Current Report Filing (8-k)

02 December 2021 - 7:52AM

Edgar (US Regulatory)

false

0000315131

0000315131

2021-11-10

2021-11-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Date of Report: (Date of Earliest Event Reported): December 1, 2021

PHX MINERALS INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Oklahoma

|

001-31759

|

73-1055775

|

|

(State or other jurisdiction

|

(Commission File Number)

|

(I.R.S. Employer

|

|

of incorporation)

|

|

Identification No.)

|

|

1601 NW Expressway,

|

|

|

|

Suite 1100

|

|

|

|

Oklahoma City, OK

|

|

73118

|

|

(Address of principal executive offices)

|

|

(Zip code)

|

(405) 948-1560

(Registrant’s telephone number including area code)

Not Applicable

(Former name or former address if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant in Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Class A Common Stock, $0.01666 par value

|

|

PHX

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item 2.01

|

Completion of Acquisition or Disposition of Assets.

|

As previously disclosed, on November 10, 2021, PHX Minerals Inc. (the “Company” or “PHX”) entered into a Purchase and Sale Agreement (the “Purchase Agreement”) with Vendera Resources III, LP and Vendera Management III LLC to acquire certain mineral and royalty assets located in Bienville, Bossier, Caddo, De Soto, Red River and Sabine Parishes, Louisiana and Nacogdoches County, Texas located in the Haynesville play (the “Assets”).

On December 1, 2021, the Company completed the acquisition of the Assets for an aggregate consideration of $5,306,389, comprised of $626,389 in cash and 1,519,481 shares of the Company’s common stock (the “Equity Consideration”). The Assets acquired include mineral and royalty assets totaling approximately 827 net royalty acres in the Haynesville play.

The Purchase Agreement includes registration rights relating to the Equity Consideration pursuant to which the Company agrees to register with the Securities and Exchange Commission the shares constituting the Equity Consideration. The Company agrees to file a resale registration statement and to use commercially reasonable efforts to cause such registration statement to be declared effective as soon as reasonably practicable after the filing thereof. The Equity Consideration is subject to a 120-day lock-up period.

The foregoing description of the Purchase Agreement is qualified in its entirety by reference to the full text of the Purchase Agreement, which has been filed as Exhibit 10.1 to the Current Report on Form 8-K filed on November 12, 2021, and which is incorporated by reference herein.

|

|

Item 3.02

|

Unregistered Sales of Equity Securities.

|

The information regarding the Purchase Agreement and the issuance of the Equity Consideration contemplated thereunder set forth in Item 2.01 of this Current Report on Form 8-K is incorporated into this Item 3.02 by reference. The Equity Consideration was issued in reliance upon an exemption from the registration requirements of the Securities Act of 1933, as amended, pursuant to Section 4(a)(2) thereof, which exempts transactions by an issuer not involving any public offering.

|

Item 9.01

|

Financial Statements & Exhibits.

|

(d) Exhibits

* The Purchase and Sale Agreement contains schedules and exhibits that have been omitted pursuant to Item 601(b) of Regulation S-K. The Company agrees to furnish a supplemental copy of any such omitted exhibit or schedule to the Securities and Exchange Commission upon request.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

PHX MINERALS INC.

|

|

|

By:

|

/s/ Chad L. Stephens

|

|

|

|

|

Chad L. Stephens

|

|

|

|

|

Chief Executive Officer

|

|

|

|

|

|

|

DATE:

|

December 1, 2021

|

|

|

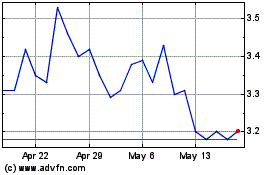

PHX Minerals (NYSE:PHX)

Historical Stock Chart

From Jun 2024 to Jul 2024

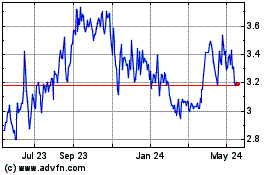

PHX Minerals (NYSE:PHX)

Historical Stock Chart

From Jul 2023 to Jul 2024