- e2Companies LLC (“e2” or the “Company”) is the creator of the

industry’s first Virtual Utility® and a leading provider of

integrated solutions for power generation, distribution and energy

economics.

- e2 has a track record of sustained revenue growth at a CAGR of

110% since 2021, with unaudited full year 2024 revenue of $28.7

million, and a customer pipeline of more than a billion dollars in

qualified opportunities.

- e2 is seeing strong demand for its power solutions across

industry sectors. Its current and past customers include Nabors

Industries, Liberty Mutual, FedEx, GEICO, Cleveland Clinic, Case

Western Reserve University, Erie County Public Works, Frontier

Communications, and GlaxoSmithKline.

- e2’s technology addresses several challenges arising from the

international growth of data centers, including meeting the

volatile power demand and hyper dynamic processing ability of new

AI chips, positioning the Company to benefit from the AI data

center boom.

- e2 recently announced a strategic collaboration with Nabors

Industries Ltd. (“Nabors”) to bring e2’s integrated power solutions

to the oilfield and broader energy markets.

- The transaction is expected to provide approximately $400

million in gross proceeds to the new public company, inclusive of

approximately $331 million of cash held in Nabors Energy Transition

Corp. II’s (“NETD”) trust account (before giving effect to

potential redemptions) and proceeds from a private placement of

NETD common stock or structured securities or e2 units or

structured securities (the “Private Placement”).

- The transaction values e2 at a pre-money equity value of $500

million, providing an attractive entry point for NETD shareholders.

e2’s pro forma enterprise value of the new public company is

approximately $770 million with a pro forma equity value of

approximately $1 billion (each assuming no redemptions and

anticipated Private Placement proceeds).

- Existing e2 unitholders and management will roll 100% of their

equity holdings into the new public company. The transaction is

expected to be completed during the third quarter of 2025.

- The combined entity will be named e2Companies, Inc. and is

expected to be listed on Nasdaq under the ticker symbol

“VUTL”.

e2Companies LLC, an innovative provider of integrated solutions

for on-site power generation, distribution and energy

cost-optimization, and Nabors Energy Transition Corp. II (Nasdaq:

NETD), today announced a definitive agreement for a business

combination (the “Transaction” or the “Business Combination”) that

would result in e2 becoming a publicly-listed company on Nasdaq

under the ticker symbol “VUTL”.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250212923682/en/

e2Companies, Creator of the Energy

Industry’s First Virtual Utility®, To Go Public Through Business

Combination with Nabors Energy Transition Corp. II (Photo: Business

Wire)

NETD is primarily sponsored by Nabors Industries Ltd. (NYSE:

NBR), a leading provider of advanced technology for the energy

industry and one of the world’s largest drilling rig, services and

technology providers. e2 recently announced a strategic

collaboration with Nabors on integrated power solutions for the

oilfield and broader energy markets.

Company Background

e2 is the creator of the energy industry’s first Virtual

Utility®, an AI-based platform that delivers integrated hardware

and software solutions for on-site power generation, energy

storage, distribution and improved energy cost economics to power

critical industries such as manufacturing, data centers, oil &

gas, and healthcare.

e2’s Virtual Utility® platform delivers uninterruptible, on-site

power generation combined with energy storage and grid optimization

services through utilization of both hardware and AI-enabled

software integrated solutions. Virtual Utility® delivers a

resilient and customizable alternative to diesel engines and

traditional power grids.

The Company’s patented R3Di® System, the heart of the Virtual

Utility®, is a self-contained, turnkey, on-site power hardware

system that can operate behind-the-meter without reliance on a grid

interconnection and as such is agnostic as to its energy source.

The R3Di® system has been verified to save approximately 13,000

tons of CO2 emissions over its lifetime compared to conventional

backup power systems and is future proofed for compatibility with a

wide range of renewable power generation sources. In addition, the

R3Di® system absorbs a higher range of load profiles than

conventional backup systems, making it ideal for critical

industries with volatile power demand, such as oil & gas and

some nascent AI technologies. Grove365®, the system’s AI-powered

grid response optimization monitoring software platform, acts as an

operational hub, providing real-time data and AI-based predictive

analytics.

The Virtual Utility® system addresses several challenges arising

from the AI data center boom and global electrification of

economies. As worldwide electric grids age, upgrading or replacing

infrastructure has become backlogged - at the exact time that calls

on the traditional electric grid are increasing faster than ever.

Costs and timelines to make the traditional grid capable of meeting

this demand have become unacceptable to many, with electric utility

interconnections often taking five or more years to be completed,

if completed at all. In this environment, localized microgrids,

such as those enabled by e2’s systems, have emerged as turnkey

solutions for delivering reliability and meeting the world’s

growing electricity demand. Additionally, Virtual Utility® is one

of the only solutions that stabilizes the hyper-dynamic processing

ability of data centers with AI chips, positioning the Company to

significantly benefit from the growing power demands of the AI data

center boom.

e2’s products and solutions have been deployed, or are

contracted to be deployed, at more than 165 sites globally, with

customers that include Nabors, Liberty Mutual, FedEx, ESPN, GEICO,

Cleveland Clinic, Case Western Reserve University, Erie County

Public Works, Frontier Communications, and GlaxoSmithKline. The

Company’s Grove365® platform currently monitors 490 assets at 165

locations globally and has operated for a total of over 90 million

grid monitoring hours. e2 has demonstrated sustained rapid revenue

growth at a CAGR of 110% since 2021, with unaudited full year 2024

revenues of $28.7 million, and believes this transaction will

better enable it to continue to capitalize on a customer pipeline

of more than a billion dollars in qualified opportunities.

e2’s Flexible Business Model

e2’s business model reflects the diversity of needs of its

customers, allowing a range of engagements, from equipment sales

and service to full-service energy management.

Under e2’s original equipment manufacturer sales (OEM) model,

the Company sells customers R3Di® system hardware to manage

provision of power to facilities, whether from a grid

interconnection or distributed power generation assets. Typical

customer contracts remain in place for 15 years, during which time

e2 provides customers with monitoring, maintenance and compliance

services for the equipment.

Alternatively, e2’s energy service agreement (ESA) model sees

the Company provide comprehensive energy solutions to customers,

including installation, operation and maintenance of R3Di® systems

at the customer’s site, and generation of on-site power. e2

utilizes its Grove365® to monitor system performance and usage in

this full-service model, in which equipment remains on e2’s balance

sheet. Contracts for ESA engagements are typically 15 years in

duration.

e2 also provides certain fee-based grid monitoring and

compliance services through its AI-based Grove365® platform, the

data from which further strengthens the AI capabilities of the

Grove365® platform to remotely direct e2’s energy management

units.

Strategic Collaboration with Nabors Industries

On December 10, 2024, e2 and Nabors, NETD’s primary sponsor,

announced a strategic collaboration that will expand e2’s

opportunities for integrated power solutions in the oilfield and

broader energy markets.

By combining Nabors’ global expertise and relationships in oil

and gas and energy transition with e2’s Virtual Utility®, the

companies aim to develop and market tailored solutions for the

unique demands of the oilfield. e2 and Nabors are jointly

discussing strategies, designs and multi-million-dollar purchase

orders to deploy e2’s R3Di on-site power units with oilfield

customers and other strategic partners. Additionally, the parties

expect to collaborate on U.S.-based energy storage solutions to

potentially further improve R3Di® system performance.

Oil and gas operations account for 15% of global energy-related

emissions and the global market for oil and gas electrification is

expected to grow at a 31% CAGR to more than $23 billion by 2030,

according to research by Global Market Insights Inc. Companies

transitioning away from diesel-powered operations to reduce costs

and emissions require reliable microgrid power solutions that avoid

overloading electrical grids, especially considering competing

demands from the growth in AI and data centers and increasing

industrial electrification. The global microgrid market size is

projected to reach $87.8 billion by 2029, growing at a CAGR of

18.5% between 2024 to 2029, according to MarketsandMarkets

research.

Management Commentary

James Richmond, Executive Chairman and CEO of e2, commented,

“Electric power demand is rising rapidly across a variety of

sectors in the economy, including data centers, industrials and oil

and gas, exceeding historical highs and on pace to outstrip supply.

As companies globally electrify their operations to meet

decarbonization goals, our power solutions solve the critical

issues of grid resiliency and reliability that have become a focal

point for ensuring business continuity. Our business combination

with NETD and strategic collaboration with Nabors will accelerate

the deployment of our integrated power solutions to address the

grid instability challenges that have emerged as a result of this

growing supply and demand imbalance.”

Anthony Petrello, President and CEO of NETD and Chairman,

President and CEO of Nabors, commented, “We believe the e2 solution

has clear, value-creating application in the oilfield sector. We

will be working together to drive market penetration of e2’s

portfolio. Moreover, given the widely acknowledged and increasing

challenges to the global electrical grid and surging power demand –

driven in part by data centers supporting artificial intelligence

and the rapid rise of electrification – we believe e2 is uniquely

positioned to capitalize on these market tailwinds. We believe the

business combination with NETD will further accelerate e2’s growth

and deliver long-term shareholder value while furthering Nabors’

commitment to ‘Energy Without Compromise’ and support of companies

on the cutting edge of advanced energy technology.”

Transaction Overview

The Transaction is expected to provide approximately $400

million in gross proceeds to the new public company, inclusive of

$331 million of cash held in NETD’s trust account (before giving

effect to potential redemptions) and anticipated Private Placement

proceeds.

The Transaction values e2 at a pre-money equity value of $500

million, providing an attractive entry point for NETD shareholders.

It also implies a pro forma enterprise value of the new public

company of approximately $770 million and a pro forma equity value

of approximately $1 billion (each assuming no redemptions and

anticipated Private Placement proceeds).

e2’s existing management team will continue to lead the Company

following the completion of the Transaction. No existing e2

shareholders or management will receive cash (other than payment of

certain fees to e2 management) as part of the Transaction, as all

will roll 100% of their equity holdings into the new public

company. Additionally, e2’s management team, e2’s primary

shareholders, NETD’s sponsor and certain affiliates of NETD’s

sponsor have committed to customary lock-ups.

The proposed Transaction was unanimously approved by the Boards

of Directors of NETD and e2. Completion of the proposed Transaction

is subject to customary closing conditions and is anticipated to

occur in the third quarter of 2025.

Additional information about the proposed Transaction, including

a copy of the business combination agreement and the investor

presentation, will be provided in a Current Report on Form 8-K to

be filed by NETD with the U.S. Securities and Exchange Commission

(the “SEC”) and available at www.sec.gov.

Legal Advisors

Vinson & Elkins LLP is acting as legal advisor to NETD.

Haynes & Boone LLP is acting as legal advisor to e2. Milbank

LLP is acting as legal advisor to Nabors.

About e2Companies

e2 is the first vertically integrated Virtual Utility® for power

generation, distribution, and energy economics in the marketplace.

e2’s patented technology, the R3Di® System, provides automated grid

stability for continuous on-site power and seamless resiliency,

independent of grid conditions. The R3Di® System is continuously

monitored by the Grove365® to optimize resources, track ESG

targets, and unlock new revenue opportunities for customers. This

automated platform is self-sustaining and designed to adapt to

future grid advancements including renewables, hydrogen,

geothermal, biofuel, and autonomous grid operations.

About Nabors Energy Transition Corp. II

Nabors Energy Transition Corp. II is a blank check company

formed for the purpose of effecting a merger, amalgamation, share

exchange, asset acquisition, share purchase, reorganization or

similar business combination with one or more businesses or

entities. NETD intends to identify solutions, opportunities,

companies or technologies that focus on advancing the energy

transition; specifically, ones that facilitate, improve or

complement the reduction of carbon or greenhouse gas emissions

while satisfying growing energy consumption across markets

globally.

About Nabors Industries

Nabors Industries Ltd. (NYSE: NBR) is a leading provider of

advanced technology for the energy industry. With presence in more

than 20 countries, Nabors has established a global network of

people, technology and equipment to deploy solutions that deliver

safe, efficient and responsible energy production. By leveraging

its core competencies, particularly in drilling, engineering,

automation, data science and manufacturing, Nabors aims to innovate

the future of energy and enable the transition to a lower-carbon

world.

Important Information for Shareholders

This communication does not constitute an offer to sell or the

solicitation of an offer to buy any securities or constitute a

solicitation of any vote or approval.

In connection with the Business Combination, NETD and e2 will

file with the SEC registration statement on Form S-4 (the

“Registration Statement”), which will include (i) a preliminary

prospectus of NETD relating to the offer of securities to be issued

in connection with the Business Combination, (ii) a preliminary

proxy statement of NETD to be distributed to holders of NETD’s

capital shares in connection with NETD’s solicitation of proxies

for vote by NETD’s shareholders with respect to the Business

Combination and other matters described in the Registration

Statement and (iii) a consent solicitation statement of e2 to be

distributed to unitholders of e2 in connection with e2’s

solicitation for votes to approve the Business Combination. NETD

and e2 also plan to file other documents with the SEC regarding the

Business Combination. After the Registration Statement has been

declared effective by the SEC, a definitive proxy

statement/prospectus/consent solicitation statement will be mailed

to the shareholders of NETD and unitholders of e2. INVESTORS AND

SECURITY HOLDERS OF NETD AND E2 ARE URGED TO READ THE REGISTRATION

STATEMENT, THE PROXY STATEMENT/PROSPECTUS/CONSENT SOLICITATION

STATEMENT CONTAINED THEREIN (INCLUDING ALL AMENDMENTS AND

SUPPLEMENTS THERETO) AND ALL OTHER DOCUMENTS RELATING TO THE

BUSINESS COMBINATION THAT WILL BE FILED WITH THE SEC CAREFULLY AND

IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION ABOUT THE BUSINESS COMBINATION.

Investors and security holders will be able to obtain free

copies of the proxy statement/prospectus/consent solicitation

statement and other documents containing important information

about NETD and e2 once such documents are filed with the SEC,

through the website maintained by the SEC at http://www.sec.gov. In

addition, the documents filed by NETD may be obtained free of

charge from NETD’s website at www.nabors-etcorp.com or by written

request to NETD at 515 West Greens Road, Suite 1200, Houston, TX

77067.

Participants in the Solicitation

NETD, Nabors, e2 and their respective directors and executive

officers may be deemed to be participants in the solicitation of

proxies from the shareholders of NETD in connection with the

Business Combination. Information about the directors and executive

officers of NETD is set forth in NETD’s Annual Report on Form 10-K

for the year ended December 31, 2023, filed with the SEC on March

27, 2024. To the extent that holdings of NETD’s securities have

changed since the amounts printed in NETD’s Annual Report on Form

10-K for the year ended December 31, 2023, such changes have been

or will be reflected on Statements of Change in Ownership on Form 4

filed with the SEC. Other information regarding the participants in

the proxy solicitation and a description of their direct and

indirect interests, by security holdings or otherwise, will be

contained in the proxy statement/prospectus/consent solicitation

statement and other relevant materials to be filed with the SEC

when they become available. You may obtain free copies of these

documents as described in the preceding paragraph.

Forward Looking Statements

The information included herein and in any oral statements made

in connection herewith include “forward-looking statements”. All

statements, other than statements of present or historical fact

included herein, regarding the Business Combination, NETD’s and

e2’s ability to consummate the Transaction, the benefits of the

Transaction and NETD’s and e2’s future financial performance

following the Transaction, as well as NETD’s and e2’s strategy,

future operations, financial position, estimated revenues and

losses, projected costs, prospects, plans and objectives of

management are forward-looking statements. When used herein,

including any oral statements made in connection herewith, the

words “could,” “should,” “will,” “may,” “believe,” “anticipate,”

“intend,” “estimate,” “expect,” “project,” the negative of such

terms and other similar expressions are intended to identify

forward-looking statements, although not all forward-looking

statements contain such identifying words. These forward-looking

statements are based on NETD and e2 management’s current

expectations and assumptions about future events and are based on

currently available information as to the outcome and timing of

future events. Except as otherwise required by applicable law, NETD

and e2 disclaim any duty to update any forward-looking statements,

all of which are expressly qualified by the statements in this

section, to reflect events or circumstances after the date hereof.

NETD and e2 caution you that these forward-looking statements are

subject to risks and uncertainties, most of which are difficult to

predict and many of which are beyond the control of NETD and e2.

These risks include, but are not limited to, general economic,

financial, legal, political and business conditions and changes in

domestic and foreign markets; the inability of the parties to

successfully or timely consummate the Transactions or to satisfy

the conditions to the closing of the Transactions, including

satisfaction of the minimum proceeds condition and the risk that

any required regulatory approvals are not obtained, are delayed or

are subject to unanticipated conditions that could adversely affect

the combined company; the risk that the approval of the

shareholders of NETD for the Transaction is not obtained; the

failure to realize the anticipated benefits of the Transaction,

including as a result of a delay in consummating the Transaction or

difficulty in, or costs associated with, integrating the businesses

of NETD and e2; the amount of redemption requests made by NETD’s

shareholders; the outcome of any current or future legal

proceedings or regulatory investigations, including any that may be

instituted against NETD or e2 following announcement of the

Transaction; the occurrence of events that may give rise to a right

of one or both of NETD and e2 to terminate the definitive

agreements related to the Business Combination; difficulties or

delays in the development of e2’s business; the risks related to

the rollout of e2’s business and the timing of expected business

milestones; potential benefits and commercial attractiveness to its

customers of e2’s products; the potential success of e2’s marketing

and expansion strategies; the effects of competition on e2’s future

business; the ability of e2 to convert its currently contracted

revenues from new original equipment manufacturer sales and energy

service agreements into actual revenue; the ability of e2 to

recruit and retain key executives, employees and consultants; and

the ability of e2 management to successfully manage a public

company. Should one or more of the risks or uncertainties described

herein and in any oral statements made in connection therewith

occur, or should underlying assumptions prove incorrect, actual

results and plans could differ materially from those expressed in

any forward-looking statements. Additional information concerning

these and other factors that may impact NETD’s expectations can be

found in NETD’s periodic filings with the SEC, including NETD’s

Annual Report on Form 10-K filed with the SEC on March 27, 2024 and

any subsequently filed Quarterly Reports on Form 10-Q. NETD’s SEC

filings are available publicly on the SEC’s website at

www.sec.gov.

e2 Investor Center, Announcement Webcast:

www.e2companies.com/investors

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250212923682/en/

e2 Media & Investor Contact: e2Companies@icrinc.com

Nabors and NETD Investor Contacts: William C. Conroy +1

281-775-2423 william.conroy@nabors.com Kara Peak +1 281-775-4954

kara.peak@nabors.com Nabors and NETD Media Contact: Kolby

Franz +1 281-775-8536 Kolby.franz@nabors.com

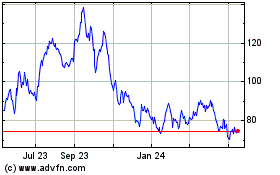

Nabors Industries (NYSE:NBR)

Historical Stock Chart

From Feb 2025 to Mar 2025

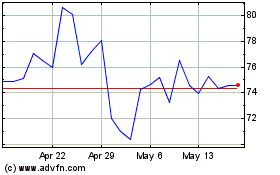

Nabors Industries (NYSE:NBR)

Historical Stock Chart

From Mar 2024 to Mar 2025