McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) today

reported its first quarter (Q1) results for the period ended March

31st, 2024.

“During a recent trip to Argentina,

together with several members of our senior management, we had the

distinct pleasure of meeting with President Milei. He spoke about

his plans to improve the lives of people and stimulate the

country’s economy through fiscal discipline and

foreign-investment-friendly policies. We had a wide-ranging

conversation about what steps could be taken to encourage large

capital inflows to invest in productive assets that create a strong

tax base and provide long-term high paying jobs. We spoke about our

Los Azules copper project and how we have invested significant

funds to advance it to the point where it could be producing large

quantities of pure green copper cathodes by

2030.

It was very refreshing to meet a head of

state who is an engaging communicator with plans based on sound

economic principles designed to unburden the economy and get

Argentina growing. I was a fan of Javier Milei before he was

elected as President, when I saw videos of him campaigning

brandishing a chainsaw and promising to cut the bureaucracy, free

up the economy, and encourage domestic and foreign

investment.

Today there exists an infectious

optimism about Argentina that didn’t exist before President Milei

was elected. I wanted to share my impressions as I believe it bodes

well for the continued appreciation of our largest asset, Los

Azules, and for our joint venture mine San José. Relaxation of

exchange controls is contemplated, and the legislative reforms

currently working their way through government are beneficial to

large infrastructure projects across many industries, including

mining.

At Los Azules, we had 22 drills

operating this season and we succeeded in drilling over 69,000

meters to date, an impressive achievement, putting us on track to

deliver our final feasibility report in Q1 2025.

During Q1 our Gold Bar mine performed

well achieving a low production cost/oz due to the mine sequence

being light on waste movements, the Fox Complex grappled with

lower-than-expected grades which produced higher than planned

cost/oz, and the San José mine had higher production and lower

cost/oz for the quarter, outperforming their seasonally weaker

period,” said Rob McEwen, Chairman and

Chief Owner.

Financial Results

McEwen Mining's ownership of McEwen

Copper decreased from 51.9% to 47.7% after the October 2023

financing, and as a result the Company’s financial statements no

longer consolidate McEwen Copper on a 100% basis, and instead

account for McEwen Copper as an equity investment.

Our gross profit in Q1 was $6.0

million, compared to a gross profit of $4.4 million in Q1

2023. A 15% increase in the gold price and a 3% increase in metal

sold contributed to the improvement in gross profit.

Adjusted EBITDA(1) was $6.3

million, or $0.13 per share in Q1,

compared to an adjusted EBITDA of negative $2.9 million, or ($0.06)

per share in Q1 2023. Adjusted EBITDA removes the impact of our

McEwen Copper investment and represents the results from our mining

operations.

We reported a consolidated net loss of

$20.4 million, or ($0.41) per

share in Q1, compared to a net loss of $43.1 million, or

($0.91) per share in Q1 2023. The largest contributor to our net

loss was an $18.0 million loss attributable to our

investment in McEwen Copper. We also incurred $3.9

million in exploration expenses at our Fox Complex and

Gold Bar mine operations.

Liquidity and Capital

Resources

We reported consolidated cash and cash

equivalents of $22.0 million and consolidated

working capital of $14.1 million as at March 31,

2024, compared to the respective numbers of $23.0 million and $22.7

million at December 31, 2023. Total long-term debt was

$40.0 million at the end of Q1, decreased from

$65.0 million in Q1 2023.

Gold & Silver Production (See Table

1)

Consolidated production from our three operating

mines was 32,725 gold equivalent ounces

(GEOs)(3) in Q1, compared to 30,400 GEOs in Q1 2023. The

average realized price of sales during Q1 was

$2,131 per GEO for 100% owned mines and

$2,214 per GEO for San José. Production guidance

remains 130,000-145,000 GEOs for the

full year 2024.

Individual Mine

Performance:

Gold Bar Mine, Nevada (100%

owned)

At Gold Bar, we

produced 11,716 GEOs, an increase

of 82% compared to Q1 2023, when

production was adversely impacted by major flooding. The Gold Bar

mine guidance is 40,000 to 43,000 GEOs for full year 2024.

Cash costs and AISC per GEO sold for the Gold

Bar mine in Q1

were $1,088 and $1,201,

respectively, which was significantly lower compared to full year

guidance of $1,550 and $1,750, respectively. As operations move

towards higher strip ratio mining areas in the second half of 2024,

we expect to see our average unit costs increase closer to guidance

values.

Fox Complex Mine, Ontario (100%

owned)

At Fox, production was below plan

at 7,486 GEOs, due to lower than

expected mined grades. As a result of the lower mined and stockpile

grades, our cash costs(2) and AISC per GEO(2) sold for

Fox in Q1

were $1,555 and $1,928,

respectively, higher than full year guidance of $1,325 and $1,550,

respectively.

Subsequent to quarter end we have begun to see

higher grades of gold production and we reiterate production

cost/oz guidance at Fox of 40,000 to 42,000 GEOs for the full year

2024.

San José Mine (49% owned)

At San José, Q1 production increased

by 15% compared to Q1 2023 due to an

improvement in average grade processed. San José

produced 12,934 attributable GEOs during

Q1, exceeding their year-to-date plan. The next three quarters in

2024 are expected to achieve higher production. We reiterate full

year guidance of 50,000 to 60,000 attributable GEOs.

Cash costs and AISC per GEO sold for San José in

Q1

were $1,607 and $1,947,

respectively, as compared to full year guidance of $1,500 and

$1,700, respectively. As production increases through 2024, average

unit costs are expected to trend lower to meet guidance.

San José Exploration

Near mine exploration drilling is being

conducted underground at the Frea, Odin, and Remal N. veins.

Recently, hole SJM-663 was drilled along the southeast extension of

the Frea vein and hit 12 m of 12.7

g/t Au and

101 g/t Ag at a lower

elevation within the vein. This has opened a new area for

additional exploration, which is underway with 260-foot (80-meter)

step-outs and the potential to extend over 2,300 ft. (700 m).

An open pit was constructed along the southeast

portion of the Odin vein (“Contorno OP”) in an area where high

grade mineralization was close to the surface. Mining from the

Contorno OP was successful, therefore shallow drilling has been

carried out 400 ft (120 m) along strike through a sequence of veins

called Dalia, Odin, and Sigmoide Odin Sur (“SOS”) to determine if

the pit can be extended, with some encouraging results summarized

below (see Figure 1):

|

Hole ID |

Vein |

Assay Result |

|

SJD-2775 |

Dalia |

2.8 m of 1.1 g/t Au and 221 g/t Ag |

| |

Odin |

1.0 m of

1.9 g/t Au and 216 g/t Ag |

| |

SOS |

1.5 m of

1.8 g/t Au and 166 g/t Ag |

|

|

|

|

|

SJD-2776 |

Dalia |

2.6 m of 2.0 g/t Au and 513 g/t Ag |

| |

Odin |

1.3 m of

0.4 g/t Au and 12 g/t Ag |

| |

SOS |

0.9 m of

0.1 g/t Au and 13 g/t Ag |

|

|

|

|

|

SJD-2777 |

Dalia |

3.5 m of

1.3 g/t Au and 86 g/t Ag |

| |

Odin |

2.3 m of

5.5 g/t Au and 70 g/t Ag |

| |

SOS |

0.9 m of

0.2 g/t Au and 43 g/t Ag |

|

|

|

|

|

SJD-2778 |

Dalia |

1.7 m of

0.5 g/t Au and 19 g/t Ag |

| |

Odin |

1.4 m of

0.3 g/t Au and 54 g/t Ag |

| |

SOS |

1.0 m of

1.4 g/t Au and 70 g/t Ag |

|

|

|

|

|

SJD-2788 |

Dalia |

1.5 m of

4.8 g/t Au and 51 g/t Ag |

| |

Odin |

2.7 m of 7.6 g/t Au and 360 g/t Ag |

| |

SOS |

6.2 m of 23.3 g/t Au and 314 g/t Ag |

|

|

|

|

|

SJD-2789 |

Dalia |

0.9 m of

1.4 g/t Au and 125 g/t Ag |

| |

Odin |

1.6 m of 3.2 g/t Au and 287 g/t Ag |

| |

SOS |

1.5 m of 3.5 g/t Au and 281 g/t Ag |

|

|

|

|

|

SJD-2795 |

Dalia |

0.9 m of

0.6 g/t Au and 90 g/t Ag |

| |

Odin |

1.7 m of

2.8 g/t Au and 137 g/t Ag |

| |

SOS |

4.7 m of

2.6 g/t Au and 60 g/t Ag |

|

|

|

|

Exploration programs were also conducted to the south of the San

José mine adjacent to Newmont’s Cerro Negro mine property. Mapping

and sampling were completed on the El Retiro and Liv Este targets.

Geophysics and four trenches (8,200 ft or 2,500 m in total) were

also completed over El Retiro. Trench results, mapping and sampling

reports are pending for both targets. These targets will be

interpreted over the Argentinean winter, with the plan to drill

both of them in the second half of the year.

Figure 1: Plan map of near surface veins

and Contorno open pit

McEwen Copper (47.7% owned)

The Los Azules project is one of the world’s

largest undeveloped copper porphyry copper deposits. From its

creation in 2021 to the end of Q1 2024, McEwen Copper has invested

over $230 million in exploration expenditures to advance the Los

Azules project. Based on our financings in Q4 2023, McEwen Copper

has an implied market value of $800 million.

Key highlights of our Q1 and recent activities

at Los Azules:

Drilling Program

Our 2023-2024 drilling program began in October

2023. To date, we have completed approximately 227,000 feet (69,200

meters) of drilling consisting of resource, metallurgical,

geotechnical, and hydrogeological targets, in addition to drilling

for condemnation and stability. With the onset of winter, rigs are

currently demobilizing, and the drilling season is coming to a

close.

2023-2024 Preliminary Assay

Results

Preliminary assay results from the 2023-2024

drilling season have been received and analyzed. These assay

results include significant copper values over wide intercepts that

generally correspond well with the resource block model used in the

June 2023 Preliminary Economic Assessment (“PEA”) for Los Azules.

Selected drill highlights include:

- 257 m of 0.76% Cu, in the

Enriched zone (Hole AZ23205)

- 446 m of 0.63% Cu, including

76 m of 0.92% Cu (Hole

AZ23228)

- 250 m of 0.68% Cu, in the

Enriched zone, including 192 m of 0.83% Cu (Hole AZ23230)

Further details on our assay results were

released in our press release dated February 26, 2024.

Improved Copper Recovery

Copper heap leaching metallurgical tests

conducted at SGS Chile Limitada in Santiago, Chile supported an

average copper recovery of 76.0% using conventional bio-heap

leaching technology. This increase of 3.2% compared to the recovery

rate utilized in the 2023 PEA represents a potential after-tax

NPV(8%) increase of approximately $262 million. Additional details

are included in our press release dated February 22, 2024.

Environmental Impact

Assessment

The first presentation of the Environmental

Impact Assessment to the Technical Evaluation Commission took place

on November 24, 2023. In April 2024, McEwen Copper convened a

technical meeting with members of the government's technical

commission to discuss the assessment of the environmental impact

report on exploitation.

Timberline Acquisition

On April 16, 2024, the Company entered into a

definitive agreement and plan of merger to acquire all of the

issued and outstanding shares of Timberline Resources Corporation

(“Timberline”) by way of a merger between Timberline and the

Company. If the transaction is approved by the Timberline

shareholders at an upcoming special meeting they will have the

right to receive 0.01 of a share of the Company’s common stock for

each share of Timberline’s common stock. The acquisition of

Timberline presents McEwen Mining with the opportunity to:

- Strengthen its core portfolio of

projects in Nevada, a very favorable mining jurisdiction;

- Acquire gold resources at a low

per-ounce cost, with the potential to contribute to McEwen’s gold

production growth within 2 to 5 years depending on the mining

scenario;

- Grow our portfolio of prospective

exploration targets, including deep sulfide gold targets and

poly-metallic base metal targets;

- Realize synergies between

Timberline’s projects and the Company’s Gold Bar mine, including

common technical personnel, procurement functions, shared mine

infrastructure, synergies in recruiting and human resources in the

region around Eureka, Nevada.

Management Conference Call

Management will discuss our Q1 financial results

and project developments and follow with a question and answer

session. Questions can be asked directly by participants over the

phone during the webcast.

|

Thursday, May

9th, 2024 at 11:00 AM

EDT |

Toll Free Dial-In North America: |

(888) 210-3454 |

|

Toll Free Dial-In Other Countries: |

https://events.q4irportal.com/custom/access/2324/ |

|

Toll Dial-In: |

(646) 960-0130 |

|

Conference ID Number: |

3232920 |

|

Webcast Link: |

https://events.q4inc.com/attendee/871742148 |

|

|

|

|

An archived replay of the webcast will be

available approximately 2 hours following the conclusion of the

live event. Access the replay on the Company’s media page at

https://www.mcewenmining.com/media.

Table 1 below provides

production and cost results for Q1, with comparative results from

Q1 2023 and our guidance range for 2024.

|

|

Q1 |

Full Year 2024Guidance Range |

|

2023 |

|

2024 |

|

Consolidated Production |

|

|

|

|

GEOs(2) |

30,400 |

32,750(4) |

130,000-145,000 |

|

Gold Bar Mine, Nevada |

|

|

|

|

GEOs |

6,500 |

|

11,700 |

40,000-43,000 |

| Cash Costs/GEO(1) |

$1,491 |

|

$1,088 |

$1,450-1,550 |

|

AISC/GEO(1) |

$1,725 |

|

$1,201 |

$1,650-1,750 |

|

Fox Complex, Canada |

|

|

|

| GEOs |

12,700 |

|

7,500 |

40,000-42,000 |

| Cash Costs/GEO |

$1,088 |

|

$1,555 |

$1,225-1,325 |

|

AISC/GEO |

$1,311 |

|

$1,928 |

$1,450-1,550 |

| Total Gold Bar +

Fox |

|

|

|

| GEOs |

19,200 |

|

19,200 |

|

| Cash Costs/GEO |

$1,220 |

|

$1,268 |

|

|

AISC/GEO |

$1,446 |

|

$1,481 |

|

|

San José Mine, Argentina (49%) |

|

|

|

| GEOs |

11,200 |

|

12,950 |

50,000-60,000 |

| Cash Costs/GEO |

$1,800 |

|

$1,607 |

$1,300-1,500 |

|

AISC/GEO |

$2,234 |

|

$1,947 |

$1,500-1,700 |

Notes:

- Cash gross profit, cash costs per

ounce, all-in sustaining costs (AISC) per ounce, and adjusted

EBITDA and adjusted EBITDA per share are non-GAAP financial

performance measures with no standardized definition under U.S.

GAAP. For definition of the non-GAAP measures see

"Non-GAAP- Financial Measures" section in this press release;

for the reconciliation of the non-GAAP measures to the closest U.S.

GAAP measures, see the Management Discussion and Analysis for the

quarter ended March 31, 2023, filed on Edgar and SEDAR.

- 'Gold Equivalent Ounces' are

calculated based on a gold to silver price ratio of 84:1 for Q1

2023 and 89:1 for Q1 2024. 2024 production guidance is calculated

based on 85:1 gold to silver price ratio.

- Represents the portion attributable

to us from our 49% interest in the San José Mine.

- Includes 600 oz Au from El Gallo

pond cleanout that was paid in Q1 2024.

Technical Information

The technical content of this news release

related to financial results, mining and development projects has

been reviewed and approved by William (Bill) Shaver, P.Eng., COO of

McEwen Mining and a Qualified Person as defined by SEC S-K 1300 and

the Canadian Securities Administrators National Instrument 43-101

"Standards of Disclosure for Mineral Projects."

Reliability of Information Regarding San

JoséMinera Santa Cruz S.A., the owner of the San José

Mine, is responsible for and has supplied to the Company all

reported results from the San José Mine. McEwen Mining’s joint

venture partner, a subsidiary of Hochschild Mining plc, and its

affiliates other than MSC do not accept responsibility for the use

of project data or the adequacy or accuracy of this release.

CAUTIONARY NOTE REGARDING NON-GAAP

MEASURES

In this release, we have provided information

prepared or calculated according to United States Generally

Accepted Accounting Principles (“U.S. GAAP”), as well as provided

some non-U.S. GAAP ("non-GAAP") performance measures. Because the

non-GAAP performance measures do not have any standardized meaning

prescribed by U.S. GAAP, they may not be comparable to similar

measures presented by other companies.

Cash Costs and All-in Sustaining CostsCash costs

consist of mining, processing, on-site general and administrative

costs, community and permitting costs related to current

operations, royalty costs, refining and treatment charges (for both

doré and concentrate products), sales costs, export taxes and

operational stripping costs, and exclude depreciation and

amortization. All-in sustaining costs consist of cash costs (as

described above), plus accretion of retirement obligations and

amortization of the asset retirement costs related to operating

sites, sustaining exploration and development costs, sustaining

capital expenditures, and sustaining lease payments. Both cash

costs and all-in sustaining costs are divided by the gold

equivalent ounces sold to determine cash costs and all-in

sustaining costs on a per ounce basis. We use and report these

measures to provide additional information regarding operational

efficiencies on an individual mine basis, and believe that these

measures provide investors and analysts with useful information

about our underlying costs of operations. A reconciliation to

production costs applicable to sales, the nearest U.S. GAAP measure

is provided in McEwen Mining's Annual Report on Form 10-K for the

year ended December 31, 2023.

| |

|

Three months ended March 31, 2024 |

| |

|

Gold Bar |

|

Fox Complex |

|

Total |

| |

|

(in thousands, except

per ounce) |

|

Production costs applicable to sales - Cash costs (100%

owned) |

|

$ |

13,268 |

|

$ |

11,842 |

|

$ |

25,110 |

|

In‑mine exploration |

|

|

799 |

|

|

— |

|

|

799 |

|

Capitalized underground mine development (sustaining) |

|

|

— |

|

|

2,302 |

|

|

2,302 |

|

Capital expenditures on plant and equipment (sustaining) |

|

|

551 |

|

|

— |

|

|

551 |

|

Sustaining leases |

|

|

21 |

|

|

539 |

|

|

560 |

| All‑in sustaining

costs |

|

$ |

14,639 |

|

$ |

14,683 |

|

$ |

29,322 |

| Ounces sold, including stream

(GEO) |

|

|

12.2 |

|

|

7.6 |

|

|

19.8 |

| Cash cost per ounce

sold ($/GEO) |

|

$ |

1,088 |

|

$ |

1,555 |

|

$ |

1,268 |

| AISC per ounce sold

($/GEO) |

|

$ |

1,201 |

|

$ |

1,928 |

|

$ |

1,481 |

| |

|

|

|

|

|

|

|

|

|

| |

|

Three months ended March 31, 2023 |

| |

|

Gold Bar |

|

Fox Complex |

|

Total |

| |

|

(in thousands, except per ounce) |

|

Production costs applicable to sales - Cash costs (100% owned) |

|

$ |

9,341 |

|

$ |

14,072 |

|

$ |

23,413 |

|

Mine site reclamation, accretion and amortization |

|

|

— |

|

|

— |

|

|

— |

|

In‑mine exploration |

|

|

482 |

|

|

— |

|

|

482 |

|

Capitalized underground mine development (sustaining) |

|

|

— |

|

|

2,655 |

|

|

2,655 |

|

Capital expenditures on plant and equipment (sustaining) |

|

|

693 |

|

|

— |

|

|

693 |

|

Sustaining leases |

|

|

289 |

|

|

222 |

|

|

511 |

| All‑in sustaining costs |

|

$ |

10,805 |

|

$ |

16,949 |

|

$ |

27,754 |

| Ounces sold, including stream

(GEO) |

|

|

6.3 |

|

|

12.9 |

|

|

19.2 |

| Cash cost per ounce sold

($/GEO) |

|

$ |

1,491 |

|

$ |

1,088 |

|

$ |

1,220 |

| AISC per ounce sold

($/GEO) |

|

$ |

1,725 |

|

$ |

1,311 |

|

$ |

1,446 |

| |

|

|

|

|

|

|

|

|

|

| |

|

Three months ended March 31, |

| |

|

2024 |

|

|

2023 |

|

| San José mine cash

costs (100% basis) |

|

(in thousands, except

per ounce) |

|

Production costs applicable to sales - Cash

costs |

|

$ |

47,884 |

|

|

$ |

41,124 |

|

|

Mine site reclamation, accretion and amortization |

|

|

304 |

|

|

|

292 |

|

|

Site exploration expenses |

|

|

2,104 |

|

|

|

1,952 |

|

|

Capitalized underground mine development (sustaining) |

|

|

7,331 |

|

|

|

7,130 |

|

|

Less: Depreciation |

|

|

(799 |

) |

|

|

(550 |

) |

|

Capital expenditures (sustaining) |

|

|

1,200 |

|

|

|

1,089 |

|

| All‑in sustaining

costs |

|

$ |

58,024 |

|

|

$ |

51,036 |

|

| Ounces sold (GEO) |

|

|

29.8 |

|

|

|

22.8 |

|

| Cash cost per ounce

sold ($/GEO) |

|

$ |

1,607 |

|

|

$ |

1,800 |

|

| AISC per ounce sold

($/GEO) |

|

$ |

1,947 |

|

|

$ |

2,234 |

|

| |

|

|

|

|

|

|

|

|

Cash Gross ProfitCash gross profit is a non-GAAP

financial measure and does not have any standardized meaning. We

use cash gross profit to evaluate our operating performance and

ability to generate cash flow; we disclose cash gross profit as we

believe this measure provides valuable assistance to investors and

analysts in evaluating our ability to finance our ongoing business

and capital activities. The most directly comparable measure

prepared in accordance with GAAP is gross profit. Cash gross profit

is calculated by adding depletion and depreciation to gross profit.

A reconciliation to gross profit, the nearest U.S. GAAP measure is

provided in McEwen Mining's Annual Report on Form 10-K for the year

ended December 31, 2023.

Adjusted EBITDA and adjusted EBITDA per

shareAdjusted earnings before interest, taxes, depreciation, and

amortization (“Adjusted EBITDA”) is a non-GAAP financial measure

and does not have any standardized meaning. We use adjusted EBITDA

to evaluate our operating performance and ability to generate cash

flow from our wholly owned operations in production; we disclose

this metric as we believe this measure provides valuable assistance

to investors and analysts in evaluating our ability to finance our

precious metal operations and capital activities separately from

our copper exploration operations. The most directly comparable

measure prepared in accordance with GAAP is net loss before income

and mining taxes. Adjusted EBITDA is calculated by adding back

McEwen Copper's income or loss impacts on our consolidated income

or loss before income and mining taxes.

| |

|

Three months ended March 31, |

| |

|

2024 |

|

|

2023 |

|

| Adjusted

EBITDA |

|

(in thousands) |

|

Net loss before income and mining taxes |

|

$ |

(22,940 |

) |

|

$ |

(36,946 |

) |

| Less: |

|

|

|

|

|

|

| Depreciation and

depletion |

|

|

10,278 |

|

|

|

7,178 |

|

| Loss from investment in McEwen

Copper Inc. (Note 9) |

|

|

18,012 |

|

|

|

— |

|

| Advanced Projects – McEwen

Copper Inc. |

|

|

— |

|

|

|

31,880 |

|

| General, interest and other –

McEwen Copper Inc. |

|

|

— |

|

|

|

(6,313 |

) |

| Interest expense |

|

|

972 |

|

|

|

1,347 |

|

| Adjusted EBITDA |

|

$ |

6,322 |

|

|

$ |

(2,854 |

) |

| Weighted average shares

outstanding (thousands) |

|

|

49,440 |

|

|

|

47,428 |

|

| Adjusted EBITDA per share |

|

$ |

0.13 |

|

|

$ |

(0.06 |

) |

| |

|

|

|

|

|

|

|

|

CAUTION CONCERNING FORWARD-LOOKING

STATEMENTS

This news release contains certain

forward-looking statements and information, including

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. The forward-looking

statements and information expressed, as at the date of this news

release, McEwen Mining Inc.'s (the "Company") estimates, forecasts,

projections, expectations or beliefs as to future events and

results. Forward-looking statements and information are necessarily

based upon a number of estimates and assumptions that, while

considered reasonable by management, are inherently subject to

significant business, economic and competitive uncertainties, risks

and contingencies, and there can be no assurance that such

statements and information will prove to be accurate. Therefore,

actual results and future events could differ materially from those

anticipated in such statements and information. Risks and

uncertainties that could cause results or future events to differ

materially from current expectations expressed or implied by the

forward-looking statements and information include, but are not

limited to, effects of the COVID-19 pandemic, fluctuations in the

market price of precious metals, mining industry risks, political,

economic, social and security risks associated with foreign

operations, the ability of the Company to receive or receive in a

timely manner permits or other approvals required in connection

with operations, risks associated with the construction of mining

operations and commencement of production and the projected costs

thereof, risks related to litigation, the state of the capital

markets, environmental risks and hazards, uncertainty as to

calculation of mineral resources and reserves, foreign exchange

volatility, foreign exchange controls, foreign currency risk, and

other risks. Readers should not place undue reliance on

forward-looking statements or information included herein, which

speak only as of the date hereof. The Company undertakes no

obligation to reissue or update forward-looking statements or

information as a result of new information or events after the date

hereof except as may be required by law. See McEwen Mining's Annual

Report on Form 10-K for the fiscal year ended December 31, 2023,

and other filings with the Securities and Exchange Commission,

under the caption "Risk Factors", for additional information on

risks, uncertainties and other factors relating to the

forward-looking statements and information regarding the Company.

All forward-looking statements and information made in this news

release are qualified by this cautionary statement.

The NYSE and TSX have not reviewed and do not

accept responsibility for the adequacy or accuracy of the contents

of this news release, which has been prepared by management of

McEwen Mining Inc.

ABOUT MCEWEN MINING

McEwen Mining is a gold and silver producer with

operations in Nevada, Canada, Mexico and Argentina. McEwen Mining

also holds a 47.7% interest in McEwen Copper, which is developing

the large, advanced-stage Los Azules copper project in Argentina.

The Company’s goal is to improve the productivity and life of its

assets with the objective of increasing the share price and

providing a yield. Rob McEwen, Chairman and Chief Owner, has a

personal investment in the Company of US$220 million. His annual

salary is US$1.

Want News Fast?

Subscribe to our email list by clicking

here:https://www.mcewenmining.com/contact-us/#section=followUs

and receive news as it happens!

|

|

|

|

|

|

|

|

|

|

WEB SITE |

|

SOCIAL

MEDIA |

|

|

|

|

|

www.mcewenmining.com |

|

McEwen Mining |

Facebook: |

facebook.com/mcewenmining |

|

|

|

|

|

LinkedIn: |

linkedin.com/company/mcewen-mining-inc- |

|

|

|

CONTACT

INFORMATION |

|

Twitter: |

twitter.com/mcewenmining |

|

|

|

150 King Street West |

|

Instagram: |

instagram.com/mcewenmining |

|

|

|

Suite 2800, PO Box 24 |

|

|

|

|

|

|

|

Toronto, ON, Canada |

|

McEwen Copper |

Facebook: |

facebook.com/mcewencopper |

|

|

|

M5H 1J9 |

|

LinkedIn: |

linkedin.com/company/mcewencopper |

|

|

|

|

|

Twitter: |

twitter.com/mcewencopper |

|

|

|

Relationship with

Investors: |

|

Instagram: |

instagram.com/mcewencopper |

|

|

|

(866)-441-0690 - Toll free line |

|

|

|

|

|

|

|

(647)-258-0395 |

|

Rob

McEwen |

Facebook: |

facebook.com/mcewenrob |

|

|

|

Mihaela Iancu ext. 320 |

|

LinkedIn: |

linkedin.com/in/robert-mcewen-646ab24 |

|

|

|

info@mcewenmining.com |

|

Twitter: |

twitter.com/robmcewenmux |

|

|

|

|

|

|

|

|

|

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/7d3034fe-b5be-4eca-9d65-969482935464

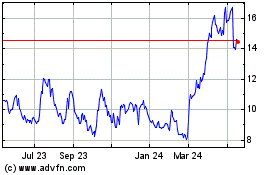

McEwen Mining (TSX:MUX)

Historical Stock Chart

From Nov 2024 to Dec 2024

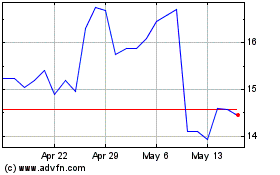

McEwen Mining (TSX:MUX)

Historical Stock Chart

From Dec 2023 to Dec 2024