- Fourth quarter sales of $985 million; full year 2023 sales of

$4.1 billion.

- Operating income in the fourth quarter increased 50 percent to

$167 million reflecting ROS of 17.0 percent, an increase of 590

basis points when compared to fourth quarter 2022; on an adjusted

basis, ROS expanded 190 basis points to 20.1 percent. Full year

operating income increased 24 percent to $739 million reflecting

ROS of 18.0 percent, an increase of 360 basis points from the prior

year; on an adjusted basis, ROS expanded 220 basis points to 20.8

percent.

- Fourth quarter GAAP EPS of $1.25 and adjusted EPS of $0.87;

full year 2023 GAAP EPS of $3.75 and adjusted EPS of $3.75.

- Full year net cash provided by operating activities of

continuing operations was $621 million, an increase of $257 million

compared to the prior year and free cash flow provided by

continuing operations for the full year was $550 million, an

increase of $267 million compared to full year 2022.

- The Company introduces 2024 GAAP EPS guidance of $3.82 to $3.92

and adjusted EPS guidance of $4.15 to $4.25.

Reconciliations of GAAP to Non-GAAP measures are in the attached

financial tables.

Pentair plc (NYSE: PNR) today announced fourth quarter 2023

sales of $985 million. Sales were down 2 percent compared to sales

for the same period last year. Excluding currency translation,

acquisitions and divestitures, core sales declined 2 percent in the

fourth quarter. Fourth quarter 2023 earnings per diluted share from

continuing operations (“EPS”) were $1.25 compared to $0.58 in the

fourth quarter of 2022. On an adjusted basis, the Company reported

EPS of $0.87 compared to $0.82 in the fourth quarter of 2022.

Segment income, adjusted net income, free cash flow, and adjusted

EPS are described in the attached schedules.

Fourth quarter 2023 operating income was $167 million, up 50

percent compared to operating income for the fourth quarter of

2022, and return on sales (“ROS”) was 17.0 percent, an increase of

590 basis points when compared to the fourth quarter of 2022. On an

adjusted basis, the Company reported segment income of $198

million, up 8 percent for the fourth quarter of 2023 compared to

segment income for the fourth quarter of 2022, and ROS was 20.1

percent, an increase of 190 basis points when compared to the

fourth quarter of 2022.

“Our strong results in 2023 reflected the power of our balanced

and resilient water portfolio, our focused growth strategy, and

solid execution from our relentless team,” said John L. Stauch,

Pentair’s President and Chief Executive Officer. “Each of our three

segments drove record margins in 2023. Our Transformation

initiatives remain on track and have yielded strong margin

expansion to continue to deliver shareholder value. In 2023, we

generated significant free cash flow and continued to pay down

debt, ending the year with an even stronger balance sheet. And, we

raised our dividend for the 48th consecutive year which further

solidified our status as a dividend aristocrat.”

Full year 2023 sales were $4.1 billion. Sales were flat compared

to sales last year. Excluding currency translation, acquisitions

and divestitures, core sales declined 5 percent in 2023. Full year

2023 EPS from continuing operations was $3.75 compared to $2.92 in

2022. On an adjusted basis, the Company reported EPS of $3.75

compared to $3.68 in 2022.

Full year 2023 operating income was $739 million, up 24 percent

compared to operating income in 2022, and ROS was 18.0 percent, an

increase of 360 basis points when compared to 2022. On an adjusted

basis, the Company reported segment income of $855 million, up 11

percent in 2023, compared to segment income in 2022, and ROS was

20.8 percent, an increase of 220 basis points when compared to

2022.

Flow (previously named “Industrial and Flow Technologies”) sales

were up 1 percent in the fourth quarter of 2023 compared to sales

for the same period last year. Excluding currency translation,

acquisitions and divestitures, core sales declined 1 percent in the

fourth quarter. Segment income of $65 million was flat compared to

the fourth quarter of 2022, and ROS was 17.2 percent, a decrease of

20 basis points when compared to the fourth quarter of 2022.

Flow sales were up 5 percent for the full year of 2023 compared

to sales for the same period last year. Excluding currency

translation, acquisitions and divestitures, core sales grew 5

percent in 2023. Segment income of $282 million was up 17 percent

compared to 2022, and ROS was 17.8 percent, an increase of 170

basis points when compared to 2022.

Water Solutions sales were down 5 percent in the fourth quarter

of 2023 compared to sales for the same period last year. Excluding

currency translation, acquisitions and divestitures, core sales

declined 4 percent in the fourth quarter. Segment income of $52

million was up 15 percent compared to the fourth quarter of 2022,

and ROS was 19.1 percent, an increase of 320 basis points when

compared to the fourth quarter of 2022.

Water Solutions sales were up 19 percent for the full year of

2023 compared to sales for the same period last year. Excluding

currency translation, acquisitions and divestitures, core sales

grew 1 percent in 2023. Segment income of $248 million was up 66

percent compared to 2022, and ROS was 21.0 percent, an increase of

590 basis points when compared to 2022.

Pool sales were down 2 percent in the fourth quarter of 2023

compared to sales for the same period last year. Excluding currency

translation, acquisitions and divestitures, core sales declined 2

percent in the fourth quarter. Segment income of $105 million was

up 5 percent compared to the fourth quarter of 2022, and ROS was

31.3 percent, an increase of 220 basis points when compared to the

fourth quarter of 2022.

Pool sales were down 18 percent for the full year of 2023

compared to sales for the same period last year. Excluding currency

translation, acquisitions and divestitures, core sales declined 18

percent in 2023. Segment income of $417 million was down 10 percent

compared to 2022, and ROS was 31.0 percent, an increase of 270

basis points when compared to 2022.

Full year net cash provided by operating activities of

continuing operations was $621 million and free cash flow from

continuing operations was $550 million.

Pentair paid a regular cash dividend of $0.22 per share in the

fourth quarter of 2023. Pentair previously announced on December

11, 2023 that it will pay a regular quarterly cash dividend of

$0.23 per share on February 2, 2024 to shareholders of record at

the close of business on January 19, 2024. This dividend reflects a

5 percent increase in the Company’s regular cash dividend rate and

marks the 48th consecutive year that Pentair has increased its

dividend.

OUTLOOK

Mr. Stauch concluded, “As we look to 2024, we are committed to

driving growth, profitability and returns by focusing on our

mission to help the world sustainably move, improve, and enjoy

water, life’s most essential resource. We are investing in key

areas to drive long-term growth and optimizing our sourcing and

operational footprint which we expect to continue to drive further

margin expansion in 2024 as these Transformation initiatives

scale.”

The Company is introducing 2024 GAAP EPS guidance of

approximately $3.82 to $3.92 and on an adjusted basis of

approximately $4.15 to $4.25, which includes a $0.07 negative

impact, primarily driven by changes in global tax standards. This

is an increase of 11 percent to 13 percent compared to 2023. The

Company anticipates full year 2024 sales to increase 2 percent to 3

percent on a reported basis.

In addition, the Company introduces first quarter 2024 GAAP EPS

of approximately $0.81 to $0.84 and on an adjusted EPS basis of

approximately $0.88 to $0.91. The Company expects first quarter

sales to be down approximately 2 percent to 3 percent on a reported

basis compared to first quarter 2023.

EARNINGS CONFERENCE CALL

Pentair President and Chief Executive Officer John L. Stauch and

Chief Financial Officer Robert P. Fishman will discuss the

Company’s fourth quarter and full year 2023 results on a conference

call with investors at 9:00 a.m. Eastern today. A live audio

webcast of the call, along with the related presentation, can be

accessed in the Investor Relations section of the Company’s

website, www.pentair.com, shortly

before the call begins.

Reconciliations of non-GAAP financial measures are set forth in

the attachments to this release and in the presentations, each of

which can be found on Pentair’s website. The webcast and

presentations will be archived at the Company’s website following

the conclusion of the event.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

This release contains statements that we believe to be

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. All statements, other

than statements of historical fact, are forward-looking statements.

Without limitation, any statements preceded or followed by or that

include the words “targets,” “plans,” “believes,” “expects,”

“intends,” “will,” “likely,” “may,” “anticipates,” “estimates,”

“projects,” “should,” “would,” “could,” “positioned,” “strategy,”

or “future” or words, phrases, or terms of similar substance or the

negative thereof are forward-looking statements. These

forward-looking statements are not guarantees of future performance

and are subject to risks, uncertainties, assumptions and other

factors, some of which are beyond our control, which could cause

actual results to differ materially from those expressed or implied

by such forward-looking statements. These factors include the

overall global economic and business conditions impacting our

business, including the strength of housing and related markets and

conditions relating to international hostilities; supply, demand,

logistics, competition and pricing pressures related to and in the

markets we serve; the ability to achieve the benefits of our

restructuring plans, cost reduction initiatives and Transformation

Program; the impact of raw material, logistics and labor costs and

other inflation; volatility in currency exchange rates and interest

rates; failure of markets to accept new product introductions and

enhancements; the ability to successfully identify, finance,

complete and integrate acquisitions; risks associated with

operating foreign businesses; the impact of seasonality of sales

and weather conditions; our ability to comply with laws and

regulations; the impact of changes in laws, regulations and

administrative policy, including those that limit U.S. tax benefits

or impact trade agreements and tariffs; the outcome of litigation

and governmental proceedings; and the ability to achieve our

long-term strategic operating and ESG goals. Additional information

concerning these and other factors is contained in our filings with

the U.S. Securities and Exchange Commission (the “SEC”), including

our Annual Report on Form 10-K for the year ended December 31, 2022

and our quarterly reports on Form 10-Q. All forward-looking

statements, including all financial forecasts, speak only as of the

date of this release. Pentair assumes no obligation, and disclaims

any obligation, to update the information contained in this

release.

ABOUT PENTAIR PLC

At Pentair, we help the world sustainably move, improve, and

enjoy water, life’s most essential resource. From our residential

and commercial water solutions, to industrial water management and

everything in between, Pentair is focused on smart, sustainable

water solutions that help our planet and people thrive.

Pentair had revenue in 2023 of approximately $4.1 billion, and

trades under the ticker symbol PNR. With approximately 10,500

global employees serving customers in more than 150 countries, we

work to help improve lives and the environment around the world. To

learn more, visit www.pentair.com.

Pentair plc and

Subsidiaries

Condensed Consolidated

Statements of Operations (Unaudited)

Three months ended

Twelve months ended

In millions, except per-share data

December 31,

2023

December 31,

2022

December 31,

2023

December 31,

2022

Net sales

$

984.6

$

1,002.9

$

4,104.5

$

4,121.8

Cost of goods sold

618.5

678.1

2,585.3

2,757.2

Gross profit

366.1

324.8

1,519.2

1,364.6

% of net sales

37.2

%

32.4

%

37.0

%

33.1

%

Selling, general and administrative

175.6

190.1

680.2

677.1

% of net sales

17.8

%

19.0

%

16.6

%

16.4

%

Research and development

23.5

23.1

99.8

92.2

% of net sales

2.4

%

2.3

%

2.4

%

2.2

%

Operating income

167.0

111.6

739.2

595.3

% of net sales

17.0

%

11.1

%

18.0

%

14.4

%

Other expense (income)

Gain on sale of businesses

—

—

—

(0.2

)

Other expense (income)

6.4

(17.4

)

2.0

(16.9

)

Net interest expense

26.6

27.6

118.3

61.8

% of net sales

2.7

%

2.8

%

2.9

%

1.5

%

Income from continuing operations before

income taxes

134.0

101.4

618.9

550.6

(Benefit) provision for income taxes

(74.1

)

5.1

(4.0

)

67.4

Effective tax rate

(55.3

)%

5.0

%

(0.6

)%

12.2

%

Net income from continuing

operations

208.1

96.3

622.9

483.2

Loss from discontinued operations, net of

tax

(0.1

)

(1.3

)

(0.2

)

(2.3

)

Net income

$

208.0

$

95.0

$

622.7

$

480.9

Earnings (loss) per ordinary

share

Basic

Continuing operations

$

1.26

$

0.59

$

3.77

$

2.93

Discontinued operations

—

(0.01

)

—

(0.01

)

Basic earnings per ordinary share

$

1.26

$

0.58

$

3.77

$

2.92

Diluted

Continuing operations

$

1.25

$

0.58

$

3.75

$

2.92

Discontinued operations

—

(0.01

)

—

(0.02

)

Diluted earnings per ordinary share

$

1.25

$

0.57

$

3.75

$

2.90

Weighted average ordinary shares

outstanding

Basic

165.3

164.5

165.1

164.8

Diluted

166.7

165.2

166.3

165.6

Cash dividends paid per ordinary

share

$

0.22

$

0.21

$

0.88

$

0.84

Pentair plc and

Subsidiaries

Condensed Consolidated Balance

Sheets (Unaudited)

December 31,

2023

December 31,

2022

In millions

Assets

Current assets

Cash and cash equivalents

$

170.3

$

108.9

Accounts receivable, net

561.7

531.5

Inventories

677.7

790.0

Other current assets

159.3

128.1

Total current assets

1,569.0

1,558.5

Property, plant and equipment,

net

362.0

344.5

Other assets

Goodwill

3,274.6

3,252.6

Intangibles, net

1,042.4

1,094.6

Other non-current assets

315.3

197.3

Total other assets

4,632.3

4,544.5

Total assets

$

6,563.3

$

6,447.5

Liabilities and Equity

Current liabilities

Accounts payable

$

278.9

$

355.0

Employee compensation and benefits

125.4

106.0

Other current liabilities

545.3

602.1

Total current liabilities

949.6

1,063.1

Other liabilities

Long-term debt

1,988.3

2,317.3

Pension and other post-retirement

compensation and benefits

73.6

70.8

Deferred tax liabilities

40.0

43.3

Other non-current liabilities

294.7

244.9

Total liabilities

3,346.2

3,739.4

Equity

3,217.1

2,708.1

Total liabilities and equity

$

6,563.3

$

6,447.5

Pentair plc and

Subsidiaries

Condensed Consolidated

Statements of Cash Flows (Unaudited)

Years ended December

31

In millions

2023

2022

Operating activities

Net income

$

622.7

$

480.9

Loss from discontinued operations, net of

tax

0.2

2.3

Adjustments to reconcile net income

from continuing operations to net cash provided by operating

activities of continuing operations

Equity income of unconsolidated

subsidiaries

(2.8

)

(1.8

)

Depreciation

59.5

54.1

Amortization

55.3

52.5

Gain on sale of businesses

—

(0.2

)

Deferred income taxes

(92.5

)

(44.8

)

Share-based compensation

29.1

24.9

Asset impairment and write-offs

7.9

25.6

Amortization of bridge financing debt

issuance costs

—

9.0

Pension and other post-retirement expense

(benefit)

12.1

(12.2

)

Pension and other post-retirement

contributions

(8.7

)

(8.8

)

Gain on sale of assets

(3.4

)

(2.3

)

Changes in assets and liabilities, net

of effects of business acquisitions

Accounts receivable

(24.4

)

30.4

Inventories

109.6

(187.0

)

Other current assets

(29.1

)

(16.5

)

Accounts payable

(75.1

)

(56.9

)

Employee compensation and benefits

17.2

(35.2

)

Other current liabilities

(59.5

)

46.5

Other non-current assets and

liabilities

2.7

3.8

Net cash provided by operating activities

of continuing operations

620.8

364.3

Net cash used for operating activities of

discontinued operations

(1.6

)

(1.0

)

Net cash provided by operating

activities

619.2

363.3

Investing activities

Capital expenditures

(76.0

)

(85.2

)

Proceeds from sale of property and

equipment

5.6

4.1

Acquisitions, net of cash acquired

(0.6

)

(1,580.9

)

(Payments) receipts upon the settlement of

net investment hedges

(18.5

)

78.9

Other

4.1

0.3

Net cash used for investing activities

(85.4

)

(1,582.8

)

Financing activities

Net (repayments) borrowings of revolving

long-term debt

(320.0

)

124.5

Proceeds from long-term debt

—

1,391.3

Repayments of long-term debt

(12.5

)

(88.3

)

Debt issuance costs

—

(15.8

)

Shares issued to employees, net of shares

withheld

9.6

(2.7

)

Repurchases of ordinary shares

—

(50.0

)

Dividends paid

(145.2

)

(138.6

)

Receipts upon the settlement of cross

currency swaps

—

12.3

Net cash (used for) provided by financing

activities

(468.1

)

1,232.7

Effect of exchange rate changes on cash

and cash equivalents

(4.3

)

1.2

Change in cash and cash

equivalents

61.4

14.4

Cash and cash equivalents, beginning of

year

108.9

94.5

Cash and cash equivalents, end of

year

$

170.3

$

108.9

Pentair plc and

Subsidiaries

Reconciliation of the GAAP

Operating Activities Cash Flow to the Non-GAAP Free Cash Flow

(Unaudited)

Years ended December

31

In millions

2023

2022

Net cash provided by operating activities

of continuing operations

$

620.8

$

364.3

Capital expenditures

(76.0

)

(85.2

)

Proceeds from sale of property and

equipment

5.6

4.1

Free cash flow from continuing

operations

$

550.4

$

283.2

Net cash used for operating activities of

discontinued operations

(1.6

)

(1.0

)

Free cash flow

$

548.8

$

282.2

Pentair plc and

Subsidiaries

Supplemental Financial

Information by Reportable Segment (Unaudited)

2023

In millions

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

Full

Year

Net sales

Flow

$

391.8

$

411.6

$

400.2

$

378.5

$

1,582.1

Water Solutions

272.0

336.2

299.4

269.6

1,177.2

Pool

364.3

334.3

308.8

336.2

1,343.6

Other

0.5

0.4

0.4

0.3

1.6

Consolidated

$

1,028.6

$

1,082.5

$

1,008.8

$

984.6

$

4,104.5

Segment income (loss)

Flow

$

65.0

$

74.8

$

77.5

$

65.0

$

282.3

Water Solutions

52.4

74.8

68.8

51.6

247.6

Pool

116.2

105.1

90.6

105.1

417.0

Other

(22.6

)

(20.5

)

(24.8

)

(23.9

)

(91.8

)

Consolidated

$

211.0

$

234.2

$

212.1

$

197.8

$

855.1

Return on sales

Flow

16.6

%

18.2

%

19.4

%

17.2

%

17.8

%

Water Solutions

19.3

%

22.2

%

23.0

%

19.1

%

21.0

%

Pool

31.9

%

31.4

%

29.3

%

31.3

%

31.0

%

Consolidated

20.5

%

21.6

%

21.0

%

20.1

%

20.8

%

Pentair plc and

Subsidiaries

Supplemental Financial

Information by Reportable Segment (Unaudited)

2022

In millions

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

Full

Year

Net sales

Flow

$

358.1

$

377.4

$

389.5

$

375.8

$

1,500.8

Water Solutions

205.8

222.2

275.3

283.5

986.8

Pool

435.4

464.0

390.0

343.3

1,632.7

Other

0.3

0.6

0.3

0.3

1.5

Consolidated

$

999.6

$

1,064.2

$

1,055.1

$

1,002.9

$

4,121.8

Segment income (loss)

Flow

$

52.2

$

59.1

$

65.7

$

65.3

$

242.3

Water Solutions

22.2

32.5

49.3

45.0

149.0

Pool

116.3

136.7

109.3

99.8

462.1

Other

(18.6

)

(22.4

)

(17.4

)

(27.3

)

(85.7

)

Consolidated

$

172.1

$

205.9

$

206.9

$

182.8

$

767.7

Return on sales

Flow

14.6

%

15.7

%

16.9

%

17.4

%

16.1

%

Water Solutions

10.8

%

14.6

%

17.9

%

15.9

%

15.1

%

Pool

26.7

%

29.5

%

28.0

%

29.1

%

28.3

%

Consolidated

17.2

%

19.3

%

19.6

%

18.2

%

18.6

%

Pentair plc and

Subsidiaries

Reconciliation of GAAP to

Non-GAAP Financial Measures for the Year Ended December 31,

2023

Excluding the Effect of

Adjustments (Unaudited)

In millions, except per-share data

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

Full

Year

Net sales

$

1,028.6

$

1,082.5

$

1,008.8

$

984.6

$

4,104.5

Operating income

183.6

208.5

180.1

167.0

739.2

Return on sales

17.8

%

19.3

%

17.9

%

17.0

%

18.0

%

Adjustments:

Restructuring and other

2.9

0.6

1.6

(1.7

)

3.4

Transformation costs

8.5

6.0

13.5

16.3

44.3

Intangible amortization

13.8

13.9

13.8

13.8

55.3

Legal accrual adjustments and

settlements

(1.9

)

4.1

—

—

2.2

Asset impairment and write-offs

3.9

0.5

1.8

1.7

7.9

Equity income of unconsolidated

subsidiaries

0.2

0.6

1.3

0.7

2.8

Segment income

211.0

234.2

212.1

197.8

855.1

Adjusted return on sales

20.5

%

21.6

%

21.0

%

20.1

%

20.8

%

Net income from continuing operations—as

reported

128.5

154.2

132.1

208.1

622.9

Pension and other post-retirement

mark-to-market loss

—

—

—

6.1

6.1

Other income

—

(5.1

)

—

—

(5.1

)

Adjustments to operating income

27.2

25.1

30.7

30.1

113.1

Income tax adjustments (1)

(4.6

)

(3.1

)

(6.6

)

(98.5

)

(112.8

)

Net income from continuing operations—as

adjusted

$

151.1

$

171.1

$

156.2

$

145.8

$

624.2

Continuing earnings per ordinary

share—diluted

Diluted earnings per ordinary share—as

reported

$

0.78

$

0.93

$

0.79

$

1.25

$

3.75

Adjustments

0.13

0.10

0.15

(0.38

)

—

Diluted earnings per ordinary share—as

adjusted

$

0.91

$

1.03

$

0.94

$

0.87

$

3.75

(1)

Income tax adjustments in the fourth

quarter include $74.3 million resulting from favorable impacts

of worthless stock deductions related to exiting certain businesses

in our Water Solutions segment and favorable discrete items

primarily related to the recognition of deferred tax assets.

Pentair plc and

Subsidiaries

Reconciliation of GAAP to

Non-GAAP Financial Measures for the Year Ending December 31,

2024

Excluding the Effect of

Adjustments (Unaudited)

Forecast

In millions, except per-share data

First

Quarter

Full

Year

Net sales

approx

Down 2% - 3%

approx

Up 2% - 3%

Operating income

approx

Up 3% - 7%

approx

Up 17% - 20%

Adjustments:

Intangible amortization

approx

$ 14

approx

$ 55

Equity income of unconsolidated

subsidiaries

approx

1

approx

4

Segment income

approx

Down 3% - flat

approx

Up 8% - 11%

Net income from continuing operations—as

reported

approx

$135 - $140

approx

$636 - $653

Adjustments to operating income

approx

14

approx

55

Income tax adjustments

approx

(2)

approx

—

Net income from continuing operations—as

adjusted

approx

$147 - $152

approx

$691 - $708

Continuing earnings per ordinary

share—diluted

Diluted earnings per ordinary share—as

reported

approx

$0.81 - $0.84

approx

$3.82 - $3.92

Adjustments

approx

0.07

approx

0.33

Diluted earnings per ordinary share—as

adjusted

approx

$0.88 - $0.91

approx

$4.15 - $4.25

Pentair plc and

Subsidiaries

Reconciliation of Net Sales

Growth to Core Net Sales Growth by Segment

For the Quarter and Year Ended

December 31, 2023 (Unaudited)

Q4 Net Sales Growth

Full Year Net Sales

Growth

Core

Currency

Acq. / Div.

Total

Core

Currency

Acq. / Div.

Total

Total Pentair

(2.3

)%

0.7

%

(0.2

)%

(1.8

)%

(4.9

)%

0.1

%

4.4

%

(0.4

)%

Flow

(0.9

)%

1.6

%

—

%

0.7

%

5.1

%

0.3

%

—

%

5.4

%

Water Solutions

(4.5

)%

0.4

%

(0.8

)%

(4.9

)%

1.1

%

(0.3

)%

18.5

%

19.3

%

Pool

(2.1

)%

—

%

—

%

(2.1

)%

(17.6

)%

(0.1

)%

—

%

(17.7

)%

Pentair plc and

Subsidiaries

Reconciliation of GAAP to

Non-GAAP Financial Measures for the Year Ended December 31,

2022

Excluding the Effect of

Adjustments (Unaudited)

In millions, except per-share data

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

Full

Year

Net sales

$

999.6

$

1,064.2

$

1,055.1

$

1,002.9

$

4,121.8

Operating income

145.8

190.8

147.1

111.6

595.3

Return on sales

14.6

%

17.9

%

13.9

%

11.1

%

14.4

%

Adjustments:

Restructuring and other

2.1

1.1

12.5

16.7

32.4

Transformation costs

5.5

5.2

10.1

6.4

27.2

Intangible amortization

6.6

6.3

18.5

21.1

52.5

Legal accrual adjustments and

settlements

(0.7

)

0.5

—

0.4

0.2

Asset impairment and write-offs

—

—

—

25.6

25.6

Inventory step-up

—

—

5.8

—

5.8

Deal-related costs and expenses

6.4

1.6

13.4

0.8

22.2

Russia business exit impact

5.9

—

(0.8

)

(0.4

)

4.7

Equity income of unconsolidated

subsidiaries

0.5

0.4

0.3

0.6

1.8

Segment income

172.1

205.9

206.9

182.8

767.7

Adjusted return on sales

17.2

%

19.3

%

19.6

%

18.2

%

18.6

%

Net income from continuing operations—as

reported

118.5

153.0

115.4

96.3

483.2

Gain on sale of businesses

—

—

(0.2

)

—

(0.2

)

Pension and other post-retirement

mark-to-market gain

—

—

—

(17.5

)

(17.5

)

Amortization of bridge financing fees

2.6

5.1

1.3

—

9.0

Adjustments to operating income

25.8

14.7

59.5

70.6

170.6

Income tax adjustments

(5.4

)

(3.8

)

(12.3

)

(14.4

)

(35.9

)

Net income from continuing operations—as

adjusted

$

141.5

$

169.0

$

163.7

$

135.0

$

609.2

Continuing earnings per ordinary

share—diluted

Diluted earnings per ordinary share—as

reported

$

0.71

$

0.92

$

0.70

$

0.58

$

2.92

Adjustments

0.14

0.10

0.29

0.24

0.76

Diluted earnings per ordinary share—as

adjusted

$

0.85

$

1.02

$

0.99

$

0.82

$

3.68

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240130856657/en/

PENTAIR CONTACTS: Shelly Hubbard Vice President, Investor

Relations Direct: 763-656-5575 Email:

shelly.hubbard@pentair.com

Rebecca Osborn Director, External Communications Direct:

763-656-5589 Email: rebecca.osborn@pentair.com

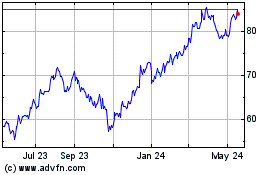

Pentair (NYSE:PNR)

Historical Stock Chart

From Jan 2025 to Feb 2025

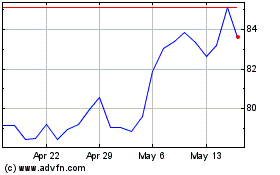

Pentair (NYSE:PNR)

Historical Stock Chart

From Feb 2024 to Feb 2025