Ascot Resources Announces Increase to Previously Announced Bought Deal Offering to C$29 Million

10 July 2024 - 3:29AM

Ascot Resources Ltd. (TSX: AOT; OTCQX:

AOTVF) ("

Ascot" or the

"

Company") is pleased to announce that due to

strong demand, it has increased the size of the previously

announced public offering of flow-through units (the “Flow-Through

Units”) to 30,242,000 Flow-Through Units at a price of C$0.496 per

Flow-Through Unit and of hard dollar units (the “HD Units”) to

32,560,000 HD Units at a price of C$0.43 per HD Unit (together, the

“Offered Securities”) for gross proceeds of approximately C$29

million (the “Offering”). In connection therewith, the Company has

entered into an amended agreement with a syndicate of underwriters

led by BMO Capital Markets and Desjardins Capital Markets

(collectively, the “Underwriters”). Each Offered Security shall

consist of one common share of the Company (each, a “Share") and

one common share purchase warrant of the Company (each, a

“Warrant”). Each Warrant will entitle the holder to acquire one

Share (each, a “Warrant Share”) at a price of C$0.52 per Warrant

Share for a period of 24 months following Closing. In addition, the

Company has also granted the Underwriters an option, exercisable up

to 48 hours prior to the closing of the Offering, to purchase up to

an additional 11,628,000 HD Units for additional gross proceeds of

up to C$5,000,040 pursuant to the Offering.

The gross proceeds raised from the Shares and

Warrants comprising Flow-Through Units will be used by the Company

to incur eligible “Canadian development expenses" (within the

meaning of the Income Tax Act (Canada)) (the “Qualifying

Expenditures”). The Qualifying Expenditures will be incurred or

deemed to be incurred and renounced to the purchasers of the

Flow-Through Units with an effective date no later than December

31, 2024. The net proceeds raised pursuant to the issuance of the

HD Units will be used for the ongoing commissioning and ramp-up of

the Premier Gold Mine, for additional working capital, and for

general corporate purposes.

The Offering is expected to close on or about

July 25, 2024 and is subject to the Company receiving all necessary

regulatory approvals, including the approval of the Toronto Stock

Exchange.

The securities offered have not been registered

under the U.S. Securities Act of 1933, as amended, and may not be

offered or sold in the United States absent registration or an

applicable exemption from the registration requirements. This press

release shall not constitute an offer to sell or the solicitation

of an offer to buy nor shall there be any sale of the securities in

any State in which such offer, solicitation or sale would be

unlawful.

On behalf of the Board of Directors of

Ascot Resources Ltd.

“Derek C. White”President & CEO,

Director

For further information

contact:David Stewart, P.Eng.VP, Corporate Development

& Shareholder Communicationsdstewart@ascotgold.com778-725-1060

ext. 1024

About Ascot Resources Ltd.

Ascot is a Canadian mining company focused on

commissioning its 100%-owned Premier Gold Mine, which poured first

gold in April 2024 and is located on Nisga’a Nation Treaty Lands,

in the prolific Golden Triangle of northwestern British Columbia.

Concurrent with commissioning Premier towards commercial production

anticipated in the second half of 2024, the Company continues to

explore its properties for additional high-grade gold

mineralization. Ascot’s corporate office is in Vancouver, and its

shares trade on the TSX under the ticker AOT and on the OTCQX under

the ticker AOTVF. Ascot is committed to the safe and responsible

operation of the Premier Gold Mine in collaboration with Nisga’a

Nation and the local communities of Stewart, BC and Hyder,

Alaska.

For more information about the Company, please

refer to the Company’s profile on SEDAR+ at www.sedarplus.ca or

visit the Company’s web site at www.ascotgold.com.

The TSX has not reviewed and does not accept

responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding

Forward-Looking Information

All statements and other information contained

in this press release about anticipated future events may

constitute forward-looking information under Canadian securities

laws ("forward-looking statements"). Forward-looking statements are

often, but not always, identified by the use of words such as

"seek", "anticipate", "believe", "plan", "estimate", "expect",

"targeted", "outlook", "on track" and "intend" and statements that

an event or result "may", "will", "should", "could", “would” or

"might" occur or be achieved and other similar expressions. All

statements, other than statements of historical fact, included

herein are forward-looking statements, including statements in

respect of the closing of the Offering, the use of proceeds of the

Offering, advancement and development of the Premier Gold Mine and

the timing related thereto, the completion of the Premier Gold

Mine, the production of gold and management’s outlook for the

remainder of 2024 and beyond. These statements involve known and

unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those

anticipated in such forward-looking statements, including risks

related to the business of Ascot; exploration and potential

development of Ascot's projects; business and economic conditions

in the mining industry generally; fluctuations in commodity prices

and currency exchange rates; interpretation of drill results and

the geology, continuity and grade of mineral deposits; the need for

cooperation of government agencies and indigenous groups in the

exploration and development of Ascot’s properties and the issuance

of required permits; the need to obtain additional financing to

develop properties and uncertainty as to the availability and terms

of future financing; the possibility of delay in exploration or

development programs and uncertainty of meeting anticipated program

milestones; uncertainty as to timely availability of permits and

other governmental approvals; receipt of necessary stock exchange

approval for the Offering; and the risks, uncertainties and other

factors identified in Ascot's periodic filings with Canadian

securities regulators, available on Ascot's SEDAR+ profile at

www.sedarplus.ca including the Annual Information Form dated March

25, 2024 under the heading "Risk Factors". Forward-looking

statements are based on assumptions made with regard to: the

estimated costs associated with construction of the project; the

ability to maintain throughput and production levels at the PGP

mill; the tax rate applicable to the Company; future commodity

prices; the grade of mineral resources and mineral reserves; the

ability of the Company to convert inferred mineral resources to

other categories; the ability of the Company to reduce mining

dilution; the ability to reduce capital costs; and exploration

plans. Forward-looking statements are based on estimates and

opinions of management at the date the statements are made.

Although Ascot believes that the expectations reflected in such

forward-looking statements and/or information are reasonable, undue

reliance should not be placed on forward-looking statements since

Ascot can give no assurance that such expectations will prove to be

correct. Ascot does not undertake any obligation to update

forward-looking statements, other than as required by applicable

laws. The forward-looking information contained in this news

release is expressly qualified by this cautionary statement.

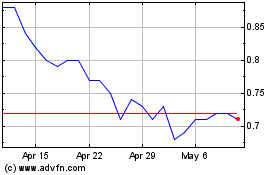

Ascot Resources (TSX:AOT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Ascot Resources (TSX:AOT)

Historical Stock Chart

From Feb 2024 to Feb 2025