ART Advanced Research Technologies Inc. (ART) (TSX: ARA), a

Canadian medical device company and a leader in optical molecular

imaging products for the healthcare and pharmaceutical industries,

announces its financial results for the third quarter ended

September 30, 2008. ART reported revenues of $1,354,365 for the

three-month period ended September 30, 2008, compared to $267,741

for the same quarter in 2007. For the nine-month period ended

September 30, 2008, revenues were $3,809,146, compared to $703,907

for the same period in 2007. For the 2008 third quarter, the

operating loss decreased by $364,326, or 17%, to $1,725,482, from

$2,089,808 for the same period a year ago. For the nine-month

period ended September 30, 2008, the operating loss was $4,150,766,

compared to $7,566,216, for the nine-month period ended September

30, 2007. ART incurred a net loss for the three-month period ended

September 30, 2008, of $1,545,940 or $0.02 per share, compared to

$2,200,777 or $0.04 per share for the same quarter in 2007. For the

nine-month period ended September 30, 2008, the net loss was

$3,926,616 or $0.04 per share, compared to $6,939,854 or $0.12 per

share, for the nine-month period ended September 30, 2007. All

dollar amounts referenced herein are in U.S. dollars, unless

otherwise stated.

2008 Third Quarter Highlights

- ART recognized revenue of $1.3 million from Optix� unit sales,

and has a backlog representing approximately $600,000 in additional

Optix unit sales.

- ART closed a private placement of approximately $6.0 million

in preferred shares.

- ART continued to manage expenses carefully, resulting in a

lower burn-rate compared to last year.

Post Quarter Events

- Final scans using the SoftScan� device were completed for the

treatment monitoring pilot study at the Sunnybrook Health Sciences

Centre in Toronto and, deeming these results as significant, the

team at Sunnybrook will be submitting them for publication in a

peer-reviewed journal.

Revenues

For the three-month period ended September 30, 2008, revenues

were $1,354,365, compared to $267,741 for the same period ended

September 30, 2007. Sales resulting from products amounted to

$1,221,436 in the quarter ended September 30, 2008, compared to

$267,741 for the same quarter of last year. Revenues resulting from

sales of products for the nine-month period ended September 30,

2008 amounted to $2,464,825, compared to $703,907 for the same

period of last year. The increase in product sales in 2008 when

compared to 2007 is explained by the Company's transition to a

direct distribution model. By selling directly to its customers,

the Company now generates a higher revenue per system since it does

not have to provide discounts to an exclusive distributor. During

the quarter ended September 30, 2008, product sales resulted from

the sale of four Optix� systems and Fenestra� products whereas for

the same quarter in 2007, product sales included Fenestra products

and add-ons for Optix systems only. The Company sold one service

contract, and recognized a total of $132,929 in services and other

revenues during the third quarter ended September 30, 2008. During

the same period ended September 30, 2007, there were no sales

resulting from services. During the nine-month period ended

September 30, 2008, ART sold the first SoftScan unit, five Optix

units, and add-ons for Optix systems that resulted in the

conversion of two single-wavelength Optix systems to the MX2

version. Also, the Company recognized revenues totaling $1,075,517

from services rendered on behalf of GE, as ART is completing the

transition out of the Optix distribution agreement with GE. During

the nine-month period ended September 30, 2007, there were no sales

of add-ons for Optix systems that resulted in the conversion of

single-wavelength Optix systems to the MX2 version and there were

no sales resulting from services.

Gross Margin

During the three-month and nine-month periods ended September

30, 2008, ART generated a gross margin of 45% and 62% respectively

from the sales of its products, compared to 66% and 55% for the

same periods in the previous year. The gross margin generated on

the sales of services and other revenues was 92% and 95%

respectively for the three-month and nine-month periods ended

September 30, 2008. No gross margin on sales of services is

recorded for 2007, as there were no sales of service contracts

during the same period in 2007. The decrease of the gross margin

ratio for the three-month period ended September 30, 2008, compared

to the same quarter of the previous year, is primarily due to a

different sales product mix. For the three-month period ended

September 30, 2008, the lower gross margin ratio is explained by

the fact that ART accounted for the cost of four systems during the

current period, as compared to last year when the Company mainly

sold add-ons, for which a higher gross margin ratio is typically

recognized. The increase in the gross margin ratio during the

nine-month period ended September 30, 2008, compared to the same

period in 2007 resulted from services and other revenues as well as

the sale of the SoftScan unit in the first quarter of 2008, where

the gross margin on this unit represented almost 100% of the sale,

given that this unit had been sold as a prototype and therefore

expensed as incurred in previous years.

Operating Expenses

The Company's research and development ("R&D") expenditures

for the three-month period ended September 30, 2008, net of

investment tax credits, amounted to $637,713, compared to

$1,093,057 for the same period ended September 30, 2007. For the

nine-month period ended September 30, 2008, R&D expenditures,

net of investment tax credits, were $2,110,642, compared to

$3,990,556 for the nine-month period ended September 30, 2007. The

R&D expenditures during the three-month and the nine-month

periods ended September 30, 2008, decreased by 42% and 47%

respectively, compared to the same periods in 2007. The decrease

was related to the medical sector given that the SoftScan program

reached important approval milestones in the first quarter of 2007

by obtaining the CE marking for Europe. As well, in the preclinical

sector, a decrease in R&D expenses was due to the completion of

the project leading to the new Optix MX2 system. The costs

associated with the achievement of these milestones, therefore, did

not have to be incurred again in 2008. As a part of its R&D

activities, ART continued to support the Optix product as R&D

teams collaborated with clients for the development of applications

using the new MX2 version of the system.

Selling, general, and administrative ("SG&A") expenses for

the three-month period ended September 30, 2008, totaled

$1,523,315, compared to $1,088,071 for the same period ended

September 30, 2007. For the nine-month period ended September 30,

2008, SG&A expenses were $4,275,379, compared to $3,706,266 for

the nine-month period ended September 30, 2007. The SG&A

expenses increased by $435,244 during the three-month period ended

September 30, 2008 and by $569,113 in the nine-month period ended

September 30, 2008, compared to the same periods of 2007. The

increase of the SG&A expenses during the three-month and the

nine-month periods was mainly due to the hiring of the new direct

sales force, which was effective in the first quarter of 2008, and

the direct marketing expenses incurred to support the

commercialization of the Optix, SoftScan and Fenestra products.

Net Loss

As a result of the foregoing factors, the net loss for the

three-month period ended September 30, 2008, was $1,545,940 or

$0.02 per share, compared to $2,200,777 or $0.04 per share for the

quarter ended September 30, 2007. For the nine-month period ended

September 30, 2008, the net loss was $3,926,616 or $0.04 per share,

compared to $6,939,854 or $0.12 per share, for the nine-month

period ended September 30, 2007.

Financial Position

As at September 30, 2008, ART has $5,018,947 in cash and cash

equivalents, and a working capital of $6,527,294.

The financial statements, accompanying notes to the financial

statements, and Management's Discussion and Analysis for the

three-month period ended September 30, 2008, will be available

online at www.sedar.com, or at www.art.ca, in the "Investors"

section. Summary financial tables are provided below. A detailed

list of the risks and uncertainties affecting the Company can be

found in the Management's Discussion and Analysis for the year

ended December 31, 2007, and in the Company's most recent Annual

Information Form, available on SEDAR at www.sedar.com.

Conference Call

ART will host a conference call today at 5:00 PM (EDT). The

telephone number to access the conference call is (514) 861-1531

when dialing within the Montreal area, or (877) 667-7766 for the

rest of North America. Outside of North America, please dial (514)

861-1531. A replay of the call will be available until November 25,

2008. To listen to the replay from the Montreal area, please dial

(514) 861-2272, or, (800) 408-3053 for the rest of North America.

From outside of North America, please dial (514) 861-2272. The

access code for the replay is 3273598#.

About ART

ART Advanced Research Technologies Inc. is a leader in molecular

imaging products for the healthcare and pharmaceutical industries.

ART has developed products in medical imaging, medical diagnostics,

disease research, and drug discovery with the goal of bringing new

and better treatments to patients faster. The Optix� optical

molecular imaging system, designed for monitoring physiological

changes in living systems at the preclinical study phases of new

drugs, is used by industry and academic leaders worldwide. The

SoftScan� optical medical imaging device is designed to improve the

diagnosis and treatment of breast cancer. Finally, the Fenestra�

line of molecular imaging contrast products provides image

enhancement for a wide range of preclinical Micro CT applications

allowing scientists to see greater detail in their imaging studies,

with potential extension into other major imaging modalities. ART

is commercializing some of these products in a global strategic

alliance with GE Healthcare, a world leader in mammography and

imaging. ART's shares are listed on the TSX under the ticker symbol

ARA. For more information on ART, visit our website at

www.art.ca.

This press release may contain forward-looking statements

subject to risks and uncertainties that would cause actual events

to differ materially from expectations. These risks and

uncertainties are described in the most recent Annual Information

Form and the financial statements for the year ended December 31,

2007, available on SEDAR (www.sedar.com).

Financial Statements (in U.S. dollars)

ART Advanced Research Technologies Inc.

Balance sheets

(In U.S. dollars)

September 30, December 31,

2008 2007

(unaudited)

-------------------------------------------------------------------------

ASSETS

Current assets

Cash $1,631,977 $561,325

Term deposits, 2.75% maturing in October

2008 (2007 - 4.05% maturing in January

2008) 3,386,970 3,026,329

Accounts receivable 2,303,600 1,768,146

Investment tax credits receivable 755,430 1,558,709

Inventories 1,350,241 1,510,499

Prepaid expenses 815,471 260,199

-------------------------------------------------------------------------

10,243,689 8,685,207

Property and equipment 505,525 551,210

Patents 1,774,108 2,135,855

Deferred development costs 2,304,556 1,268,438

-------------------------------------------------------------------------

$14,827,878 $12,640,710

-------------------------------------------------------------------------

-------------------------------------------------------------------------

LIABILITIES

Current liabilities

Bank loan 566,091 605,266

Accounts payable and accrued liabilities 2,851,705 2,652,219

Deferred revenues 110,579 156,167

Deferred grant 147,962 152,305

Current portion of obligations under

capital leases 40,058 -

-------------------------------------------------------------------------

3,716,395 3,565,957

Obligations under capital leases 55,823 -

-------------------------------------------------------------------------

-------------------------------------------------------------------------

3,772,218 3,565,957

-------------------------------------------------------------------------

-------------------------------------------------------------------------

SHAREHOLDERS' EQUITY

Share capital and share purchase warrants 39,142,553 32,217,942

Contributed surplus 4,823,965 4,537,336

Deficit (35,518,077) (31,007,264)

Accumulated other comprehensive income 2,607,219 3,326,739

-------------------------------------------------------------------------

11,055,660 9,074,753

-------------------------------------------------------------------------

$14,827,878 $12,640,710

-------------------------------------------------------------------------

-------------------------------------------------------------------------

ART Advanced Research Technologies Inc.

Shareholders's Equity

As at September 30, 2008

(In U.S. dollars)

Common Shares Preferred Shares

-------------------------------------------------------------------------

Number Amount Number Amount

-------------------------------------------------------------------------

Balance as at January 1,

2007 52,248,981 $14,561,504 8,341,982 $7,907,043

Net loss

Translation adjustment

-------------------------------------------------------------------------

Comprehensive loss

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Issue of shares for

business acquisition 162,369 95,262

Issue of shares for

cash 42,129,242 8,373,257

Issue of share purchase

warrants

Share and share purchase

warrant issue expenses

Stock-based compensation

Expired warrants

-------------------------------------------------------------------------

Balance as at December

31, 2007 94,540,592 $23,030,023 8,341,982 $7,907,043

-------------------------------------------------------------------------

-------------------------------------------------------------------------

(unaudited)

Balance as at

January 1, 2008 94,540,592 $23,030,023 8,341,982 $7,907,043

Net loss

Translation adjustment

-------------------------------------------------------------------------

Comprehensive income

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Issue of shares for

cash 53,101,296 7,100,000

Share issue expenses

Stock-based compensation

Expired warrants

-------------------------------------------------------------------------

Balance as at September

30, 2008 94,540,592 $23,030,023 61,443,278 $15,007,043

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Share Capital

and Share

Purchase

Warrants Warrants

-------------------------------------------------------------------------

Number Amount Total

-------------------------------------------------------------------------

Balance as at January 1, 2007 3,958,523 $1,562,623 $24,031,170

Net loss

Translation adjustment

-------------------------------------------------------------------------

Comprehensive loss

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Issue of shares for business

acquisition 95,262

Issue of shares for cash 8,373,257

Issue of share purchase warrants 2,175,841 497,288 497,288

Share and share purchase warrant

issue expenses

Stock-based compensation

Expired warrants (1,278,573) (779,035) (779,035)

-------------------------------------------------------------------------

Balance as at December 31, 2007 4,855,791 $1,280,876 $32,217,942

-------------------------------------------------------------------------

-------------------------------------------------------------------------

(unaudited)

Balance as at January 1, 2008 4,855,791 $1,280,876 $32,217,942

Net loss

Translation adjustment

-------------------------------------------------------------------------

Comprehensive income

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Issue of shares for cash 7,100,000

Share issue expenses

Stock-based compensation

Expired warrants (594,907) (175,389) (175,389)

-------------------------------------------------------------------------

Balance as at September 30, 2008 4,260,884 $1,105,487 $39,142,553

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Accumulated

Other

Contributed Comprehensive

Surplus Deficit Income Total

-------------------------------------------------------------------------

Balance as at

January 1, 2007 $3,586,059 $(21,247,643) $1,841,127 $8,210,713

Net loss (8,623,447) (8,623,447)

Translation

adjustment 1,485,612 1,485,612

-------------------------------------------------------------------------

Comprehensive loss (8,623,447) 1,485,612 (7,137,835)

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Issue of shares for

business acquisition 95,262

Issue of shares for

cash 8,373,257

Issue of share

purchase warrants 497,288

Share and share

purchase warrant

issue expenses (1,136,174) (1,136,174)

Stock-based

compensation 172,242 172,242

Expired warrants 779,035 -

-------------------------------------------------------------------------

Balance as at

December 31, 2007 $4,537,336 $(31,007,264) $3,326,739 $9,074,753

-------------------------------------------------------------------------

-------------------------------------------------------------------------

(unaudited)

Balance as at

January 1, 2008 $4,537,336 $(31,007,264) $3,326,739 $9,074,753

Net loss (3,926,616) (3,926,616)

Translation adjustment (719,520) (719,520)

-------------------------------------------------------------------------

Comprehensive income (3,926,616) (719,520) (4,646,136)

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Issue of shares for

cash 7,100,000

Share issue expenses (584,197) (584,197)

Stock-based

compensation 111,240 111,240

Expired warrants 175,389 -

-------------------------------------------------------------------------

Balance as at

September 30, 2008 $4,823,965 $(35,518,077) $2,607,219 $11,055,660

-------------------------------------------------------------------------

-------------------------------------------------------------------------

ART Advanced Research Technologies Inc.

Operations

(In U.S. dollars)

(Unaudited)

Three-month Periods ended Nine-month Periods ended

September 30 September 30

-------------------------------------------------------------------------

2008 2007 2008 2007

-------------------------------------------------------------------------

Sales

Products $1,221,436 $267,741 $2,464,825 $703,907

Services and other

revenues 132,929 - 1,344,321 -

-------------------------------------------------------------------------

1,354,365 267,741 3,809,146 703,907

-------------------------------------------------------------------------

Cost of sales

Products 672,385 91,120 924,580 313,312

Services and other

revenues 11,051 - 68,151 -

-------------------------------------------------------------------------

683,436 91,120 992,731 313,312

-------------------------------------------------------------------------

Gross margin 670,929 176,621 2,816,415 390,595

-------------------------------------------------------------------------

Operating expenses

Research and

development, net of

investment tax

credits 637,713 1,093,057 2,110,642 3,990,556

Selling, general

and administrative 1,523,315 1,088,071 4,275,379 3,706,266

Amortization 235,383 85,301 581,160 259,989

-------------------------------------------------------------------------

2,396,411 2,266,429 6,967,181 7,956,811

-------------------------------------------------------------------------

Operating loss 1,725,482 2,089,808 4,150,766 7,566,216

Other expenses

(revenues) (179,542) 110,969 (224,150) 184,943

-------------------------------------------------------------------------

Loss from operations

before income taxes 1,545,940 2,200,777 3,926,616 7,751,159

Current income taxes

(recovery) - - - (881,305)

-------------------------------------------------------------------------

Net loss $1,545,940 $2,200,777 $3,926,616 $6,939,854

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Basic and diluted net

loss per share $0.02 $0.04 $0.04 $0.12

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Basic and diluted

weighted average

number of common

shares outstanding 94,540,592 63,290,592 94,540,592 60,148,336

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Number of common

shares outstanding,

end of period 94,540,592 63,290,592 94,540,592 63,290,592

-------------------------------------------------------------------------

-------------------------------------------------------------------------

ART Advanced Research Technologies Inc.

Cash Flows

(In U.S. dollars)

(Unaudited)

Three-month Periods ended Nine-month Periods ended

September 30 September 30

-------------------------------------------------------------------------

2008 2007 2008 2007

-------------------------------------------------------------------------

OPERATING ACTIVITIES

Net loss $(1,545,940)$(2,200,777) $(3,926,616)$(6,939,854)

Items not affecting cash

Amortization 235,383 85,301 581,160 259,988

Stock-based

compensation 37,080 28,274 111,240 129,274

Gain on disposal of

fixed assets (835) - (27,542) -

Net changes in working

capital items

Accounts receivable (333,907) (90,352) (669,177) (229,936)

Investment tax credits

receivable (155,018) (178,725) 748,638 (461,078)

Inventories 257,283 19,805 57,806 19,866

Prepaid expenses (44,314) 55,568 (603,903) 70,703

Accounts payable and

accrued liabilities 792,624 (165,761) 365,924 (1,096,831)

Deferred revenues (82,375) - (34,848) -

Deferred grant - - 5,821 -

Income taxes payable - - - (811,304)

-------------------------------------------------------------------------

Cash flows from operating

activities (840,019) (2,446,667) (3,391,497) (9,059,172)

-------------------------------------------------------------------------

INVESTING ACTIVITIES

Short-term investments - 2,017,154 - (742,305)

Additions of property

and equipment (1,657) (16,629) (11,402) (112,780)

Proceeds from disposal of

property and equipment 1,617 - 60,789 -

Patents (27,466) - (159,309) -

Deferred development

costs (471,601) (251,829) (1,235,147) (493,635)

-------------------------------------------------------------------------

Cash flows from investing

activities (499,107) 1,748,696 (1,345,069) (1,348,720)

-------------------------------------------------------------------------

FINANCING ACTIVITIES

Bank loan - - 546,398

Repayment of obligations

under capital leases (9,761) - (27,756) -

Issue of convertible

preferred shares 6,000,000 - 7,100,000 -

Issue of common shares

and share purchase

warrants - - - 3,887,999

Equity issue expenses (502,004) - (584,197) (195,403)

-------------------------------------------------------------------------

Cash flows from financing

activities 5,488,235 - 6,488,047 4,238,994

Effect of foreign

currency translation

adjustments (256,497) 59,985 (320,188) 316,568

-------------------------------------------------------------------------

5,231,738 59,985 6,167,859 4,555,562

-------------------------------------------------------------------------

Net increase (decrease)

in cash and cash

equivalents 3,892,612 (637,986) 1,431,293 (5,852,330)

Cash and cash equivalents,

beginning of period 1,126,335 1,332,592 3,587,654 6,546,936

-------------------------------------------------------------------------

Cash and cash equivalents,

end of period $5,018,947 $694,606 $5,018,947 $694,606

-------------------------------------------------------------------------

-------------------------------------------------------------------------

CASH AND CASH

EQUIVALENTS

Cash $1,631,977 $544,606 $1,631,977 $544,606

Term deposits 3,386,970 150,000 3,386,970 150,000

-------------------------------------------------------------------------

$5,018,947 $694,606 $5,018,947 $694,606

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Supplemental disclosure

of cash flow

information

Interest paid $13,113 $69,912 $46,128 $93,344

Interest received $15,521 $17,315 $51,661 $44,193

-------------------------------------------------------------------------

The accompanying notes are an integral part of the financial statements.

Contacts: ART Advanced Research Technologies Inc. Jacques Bedard

Chief Financial Officer 514-832-0777 jbedard@art.ca www.art.ca

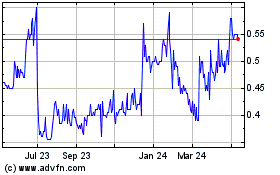

Aclara Resources (TSX:ARA)

Historical Stock Chart

From Jan 2025 to Feb 2025

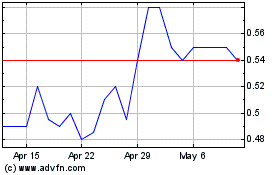

Aclara Resources (TSX:ARA)

Historical Stock Chart

From Feb 2024 to Feb 2025