Canadian Banc Corp. Monthly Dividend Declaration for Class A & Preferred Share

20 July 2021 - 11:00PM

Canadian Banc Corp. (The "Company") declares its monthly

distribution of $0.10267 for each Class A share and $0.04167 for

each Preferred share. Distributions are payable August 10, 2021 to

shareholders on record as at July 30, 2021.

Under the distribution policy announced in

September 2013, the monthly dividend payable on the Class A shares

is determined by applying a 10% annualized rate on the volume

weighted average market price (VWAP) of the Class A shares over the

last 3 trading days of the preceding month. As a result, Class A

shareholders of record on July 30, 2021 will receive a dividend of

$0.10267 per share based on the VWAP of $12.32 payable on August

10, 2021. The yield will remain stable at 10.00% (based on the

VWAP) under this distribution policy.

Preferred shareholders will receive prime plus

1.50% with a minimum rate of 5.00%.

Since inception Class A shareholders have

received a total of $16.82 per share and Preferred shareholders

have received a total of $8.50 per share inclusive of this

distribution, for a combined total of $25.32.

The Company invests in a portfolio of six

publicly traded Canadian Banks as follows: Bank of Montreal,

Canadian Imperial Bank of Commerce, National Bank of Canada, Royal

Bank of Canada, Bank of Nova Scotia, Toronto-Dominion Bank. Shares

held within the portfolio are expected to range between 5-20% in

weight but may vary at any time. To generate additional returns

above the dividend income earned on the portfolio, The Company

engages in a selective covered call writing program.

|

Distribution Details |

| |

|

| Class A Share

(BK) |

$0.10267 |

| Preferred Share

(BK.PR.A) |

$0.04167 |

| Ex-Dividend

Date: |

July 29, 2021 |

| Record

Date: |

July 30, 2021 |

|

Payable Date: |

August 10, 2021 |

Investor Relations: 1-877-478-2372Local:

416-304-4443www.canadianbanc.cominfo@quadravest.com

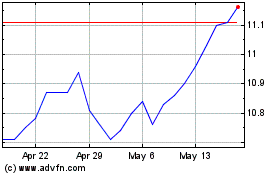

Canadian Banc (TSX:BK)

Historical Stock Chart

From Jun 2024 to Jul 2024

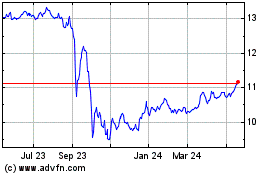

Canadian Banc (TSX:BK)

Historical Stock Chart

From Jul 2023 to Jul 2024