0001008654false00010086542024-01-112024-01-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

January 5, 2024

Date of Report (Date of earliest event reported)

TUPPERWARE BRANDS CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | 1-11657 | 36-4062333 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | |

| 14901 South Orange Blossom Trail | Orlando | FL | 32837 |

| (Address of principal executive offices) | (Zip Code) |

407 826-5050

Registrant's telephone number, including area code

_________________________________________

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | |

| Common Stock, $0.01 par value | TUP | New York Stock Exchange | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On January 5, 2024, Tupperware Brands Corporation (the “Company”) received written notification from the New York Stock Exchange (the “NYSE”) that the Company is not in compliance with Section 302 of the NYSE Listed Company Manual due to the Company’s failure to hold an annual meeting for the Company’s fiscal year ended December 31, 2022 (the “Fiscal Year 2022 Annual Meeting”) by December 31, 2023.

The Fiscal Year 2022 Annual Meeting was initially delayed due to significant delays in the Company’s audit and financial close process in connection with the filing of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (the “2022 Form 10-K”). The Company filed the 2022 Form 10-K on October 13, 2023. Thereafter, the Fiscal Year 2022 Annual Meeting was further delayed as a result of the Company’s efforts to retain a new independent auditor for the Company’s integrated audit of the fiscal year ended December 30, 2023. As previously disclosed in a Current Report on Form 8-K filed with the U.S. Securities and Exchange Commission on October 27, 2023, the Company’s former independent auditor informed the Company of its decision to decline to stand for re-appointment as the Company’s registered public accounting firm. While the Company’s independent auditor evaluation and engagement process is ongoing, the Company has decided to delay the Fiscal Year 2022 Annual Meeting until such time as the Company’s new independent auditor is appointed and an auditor ratification proposal may be voted upon by the Company’s shareholders at the Fiscal Year 2022 Annual Meeting.

The Company is working to regain compliance with Section 302 of the NYSE Listed Company Manual as soon as practicable.

The Company will continue to be included in the list of NYSE noncompliant issuers and the below compliance (“.BC”) indicator will continue to be disseminated with the Company’s ticker symbol(s). The website posting and .BC indicator will be removed when the Company has regained compliance with all applicable continued listing standards.

Item 7.01 Regulation FD Disclosure.

Fiscal Year 2023 Quarterly Reports and Annual Report

As disclosed in the Company’s 2022 Form 10-K, on April 3, 2023, the Company received a notice of noncompliance from the NYSE as a result of the Company’s failure to timely file its 2022 Form 10-K, and subsequently, its Quarterly Reports on Form 10-Q for the first, second and third quarters of 2023 (the “2023 Quarterly Reports on Form 10-Q”). The Company filed the 2022 Form 10-K on October 13, 2023. However, given the time needed to evaluate and engage a new independent registered public accounting firm to serve as independent auditor for the fiscal year ended December 30, 2023, the Company continues to be delayed in filing its 2023 Quarterly Reports on Form 10-Q. If the Company fails to file its 2023 Quarterly Reports on Form 10-Q by March 31, 2024, then the NYSE may commence suspension or delisting procedures.

NYSE Market Capitalization and Closing Price Listing Standards

As disclosed in the Company’s 2022 Form 10-K, on June 1, 2023, the Company received written notification from the NYSE that the Company no longer satisfied the continued listing compliance standards set forth under Sections 802.01B and 802.01C of the NYSE Listed Company Manual because (i) its average global market capitalization over a consecutive 30 trading-day period was less than $50 million and, at the same time, its last reported stockholders’ equity was less than $50 million and (ii) the average closing price of the Company’s common stock was less than $1.00 over a consecutive 30 trading-day period. In accordance with NYSE procedures, the Company submitted a business plan to the NYSE demonstrating how the Company intended to regain compliance with the standards within 18 months. On August 1, 2023 the NYSE notified the Company that it had regained compliance with the minimum stock price standard of Section 802.01C of the NYSE Listed Company Manual. Despite the Company having achieved average global market capitalization of greater than $50 million with stockholders’ equity equal to $50 million over a consecutive 30 trading-day period, however, the Company continues to be out of compliance with the average global market capitalization standard of Section 802.01B of the NYSE Listed Company Manual, because the cure period has not yet ended. The NYSE may, however, choose to shorten the compliance period, if prior to the end of the 18 month cure period, the Company’s market capitalization is over $50 million with stockholders’ equity equal to $50 million for two consecutive quarters. If the Company continues to maintain its 30 trading-day market capitalization over $50 million with stockholders’ equity equal to $50 million through February 1, 2024, the Company expects to reach two consecutive quarters of compliance with the market capitalization listing standard and become eligible to cure the deficiency on an accelerated basis. If the Company fails to regain compliance during the cure period, or if the Company fails to meet material aspects of the business plan, then NYSE may commence suspension or delisting procedures.

Forward-Looking Statements

This Current Report includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including with respect to the Company’s ability to regain compliance with Section 302 of the NYSE continued listing standards, the timing of the filing of the 2023 Quarterly Reports on Form 10-Q, and, the Company’s ability to regain compliance with Section 802.01B of the NYSE continued listing standards. Such forward-looking statements are based on assumptions about many important factors, including the following, which could cause actual results to differ materially from those in the forward-looking statements: the Company’s ability to hold an annual meeting for the fiscal year ended December 31, 2022, the Company’s ability to engage a new independent registered public accounting firm to serve as its independent auditor for the fiscal year ended December 30, 2023, whether the NYSE commences suspension or delisting procedures prior to the end of the Company’s current cure periods, which expire on March 31, 2024 with respect to the filing of the 2023 Quarterly Reports on Form 10-Q and December 31, 2024 with respect to achievement of the market capitalization continued listing standard, and other risks identified in the Company’s most recent filing on Form 10-K and other SEC filings, all of which are available on the Company’s website. The Company does not undertake to update its forward-looking statements unless otherwise required by law.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit Number | Description |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | TUPPERWARE BRANDS CORPORATION |

| | |

| | | |

| Date: | January 11, 2024 | By: | /s/ Karen M. Sheehan |

| | | Karen M. Sheehan |

| | | Executive Vice President, Chief Legal Officer & Secretary |

| | | |

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

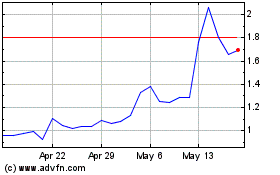

Tupperware Brands (NYSE:TUP)

Historical Stock Chart

From Nov 2024 to Dec 2024

Tupperware Brands (NYSE:TUP)

Historical Stock Chart

From Dec 2023 to Dec 2024