First Quantum Minerals Ltd. (“First Quantum” or the "Company”)

(TSX: FM) today reports results for the three months ended

September 30, 2024 (“Q3 2024” or the "third quarter") of net

earnings attributable to shareholders of the Company of $108

million ($0.13 earnings per share) and adjusted earnings1 of $119

million ($0.14 adjusted earnings per share2).

“While it is pleasing to see continued strong

operational performance from the Zambian operations during the

third quarter, this was marred by a tragic accident in September

resulting in the death of a colleague at Kansanshi. We continue to

support the family and we remain committed to ensure the safety of

our colleagues across the business. While ZESCO power restrictions

continue, our Zambian team's proactive actions have resulted in

minimal production impacts. The S3 Expansion continues to make good

progress for production in the second half of 2025,” commented

Tristan Pascall, Chief Executive Officer of First Quantum. “In

Panama, we continue to engage with local authorities for the

approval of the Preservation and Safe Management program for Cobre

Panamá. With Cobre Panamá remaining in a state of preservation and

safe management and the ongoing capital expenditures related to the

S3 Expansion, we are continuing efforts to maintain the strength of

the balance sheet and, as such, additional hedges were added during

the quarter.”

Q3 2024 SUMMARY

In Q3 2024, First Quantum reported gross profit

of $456 million, EBITDA1 of $520 million, net earnings

attributable to shareholders of $0.13 per share, and adjusted

earnings per share2 of $0.14. Relative to the second quarter of

2024 (“Q2 2024”), third quarter financial results improved due to

higher copper and gold sales volumes along with stronger realized

gold prices. Total copper production for the third quarter was

116,088 tonnes, a 13% increase from Q2 2024. Copper C1 cash cost3

was $1.57 per lb in the third quarter, a decrease of 9%

quarter-over-quarter.

There were a number of developments during the

third quarter that are also detailed in this news release:

- 2024 Guidance

for copper production has narrowed to the top end of previous

guidance, while gold production guidance has increased. Copper C1

cash cost3 guidance has narrowed to the low end of previous

guidance.

- During the

quarter, the Company entered into additional derivative contracts.

More than half of planned production and sales remains exposed to

spot copper prices through the period until the end of 2025.

- On October 15,

2024, FQM Trident signed a $425 million unsecured term loan

facility with a maturity date of September 2028 to replace the

previous Trident facility that was scheduled to mature in December

2025.

- While Zambia’s

energy crisis persisted in the third quarter, operational

adjustments minimized the effect on copper production. Minimal

operational interruptions are expected heading into the fourth

quarter of 2024.

- As part of the

ongoing board renewal program, the Company is pleased to announce

the appointments of Ms. Juanita Montalvo and Mr. Hanjun ("Kevin")

Xia to its Board of Directors with immediate effect.

_______________________1 EBITDA and

adjusted earnings (loss) are non-GAAP financial measures. These

measures do not have a standardized meaning prescribed by IFRS and

might not be comparable to similar financial measures disclosed by

other issuers. See “Regulatory Disclosures”.2 Adjusted

earnings (loss) per share is a non-GAAP ratio which does not have a

standardized meaning prescribed by IFRS and might not be comparable

to similar financial measures disclosed by other issuers. See

“Regulatory Disclosures”.3 C1 cash cost (C1) is a non-GAAP ratio,

which does not have a standardized meaning prescribed by IFRS and

might not be comparable to similar financial measures disclosed by

other issuers. See “Regulatory Disclosures”

Q3 2024 OPERATIONAL HIGHLIGHTS

Total copper production for the third quarter

was 116,088 tonnes, a 13% increase from Q2 2024 as a result of

higher production at the Zambian operations. While Zambia’s energy

crisis persisted in the third quarter, First Quantum’s proactive

sourcing of supplementary power minimized disruptions, allowing

normal operations to continue for most of the quarter. The impact

of higher costs associated with the imported power was mitigated by

strong gold by-product credits during the quarter. Copper C1 cash

cost1 was $0.16 per lb lower quarter-over-quarter at $1.57 per lb,

reflecting higher copper production, along with lower fuel costs.

Copper sales volumes totalled 112,094 tonnes, approximately 3,994

tonnes lower than production due to the timing of shipments.

- Kansanshi

reported the highest quarterly copper production since the fourth

quarter of 2021. Copper production of 49,810 tonnes in Q3 2024 was

8,303 tonnes higher than the previous quarter as continued mining

discipline resulted in higher feed grades on the mixed and oxide

circuits. During the quarter, the sulphide and mixed mills were

swapped to increase the throughput of mixed material which

contained higher grades. Gold production of 31,659 ounces for the

third quarter of 2024 was the highest quarterly production since

the first quarter of 2022. Copper C1 cash cost1 of $1.29 per lb was

$0.22 lower quarter-over-quarter due to improved production

volumes. Production guidance for 2024 has increased to 155,000 -

165,000 tonnes of copper from 130,000 - 150,000 tonnes while gold

production guidance has increased to 90,000 - 100,000 ounces from

65,000 - 75,000 ounces. A swap of the mixed and sulphide mills will

continue in the fourth quarter in order to maximize mixed grade

through the mills. Fourth quarter gold production is expected to be

lower than the third quarter due to lower grades.

- Sentinel

reported copper production of 58,412 tonnes in Q3 2024,

approximately 4,817 tonnes higher than the previous quarter as

improved throughput levels benefitted from better performance of

the in-pit crushers as well as improved fragmentation of the ore.

Copper C1 cash cost1 of $1.86 per lb was lower than the preceding

quarter as a result of higher production volumes. Copper production

guidance for 2024 has narrowed to 220,000 - 230,000 tonnes from

220,000 - 250,000 tonnes. Mining performance and throughput is

expected to further improve over the remainder of the year with the

ongoing development of Stage 3 (Western Cut-back) which will enable

improved mining productivities due to the increased availability of

softer material on shorter haul cycles. The improvement in

fragmentation experienced in the third quarter that led to improved

crushing and milling rates is expected to continue for the

remainder of the year. The development of the Stage 1 sump is on

schedule to be completed during October 2024 along with other site

works in preparation for the upcoming wet season.

- Enterprise had

its first full quarter of commercial production, producing 4,827

tonnes of nickel during the third quarter, a decrease from 6,147

tonnes in Q2 2024. The plant has been stable and achieved record

throughput in August 2024. The plant was shut down for the last

nine days of September due to power supply restrictions in order to

prioritize power for the copper circuit. Plant operations resumed

in October. Production guidance for 2024 for Enterprise remains

unchanged at 17,000 – 20,000 contained tonnes of nickel. Good

progress has been made in preparation for the wet season and

securing of the south wall. The focus for the remainder of the year

will be on increasing mobile equipment reliability through

supporting the contractor uplift maintenance practices in order to

increase mining volumes.

- Cobre Panamá

remains in a phase of preservation and safe management ("P&SM")

with production halted and production guidance suspended. During

the quarter, the process plant assets inspection frequency was

changed from 28 to 56 days, while the equipment start-up frequency

remains unchanged at 14 days to ensure equipment preservation

through dynamic lubrication and monitoring asset conditions. All

the major ultra-class mobile equipment is in a maintenance cycle

that adheres to the original equipment manufacturer’s long-term

storage recommendations and includes periodic inspections as well

as scheduled startups. In addition to asset preservation, a key

focus continues to be on maintaining the environmental stability

for all areas of the site and compliance with the environmental and

social impact study for the project, which remains in force. The

costs for the P&SM program in the third quarter were

approximately $13 million per month, which included labour,

maintenance spares, contractor’s services, electricity, and other

general expenses. During the quarter, activities on site were

further curtailed with reduction in active equipment for the

tailings management facility and open pit maintenance. For the

remainder of the year, P&SM expenses are expected to be $11 -

$13 million per month, depending on the level of environmental

stability and asset integrity programs. The Company is actively

managing the P&SM costs of Cobre Panamá and will adjust the

level of employment and cost of these activities according to the

conditions on the ground in Panama. Approximately 121 thousand dry

metric tonnes of copper concentrate remain onsite.

_______________________

1 C1 cash cost (C1) is a non-GAAP ratio, which

does not have a standardized meaning prescribed by IFRS and might

not be comparable to similar financial measures disclosed by other

issuers. See “Regulatory Disclosures”

FINANCIAL HIGHLIGHTS

Financial results continue to be impacted by

Cobre Panamá being in a phase of P&SM, however, the third

quarter benefitted from higher copper and gold sales volumes along

with stronger gold prices.

- Gross profit for

the third quarter of $456 million was $123 million higher than Q2

2024, while EBITDA1 of $520 million for the same period was

$184 million higher.

- Cash flows from

operating activities of $260 million ($0.31 per share2) for the

quarter were $137 million lower than Q2 2024.

- Net

debt3 increased by $154 million during the quarter,

attributable mainly to planned capital expenditures at Kansanshi

and an increase in net working capital, taking the net debt3 level

to $5,591 million, with total debt at $6,284 million as at

September 30, 2024.

_______________________1 EBITDA is a non-GAAP

financial measure which does not have a standardized meaning

prescribed by IFRS and might not be comparable to similar financial

measures disclosed by other issuers. See “Regulatory Disclosures”.2

Cash flows from operating activities per share is a non-GAAP ratio,

which does not have a standardized meaning prescribed by IFRS and

might not be comparable to similar financial measures disclosed by

other issuers. See “Regulatory Disclosures”.3 Net debt is a

supplementary financial measure which does not have a standardized

meaning prescribed by IFRS and might not be comparable to similar

financial measures disclosed by other issuers. See “Regulatory

Disclosures”.

HEDGING PROGRAM

During the quarter, and consistent with the

approach outlined in the second quarter results of 2024, the

Company entered into derivative contracts, in the form of

additional unmargined zero cost copper collars, as protection from

downside price movements, financed by selling price upside beyond

certain levels on a matched portion of production. More than half

of planned production and sales remains exposed to spot copper

prices through the period until the end of 2025.

At October 22, 2024, the Company had zero

cost copper collar contracts for 245,400 tonnes at weighted average

prices of $4.18 per lb to $5.01 per lb outstanding with maturities

to December 2025.

FQM TRIDENT FACILITY

At Trident, on October 15, 2024, FQM Trident

signed a $425 million unsecured term loan facility (the “FQM

Trident Facility”) with a maturity date of September 2028 to

replace the previous Trident facility that was scheduled to mature

in December 2025. Repayments on the FQM Trident Facility will

commence in March 2026 and are due every six months thereafter.

This action is in line with the Company’s prudent management of its

debt maturities.

CONSOLIDATED FINANCIAL HIGHLIGHTS

|

|

QUARTERLY |

|

|

Q3 2024 |

Q2 2024 |

Q3 2023 |

|

Sales revenues |

|

1,279 |

|

|

1,231 |

|

|

2,029 |

|

|

Gross profit |

|

456 |

|

|

333 |

|

|

660 |

|

|

Net earnings (loss) attributable to shareholders of the

Company |

|

108 |

|

|

(46 |

) |

|

325 |

|

|

Basic earnings (loss) per share |

$0.13 |

|

|

($0.06 |

) |

$0.47 |

|

|

Diluted earnings (loss) per share |

$0.13 |

|

|

($0.06 |

) |

$0.47 |

|

|

Cash flows from operating activities3 |

|

260 |

|

|

397 |

|

|

594 |

|

|

Net debt1 |

|

5,591 |

|

|

5,437 |

|

|

5,637 |

|

|

EBITDA1,2 |

|

520 |

|

|

336 |

|

|

969 |

|

|

Adjusted earnings (loss)1 |

|

119 |

|

|

(13 |

) |

|

359 |

|

|

Adjusted earnings (loss) per share3 |

$0.14 |

|

|

($0.02 |

) |

$0.52 |

|

|

Cash cost of copper production excluding Cobre Panamá (C1) (per

lb)3,4 |

$1.57 |

|

$1.73 |

|

$1.66 |

|

|

Total cost of copper production excluding Cobre Panamá (C3) (per

lb)3,4 |

$2.54 |

|

$2.83 |

|

$2.60 |

|

|

Copper all-in sustaining cost excluding Cobre Panamá (AISC) (per

lb)3,4 |

$2.35 |

|

$2.71 |

|

$2.54 |

|

|

Cash cost of copper production (C1) (per lb)3,4 |

$1.57 |

|

$1.73 |

|

$1.42 |

|

|

Total cost of copper production (C3) (per lb)3,4 |

$2.59 |

|

$2.87 |

|

$2.29 |

|

|

Copper all-in sustaining cost (AISC) (per lb)3,4 |

$2.42 |

|

$2.82 |

|

$2.02 |

|

|

Realized copper price (per lb)3 |

$4.24 |

|

$4.39 |

|

$3.70 |

|

|

Net earnings (loss) attributable to shareholders of the

Company |

|

108 |

|

|

(46 |

) |

|

325 |

|

|

Adjustments attributable to shareholders of the Company: |

|

|

|

|

Adjustment for expected phasing of Zambian value-added tax

(“VAT”) |

|

(17 |

) |

|

(27 |

) |

|

(15 |

) |

|

Loss on redemption of debt |

|

– |

|

|

– |

|

|

– |

|

|

Total adjustments to EBITDA1 excluding depreciation2 |

|

32 |

|

|

71 |

|

|

61 |

|

|

Tax adjustments |

|

– |

|

|

6 |

|

|

(12 |

) |

|

Minority interest adjustments |

|

(4 |

) |

|

(17 |

) |

|

– |

|

|

Adjusted earnings (loss)1 |

|

119 |

|

|

(13 |

) |

|

359 |

|

1 EBITDA and adjusted earnings (loss) are

non-GAAP financial measures, and net debt is a supplementary

financial measure. These measures do not have a standardized

meaning under IFRS and might not be comparable to similar financial

measures disclosed by other issuers. Adjusted earnings (loss) have

been adjusted to exclude items from the corresponding IFRS measure,

net earnings (loss) attributable to shareholders of the Company,

which are not considered by management to be reflective of

underlying performance. The Company has disclosed these measures to

assist with the understanding of results and to provide further

financial information about the results to investors and may not be

comparable to similar financial measures disclosed by other

issuers. The use of adjusted earnings (loss) and EBITDA represents

the Company’s adjusted earnings (loss) metrics. See “Regulatory

Disclosures”. 2 Adjustments to EBITDA in 2024 principally

relate to impairment expense, restructuring expense and foreign

exchange losses (2023 - royalties, restructuring expenses and

foreign exchange losses).3 Adjusted earnings (loss) per share,

realized metal prices, copper all-in sustaining cost (copper AISC),

copper C1 cash cost (copper C1) and total cost of copper (copper

C3) are non-GAAP ratios, which do not have a standardized meaning

prescribed by IFRS and might not be comparable to similar financial

measures disclosed by other issuers. See “Regulatory

Disclosures”.4 Excludes the sale of copper anode produced from

third-party concentrate purchased at Kansanshi. Sales of copper

anode attributable to third-party concentrate purchases were 7,537

tonnes for the three months ended September 30, 2024, (11,228

tonnes for the three months ended September 30, 2023).

CONSOLIDATED OPERATING HIGHLIGHTS

|

|

QUARTERLY |

|

|

Q3 2024 |

Q2 2024 |

Q3 2023 |

|

Copper production (tonnes)1 |

|

116,088 |

|

102,709 |

|

221,550 |

|

Cobre Panamá |

|

– |

|

– |

|

112,734 |

|

Kansanshi |

|

49,810 |

|

41,507 |

|

39,600 |

|

Sentinel |

|

58,412 |

|

53,595 |

|

63,805 |

|

Other Sites |

|

7,866 |

|

7,607 |

|

5,411 |

|

Copper sales (tonnes)2 |

|

112,094 |

|

94,628 |

|

218,946 |

|

Cobre Panamá |

|

– |

|

– |

|

113,616 |

|

Kansanshi2 |

|

49,131 |

|

36,332 |

|

41,820 |

|

Sentinel |

|

53,662 |

|

51,113 |

|

58,600 |

|

Other Sites |

|

9,301 |

|

7,183 |

|

4,910 |

|

Gold production (ounces) |

|

41,006 |

|

32,266 |

|

73,125 |

|

Cobre Panamá |

|

– |

|

– |

|

45,996 |

|

Kansanshi |

|

31,659 |

|

23,575 |

|

19,946 |

|

Guelb Moghrein |

|

8,621 |

|

8,144 |

|

6,765 |

|

Other sites |

|

726 |

|

547 |

|

418 |

|

Gold sales (ounces)3 |

|

43,371 |

|

37,140 |

|

77,106 |

|

Cobre Panamá |

|

– |

|

– |

|

45,959 |

|

Kansanshi |

|

34,186 |

|

28,860 |

|

23,704 |

|

Guelb Moghrein |

|

8,382 |

|

7,572 |

|

7,292 |

|

Other sites |

|

803 |

|

708 |

|

151 |

|

Nickel production (contained tonnes)4 |

|

4,827 |

|

7,400 |

|

7,046 |

|

Nickel sales (contained tonnes)5 |

|

4,598 |

|

7,645 |

|

5,749 |

|

Cash cost of copper production (C1) (per lb)2,6 |

$1.57 |

$1.73 |

$1.42 |

|

C1 (per lb) excluding Cobre Panamá 2,6 |

$1.57 |

$1.73 |

$1.66 |

|

Total cost of copper production (C3) (per lb)2,6 |

$2.59 |

$2.87 |

$2.29 |

|

Copper all-in sustaining cost (AISC) (per lb)2,6 |

$2.42 |

$2.82 |

$2.02 |

|

AISC (per lb) excluding Cobre Panamá 2,6 |

$2.35 |

$2.71 |

$2.54 |

1 Production is presented on a contained basis,

and is presented prior to processing through the Kansanshi

smelter.2 Sales exclude the sale of copper anode produced from

third-party concentrate purchased at Kansanshi. Sales of copper

anode attributable to third-party concentrate purchases were 7,537

tonnes for the three months ended September 30, 2024, respectively,

(11,228 tonnes for the three months ended September 30, 2023).3

Excludes refinery-backed gold credits purchased and delivered under

the precious metal streaming arrangement (see “Precious Metal

Stream Arrangement”).4 Nickel production includes 3,875 tonnes of

pre-commercial production from Enterprise for the three months

ended June 30, 2024, which is not included in earnings (loss) or

C1, C3 and AISC calculations. (1,556 tonnes for the three months

ended September 30, 2023).5 Nickel sales (contained tonnes)

includes 1,388 tonnes of of pre-commercial sales from Enterprise

for the three months ended June 2024. (97 tonnes for the three

months ended September 30, 2023.6 Copper all-in sustaining cost

(copper AISC), copper C1 cash cost (copper C1), and total cost of

copper (copper C3) are non-GAAP ratios, which do not have a

standardized meaning prescribed by IFRS and might not be comparable

to similar financial measures disclosed by other issuers. See

“Regulatory Disclosures”.

REALIZED METAL

PRICES1

|

|

QUARTERLY |

|

|

Q3 2024 |

Q2 2024 |

Q3 2023 |

|

Average LME copper cash price (per lb) |

$4.18 |

|

$4.42 |

|

$3.79 |

|

|

Realized copper price1 (per lb) |

$4.24 |

|

$4.39 |

|

$3.70 |

|

|

Treatment/refining charges (“TC/RC”) (per lb) |

|

($0.06 |

) |

|

($0.06 |

) |

|

($0.15 |

) |

|

Freight charges (per lb) |

|

($0.03 |

) |

|

($0.05 |

) |

|

($0.02 |

) |

|

Net realized copper price1 (per lb) |

$4.15 |

|

$4.28 |

|

$3.53 |

|

|

Average LBMA cash price (per oz) |

$2,474 |

|

$2,338 |

|

$1,929 |

|

|

Net realized gold price1,2 (per oz) |

$2,383 |

|

$2,207 |

|

$1,764 |

|

|

Average LME nickel cash price (per lb) |

$7.37 |

|

$8.35 |

|

$9.23 |

|

|

Net realized nickel price1 (per lb) |

$7.35 |

|

$7.86 |

|

$8.96 |

|

1 Realized metal prices are a non-GAAP

ratio, do not have standardized meanings under IFRS and might not

be comparable to similar financial measures disclosed by other

issuers. See “Regulatory Disclosures” for further

information. 2 Excludes gold revenues recognized under

the precious metal stream arrangement.

2024 GUIDANCE

Guidance is based on a number of assumptions and

estimates as of September 30, 2024, including among other things,

assumptions about metal prices and anticipated costs and

expenditures. Guidance involves estimates of known and unknown

risks, uncertainties and other factors, which may cause the actual

results to be materially different.

Guidance has been updated to reflect performance

year-to-date and the outlook for the remainder of the year. Copper

production guidance has narrowed to a range of 400,000 – 420,000

tonnes from 370,000 – 420,000 tonnes. Strong performance from

Kansanshi, Guelb Moghrein and Cayeli has resulted in an increase in

copper production guidance for these operations. Sentinel guidance

range has been narrowed with the upper end reduced based on

performance to date. Gold production guidance has increased to

120,000 – 135,000 ounces from 95,000 – 115,000 ounces to reflect

higher grades experienced to date at Kansanshi. Nickel production

guidance remains unchanged.

Copper unit cost guidance has been narrowed for

both C11 and AISC1 to reflect performance to date, coupled with a

favourable Zambian kwacha/US dollar exchange rate and strong

by-product credits, partially offset by increased Zambian

electricity costs. Guidance does not include any P&SM costs

with respect to Cobre Panamá. C1 cash costs1 guidance assumes a

gold price of $2,500 per ounce for the remainder of the year, an

average Brent crude oil price of $85 per barrel and a Zambian

kwacha/US dollar exchange rate of 25.

Previous nickel unit cash cost guidance for 2024

was for Ravensthorpe only and was withdrawn in the second quarter.

There is no guidance provided for Enterprise as operations ramp up

this year. Care and maintenance costs for Ravensthorpe are expected

to be approximately $2 million per month in the fourth quarter.

Guidance for total capital expenditure remains

unchanged at $1,250 - $1,400 million.

PRODUCTION GUIDANCE

|

000’s |

2024Previous Guidance |

2024Updated Guidance |

|

Copper (tonnes) |

370 – 420 |

400 – 420 |

|

Gold (ounces) |

95 – 115 |

120 – 135 |

|

Nickel (contained tonnes) |

22 – 25 |

22 – 25 |

_______________________1 Realized metal prices,

C1 cash cost (C1), and all-in sustaining cost (AISC) are non-GAAP

ratios which do not have a standardized meaning prescribed by IFRS

and might not be comparable to similar financial measures disclosed

by other issuers. See “Regulatory Disclosures”.

PRODUCTION GUIDANCE BY OPERATION1

|

Copper production guidance (000’s tonnes) |

2024Previous Guidance |

2024Updated Guidance |

|

Kansanshi |

130 – 150 |

155 – 165 |

|

Trident - Sentinel |

220 – 250 |

220 – 230 |

|

Other sites |

20 |

25 |

|

Gold production guidance (000’s ounces) |

|

|

|

Kansanshi |

65 – 75 |

90 – 100 |

|

Guelb Moghrein |

28 – 38 |

28 – 33 |

|

Other sites |

2 |

2 |

|

Nickel production guidance (000’s contained

tonnes) |

|

|

|

Ravensthorpe |

5 |

5 |

|

Trident - Enterprise |

17 – 20 |

17 – 20 |

1 Production is stated on a 100% basis as the

Company consolidates all operations.

CASH COST1 AND ALL-IN SUSTAINING COST1

|

Total Copper |

2024Previous Guidance |

2024Updated Guidance |

|

C1 (per lb)1 |

$1.80 – $2.05 |

$1.80 – $1.95 |

|

AISC (per lb)1 |

$2.70 – $3.00 |

$2.70 – $2.90 |

1 C1 cash cost (C1), and all-in sustaining cost

(AISC) are non-GAAP ratios which do not have a standardized meaning

prescribed by IFRS and might not be comparable to similar financial

measures disclosed by other issuers. See “Regulatory

Disclosures”.

PURCHASE AND DEPOSITS ON PROPERTY, PLANT & EQUIPMENT

|

|

2024 |

|

Capitalized stripping1 |

180 – 230 |

|

Sustaining capital1 |

260 – 290 |

|

Project capital1 |

810 – 880 |

|

Total capital expenditure |

1,250 – 1,400 |

1 Capitalized stripping, sustaining capital and project capital

are non-GAAP financial measures which do not have a standardized

meaning prescribed by IFRS and might not be comparable to similar

financial measures disclosed by other issuers. See “Regulatory

Disclosures”.

ZAMBIA POWER UPDATE

During the quarter, Zambia’s energy crisis

persisted due to the El Niño-induced drought, which has

significantly reduced the country’s hydropower generation. Despite

these challenges, First Quantum’s proactive sourcing of

supplementary power minimized disruptions, allowing normal

operations to continue for most of the quarter.

In late September 2024, planned maintenance work

on a 150 MW thermal generation unit at Maamba Collieries led to a

nine-day, 30% power reduction imposed on Zambian Electricity Supply

Corporation Limited (“ZESCO”)-supplied power to the Company’s

Zambian mine sites. However, the Company’s supplementary sourcing

strategy limited the actual impact on its Zambian mine sites to a

10% reduction in maximum power availability during the 9-day

period. Operational adjustments, including rescheduling maintenance

and prioritizing critical activities, minimized the effect on

copper production.

By the end of the quarter, with the restoration

of 150 MW from the thermal generation unit and increased ZESCO

imports from South Africa, power availability at the Company’s

Zambian mine sites returned to normal and minimal operational

interruptions are expected heading into the fourth quarter of

2024.

The annualized impact of $0.06 per lb on Copper

C1 cash costs1 from the supplementary sourcing strategy is aligned

with estimates communicated in the second quarter of 2024 and

expected to remain unchanged for the balance of the financial

year.

_______________________1 Copper C1 cash cost

(copper C1) is a non-GAAP ratio, which does not have a standardized

meaning prescribed by IFRS and might not be comparable to similar

financial measures disclosed by other issuers. See “Regulatory

Disclosures”.

ZAMBIA 2025 NATIONAL BUDGET

The 2025 National Budget was presented on

September 27, 2024 by the Minister of Finance and National

Planning, Dr. Situmbeko Musokotwane, under the theme "Building

Resilience for Inclusive Growth and Improved Livelihoods".

No significant changes were announced to the

mining tax regime, with the Minister reaffirming his commitment to

maintaining stable and predictable tax policies to encourage

investment.

COBRE PANAMÁ UPDATE

At the request of the Ministry of Commerce and

Industries (“MICI”), Cobre Panamá delivered a draft plan for the

first phase of the P&SM plan on January 16, 2024. The incoming

administration reviewed the P&SM plan upon taking office in

July 2024 and requested additional information, which was submitted

by the Company on August 27, 2024, along with a formal presentation

to MICI on September 25, 2024. The plan is still pending government

approval and, therefore, not all aspects of the plan have been

implemented by the Company.

During the quarter, President Mulino made public

statements to the effect that his government intends to address the

Cobre Panamá mine in early 2025. The Government of Panama ("GOP")

also announced that an integrated audit of Cobre Panamá would be

conducted with international experts to establish a factual basis

to aid in decision making for the future of the mine. The Company

welcomes this audit process, although the timeline remains

unclear.

In parallel with the P&SM of the site, the

Company has also embarked on a comprehensive program of public

outreach in order to make more transparent information available to

the public about Cobre Panamá. Since the beginning of 2024, these

efforts have reached over 20,000 Panamanian citizens through site

visits (which are currently suspended, pending P&SM approval)

and briefings in universities, schools, and public spaces. A

further 40,000 Panamanians have undertaken an online virtual tour

of the mine.

Steps towards two arbitration proceedings have

been taken by the Company, one under the Canada-Panama Free Trade

Agreement (“FTA”) and the other under the International Chamber of

Commerce (“ICC”) pursuant to the arbitration clause of the

Refreshed Concession Contract.

- ICC

Arbitration: On November 29, 2023, Minera Panamá S.A.

("MPSA") initiated arbitration before the ICC's International Court

of Arbitration pursuant to the ICC’s Rules of Arbitration and

Clause 46 of the Refreshed Concession Contract to protect its

rights under Panamanian law and the Refreshed Concession Contract

that the GOP agreed to in October 2023. The arbitration clause of

the contract provides for arbitration in Miami, Florida. A final

hearing for this matter is scheduled for September 2025.

-

FTA Arbitration: On November 14,

2023, First Quantum submitted a notice of intent to the GOP

initiating the consultation period required under the FTA. First

Quantum submitted an updated notice of intent on February 7, 2024.

First Quantum is entitled to seek any and all relief appropriate in

arbitration, including, but not limited to, damages and reparation

for Panama’s breaches of the Canada-Panama FTA. These breaches

include, among other things, the GOP’s failure to permit MPSA to

lawfully operate the Cobre Panamá mine prior to the Supreme Court’s

November 2023 decision and the GOP’s pronouncements and actions

concerning closure plans and P&SM at Cobre Panamá. The Company

has the right to file its arbitration claim under the FTA within

three years of Panama’s breaches of the FTA.

The Company reiterates that arbitration is not

the preferred outcome for the situation in Panama and it remains

committed to dialogue with the GOP and to being part of a solution

for the country and its people.

KANSANSHI S3 EXPANSION

During the third quarter of 2024, assembly of

the SAG and ball mills at the S3 Expansion at Kansanshi was

completed and installation of the gearless mill drives commenced.

Work in priority areas, including the primary crusher, continued as

per schedule and focus now shifts to piping and electrical work.

Commissioning activities have started in the 33kv distribution

substation and is expected to be energized in the fourth quarter.

System configuration of the plant control system has been completed

for the primary circuit and is now focused on ancillary systems and

services. The plant simulator has been made available for operator

training on site. The majority of the capital spend on the S3

Expansion is expected to occur in 2024, with first production

expected in the second half of 2025.

BOARD RENEWAL

As part of the ongoing board renewal program,

the Company is pleased to announce the appointments of Ms. Juanita

Montalvo, a Managing Partner at Acasta Cuba Capital, and Mr. Hanjun

("Kevin") Xia, currently at Jiangxi Copper, to its Board of

Directors with immediate effect.

Ms. Montalvo has over 25 years of governance,

executive, operations and investment experience in the mining,

extractive and agricultural industries in various jurisdictions

including Latin America and Africa. She is a Managing Partner at

Privus Capital Inc., focused on private equity and strategic

corporate investments, and an Independent Director of Dundee

Precious Metals. Ms. Montalvo has held various leadership roles,

including Senior Vice President Corporate Affairs and

Sustainability at Sherritt International Corporation and Country

Manager in Madagascar during the construction of the Ambatovy Joint

Venture. She is the Chairman of Wildlife Conservation Society

Canada and a founding member of the Women for Nature initiative of

Nature Canada. She holds a B.Sc. in Biology and Biochemistry, a

B.A. in International Development Studies, and a Masters in

Development Economics, all from Dalhousie University. She is also

part of McKinsey's LGBTQ Leadership Master Class Alumni and has the

ICD.D designation from the Institute of Corporate Directors and

Rotman School of Management.

Mr. Xia has over 20 years of experience in the

global copper industry, covering the entire industrial chain from

mining, smelting and processing to marketing and trading. Mr. Xia

is currently at Jiangxi Copper Company Limited, holding various

roles since 2001, including Coordinator in the Department of

Overseas Economic and Technical Cooperation, International

Cooperation Project Manager, Investor and Government Relations

Manager, Director of the Office for Chairman and CEO and, more

recently, President of Marketing and Trading. Mr. Xia holds a

College degree in English from Shangrao Normal University and an

MBA from Jiangxi University of Finance and Economics.

COMPLETE FINANCIAL STATEMENTS AND MANAGEMENT’S

DISCUSSION AND ANALYSIS

The complete Consolidated Financial Statements

and Management’s Discussion and Analysis for the three and nine

months ended September 30, 2024 are available at

www.first-quantum.com and at www.sedarplus.com and should be read

in conjunction with this news release.

CONFERENCE CALL DETAILS

The Company will host a conference call and

webcast to discuss the results on Wednesday, October 23, 2024 at

9:00 am (EST).

Conference call and webcast details:Toll-free

North America: 1-844-763-8274Toll-free International:

+1-647-484-8814Webcast: Direct link or on our website

A replay of the webcast will be available on the

First Quantum website.

For further information, visit our website at

www.first-quantum.com or contact:

Bonita To, Director, Investor Relations(416)

361-6400 Toll-free: 1 (888) 688-6577E-Mail: info@fqml.com

REGULATORY DISCLOSURES

Non-GAAP and Other Financial Measures

EBITDA, ADJUSTED EARNINGS (LOSS) AND ADJUSTED EARNINGS (LOSS)

PER SHARE

EBITDA, adjusted earnings (loss) and adjusted

earnings (loss) per share exclude certain impacts which the Company

believes are not reflective of the Company’s underlying performance

for the reporting period. These include impairment and related

charges, foreign exchange revaluation gains and losses, gains and

losses on disposal of assets and liabilities, one-time costs

related to acquisitions, dispositions, restructuring and other

transactions, revisions in estimates of restoration provisions at

closed sites, debt extinguishment and modification gains and

losses, the tax effect on unrealized movements in the fair value of

derivatives designated as hedged instruments, and adjustments for

expected phasing of Zambian VAT.

|

|

QUARTERLY |

|

|

Q3 2024 |

Q2 2024 |

Q3 2023 |

|

Operating profit |

329 |

|

117 |

|

585 |

|

|

Depreciation |

159 |

|

148 |

|

323 |

|

|

Other adjustments: |

|

|

|

|

|

Foreign exchange loss |

23 |

|

6 |

|

23 |

|

|

Impairment expense1 |

2 |

|

61 |

|

– |

|

|

Restructuring expense2 |

2 |

|

6 |

|

31 |

|

|

Other expense |

5 |

|

(2 |

) |

8 |

|

|

Revisions in estimates of restoration provisions at closed

sites |

– |

|

– |

|

(1 |

) |

|

Total adjustments excluding depreciation |

32 |

|

71 |

|

61 |

|

|

EBITDA |

520 |

|

336 |

|

969 |

|

1 The three and nine months ended September 30,

2024 include an impairment charge of $2 million and $71 million

respectively, following the decision to scale back operations at

Ravensthorpe in Q1 and subsequently placing the mine on care and

maintenance in May. 2 The three months ended September 30, 2023,

following a corporate reorganization within the Kansanshi segment,

included a restructuring expense of $31 million.

|

|

QUARTERLY |

|

|

Q3 2024 |

Q2 2024 |

Q3 2023 |

|

Net earnings (loss) attributable to shareholders of the

Company |

|

108 |

|

|

(46 |

) |

|

325 |

|

|

Adjustments attributable to shareholders of the Company: |

|

|

|

|

Adjustment for expected phasing of Zambian VAT |

|

(17 |

) |

|

(27 |

) |

|

(15 |

) |

|

Loss on redemption of debt |

|

– |

|

|

– |

|

|

– |

|

|

Total adjustments to EBITDA excluding depreciation |

|

32 |

|

|

71 |

|

|

61 |

|

|

Tax adjustments |

|

– |

|

|

6 |

|

|

(12 |

) |

|

Minority interest adjustments |

|

(4 |

) |

|

(17 |

) |

|

– |

|

|

Adjusted earnings (loss) |

|

119 |

|

|

(13 |

) |

|

359 |

|

|

Basic earnings (loss) per share as reported |

$0.13 |

|

|

($0.06 |

) |

$0.47 |

|

|

Diluted earnings (loss) per share |

$0.13 |

|

|

($0.06 |

) |

$0.47 |

|

|

Adjusted earnings (loss) per share |

$0.14 |

|

|

($0.02 |

) |

$0.52 |

|

REALIZED METAL PRICES

Realized metal prices are used by the Company to

enable management to better evaluate sales revenues in each

reporting period. Realized metal prices are calculated as gross

metal sales revenues divided by the volume of metal sold in lbs.

Net realized metal price is inclusive of the treatment and refining

charges (TC/RC) and freight charges per lb.

OPERATING CASHFLOW PER SHARE

In calculating the operating cash flow per

share, the operating cash flow calculated for IFRS purposes is

divided by the basic weighted average common shares outstanding for

the respective period.

NET DEBT

Net debt is comprised of bank overdrafts and

total debt less unrestricted cash and cash equivalents.

CASH COST, ALL-IN SUSTAINING COST, TOTAL COST

The consolidated cash cost (C1), all-in

sustaining cost (AISC) and total cost (C3) presented by the Company

are measures that are prepared on a basis consistent with the

industry standard definitions by the World Gold Council and Brook

Hunt cost guidelines but are not measures recognized under IFRS. In

calculating the C1 cash cost, AISC and C3, total cost for each

segment, the costs are measured on the same basis as the segmented

financial information that is contained in the financial

statements.

C1 cash cost includes all mining and processing

costs less any profits from by-products such as gold, silver, zinc,

pyrite, cobalt, sulphuric acid, or iron magnetite and is used by

management to evaluate operating performance. TC/RC and freight

deductions on metal sales, which are typically recognized as a

component of sales revenues, are added to C1 cash cost to arrive at

an approximate cost of finished metal.

AISC is defined as cash cost (C1) plus general

and administrative expenses, sustaining capital expenditure,

deferred stripping, royalties and lease payments and is used by

management to evaluate performance inclusive of sustaining

expenditure required to maintain current production levels.

C3 total cost is defined as AISC less sustaining

capital expenditure, deferred stripping and general and

administrative expenses net of insurance, plus depreciation and

exploration. This metric is used by management to evaluate the

operating performance inclusive of costs not classified as

sustaining in nature such as exploration and depreciation.

|

For the three months ended September 30, 2024 |

Cobre Panamá |

Kansanshi |

Sentinel |

Guelb Moghrein |

Las Cruces |

Çayeli |

Pyhäsalmi |

Copper |

Ravensthorpe |

Enterprise |

Nickel |

Corporate & other |

Total |

|

Cost of sales1 |

(11 |

) |

(392 |

) |

(309 |

) |

(50 |

) |

1 |

|

(19 |

) |

(3 |

) |

(783 |

) |

– |

(30 |

) |

(30 |

) |

(10 |

) |

(823 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

– |

|

|

|

|

Depreciation |

11 |

|

68 |

|

70 |

|

4 |

|

– |

|

1 |

|

(1 |

) |

153 |

|

– |

5 |

|

5 |

|

1 |

|

159 |

|

|

By-product credits |

– |

|

81 |

|

– |

|

36 |

|

– |

|

4 |

|

5 |

|

126 |

|

– |

1 |

|

1 |

|

– |

|

127 |

|

|

Royalties |

– |

|

50 |

|

32 |

|

2 |

|

– |

|

2 |

|

– |

|

86 |

|

– |

5 |

|

5 |

|

– |

|

91 |

|

|

Treatment and refining charges |

1 |

|

(5 |

) |

(9 |

) |

(3 |

) |

– |

|

(4 |

) |

– |

|

(20 |

) |

– |

– |

|

– |

|

– |

|

(20 |

) |

|

Freight costs |

– |

|

– |

|

(2 |

) |

– |

|

– |

|

(1 |

) |

– |

|

(3 |

) |

– |

– |

|

– |

|

– |

|

(3 |

) |

|

Finished goods |

– |

|

(3 |

) |

(10 |

) |

1 |

|

– |

|

3 |

|

(2 |

) |

(11 |

) |

– |

(5 |

) |

(5 |

) |

– |

|

(16 |

) |

|

Other4 |

(2 |

) |

63 |

|

– |

|

1 |

|

– |

|

(1 |

) |

– |

|

61 |

|

– |

(2 |

) |

(2 |

) |

9 |

|

68 |

|

|

Cash cost (C1)2,4 |

(1 |

) |

(138 |

) |

(228 |

) |

(9 |

) |

1 |

|

(15 |

) |

(1 |

) |

(391 |

) |

– |

(26 |

) |

(26 |

) |

– |

|

(417 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

– |

|

|

|

|

Depreciation (excluding depreciation in finished goods) |

(11 |

) |

(67 |

) |

(76 |

) |

(5 |

) |

(1 |

) |

1 |

|

1 |

|

(158 |

) |

– |

(7 |

) |

(7 |

) |

(1 |

) |

(166 |

) |

|

Royalties |

– |

|

(50 |

) |

(32 |

) |

(2 |

) |

– |

|

(2 |

) |

– |

|

(86 |

) |

– |

(5 |

) |

(5 |

) |

– |

|

(91 |

) |

|

Other |

– |

|

(3 |

) |

(2 |

) |

(1 |

) |

(1 |

) |

1 |

|

– |

|

(6 |

) |

– |

– |

|

– |

|

– |

|

(6 |

) |

|

Total cost (C3)2,4 |

(12 |

) |

(258 |

) |

(338 |

) |

(17 |

) |

(1 |

) |

(15 |

) |

– |

|

(641 |

) |

– |

(38 |

) |

(38 |

) |

(1 |

) |

(680 |

) |

|

Cash cost (C1)2,4 |

(1 |

) |

(138 |

) |

(228 |

) |

(9 |

) |

1 |

|

(15 |

) |

(1 |

) |

(391 |

) |

– |

(26 |

) |

(26 |

) |

– |

|

(417 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

– |

|

|

– |

|

|

General and administrative expenses |

(18 |

) |

(7 |

) |

(12 |

) |

(1 |

) |

– |

|

– |

|

– |

|

(38 |

) |

– |

(1 |

) |

(1 |

) |

– |

|

(39 |

) |

|

Sustaining capital expenditure and deferred stripping3 |

– |

|

(35 |

) |

(47 |

) |

(2 |

) |

– |

|

(2 |

) |

– |

|

(86 |

) |

– |

(15 |

) |

(15 |

) |

– |

|

(101 |

) |

|

Royalties |

– |

|

(50 |

) |

(32 |

) |

(2 |

) |

– |

|

(2 |

) |

– |

|

(86 |

) |

– |

(5 |

) |

(5 |

) |

– |

|

(91 |

) |

|

Lease payments |

– |

|

– |

|

– |

|

– |

|

– |

|

– |

|

– |

|

– |

|

– |

– |

|

– |

|

– |

|

– |

|

|

AISC2,4 |

(19 |

) |

(230 |

) |

(319 |

) |

(14 |

) |

1 |

|

(19 |

) |

(1 |

) |

(601 |

) |

– |

(47 |

) |

(47 |

) |

– |

|

(648 |

) |

|

AISC (per lb)2,4 |

– |

|

$2.15 |

|

$2.61 |

|

$1.55 |

|

– |

|

$2.54 |

|

– |

|

$2.42 |

|

– |

$5.97 |

|

$5.97 |

|

– |

|

|

|

Cash cost – (C1) (per lb)2,4 |

– |

|

$1.29 |

|

$1.86 |

|

$1.09 |

|

– |

|

$1.93 |

|

– |

|

$1.57 |

|

– |

$3.37 |

|

$3.37 |

|

– |

|

|

|

Total cost – (C3) (per lb)2,4 |

– |

|

$2.42 |

|

$2.76 |

|

$1.87 |

|

– |

|

$2.32 |

|

– |

|

$2.59 |

|

– |

$4.76 |

|

$4.76 |

|

– |

|

|

1 Total cost of sales per the Consolidated

Statement of Earnings (Loss) in the Company’s unaudited condensed

interim consolidated financial statements.2 C1 cash cost (C1),

total costs (C3), and all-in sustaining costs (AISC) are non-GAAP

ratios which do not have a standardized meaning prescribed by IFRS

and might not be comparable to similar financial measures disclosed

by other issuers. See “Regulatory Disclosures”.3 Sustaining

capital expenditure and deferred stripping are non-GAAP financial

measures which do not have a standardized meaning prescribed by

IFRS and might not be comparable to similar financial measures

disclosed by other issuers. See “Regulatory

Disclosures”.4 Excludes purchases of copper concentrate from

third parties treated through the Kansanshi Smelter.

|

For the three months ended September 30, 2023 |

Cobre Panamá |

Kansanshi |

Sentinel |

Guelb Moghrein |

Las Cruces |

Çayeli |

Pyhäsalmi |

Copper |

Corporate & other |

Ravensthorpe |

Total |

|

Cost of sales1 |

(497 |

) |

(362 |

) |

(308 |

) |

(50 |

) |

(15 |

) |

(9 |

) |

(4 |

) |

(1,245 |

) |

(8 |

) |

(114 |

) |

(1,369 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation |

169 |

|

58 |

|

73 |

|

4 |

|

– |

|

4 |

|

– |

|

308 |

|

1 |

|

14 |

|

323 |

|

|

By-product credits |

72 |

|

43 |

|

– |

|

27 |

|

– |

|

1 |

|

5 |

|

148 |

|

– |

|

4 |

|

152 |

|

|

Royalties |

19 |

|

34 |

|

32 |

|

2 |

|

– |

|

– |

|

– |

|

87 |

|

– |

|

5 |

|

92 |

|

|

Treatment and refining charges |

(57 |

) |

(7 |

) |

(12 |

) |

(2 |

) |

– |

|

(1 |

) |

– |

|

(79 |

) |

– |

|

– |

|

(79 |

) |

|

Freight costs |

– |

|

– |

|

(6 |

) |

– |

|

– |

|

(1 |

) |

– |

|

(7 |

) |

– |

|

– |

|

(7 |

) |

|

Finished goods |

4 |

|

11 |

|

(2 |

) |

4 |

|

2 |

|

(6 |

) |

(1 |

) |

12 |

|

– |

|

6 |

|

20 |

|

|

Other4 |

4 |

|

85 |

|

2 |

|

– |

|

13 |

|

– |

|

– |

|

104 |

|

7 |

|

– |

|

111 |

|

|

Cash cost (C1)2,4 |

(286 |

) |

(138 |

) |

(221 |

) |

(15 |

) |

– |

|

(12 |

) |

– |

|

(672 |

) |

– |

|

(85 |

) |

(757 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation (excluding depreciation in finished goods) |

(169 |

) |

(60 |

) |

(73 |

) |

(5 |

) |

– |

|

(4 |

) |

(1 |

) |

(312 |

) |

(1 |

) |

(14 |

) |

(327 |

) |

|

Royalties |

(19 |

) |

(34 |

) |

(32 |

) |

(2 |

) |

– |

|

– |

|

– |

|

(87 |

) |

– |

|

(5 |

) |

(92 |

) |

|

Other |

(5 |

) |

(3 |

) |

(2 |

) |

– |

|

– |

|

– |

|

– |

|

(10 |

) |

– |

|

(3 |

) |

(13 |

) |

|

Total cost (C3)2,4 |

(479 |

) |

(235 |

) |

(328 |

) |

(22 |

) |

– |

|

(16 |

) |

(1 |

) |

(1,081 |

) |

(1 |

) |

(107 |

) |

(1,189 |

) |

|

Cash cost (C1)2,4 |

(286 |

) |

(138 |

) |

(221 |

) |

(15 |

) |

– |

|

(12 |

) |

– |

|

(672 |

) |

– |

|

(85 |

) |

(757 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative expenses |

(13 |

) |

(8 |

) |

(11 |

) |

(1 |

) |

(1 |

) |

– |

|

– |

|

(34 |

) |

– |

|

(5 |

) |

(39 |

) |

|

Sustaining capital expenditure and deferred stripping3 |

(47 |

) |

(64 |

) |

(46 |

) |

(2 |

) |

– |

|

(2 |

) |

– |

|

(161 |

) |

– |

|

(8 |

) |

(169 |

) |

|

Royalties |

(19 |

) |

(34 |

) |

(32 |

) |

(2 |

) |

– |

|

– |

|

– |

|

(87 |

) |

– |

|

(5 |

) |

(92 |

) |

|

Lease payments |

– |

|

– |

|

– |

|

– |

|

– |

|

– |

|

– |

|

– |

|

– |

|

– |

|

– |

|

|

AISC2,4 |

(365 |

) |

(244 |

) |

(310 |

) |

(20 |

) |

(1 |

) |

(14 |

) |

– |

|

(954 |

) |

– |

|

(103 |

) |

(1,057 |

) |

|

AISC (per lb)2,4 |

$1.52 |

|

$2.84 |

|

$2.32 |

|

$3.77 |

|

– |

|

$2.59 |

|

– |

|

$2.02 |

|

– |

|

$11.46 |

|

|

|

Cash cost – (C1) (per lb)2,4 |

$1.19 |

|

$1.63 |

|

$1.65 |

|

$3.18 |

|

– |

|

$1.80 |

|

– |

|

$1.42 |

|

– |

|

$9.48 |

|

|

|

Total cost – (C3) (per lb)2,4 |

$1.99 |

|

$2.73 |

|

$2.46 |

|

$4.13 |

|

– |

|

$2.88 |

|

– |

|

$2.29 |

|

– |

|

$11.73 |

|

|

1 Total cost of sales per the Consolidated

Statement of Earnings (Loss) in the Company’s unaudited condensed

interim consolidated financial statements.2 C1 cash cost (C1),

total costs (C3) and all-in sustaining costs (AISC) are non-GAAP

ratios which do not have a standardized meaning prescribed by IFRS

and might not be comparable to similar financial measures disclosed

by other issuers. See “Regulatory Disclosures”.3 Sustaining

capital expenditure and deferred stripping are non-GAAP financial

measures which do not have a standardized meaning prescribed by

IFRS and might not be comparable to similar financial measures

disclosed by other issuers. See “Regulatory

Disclosures”.4 Excludes purchases of copper concentrate from

third parties treated through the Kansanshi Smelter.

CAUTIONARY STATEMENT ON FORWARD-LOOKING

INFORMATION

Certain statements and information herein,

including all statements that are not historical facts, contain

forward-looking statements and forward-looking information within

the meaning of applicable securities laws. The forward-looking

statements include estimates, forecasts and statements as to the

Company’s expectations regarding production, sales volumes and full

year copper C1 cash costs and AISC; the effect and duration of the

SRA; the status of Cobre Panamá and the P&SM program and the

closure of Cobre Panamá, including the timing and operating

expenses thereof and the time, results of the pending environmental

audit at Cobre Panamá and the process proposed by the new

government in Panama; development and operation of the Company’s

projects; the battery-powered dump truck trial at Kansanshi;

efforts to support food security in Zambia; the effect, timing,

capital expenditures and production of the S3 Expansion and the

expected timeline for commissioning of the 33kV distribution

substation of the S3 Expansion; the increase in throughput capacity

of the Kansanshi smelter; the Company’s expectations regarding

throughput capacity, mining performance and fragmentation at

Sentinel; anticipated mining volumes and throughput at Enterprise;

construction and commissioning of the CIL plant at Guelb Moghrein;

care and maintenance costs at Ravensthorpe and the status of

environmental approvals for Shoemaker Levy, Wind Farm and Tamarine

Quarry; the timing of receipt of concessions, approvals, permits

required for Taca Taca, including the ESIA and water use permits,

and the ongoing engineering study; the amount and timing of the

Company’s expenditures at La Granja, project development and the

Company’s plans for community engagement and completion of an

engineering study for La Granja; the curtailment of power supply in

Zambia and the Company’s ability to secure sufficient power to

substitute curtailments and avoid interruptions to operations; the

expected positive impact of Zambia’s rainy season on improved

hydropower generation; ; the Company’s future potential offtake

arrangements with independent power producers; the expected impact

of the 2025 Budget on increased costs for diesel and fuel heavy oil

for the mining sector the timing of approval of the renewal

application at Haquira and the Company’s goals regarding its

drilling program; the estimates regarding the interest expense on

the Company’s debt, cash flow on interest paid, capitalized

interest and depreciation expense; the expected effective tax rate

for the Company for 2024; the effect of foreign exchange on the

Company’s cost of sales and cash costs; the Company’s hedging

programs; the effect of seasonality on the Company’s results;

capital expenditure and mine production costs; the outcome of mine

permitting and other required permitting; the timing and outcome of

legal and arbitration proceedings which involve the Company;

estimates of the future price of certain precious and base metals;

estimated mineral reserves and mineral resources; mineral grade

estimates; the Company’s project pipeline, development and growth

plans and exploration and development program, future expenses and

exploration and development capital requirements; plans, targets

and commitments regarding climate change-related physical and

transition risks and opportunities (including intended actions to

address such risks and opportunities); and greenhouse gas emissions

and energy efficiency. Often, but not always, forward-looking

statements or information can be identified by the use of words

such as “aims”, “plans”, “expects” or “does not expect”, “is

expected”, “budget”, “scheduled”, “estimates”, “forecasts”,

“intends”, “anticipates” or “does not anticipate” or “believes” or

variations of such words and phrases or statements that certain

actions, events or results “may”, “could”, “would”, “might” or

“will” be taken, occur or be achieved.

With respect to forward-looking statements and

information contained herein, the Company has made numerous

assumptions including among other things, assumptions about the

geopolitical, economic, permitting and legal climate in which the

Company operates; continuing production at all operating

facilities; the price of certain precious and base metals including

copper, gold, nickel, silver, cobalt, pyrite and zinc; exchange

rates; anticipated costs and expenditure; the Company’s ability to

secure sufficient power to avoid interruption resulting from power

curtailment at its Zambian operations; mineral reserve and mineral

resource estimates; the timing and sufficiency of deliveries

required for the Company’s development and expansion plans; the

success of Company’s actions and plans to reduce greenhouse gas

emissions; and the ability to achieve the Company’s goals.

Forward-looking statements and information by their nature are

based on assumptions and involve known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements, or industry results, to be materially

different from any future results, performance or achievements

expressed or implied by such forward-looking statements or

information. These factors include, but are not limited to, future

production volumes and costs, the temporary or permanent closure of

uneconomic operations, costs for inputs such as oil, power and

sulphur, political stability in Panama, Zambia, Peru, Mauritania,

Finland, Turkey, Argentina and Australia, adverse weather

conditions in Panama, Zambia, Finland, Turkey, Mauritania, and

Australia, potential social and environmental challenges (including

the impact of climate change), power supply, mechanical failures,

water supply, procurement and delivery of parts and supplies to the

operations and events generally impacting global economic,

political and social stability and legislative and regulatory

reform. For mineral resource and mineral reserve figures appearing

or referred to herein, varying cut-off grades have been used

depending on the mine, method of extraction and type of ore

contained in the orebody.

See the Company’s Annual Information Form for

additional information on risks, uncertainties and other factors

relating to the forward-looking statements and information.

Although the Company has attempted to identify factors that would

cause actual actions, events or results to differ materially from

those disclosed in the forward-looking statements or information,

there may be other factors that cause actual results, performances,

achievements or events not as anticipated, estimated or intended.

Also, many of these factors are beyond First Quantum’s control.

Accordingly, readers should not place undue reliance on

forward-looking statements or information. The Company undertakes

no obligation to reissue or update forward-looking statements or

information as a result of new information or events after the date

hereof except as may be required by law. All forward-looking

statements made and information contained herein are qualified by

this cautionary statement.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/34b48212-3d12-4b56-80af-a3ad4794a674

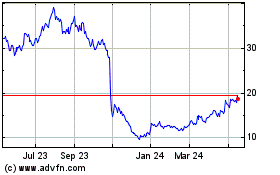

First Quantum Minerals (TSX:FM)

Historical Stock Chart

From Dec 2024 to Jan 2025

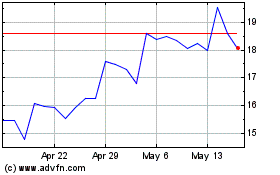

First Quantum Minerals (TSX:FM)

Historical Stock Chart

From Jan 2024 to Jan 2025