false000181981000018198102024-08-142024-08-140001819810us-gaap:CommonStockMember2024-08-142024-08-140001819810us-gaap:WarrantMember2024-08-142024-08-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

August 14, 2024

Date of Report (Date of earliest event reported)

___________________________________

Redwire Corporation

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

Delaware (State or other jurisdiction of incorporation or organization) | 001-39733 (Commission File Number) | 98-1550429 (I.R.S. Employer Identification Number) |

8226 Philips Highway, Suite 101 Jacksonville, Florida 32256 |

(Address of principal executive offices and zip code) |

(650) 701-7722 |

(Registrant's telephone number, including area code) |

__________________________________Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | RDW | New York Stock Exchange |

| Warrants, each to purchase one share of Common Stock | RDW WS | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 - Regulation FD Disclosure

On August 14, 2024, Redwire Corporation (the “Company”) issued a press release (the “Press Release”) announcing the Company’s acquisition of Hera Systems, Inc. ("Hera Systems") pursuant to the Agreement and Plan of Merger dated August 14, 2024 by and among various entities including, but not limited to, subsidiaries of the Company and Hera Systems. The Press Release also announces the Company’s revised revenue guidance for fiscal year 2024 pursuant to which the Company increases previously provided revenue guidance by $10 million from $300 million to $310 million for the full fiscal year. A copy of the Press Release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

In accordance with General Instruction B.2. of Form 8-K, the information in Items 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liability of that section, nor shall it be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933, whether made before or after the date hereof, regardless of any general incorporation language in such filing. This Item 7.01 will not be deemed a determination or admission as to the materiality of any information in this Item 7.01 that is required to be disclosed solely by Regulation FD.

Item 9.01 - Financial Statements and Exhibits

(d) Exhibits:

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: August 14, 2024

| | | | | |

| Redwire Corporation |

| |

By: | /s/ Jonathan Baliff |

Name: | Jonathan Baliff |

Title: | Chief Financial Officer and Director |

Redwire to Acquire Spacecraft Developer Hera Systems

Expands National Security Mission Capabilities and Solutions

Advances Value Chain Position with Enhanced Product Offerings

JACKSONVILLE, Fla. (August 14, 2024) – Redwire Corporation (NYSE: RDW), a leader in space infrastructure for the next generation space economy, today announced that it has signed a definitive agreement to acquire Hera Systems, Inc., a spacecraft developer focused on specialized missions for national security space customers. With the addition of Hera Systems’ cutting-edge platform, Redwire expects to strengthen its spacecraft portfolio and be well-equipped to support specialized National Security Space missions in geostationary orbit (GEO).

Founded in 2013, Hera Systems is a privately held company headquartered in San Jose, California that focuses on developing a new class of high-performance spacecraft to support the evolving requirements for national security missions operating in contested space. Hera Systems’ advanced platform incorporates cyber-secure communications, resilient power systems, highly accurate pointing, extensive maneuverability and massive on-board computing power supporting mission- and payload-specific machine learning. In 2022, Hera Systems was contracted by Orion Space Solutions to develop three satellites for U.S. Space Force’s Tetra-5 mission—an on-orbit servicing demonstration in GEO.

Redwire has significantly increased its national security space business, recently announcing it was awarded a prime contract to develop and demonstrate a Very Low Earth Orbit (VLEO) spacecraft for DARPA’s Otter program. Redwire continues to support the warfighter as an antenna supplier for the Space Development Agency’s Transport Layer program dating back to Tranche 0 in 2020.

“Hera Systems’ platform is highly complementary with Redwire’s suite of national security space solutions,” said Peter Cannito, Chairman and CEO of Redwire. “Similar to our focus on VLEO platforms, we see increasing opportunities to unlock and deliver new solutions in MEO, GEO and other domains to support the warfighter and address critical needs in National Security Space. This transaction fits squarely within our growth strategy by adding significant capabilities to move up the value chain in select areas of emerging hybrid architectures.”

Hera Systems has experienced profitable topline growth, and for the year ended December 31, 2023, Hera recorded $15 million of revenue. Redwire will finance this acquisition with balance sheet liquidity and expects Hera Systems to add meaningfully to future growth and profitability. As part of this acquisition, which is expected to close in the third quarter, Redwire is adjusting its full-year 2024 guidance from $300 million in revenue to $310 million in revenue.

GH Partners LLC is serving as financial advisor and Hogan Lovells is serving as legal advisor to Redwire.

About Redwire

Redwire Corporation (NYSE:RDW) is a global space infrastructure and innovation company enabling civil, commercial, and national security programs. Redwire’s proven and reliable capabilities include avionics, sensors, power solutions, critical structures, mechanisms, radio frequency systems, platforms, missions, and microgravity payloads. Redwire combines decades of flight heritage and proven experience with an agile and innovative culture. Redwire’s approximately 700 employees working from 14 facilities located throughout the United States and Europe are committed to building a bold future in space for humanity, pushing the envelope of discovery and science while creating a better world on Earth. For more information, please visit redwirespace.com.

Cautionary Statement Regarding Forward-Looking Statements

Readers are cautioned that the statements contained in this press release regarding expectations of our performance or other matters that may affect our business, results of operations, or financial condition are “forward-looking statements” as defined by the “safe harbor” provisions in the Private Securities Litigation Reform Act of 1995. Such statements are made in reliance on the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934. All statements, other than statements of historical fact, included or incorporated in this press release, including statements regarding our strategy, financial position, guidance, funding for continued operations, cash reserves, liquidity, projected costs, plans, projects, awards and contracts, and objectives of management, among others, are forward-looking statements. Words such as “expect,” “anticipate,” “should,” “believe,” “hope,” “target,” “continued,” “project,” “plan,” “goals,” “opportunity,” “appeal,” “estimate,” “potential,” “predict,” “demonstrates,” “may,” “will,” “might,” “could,” “intend,” “shall,” “possible,” “forecast,” “trends,” “contemplate,” “would,” “approximately,” “likely,” “outlook,” “schedule,” “on track,” “poised,” “pipeline,” and variations of these terms or the negative of these terms and similar expressions are intended to identify these forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements are not guarantees of future performance, conditions or results. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond our control.

These factors and circumstances include, but are not limited to: (1) risks associated with the continued economic uncertainty, including high inflation, supply chain challenges, labor shortages, high interest rates, foreign currency exchange volatility, concerns of economic slowdown or recession and reduced spending or suspension of investment in new or enhanced projects; (2) the failure of financial institutions or transactional counterparties; (3) the Company’s limited operating history and history of losses to date; (4) the inability to successfully integrate recently completed and future acquisitions; (5) the development and continued refinement of many of the Company’s proprietary technologies, products and service offerings; (6) competition with new or existing companies; (7) the possibility that the Company’s expectations and assumptions relating to future results may prove incorrect; (8) adverse publicity stemming from any incident or perceived risk involving Redwire or our competitors; (9) unsatisfactory performance of our products resulting from challenges in the space environment, extreme space weather events, or otherwise; (10) the emerging nature of the market for in-space infrastructure services; (11) inability to realize benefits from new offerings or the application of our technologies; (12) the inability to convert orders in backlog into revenue; (13) our dependence on U.S. government contracts, which are only partially funded and subject to immediate termination; (14) the fact that we are subject to stringent U.S. economic sanctions, and trade control laws and regulations; (15) the need for substantial additional funding to finance our operations, which may not be available when we need it, on acceptable terms or at all; (16) the fact that the issuance and sale of shares of our Series A Convertible Preferred Stock has reduced the relative voting power of holders of our common stock and diluted the ownership of holders of our capital stock; (17) AE Industrial Partners and Bain Capital have significant influence over us, which could limit your ability to influence the outcome of key transactions; (18) provisions in our Certificate of Designation with respect to our Series A Convertible Preferred Stock may delay or prevent our acquisition by a third party, which could also reduce the market price of our capital stock; (19) our Series A Convertible Preferred Stock has rights, preferences and privileges that are not held by, and are preferential to, the rights of holders of our other outstanding capital stock; (20) there may be sales of a substantial amount of our common stock by our current stockholders, and these sales could cause the price of our common stock and warrants to fall; (21) the impact of the issuance of the Series A Convertible Preferred Stock on the price and market for our common stock; (22) the trading price of our common stock and warrants is and may continue to be volatile; (23) risks related to short sellers of our common stock; (24) inability to report our financial condition or results of operations accurately or timely as a result of identified material weaknesses in internal control over financial reporting; and (25) other risks and uncertainties described in our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q and those indicated from time to time in other documents filed or to be filed with the SEC by the Company.

The forward-looking statements contained in this press release are based on our current expectations and beliefs concerning future developments and their potential effects on us. If underlying assumptions to forward-looking statements prove inaccurate, or if known or unknown risks or uncertainties materialize, actual results could vary materially from those anticipated, estimated, or projected. The forward-looking statements contained in this press release are made as of the date of this press release, and the Company disclaims any intention or obligation, other than imposed by law, to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. Persons reading this press release are cautioned not to place undue reliance on forward-looking statements.

Media Contact:

Tere Riley

tere.riley@redwirespace.com

OR

Investors:

investorrelations@redwirespace.com

904-425-1431

v3.24.2.u1

Cover Page

|

Aug. 14, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 14, 2024

|

| Entity Registrant Name |

Redwire Corporation

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39733

|

| Entity Tax Identification Number |

98-1550429

|

| Entity Address, Address Line One |

8226 Philips Highway, Suite 101

|

| Entity Address, City or Town |

Jacksonville

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

32256

|

| City Area Code |

650

|

| Local Phone Number |

701-7722

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001819810

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

RDW

|

| Security Exchange Name |

NYSE

|

| Warrant |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each to purchase one share of Common Stock

|

| Trading Symbol |

RDW WS

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

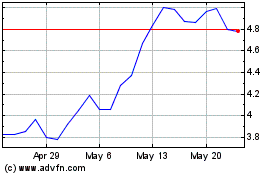

Redwire (NYSE:RDW)

Historical Stock Chart

From Dec 2024 to Jan 2025

Redwire (NYSE:RDW)

Historical Stock Chart

From Jan 2024 to Jan 2025