. Restructuring-related

adjustments are recoveries of previously recorded

restructuring-related charges resulting from changes in estimates

of accruals recorded in prior periods. The restructuring-related

adjustments in fiscal 2023 are recoveries of previously recorded

restructuring-related charges resulting from changes in estimates

of accruals recorded in prior periods.

[4] Acquisition-related

costs are transaction and integration costs, including legal,

accounting and other professional fees, severance, stock-based

compensation, and other integration related costs. These charges

are primarily recorded within selling, general and administrative

expenses within the Condensed Consolidated Statements of Income.

Acquisition-related costs are significantly impacted by the timing

and complexity of the underlying acquisition related activities and

are not indicative of the Company’s ongoing operating performance.

The acquisition-related costs in fiscal 2024 are associated with

the acquisition of Supreme Cabinetry Brands, Inc., which was

announced in the second quarter of fiscal 2024 and closed early in

the third quarter of fiscal 2024, and are comprised primarily of

professional fees.

[5] Purchase accounting cost

of products sold relates to the fair market value adjustment

required under GAAP for inventory obtained in the acquisition of

Supreme Cabinetry Brands, Inc. All inventory obtained was sold in

the third quarter of 2024.

[6] Non-recurring components

of interest expense are one-time costs associated with the

refinancing of debt facilities and usage of temporary debt

facilities. The non-recurring components of interest expense were

incurred in the second quarter of fiscal 2024 related primarily to

non-recurring write-offs of deferred financing costs resulting from

the debt restructuring transaction. These charges are classified as

interest expense within the Condensed Consolidated Statements of

Income and are not indicative of the Company’s ongoing operating

performance.

[7] Beginning in the second

quarter of fiscal 2024 reporting, management began adding back

amortization of intangible assets in calculating adjusted net

income and adjusted diluted EPS for all periods presented. Non-cash

amortization expenses are not indicative of the Company’s ongoing

operations. Prior period information has been recast to reflect the

updated presentation.

[8] In order to calculate

Adjusted Net Income, each of the items described in Items [1] - [7]

above reflect tax effects based upon an estimated annual effective

income tax rate of 25.0 percent, inclusive of recurring permanent

differences and the net effect of state income taxes and excluding

the impact of discrete income tax items. Discrete items are

recorded in the relevant period identified and include, but are not

limited to, changes in judgment or estimates of uncertain tax

positions related to prior periods, return-to-provision

adjustments, the tax effect of relevant stock-based compensation

items, certain changes in the valuation allowance for the

realizability of deferred tax assets, or enacted changes in tax

law. Management believes this approach assists investors in

understanding the income tax provision and the estimated annual

effective income tax rate related to ongoing operations.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

September 29,

September 24,

(U.S. Dollars presented in millions)

2024

2023

ASSETS

Current assets

Cash and cash equivalents

$

108.4

$

122.5

Accounts receivable, net

216.1

233.6

Inventories

299.4

269.4

Other current assets

63.0

58.5

TOTAL CURRENT ASSETS

686.9

684.0

Property, plant and equipment, net

456.7

341.5

Operating lease right-of-use assets,

net

71.3

61.6

Goodwill

1,129.4

924.6

Other intangible assets, net

577.9

338.5

Other assets

38.0

28.1

TOTAL ASSETS

$

2,960.2

$

2,378.3

LIABILITIES AND EQUITY

Current liabilities

Accounts payable

$

175.3

$

179.7

Current portion of long-term debt

—

8.2

Current operating lease liabilities

16.8

15.4

Other current liabilities

186.3

164.6

TOTAL CURRENT LIABILITIES

378.4

367.9

Long-term debt

1,062.3

699.3

Deferred income taxes

154.0

84.2

Pension and other postretirement plan

liabilities

7.5

12.1

Operating lease liabilities

56.7

48.4

Other non-current liabilities

13.7

9.9

TOTAL LIABILITIES

1,672.6

1,221.8

Stockholders' equity

1,287.6

1,156.5

TOTAL EQUITY

1,287.6

1,156.5

TOTAL LIABILITIES AND EQUITY

$

2,960.2

$

2,378.3

Reconciliation of Net Debt

Current portion of long-term debt

$

—

$

8.2

Long-term debt

1,062.3

699.3

Less: Cash and cash equivalents

(108.4

)

(122.5

)

Net Debt

$

953.9

$

585.0

Adjusted EBITDA for Prior Fiscal Year

383.4

411.4

Less: Adjusted EBITDA for 39 weeks ended

September 24, 2023

(297.6

)

(313.6

)

Plus: Adjusted EBITDA for 39 weeks ended

September 29, 2024

289.0

297.6

Adjusted EBITDA (trailing twelve

months)

$

374.8

$

395.4

Net Debt to Adjusted EBITDA

2.5x

1.5x

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited)

39 Weeks Ended

September 29,

September 24,

(U.S. Dollars presented in millions)

2024

2023

OPERATING ACTIVITIES

Net income

$

111.9

$

145.9

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation

39.5

34.9

Amortization of intangibles

13.7

11.6

Restructuring charges, net of cash

payments

4.3

(13.9

)

Write-off and amortization of finance

fees

8.2

1.7

Stock-based compensation

16.8

13.2

Changes in operating assets and

liabilities:

Accounts receivable

(2.3

)

60.1

Inventories

(32.5

)

103.9

Other current assets

(1.8

)

6.9

Accounts payable

18.0

(42.8

)

Accrued expenses and other current

liabilities

(3.5

)

9.2

Other items

4.6

5.8

NET CASH PROVIDED BY OPERATING

ACTIVITIES

176.9

336.5

INVESTING ACTIVITIES

Capital expenditures

(34.6

)

(21.4

)

Proceeds from the disposition of

assets

8.4

0.3

Acquisition of business, net of cash

acquired

(515.7

)

—

NET CASH USED IN INVESTING

ACTIVITIES

(541.9

)

(21.1

)

FINANCING ACTIVITIES

Issuance of long-term and short-term

debt

1,130.0

55.0

Repayments of long-term and short-term

debt

(767.5

)

(327.5

)

Payment of financing fees

(17.8

)

—

Repurchase of common stock

(6.5

)

(15.6

)

Payments of employee taxes withheld from

share-based awards

(5.3

)

(3.0

)

Other items

(1.6

)

(1.0

)

NET CASH PROVIDED BY (USED IN)

FINANCING ACTIVITIES

331.3

(292.1

)

Effect of foreign exchange rate changes on

cash and cash equivalents

(5.6

)

(1.9

)

NET (DECREASE) INCREASE IN CASH, CASH

EQUIVALENTS, AND RESTRICTED CASH

$

(39.3

)

$

21.4

Cash, cash equivalents, and restricted

cash at beginning of period

$

148.7

$

101.1

Cash, cash equivalents, and restricted

cash at end of period

$

109.4

$

122.5

Cash and cash equivalents

$

108.4

$

122.5

Restricted cash included in other

assets

1.0

—

Total cash, cash equivalents and

restricted cash

$

109.4

$

122.5

Reconciliation of Free Cash

Flow

Net cash provided by operating

activities

$

176.9

$

336.5

Less: Capital expenditures

(34.6

)

(21.4

)

Free cash flow

$

142.3

$

315.1

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241105225994/en/

Investor Relations: Investorrelations@masterbrand.com

Media Contact: Media@masterbrand.com

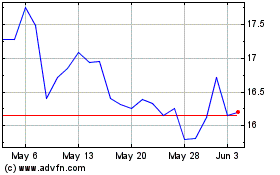

Masterbrand (NYSE:MBC)

Historical Stock Chart

From Dec 2024 to Jan 2025

Masterbrand (NYSE:MBC)

Historical Stock Chart

From Jan 2024 to Jan 2025