0001444380FALSE00014443802025-01-132025-01-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 13, 2025

NEVRO CORP.

(Exact name of Registrant as Specified in Its Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-36715 | | 56-2568057 |

(State or Other Jurisdiction

of Incorporation) | | (Commission File Number) | | (IRS Employer

Identification No.) |

| | | | | |

| 1800 Bridge Parkway | | | | |

Redwood City, California | | | | 94065 |

| (Address of Principal Executive Offices) | | | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (650) 251-0005

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.001 par value per share | | NVRO | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On January 13, 2025, Nevro Corp. (“Nevro” or the “Company”) issued a press release announcing its preliminary unaudited revenue for the fourth quarter and full year ended December 31, 2024. A copy of the press release is furnished as Exhibit 99.1 to this report.

The information furnished pursuant to this Item 2.02 of this Current Report on Form 8-K and the Exhibit 99.1 attached hereto shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained in this Item 2.02 and in the press release attached as Exhibit 99.1 to this Current Report on Form 8-K shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission made by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | | NEVRO CORP. |

| | | | |

| Date: | January 13, 2025 | By: | /s/ Roderick H. MacLeod |

| | | | Roderick H. MacLeod

Chief Financial Officer |

Nevro Announces Preliminary Fourth-Quarter

and Full-Year 2024 Revenue Results

Cash, Cash Equivalents and Short-Term Investments Increased

Approximately $15.5 million in the Fourth Quarter of 2024

REDWOOD CITY, California – January 13, 2025 – Nevro Corp. (NYSE: NVRO), a global medical device company that is delivering comprehensive, life-changing solutions for the treatment of chronic pain, today announced its preliminary, unaudited fourth-quarter and full-year 2024 revenue and other financial results.

Preliminary, Unaudited Financial Highlights

•Fourth-quarter 2024 worldwide revenue is expected to be approximately $105 million to $106 million, representing a decrease of 9% to 10% on a reported and constant currency basis compared with the fourth quarter of 2023; fourth-quarter 2024 U.S. revenue is expected to be approximately $91 million to $92 million, representing a decrease of 9% to 10% compared with the fourth quarter of 2023.

•Full-year 2024 worldwide revenue is expected to be approximately $408 million to $409 million, representing a year-over-year decrease of approximately 4% on a reported and constant currency basis compared with the full-year 2023; full-year 2024 U.S. revenue is expected to be approximately $352.5 million to $353.5 million, or an approximately 4% decrease compared with full-year 2023. Full-year 2024 worldwide revenue is higher than the guidance the company provided in November 2024 primarily due to the impact of greater-than-anticipated spinal cord stimulation (SCS) device replacement procedures in the fourth quarter of 2024.

•Cash, cash equivalents and short-term investments are expected to total approximately $292.5 million as of December 31, 2024, an increase of approximately $15.5 million from September 30, 2024.

“We are pleased that our full-year 2024 worldwide revenue is coming in ahead of our expectations,” said Kevin Thornal, Nevro’s CEO and president. “Also, as we previously communicated, we reallocated investments to our direct-to-consumer (DTC) advertising efforts in the third quarter of 2024, and we continue to see patient interest and response as a result. We anticipate that the benefit from our DTC advertising will ramp throughout 2025, with a more meaningful impact in the second half of the year. Importantly, our balance sheet remains strong, reflecting our continued focus on working capital management and the benefits from our 2024 restructurings.”

The company expects to report its fourth-quarter and full-year 2024 financial results and provide full-year 2025 guidance on its fourth-quarter 2024 earnings call in early March 2025.

Strategic Review Process

As previously announced, Nevro remains in ongoing discussions as it continues to explore strategic options to accelerate its growth, diversify its product portfolio and deliver shareholder value. The company will not provide any further comment or update on this process at this time.

Internet Posting of Information

Nevro routinely posts information that may be important to investors in the "Investor Relations" section of its website at www.nevro.com. The company encourages investors and potential investors to consult the Nevro website regularly for important information about Nevro.

About Nevro

Headquartered in Redwood City, California, Nevro is a global medical device company focused on delivering comprehensive, life-changing solutions that continue to set the standard for enduring patient outcomes in chronic pain treatment. The company started with a simple mission to help more patients suffering from debilitating pain and developed its proprietary 10 kHz Therapy™, an evidence-based, non-pharmacologic innovation that has impacted the lives of more than 115,000 patients globally. Nevro's comprehensive HFX™ spinal cord stimulation (SCS) platform includes the Senza® SCS system and support services for the treatment of chronic pain of the trunk and limb and painful diabetic neuropathy.

Nevro also provides minimally invasive treatment options for patients suffering from chronic sacroiliac joint ("SI joint") pain and offers the most comprehensive portfolio of products in the SI joint fusion space, designed to meet the preferences of physicians and varying patient needs in order to improve outcomes and quality of life for patients.

Senza®, Senza II®, Senza Omnia™, and HFX iQ are the only SCS systems that deliver Nevro's proprietary 10 kHz Therapy. Nevro's unique support services provide every patient with an HFX Coach™ throughout their pain relief journey and every physician with Nevrocloud™ insights for enhanced patient and practice management.

SENZA, SENZA II, SENZA OMNIA, OMNIA, HF10, the HF10 logo, 10 kHz Therapy, HFX, the HFX logo, HFX iQ, the HFX iQ logo, HFX Algorithm, HFX CONNECT, the HFX Connect logo, HFX ACCESS, the HFX Access logo, HFX COACH, the HFX Coach logo, Nevrocloud, RELIEF MULTIPLIED, HFX AdaptivAI, the X logo, NEVRO, and the NEVRO logo are trademarks or registered trademarks of Nevro Corp. Patents covering Senza HFX iQ and other Nevro products are listed at Nevro.com/patents. Bluetooth® and the Bluetooth symbol are registered trademarks of their respective owners.

To learn more about Nevro, connect with us on LinkedIn, X, Facebook, and Instagram.

Forward-Looking Statements

In addition to historical information, this press release contains forward-looking statements reflecting the current beliefs and expectations of the company’s management, made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including: expected fourth quarter 2024 U.S. and worldwide revenue; expected full-year 2024 U.S. and worldwide revenue; expected cash, cash equivalents and short-term investments; the impact of SCS device replacement procedures; the impact of our DTC advertising efforts; our belief that the actions we have taken and intend to take will further position us for growth, success, profitability and value creation; our belief that evaluating and/or engaging in strategic opportunities will help us diversify and grow our business, which we believe may position us to accelerate our goals of profitability and maximizing shareholder value; and our beliefs with regards to the SCS market and factors impacting our results, including the duration in which those factors will continue to impact our results. These forward-looking statements are based upon information that is currently

available to us or our current expectations, speak only as of the date hereof, and are subject to numerous risks and uncertainties, including our ability to successfully commercialize our products; our ability to manufacture our products to meet demand; the level and availability of third-party payor reimbursement for our products; our ability to effectively manage our anticipated growth and the costs and expenses of operating our business; our ability to protect our intellectual property rights and proprietary technologies; our ability to operate our business without infringing the intellectual property rights and proprietary technology of third parties; competition in our industry; additional capital and credit availability; our ability to successfully integrate any additive acquisitions we may make, including our acquisition of Vyrsa™ Technologies; our ability to attract and retain qualified personnel; our ability to accurately forecast financial and operating results; our ability to successfully evaluate and execute on potential strategic opportunities; and product liability claims. These factors, together with those that are described in greater detail in our Annual Report on Form 10-K filed on February 23, 2024, as well as any reports that we may file with the Securities and Exchange Commission in the future, may cause our actual results, performance or achievements to differ materially and adversely from those anticipated or implied by our forward-looking statements. We expressly disclaim any obligation, except as required by law, or undertaking to update or revise any such forward-looking statements. Nevro's operating results for the period ending December 31, 2024, are not necessarily indicative of the company’s operating results for any future periods.

Investor and Media Contact:

Angie McCabe

Vice President, Investor Relations & Corporate Communications

angeline.mccabe@nevro.com

# # #

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

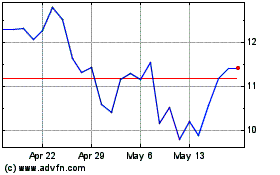

Nevro (NYSE:NVRO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Nevro (NYSE:NVRO)

Historical Stock Chart

From Jan 2024 to Jan 2025