Hannover Re expressed satisfaction with its Group net income as

at 30 September 2011. 'Despite loss expenditure overshadowed by the

severe natural catastrophe losses of the first quarter as well as a

challenging capital market environment, we succeeded in generating

Group net income for the first nine months of EUR 381.7 million.

This puts in place a good platform for achieving our profit target

of at least EUR 500 million for the full financial year', Chief

Executive Officer Ulrich Wallin confirmed.

Continued organic growth Gross written premium in total business

increased by 6.0% as at 30 September 2011 to reach EUR 9.1 billion

(EUR 8.6 billion). At constant exchange rates growth would have

come in at 8.1%. The level of retained premium was virtually

unchanged at 90.7% (91.0%). Net premium climbed 5.5% to EUR 7.9

billion (EUR 7.5 billion). The increase would have amounted to 7.5%

at constant exchange rates.

Group net income in line with current expectations The operating

profit (EBIT) of EUR 487.8 million fell short of the strong

performance in the comparable period (EUR 862.0 million) owing to

the heavy burden of major losses in the first quarter and reduced

profitability in life and health reinsurance. The result in the

previous year had, however, been influenced by positive special

effects. Group net income totalled EUR 381.7 million (EUR 582.0

million). Earnings per share came in at EUR 3.16 (EUR 4.83).

Satisfactory result in non-life reinsurance despite heavy major

loss expenditure The situation on international reinsurance markets

is broadly positive. In view of the substantial natural catastrophe

events that occurred in the first quarter, the treaty renewals

during the year brought the anticipated sharp surges in rates -

especially under programmes that had suffered losses. In the area

of casualty covers, however, at best moderate improvements in

conditions can be observed for reinsurers, although the lowest

point has now passed. Gross premium in non-life reinsurance

increased by 8.2% as at 30 September 2011 to stand at EUR 5.2

billion (EUR 4.8 billion). At constant exchange rates, especially

against the US dollar, growth would have been as much as 10.5%. The

level of retained premium remained virtually unchanged at 90.3%

(90.5%). Net premium earned climbed 8.0% to EUR 4.4 billion (EUR

4.1 billion). The increase would have been 10.0% at constant

exchange rates.

The third quarter passed off relatively moderately in terms of

major losses; at EUR 118.0 million, the strain was below the

expected level of EUR 165 million. The largest single loss was

hurricane 'Irene', with a net cost of EUR 20.2 million for Hannover

Re's account. In view of the exceptionally heavy major loss

incidence in the first quarter, the net burden of major losses as

at 30 September 2011 totalled EUR 743.2 million - a figure still

well in excess of the corresponding period of the previous year

(EUR 554.1 million).

The combined ratio stood at 105.0% (99.0%), or 95.2% (98.2%) for

the third quarter in isolation. The net underwriting result came in

at -EUR 229.2 million (EUR 32.4 million).

As anticipated, the operating profit (EBIT) fell short of the

comparable figure for the previous year (EUR 633.4 million) at EUR

332.9 million. Group net income totalled EUR 295.0 million (EUR

437.7 million). 'Bearing in mind that the major loss expenditure is

EUR 343 million higher than our expectation for the first nine

months, this performance is thoroughly gratifying overall', Mr.

Wallin emphasised. 'It is a testament to the underlying favourable

development of our non-life reinsurance portfolio.' This is all the

more true given that the performance of the inflation swaps taken

out for hedging purposes also adversely impacted the result in the

third quarter. Earnings per share amounted to EUR 2.45 (EUR

3.63).

Result in life and health reinsurance particularly hard hit by

adverse capital market climate The international life and health

reinsurance markets continue to offer attractive business

opportunities. The demographic shift in mature markets such as the

United States, United Kingdom, Germany, France and Australia is

generating heightened awareness of the need for provision. Yet in

leading emerging markets such as China, India and Brazil demand for

retirement provision solutions is also rising.

Gross written premium improved by 3.0% as at 30 September 2011

to reach EUR 3.8 billion (EUR 3.7 billion). At constant exchange

rates growth would have come in at 5.0%. Net premium earned

increased by 2.4% to EUR 3.5 billion (EUR 3.4 billion). The

increase would have been 4.6% at constant exchange rates.

Profitability in life and health reinsurance did not entirely

live up to expectations. Among other factors, the further widening

of credit spreads on bond markets resulted in a strain of EUR 69.9

million on deposits held by US clients for Hannover Re's account.

In addition, negative currency effects of EUR 11.8 million were

incurred for the first nine months, contrasting with a positive

effect of EUR 31.8 million in the corresponding period of the

previous year.

'The operating profit (EBIT) of EUR 138.6 million generated

despite the adverse factors is a testament to the good quality and

excellent diversification of our book of business', Mr. Wallin

emphasised. 'In most markets the business development was - as

anticipated - pleasing.' The EBIT margin stood at 4.0% (6.3%). As

expected, the Group net income of EUR 113.1 million did not match

up to the result for the corresponding period of the previous year

(EUR 170.2 million). Earnings per share amounted to EUR 0.94 (EUR

1.41).

Investment income thoroughly satisfactory despite low interest

rate level Despite the turmoil on international capital markets

Hannover Re is thoroughly satisfied with the development of its

investments. This can be attributed in particular to the fact that

holdings of listed equities have only been very minimal since the

first quarter, as a consequence of which virtually no strains were

incurred in this area. 'Our policy on bonds continues to be geared

towards a diversified portfolio', Mr. Wallin explained. 'Relative

to our total assets under own management, our exposure to Eurozone

countries with high credit spreads remains slight at roughly 1.5%.

Our portfolio does not contain any instruments of Greek

issuers.'

The portfolio of assets under own management grew sharply to EUR

27.1 billion (EUR 25.4 billion). Despite the sustained low level of

interest rates, ordinary income excluding interest on deposits

comfortably surpassed the corresponding period of the previous year

(EUR 655.1 million) to reach EUR 712.0 million. Interest on

deposits also increased to EUR 247.2 million (EUR 223.7 million).

Owing to the widening of credit spreads on bond markets, the

unrealised losses on deposits held by US life insurers for Hannover

Re's account increased to EUR 69.9 million. Altogether, the

unrealised losses on assets recognised at fair value through profit

or loss amounted to EUR 70.0 million (EUR 93.6 million). The

inflation swaps taken out to hedge part of the inflation risks

associated with the loss reserves in the technical account gave

rise to unrealised losses of EUR 11.3 million (EUR 89.4

million).

With interest rates in some cases at historically low levels

Hannover Re realised gains in the third quarter, producing a net

balance of realised gains in an amount of EUR 113.4 million (EUR

135.2 million). Net investment income clearly surpassed the

previous year's level at EUR 950.8 million (EUR 872.2 million). The

average return on investments under own management thus stood at

3.6%, a figure slightly in excess of the defined target of

3.5%.

Equity base further strengthened The equity attributable to

shareholders of Hannover Re grew by EUR 189.8 million relative to

the position as at 31 December 2010 to reach EUR 4.7 billion (EUR

4.5 billion). The book value per share consequently increased by

4.2% to EUR 38.96 (EUR 37.39 ). The annualised return on equity

stood at 11.1% (19.0%).

Outlook for 2011 In light of the available market opportunities

in international reinsurance business and its very good

positioning, Hannover Re is looking to grow its net premium volume

for the current year by 7% to 8% at constant exchange rates.

In non-life reinsurance market conditions remain good. In view

of the heavy losses from natural disasters, especially in the first

quarter, the market hardening observed across the board - albeit to

varying degrees - in the renewals during the year appears set to

continue. This tendency was confirmed not only by the industry

gatherings in Monte Carlo, Baden-Baden and the United States, but

also by the most recent round of renewals in North America.

Hannover Re expects net premium in total non-life reinsurance to

grow by around 8% to 10% assuming exchange rates remain

unchanged.

The prospects in international life and health reinsurance

remain favourable. A particularly significant factor here is the

demographic trend in established insurance markets such as the

United States, Japan, United Kingdom and Germany. Yet rising demand

can also be observed in the markets of Eastern Europe and Asia. In

key markets for Hannover Re, including the United States,

risk-oriented reinsurance solutions are taking on greater

importance. Financially oriented reinsurance solutions, i.e. models

designed to strengthen the solvency base of primary insurers,

continue to enjoy sustained demand. Business involving longevity

risks also offers healthy growth opportunities, particularly in the

United Kingdom. For the current financial year Hannover Re is

looking to grow net premium in life and health reinsurance by more

than 5% at constant exchange rates.

On the investments side the expected positive cash flow should -

subject to stable exchange rates - lead to further growth in the

asset portfolio. In the area of fixed-income securities the

emphasis continues to be on the high quality and diversification of

the portfolio. The targeted return on investment for the 2011

financial year is 3.5%.

In view of its very good positioning and the advantageous

situation on reinsurance markets, Hannover Re expects to generate

Group net income of at least EUR 500 million for 2011. This is

subject to the premise that the burden of major losses in the

fourth quarter does not significantly exceed the remaining expected

level and also assumes that there are no drastic downturns on

capital markets.

Depending on the development of the underwriting result and IFRS

equity in the fourth quarter the company aims to pay a dividend for

the 2011 financial year which could even exceed 40% of Group net

income.

Please visit: www.hannover-re.com

Hannover Re, with a gross premium of around EUR 11 billion, is

the third-largest reinsurer in the world. It transacts all lines of

non-life and life and health reinsurance and is present on all

continents with around 2,200 staff. The rating agencies most

relevant to the insurance industry have awarded Hannover Re very

strong insurer financial strength ratings (Standard & Poor's

AA- 'Very Strong' and A.M. Best A 'Excellent').

Please note the disclaimer:

www.hannover-re.com/misc/disclaimer-pr-050811 Key figures of the

Hannover Re Group (IFRS basis)

in Mio. EUR Q1-3/2011 +/- Vorjahr

Q1-3/2010 2010

Hannover Rück-Gruppe Gebuchte

Bruttoprämie 9.064,7 +6,0 % 8.554,6 Verdiente Nettoprämie 7.879,9

+5,5 % 7.471,2 Versicherungstechnisches Ergebnis -413,3 -153,0

Kapitalanlageergebnis1) 950,8 +9,0 % 872,2 Operatives Ergebnis

(EBIT) 487,8 -43,4 % 862,0 Konzernergebnis 381,7 -34,4 % 582,0

Ergebnis je Aktie in EUR 3,16 -34,4 % 4,83 Selbstbehalt 90,7 % 91,0

% EBIT-Rendite2) 6,2 % 11,5 % Eigenkapitalrendite (nach Steuern)3)

11,1 % 19,0 % in Mio. EUR Q1-3/2011 +/- Vorjahr Q1-3/2010

2010 Haftendes Kapital4) 7.046,5 +0,9 % 6.987,0 Kapitalanlagen

(ohne Depotforderungen) 27.062,8 +6,5 % 25.411,1 Bilanzsumme

48.024,8 +2,8 % 46.725,3 Buchwert je Aktie in EUR 38,96 +4,2 %

37,39

Schaden-Rückversicherung in Mio. EUR Q1-3/2011

+/- Vorjahr Q1-3/2010 2010 Gebuchte Bruttoprämie 5.220,5 +8,2 %

4.824,9 Verdiente Nettoprämie 4.391,2 +8,0 % 4.066,8

Versicherungstechnisches Ergebnis -229,2 32,4 Operatives Ergebnis

(EBIT) 332,9 -47,4 % 633,4 Konzernergebnis 295,0 -32,6 % 437,7

Selbstbehalt 90,3 % 90,5 % Kombinierte Schaden-/Kostenquote5) 105,0

% 99,0 % EBIT-Rendite2) 7,6 % 15,6 %

Personen-Rückversicherung in Mio. EUR Q1-3/2011 +/- Vorjahr

Q1-3/2010 2010 Gebuchte Bruttoprämie 3.843,6 +3,0 % 3.730,4

Verdiente Nettoprämie 3.486,9 +2,4 % 3.404,9 Operatives Ergebnis

(EBIT) 138,6 -35,1 % 213,6 Konzernergebnis 113,1 -33,5 % 170,2

Selbstbehalt 91,1 % 91,5 % EBIT-Rendite2) 4,0 % 6,3 % 1)

Einschließlich Depotzinsaufwendungen 2) Operatives Ergebnis (EBIT)

/ verdiente Nettoprämie 3) Annualisiert 4) Eigenkapital der

Aktionäre der Hannover Rück AG + Anteil nicht beherrschender

Gesellschafter + Hybridkapital 5) Einschließlich Depotzinsen

Kennzahlen der Hannover Rück-Gruppe (auf IFRS-Basis)

in Mio. EUR Q3/2011 +/- Vorjahr Q3/2010

Hannover Rück-Gruppe Gebuchte Bruttoprämie 3.019,9 +5,1 %

2.872,3 Verdiente Nettoprämie 2.732,0 +3,0 % 2.651,5

Versicherungstechnisches Ergebnis 33,0 -32,9

Kapitalanlageergebnis1) 278,0 -13,3 % 320,8 Operatives Ergebnis

(EBIT) 241,0 -35,1 % 371,3 Konzernergebnis 163,2 -39,9 % 271,4

Ergebnis je Aktie in EUR 1,35 -39,9 % 2,25 Selbstbehalt 90,3 % 92,3

% EBIT-Rendite2) 8,8 % 14,0 % Eigenkapitalrendite (nach Steuern)3)

14,5 % 25,0 %

Schaden-Rückversicherung in Mio. EUR

Q3/2011 +/- Vorjahr Q3/2010 Gebuchte Bruttoprämie 1.676,0 +7,9 %

1.553,2 Verdiente Nettoprämie 1.542,6 +8,0 % 1.428,6

Versicherungstechnisches Ergebnis 70,3 25,2 Operatives Ergebnis

(EBIT) 181,8 -39,3 % 299,6 Konzernergebnis 130,9 -41,2 % 222,5

Selbstbehalt 91,1 % 91,4 % Kombinierte Schaden-/Kostenquote4) 95,2

% 98,2 % EBIT-Rendite2) 11,8 % 21,0 %

Personen-Rückversicherung in Mio. EUR Q3/2011 +/- Vorjahr

Q3/2010 Gebuchte Bruttoprämie 1.343,8 +1,9 % 1.319,3 Verdiente

Nettoprämie 1.189,2 -2,8 % 1.223,4 Operatives Ergebnis (EBIT) 60,2

-11,6 % 68,2 Konzernergebnis 39,2 -30,5 % 56,4 Selbstbehalt 89,4 %

93,3 % EBIT-Rendite2) 5,1 % 5,6 %

1) Including expense on funds withheld and contract deposits

2) Operating profit / loss (EBIT) / net premium earned

3) Annualised

4) Including interest income on contract deposits and funds withheld

Language: English Company: Hannover Rückversicherung AG Karl-Wiechert-Allee 50 30625 Hannover Germany Phone: +49-(0)511-5604-1500 Fax: +49-(0)511-5604-1648 E-mail: info@hannover-re.com Internet: www.hannover-re.com ISIN: DE0008402215 WKN: 840 221 Listed: Regulierter Markt in Frankfurt (Prime Standard), Hannover; Freiverkehr in Berlin, Düsseldorf, Hamburg, München, Stuttgart; Terminb�rse EUREX End of News DGAP News-Service

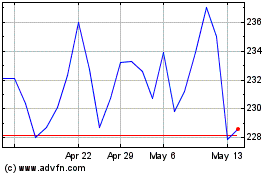

Hannover Ruck (TG:HNR1)

Historical Stock Chart

From Jun 2024 to Jul 2024

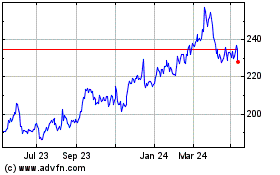

Hannover Ruck (TG:HNR1)

Historical Stock Chart

From Jul 2023 to Jul 2024