Enterprise Group Announces Results for the Fourth Quarter of 2017

08 February 2018 - 12:30AM

Enterprise Group, Inc. (“Enterprise,” or “the Company”) (TSX:E), a

consolidator of services to the energy sector focused primarily on

construction services and specialized equipment rental, today

released its Q4 2017 and FY2017 results. (Table below).

Key investment metrics evidencing ongoing growth:

- Q4 2017 revenue $10.7m versus Q4 2016 at $8.3m

- EBITDA Q4 2017 $2.56m versus Q4 2016 $1.87m

- Net Income Q4 2017 $1.1m versus Q4 2016 loss ($9.9m)

- EPS Q4 2017 $0.02 versus Q4 2016 loss ($0.18)

|

Consolidated:(1) |

Three months December

31, 2017 |

Three months December 31, 2016 |

Year ended December 31,

2017 |

Year ended December 31,

2016 |

|

Revenue |

$ |

10,687,760 |

|

$ |

8,326,646 |

|

$ |

37,667,118 |

|

$ |

28,723,585 |

|

|

Gross margin |

$ |

2,870,702 |

|

$ |

2,415,477 |

|

$ |

9,524,333 |

|

$ |

6,828,782 |

|

|

Gross margin % |

|

27 |

% |

|

29 |

% |

|

25 |

% |

|

24 |

% |

|

EBITDA |

$ |

2,563,045 |

|

$ |

1,872,760 |

|

$ |

6,990,897 |

|

$ |

3,851,894 |

|

|

Net income (loss) and comprehensive income (loss) |

$ |

1,094,583 |

|

($ |

9,920,464 |

) |

($ |

214,414 |

) |

($ |

13,165,040 |

) |

|

EPS |

$ |

0.02 |

|

($ |

0.18 |

) |

$ |

0.00 |

|

($ |

0.24 |

) |

(1) The Company’s annual yearend audit is currently under way

however it has not yet been completed. The financial

figures presented in this release are reported in Canadian dollars,

have been prepared in accordance with International Financial

Reporting Standards and are subject to audit verification

and adjustments. The Company expects to release its

audited consolidated yearend financial statements and MD&A no

later than March 29, 2018.

“While the business landscape has, and continues

to improve, we are maintaining our posture of rationalizing costs

and enhancing efficiencies,” stated Desmond O’Kell, Senior Vice

President. “With a positive Q4 2017 EPS over the same period in

2016 and showing significant increases in revenues and EBITDA for

the same period, we look forward to a very active and profitable

2018.”

Throughout 2017, Enterprise has experienced a

meaningful increase in activity from its existing customers coupled

with a substantial surge in new customers, which has resulted in

increased market share for its four business units.

Management’s efforts to streamline and maximize efficiencies have

translated into improved margins, positive cash-flow quarter after

quarter and a strong return to profitability.

In the second half of 2017 the Company returned

to profitability. Q3 and Q4 2017 delivered EPS of $0.01 and $0.02

respectively, while prior to this period the Company maintained

positive cashflow through the challenging downturn that began

2014-2015.

Previously released: On January

8th, 2018, Enterprise announced that it had secured a one-year

rental equipment supply and services agreement valued at C$9.1

million with one of Canada’s largest energy producers focused on

growing its strong portfolio of diverse resource plays.

For questions or additional information, please

contact: Leonard Jaroszuk, President & CEO, or Desmond

O’Kell, Senior Vice-President 780-418-4400

contact@enterprisegrp.ca

Forward Looking Information Certain statements

contained in this news release constitute forward-looking

information. These statements relate to future events or the

Company’s future performance. The use of any of the words "could",

"expect", "believe", "will", "projected", "estimated" and similar

expressions and statements relating to matters that are not

historical facts are intended to identify forward-looking

information and are based on the Company's current belief or

assumptions as to the outcome and timing of such future events.

Actual future results may differ materially. The Company's Annual

Information Form and other documents filed with securities

regulatory authorities (accessible through the SEDAR website

www.sedar.com) describe the risks, material assumptions and other

factors that could influence actual results and which are

incorporated herein by reference. The Company disclaims any

intention or obligation to publicly update or revise any

forward-looking information, whether as a result of new

information, future events or otherwise, except as may be expressly

required by applicable securities laws.

Non-IFRS Measures The Company uses

International Financial Reporting Standards (“IFRS”).

EBITDA/EBITDAS is not a measure that has any standardized meaning

prescribed by IFRS and is therefore referred to as a non-IFRS

measure. This news release contains references to

EBITDA/EBITDAS. This non-IFRS measure used by the Company may

not be comparable to a similar measure used by other

companies. Management believes that in addition to net

income, EBITDA/EBITDAS is a useful supplemental measure as it

provides an indication of the results generated by the Company’s

principal business activities prior to consideration of how those

activities are financed or how the results are taxed.

EBITDA/EBITDAS is calculated as net income excluding depreciation,

amortization, interest, taxes and stock based compensation.

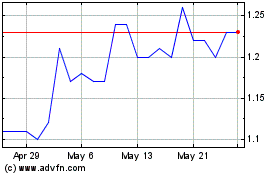

Enterprise (TSX:E)

Historical Stock Chart

From Oct 2024 to Nov 2024

Enterprise (TSX:E)

Historical Stock Chart

From Nov 2023 to Nov 2024