- Statement of Changes in Beneficial Ownership (4)

08 August 2012 - 7:38AM

Edgar (US Regulatory)

|

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue.

See

Instruction 1(b).

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934, Section 17(a) of the Public

Utility Holding Company Act of 1935 or Section 30(f) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

HELEN SUZANNE L

|

2. Issuer Name

and

Ticker or Trading Symbol

MOHAWK INDUSTRIES INC

[

MHK

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director

_____ 10% Owner

_____ Officer (give title below)

__

X

__ Other (specify below)

Possible member of group

|

|

(Last)

(First)

(Middle)

C/O MOHAWK INDUSTRIES INC, 2001 ANTIOCH ROAD

|

3. Date of Earliest Transaction

(MM/DD/YYYY)

5/31/2012

|

|

(Street)

DALTON, GA 30721

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_

X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

|

Common Stock

|

|

|

|

|

|

|

|

141646

|

I

|

By Fam Ltd PS and Gen Ptr

(1)

(2)

|

|

Common Stock

|

|

|

|

|

|

|

|

395202

|

I

|

PAS Trust

(3)

(4)

(5)

(6)

|

|

Common Stock

|

5/31/2012

|

|

G

|

V

|

524635

|

D

|

$0

|

0

|

D

(3)

(4)

(5)

(6)

|

|

|

Common Stock

|

5/31/2012

|

|

G

|

V

|

524635

|

A

|

$0

|

524635

|

I

|

SLH Partners LP

(7)

|

|

Common Stock

|

8/2/2012

|

|

J

(8)

|

|

524635

|

D

|

(8)

|

0

|

I

|

SLH Partners, LP

(8)

|

|

Common Stock

|

8/2/2012

|

|

J

(8)

|

|

524635

|

A

|

(8)

|

524635

|

I

|

Fam Trust

(8)

|

Table II - Derivative Securities Beneficially Owned (

e.g.

, puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3)

|

2. Conversion or Exercise Price of Derivative Security

|

3. Trans. Date

|

3A. Deemed Execution Date, if any

|

4. Trans. Code

(Instr. 8)

|

5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

6. Date Exercisable and Expiration Date

|

7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4)

|

8. Price of Derivative Security

(Instr. 5)

|

9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4)

|

10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4)

|

11. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

(A)

|

(D)

|

Date Exercisable

|

Expiration Date

|

Title

|

Amount or Number of Shares

|

|

Explanation of Responses:

|

|

(

1)

|

Reporting Person may be considered a member of a "group" with certain family members and entities formed for the benefit of certain family members; however, Reporting Person disclaims the existence of such a "group" and disclaims beneficial ownership of any shares not reported herein and any shares in which she has no pecuniary interest.

|

|

(

2)

|

Reporting Person is one of three family members who are equal shareholders of Helm Management Corporation ("Helm"). Helm owns 1,646 shares of issuer common stock directly and has indirect beneficial ownership of 140,000 held by Cuddy Holdings, L.P. ("Cuddy"), of which Helm is the general partner. Reporting Person disclaims beneficial ownership of the shares held by Helm and Cuddy to the extent that she does not have a pecuniary interest.

|

|

(

3)

|

Reporting Person previously reported 2,735,604 shares indirectly beneficially owned which were held by JMS Group, L.P. ("JMS Group"). Three siblings, including the Reporting Person, were originally equal control members of the general partner SLJ Management Company ("SJL"). JMS Group held shares for the benefit of Lorberbaum family members and entities for the benefit of Lorberbaum family members. In 2009 and 2010 JMS Group distributed a total of 904,484 shares of issuer Common Stock in two transactions to Mark Lorberbaum on a pro rata basis in redemption of his interests in JMS Group and SJL. Mark Lorberbaum discontinued as a control person of SJL and JMS Group after the distributions, On December 13, 2011 JMS Group distributed 548,202 shares of issuer Common Stock to a PAS Trust for the benefit of Jeffrey Lorberbaum on a pro rata basis in redemption of the limited partnership interest formerly held by his PAS Trust.

|

|

(

4)

|

On February 29, 2012 JMS Group distributed 356,185 shares of issuer Common Stock to the Reporting Person and 548,202 shares to the PAS Trust for the benefit of Reporting Person, each distribution being on a pro rata basis in redemption of limited partnership interest formerly held by the Reporting Person and her PAS Trust. The distributions from JMS Group and her PAS Trust represented her entire pecuniary interest in JMS Group. On February 29, 2012 JMS Group distributed 356,185 shares of issuer Common Stock to Jeffrey Lorberbaum. JMS Group no longer holds any issuer Common Stock. Reporting Person and her family affiliates retain investment control of their respective amount of shares in which they had a pecuniary interest prior to the distributions and there were no sales or dispositions of shares to third parties.

|

|

(

5)

|

On March 1, 2012 the general partner of JMS Group, SJL, distributed 10,350 shares of issuer Common Stock to the Reporting Person on a pro rata basis in redemption of her interest in SJL and distributed an equal number of shares on a pro rata basis to Jeffrey Lorberbaum in redemption of his interest in SJL. SJL no longer holds any issuer shares.

|

|

(

6)

|

On March 1, 2012 the PAS Trust for the benefit of the Reporting Person distributed 153,000 shares of issuer Common Stock to the Reporting Person, reducing her indirect interest through her PAS Trust to 395,202 shares and increasing her direct holdings of issuer Common Stock to 524,635 shares. The Reporting Person' beneficial ownership was not changed.

|

|

(

7)

|

Reporting Person controls SHL Partners LP and is therefore the indirect owner of the shares held by SHL Partners LP.

|

|

(

8)

|

Reflects the exchange of the Reporting Person's 99.9% limited partnership interest in SLH Partners LP to the SLH Family Dynasty Trust ("Dynasty Trust") for a promissory note from Dynasty Trust. Dynasty Trust is controlled by the Reporting Person. Reporting Person disclaims beneficial ownership in the shares held by Dynasty Trust except to the extent of her pecuniary interest.

|

Reporting Owners

|

|

Reporting Owner Name / Address

|

Relationships

|

|

Director

|

10% Owner

|

Officer

|

Other

|

HELEN SUZANNE L

C/O MOHAWK INDUSTRIES INC

2001 ANTIOCH ROAD

DALTON, GA 30721

|

|

|

|

Possible member of group

|

Signatures

|

|

Suzanne L. Helen

|

|

8/7/2012

|

|

**

Signature of Reporting Person

|

Date

|

|

Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly.

|

|

*

|

If the form is filed by more than one reporting person,

see

Instruction 4(b)(v).

|

|

**

|

Intentional misstatements or omissions of facts constitute Federal Criminal Violations.

See

18 U.S.C. 1001 and 15 U.S.C. 78ff(a).

|

|

Note:

|

File three copies of this Form, one of which must be manually signed. If space is insufficient,

see

Instruction 6 for procedure.

|

|

Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

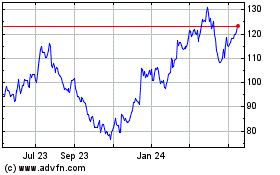

Mohawk Industries (NYSE:MHK)

Historical Stock Chart

From Jun 2024 to Jul 2024

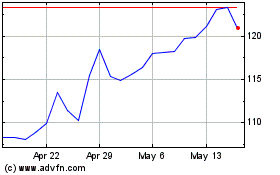

Mohawk Industries (NYSE:MHK)

Historical Stock Chart

From Jul 2023 to Jul 2024