Avis Budget's Board Slate Includes Three Picks From Largest Shareholder -- Update

22 March 2018 - 11:26AM

Dow Jones News

By Maria Armental

Avis Budget Group Inc. (CAR), which has been locked in a fight

with its biggest stakeholder, SRS Investment Management, is urging

investors to support a slate of board nominees that includes three

candidates picked by SRS.

The car-rental company said in a proxy filing Wednesday that

among the candidates it endorsed are Sanoke Viswanathan, a mutually

agreed-upon independent director who has served on Avis's board

since 2016, SRS President Jagdeep Pahwa and Carl Sparks, who most

recently worked as chief executive of Insight Ventures-backed

Academic Partnerships.

Avis lead independent director Leonard Coleman said the

12-nominee slate demonstrates the company's "willingness to work

cooperatively with a significant shareholder to advance the best

interests of all shareholders."

Left out: SRS partner Brian Choi, who was appointed to the board

with Mr. Viswanathan under the 2016 pact with SRS and most recently

served on the compensation committee.

That means that, if elected, SRS would control three board

seats. SRS had sought to add three seats to the two it already

controlled.

Avis also proposed adding Francis Shammo, former Verizon

Communications Inc. (VZ) finance chief, and Glenn Lurie, CEO of

Synchronoss Technologies Inc. (SNCR), as independent nominees to

the board.

After Avis's announcement on Wednesday, SRS indicated it

intended to continue the fight.

Avis's proposed slate, SRS said in a statement, "falls short of

achieving the board refreshment that we believe is necessary to

enact meaningful change for Avis stockholders. Accordingly, we

intend to move forward with the nomination of our five director

candidates" at Avis's annual meeting.

A SRS representative declined to comment beyond the

statement.

Avis and SRS have been publicly sparring this year over how many

seats the investor's stake warranted. Avis had previously said it

attempted to offer SRS a third seat, but SRS had rejected that

compromise because of the strings the company sought to attach to

the new agreement. SRS said its requests for more of a say fit the

size of its investment, but Avis said it felt the investor was

seeking to gain control.

The stock, which Tuesday set a 52-week high, closed Wednesday

down 1.9% at $49.40. Avis shares were unchanged after hours.

--David Benoit contributed to this story.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

March 21, 2018 20:11 ET (00:11 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

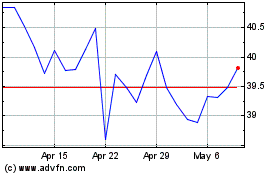

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Apr 2024 to May 2024

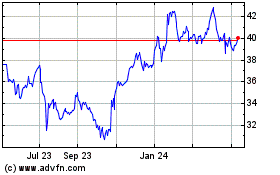

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From May 2023 to May 2024