Fairfax Announces Acquisition of Additional Fairfax India Shares

16 February 2022 - 11:45PM

Fairfax Financial Holdings Limited (TSX: FFH and FFH.U) (“Fairfax”)

announces that it has acquired, through its subsidiaries, an

aggregate of 5,416,000 subordinate voting shares (the “Subordinate

Voting Shares”) of Fairfax India Holdings Corporation (TSX: FIH.U)

(“Fairfax India”), representing 4.93% of the issued and outstanding

Subordinate Voting Shares of Fairfax India, from two existing

shareholders at a price of US$12.00 (approximately C$15.29) per

Subordinate Voting Share for an aggregate purchase price of

approximately US$64.9 million (approximately C$82.8 million) (the

“Share Purchase”).

Prior to the Share Purchase, Fairfax

beneficially owned, and/or exercised control or direction over, (i)

23,030,285 Subordinate Voting Shares, representing 20.97% of

Fairfax India’s issued and outstanding Subordinate Voting Shares,

and (ii) 30,000,000 multiple voting shares of Fairfax India

(“Multiple Voting Shares”), representing 100% of the issued and

outstanding Multiple Voting Shares. Fairfax’s aggregate ownership,

control and/or direction of the Subordinate Voting Shares and

Multiple Voting Shares before giving effect to the Share Purchase

represented a 37.92% equity interest and a 94.61% voting interest

in Fairfax India.

After giving effect to the Share Purchase,

Fairfax now beneficially owns, and/or exercises control or

direction over, (a) 28,446,285 Subordinate Voting Shares,

representing 25.90% of Fairfax India’s issued and outstanding

Subordinate Voting Shares, and (b) 30,000,000 Multiple Voting

Shares, representing 100% of the issued and outstanding Multiple

Voting Shares. Fairfax’s aggregate ownership, control and direction

of the Subordinate Voting Shares and Multiple Voting Shares

following completion of the Share Purchase represents a 41.80%

equity interest and a 94.94% voting interest in Fairfax India.

The Subordinate Voting Shares were acquired by

Fairfax for investment purposes, and in the future, it may discuss

with management and/or the board of directors of Fairfax India any

of the transactions listed in clauses (a) to (k) of item 5 of Form

F1 of National Instrument 62-103 – The Early Warning System and

Related Take-over Bid and Insider Reporting Issues and it may

further purchase, hold, vote, trade, dispose or otherwise deal in

the securities of Fairfax India, in such manner as it deems

advisable to benefit from changes in market prices of Fairfax

India’s securities, publicly disclosed changes in the operations of

Fairfax India, its business strategy or prospects or from a

material transaction of Fairfax India. Fairfax acquired the

Subordinate Voting Shares pursuant to the private agreement

exemption under section 4.2(1) of National Instrument 62-104 –

Take-over Bids and Issuer Bids. Pursuant to the exemption, the

purchase price paid for the Subordinate Voting Shares was less than

115% of the market price of the Subordinate Voting Shares as of the

date of the agreement between Fairfax and the two existing

shareholders.

An early warning report will be filed by Fairfax

in accordance with applicable securities laws and will be available

on SEDAR at www.sedar.com or may be obtained directly from John

Varnell, Vice President, Corporate Development of Fairfax upon

request at the telephone number below. Rates of exchange in this

press release are based on the C$/US$ close on February 15, 2022

(as reported by the Bank of Canada).

Fairfax and Fairfax India’s head and registered

offices are located at 95 Wellington Street West, Suite 800,

Toronto, Ontario, M5J 2N7.

Fairfax is a holding company which, through its

subsidiaries, is primarily engaged in property and casualty

insurance and reinsurance and the associated investment

management.

| For further

information contact: |

John Varnell,

Vice President, Corporate Development at (416) 367-4941 |

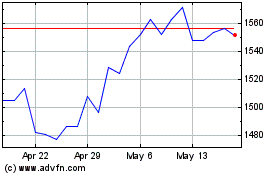

Fairfax Financial (TSX:FFH)

Historical Stock Chart

From Oct 2024 to Nov 2024

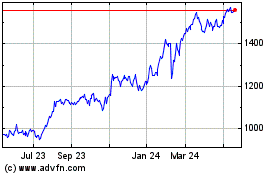

Fairfax Financial (TSX:FFH)

Historical Stock Chart

From Nov 2023 to Nov 2024