Hammond Power Solutions Inc. Announces Q1 2014 Financial Results

Gaining Momentum - Bookings Increase 32%

(Dollar amounts are in thousands unless otherwise specified)

GUELPH, ONTARIO--(Marketwired - Apr 24, 2014) - Hammond Power

Solutions Inc. ("HPS") (TSX:HPS.A) a leading manufacturer of

dry-type and cast resin transformers and related magnetics, today

announced its financial results for the first quarter of 2014.

Bill Hammond,

Chairman & Chief Executive Officer of Hammond Power Solutions

Inc. commented, "Hammond Power Solutions first quarter of 2014 has

been challenging, but we are finally seeing concrete reasons to

believe that a more positive business environment lays ahead for

HPS."

FIRST QUARTER

RESULTS

Sales for the

quarter-ended March 29, 2014 were $59,953, a decline of $3,719 or

5.8% from Quarter 1, 2013 sales of $63,672. U.S. sales were $33,747

in Quarter 1, 2014 a reduction of $1,438 or 4.1% from Quarter 1,

2013. Canadian sales were $17,930 for the quarter, a decrease over

Quarter 1, 2013, of $3,342 or 15.7%. These declines were largely

due to lower Quarter 4, 2013 booking rates in several market

segments which include delayed construction related business

attributed to the severe weather conditions in the quarter.

International sales in Quarter 1, 2014 were $8,276 versus $7,222 in

Quarter 1, 2013, an increase of $1,054 or 14.6%.

The Company realized

an increase in bookings of 13.3% over Quarter 4, 2013 as a result

of higher direct bookings and an increase of 31.5% as compared

against Quarter 1, 2013, due to a significant increase in bookings

in both the direct and distributor channels in North America.

"We are pleased with

our lift in bookings rates. This bodes well going forward. We are

starting to see general activity in the United States to slowly

accelerate in most markets and regions. We are also seeing growth

from our European and Indian operations compared to 2013," Bill

Hammond further commented.

Quarter 1, 2014

gross margin dollars decreased by $2,330 compared to Quarter 1,

2013. Gross margin rate decreased to 23.2% in Quarter 1, 2014

versus 24.0% in Quarter 1, 2013 due to selling price pressures and

the effect that lower production has on the absorption of factory

costs.

Total selling and

distribution expenses were $7,058 in Quarter 1, 2014 versus $6,542

in Quarter 1, 2013, an increase of $516 or 7.9%. These expenses

represent 11.8% of sales in Quarter 1, 2014 and 10.9% of sales in

Quarter 1, 2013.

The general and

administrative expenses for Quarter 1, 2014 totaled $5,546, a

slight increase of $151 or 2.8% when compared to Quarter 1, 2013

expenses of $5,395. This represents 9.3% of sales in Quarter 1,

2014 as compared to 8.5% of sales in Quarter 1, 2013

Quarter 1, 2014

earnings from operations decreased by $2,056 or 61.2% from the same

quarter last year, finishing at $1,303 compared to $3,359. This

reduction was a result of the lower sales.

The interest expense

for Quarter 1, 2014 finished at $257, an increase of $88 or 52.1%

compared to the Quarter 1, 2013 expense of $169. The increase in

interest expense for the quarter was a result of higher operating

debt levels attributed to higher working capital utilization.

The foreign exchange

gain in Quarter 1, 2014 was $97, relating primarily to the

transactional exchange pertaining to the Company's U.S. dollar

trade accounts payable in Canada, compared to a foreign exchange

gain of $8 in Quarter 1, 2013.

Net earnings for

Quarter 1, 2014 decreased by $1,387 or 72.7% and finished at $520

compared to net earnings of $1,907 in Quarter 1, 2013. Decreased

sales, lower gross margin rate dollars, increased interest costs

and higher general and administrative expenses were the main

contributing factors to the quarter decline.

Net cash used in

operating activities for Quarter 1, 2014 was $1,645 versus $1,011

in Quarter 1, 2013, an increase of $634 as a result of lower net

earnings.

The Company's

overall debt, net of cash was $24,965 in Quarter 1, 2014 compared

to a net debt position of $18,934 in Quarter 1, 2013, an increase

in debt position of $6,031. This debt position change was a result

of the purchase of Marnate and the change in non-cash working

capital.

The Company

continued with its regular quarterly dividend program, paying six

cents ($0.06) per Class A Subordinate Voting Share of HPS and six

cents ($0.06) per Class B Common Share of HPS on March 27,

2014.

Mr. Hammond

concluded, "We are cautiously optimistic about our growth going

forward. This is supported by our growing bookings and backlog and

we continue to expand our penetration of the geographies we serve.

We are confident that our financial strength, core competencies and

long term strategies will accelerate our growth as markets start to

improve."

FINANCIAL

RESULTS

| THREE MONTHS ENDED: |

| (dollars in thousands) |

|

|

March 29, 2014 |

March 30, 2013 |

Change |

|

|

Sales |

$ |

59,953 |

$ |

63,672 |

$ |

(3,719 |

) |

|

|

|

|

|

|

|

|

|

|

Earnings from Operations |

$ |

1,303 |

$ |

3,359 |

$ |

(2,056 |

) |

|

|

|

|

|

|

|

|

|

|

Exchange Gain |

$ |

97 |

$ |

8 |

$ |

89 |

|

|

|

|

|

|

|

|

|

|

|

Net Earnings |

$ |

520 |

$ |

1,907 |

$ |

(1,387 |

) |

|

|

|

|

|

|

|

|

|

|

Earnings per share |

|

|

|

|

|

|

|

|

|

$ |

0.04 |

$ |

0.16 |

$ |

(0.12 |

) |

|

Basic |

|

|

|

|

|

|

|

|

|

$ |

0.04 |

$ |

0.16 |

$ |

(0.12 |

) |

|

Diluted |

|

|

|

|

|

|

|

|

Cash Used in Operations |

$ |

1,645 |

$ |

1,011 |

$ |

634 |

|

TELECONFERENCE

Hammond Power

Solutions Inc. will hold a conference call on Friday, April 25,

2014 at 10:00 a.m. EST, to discuss the Company's financial results

for the first quarter 2014.

Listeners may attend

the conference by dialing:

| 1-416-340-2216 / 1-866-226-1792 / 1-800-9559-6849 |

|

|

|

|

Instant Replay |

|

| Dial

in numbers |

905-694-9451 or 1-800-408-3053 |

| Pass

code |

7239947 |

| End

date |

May

9, 2014 |

Caution Regarding

Forward-Looking Information

This press release

contains forward-looking statements that involve a number of risks

and uncertainties, including statements that relate to among other

things, HPS' strategies, intentions, plans, beliefs, expectations

and estimates, and can generally be identified by the use of words

such as "may", "will", "could", "should", "would", "likely",

"expect", "intend", "estimate", "anticipate", "believe", "plan",

"objective" and "continue" and words and expressions of similar

import. Although HPS believes that the expectations reflected in

such forward-looking statements are reasonable, such statements

involve risks and uncertainties, and undue reliance should not be

placed on such statements. Certain material factors or assumptions

are applied in making forward-looking statements, and actual

results may differ materially from those expressed or implied in

such statements. Important factors that could cause actual results

to differ materially from expectations include but are not limited

to: general business and economic conditions (including but not

limited to currency rates); changes in laws and regulations; legal

and regulatory proceedings; and the ability to execute strategic

plans. HPS does not undertake any obligation to update publicly or

to revise any of the forward-looking statements contained in this

document, whether as a result of new information, future events or

otherwise, except as required by law.

ABOUT HAMMOND POWER

SOLUTIONS INC.

Hammond Power

Solutions Inc. (TSX:HPS.A) is a North American leader for the

design and manufacture of dry-type custom electrical engineered

magnetics, electrical dry-type and cast resin transformers. Leading

edge engineering capabilities, high quality products, and

responsive service to customers' needs have all served to establish

HPS as a technical and innovative leader in the electrical and

electronic industries.

HPS has operations

in Canada, the United States, Mexico, India and Italy.

Hammond Power Solutions Inc.Dawn HendersonManager Investor

Relations(519) 822-2441 x414ir@hammondpowersolutions.com

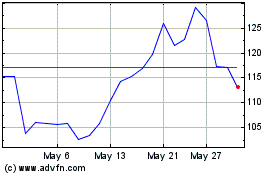

Hammond Power Solutions (TSX:HPS.A)

Historical Stock Chart

From Nov 2024 to Dec 2024

Hammond Power Solutions (TSX:HPS.A)

Historical Stock Chart

From Dec 2023 to Dec 2024