UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2024

Commission File Number: 001-39974

WEST FRASER TIMBER CO. LTD.

(Exact name of Registrant, as specified in its charter)

1500 - 885 West Georgia Street

Vancouver, British Columbia

Canada, V6C 3E8

Tel: (604) 895-2700

(Address and Telephone Number of Registrant's Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

The information contained in Exhibits 99.1 and 99.2 of this Form 6-K is incorporated by reference into the Registrant’s registration statements on Form S-8: File Nos. 333-257254 and 333-252631.

EXHIBIT INDEX

| | | | | |

| Exhibit | Description |

| 99.1 | |

| 99.2 | |

| 99.3 | |

| 99.4 | |

| 99.5 | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | |

Date: July 24, 2024 |

WEST FRASER TIMBER CO. LTD. |

| /s/ Christopher A. Virostek |

Christopher A. Virostek

Senior Vice-President, Finance and Chief Financial Officer |

West Fraser Timber Co. Ltd.

Condensed Consolidated Balance Sheets

(in millions of United States dollars, except where indicated - unaudited)

| | | | | | | | | | | |

| | June 28, | December 31, |

| Note | 2024 | 2023 |

| Assets | |

|

|

| Current assets | |

|

|

Cash and cash equivalents | | $ | 1,004 | | $ | 900 | |

Receivables | | 392 | | 311 | |

Income taxes receivable | | 57 | | 93 | |

Inventories | 5 | 846 | | 851 | |

Prepaid expenses | | 59 | | 40 | |

| Assets held for sale | 6 | — | | 182 | |

| | 2,358 | | 2,377 | |

Property, plant and equipment | | 3,806 | | 3,835 | |

Timber licences | | 367 | | 376 | |

Goodwill and other intangible assets | | 2,278 | | 2,307 | |

Export duty deposits | 17 | 390 | | 377 | |

Other assets | | 140 | | 137 | |

Deferred income tax assets | | 8 | | 6 | |

| | $ | 9,347 | | $ | 9,415 | |

| | | |

| Liabilities | | | |

| Current liabilities | | | |

Payables and accrued liabilities | | $ | 596 | | $ | 620 | |

Current portion of long-term debt | 7 | 300 | | 300 | |

| Current portion of reforestation and decommissioning obligations | | 59 | | 60 | |

Income taxes payable | | 59 | | 7 | |

| Liabilities associated with assets held for sale | 6 | — | | 63 | |

| | 1,014 | | 1,050 | |

Long-term debt | 7 | 200 | | 199 | |

Other liabilities | 8 | 232 | | 260 | |

Deferred income tax liabilities | | 658 | | 683 | |

| | 2,104 | | 2,193 | |

| Shareholders’ Equity | | | |

Share capital | 10 | 2,573 | | 2,607 | |

Retained earnings | | 4,978 | | 4,913 | |

Accumulated other comprehensive loss | | (308) | | (297) | |

| | 7,244 | | 7,223 | |

| | $ | 9,347 | | $ | 9,415 | |

The number of Common shares and Class B Common shares outstanding at July 23, 2024 was 80,373,875.

West Fraser Timber Co. Ltd.

Condensed Consolidated Statements of Earnings (Loss) and Comprehensive Earnings (Loss)

(in millions of United States dollars, except where indicated - unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | June 28, | June 30, | | June 28, | June 30, |

| | 2024 | 2023 | | 2024 | 2023 |

| | | | | | |

| Sales | | $ | 1,705 | | $ | 1,608 | | | $ | 3,332 | | $ | 3,235 | |

| | | | | | |

| Costs and expenses | | | | | | |

| Cost of products sold | | 1,133 | | 1,194 | | | 2,250 | | 2,439 | |

| Freight and other distribution costs | | 215 | | 230 | | | 435 | | 464 | |

| Export duties, net | 17 | 15 | | 25 | | | 30 | | 38 | |

| Amortization | | 138 | | 135 | | | 276 | | 273 | |

| Selling, general and administration | | 70 | | 78 | | | 146 | | 154 | |

| Equity-based compensation | | (4) | | 12 | | | — | | 14 | |

| Restructuring and impairment charges | 11 | 5 | | 129 | | | 16 | | 132 | |

| | 1,573 | | 1,804 | | | 3,152 | | 3,515 | |

| | | | | | |

| Operating earnings (loss) | | 132 | | (196) | | | 180 | | (281) | |

| | | | | | |

| Finance income, net | 12 | 6 | | 9 | | | 15 | | 16 | |

| Other income (expense) | 13 | 1 | | 10 | | | (5) | | 24 | |

| Earnings (loss) before tax | | 139 | | (177) | | | 189 | | (240) | |

| Tax recovery (provision) | 14 | (34) | | 46 | | | (50) | | 67 | |

| Earnings (loss) | | $ | 105 | | $ | (131) | | | $ | 139 | | $ | (173) | |

| | | | | | |

Earnings (loss) per share (dollars) | | | | | | |

| Basic | 15 | $ | 1.29 | | $ | (1.57) | | | $ | 1.71 | | $ | (2.07) | |

| Diluted | 15 | $ | 1.20 | | $ | (1.57) | | | $ | 1.63 | | $ | (2.07) | |

| | | | | | |

| Comprehensive earnings (loss) | | | | | | |

| Earnings (loss) | | $ | 105 | | $ | (131) | | | $ | 139 | | $ | (173) | |

| Other comprehensive earnings | | | | | | |

| Items that may be reclassified to earnings | | | | | | |

| Translation gain (loss) on operations with different functional currencies | | (2) | | 15 | | | (11) | | 28 | |

Items that will not be reclassified to earnings | | | | | | |

| Actuarial gain (loss) on retirement benefits, net of tax | 9 | 8 | | (15) | | | 26 | | (8) | |

| | 6 | | (1) | | | 15 | | 21 | |

| Comprehensive earnings (loss) | | $ | 111 | | $ | (131) | | | $ | 155 | | $ | (152) | |

West Fraser Timber Co. Ltd.

Condensed Consolidated Statements of Changes in Shareholders' Equity

(in millions of United States dollars, except where indicated - unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | June 28, | June 30, | | June 28, | June 30, |

| Note | 2024 | 2023 | | 2024 | 2023 |

| | | | | | |

| Share capital | | | | | | |

| Balance - beginning of period | | $ | 2,604 | | $ | 2,667 | | | $ | 2,607 | | $ | 2,667 | |

| | | | | | |

| Repurchase of Common shares for cancellation | 10 | (31) | | — | | | (34) | | — | |

| Balance - end of period | | $ | 2,573 | | $ | 2,667 | | | $ | 2,573 | | $ | 2,667 | |

| | | | | | |

| Retained earnings | | | | | | |

| Balance - beginning of period | | $ | 4,936 | | $ | 5,224 | | | $ | 4,913 | | $ | 5,283 | |

| Actuarial gain (loss) on retirement benefits, net of tax | 9 | 8 | | (15) | | | 26 | | (8) | |

| Repurchase of Common shares for cancellation | 10 | (45) | | — | | | (50) | | — | |

| Earnings (loss) for the period | | 105 | | (131) | | | 139 | | (173) | |

| Dividends declared | | (26) | | (25) | | | (50) | | (50) | |

| Balance - end of period | | $ | 4,978 | | $ | 5,053 | | | $ | 4,978 | | $ | 5,053 | |

| | | | | | |

| Accumulated other comprehensive loss | | | | | | |

| Balance - beginning of period | | $ | (306) | | $ | (318) | | | $ | (297) | | $ | (332) | |

| Translation gain (loss) on operations with different functional currencies | | (2) | | 15 | | | (11) | | 28 | |

| Balance - end of period | | $ | (308) | | $ | (304) | | | $ | (308) | | $ | (304) | |

| | | | | | |

| Shareholders' Equity | | $ | 7,244 | | $ | 7,417 | | | $ | 7,244 | | $ | 7,417 | |

West Fraser Timber Co. Ltd.

Condensed Consolidated Statements of Cash Flows

(in millions of United States dollars, except where indicated - unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | June 28, | June 30, | | June 28, | June 30, |

| Note | 2024 | 2023 | | 2024 | 2023 |

| Cash provided by operating activities | |

|

| | | |

| Earnings (loss) | | $ | 105 | | $ | (131) | | | $ | 139 | | $ | (173) | |

| Adjustments | | | | | | |

| Amortization | | 138 | | 135 | | | 276 | | 273 | |

| Restructuring and impairment charges | 11 | 5 | | 129 | | | 16 | | 132 | |

| Finance income, net | 12 | (6) | | (9) | | | (15) | | (16) | |

| Foreign exchange gain | | — | | (2) | | | (3) | | (2) | |

Export duty | 17 | — | | 12 | | | — | | 12 | |

| Retirement benefit expense | | 19 | | 16 | | | 34 | | 35 | |

| Net contributions to retirement benefit plans | | (15) | | (17) | | | (28) | | (32) | |

| Tax provision (recovery) | 14 | 34 | | (46) | | | 50 | | (67) | |

| Income taxes paid | | — | | (10) | | | (3) | | (15) | |

| Unrealized loss (gain) on electricity swaps | | (5) | | (5) | | | 6 | | (20) | |

| Other | | (19) | | (11) | | | (4) | | 10 | |

| Changes in non-cash working capital | | | | | | |

| Receivables | | 3 | | 65 | | | (90) | | (42) | |

| Inventories | | 165 | | 226 | | | 17 | | 121 | |

| Prepaid expenses | | (24) | | (30) | | | (19) | | (24) | |

| Payables and accrued liabilities | | (22) | | (51) | | | (38) | | (118) | |

| | 378 | | 272 | | | 338 | | 73 | |

| Cash used for financing activities | | | | | | |

Repayment of lease obligations | | (3) | | (5) | | | (6) | | (8) | |

Finance expense paid | | (11) | | (9) | | | (15) | | (12) | |

Repurchase of Common shares for cancellation | 10 | (71) | | — | | | (79) | | — | |

Dividends paid | | (24) | | (25) | | | (49) | | (50) | |

| | (110) | | (39) | | | (148) | | (70) | |

| Cash provided by (used for) investing activities | | | | | | |

Proceeds from sale of pulp mills | | 119 | | — | | | 124 | | — | |

Additions to capital assets | | (102) | | (106) | | | (224) | | (205) | |

| Interest received | | 11 | | 11 | | | 22 | | 20 | |

| | 28 | | (95) | | | (78) | | (184) | |

| Change in cash and cash equivalents | | 296 | | 138 | | | 112 | | (181) | |

| Foreign exchange effect on cash and cash equivalents | | (3) | | 9 | | | (7) | | 12 | |

| Cash and cash equivalents - beginning of period | | 711 | | 847 | | | 900 | | 1,162 | |

| Cash and cash equivalents - end of period | | $ | 1,004 | | $ | 994 | | | $ | 1,004 | | $ | 994 | |

West Fraser Timber Co. Ltd.

Notes to Condensed Consolidated Financial Statements

For the three and six months ended June 28, 2024 and June 30, 2023

(figures are in millions of United States dollars, except where indicated - unaudited)

1.Nature of operations

West Fraser Timber Co. Ltd. ("West Fraser", the “Company”, "we", "us" or "our") is a diversified wood products company with more than 60 facilities in Canada, the United States, the United Kingdom, and Europe, which promotes sustainable forest practices in its operations. The Company produces lumber, engineered wood products (OSB, LVL, MDF, plywood, and particleboard), pulp, newsprint, wood chips, other residuals, and renewable energy. West Fraser’s products are used in home construction, repair and remodelling, industrial applications, papers, tissue, and box materials. Our executive office is located at 885 West Georgia Street, Suite 1500, Vancouver, British Columbia. West Fraser was formed by articles of amalgamation under the Business Corporations Act (British Columbia) and is registered in British Columbia, Canada. Our Common shares are listed for trading on the Toronto Stock Exchange (“TSX”) and on the New York Stock Exchange (“NYSE”) under the symbol WFG.

2.Basis of presentation

These condensed consolidated financial statements have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS Accounting Standards”) applicable to the preparation of interim financial statements, under International Accounting Standard (“IAS”) 34, Interim Financial Reporting. These condensed consolidated financial statements use the same accounting policies as the most recent audited annual consolidated financial statements.

These condensed consolidated interim financial statements were authorized for issue by the Audit Committee of the Company’s Board of Directors on July 24, 2024. These condensed consolidated interim financial statements should be read in conjunction with our audited annual consolidated financial statements for the year ended December 31, 2023.

Our fiscal year is the calendar year ending December 31. Effective January 1, 2023, our fiscal quarters are the 13-week periods ending on the last Friday of March, June, and September with the fourth quarter ending December 31. References to the three months ended June 28, 2024 and the second quarter of 2024 relate to the 13-week period ended June 28, 2024 and references to the six months ended June 28, 2024 relate to the 26-week period ended June 28, 2024.

Figures have been rounded to millions of dollars to reflect the accuracy of the underlying balances and as a result certain tables may not add due to rounding impacts.

Assets and liabilities transferred as a result of the sales of the Hinton pulp mill, Quesnel River Pulp mill, and Slave Lake Pulp mill were presented as part of assets held for sale and liabilities held for sale respectively as at December 31, 2023 (see note 6) and are not included in the other balance sheet amounts presented.

Application of new and revised accounting standards

In January 2020, the IASB issued Classification of Liabilities as Current or Non-current (Amendments to IAS 1). The amendments clarify that the classification of liabilities as current or non-current should be based on rights that exist at the end of the reporting period. The amendments also clarify the definition of a settlement and provide situations that would be considered as a settlement of a liability. In October 2022, the IASB issued Non-current Liabilities with Covenants (Amendments to IAS 1). These further amendments clarify how to address the effects on classification and disclosure of covenants that an entity is required to comply with on or before the reporting date and covenants that an entity must comply with only after the reporting date. We have adopted these amendments effective January 1, 2024. These amendments did not have a material impact on our consolidated financial statements.

Accounting standards issued but not yet applied

IFRS 18, Presentation and Disclosure in Financial Statements

In April 2024, the IASB issued IFRS 18, Presentation and Disclosure in Financial Statements ("IFRS 18"), which replaces IAS 1, Presentation of Financial Statements. IFRS 18 introduces new requirements to improve comparability in the reporting of financial performance to give investors a better basis for analyzing and comparing entities. The standard impacts the presentation of the financial statements and notes, in particular the income statement where entities will be required to

present separate categories of income and expense for operating, investing, and financing activities with prescribed subtotals for each new category. IFRS 18 will also require management-defined performance measures to be explained and included in a separate note within the financial statements. IFRS 18 is effective for reporting periods beginning on or after January 1, 2027. We are currently assessing the impact of this amendment on our consolidated financial statements.

3.Business combinations

Cariboo Pulp & Paper

We attained sole control of Cariboo Pulp & Paper (“CPP”) during Q1-24 in relation to an agreement (“the CPP agreement”) with Mercer International Inc. (“Mercer”) to dissolve our 50/50 joint venture in Cariboo Pulp & Paper (“CPP JV”). No termination or other amounts are payable by either company in connection with the CPP agreement.

CPP produces northern bleached softwood kraft (“NBSK”) pulp, related by-products, and energy. Prior to the CPP agreement, we accounted for the CPP JV under IFRS Accounting Standards by recognizing our share of the assets, liabilities, revenues, and expenses related to this joint operation.

Prior to the CPP agreement, the CPP JV was a joint operation under IFRS Accounting Standards that met the definition of a business. Accordingly, we applied the requirements for a business combination achieved in stages in accordance with IFRS 3, Business Combinations.

This required us to first remeasure the carrying value of our 50% interest in the CPP JV to fair value and then recognize an additional 50% interest in CPP at fair value in accordance with the requirements of IFRS 3.

The determination of the fair value of identifiable assets and liabilities required management to use estimates that contain uncertainty and critical judgments. We applied the income approach in determining the fair value of property, plant, and equipment. Cash flow forecasts were based on internal estimates for 2024 through 2027 and estimated mid-cycle earnings for subsequent years. Assumptions included production volume, product pricing, raw material input cost, production cost, terminal multiple, and discount rate. Key assumptions were determined using external sources and historical data from internal sources.

We recognized a net gain on the business combination as the estimated fair value of 100% of CPP’s identifiable assets and liabilities exceeded the carrying value of our 50% interest in the CPP JV prior to the CPP agreement.

| | | | | |

| Fair value of identifiable assets and liabilities (100% interest in CPP): | |

| Cash | $ | 2 | |

| Accounts receivable | 3 | |

| Inventories | 35 | |

| Prepaid expenses | 1 | |

| Property, plant and equipment | 59 | |

| Payables and accrued liabilities | (39) | |

| Other liabilities | (14) | |

| Deferred income tax liabilities | (1) | |

| 44 | |

| Less: Carrying value of our previously held 50% interest in the CPP JV | (43) | |

| Net gain resulting from the CPP agreement | $ | 1 | |

The net gain resulting from the CPP agreement was recognized as other income.

Spray Lake Acquisition

On November 17, 2023, we acquired 100 percent of the shares in Spray Lake Sawmills (1980) Ltd., which operates a lumber mill located in Cochrane, Alberta, and the associated timber licenses (“Spray Lake Acquisition”) for cash consideration of $101 million (CAD$139 million). This acquisition has been accounted for as an acquisition of a business in accordance with IFRS 3 Business Combinations. We have allocated the purchase price based on our estimated fair value of the assets acquired and the liabilities assumed as follows:

| | | | | |

| West Fraser purchase consideration: | |

| Cash consideration | $ | 101 | |

| |

| Fair value of net assets acquired: | |

| Cash | $ | 1 | |

| Accounts receivable | 3 | |

| Inventories | 24 | |

| Prepaid expenses | 1 | |

| Income taxes receivable | 1 | |

| Property, plant and equipment | 58 | |

| Timber licenses | 41 | |

| Payables and accrued liabilities | (8) | |

| Other liabilities | (3) | |

| Deferred income tax liabilities | (18) | |

| $ | 101 | |

4.Seasonality of operations

Our operating results are subject to seasonal fluctuations that may impact quarter-to-quarter comparisons. Consequently, interim operating results may not proportionately reflect operating results for a full year.

Market demand varies seasonally, as home building activity and repair-and-remodelling work are generally stronger in the spring and summer months. Extreme weather conditions, including wildfires in Western Canada and hurricanes in the U.S. South, may periodically affect operations, including logging, manufacturing and transportation. Log inventory is typically built up in the northern regions of North America and Europe during the winter to sustain our lumber and EWP production during the second quarter when logging is curtailed due to wet and inaccessible land conditions. This inventory is generally consumed in the spring and summer months.

5.Inventories

| | | | | | | | |

| June 28, | December 31, |

| As at | 2024 | 2023 |

| Manufactured products | $ | 371 | | $ | 363 | |

| Logs and other raw materials | 231 | | 257 | |

| Materials and supplies | 245 | | 231 | |

| $ | 846 | | $ | 851 |

Inventories at June 28, 2024 were subject to a valuation reserve of $38 million (December 31, 2023 - $31 million) to reflect net realizable value being lower than cost.

6.Disposal of pulp mills

Sale of Hinton pulp mill

On July 10, 2023, we announced an agreement to sell our unbleached softwood kraft pulp mill in Hinton, Alberta to Mondi Group plc (“Mondi”). The transaction closed on February 3, 2024 following the completion of regulatory reviews and satisfaction of customary closing conditions.

Under the terms of the agreement, Mondi purchased specified assets, including property, plant and equipment and working capital, and assumed certain liabilities related to the Hinton pulp mill in exchange for a base purchase price of $5 million prior to working capital and other adjustments specified in the asset purchase agreement. Pursuant to the transaction, we will continue to supply fibre to the Hinton pulp mill under long-term contract, via residuals from our Alberta lumber mills.

An impairment reversal of $1 million in relation to the sale of the Hinton pulp mill is included in Restructuring and impairment charges for the six months ended June 28, 2024 (see note 11). The impairment reversal relates to the remeasurement of working capital adjustments specified in the asset purchase agreement.

Sale of Quesnel River Pulp mill and Slave Lake Pulp mill

On September 22, 2023, we announced an agreement to sell our two bleached chemithermomechanical pulp (“BCTMP”) mills, Quesnel River Pulp mill in Quesnel, B.C. and Slave Lake Pulp mill in Slave Lake, Alberta to an affiliate of a fund managed by Atlas Holdings (“Atlas”). The transaction closed on April 20, 2024 following the completion of regulatory reviews and satisfaction of customary closing conditions.

Under the terms of the agreement, Atlas purchased specified assets, including property, plant and equipment, working capital, and certain timber licenses in Alberta, and assumed certain liabilities related to the mills and timber licenses in exchange for a base purchase price of $120 million prior to working capital adjustments specified in the asset purchase agreement. Pursuant to the transaction, we will continue to supply fibre to the Quesnel River Pulp mill under long-term contract.

An impairment loss of $4 million in relation to the sale of the Quesnel River Pulp mill and Slave Lake Pulp mill is included in Restructuring and impairment charges for the six months ended June 28, 2024 (see note 11). The impairment loss relates to the remeasurement of estimated working capital adjustments specified in the asset purchase agreement.

7.Operating loans and long-term debt

Operating loans

As at June 28, 2024, our credit facilities consisted of a $1 billion committed revolving credit facility which matures July 2028, $25 million of uncommitted revolving credit facilities available to our U.S. subsidiaries, a $19 million (£15 million) credit facility dedicated to our European operations, and a $11 million (CAD$15 million) demand line of credit dedicated to our jointly‑owned newsprint operation.

As at June 28, 2024, our revolving credit facilities were undrawn (December 31, 2023 - undrawn) and the associated deferred financing costs of $2 million (December 31, 2023 - $2 million) were recorded in other assets. Interest on the facilities is payable at floating rates based on Prime Rate Advances, Base Rate Advances, Bankers’ Acceptances, or Secured Overnight Financing Rate (“SOFR”) Advances at our option.

In addition, we have credit facilities totalling $130 million (December 31, 2023 - $133 million) dedicated to letters of credit. Letters of credit in the amount of $39 million (December 31, 2023 - $43 million) were supported by these facilities.

All debt is unsecured except the $11 million (CAD$15 million) jointly-owned newsprint operation demand line of credit, which is secured by that joint operation’s current assets.

Long-term debt

| | | | | | | | |

| June 28, | December 31, |

| As at | 2024 | 2023 |

| Senior notes due October 2024; interest at 4.35% | $ | 300 | | $ | 300 | |

| Term loan due July 2025; floating interest rate | 200 | | 200 | |

| 500 | | 500 | |

| Less: deferred financing costs | — | | (1) | |

| Less: current portion | (300) | | (300) | |

| $ | 200 | | $ | 199 | |

The fair value of the long-term debt at June 28, 2024 was $498 million (December 31, 2023 - $494 million) based on rates available to us at the balance sheet date for long-term debt with similar terms and remaining maturities.

Interest rate swap contracts

We have interest rate swap contracts that have the effect of fixing the interest rate on the $200 million term loan disclosed in the long-term debt table above. In January 2024, these interest rate swaps were amended to extend their maturity from August 2024 to July 2025. Following this amendment, the weighted average fixed interest rate payable under the contract was 2.61% (previously 0.91%).

The interest rate swap contracts are accounted for as a derivative, with the changes in their fair value included in other income or expense in our consolidated statements of earnings. For the three and six months ended June 28, 2024, a loss of $1 million and a loss of $1 million (three and six months ended June 30, 2023 - a nominal gain and a loss of $2 million) were recognized in relation to the interest rate swap contracts. The fair value of the interest rate swap contracts at June 28, 2024 was an asset of $5 million (December 31, 2023 - asset of $6 million).

8.Other liabilities

| | | | | | | | | | | |

| | June 28, | December 31, |

| As at | Note | 2024 | 2023 |

Retirement liabilities | 9 | $ | 79 | | $ | 106 | |

| Non-current portion of reforestation obligations | | 50 | | 53 | |

Non-current portion of decommissioning obligations | | 21 | | 16 | |

Non-current portion of lease obligations | | 23 | | 26 | |

| Export duties | 17 | 25 | | 24 | |

| Electricity swaps | | 12 | | 12 | |

| | | |

| Other | | 22 | | 22 | |

| | $ | 232 | | $ | 260 | |

9.Retirement benefits

We maintain defined benefit and defined contribution pension plans covering most of our employees. The defined benefit plans generally do not require employee contributions and provide a guaranteed level of pension payable for life based either on length of service or on earnings and length of service, and in most cases do not increase after

commencement of retirement. We also provide group life insurance, medical and extended health benefits to certain employee groups.

We used a discount rate assumption of 5.11% at June 28, 2024 (4.69% at December 31, 2023).

The actuarial gain (loss) on retirement benefits, included in other comprehensive earnings, is as follows:

| | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 28, | June 30, | | June 28, | June 30, |

| 2024 | 2023 | | 2024 | 2023 |

| Actuarial gain (loss) | $ | 11 | | $ | (20) | | | $ | 35 | | $ | (10) | |

| Tax recovery (provision) | (3) | | 5 | | | (9) | | 3 | |

| $ | 8 | | $ | (15) | | | $ | 26 | | $ | (8) | |

10.Share capital

Authorized

400,000,000 Common shares, without par value

20,000,000 Class B Common shares, without par value

10,000,000 Preferred shares, issuable in series, without par value

Issued

| | | | | | | | | | | | | | | | | |

| June 28, 2024 | | December 31, 2023 |

| As at | Number | Amount | | Number | Amount |

| Common | 78,518,053 | $ | 2,573 | | 79,439,518 | $ | 2,607 |

| Class B Common | 2,281,478 | — | | | 2,281,478 | — | |

| Total Common | 80,799,531 | $ | 2,573 | | 81,720,996 | $ | 2,607 |

As of June 28, 2024, we held 112,459 Common shares as treasury shares for cancellation.

For the three and six months ended June 28, 2024, we issued 310 and 7,310 Common shares under our share option plans (three and six months ended June 30, 2023 - 383 Common shares) and no Common shares under our employee share purchase plan (three and six months ended June 30, 2023 - no Common shares).

Rights and restrictions of Common shares

The Common shares and Class B Common shares are equal in all respects, including the right to dividends, rights upon dissolution or winding up and the right to vote, except that each Class B Common share may at any time be exchanged for one Common share. Our Common shares are listed for trading on the TSX and NYSE under the symbol WFG, while our Class B Common shares are not. Certain circumstances or corporate transactions may require the approval of the holders of our Common shares and Class B Common shares on a separate class by class basis.

Share repurchases

On February 27, 2024, we renewed our normal course issuer bid (“2024 NCIB”) allowing us to acquire up to 3,971,380 Common shares for cancellation from March 1, 2024 until the expiry of the bid on February 28, 2025.

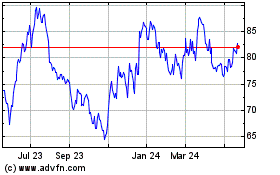

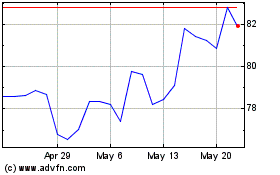

For the three and six months ended June 28, 2024, we repurchased for cancellation 935,568 and 1,041,234 Common shares (three and six months ended June 30, 2023 - no Common shares) at an average price of $78.85 and $78.90 per share under our 2023 NCIB and 2024 NCIB program.

11.Restructuring and impairment charges

| | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 28, 2024 | June 30, 2023 | | June 28, 2024 | June 30, 2023 |

| Impairment loss (reversal) related to Hinton pulp mill | $ | — | | $ | 122 | | | $ | (1) | | $ | 122 | |

| Impairment loss related to Quesnel River Pulp mill and Slave Lake Pulp mill | 5 | | — | | | 4 | | — | |

Restructuring related to Canadian and U.S. lumber operations | (1) | | — | | | 12 | | — | |

| Other restructuring charges | 1 | | — | | | 1 | | 3 | |

| Impairment related to equity accounted investment | — | | 7 | | | — | | 7 | |

| $ | 5 | | $ | 129 | | | $ | 16 | | $ | 132 | |

In the three and six months ended June 28, 2024, we recorded restructuring and impairment charges of $5 million and $16 million.

In the six months ended June 28, 2024, we recorded an impairment reversal of $1 million in relation to the sale of the Hinton pulp mill (see note 6). In addition, we recorded an impairment loss of $4 million in relation to the sale of the Quesnel River Pulp mill and Slave Lake Pulp mill (see note 6).

In the six months ended June 28, 2024, we recorded restructuring and impairment charges of $12 million associated with the announcement of the permanent closure of our Fraser Lake lumber mill and the permanent closure of our lumber mill in Maxville, Florida and the indefinite curtailment of operations at our lumber mill in Huttig, Arkansas.

12.Finance income, net

| | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 28, 2024 | June 30, 2023 | | June 28, 2024 | June 30, 2023 |

| Interest expense | $ | (7) | | $ | (6) | | | $ | (15) | | $ | (13) | |

| Interest income on cash and cash equivalents | 10 | | 11 | | | 21 | | 20 | |

| Net interest income on export duty deposits | 6 | | 3 | | | 12 | | 7 | |

| Finance income (expense) on employee future benefits | (1) | | — | | | (1) | | 1 | |

| Other | (2) | | 1 | | | (2) | | 1 | |

| $ | 6 | | $ | 9 | | | $ | 15 | | $ | 16 | |

13.Other income (expense)

| | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 28, 2024 | June 30, 2023 | | June 28, 2024 | June 30, 2023 |

| Foreign exchange gain | $ | — | | $ | 2 | | | $ | 3 | | $ | 2 | |

| Settlement gain on defined benefit pension plans | — | | 4 | | | 2 | | 4 | |

| Gain resulting from the CPP agreement | — | | — | | | 1 | | — | |

| Gain (loss) on electricity swaps | 4 | | 6 | | | (7) | | 21 | |

| Loss on interest rate swap contracts | (1) | | — | | | (1) | | (2) | |

Other | (2) | | (2) | | | (3) | | (1) | |

| $ | 1 | | $ | 10 | | | $ | (5) | | $ | 24 | |

14.Tax recovery (provision)

The tax recovery (provision) differs from the amount that would have resulted from applying the B.C. statutory income tax rate to earnings (loss) before tax as follows:

| | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 28, 2024 | June 30, 2023 | | June 28, 2024 | June 30, 2023 |

| Income tax recovery (provision) at statutory rate of 27% | $ | (38) | | $ | 48 | | | $ | (51) | | $ | 65 | |

| Rate differentials between jurisdictions and on specified activities | 3 | | (1) | | | 2 | | (1) | |

| Non-taxable amounts | — | | (2) | | | 1 | | (1) | |

| Other | 1 | | 1 | | | (2) | | 4 | |

| Tax recovery (provision) | $ | (34) | | $ | 46 | | | $ | (50) | | $ | 67 | |

15.Earnings (loss) per share

Basic earnings (loss) per share is calculated based on earnings (loss) available to Common shareholders, as set out below, using the weighted average number of Common shares and Class B Common shares outstanding.

Certain of our equity-based compensation plans may be settled in cash or Common shares at the holder’s option and for the purposes of calculating diluted earnings (loss) per share, the more dilutive of the cash-settled and equity-settled method is used, regardless of how the plan is accounted for. Plans that are accounted for using the cash-settled method will require adjustments to the numerator and denominator if the equity-settled method is determined to have a dilutive effect as compared to the cash-settled method.

The numerator under the equity-settled method is calculated based on earnings (loss) available to Common shareholders adjusted to remove the cash-settled equity-based compensation expense or recovery that has been charged or credited to earnings (loss) and deducting a notional charge using the equity‑settled method, as set out below. Adjustments to earnings (loss) are tax-effected as applicable. The denominator under the equity-settled method is calculated using the treasury stock method. Share options under the equity-settled method are considered dilutive when the average market price of our Common shares for the period exceeds the exercise price of the share option.

The equity-settled method was more dilutive for the three and six months ended June 28, 2024 and an adjustment was required for the numerator and denominator. The cash-settled method was more dilutive for the three and six months ended June 30, 2023 and therefore no adjustment was required for the numerator and denominator.

A reconciliation of the numerator and denominator used for the purposes of calculating diluted earnings per share is as follows:

| | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 28, 2024 | June 30, 2023 | | June 28, 2024 | June 30, 2023 |

| Earnings (loss) | | | | | |

Numerator for basic EPS | $ | 105 | | $ | (131) | | | $ | 139 | | $ | (173) | |

| Cash-settled recovery included in earnings | (5) | | — | | | (2) | | — | |

Equity-settled expense adjustment | (2) | | — | | | (4) | | — | |

Numerator for diluted EPS | $ | 98 | | $ | (131) | | | $ | 134 | | $ | (173) | |

| | | | | |

Weighted average number of shares (thousands) | | | | | |

Denominator for basic EPS | 81,209 | | 83,556 | | | 81,444 | | 83,556 | |

Effect of dilutive equity-based compensation | 249 | | — | | | 266 | | — | |

Denominator for diluted EPS | 81,457 | | 83,556 | | | 81,710 | | 83,556 | |

| | | | | |

Earnings (loss) per share (dollars) | | | | | |

Basic | $ | 1.29 | | $ | (1.57) | | | $ | 1.71 | | $ | (2.07) | |

Diluted | $ | 1.20 | | $ | (1.57) | | | $ | 1.63 | | $ | (2.07) | |

16.Segment and geographical information

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | Lumber | NA EWP | Pulp & Paper | Europe EWP | Corporate & Other | Total |

| June 28, 2024 |

| Sales | | | | | | |

| To external customers | $ | 686 | | $ | 809 | | $ | 91 | | $ | 119 | | $ | — | | $ | 1,705 | |

| To other segments | 11 | | 2 | | 1 | | — | | (14) | | — | |

| $ | 697 | | $ | 811 | | $ | 92 | | $ | 119 | | $ | (14) | | $ | 1,705 | |

| Cost of products sold | (590) | | (397) | | (66) | | (94) | | 14 | | (1,133) | |

| Freight and other distribution costs | (106) | | (83) | | (15) | | (11) | | — | | (215) | |

| Export duties, net | (15) | | — | | — | | — | | — | | (15) | |

| Amortization | (49) | | (71) | | (4) | | (12) | | (3) | | (138) | |

| Selling, general and administration | (37) | | (23) | | (2) | | (8) | | — | | (70) | |

| Equity-based compensation | — | | — | | — | | — | | 4 | | 4 | |

| Restructuring and impairment reversal (charges) | 1 | | (1) | | (5) | | — | | — | | (5) | |

| Operating earnings (loss) | $ | (100) | | $ | 236 | | $ | — | | $ | (6) | | $ | 2 | | $ | 132 | |

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | Lumber | NA EWP | Pulp & Paper | Europe EWP | Corporate & Other | Total |

| June 30, 2023 |

| Sales | | | | | | |

| To external customers | $ | 708 | | $ | 627 | | $ | 138 | | $ | 136 | | $ | — | | $ | 1,608 | |

| To other segments | 20 | | 2 | | — | | — | | (22) | | — | |

| $ | 728 | | $ | 629 | | $ | 138 | | $ | 136 | | $ | (22) | | $ | 1,608 | |

| Cost of products sold | (547) | | (394) | | (177) | | (99) | | 23 | | (1,194) | |

| Freight and other distribution costs | (105) | | (87) | | (28) | | (11) | | — | | (230) | |

| Export duties, net | (25) | | — | | — | | — | | — | | (25) | |

| Amortization | (44) | | (68) | | (8) | | (12) | | (3) | | (135) | |

| Selling, general and administration | (41) | | (22) | | (7) | | (7) | | (1) | | (78) | |

| Equity-based compensation | — | | — | | — | | — | | (12) | | (12) | |

| Restructuring and impairment charges | (7) | | — | | (122) | | — | | — | | (129) | |

| Operating earnings (loss) | $ | (41) | | $ | 58 | | $ | (204) | | $ | 7 | | $ | (16) | | $ | (196) | |

| | | | | | | | | | | | | | | | | | | | |

| Six Months Ended | Lumber | NA EWP | Pulp & Paper | Europe EWP | Corporate & Other | Total |

| June 28, 2024 |

| Sales | | | | | | |

| To external customers | $ | 1,359 | | $ | 1,504 | | $ | 242 | | $ | 227 | | $ | — | | $ | 3,332 | |

| To other segments | 23 | | 4 | | 5 | | — | | (31) | | — | |

| $ | 1,382 | | $ | 1,508 | | $ | 247 | | $ | 227 | | $ | (31) | | $ | 3,332 | |

| Cost of products sold | (1,115) | | (798) | | (183) | | (186) | | 33 | | (2,250) | |

| Freight and other distribution costs | (204) | | (164) | | (45) | | (21) | | — | | (435) | |

| Export duties, net | (30) | | — | | — | | — | | — | | (30) | |

| Amortization | (99) | | (141) | | (6) | | (24) | | (6) | | (276) | |

| Selling, general and administration | (74) | | (50) | | (7) | | (15) | | — | | (146) | |

| Equity-based compensation | — | | — | | — | | — | | — | | — | |

| Restructuring and impairment charges | (12) | | (1) | | (3) | | — | | — | | (16) | |

| Operating earnings (loss) | $ | (152) | | $ | 353 | | $ | 3 | | $ | (20) | | $ | (5) | | $ | 180 | |

| | | | | | | | | | | | | | | | | | | | |

| Six Months Ended | Lumber | NA EWP | Pulp & Paper | Europe EWP | Corporate & Other | Total |

| June 30, 2023 |

| Sales | | | | | | |

| To external customers | $ | 1,442 | | $ | 1,167 | | $ | 330 | | $ | 296 | | $ | — | | $ | 3,235 | |

| To other segments | 41 | | 4 | | 6 | | — | | (51) | | — | |

| $ | 1,483 | | $ | 1,171 | | $ | 336 | | $ | 296 | | $ | (51) | | $ | 3,235 | |

| Cost of products sold | (1,143) | | (798) | | (328) | | (221) | | 51 | | (2,439) | |

| Freight and other distribution costs | (211) | | (169) | | (61) | | (23) | | — | | (464) | |

| Export duties, net | (38) | | — | | — | | — | | — | | (38) | |

| Amortization | (91) | | (137) | | (17) | | (24) | | (5) | | (273) | |

| Selling, general and administration | (80) | | (47) | | (13) | | (13) | | (2) | | (154) | |

| Equity-based compensation | — | | — | | — | | — | | (14) | | (14) | |

| Restructuring and impairment charges | (9) | | — | | (123) | | — | | — | | (132) | |

| Operating earnings (loss) | $ | (89) | | $ | 20 | | $ | (207) | | $ | 15 | | $ | (20) | | $ | (281) | |

The geographic distribution of external sales based on the location of product delivery is as follows:

| | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 28, | June 30, | | June 28, | June 30, |

| 2024 | 2023 | | 2024 | 2023 |

| United States | $ | 1,176 | | $ | 1,071 | | | $ | 2,238 | | $ | 2,081 | |

| Canada | 323 | | 272 | | | 631 | | 557 | |

| U.K. and Europe | 120 | | 137 | | | 229 | | 300 | |

| Asia | 75 | | 127 | | | 220 | | 294 | |

| Other | 11 | | 1 | | | 14 | | 3 | |

| $ | 1,705 | | $ | 1,608 | | | $ | 3,332 | | $ | 3,235 | |

17.Countervailing (“CVD”) and antidumping (“ADD”) duty dispute

Additional details, including our accounting policy, can be found in note 26 - Countervailing (“CVD”) and antidumping (“ADD”) duty dispute of our audited annual consolidated financial statements for the year ended December 31, 2023.

Developments in CVD and ADD rates

We began paying CVD and ADD duties in 2017 based on the determination of duties payable by the United States Department of Commerce (“USDOC”). The CVD and ADD cash deposit rates are updated upon the finalization of the USDOC’s Administrative Review (“AR”) process for each Period of Inquiry (“POI”), as summarized in the tables below. On March 5, 2024, the USDOC initiated AR6 POI covering the 2023 calendar year. West Fraser was selected as a mandatory respondent, which will result in West Fraser continuing to be subject to a company-specific rate.

On February 1, 2024, the USDOC released the preliminary results from AR5 POI covering the 2022 calendar year, which indicated a rate of 6.74% for CVD and 5.33% for ADD for West Fraser. The duty rates are subject to an appeal process, and we will record an adjustment once the rates are finalized. If the AR5 rates were to be confirmed, it would result in an expense of $35 million before the impact of interest for the POI covered by AR5. This adjustment would reduce the export duties receivable recorded on our balance sheet. If these rates were finalized, our combined cash deposit rate would be 12.07%.

The Cash Deposit Rates and the West Fraser Estimated ADD Rate for the periods presented are as follows:

| | | | | |

| Effective dates for CVD | Cash Deposit

Rate |

AR6 POI1 | |

| January 1, 2023 - June 30, 2023 | 3.62 | % |

AR7 POI2 | |

| January 1, 2024 - June 28, 2024 | 2.19 | % |

1.The CVD rate for the AR6 POI will be adjusted when AR6 is complete and the USDOC finalizes the rate, which is not expected until 2025.

2.The CVD rate for the AR7 POI will be adjusted when AR7 is complete and the USDOC finalizes the rate, which is not expected until 2026.

| | | | | | | | |

| Effective dates for ADD | Cash Deposit

Rate | West Fraser

Estimated

Rate |

AR6 POI1 | | |

| January 1, 2023 - June 30, 2023 | 4.63 | % | 9.27 | % |

AR7 POI2 | | |

| January 1, 2024 - June 28, 2024 | 7.06 | % | 7.06 | % |

1.The ADD rate for the AR6 POI will be adjusted when AR6 is complete and the USDOC finalizes the rate, which is not expected until 2025.

2.The ADD rate for the AR7 POI will be adjusted when AR7 is complete and the USDOC finalizes the rate, which is not expected until 2026.

Impact on results

The following table reconciles our cash deposits paid during the period to export duties, net:

| | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 28, 2024 | June 30, 2023 | | June 28, 2024 | June 30, 2023 |

Cash deposits1 | $ | (15) | | $ | (13) | | | $ | (30) | | $ | (26) | |

Adjust to West Fraser Estimated ADD rate2 | — | | (12) | | | — | | (12) | |

| Export duties, net | $ | (15) | | $ | (25) | | | $ | (30) | | $ | (38) | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

1.Represents combined CVD and ADD cash deposit rate of 9.25% for January 1, 2024 to June 28, 2024 and 8.25% for January 1, 2023 to June 30, 2023.

2.Represents adjustment to the annualized West Fraser Estimated ADD rate of 7.06% for Q2-24 and YTD-24 and 9.27% for Q2-23 and YTD-23.

As of June 28, 2024, our export duties paid and payable on deposit with the USDOC were $865 million.

Impact on balance sheet

Each POI is subject to independent administrative review by the USDOC, and the results of each POI may not be offset but the results within a POI in respect of ADD and CVD may be offset.

Export duty deposits receivable is represented by:

| | | | | | |

| Six Months Ended | |

| June 28, | |

| Export duties receivable | 2024 | |

| Beginning of period | $ | 377 | |

| | |

| Interest income recognized on duty deposits receivable | 13 | |

| End of period | $ | 390 | |

Export duties payable is represented by:

| | | | | | |

| |

| Six Months Ended | |

| June 28, | |

| Export duties payable | 2024 | |

| Beginning of period | $ | 24 | | |

| | |

| | |

| Interest expense recognized on export duties payable | 1 | | |

| End of period | $ | 25 | | |

Appeals

Notwithstanding the deposit rates assigned under the investigations, our final liability for CVD and ADD will not be determined until each annual administration review process is complete and the related appeal processes are concluded.

18.Contingencies

We are subject to various investigations, claims and legal, regulatory and tax proceedings covering matters that arise in the ordinary course of business activities, including civil claims and lawsuits, regulatory examinations, investigations, audits and requests for information by governmental regulatory agencies and law enforcement authorities in various jurisdictions. Each of these matters is subject to uncertainties and it is possible that some of these matters may be resolved unfavourably. Certain conditions may exist as of the date the financial statements are issued, which may result in an additional loss. In the opinion of management none of these matters are expected to have a material effect on our results of operations or financial condition.

MANAGEMENT’S DISCUSSION & ANALYSIS

This discussion and analysis by management (“MD&A”) of West Fraser Timber Co. Ltd.’s (“West Fraser”, the “Company”, “we”, “us”, or “our”) financial performance for the three and six months ended June 28, 2024 should be read in conjunction with: (i) our unaudited condensed consolidated interim financial statements and accompanying notes for the three and six months ended June 28, 2024 (“Interim Financial Statements”); (ii) our audited annual consolidated financial statements and accompanying notes for the year ended December 31, 2023 (“Annual Financial Statements”), which have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board ("IFRS Accounting Standards"); and (iii) our related 2023 annual MD&A (“Annual MD&A”).

Our fiscal year is the calendar year ending December 31. Effective January 1, 2023, our fiscal quarters are the 13-week periods ending on the last Friday of March, June, and September with the fourth quarter ending December 31. References to the three months ended June 28, 2024 and the second quarter of 2024 relate to the 13-week period ended June 28, 2024.

Unless otherwise indicated, the financial information contained in this MD&A is derived from our Interim Financial Statements, which have been prepared in accordance with International Accounting Standard 34, Interim Financial Reporting, as issued by the International Accounting Standards Board. This MD&A uses various Non-GAAP and other specified financial measures, including “Adjusted EBITDA”, “Adjusted EBITDA by segment”, “available liquidity”, “total debt to capital ratio”, “net debt to capital ratio”, and “expected capital expenditures”. An explanation with respect to the use of these Non-GAAP and other specified financial measures is set out in the section titled “Non-GAAP and Other Specified Financial Measures”.

This MD&A includes statements and information that constitute “forward-looking information” within the meaning of Canadian securities laws and “forward-looking statements” within the meaning of United States securities laws (collectively, “forward-looking statements”). Please refer to the cautionary note titled “Forward-Looking Statements” for a discussion of these forward-looking statements and the risks that impact these forward-looking statements.

This MD&A uses capitalized terms, abbreviations and acronyms that are defined under “Glossary of Key Terms”. Dollar amounts are expressed in the United States (“U.S.”) currency unless otherwise indicated. Figures have been rounded to millions of dollars to reflect the accuracy of the underlying balances and as a result certain tables may not add due to rounding impacts. The information in this MD&A is as at July 24, 2024 unless otherwise indicated.

| | | | | | | | | | | | | | |

| OUR BUSINESS AND STRATEGY |

West Fraser is a diversified wood products company with facilities in Canada, the U.S., the U.K. and Europe, manufacturing, selling, marketing and distributing lumber, engineered wood products (OSB, LVL, MDF, plywood, particleboard), pulp, newsprint, wood chips and other residuals and renewable energy. As at June 28, 2024, our business is comprised of 32 lumber mills, 15 OSB facilities, 3 renewable energy facilities, 3 plywood facilities, 3 MDF facilities, 2 treated wood facilities, 1 particleboard facility, 1 LVL facility, 1 veneer facility, and 2 pulp and paper mills.

Our goal at West Fraser is to generate strong financial results through the business cycle, supported by robust product and geographic diversity, and relying on our committed workforce, the quality of our assets and our well-established people and culture. This culture emphasizes cost control in all aspects of the business and operating in a responsible, sustainable, financially conservative and prudent manner.

The North American wood products industry is cyclical and periodically faces difficult market conditions. Our earnings are sensitive to changes in world economic conditions, primarily those in North America, Asia and Europe and particularly to the U.S. housing market for new construction and repair and renovation spending. Most of our revenues are from sales of commodity products for which prices are sensitive to variations in supply and demand. As many of our costs are denominated in Canadian dollars, British pounds sterling and Euros, exchange rate fluctuations of the Canadian dollar,

British pound sterling and Euro against the United States dollar can and are anticipated to be a significant source of earnings volatility for us.

West Fraser strives to make sustainability a central principle upon which we and our people operate, and we believe our renewable building materials that sequester carbon are a natural climate solution and when used to shape our built environment, they can help in the fight against climate change. There are numerous government initiatives and proposals globally to address climate-related issues. Within the jurisdictions of our operations, some of these initiatives would regulate, and do regulate and/or tax the production of carbon dioxide and other greenhouse gases to facilitate the reduction of carbon emissions, providing incentives to produce and use cleaner energy. In April 2023, the Science Based Targets Initiative (“SBTi”) completed its validation of the science-based targets we set in the first quarter of 2022. This validation further supports West Fraser’s plan to achieve near-term greenhouse gas (“GHG”) reductions across all our operations located in the United States, Canada, U.K. and Europe.

We believe that maintaining a strong balance sheet and liquidity profile, along with our investment-grade debt rating, enables us to execute a balanced capital allocation strategy. Our goal is to reinvest in our operations across all market cycles to strategically enhance productivity, product mix, and capacity and to maintain a leading cost position. We believe that a strong balance sheet also provides the financial flexibility to capitalize on growth opportunities, including the pursuit of opportunistic acquisitions and larger-scale strategic growth initiatives, and is a key tool in managing our business over the long term including returning capital to shareholders.

Markets

In North America, new home construction activity in the U.S. is a significant driver of lumber and OSB demand. According to the U.S. Census Bureau, the seasonally adjusted annualized rate of U.S. housing starts averaged 1.35 million units in June 2024, with permits issued averaging 1.45 million units. U.S. housing starts were 1.41 million units for full year 2023 and 1.55 million units in 2022. In the first half of 2024, new housing construction has shown signs of stabilizing at levels moderately above pre-pandemic levels as consumers continue to manage through an environment of relatively high mortgage rates and housing affordability challenges. Supply of existing homes for sale, which have improved from depressed pandemic levels but remain historically low, and a large cohort of the population entering the typical home buying age demographic are expected to support longer-term core demand for home construction activity. Notwithstanding these factors, should the economy and employment slow more meaningfully, interest rates remain higher for longer or housing prices not adjust sufficiently lower to offset relatively elevated mortgage rates, housing affordability could continue to be adversely impacted, reducing near-term demand for new home construction and thus near-term demand for our wood-based building products.

In the second quarter, demand for our products used in repair and remodelling applications remained subdued, which appears to be contributing to a weaker pricing environment for SYP lumber than for SPF and OSB products. There is a risk that historically low rates of existing home sales and a slowing economy will put further downward pressure on short-term repair and remodelling demand, consistent with near-term industry forecasts for repair and remodelling spending. However, over the medium and longer term, an aging housing stock and stabilization of inflation and interest rates are expected to stimulate renovation and repair spending that supports growth in lumber, plywood and OSB demand.

Regarding lumber supply fundamentals, several new capacity announcements in the U.S. South in recent years have not translated into a meaningful increase in overall North American supply. Capacity contraction within other key lumber producing regions of North America has contributed to this trend, as have meaningful reductions in production from less competitive mills in the U.S. South, a region that is generally lower cost but is also heterogeneous in terms of mill costs associated with fibre supply, modernization levels and labour reliability. It’s also noteworthy that due to lengthy lumber supply chains, particularly for SPF products being railed from Western Canada, the impact of facility closures in that region can take several weeks or months before the supply effects are realized by the market. Lower demand from offshore markets for North American lumber is also a continuing factor, resulting in more domestically produced lumber remaining in the continent. Imports of lumber from Europe continue to ease from the elevated levels experienced in early 2023. However, should this import trend reverse and imports head materially higher again, the rebalancing of supply and demand for lumber products in North America could experience an even further extended time to recovery.

A number of OSB mill greenfield and re-start projects have been announced in recent years, although meaningful new supply has been slow to come to market. We believe this has largely been a function of extended vendor equipment backlogs and limited contractor availability, coupled with the 18-24 month start-up curves typical of OSB mills. While some of the announced mill projects are apt to be completed and begin production in the near-to-medium term, we continue to see meaningful constraints to significant new available OSB supply over the near term. However, should new OSB supply come to market sooner or production ramp more quickly than is typical for mill start-ups, OSB markets may experience a period of imbalance between supply and demand.

Completion of sale of Quesnel River Pulp mill and Slave Lake Pulp mill

On September 22, 2023, we announced an agreement to sell our two bleached chemithermomechanical pulp (“BCTMP”) mills, Quesnel River Pulp mill in Quesnel, B.C. and Slave Lake Pulp mill in Slave Lake, Alberta to an affiliate of a fund managed by Atlas Holdings (“Atlas”). The transaction closed on April 20, 2024 following the completion of regulatory reviews and satisfaction of customary closing conditions.

| | | | | | | | | | | | | | | | | |

Summary Results ($ millions) | Q2-24 | Q1-24 | YTD-24 | Q2-23 | YTD-23 |

| Earnings | | | | | |

| Sales | $ | 1,705 | | $ | 1,627 | | $ | 3,332 | | $ | 1,608 | | $ | 3,235 | |

| Cost of products sold | (1,133) | | (1,118) | | (2,250) | | (1,194) | | (2,439) | |

| Freight and other distribution costs | (215) | | (219) | | (435) | | (230) | | (464) | |

| Export duties, net | (15) | | (14) | | (30) | | (25) | | (38) | |

| Amortization | (138) | | (138) | | (276) | | (135) | | (273) | |

| Selling, general and administration | (70) | | (76) | | (146) | | (78) | | (154) | |

| Equity-based compensation | 4 | | (4) | | — | | (12) | | (14) | |

| Restructuring and impairment charges | (5) | | (10) | | (16) | | (129) | | (132) | |

| Operating earnings (loss) | 132 | | 48 | | 180 | | (196) | | (281) | |

| Finance income, net | 6 | | 9 | | 15 | | 9 | | 16 | |

| Other income (expense) | 1 | | (7) | | (5) | | 10 | | 24 | |

| Tax recovery (provision) | (34) | | (15) | | (50) | | 46 | | 67 | |

| Earnings (loss) | $ | 105 | | $ | 35 | | $ | 139 | | $ | (131) | | $ | (173) | |

| | | | | |

Adjusted EBITDA1 | $ | 272 | | $ | 200 | | $ | 472 | | $ | 80 | | $ | 138 | |

1.This is a non-GAAP financial measure. Refer to the “Non-GAAP and Other Specified Financial Measures” section of this document for more information on this measure.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Selected Quarterly Amounts ($ millions, unless otherwise indicated) | Q2-24 | Q1-24 | Q4-23 | Q3-23 | Q2-23 | Q1-23 | Q4-22 | Q3-22 |

| Sales | $ | 1,705 | | $ | 1,627 | | $ | 1,514 | | $ | 1,705 | | $ | 1,608 | | $ | 1,627 | | $ | 1,615 | | $ | 2,088 | |

| Earnings (loss) | $ | 105 | | $ | 35 | | $ | (153) | | $ | 159 | | $ | (131) | | $ | (42) | | $ | (94) | | $ | 216 | |

Basic EPS (dollars) | 1.29 | | 0.42 | | (1.87) | | 1.91 | | (1.57) | | (0.50) | | (1.12) | | 2.50 | |

Diluted EPS (dollars) | 1.20 | | 0.42 | | (1.87) | | 1.81 | | (1.57) | | (0.52) | | (1.13) | | 2.50 | |

Decreases in sales and earnings through Q2-23 were driven primarily by decreases in lumber and OSB pricing, inventory write-downs, maintenance-related costs and downtime in our pulp segment, and impairment charges. Earnings improved in Q3-23, driven primarily by improvements in OSB pricing, lower impairment charges, the impacts of AR4 finalization, and lower maintenance-related expenditures in our pulp segment. Sales and earnings decreased in Q4-23 due primarily to decreases in lumber and OSB pricing, higher export duties, and impairment charges related to announced facility closures and curtailments in our lumber segment. Sales and earnings improved through Q2-24 due primarily to improvements in OSB pricing and lower impairment charges, partially offset by lower lumber pricing.

Discussion & Analysis by Product Segment

Lumber Segment

| | | | | | | | | | | | | | | | | |

Lumber Segment Earnings ($ millions unless otherwise indicated) | Q2-24 | Q1-24 | YTD-24 | Q2-23 | YTD-23 |

| Sales | | | | | |

| Lumber | $ | 616 | | $ | 600 | | $ | 1,215 | | $ | 643 | | $ | 1,293 | |

| Wood chips and other residuals | 69 | | 68 | | 137 | | 75 | | 152 | |

| Logs and other | 12 | | 17 | | 29 | | 10 | | 38 | |

| 697 | | 685 | | 1,382 | | 728 | | 1,483 | |

| Cost of products sold | (590) | | (525) | | (1,115) | | (547) | | (1,143) | |

| Freight and other distribution costs | (106) | | (98) | | (204) | | (105) | | (211) | |

| Export duties, net | (15) | | (14) | | (30) | | (25) | | (38) | |

| Amortization | (49) | | (50) | | (99) | | (44) | | (91) | |

| Selling, general and administration | (37) | | (37) | | (74) | | (41) | | (80) | |

| Restructuring and impairment reversal (charges) | 1 | | (12) | | (12) | | (7) | | (9) | |

| Operating loss | $ | (100) | | $ | (52) | | $ | (152) | | $ | (41) | | $ | (89) | |

| | | | | |

Adjusted EBITDA1 | $ | (51) | | $ | 10 | | $ | (41) | | $ | 10 | | $ | 10 | |

| | | | | |

SPF (MMfbm) | | | | | |

| Production | 746 | | 710 | | 1,457 | | 618 | | 1,307 | |

| Shipments | 799 | | 705 | | 1,504 | | 685 | | 1,376 | |

SYP (MMfbm) | | | | | |

| Production | 691 | | 699 | | 1,389 | | 743 | | 1,495 | |

| Shipments | 705 | | 665 | | 1,369 | | 750 | | 1,516 | |

1.This is a non-GAAP financial measure. Refer to the “Non-GAAP and Other Specified Financial Measures” section of this document for more information on this measure.

Sales and Shipments

Lumber sales increased from Q1-24 due to higher shipment volumes offset by lower product pricing. Lumber sales decreased versus Q2-23 and YTD-23 due primarily to lower SYP product pricing and shipment volumes, offset in part by higher SPF shipment volumes.

SPF and SYP lumber pricing decreased compared to Q1-24. SYP lumber pricing decreased significantly compared to Q2-23 and YTD-23 while SPF lumber pricing was broadly comparable. The overall price variance resulted in a decrease in operating earnings and Adjusted EBITDA of $45 million compared to Q1-24, a decrease of $61 million compared to Q2-23, and a decrease of $80 million compared to YTD-23.

SPF shipment volumes increased versus all comparative periods due primarily to higher production volumes, discussed further in the section below. SPF shipment volumes increased from Q2-23 and YTD-23 due primarily to the inclusion of our Spray Lake lumber mill in Cochrane, Alberta. At the end of Q2-24, we completed shipping all of the remaining product from our Fraser Lake, B.C. lumber mill, which has now been closed.

SYP shipment volumes increased versus Q1-24. SYP shipment volumes decreased versus Q2-23 and on a year-to-date basis are down 10% versus 2023 due primarily to lower production volumes, discussed further in the section below. In Q1-24, we announced and promptly completed the indefinite curtailment of operations at our Huttig, Arkansas lumber mill and the permanent closure of our Maxville, Florida lumber mill, which reduced our SYP capacity by 270 MMfbm on an annual basis.

The overall volume variance resulted in a decrease in operating earnings and Adjusted EBITDA of $5 million compared to Q1-24, an increase of $3 million compared to Q2-23, and a $5 million increase compared to YTD-23.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SPF Sales by Destination | Q2-24 | Q1-24 | YTD-24 | Q2-23 | YTD-23 |

| MMfbm | % | MMfbm | % | MMfbm | % | MMfbm | % | MMfbm | % |

| U.S. | 466 | 58% | 422 | 60% | 888 | 59% | 455 | 66% | 918 | 67% |

| Canada | 301 | 38% | 255 | 36% | 556 | 37% | 212 | 31% | 425 | 31% |

| Other | 32 | 4% | 28 | 4% | 60 | 4% | 18 | 3% | 33 | 2% |

| 799 | | 705 | | 1,504 | | 685 | | 1,376 | |

We ship SPF to certain export markets, while our SYP sales are almost entirely within the U.S. The relative proportion of shipments of SPF to Canada increased versus 2023 due primarily to the inclusion of our Spray Lake lumber mill.

Wood chip and other residuals sales were comparable to Q1-24 but decreased versus Q2-23 and YTD-23 due primarily to lower chip pricing, offset in part by higher production volumes. Logs and other revenue decreased compared to Q1-24 and YTD-23 due primarily to lower volumes of logs sold.

Costs and Production

SPF production volumes increased from Q1-24 due primarily to higher operating schedules at certain of our mills, offset in part by the closure of our Fraser Lake, B.C. lumber mill late in the quarter. As noted above, SPF production volumes increased from Q2-23 and YTD-23 due primarily to the inclusion of our Spray Lake sawmill in Cochrane, Alberta. Our Western Canada operations have been less impacted by wildfire related curtailments in 2024, leading to an increase to SPF production year over year.

SYP production volumes decreased versus comparative periods due primarily to production curtailments taken to manage inventory levels and the impacts of the indefinite curtailment of operations at our Huttig, Arkansas lumber mill and permanent closure of our Maxville, Florida lumber mill. This loss of production was partially offset by the ramp up of output from our more modern lower cost facilities.

Costs of products sold increased from Q1-24 due primarily to higher shipment volumes and a $21 million unfavourable impact relating to inventory valuation adjustments, offset in part by lower SPF unit manufacturing costs and SYP log costs. Inventory valuation reserves increased in Q2-24 due to lower product pricing, whereas Q1-24 benefited from a release of inventory valuation reserves.

Cost of products sold versus Q2-23 and YTD-23 were impacted primarily by changes in shipment volumes, significant unfavourable impacts relating to inventory valuation adjustments, and lower SPF log costs and unit manufacturing costs.

Q2-23 and YTD-23 benefited from a significant release of inventory valuation reserves. Log inventory is built up in the northern regions of North America in the first quarter to sustain lumber operations during the second quarter when logging is curtailed due to wet and inaccessible land conditions. A large portion of these inventory valuation reserves was released as SPF lumber pricing increased at the end of Q2-23. On the other hand, SPF lumber pricing declined towards the end of Q2-24, creating an additional valuation reserve.

Most of our SPF log requirements are harvested from crown lands owned by the provinces of B.C. or Alberta. B.C.’s stumpage system is tied to reported lumber prices, with a time lag, and publicly auctioned timber harvesting rights. Alberta’s stumpage system is correlated to published lumber prices with a shorter time lag.

SPF log costs decreased versus Q2-23 and YTD-23 due primarily to lower B.C. stumpage costs.

SPF unit manufacturing costs decreased versus comparative periods due primarily to higher production in the current period and improved productivity.

SYP log costs decreased versus comparative periods as demand for logs moderated. SYP unit manufacturing costs were broadly comparable to Q1-24. SYP unit manufacturing costs increased from Q2-23 and YTD-23 due primarily to higher labour, repairs and maintenance, and energy costs as well as the impact of selective reductions in hours and shifts across our SYP platform throughout Q2-24.

Freight and other distribution costs generally trended with shipment volumes, with lower freight rates resulting from favourable changes in customer geographic mix.

Export duties expense increased compared to Q1-24 due to higher shipment volumes to the U.S. Export duties expense decreased compared to Q2-23 as a $12 million expense relating to an increase in our estimated rate was recorded in Q2-23. This was offset in part by a higher cash deposit rate and higher shipment volumes to the U.S. Export duties expense decreased compared to YTD-23 due to the impact of the 2023 adjustment to our estimated rate and lower shipment volumes to the U.S., partially offset by a higher cash deposit rate.

The following table reconciles our cash deposits paid during the period to the amounts recorded in our earnings statement:

| | | | | | | | | | | | | | | | | |

Duty impact on earnings ($ millions) | Q2-24 | Q1-24 | YTD-24 | Q2-23 | YTD-23 |

Cash deposits paid1 | $ | (15) | | $ | (14) | | $ | (30) | | $ | (13) | | $ | (26) | |

Adjust to West Fraser Estimated ADD rate2 | — | | — | | — | | (12) | | (12) | |

Export duties, net | $ | (15) | | $ | (14) | | $ | (30) | | $ | (25) | | $ | (38) | |

| | | | | |

| | | | | |

| | | | | |

1.Represents combined CVD and ADD cash deposit rate of 9.25% for January 1, 2024 to June 28, 2024 and 8.25% for January 1, 2023 to June 30, 2023.

2.Represents adjustment to the annualized West Fraser Estimated ADD rate of 7.06% for Q2-24 and YTD-24 and 9.27% for Q2-23 and YTD-23.

Amortization expense was comparable versus Q1-24. Amortization expense increased compared to Q2-23 and YTD-23 due primarily to the completion of certain capital investments in our U.S. operations and the inclusion of our Spray Lakes lumber mill in Cochrane, Alberta, offset in part by our lumber mill closures.

Selling, general and administration costs were comparable to Q1-24. Selling, general and administration costs decreased compared to Q2-23 and YTD-23 due primarily to changes in the amount of corporate overhead costs allocated to the segment and cost reductions from our lumber mill closures.

Operating earnings for the Lumber Segment decreased by $48 million compared to Q1-24, decreased by $59 million compared to Q2-23, and decreased by $63 million compared to YTD-23 for the reasons explained above.

Adjusted EBITDA for the Lumber Segment decreased by $61 million compared to Q1-24, decreased by $61 million compared to Q2-23, and decreased by $51 million compared to YTD-23. The following table shows the Adjusted EBITDA variance for the period. The impact of changes relating to our sales of logs, wood chips, and other residuals is included under Other.

| | | | | | | | | | | |

Adjusted EBITDA ($ millions) | Q1-24 to Q2-24 | Q2-23 to Q2-24 | YTD-23 to YTD-24 |

| Adjusted EBITDA - comparative period | $ | 10 | | $ | 10 | | $ | 10 | |

| Price | (45) | | (61) | | (80) | |

| Volume | (5) | | 3 | | 5 | |

| Changes in export duties | 1 | | 12 | | 11 | |

| Changes in costs | 12 | | 25 | | 66 | |

| Impact of inventory write-downs | (21) | | (40) | | (41) | |

| Other | (3) | | — | | (14) | |

| Adjusted EBITDA - current period | $ | (51) | | $ | (51) | | $ | (41) | |

Softwood Lumber Dispute

On November 25, 2016, a coalition of U.S. lumber producers petitioned the USDOC and the USITC to investigate alleged subsidies to Canadian softwood lumber producers and levy CVD and ADD duties against Canadian softwood lumber imports. The USDOC chose us as a “mandatory respondent” to both the countervailing and antidumping investigations, and as a result, we have received unique company-specific rates.

Developments in CVD and ADD rates

We began paying CVD and ADD duties in 2017 based on the determination of duties payable by the USDOC. The CVD and ADD cash deposit rates are updated based on the USDOC’s AR for each POI.

The respective Cash Deposit Rates, the AR POI Final Rate and the West Fraser Estimated ADD Rate for each period are as follows:

| | | | | |

| Effective dates for CVD | Cash Deposit

Rate |

AR6 POI1 | |

| January 1, 2023 - June 30, 2023 | 3.62 | % |

AR7 POI2 | |

| January 1, 2024 - June 28, 2024 | 2.19 | % |

1.The CVD rate for the AR6 POI will be adjusted when AR6 is complete and the USDOC finalizes the rate, which is not expected until 2025.

2.The CVD rate for the AR7 POI will be adjusted when AR7 is complete and the USDOC finalizes the rate, which is not expected until 2026.

| | | | | | | | |

| Effective dates for ADD | Cash Deposit

Rate | West Fraser

Estimated

Rate |

AR6 POI1 | | |

| January 1, 2023 - June 30, 2023 | 4.63 | % | 9.27 | % |

AR7 POI2 | | |

| January 1, 2024 - June 28, 2024 | 7.06 | % | 7.06 | % |

1.The ADD rate for the AR6 POI will be adjusted when AR6 is complete and the USDOC finalizes the rate, which is not expected until 2025.

2.The ADD rate for the AR7 POI will be adjusted when AR7 is complete and the USDOC finalizes the rate, which is not expected until 2026.

Accounting policy for duties

The CVD and ADD rates apply retroactively for each POI. We record CVD as export duty expense at the cash deposit rate until an AR finalizes a new applicable rate for each POI. We record ADD as export duty expense by estimating the rate to be applied for each POI by using our actual results and a similar calculation methodology as the USDOC and adjust when an AR finalizes a new applicable rate for each POI. The difference between the cash deposits paid and the export duty expense recognized for each POI is recorded on our balance sheet as export duty deposits receivable or payable.

The difference between the cash deposit amount and the amount that would have been due based on the final AR rate will incur interest based on the U.S. federally published interest rate. We record interest income on our duty deposits receivable, net of any interest expense on our duty deposits payable, based on this rate.

Appeals

Our 2023 annual MD&A includes additional details on Softwood Lumber Dispute appeals.

Notwithstanding the deposit rates assigned under the investigations, our final liability for CVD and ADD will not be determined until each annual administrative review process is complete and related appeals processes are concluded.

North America Engineered Wood Products Segment

| | | | | | | | | | | | | | | | | |

NA EWP Segment Earnings ($ millions unless otherwise indicated) | Q2-24 | Q1-24 | YTD-24 | Q2-23 | YTD-23 |

| Sales | | | | | |

| OSB | $ | 660 | | $ | 550 | | $ | 1,210 | | $ | 470 | | $ | 855 | |

| Plywood, LVL and MDF | 142 | | 136 | | 279 | | 154 | | 305 | |

| Wood chips, logs and other | 8 | | 10 | | 19 | | 5 | | 10 | |

| 811 | | 697 | | 1,508 | | 629 | | 1,171 | |

| Cost of products sold | (397) | | (401) | | (798) | | (394) | | (798) | |

| Freight and other distribution costs | (83) | | (81) | | (164) | | (87) | | (169) | |

| Amortization | (71) | | (71) | | (141) | | (68) | | (137) | |

| Selling, general and administration | (23) | | (27) | | (50) | | (22) | | (47) | |

| Restructuring and impairment charges | (1) | | — | | (1) | | — | | — | |

| Operating earnings | $ | 236 | | $ | 117 | | $ | 353 | | $ | 58 | | $ | 20 | |

| | | | | |

Adjusted EBITDA1 | $ | 308 | | $ | 188 | | $ | 495 | | $ | 126 | | $ | 157 | |

| | | | | |

OSB (MMsf 3/8” basis) | | | | | |

| Production | 1,735 | | 1,619 | | 3,354 | | 1,634 | | 3,192 | |

| Shipments | 1,645 | | 1,609 | | 3,254 | | 1,652 | | 3,201 | |

Plywood (MMsf 3/8” basis) | | | | | |

| Production | 192 | | 177 | | 368 | | 183 | | 362 | |

| Shipments | 189 | | 180 | | 369 | | 206 | | 369 | |

1.This is a non-GAAP financial measure. Refer to the “Non-GAAP and Other Specified Financial Measures” section of this document for more information on this measure.

Our NA EWP segment includes our North American OSB, plywood, MDF, and LVL operations.

Sales and Shipments

Sales increased versus all comparative periods due primarily to higher OSB product pricing. Higher OSB shipment volumes were a contributing factor comparing to Q1-24 and YTD-23 as well.

The price variance resulted in an increase in operating earnings and Adjusted EBITDA of $93 million compared to Q1-24, an increase of $177 million compared to Q2-23, and an increase of $309 million compared to YTD-23.

OSB shipment volumes increased compared to Q1-24 and YTD-23 due primarily to higher production, discussed further in the section below.

Plywood shipment volumes increased compared to Q1-24 due primarily to higher production, discussed further in the section below. Plywood shipments decreased marginally from Q2-23 but was comparable to YTD-23 due to stable production volumes and demand.

The volume variance resulted in an increase in operating earnings and Adjusted EBITDA of $8 million compared to Q1-24, a decrease of $2 million compared to Q2-23, and an increase of $4 million compared to YTD-23.

Costs and Production

OSB production volumes increased from Q1-24 due to improved productivity and the continued ramp-up of our Allendale, South Carolina mill. OSB production volumes increased from Q2-23 and YTD-23 due to these factors, offset in part by higher scheduled and unscheduled downtime at our other facilities.

Plywood production volumes increased from all comparative periods due to improved productivity and more consistent operating schedules.