Condor Gold Closes Previously Announced Private Placement of Units for Aggregate Gross Proceeds of £3.25 Million

17 June 2022 - 9:07PM

Condor Gold (AIM: CNR; TSX: COG) is pleased to announce the closing

of its previously announced placing of 11,607,149 units of the

Company (“

Units”) at a price of 28p per Unit (the

“

Placing”), including a Directors subscription of

1,833,573 Units, for aggregate gross proceeds of £3.25 million

before expenses (the “

Proceeds”).

Each Unit is comprised of one ordinary share of

20p each in the Company (each, an “Ordinary

Share”) and one-half of one Ordinary Share purchase

warrant (each whole Ordinary Share purchase warrant, a

“Warrant”). Each Warrant, which is unlisted and

fully transferable, entitles the holder thereof to purchase one

Ordinary Share at a price of 35p for a period of 36 months from the

date on which the shares are issued pursuant to the Placing.

The Proceeds have been received by the Company,

and the Placing Shares were admitted to trading on AIM on 17 June

2022.

TSX Matters

The Company is relying on the exemption provided

for pursuant to Section 602.1 of the TSX Company Manual (the

“Manual”) from the requirements of the Manual and

the Toronto Stock Exchange (the “TSX”) related to

the Placing, as the Company is an “Eligible Interlisted Issuer” as

defined in the Manual.

For further information please visit

www.condorgold.com or contact:

|

Condor Gold plc |

Mark Child, Chairman and CEO+44 (0) 20 7493 2784 |

|

|

Beaumont Cornish Limited |

Roland Cornish and James Biddle+44 (0) 20 7628 3396 |

|

|

SP Angel Corporate Finance LLP |

Ewan Leggat +44 (0) 20 3470 0470 |

|

|

H&P Advisory Limited |

Andrew Chubb and Nilesh Patel+44 207 907 8500 |

|

|

BlytheRay |

Tim Blythe and Megan Ray+44 (0) 20 7138 3204 |

|

About Condor Gold plc:

Condor Gold plc was admitted to AIM in May 2006

and dual listed on the TSX in January 2018. The Company is a gold

exploration and development company with a focus on Nicaragua.

In August 2018, the Company announced that the

Ministry of the Environment in Nicaragua had granted the

Environmental Permit (“EP”) for the development,

construction and operation of a processing plant with capacity to

process up to 2,800 tonnes per day at its wholly-owned La India

gold Project (“La India Project”). The EP is

considered the master permit for mining operations in Nicaragua.

Condor has purchased a new SAG Mill, which has mainly arrived in

Nicaragua. Site clearance and preparation is at an advanced

stage.

La India Project contains a Mineral Resource of

9,850 Kt at 3.6 g/t gold for 1.14 M oz gold in the Indicated

category and 8,479 Kt at 4.3 g/t gold for 1.18 M oz gold in the

Inferred category. A gold price of $1,500/oz and a cut-off grade of

0.5 g/t and 2.0 g/t gold were assumed for open pit and underground

resources, respectively. A cut-off grade of 1.5 g/t gold was

furthermore applied within a part of the Inferred Resource. Mineral

Resources are not Mineral Reserves and do not have demonstrated

economic viability. There is no certainty that any part of the

Mineral Resources will be converted to Mineral Reserves.

Environmental Permits were granted in April and

May 2020 for the Mestiza and America open pits respectively, both

located close to La India. The Mestiza open pit hosts 92 Kt at a

grade of 12.1 g/t gold (36,000 oz contained gold) in the Indicated

Mineral Resource category and 341 Kt at a grade of 7.7 g/t gold

(85,000 oz contained gold) in the Inferred Mineral Resource

category. The America open pit hosts 114 Kt at a grade of 8.1 g/t

gold (30,000 oz) in the Indicated Mineral Resource category and 677

Kt at a grade of 3.1 g/t gold (67,000 oz) in the Inferred Mineral

Resource category. Following the permitting of the Mestiza and

America open pits, together with the La India Open Pit Condor has

1.12 M oz gold open pit Mineral Resources permitted for

extraction.

Disclaimer

Neither the contents of the Company's website

nor the contents of any website accessible from hyperlinks on the

Company's website (or any other website) is incorporated into, or

forms part of, this announcement.

Qualified Persons

The technical and scientific information in this

press release has been reviewed, verified and approved by Andrew

Cheatle, P.Geo., who is a “qualified person” as defined by NI

43-101 and Gerald D. Crawford, P.E., who is a “qualified person” as

defined by NI 43-101 and is the Chief Technical Officer of Condor

Gold plc.

Technical Information

Certain disclosure contained in this news

release of a scientific or technical nature has been summarised or

extracted from the technical report entitled “Technical Report on

the La India Gold Project, Nicaragua, October 2021”, dated October

22, 2021, with an effective date of September 9, 2021 (the

“Technical Report”), prepared in accordance with NI 43-101. The

Technical Report was prepared by or under the supervision of Tim

Lucks, Principal Consultant (Geology & Project Management),

Gabor Bacsfalusi, Principal Consultant (Mining), Benjamin Parsons,

Principal Consultant (Resource Geology), each of SRK Consulting

(UK) Limited, and Neil Lincoln of Lycopodium Minerals Canada Ltd.,

each of whom is an independent “qualified person” as defined by NI

43-101.

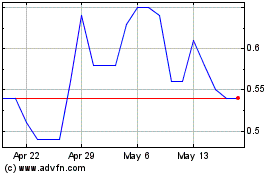

Condor Gold (TSX:COG)

Historical Stock Chart

From Jan 2025 to Feb 2025

Condor Gold (TSX:COG)

Historical Stock Chart

From Feb 2024 to Feb 2025