Parsons Corporation (NYSE: PSN) today announced financial results

for the third quarter ended September 30, 2024.

CEO Commentary“We delivered record third

quarter results for total revenue, organic revenue growth, net

income, adjusted EBITDA, operating cash flow, and contract awards.

We also achieved over 20% organic growth for the sixth consecutive

quarter, while efficiently managing the business as bottom line

growth continues to outpace our strong top line growth,” said Carey

Smith, chair, president, and chief executive officer.

"In addition, we continue to leverage our strong balance sheet

to invest in software and integrated solutions, as well as execute

accretive acquisitions that either provide distinguished defense

capabilities to counter near peer threats or strengthen our

engineering expertise and increase our geographical footprint in

high growth infrastructure markets. As a result of our strong

operating performance and our BlackSignal acquisition, we are

raising our full-year revenue, adjusted EBITDA, and cash flow

guidance ranges.”

Third Quarter 2024

ResultsYear-over-Year Comparisons (Q3 2024 vs. Q3

2023)Total revenue for the third quarter of 2024 increased

by $392 million, or 28%, to $1.8 billion. This increase was

primarily driven by organic growth of 26% due to the ramp-up of

recent contract wins and growth on existing contracts in the

company's critical infrastructure protection and cyber and

intelligence markets. Operating income increased 38% to $115

million primarily due to the ramp-up of new and existing contracts.

Net income increased 52% to $72 million. GAAP diluted earnings per

share (EPS) attributable to Parsons was $0.65 in the third quarter

of 2024, compared to $0.42 in the prior year period.

Adjusted EBITDA including noncontrolling interests for the third

quarter of 2024 was $167 million, a 31% increase over the prior

year period. Adjusted EBITDA margin expanded 20 basis points to

9.2% in the third quarter of 2024, compared to 9.0% in the third

quarter of 2023. The year-over-year adjusted EBITDA and margin

increases were driven primarily by higher volume on margin

accretive contracts and a deliberate focus on indirect cost

management. Adjusted EPS was $0.95 in the third quarter of 2024,

compared to $0.69 in the third quarter of 2023. The year-over-year

adjusted EPS increase was driven by the previously mentioned

adjusted EBITDA increase noted above.

Segment Results

Federal Solutions SegmentFederal

Solutions Year-over-Year Comparisons (Q3 2024 vs. Q3

2023)

| |

|

Three Months Ended |

|

|

Growth |

|

|

Nine Months Ended |

|

|

Growth |

|

| (in millions) |

|

September 30, 2024 |

|

|

September 30, 2023 |

|

|

Dollars/ Percent |

|

|

Percent |

|

|

September 30, 2024 |

|

|

September 30, 2023 |

|

|

Dollars/ Percent |

|

|

Percent |

|

|

Revenue |

|

$ |

1,106 |

|

|

$ |

780 |

|

|

$ |

325 |

|

|

|

42 |

% |

|

$ |

3,004 |

|

|

$ |

2,177 |

|

|

$ |

826 |

|

|

|

38 |

% |

| Adjusted EBITDA |

|

$ |

120 |

|

|

$ |

65 |

|

|

$ |

55 |

|

|

|

84 |

% |

|

$ |

316 |

|

|

$ |

207 |

|

|

$ |

108 |

|

|

|

52 |

% |

| Adjusted EBITDA margin |

|

|

10.9 |

% |

|

|

8.3 |

% |

|

|

2.6 |

% |

|

|

30 |

% |

|

|

10.5 |

% |

|

|

9.5 |

% |

|

|

1.0 |

% |

|

|

10 |

% |

Certain amounts may not foot due to rounding

Third quarter 2024 Federal Solutions revenue increased $325

million, or 42%, compared to the prior year period due to organic

growth of 39% and the contribution from the company's SealingTech

and BlackSignal acquisitions. Organic growth was driven primarily

by the ramp-up of recent contract wins and growth on existing

contracts in the company's critical infrastructure protection and

cyber and intelligence markets.

Third quarter 2024 Federal Solutions adjusted EBITDA including

noncontrolling interests increased by $55 million, or 84%. Adjusted

EBITDA margin increased 260 basis points to 10.9% from 8.3% in the

prior year period. These increases were driven primarily by

increased volume on accretive contracts, contributions from

high-margin acquisitions and improved program

execution.

Critical Infrastructure SegmentCritical

Infrastructure Year-over-Year Comparisons (Q3 2024 vs. Q3

2023)

| |

|

Three Months Ended |

|

|

Growth |

|

|

Nine Months Ended |

|

|

Growth |

|

| (in millions) |

|

September 30, 2024 |

|

|

September 30, 2023 |

|

|

Dollars/ Percent |

|

|

Percent |

|

|

September 30, 2024 |

|

|

September 30, 2023 |

|

|

Dollars/ Percent |

|

|

Percent |

|

|

Revenue |

|

$ |

705 |

|

|

$ |

638 |

|

|

$ |

66 |

|

|

|

10 |

% |

|

$ |

2,012 |

|

|

$ |

1,771 |

|

|

$ |

241 |

|

|

|

14 |

% |

| Adjusted EBITDA |

|

$ |

47 |

|

|

$ |

63 |

|

|

$ |

(16 |

) |

|

|

-25 |

% |

|

$ |

143 |

|

|

$ |

129 |

|

|

$ |

13 |

|

|

|

10 |

% |

| Adjusted EBITDA margin |

|

|

6.7 |

% |

|

|

9.8 |

% |

|

|

-3.1 |

% |

|

|

-32 |

% |

|

|

7.1 |

% |

|

|

7.3 |

% |

|

|

-0.2 |

% |

|

|

-3 |

% |

Certain amounts may not foot due to rounding

Third quarter 2024 Critical Infrastructure revenue increased 10%

from the prior year period on both an organic and inorganic basis.

Organic growth was driven by higher volume in the company's North

American and Middle East infrastructure portfolios.

Third quarter 2024 adjusted EBITDA including noncontrolling

interests decreased by $16 million, or 25%, compared to the prior

year period. Adjusted EBITDA margin decreased 310 basis points to

6.7% from 9.8% in the prior year period. The adjusted EBITDA

decreases were driven by a write-down on the legacy program that is

expected to reach substantial completion in Q4 2024.

Third Quarter 2024 Key Performance

Indicators

- Book-to-bill ratio: 1.0x. Net bookings increase $350 million,

or 24%, to $1.8 billion.

- Book-to-bill ratio (trailing twelve-months): 1.0x. Net bookings

increase $760 million, or 13%, to $6.6 billion.

- Total backlog: $8.8 billion.

- Cash flow from operating activities: Third quarter 2024: $299

million compared to $204 million in third quarter of 2023. For the

nine months ended September 30, 2024, cash flow from operating

activities increases 82% to $397 million compared to $218 million

in the prior year period.

Significant Contract WinsParsons continues to

win new business across both segments. During the third quarter of

2024, the company won four single-award contracts worth more than

$100 million each.

- Option awards totaling $287 million with a confidential

customer in the company's Federal Solutions segment.

- Booked an option period totaling $245 million on a General

Services Administration contract. This contract supports the

Department of Defense and its strategic partners in delivering

global quick reaction capabilities leveraging advanced technology

solutions across the all-domain battlespace.

- Awarded a new contract for the Georgia State Route 400 Express

Lanes where Parsons will serve as the lead designer, as a

subcontractor. This $4.6 billion project will add new express lanes

and use state-of-the-art traffic, incident management, and digital

twin systems.

- Awarded a new lead design contract for the Honolulu Authority

for Rapid Transportation's City Center Guideway and Stations

project. The company is a subcontractor on the $1.66 billion

project. The scope of work includes the design of six rail stations

and approximately three miles of elevated rail guideway and

engineering services during construction.

- In Saudi Arabia, awarded contracts valued at more than $200

million including two large program management awards.

- Awarded $134 million of contracts in the INDOPACOM region.

Parsons won a three-year $69 million contract on Kwajalein in the

Marshall Islands to provide Army family housing. The company was

also awarded $37 million in signals intelligence and cyber

operations work. Parsons received two contracts worth $28 million

to perform Advanced Geophysical Classification and Unexploded

Ordnance work on Guam and to upgrade Utility Monitoring and Control

Systems. Parsons’ presence in Guam, Kwajalein, and Hawaii continues

to strengthen and is aligned to the FY25 Pacific Deterrence

Initiative of $9.9 billion for targeted investment to enhance force

posture, infrastructure, presence and readiness of the U.S. and its

Allies in the Indo-Pacific region.

- Awarded a $62 million recompete contract with the National

Geospatial-Intelligence Agency. The contract provides background

investigation and polygraph examination support for the NGA

workforce. With this award, Parsons continues its 15+ year

relationship with NGA in the form of personnel security, insider

threat and counterintelligence, physical and industrial security

services, facility management and emergency management. The

contract includes a one-year base and four one-year options.

- Booked an option period totaling $54 million on the Combatant

Commands Cyber Mission Support contract. This contract includes

support of multi-domain operations across cyber, space, air,

ground, and maritime.

Additional Corporate HighlightsParsons

continues its successful track record of acquiring strategic

companies in high-growth markets that broaden its portfolio and

customer footprint. During the quarter, the company was named to

the prestigious S&P MidCap 400 Index and was recognized for its

sustainable infrastructure.

- After the third quarter ended, Parsons entered into a

definitive agreement to acquire BCC Engineering, LLC, one of

Florida's leading transportation engineering firms, in an all-cash

transaction valued at $230 million. BCC is a full-service

engineering firm that provides planning, design, and management

services for transportation, civil, and structural engineering

projects in Florida, Georgia, Texas, South Carolina and Puerto

Rico. This acquisition will strengthen Parsons’ position as an

infrastructure leader while expanding the company’s reach in the

Southeastern United States, an area where the Infrastructure

Investment and Jobs Act provided approximately $100 billion in

Federal Highway Administration formula dollars for fiscal years

2022-2026.

- During the third quarter, the company announced and closed its

acquisition of BlackSignal Technologies in a transaction valued at

approximately $204 million. BlackSignal is a next-generation

digital signal processing, electronic warfare, and cyber security

provider built to counter near peer threats. The strategic

acquisition expands Parsons’ customer base across the Department of

Defense and Intelligence Community and significantly strengthens

Parsons’ positioning with full-spectrum cyber and electronic

warfare, while adding new capabilities in the counterspace radio

frequency domain: markets anticipated to grow more than 10%

annually with double digit margin expectations.

- Named to S&P Dow Jones Indices prestigious S&P MidCap

400 Index.

- Honored with the Envision Gold Award from the Institute for

Sustainable Infrastructure for the company’s South Corridor Rapid

Transit project where Parsons is the lead designer. The project

provides an efficient new mass transportation option, connecting

five municipalities in South Florida by creating Miami-Dade

County’s first ever Bus Rapid Transit corridor.

Fiscal Year 2024 GuidanceThe company is

increasing its fiscal year 2024 revenue, adjusted EBITDA, and cash

flow from operations guidance ranges to reflect its strong third

quarter operating performance and its outlook for the remainder of

the year. The table below summarizes the company’s fiscal year 2024

guidance.

|

|

Current Fiscal Year2024

Guidance |

Prior Fiscal Year2024

Guidance |

| Revenue |

$6.6 billion - $6.8

billion |

$6.35 billion - $6.55

billion |

| Adjusted EBITDA including

non-controlling interest |

$590 million - $620

million |

$555 million - $595

million |

| Cash

Flow from Operating Activities |

$425

million - $465 million |

$395

million - $455 million |

Net income guidance is not presented as the company believes

volatility associated with interest, taxes, depreciation,

amortization and other matters affecting net income, including but

not limited to one-time and nonrecurring events and impact of

M&A, will preclude the company from providing accurate net

income guidance for fiscal year 2024.

Conference Call InformationParsons will host a

conference call today, October 30, 2024, at 8:00 a.m. ET to discuss

the financial results for its third quarter 2024.

Access to a webcast of the live conference call can be obtained

through the Investor Relations section of the company's website

(https://investors.parsons.com). Parties interested in

participating via telephone may register on the Investor Relations

website or by clicking here.

A replay will be available on the company's website

approximately two hours after the conference call and continuing

for one year.

About Parsons CorporationParsons (NYSE: PSN) is

a leading disruptive technology provider in the national security

and global infrastructure markets, with capabilities across cyber

and intelligence, space and missile defense, transportation,

environmental remediation, urban development, and critical

infrastructure protection. Please visit Parsons.com and follow us

on LinkedIn and Facebook to learn how we’re making an impact.

Forward-Looking Statements

This Earnings Release and materials included therewith contains

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995, Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Forward-looking

statements are based on our current expectations, beliefs, and

assumptions, and are not guarantees of future performance.

Forward-looking statements are inherently subject to uncertainties,

risks, changes in circumstances, trends and factors that are

difficult to predict, many of which are outside of our

control. Accordingly, actual performance, results and events

may vary materially from those indicated in the forward-looking

statements, and you should not rely on the forward-looking

statements as predictions of future performance, results or

events. Numerous factors could cause actual future

performance, results and events to differ materially from those

indicated in the forward-looking statements, including, among

others: the impact of COVID-19; any issue that compromises our

relationships with the U.S. federal government or its agencies or

other state, local or foreign governments or agencies; any issues

that damage our professional reputation; changes in governmental

priorities that shift expenditures away from agencies or programs

that we support; our dependence on long-term government contracts,

which are subject to the government’s budgetary approval process;

the size of addressable markets and the amount of government

spending on private contractors; failure by us or our employees to

obtain and maintain necessary security clearances or

certifications; failure to comply with numerous laws and

regulations; changes in government procurement, contract or other

practices or the adoption by governments of new laws, rules,

regulations and programs in a manner adverse to us; the termination

or nonrenewal of our government contracts, particularly our

contracts with the U.S. government; our ability to compete

effectively in the competitive bidding process and delays,

contract terminations or cancellations caused by competitors’

protests of major contract awards received by us; our ability to

generate revenue under certain of our contracts; any inability to

attract, train or retain employees with the requisite skills,

experience and security clearances; the loss of members of senior

management or failure to develop new leaders; misconduct or other

improper activities from our employees or subcontractors; our

ability to realize the full value of our backlog and the timing of

our receipt of revenue under contracts included in backlog; changes

in the mix of our contracts and our ability to accurately estimate

or otherwise recover expenses, time and resources for our

contracts; changes in estimates used in recognizing revenue;

internal system or service failures and security breaches; and

inherent uncertainties and potential adverse developments in legal

proceedings including litigation, audits, reviews and

investigations, which may result in material adverse judgments,

settlements or other unfavorable outcomes. These factors are

not exhaustive and additional factors could adversely affect our

business and financial performance. For a discussion of

additional factors that could materially adversely affect our

business and financial performance, see the factors including under

the caption “Risk Factors” in our Annual Report with the Securities

and Exchange Commission pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934 for the fiscal year ended December

31, 2023, on Form 10-K, filed on February 14, 2024, and our other

filings with the Securities and Exchange Commission, including the

Quarterly Report filed with the Securities and Exchange Commission

on October 30, 2024 on Form 10-Q for the quarter ended September

30, 2024.

All forward-looking statements are based on currently available

information and speak only as of the date on which they are

made. We assume no obligation to update any forward-looking

statements made in this presentation that becomes untrue because of

subsequent events, new information or otherwise, except to the

extent we are required to do so in connection with our ongoing

requirements under federal securities laws.

| Media: |

Investor Relations: |

| Bryce McDevitt |

Dave Spille |

| Parsons Corporation |

Parsons Corporation |

| (703) 851-4425 |

(571) 775-0408 |

|

Bryce.McDevitt@Parsons.com |

Dave.Spille@Parsons.us |

|

PARSONS CORPORATIONCONSOLIDATED

STATEMENTS OF OPERATIONS(In thousands, except per

share data)(Unaudited) |

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

|

September 30, 2024 |

|

|

September 30, 2023 |

|

|

September 30, 2024 |

|

|

September 30, 2023 |

|

| Revenue |

|

$ |

1,810,116 |

|

|

$ |

1,418,571 |

|

|

$ |

5,016,259 |

|

|

$ |

3,948,523 |

|

| Direct cost of contracts |

|

|

1,449,831 |

|

|

|

1,124,305 |

|

|

|

3,979,589 |

|

|

|

3,109,713 |

|

| Equity in (losses) earnings of

unconsolidated joint ventures |

|

|

872 |

|

|

|

10,262 |

|

|

|

(18,025 |

) |

|

|

4,497 |

|

| Selling, general and

administrative expenses |

|

|

246,169 |

|

|

|

221,188 |

|

|

|

690,391 |

|

|

|

632,393 |

|

| Operating income |

|

|

114,988 |

|

|

|

83,340 |

|

|

|

328,254 |

|

|

|

210,914 |

|

| Interest income |

|

|

4,232 |

|

|

|

492 |

|

|

|

9,209 |

|

|

|

1,591 |

|

| Interest expense |

|

|

(13,034 |

) |

|

|

(8,612 |

) |

|

|

(39,040 |

) |

|

|

(22,369 |

) |

| Loss on extinguishment of

debt |

|

|

- |

|

|

|

- |

|

|

|

(211,018 |

) |

|

|

- |

|

| Other income (expense), net |

|

|

1,921 |

|

|

|

(191 |

) |

|

|

(510 |

) |

|

|

1,666 |

|

| Total other income

(expense) |

|

|

(6,881 |

) |

|

|

(8,311 |

) |

|

|

(241,359 |

) |

|

|

(19,112 |

) |

| Income before income tax

expense |

|

|

108,107 |

|

|

|

75,029 |

|

|

|

86,895 |

|

|

|

191,802 |

|

| Income tax expense |

|

|

(22,518 |

) |

|

|

(15,218 |

) |

|

|

(12,699 |

) |

|

|

(41,944 |

) |

| Net income including

noncontrolling interests |

|

|

85,589 |

|

|

|

59,811 |

|

|

|

74,196 |

|

|

|

149,858 |

|

| Net income attributable to

noncontrolling interests |

|

|

(13,638 |

) |

|

|

(12,364 |

) |

|

|

(40,428 |

) |

|

|

(33,617 |

) |

| Net income attributable to

Parsons Corporation |

|

$ |

71,951 |

|

|

$ |

47,447 |

|

|

$ |

33,768 |

|

|

$ |

116,241 |

|

| Earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.68 |

|

|

$ |

0.45 |

|

|

$ |

0.32 |

|

|

$ |

1.11 |

|

|

Diluted |

|

$ |

0.65 |

|

|

$ |

0.42 |

|

|

$ |

0.31 |

|

|

$ |

1.03 |

|

Weighted average number of shares used to compute basic

and diluted EPS(In thousands)

(Unaudited)

| |

|

Three Months Ended |

|

|

Nine Months Ended |

|

| |

|

September 30, 2024 |

|

|

September 30, 2023 |

|

|

September 30, 2024 |

|

|

September 30, 2023 |

|

| Basic weighted average number of

shares outstanding |

|

|

106,291 |

|

|

|

104,971 |

|

|

|

106,211 |

|

|

|

104,894 |

|

| Dilutive effect of stock-based

awards |

|

|

1,661 |

|

|

|

1,178 |

|

|

|

1,628 |

|

|

|

1,020 |

|

| Dilutive effect of warrants |

|

|

561 |

|

|

|

- |

|

|

|

358 |

|

|

|

- |

|

| Dilutive effect of convertible

senior notes due 2025 |

|

|

2,573 |

|

|

|

8,917 |

|

|

|

- |

|

|

|

8,917 |

|

| Diluted weighted average number

of shares outstanding |

|

|

111,086 |

|

|

|

115,066 |

|

|

|

108,197 |

|

|

|

114,831 |

|

Net income available to shareholders used to compute

diluted EPS (In thousands) (Unaudited)

| |

|

Three Months Ended |

|

|

Nine Months Ended |

|

| |

|

September 30, 2024 |

|

|

September 30, 2023 |

|

|

September 30, 2024 |

|

|

September 30, 2023 |

|

| Net income attributable to

Parsons Corporation |

|

$ |

71,951 |

|

|

$ |

47,447 |

|

|

|

33,768 |

|

|

|

116,241 |

|

| Convertible senior notes

if-converted method interest adjustment |

|

|

54 |

|

|

|

559 |

|

|

|

- |

|

|

|

1,665 |

|

| Diluted net income attributable

to Parsons Corporation |

|

$ |

72,005 |

|

|

$ |

48,006 |

|

|

|

33,768 |

|

|

|

117,906 |

|

|

PARSONS CORPORATIONCONSOLIDATED

BALANCE SHEETS(In thousands, except share

information) |

|

|

|

|

|

September 30, 2024 |

|

|

December 31, 2023 |

|

| |

|

|

(Unaudited) |

|

|

|

|

|

Assets |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents (including $132,662 and $128,761 Cash of

consolidated joint ventures) |

|

$ |

558,823 |

|

|

$ |

272,943 |

|

| |

Accounts receivable, net

(including $348,892 and $274,846 Accounts receivable of

consolidated joint ventures, net) |

|

|

1,034,976 |

|

|

|

915,638 |

|

| |

Contract assets (including $6,260

and $11,096 Contract assets of consolidated joint ventures) |

|

|

790,001 |

|

|

|

757,515 |

|

| |

Prepaid expenses and other

current assets (including $15,284 and $11,929 Prepaid expenses and

other current assets of consolidated joint ventures) |

|

|

170,858 |

|

|

|

191,430 |

|

| |

Total current assets |

|

|

2,554,658 |

|

|

|

2,137,526 |

|

| |

|

|

|

|

|

|

|

| |

Property and equipment, net

(including $3,235 and $3,274 Property and equipment of consolidated

joint ventures, net) |

|

|

101,193 |

|

|

|

98,957 |

|

| |

Right of use assets, operating

leases (including $6,879 and $9,885 Right of use assets, operating

leases of consolidated joint ventures) |

|

|

135,367 |

|

|

|

159,211 |

|

| |

Goodwill |

|

|

1,931,157 |

|

|

|

1,792,665 |

|

| |

Investments in and advances to

unconsolidated joint ventures |

|

|

194,524 |

|

|

|

128,204 |

|

| |

Intangible assets, net |

|

|

307,952 |

|

|

|

275,566 |

|

| |

Deferred tax assets |

|

|

163,539 |

|

|

|

140,162 |

|

| |

Other noncurrent assets |

|

|

54,952 |

|

|

|

71,770 |

|

| |

Total assets |

|

$ |

5,443,342 |

|

|

$ |

4,804,061 |

|

| |

|

|

|

|

|

|

|

| Liabilities

and Shareholders' Equity |

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

| |

Accounts payable (including

$65,426 and $49,234 Accounts payable of consolidated joint

ventures) |

|

$ |

300,217 |

|

|

$ |

242,821 |

|

| |

Accrued expenses and other

current liabilities (including $173,190 and $145,040 Accrued

expenses and other current liabilities of consolidated joint

ventures) |

|

|

876,583 |

|

|

|

801,423 |

|

| |

Contract liabilities (including

$64,899 and $61,234 Contract liabilities of consolidated joint

ventures) |

|

|

300,799 |

|

|

|

301,107 |

|

| |

Short-term lease liabilities,

operating leases (including $3,962 and $4,753 Short-term lease

liabilities, operating leases of consolidated joint ventures) |

|

|

51,971 |

|

|

|

58,556 |

|

| |

Income taxes payable |

|

|

4,556 |

|

|

|

6,977 |

|

| |

Short-term debt |

|

|

115,428 |

|

|

|

- |

|

| |

Total current liabilities |

|

|

1,649,554 |

|

|

|

1,410,884 |

|

| |

|

|

|

|

|

|

|

| |

Long-term employee

incentives |

|

|

27,553 |

|

|

|

22,924 |

|

| |

Long-term debt |

|

|

1,132,980 |

|

|

|

745,963 |

|

| |

Long-term lease liabilities,

operating leases (including $2,916 and $5,132 Long-term lease

liabilities, operating leases of consolidated joint ventures) |

|

|

97,838 |

|

|

|

117,505 |

|

| |

Deferred tax liabilities |

|

|

27,931 |

|

|

|

9,775 |

|

| |

Other long-term liabilities |

|

|

93,055 |

|

|

|

120,295 |

|

| |

Total liabilities |

|

|

3,028,911 |

|

|

|

2,427,346 |

|

| Contingencies (Note

12) |

|

|

|

|

|

|

| Shareholders'

equity: |

|

|

|

|

|

|

| |

Common stock, $1 par value;

authorized 1,000,000,000 shares; 146,703,583 and 146,341,363 shares

issued; 51,357,743 and 45,960,122 public shares outstanding;

54,831,932 and 59,879,857 ESOP shares outstanding |

|

|

146,703 |

|

|

|

146,341 |

|

| |

Treasury stock, 40,501,385 shares

at cost |

|

|

(827,311 |

) |

|

|

(827,311 |

) |

| |

Additional paid-in capital |

|

|

2,781,868 |

|

|

|

2,779,365 |

|

| |

Retained earnings |

|

|

227,334 |

|

|

|

203,724 |

|

| |

Accumulated other comprehensive

loss |

|

|

(16,142 |

) |

|

|

(14,908 |

) |

| |

Total Parsons Corporation

shareholders' equity |

|

|

2,312,452 |

|

|

|

2,287,211 |

|

| |

Noncontrolling interests |

|

|

101,979 |

|

|

|

89,504 |

|

| |

Total shareholders' equity |

|

|

2,414,431 |

|

|

|

2,376,715 |

|

| |

Total liabilities and shareholders' equity |

|

|

5,443,342 |

|

|

|

4,804,061 |

|

|

PARSONS CORPORATIONCONSOLIDATED

STATEMENTS OF CASH FLOWS(In

thousands)(Unaudited) |

|

| |

|

|

For the Nine Months Ended |

|

|

|

|

|

September 30, 2024 |

|

|

September 30, 2023 |

|

| Cash flows

from operating activities: |

|

|

|

|

|

|

|

|

Net income including noncontrolling interests |

|

$ |

74,196 |

|

|

$ |

149,858 |

|

| |

Adjustments to reconcile net

(loss) income to net cash used in operating activities |

|

|

|

|

|

|

| |

Depreciation and amortization |

|

|

73,513 |

|

|

|

87,202 |

|

| |

Amortization of debt issue costs |

|

|

6,563 |

|

|

|

2,124 |

|

| |

Loss (gain) on disposal of property and equipment |

|

|

573 |

|

|

|

(27 |

) |

| |

Loss on extinguishment of debt |

|

|

211,018 |

|

|

|

- |

|

| |

Provision for doubtful accounts |

|

|

- |

|

|

|

91 |

|

| |

Deferred taxes |

|

|

(1,015 |

) |

|

|

(8,205 |

) |

| |

Foreign currency transaction gains and losses |

|

|

898 |

|

|

|

1,479 |

|

| |

Equity in losses (earnings) of unconsolidated joint ventures |

|

|

18,025 |

|

|

|

(4,497 |

) |

| |

Return on investments in unconsolidated joint ventures |

|

|

31,770 |

|

|

|

30,328 |

|

| |

Stock-based compensation |

|

|

39,960 |

|

|

|

23,872 |

|

| |

Contributions of treasury stock |

|

|

43,372 |

|

|

|

44,072 |

|

| |

Changes in assets and

liabilities, net of acquisitions and consolidated joint

ventures: |

|

|

|

|

|

|

| |

Accounts receivable |

|

|

(116,468 |

) |

|

|

(168,964 |

) |

| |

Contract assets |

|

|

(29,597 |

) |

|

|

(120,414 |

) |

| |

Prepaid expenses and other assets |

|

|

32,884 |

|

|

|

(40,470 |

) |

| |

Accounts payable |

|

|

56,665 |

|

|

|

48,294 |

|

| |

Accrued expenses and other current liabilities |

|

|

25,654 |

|

|

|

93,263 |

|

| |

Contract liabilities |

|

|

343 |

|

|

|

61,503 |

|

| |

Income taxes |

|

|

(48,912 |

) |

|

|

17,395 |

|

| |

Other long-term liabilities |

|

|

(22,602 |

) |

|

|

662 |

|

| |

Net cash provided by operating

activities |

|

|

396,840 |

|

|

|

217,566 |

|

| Cash flows

from investing activities: |

|

|

|

|

|

|

| |

Capital expenditures |

|

|

(30,446 |

) |

|

|

(30,877 |

) |

| |

Proceeds from sale of property

and equipment |

|

|

128 |

|

|

|

274 |

|

| |

Payments for acquisitions, net of

cash acquired |

|

|

(198,875 |

) |

|

|

(215,497 |

) |

| |

Investments in unconsolidated

joint ventures |

|

|

(115,446 |

) |

|

|

(81,598 |

) |

| |

Return of investments in

unconsolidated joint ventures |

|

|

25 |

|

|

|

72 |

|

| |

Proceeds from sales of

investments in unconsolidated joint ventures |

|

|

- |

|

|

|

381 |

|

| |

Net cash used in investing

activities |

|

|

(344,614 |

) |

|

|

(327,245 |

) |

| Cash flows

from financing activities: |

|

|

|

|

|

|

| |

Proceeds from borrowings under

credit agreement |

|

|

153,200 |

|

|

|

511,500 |

|

| |

Repayments of borrowings under

credit agreement |

|

|

(153,200 |

) |

|

|

(436,500 |

) |

| |

Proceeds from issuance of

convertible notes due 2029 |

|

|

800,000 |

|

|

|

- |

|

| |

Repurchases of convertible notes

due 2025 |

|

|

(495,590 |

) |

|

|

- |

|

| |

Payments for debt issuance

costs |

|

|

(19,185 |

) |

|

|

- |

|

| |

Contributions by noncontrolling

interests |

|

|

1,038 |

|

|

|

1,537 |

|

| |

Distributions to noncontrolling

interests |

|

|

(29,006 |

) |

|

|

(12,156 |

) |

| |

Repurchases of common stock |

|

|

(10,000 |

) |

|

|

(8,000 |

) |

| |

Taxes paid on vested stock |

|

|

(19,228 |

) |

|

|

(6,941 |

) |

| |

Capped call transactions |

|

|

(88,400 |

) |

|

|

- |

|

| |

Bond hedge termination |

|

|

195,549 |

|

|

|

- |

|

| |

Redemption of warrants |

|

|

(104,952 |

) |

|

|

- |

|

| |

Proceeds from issuance of common

stock |

|

|

3,740 |

|

|

|

2,940 |

|

| |

Net cash provided by financing

activities |

|

|

233,966 |

|

|

|

52,380 |

|

| |

Effect of exchange rate

changes |

|

|

(312 |

) |

|

|

166 |

|

| |

Net increase (decrease) in cash,

cash equivalents, and restricted cash |

|

|

285,880 |

|

|

|

(57,133 |

) |

| |

Cash, cash equivalents and

restricted cash: |

|

|

|

|

|

|

| |

Beginning of year |

|

|

272,943 |

|

|

|

262,539 |

|

| |

End of period |

|

$ |

558,823 |

|

|

$ |

205,406 |

|

Contract Awards (in thousands)

| |

|

Three Months Ended |

|

|

Nine Months Ended |

|

| |

|

September 30, 2024 |

|

|

September 30, 2023 |

|

|

September 30, 2024 |

|

|

September 30, 2023 |

|

|

Federal Solutions |

|

$ |

1,012,432 |

|

|

$ |

764,531 |

|

|

$ |

3,100,242 |

|

|

$ |

2,642,302 |

|

| Critical Infrastructure |

|

|

772,304 |

|

|

|

670,398 |

|

|

|

2,266,867 |

|

|

|

2,106,018 |

|

| Total Awards |

|

$ |

1,784,736 |

|

|

$ |

1,434,929 |

|

|

$ |

5,367,109 |

|

|

$ |

4,748,320 |

|

Backlog (in thousands)

| |

|

September 30, 2024 |

|

|

September 30, 2023 |

|

| Federal Solutions: |

|

|

|

|

|

|

|

Funded |

|

$ |

1,982,336 |

|

|

$ |

1,625,475 |

|

|

Unfunded |

|

|

2,936,109 |

|

|

|

3,565,223 |

|

| Total Federal Solutions |

|

|

4,918,445 |

|

|

|

5,190,698 |

|

| Critical Infrastructure: |

|

|

|

|

|

|

|

Funded |

|

|

3,811,638 |

|

|

|

3,554,754 |

|

|

Unfunded |

|

|

53,964 |

|

|

|

70,109 |

|

| Total Critical

Infrastructure |

|

|

3,865,602 |

|

|

|

3,624,863 |

|

| Total Backlog |

|

$ |

8,784,047 |

|

|

$ |

8,815,561 |

|

Book-To-Bill

Ratio1:

| |

|

Three Months Ended |

|

|

Nine Months Ended |

|

| |

|

September 30, 2024 |

|

|

September 30, 2023 |

|

|

September 30, 2024 |

|

|

September 30, 2023 |

|

|

Federal Solutions |

|

|

0.9 |

|

|

|

1.0 |

|

|

|

1.0 |

|

|

|

1.2 |

|

| Critical Infrastructure |

|

|

1.1 |

|

|

|

1.1 |

|

|

|

1.1 |

|

|

|

1.2 |

|

| Overall |

|

|

1.0 |

|

|

|

1.0 |

|

|

|

1.1 |

|

|

|

1.2 |

|

Non-GAAP Financial InformationThe tables under

"Parsons Corporation Inc. Reconciliation of Non-GAAP Measures"

present Adjusted Net Income attributable to Parsons Corporation,

Adjusted Earnings per Share, Earnings before Interest, Taxes,

Depreciation, and Amortization (“EBITDA”), Adjusted EBITDA, EBITDA

Margin, and Adjusted EBITDA Margin, reconciled to their most

directly comparable GAAP measure. These financial measures are

calculated and presented on the basis of methodologies other than

in accordance with U.S. generally accepted accounting principles

("Non-GAAP Measures"). Parsons has provided these Non-GAAP Measures

to adjust for, among other things, the impact of amortization

expenses related to our acquisitions, costs associated with a loss

or gain on the disposal or sale of property, plant and equipment,

restructuring and related expenses, costs associated with mergers

and acquisitions, software implementation costs, legal and

settlement costs, and other costs considered non-operational in

nature. These items have been Adjusted because they are not

considered core to the company’s business or otherwise not

considered operational or because these charges are non-cash or

non-recurring. The company presents these Non-GAAP Measures because

management believes that they are meaningful to understanding

Parsons’s performance during the periods presented and the

company’s ongoing business. Non-GAAP Measures are not prepared in

accordance with GAAP and therefore are not necessarily comparable

to similarly titled metrics or the financial results of other

companies. These Non-GAAP Measures should be considered a

supplement to, not a substitute for, or superior to, the

corresponding financial measures calculated in accordance with

GAAP.

1 Book-to-Bill ratio is calculated as total contract awards

divided by total revenue for the period.

|

PARSONS CORPORATIONNon-GAAP

Financial InformationReconciliation of Net Income

to Adjusted EBITDA(in thousands) |

|

| |

|

Three Months Ended |

|

|

Nine Months Ended |

|

| |

|

September 30, 2024 |

|

|

September 30, 2023 |

|

|

September 30, 2024 |

|

|

September 30, 2023 |

|

|

Net income attributable to Parsons Corporation |

|

$ |

71,951 |

|

|

$ |

47,447 |

|

|

$ |

33,768 |

|

|

$ |

116,241 |

|

|

Interest expense, net |

|

|

8,802 |

|

|

|

8,120 |

|

|

|

29,831 |

|

|

|

20,778 |

|

|

Income tax expense |

|

|

22,518 |

|

|

|

15,218 |

|

|

|

12,699 |

|

|

|

41,944 |

|

|

Depreciation and amortization (a) |

|

|

24,542 |

|

|

|

30,154 |

|

|

|

73,513 |

|

|

|

87,202 |

|

|

Net income attributable to noncontrolling interests |

|

|

13,638 |

|

|

|

12,364 |

|

|

|

40,428 |

|

|

|

33,617 |

|

|

Equity-based compensation |

|

|

21,251 |

|

|

|

9,075 |

|

|

|

44,554 |

|

|

|

25,092 |

|

|

Loss on extinguishment of debt |

|

|

- |

|

|

|

- |

|

|

|

211,018 |

|

|

|

- |

|

|

Transaction-related costs (b) |

|

|

3,770 |

|

|

|

5,493 |

|

|

|

8,958 |

|

|

|

9,028 |

|

|

Restructuring (c) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

546 |

|

|

Other (d) |

|

|

539 |

|

|

|

(38 |

) |

|

|

3,565 |

|

|

|

2,082 |

|

|

Adjusted EBITDA |

|

$ |

167,011 |

|

|

$ |

127,833 |

|

|

$ |

458,334 |

|

|

$ |

336,530 |

|

|

|

|

| (a) |

Depreciation and amortization for

the three and nine months ended September 30, 2024, is $19.4

million and $58.7 million, respectively in the Federal Solutions

Segment and $5.2 million and $14.8 million, respectively in the

Critical Infrastructure Segment. Depreciation and amortization for

the three and nine months ended September 30, 2023, is $25.0

million and $73.4 million, respectively in the Federal Solutions

Segment and $5.2 million and $13.8 million, respectively in the

Critical Infrastructure Segment. |

| (b) |

Reflects costs incurred in

connection with acquisitions and other non-recurring transaction

costs, primarily fees paid for professional services and employee

retention. |

| (c) |

Reflects costs associated with

and related to our corporate restructuring initiatives. |

| (d) |

Includes a combination of

gain/loss related to sale of fixed assets, software implementation

costs, and other individually insignificant items that are

non-recurring in nature. |

|

PARSONS CORPORATIONNon-GAAP

Financial InformationComputation of Adjusted

EBITDA Attributable to Noncontrolling

Interests(in thousands) |

|

| |

|

Three months ended |

|

|

Nine Months Ended |

|

| |

|

September 30, 2024 |

|

|

September 30, 2023 |

|

|

September 30, 2024 |

|

|

September 30, 2023 |

|

|

Federal Solutions Adjusted EBITDA attributable to Parsons

Corporation |

|

$ |

120,091 |

|

|

$ |

65,039 |

|

|

$ |

315,413 |

|

|

$ |

206,827 |

|

| Federal Solutions Adjusted

EBITDA attributable to noncontrolling interests |

|

|

35 |

|

|

|

89 |

|

|

|

125 |

|

|

|

259 |

|

| Federal Solutions Adjusted

EBITDA including noncontrolling interests |

|

$ |

120,126 |

|

|

$ |

65,128 |

|

|

$ |

315,538 |

|

|

$ |

207,086 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Critical Infrastructure

Adjusted EBITDA attributable to Parsons Corporation |

|

|

33,007 |

|

|

|

50,188 |

|

|

|

101,582 |

|

|

|

95,481 |

|

| Critical Infrastructure

Adjusted EBITDA attributable to noncontrolling interests |

|

|

13,878 |

|

|

|

12,517 |

|

|

|

41,214 |

|

|

|

33,963 |

|

| Critical Infrastructure

Adjusted EBITDA including noncontrolling interests |

|

$ |

46,885 |

|

|

$ |

62,705 |

|

|

$ |

142,796 |

|

|

$ |

129,444 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total Adjusted EBITDA

including noncontrolling interests |

|

$ |

167,011 |

|

|

$ |

127,833 |

|

|

$ |

458,334 |

|

|

$ |

336,530 |

|

|

PARSONS CORPORATIONNon-GAAP

Financial InformationReconciliation of Net Income

Attributable to Parsons Corporation to Adjusted Net Income

Attributable to Parsons Corporation (in

thousands, except per share information) |

|

| |

|

Three Months Ended |

|

|

Nine Months Ended |

|

| |

|

September 30, 2024 |

|

|

September 30, 2023 |

|

|

September 30, 2024 |

|

|

September 30, 2023 |

|

|

Net income attributable to Parsons Corporation |

|

$ |

71,951 |

|

|

$ |

47,447 |

|

|

$ |

33,768 |

|

|

$ |

116,241 |

|

| Acquisition related intangible

asset amortization |

|

|

13,328 |

|

|

|

18,800 |

|

|

|

40,777 |

|

|

|

54,926 |

|

| Equity-based compensation |

|

|

21,251 |

|

|

|

9,075 |

|

|

|

44,554 |

|

|

|

25,092 |

|

| Loss on extinguishment of

debt |

|

|

- |

|

|

|

- |

|

|

|

211,018 |

|

|

|

- |

|

| Transaction-related costs

(a) |

|

|

3,770 |

|

|

|

5,493 |

|

|

|

8,958 |

|

|

|

9,028 |

|

| Restructuring (b) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

546 |

|

| Other (c) |

|

|

539 |

|

|

|

(38 |

) |

|

|

3,565 |

|

|

|

2,082 |

|

| Tax effect on adjustments |

|

|

(8,016 |

) |

|

|

(7,883 |

) |

|

|

(74,969 |

) |

|

|

(22,958 |

) |

| Adjusted net income attributable

to Parsons Corporation |

|

|

102,823 |

|

|

|

72,894 |

|

|

|

267,671 |

|

|

|

184,957 |

|

| Adjusted earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average number of basic shares outstanding |

|

|

106,291 |

|

|

|

104,971 |

|

|

|

106,211 |

|

|

|

104,894 |

|

|

Weighted-average number of diluted shares outstanding (d) |

|

|

107,952 |

|

|

|

106,149 |

|

|

|

107,839 |

|

|

|

105,914 |

|

|

Adjusted net income attributable to Parsons Corporation per basic

share |

|

$ |

0.97 |

|

|

$ |

0.69 |

|

|

$ |

2.52 |

|

|

$ |

1.76 |

|

|

Adjusted net income attributable to Parsons Corporation per diluted

share |

|

$ |

0.95 |

|

|

$ |

0.69 |

|

|

$ |

2.48 |

|

|

$ |

1.75 |

|

|

(a) |

Reflects costs incurred in connection with acquisitions and other

non-recurring transaction costs, primarily fees paid for

professional services and employee retention. |

| (b) |

Reflects costs associated with

and related to our corporate restructuring initiatives. |

| (c) |

Includes a combination of

gain/loss related to sale of fixed assets, software implementation

costs, and other individually insignificant items that are

non-recurring in nature. |

| (d) |

Excludes dilutive effect of

convertible senior notes due 2025 due to bond hedge. |

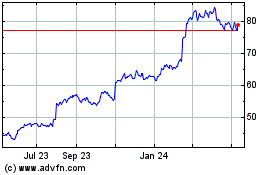

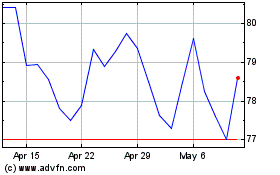

Parsons (NYSE:PSN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Parsons (NYSE:PSN)

Historical Stock Chart

From Nov 2023 to Nov 2024