- Reaffirms Commitment to Driving Accelerated Organic Growth

and Shareholder Value

- Announces Additional $2 Billion Share Repurchase

Authorization, Including a Planned Accelerated Share Repurchase

Program

- Executes Plans to Redeem Acquisition-Related Debt

Tapestry, Inc. (NYSE: TPR), a house of iconic accessories and

lifestyle brands consisting of Coach, Kate Spade, and Stuart

Weitzman, today announced that it reached an agreement with Capri

Holdings Limited (NYSE: CPRI) to terminate the merger agreement

between the parties.

Capri and Tapestry mutually agreed that terminating the merger

agreement at this time is in the best interest of both companies,

as the outcome of the legal process is uncertain and unlikely to be

resolved by the February 10, 2025 outside date.

Joanne Crevoiserat, Chief Executive Officer of Tapestry, Inc.,

said, “We have always had multiple paths to growth and our decision

today clarifies the forward strategy. Building on our successful

first quarter, we will move with speed and boldness to accelerate

growth for our organic business. Tapestry remains in a position of

strength, with distinctive brands, an agile platform, passionate

teams, and robust cash flow. We have significant runway ahead and

are pleased to announce today an additional shareholder return

program, as we believe there is no better investment at this time

than our own stock.”

Tapestry, Inc.’s Chief Financial Officer and Chief Operating

Officer, Scott Roe, said, “Tapestry’s steadfast commitment to

deliver meaningful shareholder value is unchanged. Our strong and

consistent cash flow underpins our foundational commitments to

invest in our brands and business as well as fund our dividend

program. Further, today’s additional $2 billion share repurchase

authorization highlights the strength and flexibility of our

balance sheet to unlock incremental value, while maintaining our

firm commitment to a solid investment grade rating. We are

confident in our compelling long-term organic growth agenda and the

opportunity to deliver enhanced value to all stakeholders for years

to come.”

Return of Capital to

Shareholders Given Tapestry’s strong operational

results, robust balance sheet, significant free cash flow

generation, and outlook for growth, the Company is well-positioned

to return meaningful capital to shareholders:

- Share Repurchase Program: The Company’s Board of

Directors has approved an additional $2 billion share repurchase

program, which Tapestry expects to implement at least in part

through an Accelerated Share Repurchase program (‘ASR’). The

Company intends to fund the repurchases through a combination of

cash on hand and future issuance of debt. Together with the

existing $800 million outstanding on the Company’s prior

authorization, there will be a total of $2.8 billion available for

share repurchases over this fiscal year and beyond.

- Dividend: In Fiscal 2025, as previously announced,

Tapestry expects to maintain its annual dividend rate of $1.40 per

common share. Tapestry is committed to increasing its dividend at

least in-line with earnings growth over time to achieve the stated

target payout ratio of 35% to 40%.

These actions are consistent with Tapestry’s stated capital

allocation priorities: (i.) reinvesting in its brands and business;

(ii.) capital return via the dividend; (iii.) maintaining an

investment grade rating; (iv.) utilizing excess cash flow for share

repurchases; and (v.) strategic portfolio management for long-term

value creation.

Further, Tapestry does not expect any acquisitions in the

near-term, and before moving forward with any acquisitions, the

Company will ensure Coach remains strong and Kate Spade has

returned to sustainable topline growth.

Balance Sheet Update Based

upon the termination of the merger agreement, the Company will

redeem the senior notes associated with the planned acquisition

totaling $6.1 billion in accordance with the Special Mandatory

Redemption feature, for a price equal to 101% of their principal

amount and accrued interest. There is no break fee associated with

the transaction. Tapestry has agreed to reimburse Capri’s expenses

incurred in connection with the transaction of approximately $45

million.

In addition, as noted, the Company intends to fund its share

repurchase program, in part, through the future issuance of debt.

The Company is maintaining its long-term leverage target of below

2.5x gross debt to adjusted EBITDA and remains firmly committed to

its solid investment grade rating.

Financial Outlook The

Company is reaffirming its Fiscal 2025 outlook as issued on

November 7, 2024. As previously noted, this guidance is provided on

a non-GAAP basis and does not include the net benefit to earnings

per diluted share related to the share repurchase program or

expected changes to net interest expense. The Company will update

its outlook at its next earnings announcement scheduled for

February 6, 2025.

About Tapestry, Inc. Our

global house of brands unites the magic of Coach, kate spade new

york and Stuart Weitzman. Each of our brands are unique and

independent, while sharing a commitment to innovation and

authenticity defined by distinctive products and differentiated

customer experiences across channels and geographies. We use our

collective strengths to move our customers and empower our

communities, to make the fashion industry more sustainable, and to

build a company that’s equitable, inclusive, and diverse.

Individually, our brands are iconic. Together, we can stretch

what’s possible. To learn more about Tapestry, please visit

www.tapestry.com. For important news and information regarding

Tapestry, visit the Investor Relations section of our website at

www.tapestry.com/investors. In addition, investors should continue

to review our news releases and filings with the SEC. We use each

of these channels of distribution as primary channels for

publishing key information to our investors, some of which may

contain material and previously non-public information. The

Company’s common stock is traded on the New York Stock Exchange

under the symbol TPR.

This press release may contain forward-looking statements based

on management’s current expectations. Forward-looking statements

include, but are not limited to, statements regarding the Company’s

capital deployment plans, including anticipated share repurchase

plans, and statements that can be identified by the use of

forward-looking terminology such as “may,” “can,” “if,” “continue,”

“assume,” “should,” “expect,” “confidence,” “goals,” “trends,”

“anticipate,” “intend,” “estimate,” “on track,” “future,” “plan,”

“deliver,” “potential,” “position,” “believe,” “will,” “target,”

“guidance,” “forecast,” “outlook,” “commit,” “leverage,”

“generate,” “enhance,” “innovation,” “drive,” “effort,” “progress,”

“confident,” “uncertain,” “achieve,” “strategic,” “growth,”

“proposed acquisition,” “we can stretch what’s possible,” similar

expressions, and variations or negatives of these words. Future

results may differ materially from management’s current

expectations, based upon a number of important factors, including

risks and uncertainties such as the impact of economic conditions,

recession and inflationary measures, risks associated with

operating in international markets and our global sourcing

activities, the ability to anticipate consumer preferences and

retain the value of our brands, including our ability to execute on

our e-commerce and digital strategies, the ability to successfully

implement the initiatives under our 2025 growth strategy, the

effect of existing and new competition in the marketplace, the

effect of seasonal and quarterly fluctuations on our sales or

operating results, the risk of cybersecurity threats and privacy or

data security breaches, our ability to satisfy our outstanding debt

obligations or incur additional indebtedness, the risks associated

with climate change and other corporate responsibility issues, the

impact of tax and other legislation, the risks associated with

potential changes to international trade agreements and the

imposition of additional duties on importing our products, our

ability to protect against infringement of our trademarks and other

proprietary rights, and the impact of pending and potential future

legal proceedings, etc. In addition, purchases of shares of the

Company’s common stock will be made subject to market conditions

and at prevailing market prices. Please refer to the Company’s

latest Annual Report on Form 10-K, latest Quarterly Report on Form

10-Q and its other filings with the Securities and Exchange

Commission for a complete list of risks and important factors. The

Company assumes no obligation to revise or update any such

forward-looking statements for any reason, except as required by

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241114805625/en/

Tapestry, Inc. Media: Andrea Shaw Resnick Chief Communications

Officer 212/629-2618 aresnick@tapestry.com Analysts and Investors:

Christina Colone Global Head of Investor Relations 212/946-7252

ccolone@tapestry.com

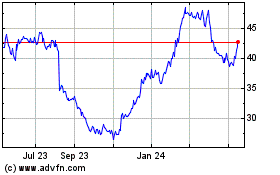

Tapestry (NYSE:TPR)

Historical Stock Chart

From Nov 2024 to Dec 2024

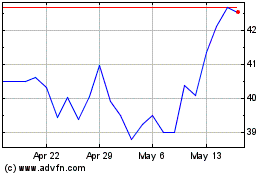

Tapestry (NYSE:TPR)

Historical Stock Chart

From Dec 2023 to Dec 2024