Imperial Announces $45 Million Non-Brokered Private Placement of Convertible Debentures

06 August 2022 - 10:03AM

Imperial Metals Corporation (the “Company”)

(TSX:III) announces its intention to secure additional financing

for the restart of the Mount Polley Mine by way of a non-brokered

private placement of $45 million aggregate principal amount of

convertible debentures (the “Convertible Debentures”).

The Mount Polley mine is currently operating at

targeted production rates. However, the restart took longer than

planned due to difficulties in hiring operating personnel, supply

chain challenges and unanticipated electrical and mechanical work.

This, together with lower copper prices, caused a shortfall in

revenues compared to budget. In addition, the rights offering was

not fully subscribed resulting in a shortfall in budgeted equity

financing. Due to these reasons, the Company now seeks additional

funding by way of a Convertible Debenture financing.

In the week following the repair of a key

electrical component on July 27th, the concentrator produced

concentrate containing approximately 336,000 pounds of copper and

550 ounces of gold against the budget for the initial week

following start-up of 188,403 pounds of copper and 495 ounces of

gold.

The Convertible Debentures will have a 5 year

term ending August 31, 2027. Each $3.20 of the principal amount

will be convertible into one common share of the Company. The

Convertible Debentures are not callable unless the closing price of

Company's common shares exceeds 140% of the conversion price for at

least 30 consecutive days. Interest at 8% per annum will be payable

semi-annually in cash with the first payment due on February 28,

2023.

The conversion premium on the common share price

under the Convertible Debenture is approximately 13.89% of the

volume weighted average trading price of the common shares on the

TSX for the 5 day period ending on August 5, 2022. Up to 14,062,500

common shares are expected to be issued if all the Convertible

Debentures issuable were converted into common shares of the

Company, subject to definitive terms and conditions and required

approvals from the TSX. N. Murray Edwards, the largest shareholder

of the Company, has advised that he intends to purchase between $30

million and $35 million of the Convertible Debentures.

The issuance of the Convertible Debentures

involves certain related parties (as such term is defined under

Multilateral Instrument 61-101 – Protection of

Minority Security Holders in Special

Transactions (“MI 61-101”)), including Mr. Edwards, which

constitutes related party transactions under

MI 61-101. These transactions are exempt from the formal

valuation requirement of Section 5.4 of MI 61-101 and the minority

approval requirement of Section 5.6 of MI 61-101 as

neither the fair market value of the Convertible Debentures issued

to related parties, nor the consideration for such Convertible

Debentures, exceed 25% of the Company’s market capitalization.

This news release does not constitute an offer

to sell or the solicitation of an offer to buy, nor shall there be

any sale of the Convertible Debentures, in any jurisdiction in

which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of such

jurisdiction.

About Imperial

Imperial is a Vancouver based exploration, mine

development and operating company with holdings that include the

Mount Polley mine (100%), the Huckleberry mine (100%), the Red

Chris mine (30%). Imperial also holds a portfolio of 23 greenfield

exploration properties in British Columbia.

Company Contacts

Brian Kynoch | President |

604.669.8959Darb Dhillon | Chief Financial Officer |

604.669.8959

Cautionary Note Regarding

Forward-Looking Statements

Certain information contained in this news

release are not statements of historical fact and are

“forward-looking” statements. Forward-looking statements relate to

future events or future performance and reflect Company

management’s expectations or beliefs regarding future events and

include, but are not limited to, statements regarding the Company’s

expectations with respect to the mine restart plans at Mount Polley

including maintenance issues and costs; the budgeted subscription

of the recent rights offering; and the issuance of the Convertible

Debentures including with respect to the anticipated terms,

interest payable and expected purchasers.

In certain cases, forward-looking statements can

be identified by the use of words such as "plans", "expects" or

"does not expect", "is expected", "outlook", "budget", "scheduled",

"estimates", "forecasts", "intends", "anticipates" or "does not

anticipate", or "believes", or variations of such words and phrases

or statements that certain actions, events or results "may",

"could", "would", "might" or "will be taken", "occur" or "be

achieved" or the negative of these terms or comparable terminology.

By their very nature forward-looking statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of the Company to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements.

In making the forward-looking statements in this

news release, the Company has applied certain factors and

assumptions that are based on information currently available to

the Company as well as the Company’s current beliefs and

assumptions. These factors and assumptions and beliefs and

assumptions include the assumption that the private placement of

convertible debenture will be completed on the announced terms, as

well as the risk factors detailed from time to time in the

Company’s interim and annual financial statements and management’s

discussion and analysis of those statements, all of which are filed

and available for review on SEDAR at www.sedar.com. Although the

Company has attempted to identify important factors that could

cause actual actions, events or results to differ materially from

those described in forward-looking statements, there may be other

factors that cause actions, events or results not to be as

anticipated, estimated or intended, many of which are beyond the

Company’s ability to control or predict. There can be no assurance

that forward-looking statements will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking statements and all

forward-looking statements in this news release are qualified by

these cautionary statements.

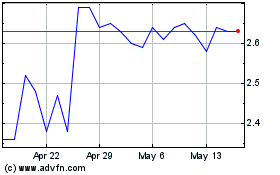

Imperial Metals (TSX:III)

Historical Stock Chart

From Nov 2024 to Dec 2024

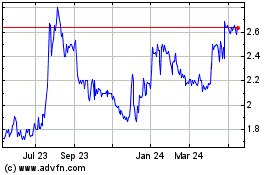

Imperial Metals (TSX:III)

Historical Stock Chart

From Dec 2023 to Dec 2024