First Quantum Minerals Ltd. (“First Quantum” or “the Company”)

(TSX: FM) today announced that it has successfully completed the

pricing of its offering (the “Offering”) of $1,300 million

aggregate principal amount of 8.625% Senior Notes due 2031 (the

“Notes”). The original offering amount of the Notes of $1,000

million has been increased to $1,300 million. The issue price of

the Notes is 100.000%.

Interest on the Notes will accrue from the issue

date at a rate of 8.625% per annum and will be payable

semi-annually. Settlement is expected to take place on or about May

30, 2023, subject to customary conditions precedent for similar

transactions. The Notes will be senior unsecured obligations of the

Company and will be guaranteed by certain of the Company's

subsidiaries.

The Company intends to apply the gross proceeds

from the sale of the Notes towards (i) the repayment of $970

million aggregate principal amount under the Company’s existing

revolving credit facility, (ii) the redemption of $300 million

aggregate principal amount of the Company’s outstanding Senior

Notes due 2025 and (iii) a portion of the fees and expenses

associated with the Offering.

The information in this announcement does not

constitute an offer of securities for sale in the United States or

any other jurisdiction. Securities may not be offered or sold in

the United States unless they are registered or are exempt from the

registration of the U.S. Securities Act of 1933, as amended (the

“U.S. Securities Act”). The Notes will not be registered under the

U.S. Securities Act, or the securities laws of any state of the

U.S. or other jurisdictions and the Notes will not be offered or

sold within the U.S. or to, or for the account or benefit of, U.S.

Persons (as defined in Regulation S of the U.S. Securities Act),

except pursuant to an exemption from, or in a transaction not

subject to, the registration requirements of the U.S. Securities

Act and the applicable laws of other jurisdictions. The Company

does not intend to conduct a public offering in the United States

or any other jurisdiction. It may be unlawful to distribute this

announcement in certain jurisdictions.

The information in this announcement does not

constitute an offer, or a solicitation of an offer, of securities

for sale in the United States, Canada, the EEA, the UK,

Switzerland, Panama, Hong Kong, Japan, Singapore, or any other

jurisdiction in which such an offer, solicitation or sale is not

permitted.

In member states of the EEA (“Member States”) or

the UK, this announcement and any offer of securities if made

subsequently is directed only at persons who are "qualified

investors" (any such person a “Qualified Investor”) as defined in

Regulation (EU) 2017/1129 (as amended and superseded) (the

“Prospectus Regulation”). Any person in the EEA or the UK who

acquires securities in any offer of securities (an "investor") or

to whom any offer of securities is made will be deemed to have

represented and agreed that it is a Qualified Investor. Any

investor will also be deemed to have represented and agreed that

any securities acquired by it in the offer have not been acquired

on behalf of persons in the EEA or the UK other than Qualified

Investors or persons in the UK and other Member States for whom the

investor has authority to make decisions on a wholly discretionary

basis, nor have the securities been acquired with a view to their

offer or resale in the EEA or the UK to persons where this would

result in a requirement for publication by the Company of a

prospectus pursuant to the Prospectus Regulation. The Company

and others will rely upon the truth and accuracy of the foregoing

representations and agreements. This announcement constitutes a

public disclosure of inside information by the Company under

Regulation (EU) 596/2014 (16 April 2014). References to Regulations

or Directives include, in relation to the UK, those Regulations or

Directives as they form part of UK domestic law by virtue of the

European Union (Withdrawal) Act 2018 or have been implemented in UK

domestic law, as appropriate.

This communication is only directed at (i)

persons having professional experience in matters relating to

investments falling within Article 19(5) of the Financial Services

and Markets Act 2000 (Financial Promotion) Order 2005, as amended,

(the “Order”), or (ii) high net worth entities falling within

Article 49(2)(a) to (d) of the Order, or (iii) persons to whom it

would otherwise be lawful to distribute to or direct at, all such

persons together being referred to as “relevant persons”. The Notes

are only available to, and any invitation, offer or agreement to

subscribe, purchase or otherwise acquire such securities will be

engaged in only with relevant persons. Any person who is not a

relevant person should not act or rely on this communication or any

of its contents.

This announcement is not, and under no

circumstances is to be construed as, a prospectus, an advertisement

or a public offering of the securities referred to herein in

Canada. No securities commission or similar regulatory authority in

Canada has reviewed or in any way passed upon this announcement or

the merits of the securities referred to herein, and any

representation to the contrary is an offence.

First Quantum's address is set out below. For

further information, please contact First Quantum at one of the

numbers listed at the end of this news release.

Suite 2600, Three Bentall Centre595 Burrard

Street, P.O. Box 49314Vancouver, British ColumbiaV7X 1L3Tel: +1 416

361 6400Toll Free: +1 888 688 6577

For further information, visit our website at

www.first-quantum.com or contact:

Bonita To, Director, Investor Relations E-Mail:

info@fqml.com

CAUTIONARY STATEMENT ON FORWARD-LOOKING

INFORMATION

Certain information contained in this news

release constitutes "forward-looking statements" within the meaning

of the Private Securities Litigation Reform Act of 1995 and

forward-looking information under applicable Canadian securities

legislation. Such forward-looking statements or information involve

known and unknown risks, uncertainties and other factors which may

cause the actual results, financial condition, performance or

achievements of the Company to be materially different from any

future results, financial condition, performance or achievements

expressed or implied by such forward-looking statements or

information. Such factors may include, among others, those factors

disclosed in the Company's documents filed from time to time with

the Alberta, British Columbia, Saskatchewan, Manitoba, New

Brunswick, Nova Scotia, Prince Edward Island, Newfoundland and

Ontario Securities Commissions, the Autorité des marchés financiers

in Quebec, the United States Securities and Exchange Commission and

the London Stock Exchange.

PROHIBITION OF SALES TO EEA OR UK RETAIL

INVESTORS

The Notes are not intended to be offered, sold

or otherwise made available to and should not be offered, sold or

otherwise made available to any retail investor in the EEA or the

UK. For these purposes, a retail investor means a person who is one

(or more) of: (i) a retail client as defined in point (11) of

Article 4(1) of Directive 2014/65/EU ("MiFID II") or (ii) a

customer within the meaning of Directive 2016/97/EU, where that

customer would not qualify as a professional client as defined in

point (10) of Article 4(1) of MiFID II or (iii) not a Qualified

Investor. Consequently, no key information document required by

Regulation (EU) No 1286/2014 (the "PRIIPs Regulation") for offering

or selling the Notes or otherwise making them available to retail

investors in the EEA or the UK has been prepared and therefore

offering or selling the Notes or otherwise making them available to

any retail investor in the EEA or the UK may be unlawful under the

PRIIPS Regulation.

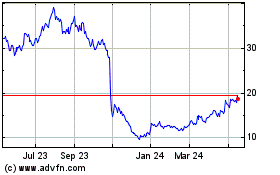

First Quantum Minerals (TSX:FM)

Historical Stock Chart

From Dec 2024 to Jan 2025

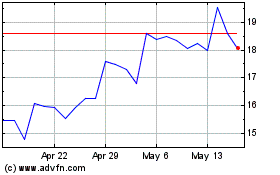

First Quantum Minerals (TSX:FM)

Historical Stock Chart

From Jan 2024 to Jan 2025